The full version of our analysis (with comments particularly valuable for Precious Metals Traders) is available to our Subscribers. Visit our archives for more gold & silver articles.

The precious metals space is poised for robust gains in the long term on the back of strong supply- and demand factors. Declining mine production for precious metals has resulted in a tight supply scenario over the past few years, triggering prices. Key producers including South Africa, the U.S., Australia and Russia are showing signs of a gradual shortfall in potential output, creating a global supply deficit. Two other reasons have coerced prices to attain present levels: the upturn in industrial activities post recession and the return of investors due to subside in volatility. With demand remaining strong, a flat to negative supply scenario augurs well for precious metals.

Gold and Silver's Safe Haven Appeal - Uncorrelated with Market Movements

The strength in gold prices post recession shows that it is not only perceived as a hedge to protect wealth during an economic recession. Demand for gold has demonstrated endurance whatever the market conditions. Although imminent corrections cannot be ruled out, gold remains the investor's safe haven - the safest bet when looking for diversification and growth.

Silver, employed as both an industrial and investment instrument, has also been fairly strong in 2010. After a relatively flat period in 2008 due to the economic uncertainty (where it still outperformed the stock market), both gold and silver have had two consecutive years of Bull Run. Analysis of the performance of gold and silver over the past five years reveals that the long term trend for both the metals is upward and uncorrelated to market movements. It is this property of gold and also silver (to a large extent) that makes it a ‘must have' in any well diversified portfolio.

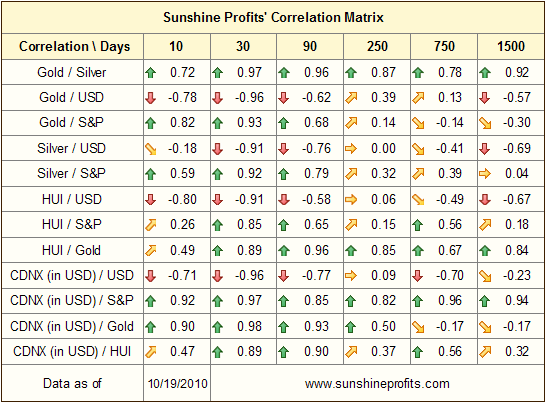

Please take a look at the latest correlation coefficients for details.

The numbers in the above table in the very long term column (based on the previous 1500 trading days) are either close to zero or negative - meaning that in the long run gold, silver, and mining stocks move in the opposite way to the USD Index, or the general stock market, or that - at best - gold moves on its own. In either case - by buying and holding your precious metals, your portfolio will be better prepared for a sudden downturn in the value of stocks or devaluation of the USD Index (here - meaning cash). In other words, if stocks and cash fail - you will still have your metals, which at that time are likely to be worth much more (in real terms) than they are today.

Gold holdings amplified in the recession because of the minimal risk of devaluation associated with the metal. In the current scenario, gold is appreciating again - this latest rally is attributed to its inverse relationship with the dollar (which is depreciating on US budget deficit concerns), improved risk appetite and inflationary worries. Market conditions, weak or strong, have always augured well for gold. There are more gains to come for gold - the greenback may weaken further with central banks seeking to build reserves with less dependence on the dollar. Gold is going to be critical in its new role as a hedge against dollar depreciation.

