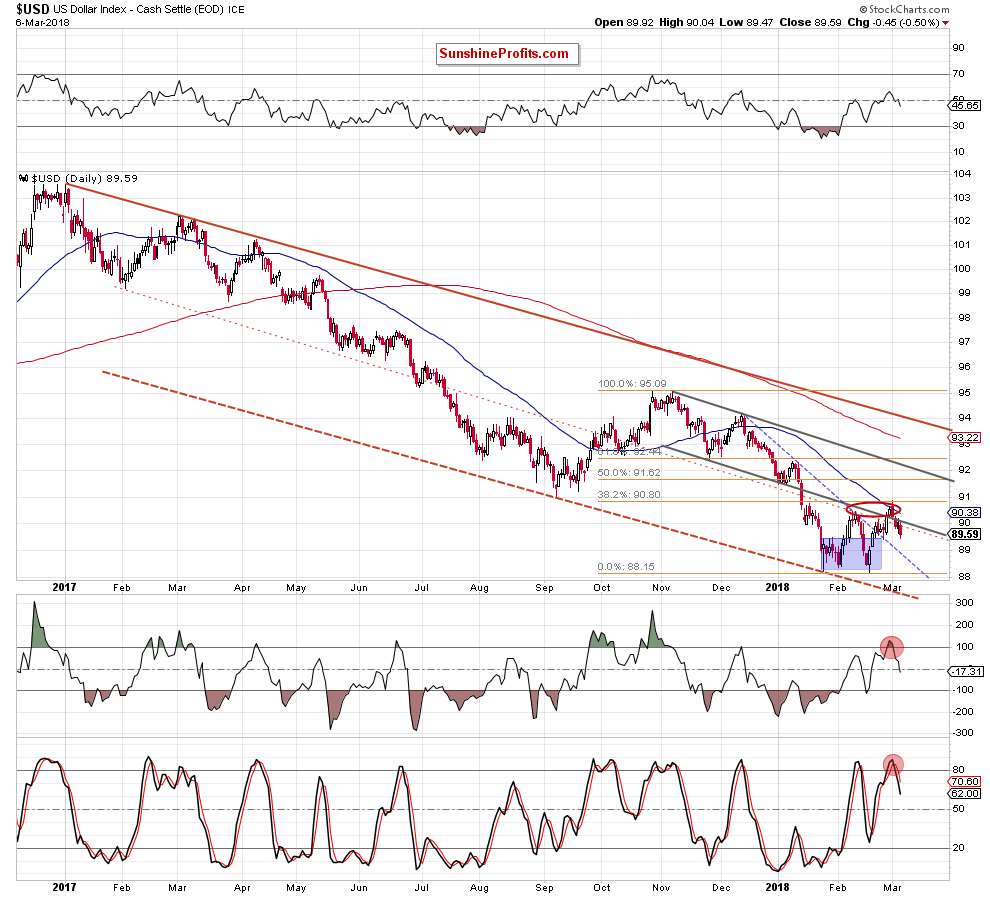

On Monday, the USD Index verified the breakdown under the lower line of the trend channel, which gave the bears a good reason to act. Yesterday, they managed to close the day under another important line, creating a bearish formation on the daily chart. What does it mean for the U.S. dollar bulls?

In our opinion the following forex trading positions are justified - summary:

Focus on the USD Index

Let’s start today’s Forex Trading Alert with the technical picture of the U.S. currency.

Quoting our Friday’s alert:

(...) the USD Index invalidated the earlier tiny breakout above the upper border of the green consolidation and the 38.2% Fibonacci retracement, which is a bearish development.

Additionally, the daily CCI and the Stochastic Oscillator increased to their overbought areas, which increases the probability that we’ll see sell signals in the coming day(s). If this is the case, the greenback will extend declines against the basket of major currency pairs in the following days.

From today’s point of view, we see that the situation developed in line with the above scenario and the greenback extended losses in recent days, slipping under the previously-broken lower border of the grey declining trend channel.

What such negative development could mean for the USD Index? Let’s zoom in our picture to find out.

