This essay is based on the Premium Update posted on October 15th, 2010. Visit our archives for more gold & silver articles.

Whether you call it a recession, or depression, or deflation, or recovery, for tens of millions of Americans, there's little difference. With the Mid-term elections upon us the odds are that the voters might make the new Congress more conservative.

Generally, it is believed that a more conservative government might lean towards self-control in spending (yeah, right), restraint in Keynesian stimulus policies, which means moderating the quantitative easing.

In the short term that could be good for the dollar and a near-term risk for gold. As the inflation worries could cease for some time, which would help the dollar and at the same time it could cause gold's gleam to fade temporarily as some people would believe that the inflationary period is over.

And then there is the so-called Presidential Election Year Cycle to take into consideration. The theory is based on the powerful incentives presidents have to get the economy looking ship-shape at the time of the next election. In other words, immediately after assuming office, presidents take whatever tough economic measures are necessary in order to set the stage for the recovery and good times. The tendency is for the market to outperform in the 3rd year after the election of the president.

Historical data seems to provide strong support for this theory.

Of course one could argue that the government's stimulus program in effect turned last year into the de facto equivalent of the third year of a president's term. What will happen next depends on how much longer and further the government will extend its stimulus. We believe that any quantitative easing and the printing of new dollars will only make precious metals a more attractive investment

Silver

This week's long-term chart for silver shows that the recent daily price increase has been accompanied by huge volume (charts courtesy by http://stockcharts.com.)

Note that in the past, when a spike was seen in daily trading volume above the 20M level, a price decline followed shortly thereafter in five of the six examples seen since the beginning of 2009. Such a volume level has been seen in recent days (marked with red and black arrows) and for this reason, a sharp decline in the coming days will not be very surprising and is, in fact, expected.

Based on past trends for similar length rallies, there is a good chance we will see a sharp decline in silver's price very soon given volume this big. A likely target level for this decline will be in the $20 to $21 range for the SLV ETF, slightly higher than we have stated last week.

There are few bullish signals at this time except for silver's price action itself. The bearish influences of the USD and the general stock market cannot be overlooked. As we stated in our pre-update message this week, "Silver is two days after its "close to the top" territory and slightly above the level created as target based on post-breakout-rallies. The deviations are not big enough for us to consider them as invalidating points made earlier."

Mining Stocks

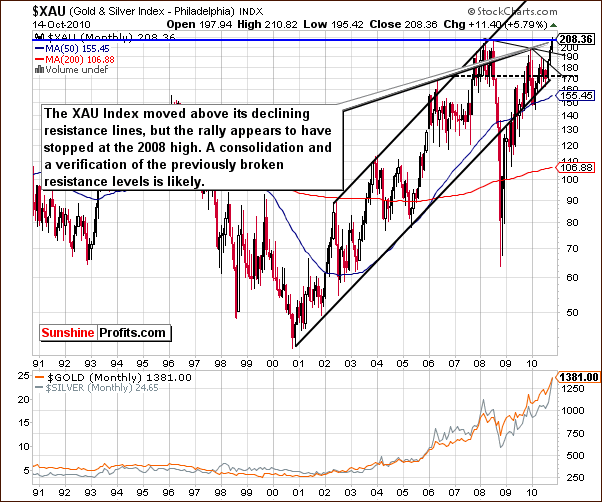

The XAU Index relates to gold and silver mining stocks and has many, many years of history. It is an important factor to consider because of its long-term resistance level - perfectly visible on the chart above. In recent days, the XAU Index approached its profound 2008 high. This is an important development especially in view of the rapid rise seen in mining stocks' prices recently (from the long-term point of view).

Two important declining resistance lines have been broken and will likely provide support in the not-too-distant future - they are marked with black thin lines on the chart above. Additionally, the lower border of the rising trend channel could coincide with one of the abovementioned resistance lines, close to the 170 level. It seems likely that a period of consolidation will be seen soon as the 2008 high level appears likely to provide strong resistance.

Indications from this chart have strong bearish implications in short term, even considered apart from other signals.

The past week saw gold mining stocks surpass their 2008 high but they did not get much above this level and thus this breakout is not really significant yet. The performance of gold itself was much stronger and on Thursday the mining stocks actually declined on a day when gold prices moved higher. Anomalies such as this are often seen around local tops and this is yet another sign supporting the likelihood that gold's rally may be coming to a close.

Summing up, multiple signs point to a consolidation period in the near-term for mining stocks. This is consistent with expectations in the gold and silver markets.

At Sunshine Profits we are constantly researching and creating new tools to help investors maximize profits. This week, Subscribers got a sneak preview of our useful new charts on stock options expirations.

With stock options expiring on the 3rd Friday each month, Subscribers focused on daily trades can greatly benefit from these charts. This new tool is of even more significance - we'd even go so far as to say, a whole lot more significant - for shot term traders in mining stocks options.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

Rescuing Chilean miners was indeed miraculous. It lasted slightly more than two months to bring them back to the surface and saving them from their nightmare. We are glad that this mission was successful. Speaking of rescue, economies are much heavier to lift up, especially when they are weighed down by the mountain of debt. Certainly a good outlook for gold in the long run.

But what can happen to gold, silver and mining stocks in the near future? We have analyzed the USD Index along with multiple other important factors to determine which road will be most likely chosen by the precious metals market. Additionally, we provide you with charts, which let you know what effect are stock options' expirations likely to have on the price of gold, silver and mining stocks.

Utilizing our analytical equipment we have slightly modified our targets for the next anticipated move. We are ready to take advantage from it and have some tips for those of you who wish to actively participate in the market these days. Moreover, we comment on the possible action that Investors interested in the junior sector might need to take soon.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.