tools spotlight

-

What I Have Learned after a Decade in the Gold Market

November 30, 2022, 5:39 PMThe gold market is very complicated, but I can offer you some tips on how to navigate through it.

The fall is the season of dying. Thus, it’s probably the best time to give up certain activities, prepare for winter (it’s coming!) and later re-birth. Hence, this is the last Gold Market Overview that I’m writing. Perhaps I’m not leaving the gold market completely, but I won’t be writing about it in this format. I am sharing here with you what I’ve learned in nearly a decade of writing about the yellow metal.

- The gold market is complicated. Gold can’t be valued like stocks or bonds because it doesn’t pay dividends or interest. It’s also neither a standard currency nor a normal commodity. Thus, simple models that focus on annual mining production or jewelry demand don’t work. Macroeconomic factors play an important role, but emotions and narratives are also important. The well-established correlations can suddenly break down, at least for a while. Hence, if someone claims that the gold market is simple and that he or she has created an elegant model for determining the price of gold, don’t trust such a person.

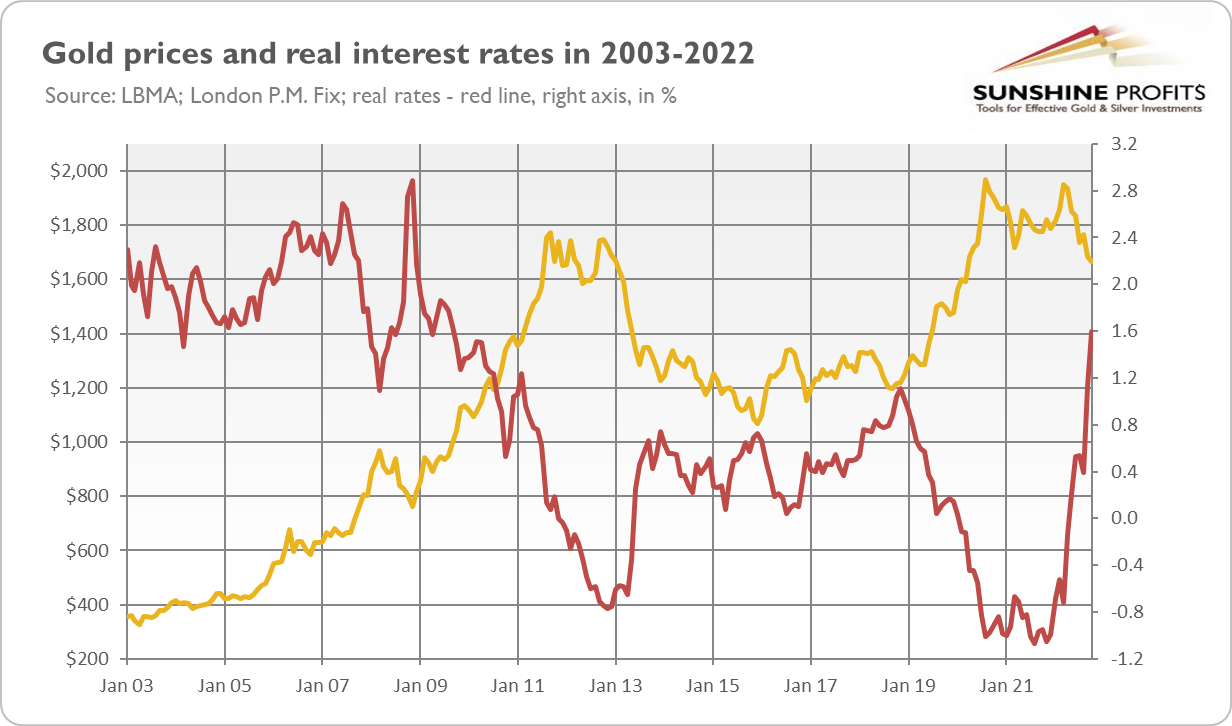

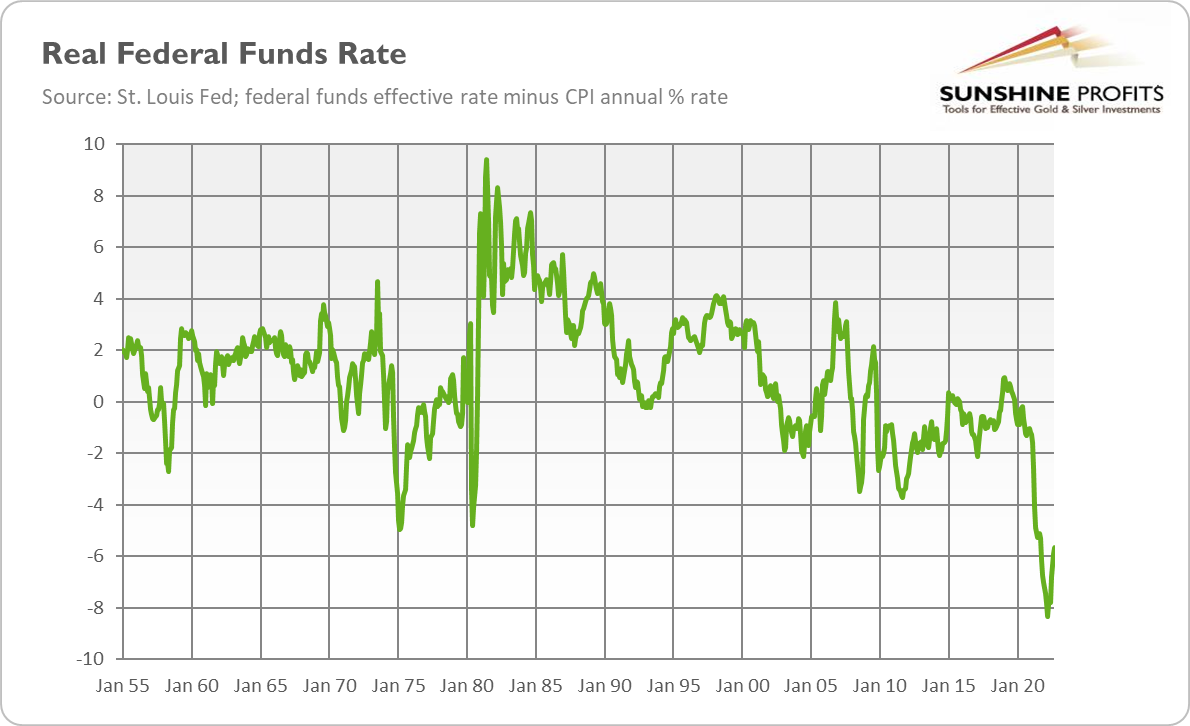

- The key fundamental factors in the gold market are real interest rates. As one can see below, these two variables appear on the chart as their mirror images. When real rates go down, gold rallies, and vice versa. However, this negative correlation changes its strength (for example, gold should plunge much more right now, given the surge in real rates), and sometimes causes even breakdowns (as it the case in 2005-2006).

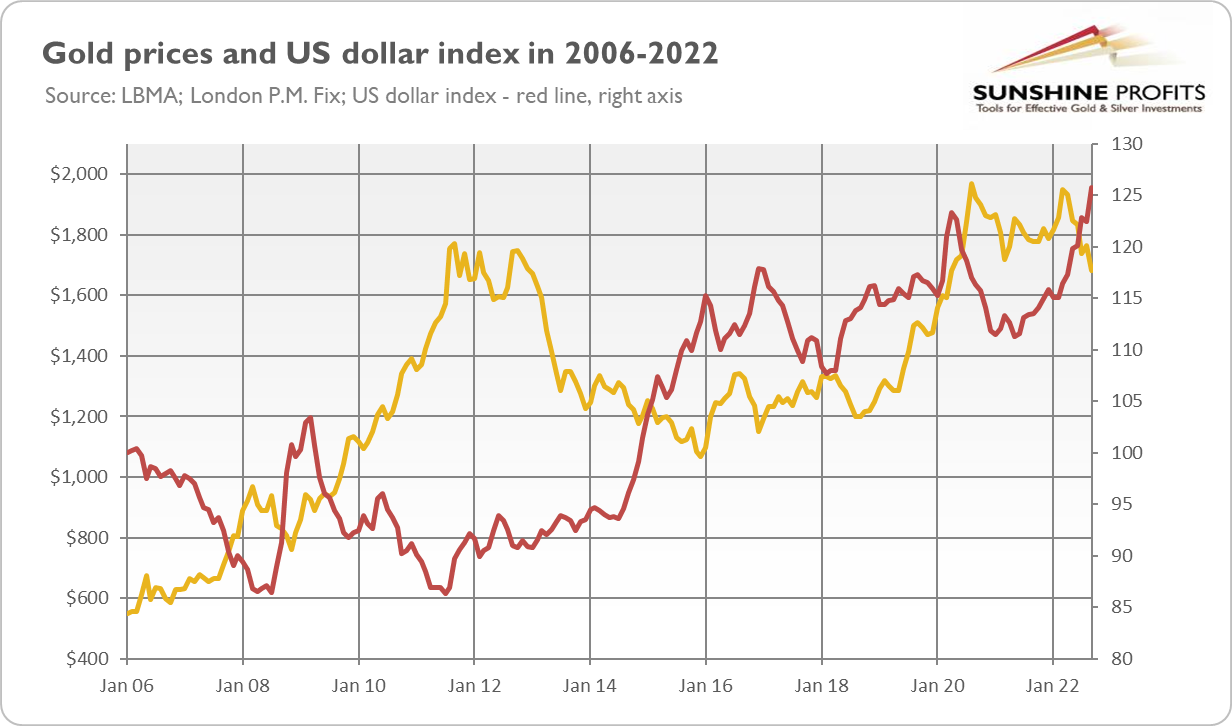

- Another significant driver of gold prices is the US dollar, whose strength is also negatively correlated with the price of the yellow metal, as the chart below shows. However, this relationship has a more fickle nature, as sometimes these two assets move in tandem.