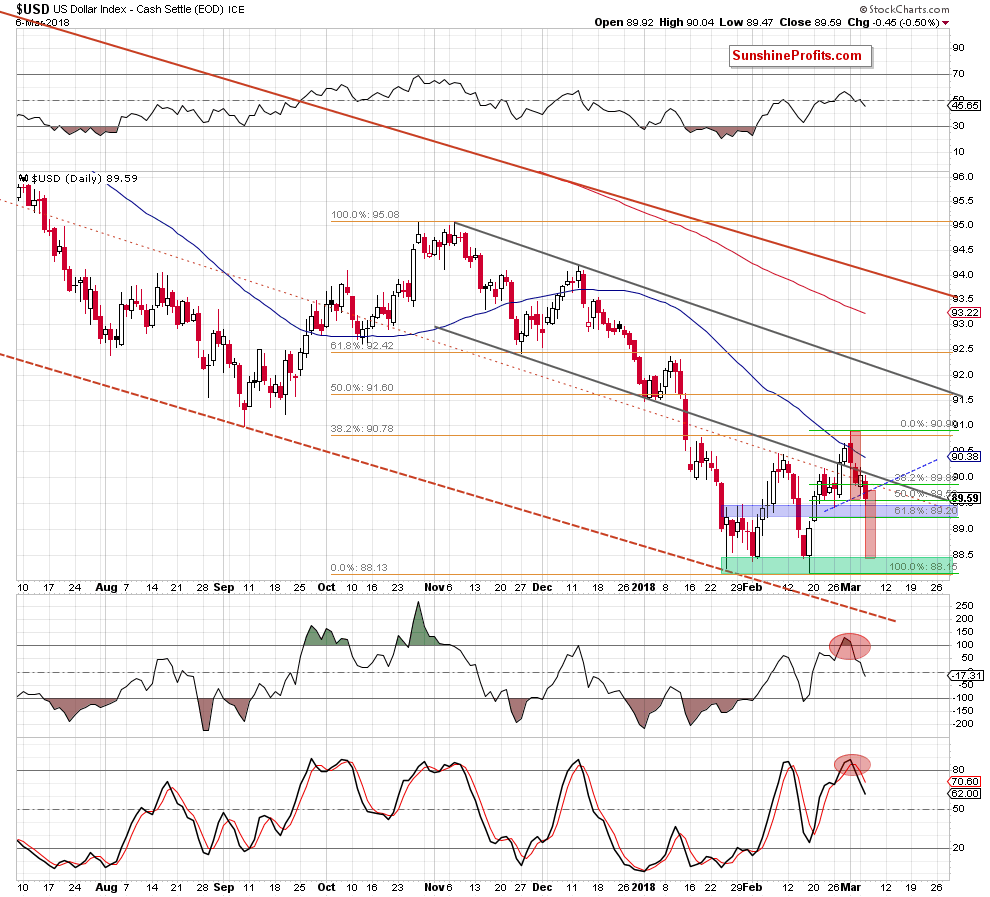

Looking at the above chart, we see that Monday’s verification of the earlier breakdown under the lower line of the grey channel encouraged currency bears yesteday, which resulted in a daily closure below the blue dashed line.

Is it important? In our opinion, it is, because this is the neck line of the head and shoulders formation and yesterday’s price action doesn’t bode well for higher values of the U.S. currency. If the situation developed in line with the bearish scenario, the index will extend declines and likely test the green support zone, which stopped declines several times earlier this year.

Nevertheless, before the bears can proceed to this scenario, they will have to break below the blue support zone created by the late January peaks, late February lows and the 61.8% Fibonacci retracement.

Will they manage to do this? The current position of the indicators favors the above scenario, but it seems reasonable for us to see a wider picture of the market, so let's check what our three currency pairs are telling about the dollar’s future.

