Based on the March 9th, 2012 Premium Update. Visit our archives for more gold & silver articles.

On Tuesday gold prices continued to break down, falling for a fifth consecutive day breaking below the 200-day moving average. On February 6th we suggested getting out of the speculative long positions, and reiterated it yet once again just a day before the crash. But this week on Tuesday, our SP Gold Bottom Indicator flashed a long-term buy signal. The indicator is just one of the unique proprietary investment tools developed by Sunshine Profits, available only to our subscribers. We tend to take this particular signal seriously since it has proved to be uncannily accurate in the past (you can click the chart to enlarge it if youre reading this essay on sunshineprofits.com).

In 2011, for example, it flashed a buy signal five times on:

· January 24th , right before a major bottom,

· June 29th , a few days before a major bottom,

· August 26th , followed by a $200 rally,

· September 27th , followed by a $150 rally

· Dec 19th, a few days before a major bottom

All in all - 5 out of the last 5 times this signal flashed, a substantial rally followed - either immediately, or a few days later. Consequently, the situation in gold is now bullish for the medium term.

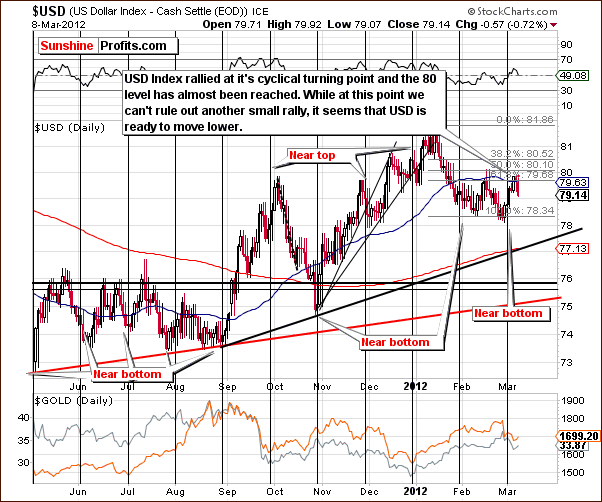

To see if our SP Gold Bottom Indicator will hit the mark yet again, let's take a closer look at the markets that can at times drive the prices of precious metals. We will start with the USD Index (charts courtesy by http://stockcharts.com.)

There has been no real change this week as the index rallied a bit early in the week and then declined. Thursdays closing level is a bit more than a point higher than a week ago, so the overall change for the week is quite minimal so far.

The index level is still quite close to the long-term resistance line and no breakout has been seen. At this point, the odds appear to favor a continuation of a downtrend here in the USD Index.

In the short-term USD Index chart, a small rally began after the cyclical turning point was reached, and the USD index approached the 80 level, reaching 79.92 only to decline thereafter. It is unclear whether the top is in or if higher index levels will be seen anytime soon.

The odds based on the long-term picture appear to favor a move to the downside with very limited upside potential from Thursdays closing index level. The downside target levels at this time appear to be close to two important support lines in the range of 77 and 75 respectively.

The situation is the USD Index is tense and at this time appears slightly more bearish than not for both: long- and short-term.

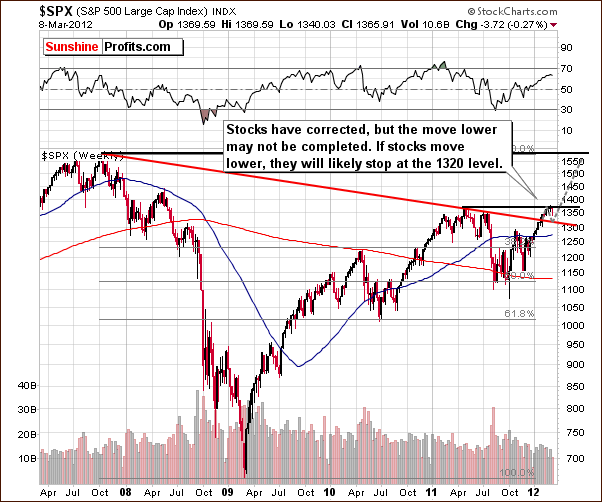

The long-term S&P 500 Index chart provides us with bearish indications this week. Target levels based on this chart in previous weeks were not reached as the S&P 500 moved about half way between the previous top and our previous target of $1,320. This downside target level appears likely when comparing recent trading patterns with those seen at the end of 2010. The decline so far has been small, so more consolidation is possible before the rally resumes.

In this short-term SPY ETF chart, we see a correction to an important support line, followed by a move higher. This is a bullish indication and an immediate move to the upside is indeed possible from here.

The situation in the general stock market is mixed with small moves to the downside possible. The S&P 500 will likely go no lower than $1,320 and this appears to be about 65% to 70% probable.

We are not certain if the correction is over or if another move to the downside is coming; the long and short-term pictures are simply not clear at this time.

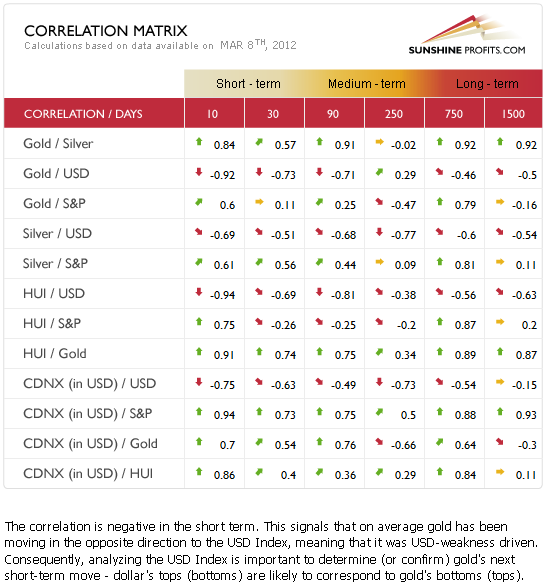

Our correlation analysis provides information that the coefficients between the precious metals sector and the general stock market weakened this week. The uncertainty in the stock market picture is therefore not as important for the precious metals, though it is a bit more important for silver than gold. The correlation between the USD Index and the precious metals remains in place and negative.

Please note that our general outlook on the precious metals market has changed from a bearish one, to a bullish one. If you recall what we wrote in our last essay on precious metals and manipulation (March 6th, 2012):

The situation ( ) is normal once again (metals move along with stocks and in the opposite way to the USD Index). Consequently, whats bullish for USD and bearish for stocks is bearish also for the precious metals market.

The picture has changed now the rally in the dollar seems to be over and, therefore, the general short-term outlook for precious metals is more bullish than not. However, we would be far from suggesting that an immediate move up is a sure thing now.

Summing up, as the short-term outlook for the dollar is rather bearish and the greenback continues to trade in the opposite direction that precious metals do, the implications are more bullish than not for gold, silver and gold and silver mining stocks. The medium-term trend is up.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

Gold moved slightly higher this week, but the key question now is if this move is just a bounce within a bigger decline or is the decline over and metals are now poised to soar. Fortunately, we believe we have found a way to distinct between these two cases. Surprisingly, it's not the analysis of volume.

Another important thing that we provide you with this week are upside targets for gold, silver and mining stocks along with probability that they will be reached within the next 3 months.

Naturally, all of the above is based on the in-depth research of multiple markets and indices. The ones that we feature this week are: USD Index, S&P 500, SPY ETF, precious metals Correlation Matrix, gold, a non-USD gold price, GLD ETF, 2006-based roadmap, silver, SLV, crude oil, XAU, HUI, GDX ETF, and 3 of our in-house developed indicators that have flashed signals this week along with our interpretation.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.