- In the long run, gold prices tend to go up. Since 1971, the price of the yellow metal has surged by about 4300%, or 17.5% annually (geometric rate or return). In real terms, gold gained “only” slightly above 490% in the past half century, or 13% annually (geometric rate of return). Given the constant loss of the dollar’s purchasing power and the inherent instability of the monetary system based on fiat money, gold should be worth more in the next several dozen years.

- However, please note that gold is not a perfect inflation hedge. Not only did gold enter a long-term bear market in the 1980s and 1990s, when inflation rates were still positive (although declining), but it has also struggled in 2021-2022, when inflation has accelerated to about 9%.

- More generally speaking, don’t play other people’s games. What I mean here is that you should distinguish between long-term investing and short-term speculation. If you trade gold on a short-term basis, the fact that it tends to go up over longer horizons is of no help to you. As Lord Keynes famously said, “the market can remain irrational longer than you can remain solvent.” Similarly, if your strategy is to buy and hold, don’t worry about the daily hustle and bustle in the marketplace.

- Don’t be attached to your opinions. The greatest mistakes occur when investors believe that they are right and markets are wrong, or when they believe that gold should be rising or declining, even though the opposite has been happening for a long time. Gold is not obliged to do what you think it should do, it does what it does, it moves the way it moves. You can either accept it or take offense at the markets. The idea that markets are wrong can help you keep your self-esteem high and not admit your mistake, but it won’t help you make money.

- Remember that gold evokes strong emotions and that many analysts and market participants have strong opinions about it (sometimes ideologically biased), which are not always correct. Gold is neither a barbarous relic nor an asset whose price should always go up (and if it’s not happening, it must prove a manipulation). Pessimistic opinions are more widespread in the financial markets, as we’re evolutionary adapted to absorb bad news, but they’re especially loud in the gold market because fear mongers can sell more gold that way.

- Most of the gold market analyses are simply bullshit, especially the press coverage. The journalists are tempted to “explain” all moves in the gold market by some cause, even if they remain within the normal range of market fluctuations. For example, they can write that the price of gold declined one day meaningfully from $1,865 to $1,850 because of the hawkish Fed’s decision. But this is nonsense, as such a drop is just a 0.8% slide, while gold’s daily standard deviation is more than 1.1%. It means that the decrease was perfectly normal, given gold’s volatility, and could occur even without any meaningful market events.

- Investing in gold is more of a pricing game than a value game. This is because gold has no ‘intrinsic value’. It implies that market sentiment is crucial in the gold market. I’m not saying that gold just moves erratically, driven by animal spirits, or that fundamental factors don’t matter, but rather that they affect the gold price via investor perceptions and moods.

- That’s not all the important points about the gold market, but I’ve run out of space here. I hope that I’ll be able to share more insights on another occasion, somewhere in this beautiful universe.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the November Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Stagflation: the Worse for Us, the Better for Gold

November 23, 2022, 1:14 PMStagflation is coming – and it could make the 1970s look like a walk in the park.

As you’ve probably noticed, I expect a recession next year, and I’m not alone, as this has become the baseline scenario for many financial institutions and analysts. Even the DSGE model used by the New York Fed shows an 80% probability of a hard landing (defined as four-quarter GDP growth dipping below -1%) over the next ten quarters. Reasons? Inflation and the Fed’s tightening cycle. The history is clear: whenever inflation has been above 5%, the Fed’s hikes in interest rates have always resulted in an economic downturn. The key yield curve has recently inverted, which means that the most reliable recessionary indicator has started to flash red light.

Although the coming recession could decrease the rate of inflation more than I assume, given the slowdown in money supply growth, I believe that high inflation (although lower compared to the current level) will continue through 2023 and perhaps also in 2024 due to the excess increase in money supply during the pandemic. It means that recession is likely to be accompanied by high inflation, forming a powerful yet negative combo, namely, stagflation.

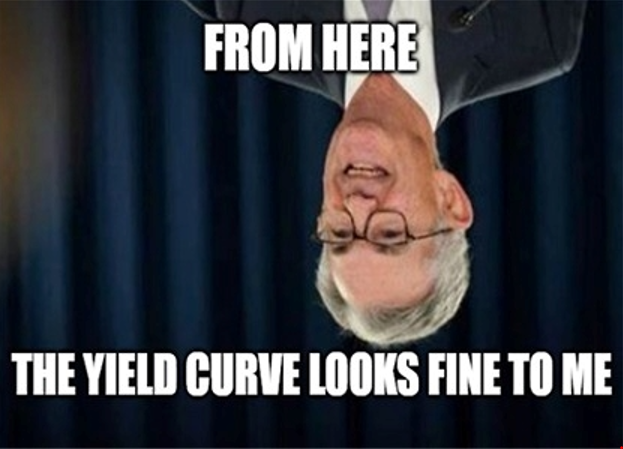

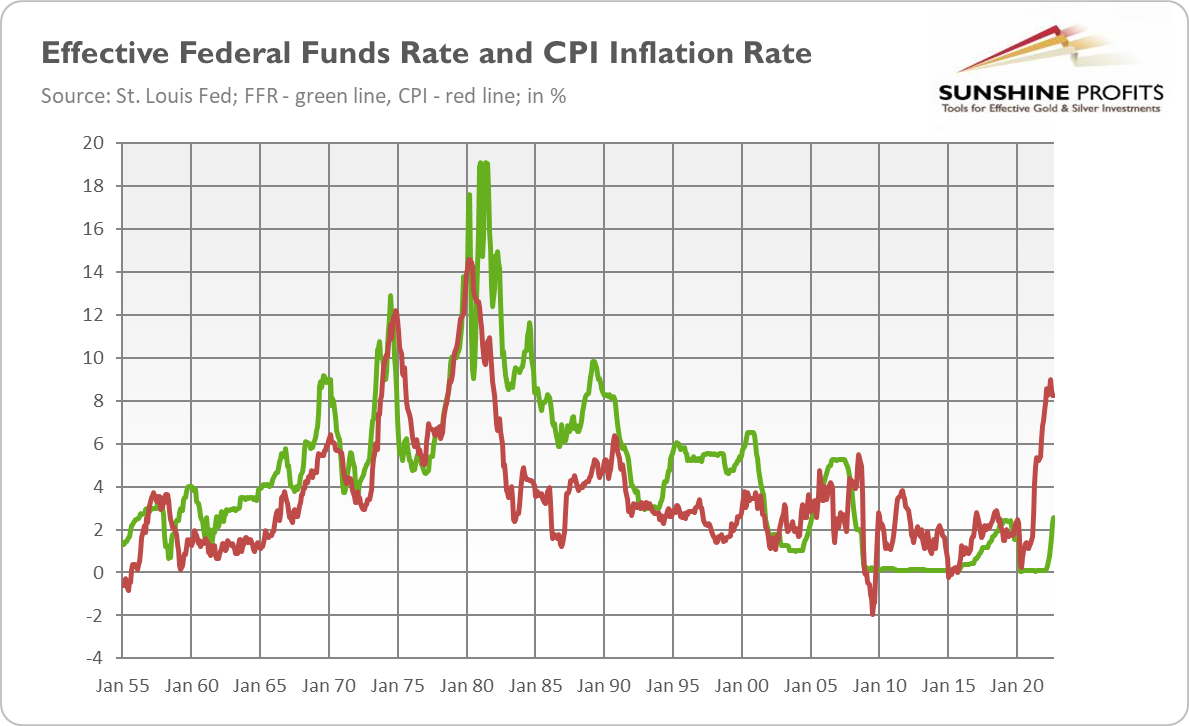

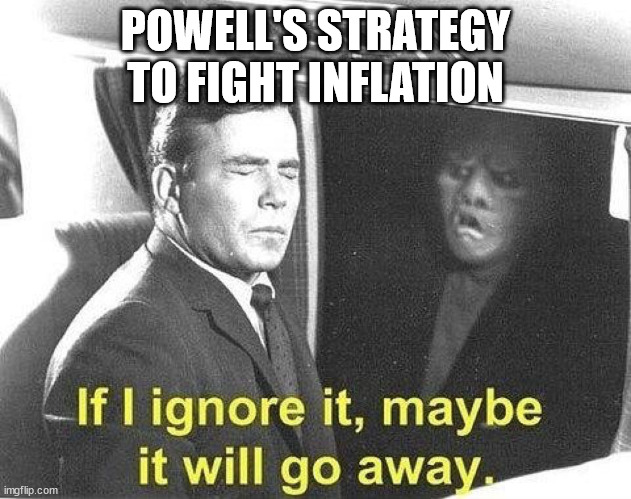

If the calls for stagflation are correct, it suggests that the coming recession won’t be mild or short-lived, as it’s not easy to combat it. In the early 1980s, Paul Volcker had to raise the federal funds rate to above 17%, and later even 19% (see the chart below), to defeat inflation, which triggered a painful double-dip recession. During stagflation, there is a lot of uncertainty in the economy, and monetary policy becomes much more complicated, as the central bank doesn’t know whether to focus on fighting inflation, which could become entrenched, or rising unemployment. In a response to the Great Recession or the Great Lockdown, the Fed could ease its monetary policy aggressively to address declining aggregate demand and neutralize deflationary pressure. But if inflation remains high, Powell’s hands are tied.