EUR/USD

On Monday, we wrote:

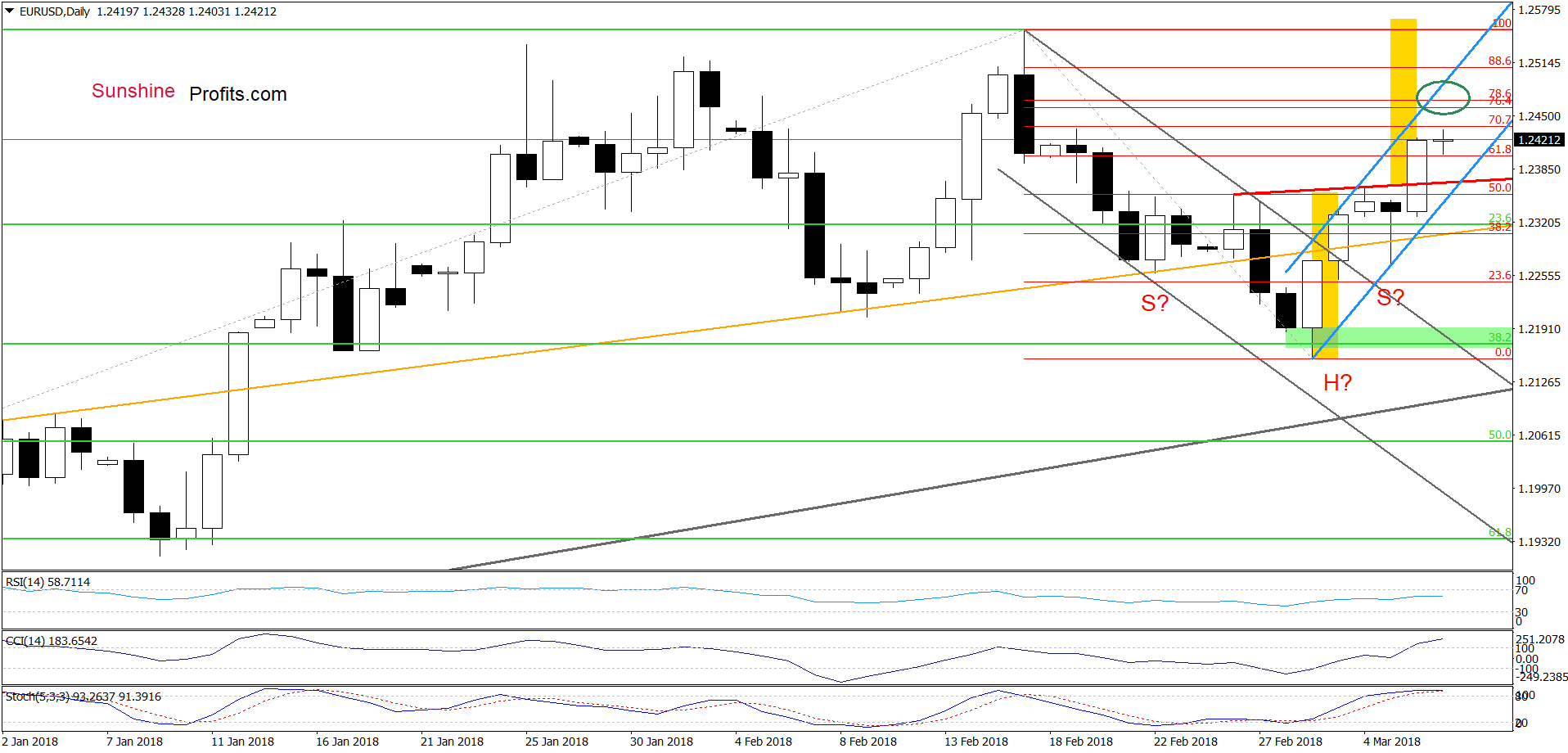

(…) What could happen if EUR/USD climbs above the last week’s peaks?

(…) we can notice a potential reverse head and shoulders formation. (…) It will (…) become a bulls’ ally when the exchange rate rises above the red resistance line based on the recent highs. At this point, it is also worth noting that if we see a daily closure above this line (…), the bulls may even take the pair to the 2018 peak.

As you see on the daily chart, currency bulls closed Tuesday above the red resistance line, which opened the way to higher levels. Nevertheless, the CCI and the Stochastic Oscillator climbed to their overbought areas, which suggests that the space for gains may be limited.