Robust Demand for Precious Metals Despite Signs of Saturation

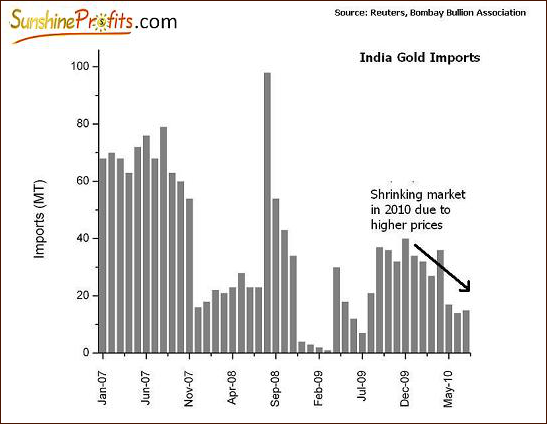

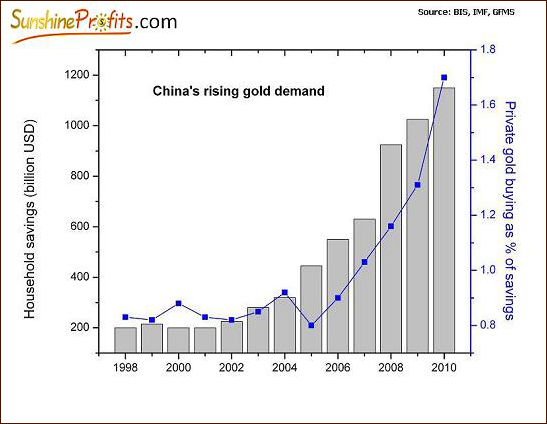

We examined long term demand for precious metals to find out whether their investment appeal is backed by strong fundamentals as well. While recent gold import numbers from India indicate that one of the key demand drivers is possibly fatigued because of price sensitivity, demand from China has been robust. China's growing demand for gold jewelry has helped position the country as the largest consumer of gold, overtaking India. China's household gold savings has also risen exponentially in the past few years. Notwithstanding the absence of standard ETFs for gold, China's investment in gold bars and coins remains strong in comparison with other countries - we expect consumption demand (particularly investment demand if not jewelry) to continue despite any further increment in prices.

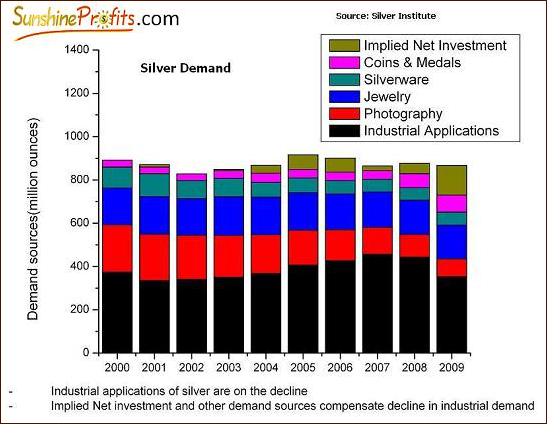

Silver demand is also expected to remain strong on increasing use as an investment vehicle. Historically fabrication demand has been the mainstay of silver, accounting for a whopping 95%, and investment demand for the balance. With demand from traditional strongholds such as the photography slowing due to emergence of new technologies, the investment side of the equation is continuing to grow with silver ETFs dominating the markets.

Although, industrial demand for silver from the photography sector is showing signs of relenting, demand from some other industrial sectors such as the electrical and electronics sectors (particularly in production of semiconductors), is rising irrespective of geography or market size. Despite the lull in 2008-09, the semiconductor industry has grown significantly in the past one year or so, on the optimism of strong demand recovery for electronic and electrical equipment.

More importantly, emerging end-uses such as nanotechnology, solar energy and silver batteries will likely substitute the unrelenting demand decline from traditional applications, providing a positive outlook for the metal. Overall, industrial demand for silver appears marginally positive with some give and take across sectors. Silver is also expected to be well supported by investment demand if industrial demand remains flat.

The demand for other precious metals - platinum and palladium - as auto catalysts had been severely affected with the U.S. auto industry plunging to abysmal lows since 2008. However, the US auto market has arrested the slide since early 2009 and is showing strength at current sales numbers, albeit at reduced levels. Auto catalyst demand is likely to remain at these levels in the US for the next few years and be boosted by improved sales in China, India and other emerging markets. Auto sales in China are reversing the downtrend, partially attributable to government incentives to refurbish the industry through implementation of the USD 585 billion fiscal stimulus. This is expected to boost domestic consumption and compensate for the contraction in exports, at least in the next one or two years. Global auto sales remains poised for strong growth, supporting platinum and palladium.

On the whole, long term prospects of precious metals are bullish on the back of a demand revival supported by supply tightness. The dynamics of gold is different from other precious metals. It is not only dictated by fundamentals alone (which appears sound anyway because of strong demand and flat supply). Currency debasement is likely to spur gold even higher from the current historic highs. Other precious metals, particularly palladium and platinum will likely remain closely tied to industrial activity.

Although the long term prospects for precious metals are bullish, there could be minor corrections in the short term. To time your investments better, we strongly advocate evaluation of detailed analysis providing suitable entry points. Subscribe to our Premium Service (Updates, Alerts, Charts and Tools) for much more in-depth analysis. We strongly encourage you to join our free mailing list today - you will be kept up-to-date with our new commentaries and you will also receive 7 days of full access to our website absolutely free. A good entry point based on expert insight is the key to superior investments and higher profits.

Thank you for reading.

Mike Stall

Sunshine Profits Contributing Author