Some analysts argue that today’s financial imbalances are not as severe as those in the run-up to the 2007-2009 global financial crisis. Partially, they’re right. Commercial banks seem to be in much better shape. What’s more, inflation has reduced the real value of debts, and it remains much higher than many interest rates, implying that governments and companies can still issue very cheap debt.

However, financial markets remain very fragile. A recent example might be the turmoil in the UK after the government proposed unfunded tax cuts that altered the price of Treasury bonds and negatively affected the financial situation of pension funds. The level of both private and public debt as a share of global GDP is much higher today than in the past, having risen from about 200% in 1999 to about 350% today. It means that the space for fiscal expansion will be more limited this time, and that the current tightening of monetary policy all over the world could have huge repercussions for the global economy. We’re already observing the first symptoms: the financial bubbles are bursting and asset prices are declining, reducing financial wealth and the value of many collaterals.

This is why economist Nouriel Roubini believes that “the next crisis will not be like its predecessors.” You see, in the 1970s, we had stagflation but no debt crisis. The Great Recession was essentially the result of the debt crisis, followed by the credit crunch and deleveraging. But it caused a negative demand shock and low inflation as a result. Now, we could have the worst of both worlds – that is, a stagflationary debt crisis.

What does it all mean for the gold market? Well, to be very accurate, nobody knows! We have never experienced stagflation combined with the debt crisis. However, gold shone both during the 1970s stagflation and the global financial crisis of 2007-2009, so my bet is that it will rally this time as well. It could, of course, decline during the period of asset sell-offs, as investors could sell it in a desperate attempt to raise cash, but it should later outperform other assets.

To be clear, it’s possible that inflation will decline and we’ll avoid stagflation or that the Fed will blink and prevent the debt crisis instead of fighting with inflation at all costs, but one or another economic crisis is going to happen. When gold smells it, it should rebound! 2023 should, therefore, be much better for gold than this year, as the economy will be approaching recession and the Fed will be less hawkish.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the November Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Stagflation Is Coming, and Gold’s Gonna Love It

November 11, 2022, 8:52 AMAs the Fed tightens monetary policy, fears of overdoing it are rising. However, the US central bank is far from overtightening. It increases the odds of stagflation and a bullish time for gold.

As central banks all over the world are tightening their monetary policies, more and more analysts, including Paul Krugman, are afraid that Powell and his colleagues are hiking interest rates too aggressively, risking going too far. They believe that inflation will soon decline, so the Fed is braking too hard.

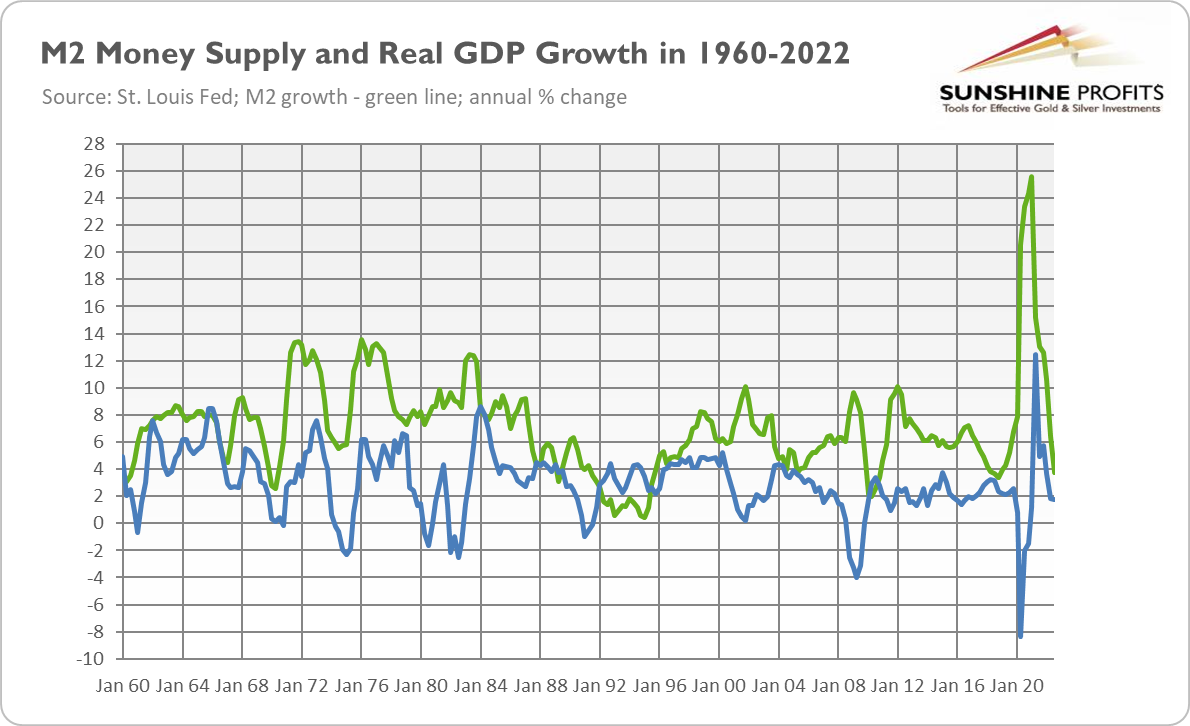

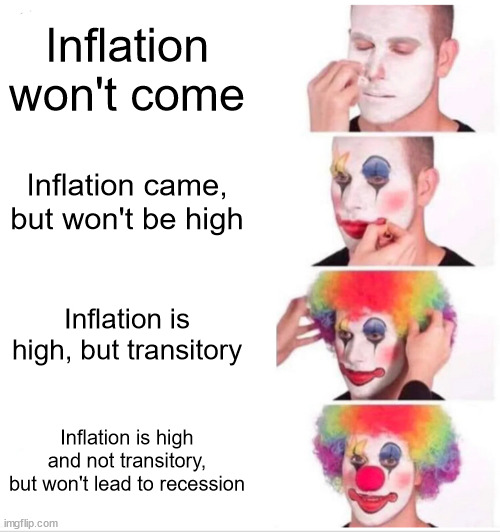

Well, as always, there is some truth in these opinions. The inflation rate is likely to decrease as the growth in the money supply decelerates and even declines below the pre-pandemic rates (see the chart below). And monetary policy operates with a long lag, which means that the effects of the hawkish Fed’s actions haven’t been fully felt by the economy. Hence, the central bankers could easily overdo. After all, they are so incompetent that overreacting to inflation after a long period of underreactin wouldn’t be surprising at all.

However, even my students are aware of lags in monetary policy, so there is a chance that someone from the army of PhDs working for the Fed has heard about them and taken them into account. But more seriously, although the pace of money supply growth has normalized, there is still an excess of money supply relative to output. As the chart below shows, since the global financial crisis, the increase in M2 money supply has been outpacing real GDP growth, reaching a peak during the pandemic. This growth differential hasn’t disappeared or turned negative yet, so with too many people chasing too few goods, inflation won’t go away very soon.

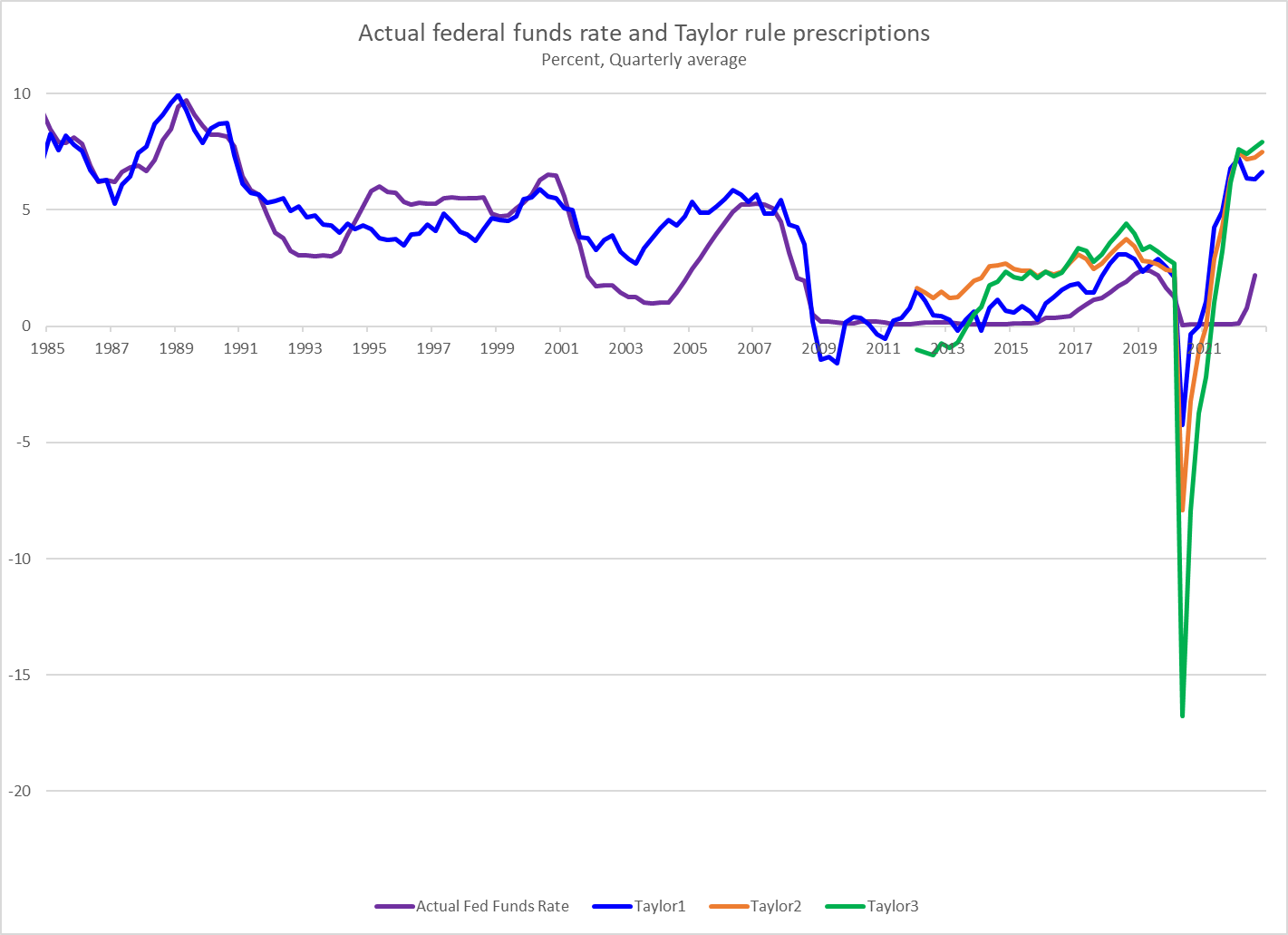

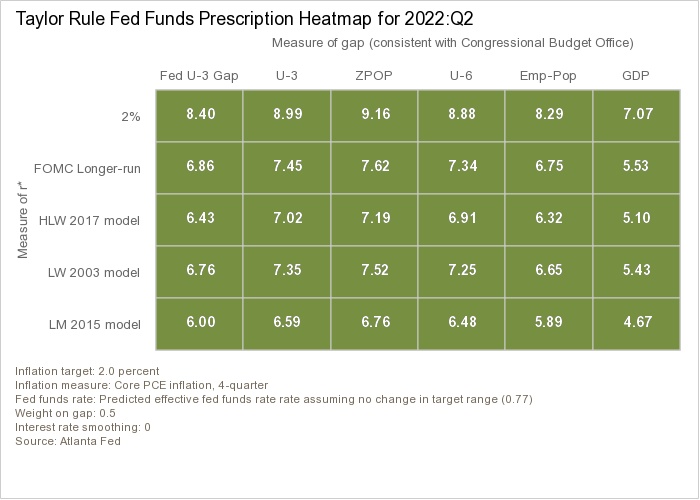

You see, the current monetary policy is hardly a tight one. According to the Taylor rule, the key tool used by the central banks, the Fed should set the federal funds rate at least at 6.7% (see the chart below) – just to have a neutral stance!

As the next chart shows, the real federal funds rate – understood as the federal funds effective rate minus the CPI annual rate – is still deeply negative. I’m not saying that inflation won’t disappear without the real federal funds rate being positive. After all, what’s fundamental for inflation is what’s happening with the money supply.

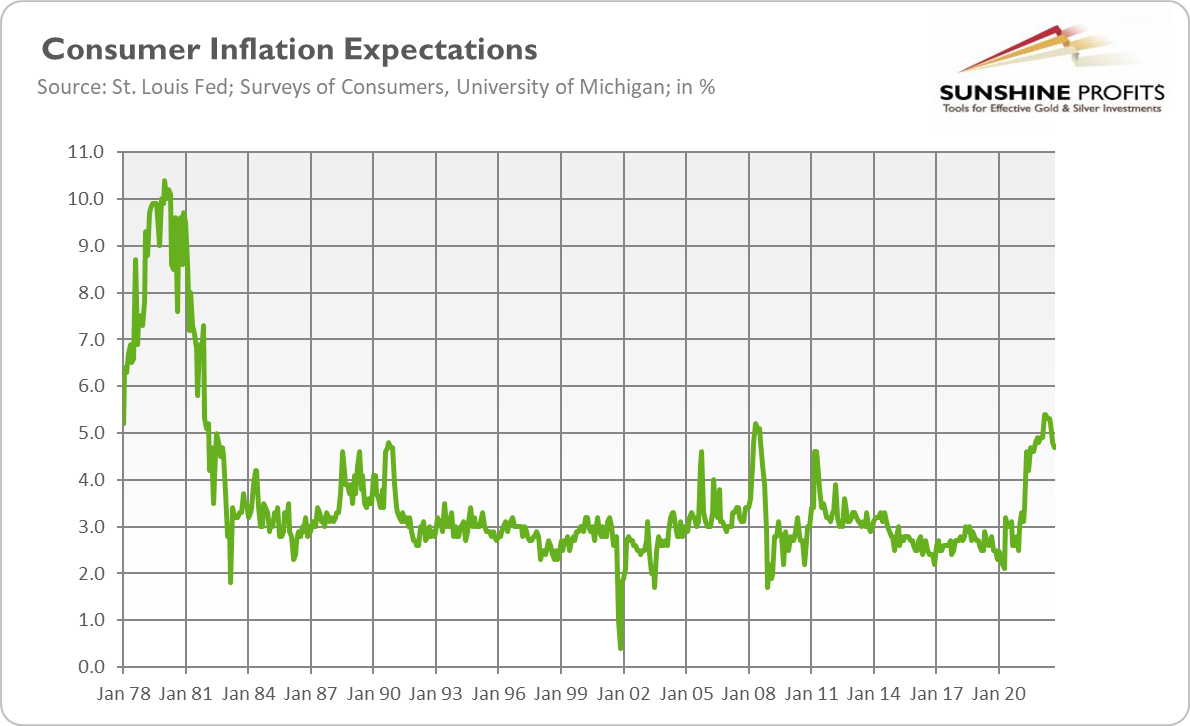

However, positive real funds rates are high enough to slow nominal growth and reduce demand in excess of supply. The point is that it could be difficult to re-anchor inflation expectations without positive interest rates. Inflation expectations seem to have already peaked, but they remain historically high (see the chart below). As a reminder, what Paul Volcker did was take a huge hike in the federal funds rate to bring rates into positive territory and restore confidence in the Fed, pushing inflation expectations down. He raised the federal funds rate to 19% at the end of 1980. The real rate surged from -4.8% to 7.3% and then to the record 9.4%. Compare it with the current -5.7 (as of the end of October). We are not even close.

What does it all mean for the gold market? Well, the truth is that the Fed is still conducting too easy, not too tight, monetary policy. The lending conditions have tightened, but this is because the financial sector has been cautious and forward-looking, not because the US central bank has become restrictive. We’re moving into this territory, but very slowly.

It implies that a recession is coming just when the real federal funds rate is still deeply negative and the chorus of voices calling for a softening of the Fed’s stance gets louder and louder. For me, this is a recipe for stagflation rather than a successful disinflation. So far, the Fed has kept a stony, hawkish face, but when the economic situation deteriorates, I bet it will blink and won’t try to fight with inflation at all costs. Have you seen how quickly the Bank of England intervened during the recent market turmoil? Actually, stagflation is certain, in the sense that the next recession will be accompanied by higher inflation than the last few ones. The question is how serious it will be!

That’s excellent news for the gold bulls, as stagflation is what gold likes best. This is because during stagflation, we have both economic stagnation and high inflation. When attacked by two enemies at the same time, most assets become vulnerable, and gold tends to outperform them. This is not surprising, as during stagflation there is a huge amount of economic uncertainty, confidence in the central bank is low, and real interest rates are on the decline, with some of them falling into negative territory. In other words, stagflation makes gold’s fundamental factors bullish.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the November Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Yield Curve Flashes Recession Alert! Better Times for Gold?

November 4, 2022, 11:50 AMThe key yield curve has inverted, shouting loudly that a recession is coming - and with it, better times for gold.

I activated the high-degree recession alert! I’ve been writing about the downturn for some time, but in October, another important indicator flashed a red light. As you can see on the chart below, the key yield curve has inverted.

Earlier this year, the spread between 10-year and 2-year US Treasury bonds (the red line) turned negative. In April, it timidly fell below zero for a while, but in July it did it again and with greater boldness, remaining since then in negative territory. Commenting on this event, I wrote:

This is a very important development, as it strengthens the recessionary signal sent by the April curve. The previous reversal was very brief and shallow – and thus not very reliable. But the second inversion within just four months implies that dark clouds are indeed gathering over the US economy.

I also added one important caveat about drawing too far-reaching conclusions about the recessionary prospects:

The more important spread between 10-year and 3-month US Treasuries hasn’t yet turned negative. However, it has flattened significantly since May, plunging to a level close to zero, and – after the next hikes in the federal funds rate – it could invert as well.

Well, this is what happened last month. As the chart above shows, the spread between 10-year and 3-month US Treasuries (blue line) fell below zero on October 18 (to -0.03%) and later on October 25 (to -0.4%), joining the club of negative spreads.

The inversion of this yield curve is a huge development, as it strengthens the recessionary signals sent by the 10-year and 2-year curves in April and June. Please remember that the 10-year and 3-month spread is believed to offer the highest accuracy and predictive power among all possible bond yields. As the chart below shows, this spread has turned negative before each recession in the 1982-2020 period (the research conducted by the New York Fed confirms this feature also for the earlier years, until 1968).

It means that each US economic downturn in the last five decades has been preceded by the inversion of this yield curve, and each fall below zero has been followed by the recession. In other words, as the inversion in this particular yield curve correctly predicted each of the last eight recessions without giving any false alarms, it makes it the most reliable recessionary indicator in modern economic history. It’s true that investors don’t have a crystal ball, but the yield curve is the next best thing they can use.

What’s also important is that the reason behind the recent inversion is not the decline in long-term yields but the increase in the 3-month Treasury yield, as the chart below shows. To be precise, both yields have risen recently, but the short-term yields simply climbed higher. Why? Well, the Fed’s tightening cycle and input price inflation made entrepreneurs and investors scramble for the funds needed to finish their investment projects. As they compete for liquidity and the Fed hikes the federal funds rate, short-term interest rates go up.

What does it all mean for the gold market? Well, the increase in the bond yields won’t help the gold prices – it can actually send them lower. However, the recessionary signal sent by the yield curve is clearly bullish for gold. If the predictive power of the yield curve remains in force, a recession is very likely to arrive by the end of 2023, as it historically used to follow the inversion of the yield curve after four quarters (or sometimes more). Hence, gold should also shine at some point in the near future. As the chart below shows, inversions of the yield curve have not only preceded recessions but also rallies in gold prices.

To be clear, what is positive for gold is not the inversion of the yield curve. Gold goes up together with the steepening of the yield curve, which happens when short-term rates decline. It occurs when the Fed smells a recession and starts to cut interest rates. In other words, gold needs the Fed’s pivot to reverse its downward trend. It’s a matter of time – some analysts believe that the January hike will be the last in this cycle – a recession is already on the way. The adoption of a more neutral stance by the Fed, which is quickly approaching, should allow gold to catch its breath and prepare for the future rally.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the November Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

The Queen Is Dead, Long Live the (Gold) King!

October 28, 2022, 12:17 PMQueen Elizabeth II died. She was a powerful anchor and symbol in the political sphere, just like gold in the financial realm.

The Power of Symbols

Her Majesty Queen Elizabeth II, the Sovereign of the United Kingdom of Great Britain and Northern Ireland and the Head of the Commonwealth, died on September 8, 2022. I’m not a British or Commonwealth citizen, nor a devoted supporter (and observer) of the British monarchy. And yet – together with millions of people all over the world – I was saddened by the death of the Queen. I began to wonder why it was such poignant news, given that she was not my monarch and that her role was purely ceremonial and formal (the Queen reigned, but didn’t rule).

The first common explanation is that Queen Elizabeth II was a fixture, a source of continuity and stability in an ever-changing world. In the words of the former Prime Minister, Lizz Truss, Queen Elizabeth was “the rock on which modern Britain was built”. Indeed, she acceded to the throne in February 1952, when Winston Churchill was Prime Minister and Harry Truman was President of the United States. It means that she ruled for more than 70 years, the longest of any British monarch and the longest recorded of any female head of state in history. She has simply always been there as Queen, many years before I and many other people were even born.

However, there must be much more than that – actually we don’t despair after the death of every old person who remembers WWII. It seems that, despite how modern and progressive we are, there is a magic in the monarchy that resonates with something deep in us. Please note that the UK’s Parliament is practically the supreme authority, but its members exercise their power in the name of the Crown. The government was, for seventy years, Her Majesty’s government, while the opposition was Her Majesty’s most loyal opposition. Of course, from the pragmatic point of view, it was just a play, but thanks to these rituals, the British monarchy remains a symbolic but integral part of the UK’s power structure.

Don’t underestimate the power of symbols! According to polls, more than a third of Britons regularly dream about the Queen and other members of the royal family. Elizabeth II could play just a symbolic role – but the symbol she embodied in herself was very powerful, almost religious nature. Actually, we can say that Elizabeth II was the most well-known representation of an archetype of the queen, one of the most important archetypes that symbolizes the wholeness and full potential of a woman and the ultimate in female leadership. The archetypal good queen is beloved as she takes care of her people and provides them with the structure they look to for safety. This is why her death disheartened so many people in the world.

The Queen and Gold

OK, but what does the Queen and her death have in common with gold (except she apparently liked gold pianos)? Should we expect some geopolitical turmoil right now that could support the price of the yellow metal? I don’t think so. Elizabeth was automatically replaced by her son as the next king, Charles III. And whoever reigns in the UK, he or she doesn’t rule, so the change on the throne shouldn’t disturb the functioning of the government. Perhaps some countries will leave the Commonwealth now, or this structure will disintegrate, but it shouldn’t pose any significant geopolitical risks that could support, even temporarily, gold prices.

I decided to write about the Queen’s death rather than because I see some parallels between the perception of the Queen in the political realm and gold in the financial sphere. Why do people despair after the death of Elizabeth? Because, as previously stated, Queen was a fixture and a symbol. So why do people buy gold? Well, because gold is also a fixture, the rock on which the modern financial system was built. The golden anchor was removed only in the early 1970s, but to this day we say “gold standard” to describe a certain ideal (for example, we say that randomized double-blind placebo control studies are the “gold standard” of epidemiologic studies). Elizabeth Windsor ruled for 70 years, while gold ruled as money for centuries, and although dethroned, it’s still with us.

People purchase gold also because it’s a powerful symbol, or even an archetypical form of money. You can easily verify it – please stop reading for a while and imagine a great treasure. What came to your mind? I bet that you saw precious metals, diamonds, etc., rather than credit cards or paper money. This is also why in times of crisis, people used to seek comfort in gold, an ultimate safe-haven asset, and in soothing speeches of the Queen. Hence, gold (nor a monarchy) is not a “barbarous relic”, but a powerful symbol deeply rooted in our psychology. If so, it won’t disappear anytime soon, but should last with us for a long time (although at what price is a completely different issue). The Queen is dead, long live the (gold) king!

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the October Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

China Is Losing Momentum. Will Gold Find It?

October 21, 2022, 12:51 PMChina is facing several economic problems right now. Will gold benefit from them?

The country was to become the biggest economic power that would dethrone the United States. Its pace of development was impressive and practically without precedent: in 1980-2010, the annualized rate of growth was an average of 10%. Understandably, everyone trembled at the mere mention of the country’s name: China. Not anymore. China’s economy is clearly losing momentum.

In some senses, the slowdown is not surprising. The wealthier the country, the more challenging it is to develop very quickly. As China’s economy grew, the deceleration was only a matter of time, and right now, the country is still severely hit by the strict zero-COVID

policy. According to Nomura bank, about 12% of China’s GDP is affected by harsh lockdowns and other sanitary measures. As a consequence, it cut the forecast of the country’s economic growth in 2022 to just 2.7%. As the chart below shows, the GDP contracted 2.6% on a quarterly basis and rose just by 0.4% year-to-year in the second quarter of this year. Beijing, we have a problem!However, the dark clouds go beyond the pandemic. Stephen Roach mentions three powerful forces at work here: a profound shift in the ideological underpinnings of Chinese governance towards less market-friendly and more nationalistic and statist ideology that focuses more on a muscular foreign policy than economic growth, a structural transformation of the economy toward more consumer and services-based, and payback for past excesses.

Other analysts add the issue of aging and population decline to this list. As the chart below shows, China’s population growth has been declining for decades – and this year it could actually shrink for the first time since the Great Famine of 1959-1961. According to the Shanghai Academy of Social Sciences’ predictions, from 2022, the population of China will decline annually by 1.1%, shrinking from 1.4 billion to about 600 million in 2100, if the trend continues. It would imply a decreased workforce and a slower pace of economic growth.

There is also a high rate of youth unemployment. In July, the unemployment rate among 16-24 year-olds hit an all-time high of 19.9%, as the chart below shows. Four years ago, when the data for the figure was finally made public, it was as low as 9.6%. Don’t expect mass riots, but high unemployment among young people could add some tensions and complicate the socio-political situation in China.

Let’s focus on an inevitable bust that came after the boom of the hyper-growth era. The best known manifestation of such a painful but necessary readjustment is, of course, the deflating property bubble. Paraphrasing Churchill’s famous phrase, never before have so many loans been taken by so many developers to build so many buildings in which so few people wanted to live! As Peter Hannam from The Guardian notes, “while China’s economy is roughly three-quarters that of the US or Europe, property assets have ballooned to double the size of America’s and triple Europe’s,” leading to one of the greatest misallocation of resources in the world. Suffice it to say that property companies are demolishing entire cities of half-finished buildings. Goodbye, ghost towns!

Remember Evergrande, which defaulted on part of its debt? This infamous company is just the tip of the iceberg. According to the S&P Global Ratings, 40% of developers are in “financial trouble,” and the situation may worsen further as some homeowners stop paying their mortgages in an untypical strike (the idea is simple: you stop construction, we stop paying mortgages). These boycotted loans could be worth as much as $300 billion.

What does China’s economic slowdown imply for the world’s economy and the gold market? Well, as China dominates global demand for many raw materials, its economic slowdown should take some pressure off commodity prices. On the other hand, the series of lockdowns could prolong the supply-chain issues and, thus, a period of elevated inflation. This could be positive for gold prices, but as long as the Fed remains hawkish and determined to beat inflation, gold will struggle.

We can't rule out the possibility that the real estate crisis will lead to a wider financial crisis, though given the peculiarities of Chinese state capitalism, I expect more of a Japan-style period of stagnation (or relatively low growth) rather than an American-style outright economic crisis. Gold could rally only if we see a contagion from China’s real estate to the US financial markets. Hence, gold bulls shouldn’t count on China’s economic problems – actually, the country’s slowdown could support the US dollar, putting gold prices under pressure. However, China’s economic slowdown would imply slower global growth, making the world more fragile and prone to recessions.

Last but not least, it could be that Xi Jinping decides to distract attention from economic problems and escalate conflict over Taiwan. In this scenario, gold could get support, although geopolitical tensions usually provide only a short-term boost.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the October Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

The Fed’s Challenge and Gold

October 14, 2022, 1:21 PMAs the economic slowdown deepens, the Fed’s challenges grow larger. It increases the risk of policy mistakes that could benefit gold.

Inflation Is Still a Challenge

It was a tough year for the Federal Reserve. The U.S. central bank’s inflation forecasts were embarrassing. In December 2021, it projected the PCEPI inflation rate at 2.6%, while it soared to 6.8% through June. The Fed disclosed $300 billion in unrealized losses on its assets as of the end of March, showing the negative impact of rising interest rates on the market value of the Fed’s balance sheet (that likely only intensified since Q1). There was a trading scandal with two top officials resigning.

The real challenges are still ahead of Powell and his colleagues. They are caught between a rock and a hard place. The rock is, of course, inflation, which was caused by the huge increase in the money supply in response to the pandemic. At its current level, above 8%, it’s intolerable and must be curbed. However, the hard place is an economic slowdown. The Fed continues its tightening cycle, but it might be too complacent about the strength of the labor market and overall economy.

Indeed, the OECD’s leading indicator of U.S. economic activity has been on a decline for months, as the chart below shows, while the latest PMI data shows a steep fall in output across the US service sector and the fastest fall in activity since May 2020.

The S&P Global US Sector PMI is really worrisome, as it shows a broad-based contraction in the private sector:

US private sector firms signalled a broad-based decline in output during August, as all seven monitored sectors registered contractions in business activity. It was only the second time on record (since October 2009) that all sectors had seen a decrease in output, the first time having been in May 2020 during the initial wave of COVID-19.

No recession risk, huh? You see, the problem is that the economy is already on the brink of recession, but the Fed hasn’t yet shown its hawkish claws. What I mean here is that with the federal funds rate at about 3% and inflation at 8.3%, the real interest rates are still deeply negative, below minus 5%, and the fiscal policy is also accommodative (although less than last year).

Thus, as Daniel Lacalle puts it rightly, “it is impossible to create a monetary tsunami slashing rates and pumping trillions of newly printed dollars into the economy and expect it to correct with a small splash of water in the face. It is worse, it is impossible to create a soft landing with an overheated engine.”

Indeed, the Fed never managed to engineer a soft landing during such high inflation.

The tightening of monetary policy initially hits only the most interest rate-sensitive sectors, such as housing, but it will affect the entire economy ultimately. The Fed reacted to inflation too late, but now – because of this delay – it could overreact, given the state of the U.S. economy, pushing it into recession.The Fed may also overstate the level of liquidity in the markets. So far, financial conditions seem to be just fine, while markets have ample liquidity. However, liquidity is very tricky as there is plenty of it – until it isn’t! History teaches us that during financial crises, liquidity quickly evaporates. The strengthening dollar only aggravates the problem, as it’s draining global liquidity and tightening conditions violently for large parts of the international financial system.

Implications for Gold

What does it all mean for the gold market? Well, the Fed’s trap is fundamentally positive for the yellow metal. For now, the Fed remains relatively hawkish, which boosts the dollar and puts gold under downward pressure. However, when the unemployment rate starts to increase and the next economic crisis begins, the Fed will have to – as a lender of last resort – reverse its course and adopt a dovish stance again. Many analysts are skeptical about the dovish pivot, but this is exactly what history suggests, especially given the level of private and public debt.

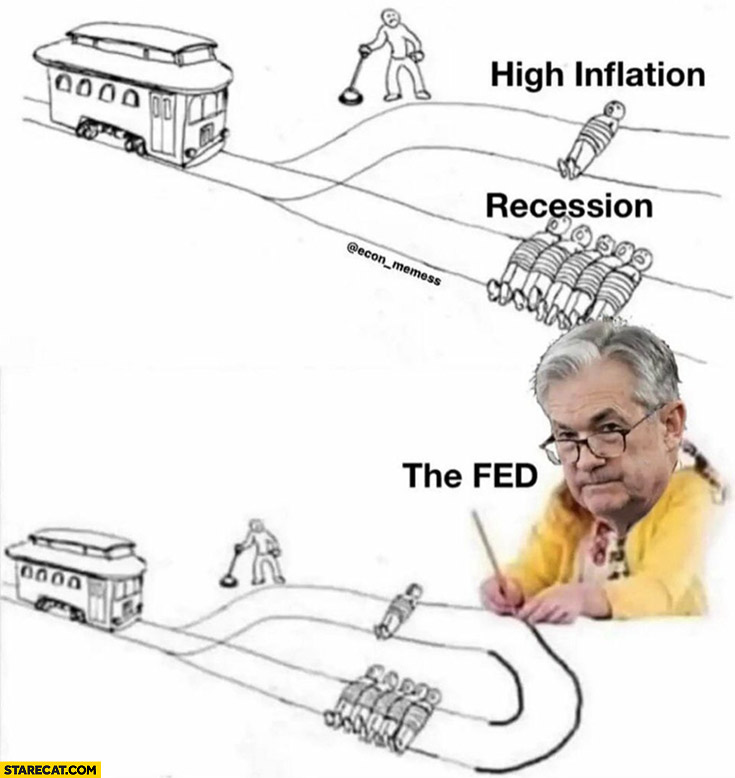

As recession is likely to be accompanied by still high inflation, the macroeconomic environment will be quite stagflationary, which should also support gold prices through low real interest rates and elevated demand for gold as an inflation hedge and a safe-haven asset. Additionally, in such an environment, there is a high chance that monetary policy will be “whipsawed, seemingly alternating between targeting lower inflation and higher growth, but with little success on either,” as Mohamed A. El-Erian puts it. This scenario is illustrated in the picture above, and it wouldn’t be good for the U.S. economy. But gold could finally shine then.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the October Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

The Queen Died, but King Dollar Lives On

September 30, 2022, 2:20 PMQueen Elizabeth II died, but King Dollar is the strongest in decades. Gold doesn’t like it.

To say that gold has been struggling this year is an understatement. As the chart below shows, the price of the yellow metal declined from above $2,000 to below $1,700 (as of September 20). That slide occurred during the highest inflation since the great stagflation of the 1970s.

One of the headwinds blowing strongly in the gold market has been the strong greenback. As the chart below shows, the American currency has been appreciating since mid-2021. The broad U.S. dollar index rose from 110.5 in June 2021 to 124 right now, or more than 12%.

Wait, wait a second. The dollar strengthened during a period of high inflation (see the chart below) in which money is losing purchasing power. How could the currency gain and lose value at the same time? It doesn’t seem to make any sense.

Nevertheless, it does. Because of inflation, the dollar is losing its internal purchasing power, i.e., how many real goods and services can we buy with these green pieces of paper? However, the exchange rate is about external purchasing power, i.e., how many pieces of paper with different symbols and signatures issued by foreign central banks we can buy. The answer is: more! As the chart below shows, the dollar is now near its highest levels in decades versus the British pound, the euro, and Japanese yen (please note that, for consistency, the chart paints the exchange rates as the dollar’s value in foreign currencies).

However, it doesn’t necessarily reflect the dollar’s greatness but the fact that other currencies have been even worse. As investors’ saying goes, the dollar is “the least-ugly mug in a beauty contest”. You see, the Fed was terribly delayed with its combat against inflation, but compared to other major central banks, such as the ECB and the Bank of Japan, it’s an uber-hawk that quickly stood up for a fight. Remember that exchange rates are all about relative values. For example, inflation in the euro area surpassed 5% in December 2021 and by now it has increased to about 9%, but the central bank didn’t lift its interest rates until July 2022.

The faster and more decisive Fed’s reaction increased the divergence in monetary policies and interest rates (see the chart below) between the dollar and the euro, which strengthened the value of the former. The mechanism was simple: higher rates in America attracted money from all over the world, and as investors have been buying dollar-denominated assets, the value of the greenback has increased.

So far, so good. Now, the question is, what does a strong dollar imply for the global economy? Problems! Why? Well, maybe because about 30% of all S&P 500 companies’ revenues are earned abroad, a stronger dollar reduces the dollar’s value of these sales. Or maybe because many governments and companies have international debts denominated in dollars?

Hence, the stronger the dollar, the higher the debt to be repaid. According to the IMF, 60% of low-income countries are in or at high risk of government debt distress. Tighter financial conditions in the U.S. and a stronger dollar could only increase the pressure on countries with foreign debts. The dollar is America’s currency, but the emerging market’s troubles. Egypt, Pakistan, and Sri Lanka have already asked the IMF for help – and others may follow suit.