So, how high could the exchange rate go in the coming days? In our opinion, the first upside target will be the resistance area marked with the green eclipse (created by the 76.4% and 78.6% Fibonacci retracements and the upper border of the blue rising trend channel). This means that as long as there is no breakout above it, higher values of EUR/USD are not likely to be seen and reversal in the coming day(s) can’t be ruled out.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

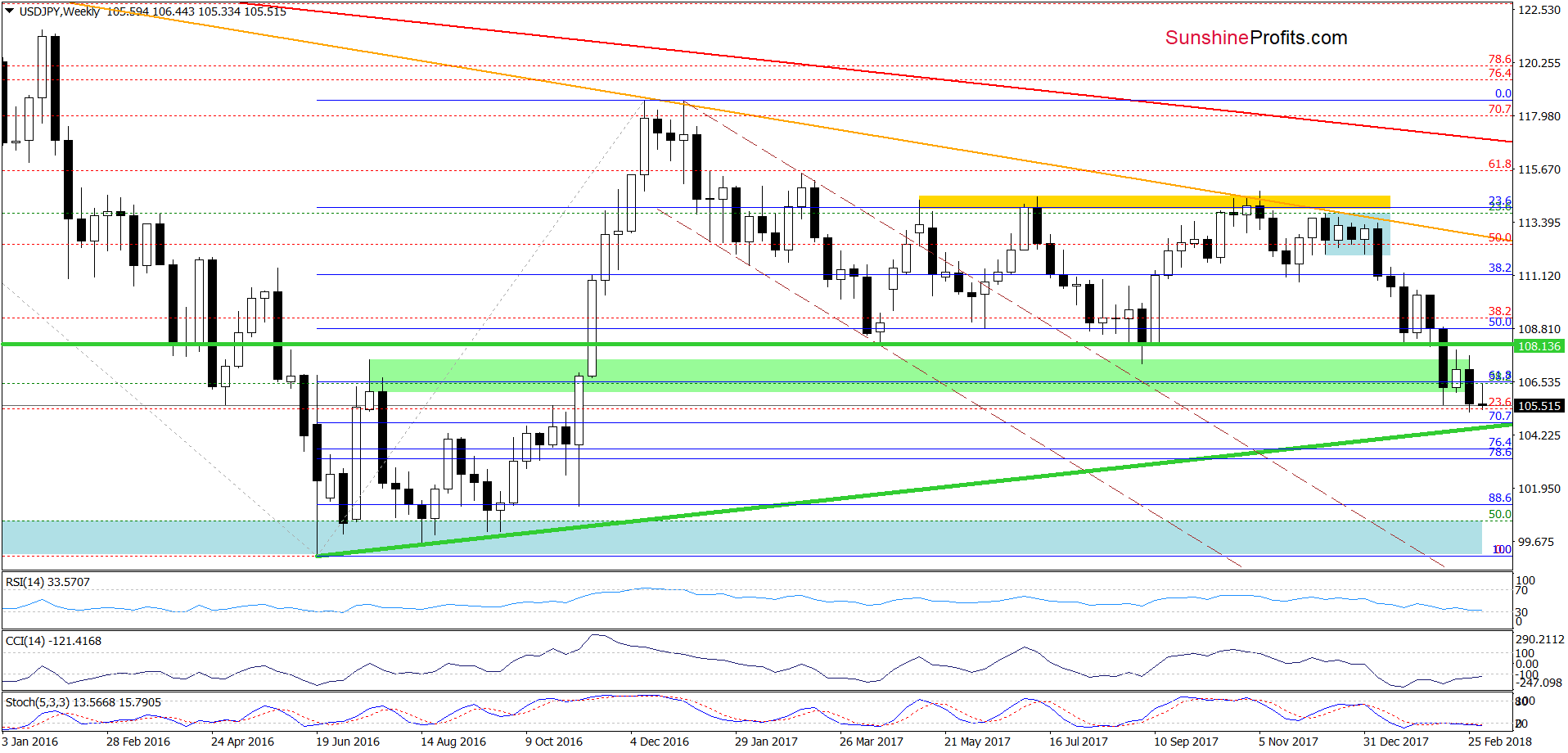

USD/JPY

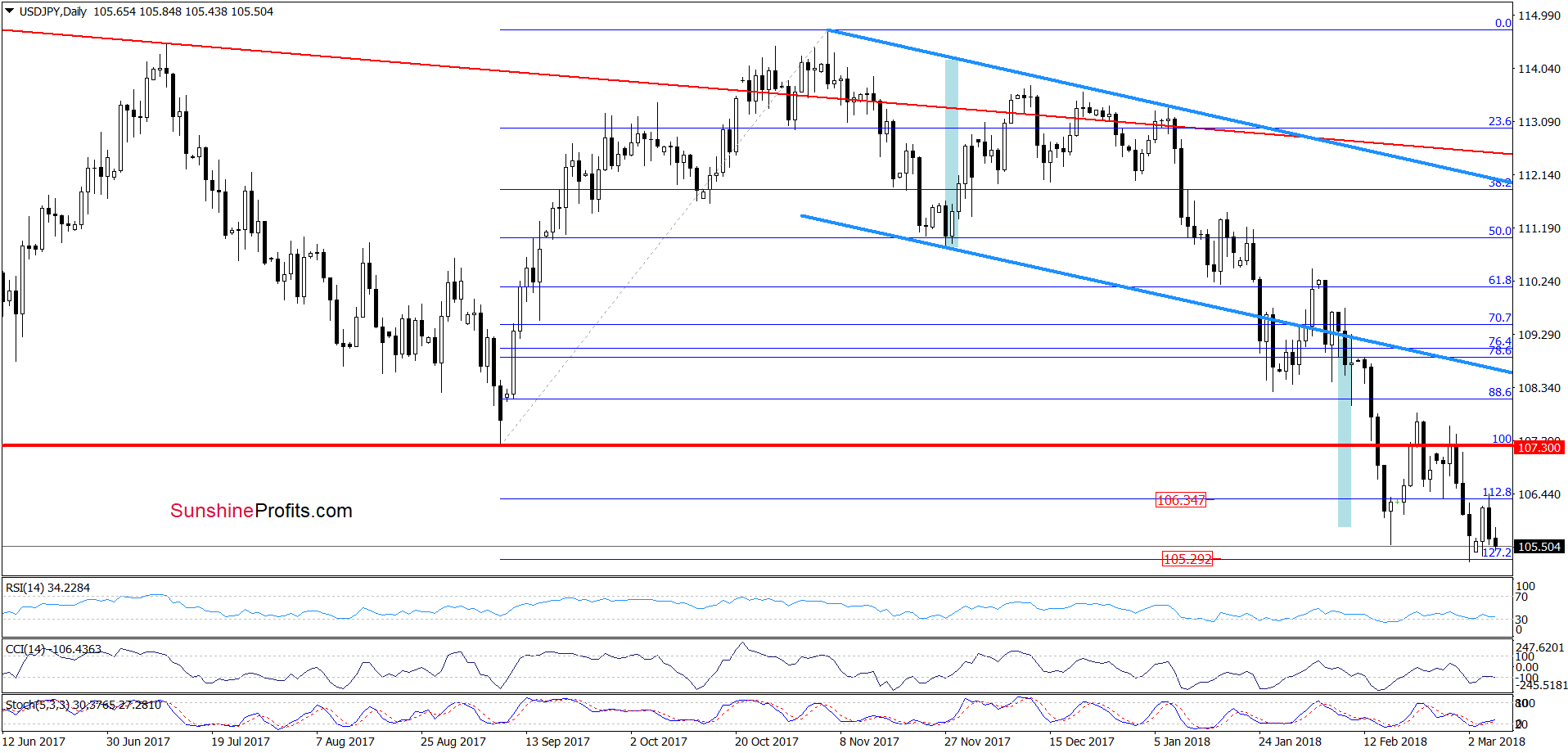

From today’s point of view, we see that although USD/JPY bounced off the 127.2% Fibonacci extension on Monday, currency bulls didn’t manage to hold gained levels, which resulted in a reversal and a comeback to the area where the exchange rate was trading when we posted our last commentary on this currency pair.

This means that what we wrote back then is still valid:

(…) USD/JPY reached our downside targets on Friday. At the moment of writing these words the pair is consolidating slightly above the 127.2% Fibonacci extension, but we think that as long as there are no buy signals generated by the indicators, currency bears can hit a fresh low.

How low could the pair g if we see such price action?

In our opinion, in the case of the breakdown below the last week’s low, the first downside target for the sellers will be the long-term green support line based on the June, August and September 2016 lows (currently around 104.66).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts