They say that every a new day is a brand new opportunity. And there's more than a grain of truth to it. The start of a new trading week has given us a new promising opportunity. Let's explore it alongside the standing of our open positions.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (a stop-loss order at 1.2596; the initial downside target at 1.2172)

- USD/JPY: short (a stop-loss order at 103.46; the initial downside target at 106.14)

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 0.9996; the initial downside target at 0.9768)

- AUD/USD: none

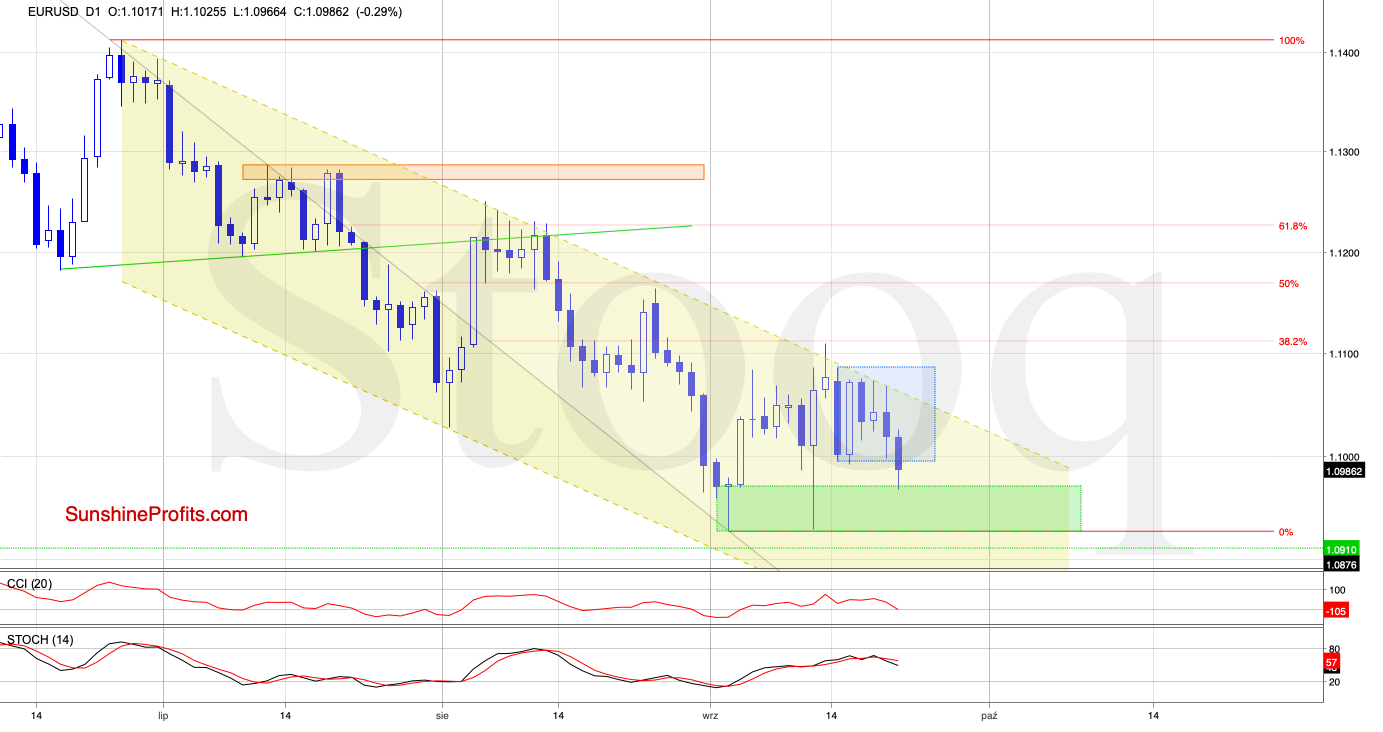

EUR/USD

We have written these words in our Friday's analysis:

(...) the proximity to the upper border of the trend channel suggests that a reversal may be just around the corner. It would be supported by the position of the Stochastic Oscillator as it is very close to flash its sell signal.

Should the exchange rate reverse and decline in the very near future, we could see a test of the lower border of the blue consolidation shortly.

Indeed, EUR/USD has made another unsuccessful attempt to break above the upper border of the declining yellow trend channel on Friday. A pullback followed, and the pair tested the lower border of the blue consolidation. The buyers then pushed the pair back inside the consolidation.

Earlier today however, the exchange rate broke below the lower border of the blue consolidation, sliding to the green support area created by the early-September lows in terms of closing prices.

The daily indicators are still on their sell signals. This increases the likelihood of further deterioration and of a test of the early-September lows in terms of intraday prices.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

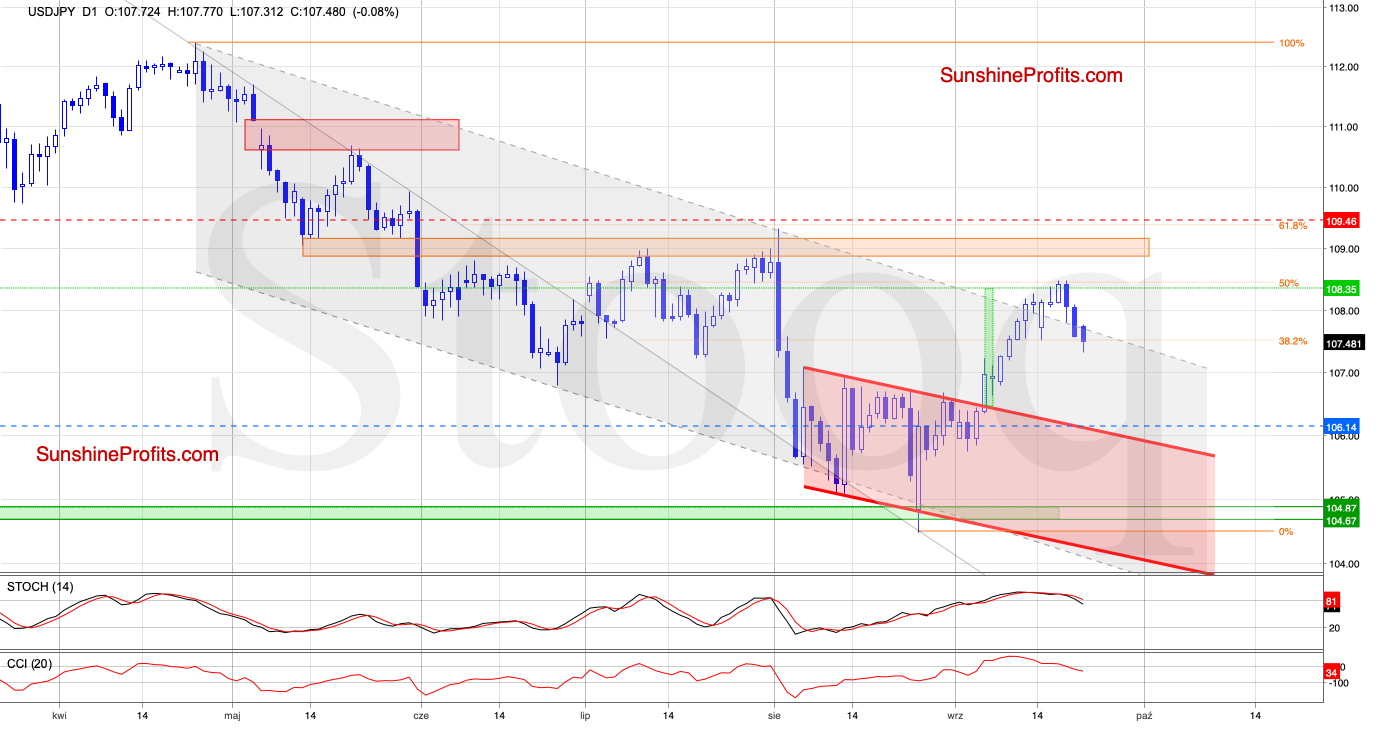

USD/JPY

We wrote these words in our Thursday's commentary:

(...) the pair invalidated yesterday's breakout. Coupled with the extended position of the daily indicators, it suggests that further deterioration is just around the corner. Nevertheless, a bigger downside move will be more likely and reliable only if the exchange rate closes today or one of the following sessions below the previously-broken upper border of the declining grey trend channel.

Should we see such a breakout invalidation, we'll consider opening short positions.

The situation developed in tune with the above scenario and USD/JPY closed Friday's session below the previously-broken upper border of the declining grey trend channel.

More deterioration followed earlier today, which together with the sell signals generated by the daily indicators increases the probability of a decline to the previously-broken upper border of the declining red trend channel.

Taking all the above into account, opening short positions is justified from the risk/reward perspective. All details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 103.46 and the initial downside target at 106.14 are justified from the risk/reward perspective.

USD/CHF

Let's quote our Thursday's commentary as it is up-to-date also today:

(...) the pink resistance zone and the proximity to the upper border of the green rising trend channel stopped the buyers.

The sellers took over, and the pair moved quite sharply lower earlier today. It suggests that further deterioration may still be ahead of us. If this is the case, we'll see at least a test of the lower border of the rising green trend channel in the following days.

USD/CHF has indeed extended losses and the Stochastic Oscillators' position supports continuation of the downside move. The CCI also points to weakening bulls.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 0.9996 and the initial downside target at 0.9768 are justified from the risk/reward perspective.

Summing up the Alert, while the euro bulls kept EUR/USD trading inside the blue consolidation on Friday, the common currency broke down earlier today and tested the early-September lows based on closing prices. The daily indicators support the downside move. USD/JPY reversed lower on Friday, closing below the upper border of the declining grey trend channel. Such a breakout invalidation justifies opening short positions. GBP/USD bulls keep showing weakness and the downside move is supported by both the CCI and Stochastic Oscillator. The open short position is therefore justified. USD/CHF reversal at the pink resistance zone and the upper border of the rising green trend channel remains in play, and the short position is justified. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist