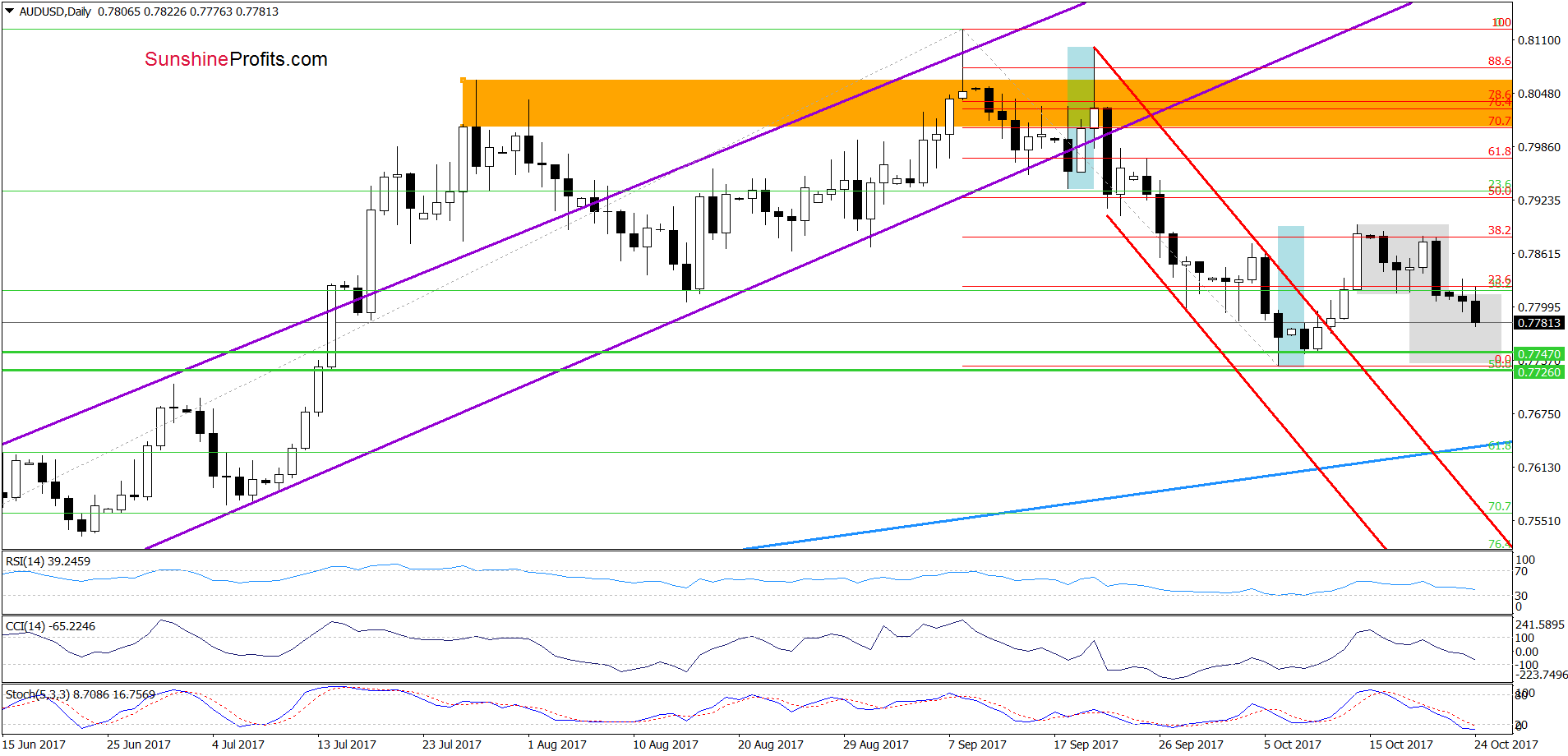

Yesterday, AUD/USD slipped under the lower border of the consolidation, which took the exchange rate below 0.7800 earlier today. How low could the pair go in the following days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1510)