Please also note that about half of international trade is invoiced in dollars, which means that importers are facing higher costs not only because of inflation and supply-chain disruptions but also because of the stronger dollar.

What does the strong dollar mean for the gold market? It goes without saying that the recent appreciation of the greenback has weighed on gold prices. If not for the strong dollar, gold would have fared much better. Indeed, this year, the yellow metal lost about 6% of its value when measured in the U.S. dollar, but it gained 6.2% in euros and 9.3% in British pounds. Thus, maybe gold’s performance hasn’t been disappointing, but simply the greenback has been shining, and maybe gold is an inflation hedge, after all (but in other currencies than the US dollar)!

It gives hope that when the dollar weakens (for example, due to the start of the recession and the Fed’s pivot, or due to the end of the war in Ukraine), gold will start rallying eventually. It seems that the greatest part of the upward move in the greenback is already behind us.

The strong dollar could also trigger some economic turbulence, which could benefit the yellow metal. However, I wouldn’t bet that financial crises in emerging markets will induce a safe-haven demand for gold. Precious metals investors don’t care too much about other countries than the U.S. or Western Europe.

There is a true silver lining for gold bulls: one reason behind the appreciation of the dollar. The Fed’s tightening cycle is only one driver, but another is safe-haven inflows. Investors have been moving to the U.S. dollar not because it is so strong, but because of economic turmoil and recessionary risk. If so, gold could at some point (perhaps when the Fed pivots and adopts a dovish policy again) start to move in tandem with the greenback.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the October Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

All Gold and Quiet on the Eastern Front

September 23, 2022, 12:36 PMThe war in Ukraine has entered its seventh month and some people believe that China is gearing up for a war with Taiwan. Will bulls invade the gold market?

In August, half a year had passed since the beginning of the war in Eastern Europe. Ukraine defended its independence but lost 13% of its territory. The six months of war between Europe’s two largest nations have brought death and suffering on a mass scale. More than 13 million people have been displaced, and nearly 7 million refugees have dispersed across Europe. Ukraine’s economy collapsed while the prices of food and energy have soared.

What is the situation on the front? Unfortunately, the aggressor’s troops maintain a relatively stable land connection with Crimea and are slowly pushing the Ukrainian army from its positions in Donbas, the main area of combat. It means that taking control of the rest of the Donetsk Oblast by the Russians is probably a matter of time, although it may take several more months. The change in favor of the Ukrainians is possible only if the West significantly increases its military supplies, which would enable an effective Ukrainian counter-offensive. It’s true that the Ukrainian counter-offensive in the direction of Kherson in the south of the country is gaining momentum – in particular thanks to the supplies of HIMARS – but a full scale operation is unlikely due to a lack of manpower and weapons.

However, that happened, Russia would then have to decide whether to give up and withdraw its troops or to announce a universal draft and full mobilization, throwing all its potential into the fight. It would take war to a whole new level, which could boost gold prices, at least temporarily.

What are the possible scenarios for the war’s end? Well, given that Russia’s military capability is gradually decreasing and the country needs an operational pause to build up its forces, it would like to sit down at the negotiating table with the aim of taking control of Donbas. However, Ukrainians are not ready to make any territorial concessions. Thus, the Russians will likely continue to bombard Ukrainian cities and blackmail the whole world with the nuclear power plant in Zaporizhia, trying to force Ukraine to negotiate and accept some territorial losses.

What are the implications for gold? Well, the war shows that gold bulls shouldn’t count on geopolitical events. Although gold initially gained during the first phase of the conflict, the impact was short-lived, as the chart below shows. At this point, when the situation has stabilized somewhat, and the war of attrition could last another several months – if not years, as some experts believe – gold is unlikely to be significantly affected by the conflict. This may change, of course, if the conflict escalates, for example, to the nuclear field.

Or to the Far East. You see, the war is having effects beyond Eastern Europe. For Beijing, the balance of power with the U.S. is shifting in its favor, as Uncle Sam’s focus is on Ukraine. If you look at the direction in which China is now going, you can clearly see its preparation for a conflict outside its own country. This is a huge departure from the well-known doctrine that China defends itself only on its own territory. Beijing’s angry response to Nancy Pelosi’s visit to Taiwan, including unprecedented drills, is very telling.

Is an invasion of Taiwan likely? Well, “the complete reunification of the motherland” is an official policy of China. What has recently changed is only the fact that China has built and modernized an impressive army, reaching a point where it could actually achieve its goal. The timing would be quite good for China, given its economic slowdown, President Xi Jinping’s aspirations, and the ongoing war in Ukraine.

Such a military conflict could be even more impactful than the war in Ukraine. This is not only because Taiwan is a great semiconductor producer and an integral part of the Western tech industry, but also because, unlike with Ukraine, the U.S. government hasn’t ruled out direct intervention to protect Taiwan. Actually, Uncle Sam, together with Japan and Australia, has verbal agreements to intervene militarily in the case of China’s attack. Hence, it could trigger WW3.

Given the fact that Taiwan is an island that could be quickly blocked by China, the U.S. and its allies wouldn’t be able to choose a middle ground and deliver weapons to Taiwan through neighboring countries like in the case of Ukraine. They would either give up Taiwan or engage in a full-scale military operation. Hence, the price of gold could react more vividly to the invasion of Taiwan than to the invasion of Ukraine.

However, Beijing is unlikely to launch a full-scale invasion of Taiwan in the near future, as China possesses only a fraction of the necessary ships to execute an amphibious assault. Moreover, the possible landing sites on the west coast are blocked by nearby mountains, and the island lacks the infrastructure to support invaders. Instead, China could choose options other than a full-scale amphibious invasion. It won’t be equally positive for gold prices, but the yellow metal could still gain somewhat, at least for a while.

The bottom line is that the war in Ukraine could last for several more months. However, gold bulls shouldn’t count that gold will benefit from it. The yellow metal could gain more only if the conflict escalates either to the nuclear field or to the Far East, with China’s attempt to invade Taiwan. However, both these scenarios remain unlikely, and even if they happen, their impact on gold should be only temporary. Fundamental factors are much more important for the long-term outlook of gold than geopolitical ones.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the September Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Wonders How Severe This Recession Will Be

September 9, 2022, 9:56 AMEconomic contraction is unfolding – but how painful will it be? The deeper the recession, the better for gold.

Let’s make it clear: an economic downturn is coming. We are already in a technical recession (GDP contracted in the first two quarters of this year), despite the White House’s attempts to change its definition.

A full-blown recession is just around the corner and will likely come out next year. At this point, another question is more interesting: how long will the pain last? Or, how deep will the contraction be? Will it be a short and shallow recession like in 1990-91 or in 2001, or a long and severe one like the Great Recession? Or maybe a short but deep one like the pandemic recession of 2020?

I don’t know . I forgot to take my crystal ball. However, I would exclude the last possibility, as the latest recession was mainly caused by the Great Lockdown – this is why it was so deep and short. This recession will be more normal – as long as recessions have anything to do with normality.

Actually, this won’t be a normal recession, as it will be accompanied by high inflation, which implies that we will experience stagflation. This is a strong argument for a deep recession. Why?

Well, the Fed is already engineering a recession (although Powell prefers talking about bringing demand and supply into balance) to slow inflation. Given how high inflation remains and how long the U.S. central bank has been in denial and inaction, it will have to continue its unprecedentedly large interest rate hikes. Such an aggressive tightening cycle could lead to a serious economic decline.

This is also what history suggests. There was no period of such high inflation that didn’t lead to a severe recession. There was a long recession in 1973-1975 and later a double-dip recession in the early 1980s. The recession of 1990-91 was milder, but inflation was lower, while the Fed’s reaction to it was faster.

Another argument that strengthens the pessimistic view is the size of monetary stimulus during the boom phase of this business cycle. The broad money supply increased by more than one fourth in 2020 in a response to the pandemic (see the chart below), as the central and commercial banks created trillions of dollars to tranquilize the population into accepting lockdowns. However, the higher the flight, the more painful the fall will be.

Last but not least, there is a lot of debt accumulated in the economy. The public debt is $30.6 trillion, or 124.7% of GDP, and there is also the private debt, which is actually larger than the public.

Thanks to recent declines, asset valuations are less stretched, but the financial system remains fragile. It’s true that banks are now in better shape than before the financial crisis of 2007-2009 and that they were rather unaffected by the pandemic. Hence, the replay of the Great Recession – when banks were severely hit, which resulted in a credit crunch – doesn’t have to occur.

However, there is so much debt that hikes in interest rates and withdrawal of liquidity in the form of quantitative tightening – not to mention any sudden events – could trigger a financial crash or an economic crisis.

What does it all mean for the gold market? Well, the mild recession, not to mention a soft landing, would be a relatively negative scenario for the yellow metal. It could still gain somewhat, but markets are forward-looking and when a recession is shallow, they would anticipate a quick recovery (which would rather support equities and other risky assets). The mild recession would also allow the Fed to stay relatively calm and to not fire all the monetary ammunition – while gold would prefer the U.S. central bank to go fully dovish.

On the other hand, a deep recession would be much better for gold. During severe economic downturns, moods are really pessimistic, and risk aversion is high. Hence, investors shift into safe-haven assets such as gold. What’s more, the Fed would then break out all available weapons to avoid a full economic catastrophe, even in the face of high inflation. This would create excellent conditions for gold to rally.

If a deep recession is accompanied by a financial crisis or sovereign-debt crisis, when confidence in a financial system and fiat money is ultra low, it would be a really perfect scenario for the yellow metal.

