Based on the September 30th, 2011 Premium Update. Visit our archives for more gold & silver articles.

Recently, investors have suffered an average market decline of 6.5% in the equity portion of their investments, the largest fall since the dark days of October 2008, with $1 trillion of paper wealth evaporating in the process. Speaking of October 2008, it was then that gold prices tumbled 18% as turmoil in global financial markets led to losses in global equity and commodity markets. The precious metal rallied 23% in the next two months.

So why did precious metals take such a fall? As our correlation matrix showed, over the past few weeks gold had decoupled from stock markets and every time stock markets sold off, gold would rise as investors would seek it out as a safe haven. However, the Chicago Mercantile Exchange (CME) began raising the amount of margin it required to buy a gold future with three raises since July. In total, margins have risen by $5, 400. (You had to put more money down to invest.) If you recall, the same thing happened with silver when it went parabolic in the spring. The CME raised margin requirements four times, amounting to an 84% hike.At that time silver also sold off. Then again, historically, margin hikes are known to be much more important for silver than they are for gold, so it seems there must have been more to the bearish case than just margin hikes.

Another factor influencing the drop was selling by investors to meet margin calls on other losses, or by investors anxious to lock in some profits and gold and silver is where the profits were to be found. This effect was particularly strong since gold moved so high recently and so many momentum players were aboard. It is important to remember that violent sell-offs in equity and other asset markets can spill over into precious metals, but after an initial selling wave, gold tends to disassociate itself and rebound.

To see if this might be the case now we will now take you to this week's technical part. We will start with the analysis of the yellow metal (charts courtesy by http://stockcharts.com.)

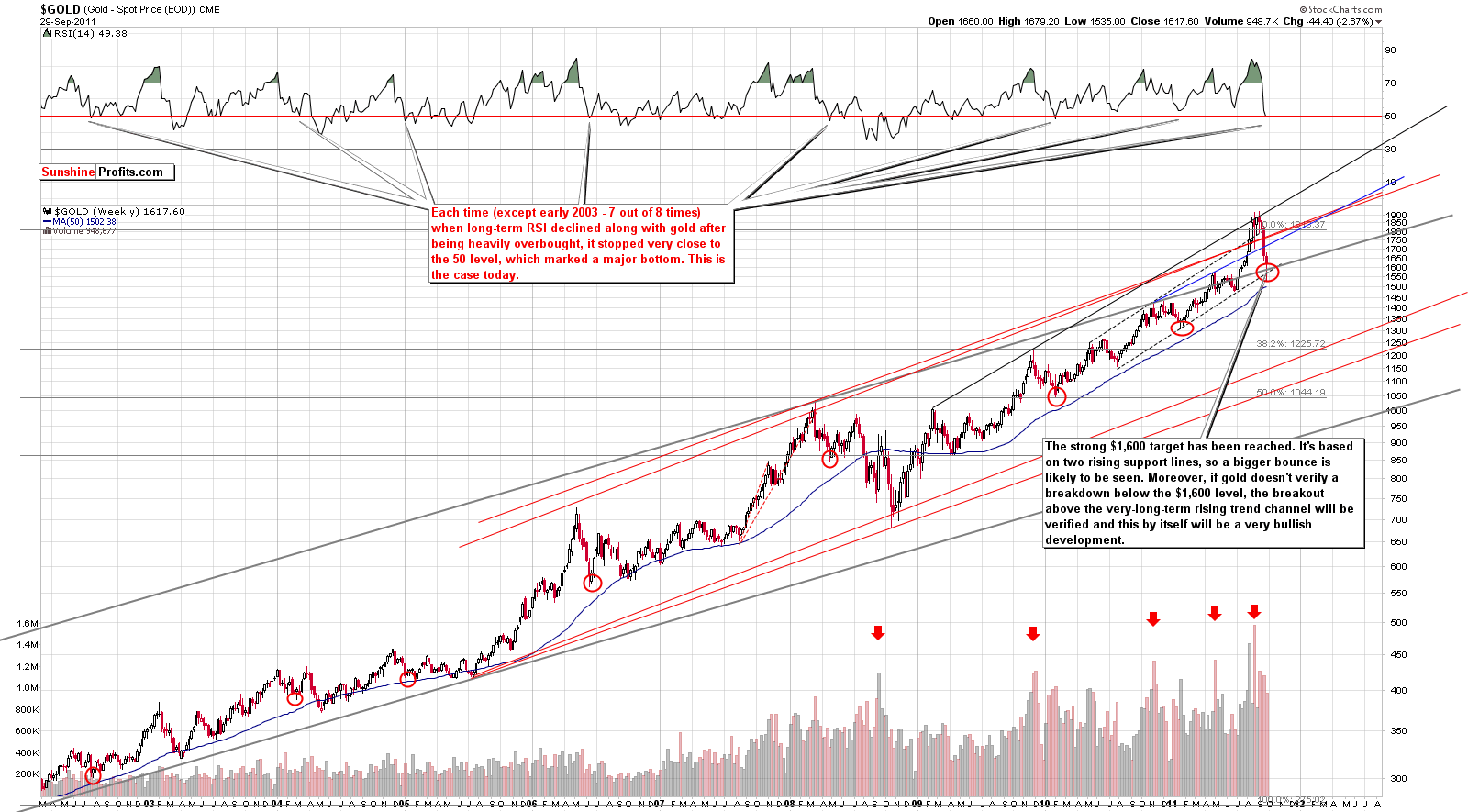

Lets take a look at the very long-term chart. Gold plunged very dramatically, but stopped close to the $1,600 target level. This level is based on two rising support lines. Clearly significant levels have been reached in both price and the RSI indicator (as seen in the upper part of the chart).

The long-term RSI, which is based on weekly closing prices, moved to the 50-level after being previously extremely overbought. Similar price actions where previously oversold RSI declined along gold prices have been seen eight times previously during this bull market. In seven of the eight times, golds decline stopped when the RSI reached the 50-level and a sizable rally soon followed. Each of these important local bottoms has been marked with a red ellipse in our chart. In some cases, the bottom was final but even when an additional decline was seen a short time later, significant rallies ensued. The RSI is close to the 50 level and it appears likely that gold will rally from here.

This is very much consistent with what we wrote last Friday in our essay on a possible move up in precious metals:

There is no doubt that like everything else, the bull run in gold will eventually come to an end, but were still a long way off. We see the sharp decline as an opportunity rather than a warning. It is a good time, for those who wished all along that they had bought gold, to do it on dips. Nothing that has taken place over the past weeks lessens our long-term optimism about gold. The same fundamentals are still in place.

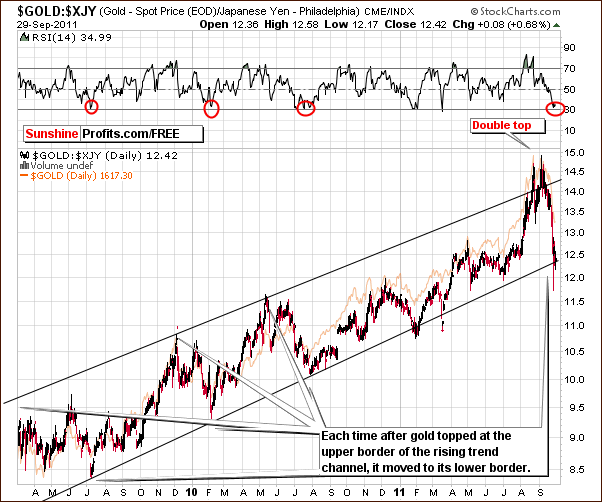

In the long-term chart for gold from a non-USD perspective, we also see that a strong support line has been reached. The previous breakout above the resistance line created by previous tops has been invalidated, but the technical damage has already been done and it seems that a rally from here is quite probable.

Looking at gold from the perspective of the Japanese yen, we also see RSI levels now oversold. Recently we have seen a decline that was much sharper than in the past. Each time the upper border of the trading channel was surpassed, index levels quickly moved to the lower border and this marked an important bottom from the USD perspective as well. Such has been the case once again, as the index moved below the lower border of the trend channel and quickly reversed. It is now right at this level. Similar price action patterns have been seen in the past and a rally generally has followed. The implications are bullish for gold.

While we will leave the short-term details for our Subscribers, we would like to feature one more important factor that is currently in play - the SP Gold Stock Extreme Indicator.

