Based on the March 23rd, 2012 Premium Update. Visit our archives for more gold articles.

Last week, we devoted the beginning of our essay on the possible move up in gold to reassure our bullish outlook on precious metals despite the fact that prices were falling then. We wrote:

Its tough being a lone voice saying that gold prices will go up when they have tumbled and the financial press is writing obituaries for the gold bull market. Its also encouraging being a lone voice saying that gold prices will go up precisely because it means that the general sentiment is very bearish and this is what we see at major bottoms.

The precious metals are on the move up and right now it seems that the bottom is in. This short-term development is in line with the long-term outlook for precious metals.

Namely, there are no indications the Fed will begin to hike rates any time soon, given the dismal U.S. housing markets. That is a bullish scenario for gold. There is a palpable threat that crude oil prices may go through the roof if an Israeli-American-Iranian conflict will disrupt the flow of oil through the Strait of Hormuz. The European sovereign debt crisis is far from over, and one of the remaining PIIGS might still fail. Portugal is seen by many as a major candidate, while Spain and Italy will have to weather through in the medium-term. And we have already lost track of how many trillions the U.S. government owes. The increasing numbers of Indians and Chinese who are entering the middle class and whose cultures value gold, will buoys up demand and, as we have indicated, there are still many uncertainties and structural problems in the world today.

Last week, Fed Chairman Bernanke defended the need for a central bank in such a world.

"The one thing people don't appreciate, I think, is that central banking is not a new development. It's been around for a very long time," he said, citing the creation of the Swedish central bank in the 17th century.

Speaking of Sweden being an early bird and a harbinger of things to come, Sweden seems to be doing away with coins and paper money. In Sweden, just 3% of the economy is powered by tangible money. Public buses dont accept cash and even churches have installed card readers to take donations. It has gone so far that even some bank branches refuse to take money, preferring to deal with electronic transfers only. The European average of cash transactions is 9%, and in the US it is 7%. The trend is clear --cash is on its way out. So go ahead and start spending all those jangling coins you have been saving in the cookie jar. The day is coming when governments will stop minting coins and printing bills, marking a paradigm shift in human economic history. It wasnt that long ago when there werent such things as credit cards. Of course, every one of our transactions will be recorded in various databases. We continue to suggest physical gold and silver ownership (in addition to other assets and trading capital) just in case things dont develop too smoothly in the coming years.