Which scenario is most likely? Given how high inflation is and how (relatively) aggressive the Fed’s tightening cycle is in response to price instability – the federal funds rate is historically still low, but the increase from 0-0.25 to 2.25-2.50% is huge in percentage terms (1800%) – I bet on a deep recession. It’s true that the boom phase was short, so not many malinvestments had time to show up, but there are many erroneous projects accumulated in the 2010s that were never corrected (some analysts even say about everything bubble).

A lot will depend on the path of inflation. If inflation decelerates relatively quickly and to an acceptable level, the Fed could announce a triumph over the inflationary beast (at least in the first battle) and reverse or at least pause interest rate hikes. Then, a recession could be relatively mild while its support for gold is positive but limited. However, if inflation remains stubbornly high, the Fed could continue its hiking cycle, which could trigger a potentially severe recession and make gold shine really bright.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the September Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

After a July Slowdown, Has Inflation Finally Peaked?

September 2, 2022, 12:48 PMInflation moderated a bit in July, fueling hopes that it has peaked. Are they justified?

Yes and no, but before I elaborate on this enigmatic answer, let’s see what happened in July. On a monthly basis, the CPI was unchanged then, after rising 1.3 percent in June, as the chart below shows. The core CPI, which excludes food and energy prices, didn’t come flat, but it still decelerated from 0.7% in June to 0.3% in July, according to the BLS.

The price hikes also took a breather on an annual basis. As the next chart shows, the seasonally adjusted rate of increase in the CPI slowed down from 9% in June to 8.5% in July.

Meanwhile, the core CPI rose 5.9%, the same pace as in the previous month. This is due to a 10.9 percent increase in the food index over the last year, the largest 12-month increase since the period ending May 1979. What’s important is that the headline inflation readings came better than the markets and analysts expected.

Does it all mean that inflation has already peaked? Yes, it’s possible, at least in the short-term. After all, the Producer Price Inflation (for finished goods) has also moderated recently. As shown in the chart below, the annual PPI rate of change rose 15.3% in July, down from 18.3% in June.

What’s more, the slowing economy coupled with the Fed’s tightening cycle could negatively affect the demand side of the economy and, thus, curb inflation. Additionally, some of the supply problems have already been resolved, while the rate of increases in the money supply has returned to a more normal level than seen before the pandemic. As one can see in the chart below, the pace of M2 money supply growth has peaked at 27% in February 2021 and since then it has decelerated below 6%.

Moreover, the monetary base has declined 8.6% in June 2022 over the last twelve months, while fiscal deficits have normalized, although at high levels.

However, it’s also possible that inflation hasn’t peaked yet. There is still strong inflationary pressure, and monetary forces operate with a significant lag. What worries me is the rising home prices (which are reflected in the CPI with a lag) and shelter costs. As the chart below shows, the CPI shelter subindex accelerated slightly from 5.6% in June to 5.7% in July. It’s really disturbing, as shelter costs are the biggest component of the CPI. They are also stickier and harder to fix than other constituents of inflation.

More generally, one month of moderation is not enough to draw any sensible conclusions about the future path of inflation, as there are always ups and downs on the way as a part of normal economic volatility. The Fed is still behind the inflation curve.

The key argument against prematurely celebrating the victory over inflation is that not all the newly created money during the pandemic has already shown up in inflation. Why? This is because people buried it in the backyard. Actually, they didn’t bury it but stashed money in their bank accounts. However, the economic effect is similar: the fresh money hasn’t been fully spent and translated into higher prices. When people spend all these excess savings, inflation will get a second boost.

Additionally, according to the Bank of International Settlements, “as inflation rises, it naturally becomes more of a focal point for agents and induces behavioural changes that tend to entrench it.” In other words, inflation has risen so much that it could become more persistent as self-feeding dynamics kick in. It means that “we may be reaching a tipping point, beyond which an inflationary psychology spreads and becomes entrenched.”

What does it imply? Well, as the main drivers are fading, inflation is likely to moderate somewhat in the near future. The local peak is near or it’s already been achieved. However, inflation is likely to stay elevated for some time. Actually, the top half of the population by wealth still has some excess savings. When people tap into them, inflation could accelerate again. I’m not saying that inflation rates will continue to rise, reaching double-digit values. My claim is that inflation hasn’t said its last word yet.

What does it all mean for the gold market? Well, the July deceleration in inflation is good news for the gold market because it may prompt the Fed to adopt a more dovish monetary policy. However, inflation is still obscenely high, which will force the U.S. central bank to continue its interest rate hikes and quantitative tightening. The second bout of inflation, if it happens, will only reinforce the hawkish stance of the Fed. But even without it, the central bank will continue its current monetary policy, unless there is a strong and decisive slide in inflation rates. The following increase in real interest rates would be negative for gold prices. However, the Fed’s monetary policy would lead at some point to recession or even to stagflation, which should make gold rally.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the September Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Sees Light at the End of the Fed’s Tightening Tunnel

August 26, 2022, 11:32 AMThe FOMC hiked rates by 75 basis points in July. However, the recession drums are getting louder, and gold likes such music.

Another large interest rate hike! The Fed raised the federal funds rate by 75 basis points to 2.25-2.50%. It was the second such big move in a row, making the current tightening cycle the steepest in modern history. So, the Fed must be hawkish now, right?

Well, not necessarily. The Fed is tightening its monetary policy – and it’s doing it relatively fast. That’s true. However, the Fed hasn’t turned hawkish or restrictive yet. You see, the Fed raised rates to a merely neutral level – and to “neutral” only in the very specific meaning of “the projected appropriate target range for the federal funds rate over the longer run” (according to the latest dot-plot). However, according to the Taylor rule, the federal funds rate should be around 7% (the median) or at least 4.7%.

Hence, despite all the hawkish rhetoric, so far, the Fed has lifted interest rates from extremely accommodating rates to moderately accommodative levels. There is still much to go to reach restrictive levels. This is bad news for gold, which generally doesn’t like rising interest rates. As the chart below shows, the Fed’s balance sheet has barely declined in recent weeks, despite the beginning of the quantitative tightening.

However, it shouldn’t be long before the Fed throws in the towel and eases its stance again. In the July monetary policy statement, the FOMC admitted that “recent indicators of spending and production have softened,” and during the press conference, Powell signaled that the pace of increases will likely slow down in the near future. Additionally, the Fed got rid of its forward guidance. Then Powell said: “We think it's time to just go on a meeting by meeting basis, and not provide the kind of clear guidance that we did on the way to neutral,” which indicates that the US central bank is very uncertain about the state of the US economy. The Fed could have provided a decisive hawkish path of rate hikes – instead, it will be data-dependent. It suggests that the Fed is worried about the recession and is preparing a justification for a dovish turn.

Last but definitely not least, the American economy has already entered a technical recession, as defined as a period of two quarters with negative economic growth. According to the Bureau of Economic Analysis, the U.S. GDP dropped 0.9% in Q2, following a 1.6% contraction in Q1. And please remember that the full effect of interest rate hikes hasn’t been felt by the economy yet. Hence, the odds of soft landing have decreased – and Powell admitted it, saying: “We know that the path [to soft landing] has clearly narrowed, really based on events that are outside of our control. And it may narrow further.”

The only thing that makes the Fed feel quite comfortable when tightening its monetary policy stance is that the unemployment rate remains very low. However, the labor market is in worse condition than the unemployment rate suggests. Moreover, the unemployment rate is a lagging indicator. Thus, if economic news worsens, especially that related to the labor market, the Fed may pivot and return to a very accommodative stance. Actually, as the chart below shows, the federal funds rate is at the same target range of 2.25-2.50% seen in 2019, when the Fed ended its previous tightening cycle and started to cut interest rates.

Of course, inflation is now much higher, so the rates could go up in a more decisive way. However, it could be difficult for the heavily indebted and financially fragile economy to stomach much higher interest rates. My bet is that the Fed could raise the federal funds rate three more times by 50 basis points at best. Then it would reach its predicted level for 2023 in the last dot-plot. Given that the economy has already weakened significantly since the time of this projection, I wouldn’t be surprised if the Fed stopped its tightening cycle earlier, for example, after only two 50 basis point hikes. It could be hard to justify interest rate cuts with such high inflation, but if inflation peaks and there is disinflation, the US central bank could at least pause hikes and adopt a more dovish rhetoric. In other words, the Fed could pull the lever and divert a runaway trolley from ‘recession’, sacrificing rather high inflation than a deep recession.

What does it all mean for the gold market? Well, the US economy is going to slow down, but that doesn’t automatically mean that the Fed will bring inflation under control. Rather, we could have stagflation, which should be positive for gold prices. The July FOMC meeting could be a game-changer for gold. This is because it was the first meeting in months that wasn’t unequivocally hawkish but included some dovish signals, mainly because of the economic slowdown (or recession). In other words, there is a light at the end of this tightening tunnel. The light that could make gold shine. The deteriorating macroeconomic outlook should boost safe-haven demand for gold, while a very steep pace of hikes (that is going to slow down soon) could make gold find its bottom and start its next rally.

Thank you for reading today’s free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, and the gold market, we invite you to read the August Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

2022 Doesn’t Have to Be Like 1980 for Gold

August 19, 2022, 1:58 PMA recession is coming – but will it really be positive for gold? After all, the yellow metal plunged in 1980, despite an economic downturn.