This essay is based on the Premium Update posted on December 1st, 2010. Visit our archives for more gold & silver articles.

Even though we have posted our previous essay just a few days ago, much happened since that time, so without further introduction we will dive right into the USD Index chart (charts courtesy of http://stockcharts.com.)

The long-term USD Index chart gives us some indications this week that a local top could already be in. The recent rise in golds price has been a result of weakness in the euro not strength in the dollar itself. The USD Index is approaching several resistance levels and is slightly above our previous stated target level. Furthermore, the recent consolidation period took place approximately half-way between todays index level and the last local bottom and commonly occurs at the mid-point of strong rallies.

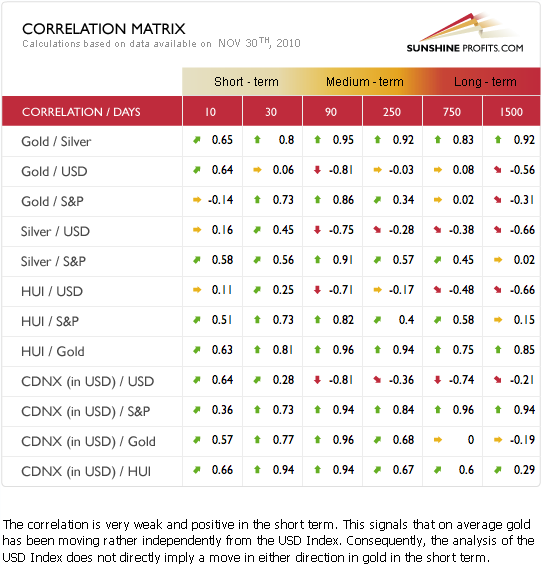

The 200-day moving average, the 38.2% retracement of the June-November downswing, and the 50% retracement from the December 2009 - June 2010 rally all provide indication that a local top is very likely. Additionally, we have the RSI indicator slightly above the 70 level, which used to mark the local tops in the past. The implications for precious metals are not immensely significant since recent correlations have been quite low. Based on historical correlations (visible in the medium- and long-term columns in the correlation matrix itself) a decline in the USD could actually give metals a boost and possibly accelerate their rally.

Summing up, the USD Index is likely to reach a local top soon or it is already in place . Gold, silver and mining stocks, which have been bullish of late, will likely be more bullish once this top is reached. A decline in USD Index levels would be an even more positive sign for the precious metals sector and likely provide additional strength to their rally.

Meanwhile, one can speak of relative decoupling of precious metals from currencies, and even (somewhat) stock markets

The note at the bottom of this weeks Correlation Matrix draws attention to the current relationship between gold and the USD Index. The general stock market and precious metals show little correlation unlike the past. For example, 10-day gold-S&P coefficient is -0.14 whereas the 30-day coefficient is 0.73. This is a dramatic change from a very high correlation to almost none at all, which reflects recent rally in gold that took place along with a decline in stocks. While the 10-day value is not significant by itself, it does suggest how the 30-day one may change in the future.

The implication is that declines in the general stock market would not cause a serious plunge in precious metals' prices. The strength that the latter have shown recently also supports this statement. The general stock market therefore should not be a major concern to precious metals investors at this time. Lower values in the 30-day column would be further confirmation of this statements validity.

Gold is not the only metal that has been on the rise lately - silver moved up in an even more profound manner.

The target level of $31 is still in place and investors are advised to monitor gold closely as silver moves towards this level. It is likely to be the case that gold and silver top/bottom will take place at the same time. We will have more to say on this in the weeks ahead.

The outlook for silver is bullish and price action seen this week confirms this sentiment. Although silvers volatility is expected to remain, the general trend appears to be upwards for the short to medium-term for the white metal.

As always, silver investors are strongly urged to monitor gold and mining stocks closely, especially when trying to time tops in the silver market. There is a strong likelihood that gold, silver and mining stocks will move together and reach tops at nearly the same time. Many indicators point to higher prices for silver but its unpredictability and volatility must always be taken into account and expected as part of the investment process.

Meanwhile, we have received several questions about the relationship between euro and gold (declining euro is bullish for dollar so it is bearish for gold - or is it?), so we would like to comment on that in the final part of this essay. One of the questions was:

Since the Euro is a primary benchmark against which the relative value of the dollar is established, the discussion among fellow PM investors increasingly turns to the scenario where the collapse of the Euro creates a spike in dollar value (triggering a subsequent collapse in PM prices).

In addition to the points made earlier in this Premium Update, we would like to provide you with additional thoughts regarding the euro down -> dollar up -> gold down scenario. In fact there were similar question several months ago, so we will base the reply on our previous comments.

Generally, the market mechanisms would work in the above-described way if we assumed that the value of gold in euros couldn't change. In this case, if the value of the dollar increased against the euro it would have to mean that its value against gold would also increase. In other words, the value of gold in USD terms would therefore decrease.

However, not only can the value of gold in the euro change, but it has very strong technical reasons to rally (as is visible on the gold:UDN ratio chart which trades very closely to the gold in euros). Moreover, it has been rallying and has now moved to new highs, as explained earlier in this update.

Now, if we assumed that the value of gold in euros moves much higher ceteris paribus (all other things unchanged), then the above implication (euro down -> dollar up -> gold down) loses its reliability.

Let's take a look at a simple situation:

Gold in euro moves up by 100% from 1,000 to 2,000.

Dollar goes up against euro from 0.7 to 0.9 (meaning that 1 dollar used to buy 0.7 euro and now it buys 0.9 euro).

What impact does it have on gold priced in dollar?

At the beginning, gold traded at $1,429 (1000 / 0.7) and now it trades at $2,222 (2000 / 0.9), which means that it increased by about 56%.

So - we have an increase in the value of gold in both: USD and EUR, which means that gold increased its value against the U.S. Dollar while the Euro decreased its value against the U.S. Dollar.

Of course, the numbers above are just hypothetical, and everything depends on the sizes of the respective rallies/declines, but the above example clearly shows that a decrease in the value of the euro (against the dollar) does not need to translate into a lower price for gold.

At this moment, it's not surprising to see European investors purchasing gold in response to their economic problems. Yes, there will be investors willing to purchase dollars as a safe-haven (which we found rather ironic when we first commented on this topic several months ago, and we still do), but some may be willing to purchase gold and silver.

Summing up, given the strength in precious metals fundamentals, we believe that fully investing long-term capital is both wise and prudent at this time as well as holding a small speculative position. Long positions should be held onto at this time. Investors are encouraged to subscribe to our services to gain further insights that will enable them to keep abreast of any changes in the state of the precious metals, should any of the bullish signals change - or should the bearish one emerge.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

The Greek philosopher Diogenes as early as the 4th century BC called money the politicians' game of dice. It seems like he hit it on the nail and that not much has changed since then. Fiat money requires faith, which seems to be rapidly evaporating, especially when it comes to the euro and dollar. That bodes well for the future of gold.

Gold is going up even though the USD Index is rallying - how is this possible if gold is priced in the dollar? In this week's update we comment on the current situation in the Euro and USD Indices and explain its implications for Gold Investors and short-term Traders.

6 of the 22 charts featured this week are dedicated to gold to make sure you are up-to-date with the most recent patterns and trading signals. Among many other things, we've covered the Dow Jones Transportation Index (which does not trade in tune with most of the indices) and precious metals stocks' performance relative to all other stocks, as it provides us with additional insight.

Finally, one of the SP indicators has just flashed a signal, so we comment on its consequences as well.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.