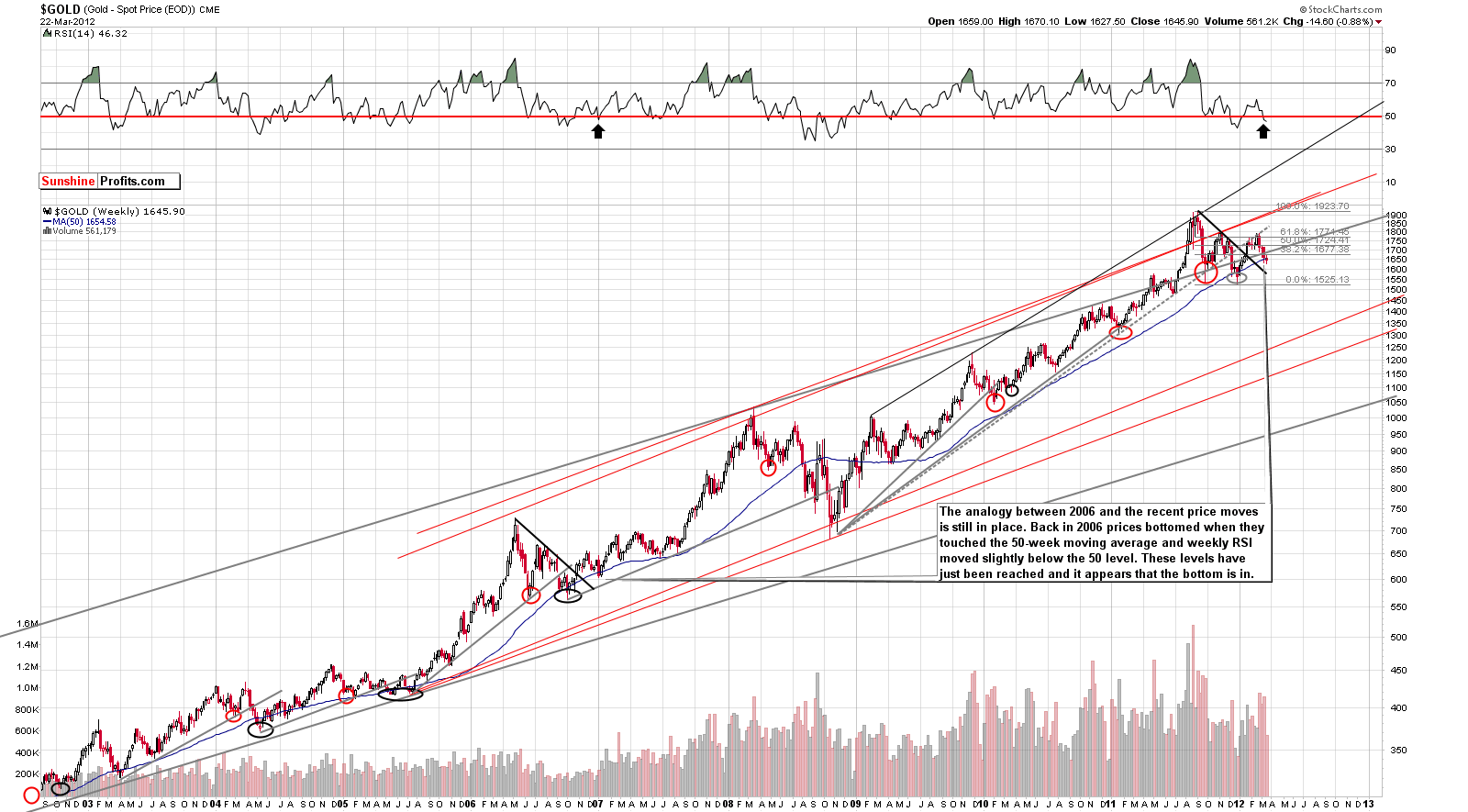

Having written so much about gold, well begin the technical part with the analysis of the yellow metal. We will start with the very long-term chart (charts courtesy byhttp://stockcharts.com.)

In this chart (you can click the chart to enlarge it if youre reading this essay at sunshineprofits.com) no large scale developments have been seen. However, this week saw gold rally quite considerably. The RSI level has now moved back to the 50-level and the self-similar pattern from the very long-term perspective is very much in play. The implications are that the bottom is almost certainly behind us and we are in for a rally in gold.

Just to bring the self-similar pattern back to our minds: back in 2007, golds price held below the 50-week moving average for about two weeks. This time around, golds price moved below this average twice before jumping up. We saw two weeks below this important support level and a move up afterwards. This is one more commonality which shows the similarity between the current trading pattern and the one seen five years ago.

Taking a look at the chart from 2006-07, we see that we are just above the range of the local bottom in our trading pattern. Gold did not rally immediately after bottoming but rather consolidated for several days before the start of a very sharp rally. This is what happened last week.

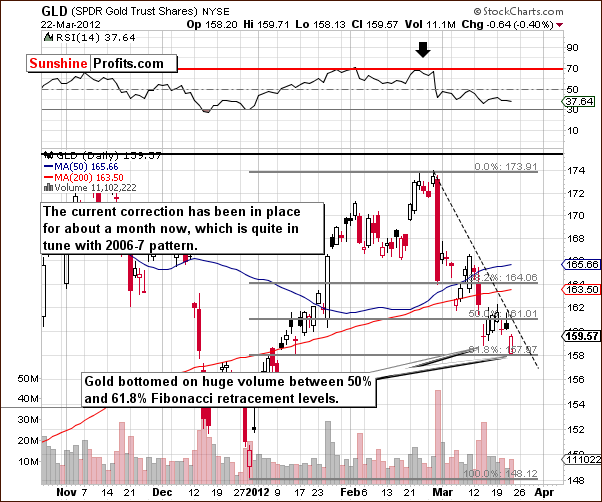

It seems valid to focus on the time that elapsed during the period of correction. A closer look shows that it was approximately a month before the final bottom was seen in 2007. If we compare it with the situation now, we might see that the recent correction in gold started on February 29th, 2012 (the already infamous Wednesday), and lasted until March 23rd, which is nearly a month. The similarity seems striking.

We now turn to the current short-term GLD ETF chart. Continuing our discussion on the length of time, we see that the first local top was on February 23rd and from then until last Friday was precisely one month. The self-similar pattern is very much in play and it very likely confirms that golds bottom is now in.

In the chart of gold from a non-USD perspective, we have a bullish picture once again. A small move below the rising support line was stopped by the declining medium-term support line and gold moved up afterwards. It seems that the yellow metal has gained some momentum, so the situation here remains bullish.

Summing up, the self-similar pattern remains very much in place and the bottom in gold is very likely in.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

Gold declined early on Thursday, but immediately corrected about 80% of the decline. At the same time, silver declined more significantly and miners moved below their important support level. In today's Premium Update we comment on all of these important events and put them into proper perspective. One particularly interesting signal was seen in relation to the mining stocks and gold.

Areas covered in today's report include: USD Index, S&P 500, SPY ETF, crude oil, Correlation Matrix, gold (including details regarding the self-similar pattern), GLD ETF, gold from non-USD perspective, silver, SLV ETF, XAU, HUI, GDX ETF, Gold Miners Bullish Percent Index, and GDX:GLD ratio. Naturally, we provide price targets for gold, silver and miners.

Additionally, we comment on our in-house developed "extreme" indicator, miners' (lack of) performance relative to gold, disconnection between prices of gold and gold ETFs, the expected length of the bull market in the precious metals, inflation expectations, log scale on charts, comparison of today and 2008, and more.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.