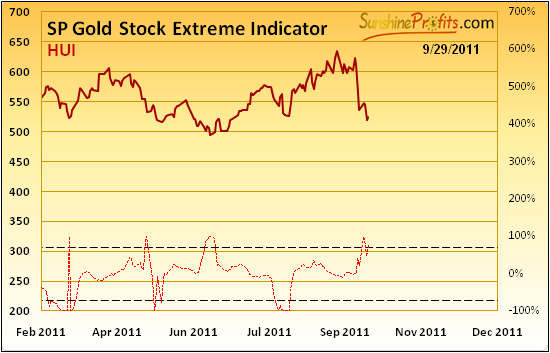

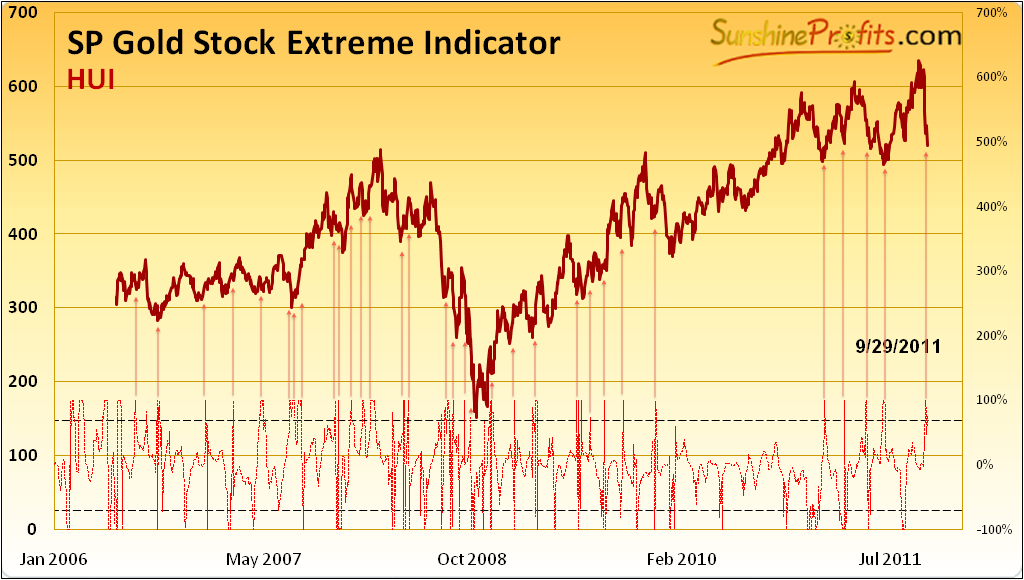

The SP Gold Stock Extreme Indicator moved above the upper dashed line, which was very close to a local bottom each time (!) since 2008 and in most cases before this date. As we can see, not each and every bottom was indicated, but when we have actually seen SP Gold Stock Extreme Indicator flashing a buy signal, each time a short-term rally followed. What we have seen right now is a very strong buy signal.

Does it mean that gold / gold stocks are guaranteed to move up from here? Of course not - there are no sure bets in any market. However, it does mean that it's very likely. What price action precisely can you expect given this particular signal?

The best way to estimate the size of the move of any indicator (including our own) is to simply take a look at the chart and see what happened previously when analogous signals flashed.

In this case, we are looking for at least a 1-3 week rally thats visible from the long-term perspective. Please take a look below for details (if you're reading this essay on our website, you can click this chart to enlarge it).

Summing up, based on multiple factors, including charts and indicators, it appears that we are close to or have already seen a major bottom in gold.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

Our latest Premium Update includes an extensive (26 charts/tables) discussion of the current situation in the precious metals sector. What should Traders do? How should Investors position themselves? Answers to both questions are supported by multiple factors and charts. In this week's issue we covered the following:

- Long-term bond yields

- Euro's breakdown

- Cyclical tendencies for USD and silver

- Gold vs. USD

- General stock market

- Precious metals correlations

- Gold, silver and mining stocks bottoms?

- Gold seen from non-USD and yen perspectives

- Gold:Silver Ratio

- Platinum

- XAU and HUI Indices

- Gold Miner's Bullish Percent Index

- SP Gold Bottom Indicator

- SP Gold Stock Extreme Indicator

- SP Gold Stock Extreme Indicator

- SP Short Term Gold Stock Bottom Indicator

- SP Junior Long-term Indicator

- GDXJ:GDX ratio

- Is 2008-like crash in the cards?

- ... and more

Additionally, the latest Premium Update includes our up-to-date top gold & silver junior rankings

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.