Based on the November 10th, 2011 Premium Update. Visit our archives for more gold & silver articles.

This weeks events are like theater, with shades of a Greek tragedy. In a play the audience knows that if there is a gun in the first act, it will be fired in the third. Now were in the second act and so far, the plot is predictable. The script was written back in 2008 when the subprime crisis hit.

This week one of the actors, a wily 75-year-old politician who, in an opera-like plot survived allegations of sex and corruption, finally had to get off the stage. Italian Premier Silvio Berlusconi pledged to step down after the Italian Parliament will approve austerity measures meant to stave off the nightmare scene of a bailout. Italys borrowing costs rose further towards unsustainable levels on Wednesday passing the key 7% level brushing up against levels that, once crossed by Greece, Portugal and Ireland, led to a quick erosion of confidence that triggered international bailouts. Italy has amassed more than $2.6 trillion in debt and its bonds are among the most widely held in the world. Any hint in this theatrical plot that they might not be worth their promised value could shatter investor confidence.

Analysts are concerned that if interest rates on Italian debt keep rising, the country may no longer be able to afford to borrow on the open markets and instead would have to turn to official lenders like the European Union or the International Monetary Fund. Given Italys size its economy is bigger than Russias or Indias it would certainly test the resources of euro-zone nations and the International Monetary Fund. Such a situation, coupled with the deterioration of the dollar, would most likely result in higher uncertainty among investors and in higher prices across the precious metals sector.

Having said that about the more distant future, we would like to move from Italy to gold and take a look at golds performance for the upcoming short term. Lets start the technical portion with gold itself (charts courtesy by http://stockcharts.com.)

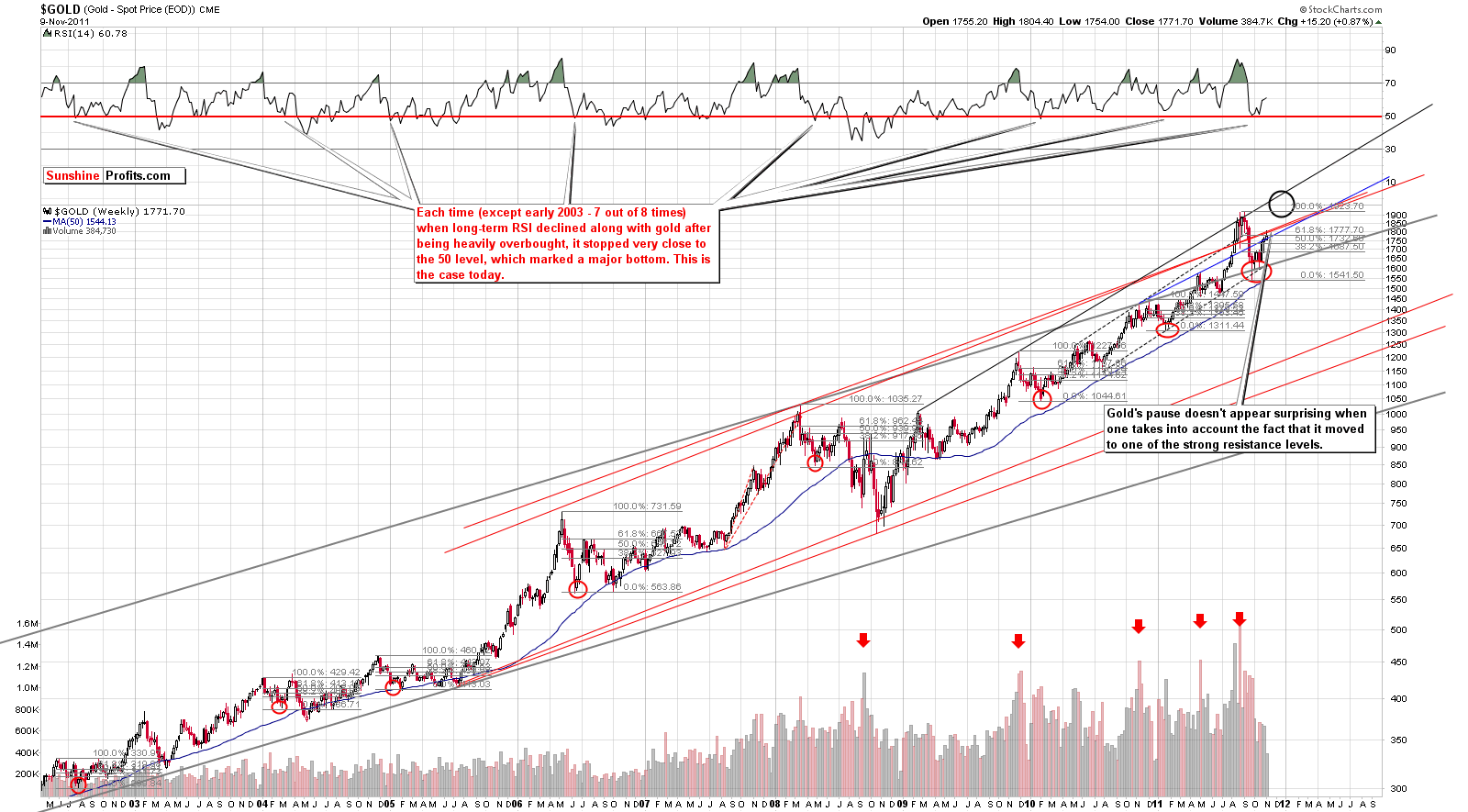

We begin with a look at the very long-term chart (please click the above chart to enlarge it). If you recall what we wrote on October 21st, 2011 (just before the recent rally) in our essay on the bullish outlook for gold:

We are inclined to think that were relatively close to an upswing in gold. The point here is if a decline is seen before the upswing, it could simply be the formation of a double bottom with the rally yet to come. So a short move down did not invalidate any rally this week since the rally had not yet begun. We have simply seen a rebound after an initial bottom with a second bottom now being formed. As long as the two support levels in the $1,600 range hold, the outlook remains bullish.

Once again, the bullish case appears to be in the cards. From a long-term perspective the recent decline appears quite small. We look at this chart to see if Wednesdays market action is cause for concern.

Given that gold has reached the upper border of the very long-term trend channel based on the 2005-2011 rally, the 1.5% decline seen on Wednesday is not really of great concern. This appears to be quite a normal development and since this same resistance line has been broken recently, it could fail to hold golds rally when approached once again. In short, the pause in the rally is not something to worry about right now.

In the long-term chart of gold from a non-USD perspective, gold has reached the upper border of the rising trend channel, a resistance level, which was broken just a few months ago. The resistance level created by previous tops is likely much stronger. The pause is visible in this chart but it is unlikely that the rally has stopped. A move to the level of previous highs seems to be a good possibility.

Looking at gold from perspective of the Japanese yen, the RSI level of the index is far from oversold and is not giving a sell immediately signal either. It seems the time to sell would likely be when the index moves up to around 14.5 15, the upper border of the rising trend channel. In the past, RSI levels close to 70 did not coincide with final tops for this index. Generally, an intermediate top was seen followed by a period of additional rally. This seems to be a likely scenario for the coming weeks here as well.

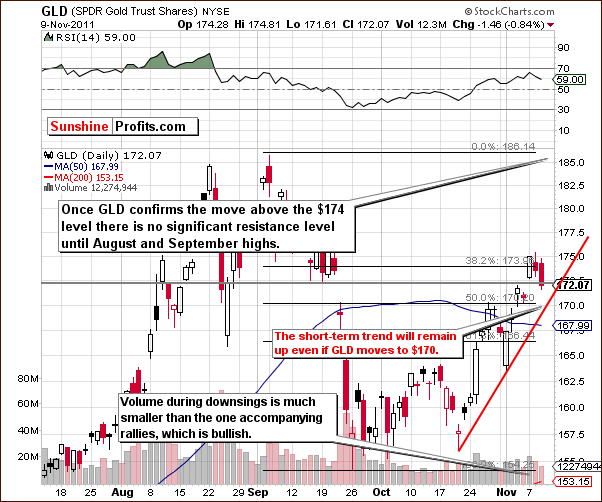

In the short-term GLD ETF chart, we see that the decline in golds price has not changed the short-term trend. Prices are well above the rising support line and insignificantly below the level of the mid-September low. There is still an important resistance line in play, the 38.2% Fibonacci retracement level based on the whole September decline.

The GLD is now verifying a breakout above $172 and appears to be consolidating somewhat. The move above the resistance line close to $174 was not verified, however. There does not seem to be a need to worry as it still appears that an additional rally will likely come soon. In fact, even a move lower, to $170, would not be a reason for concern.

Volume levels this week were low on declines and higher when prices rose. This confirms the bullish, short-term outlook here.

Summing up, the short-term trend for gold remains up and Wednesdays price decline was truly quite small in relation to the size of the recent rally and the daily upswings of the past week. This is a sign of strength especially when considering that the dollar was moving higher as well. It appears that the outlook for gold continues to be bullish for the short and long term.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

While gold has previously rallied significantly (and basically erased the late-September slide), the analogous move in silver was much less spectacular. The situation is quite interesting and in today's Premium Update we focus on the implications for gold and silver investors. Among many other things that were covered, we analyze: Euro and USD Indices, the general stock market, silver from non-USD perspective, mining stocks, platinum, and much more. Additionally, we comment on the recent changes in the precious metals correlations with other markets.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.