- GBP/USD: short (a stop-loss order at 1.3773; the initial downside target at 1.3000)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

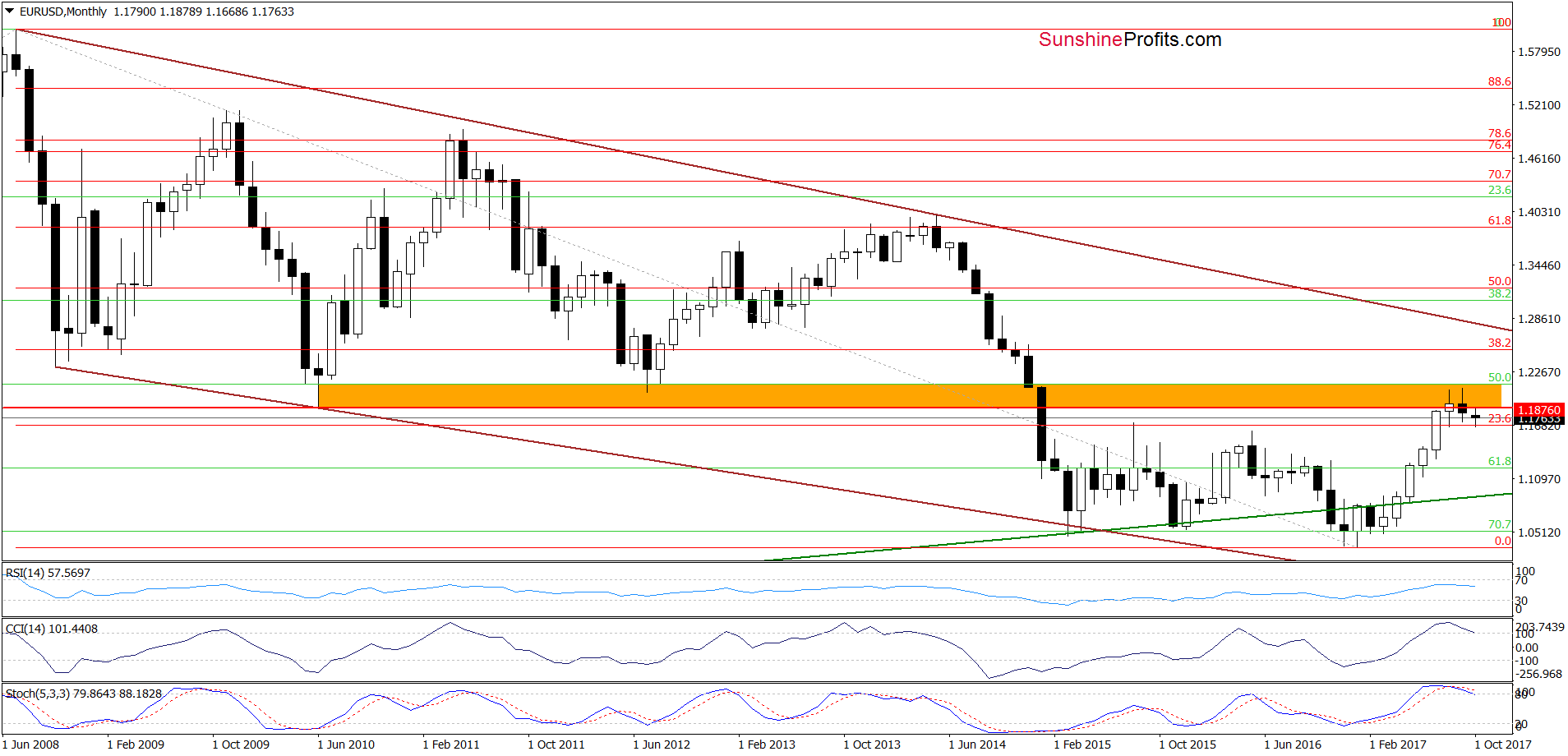

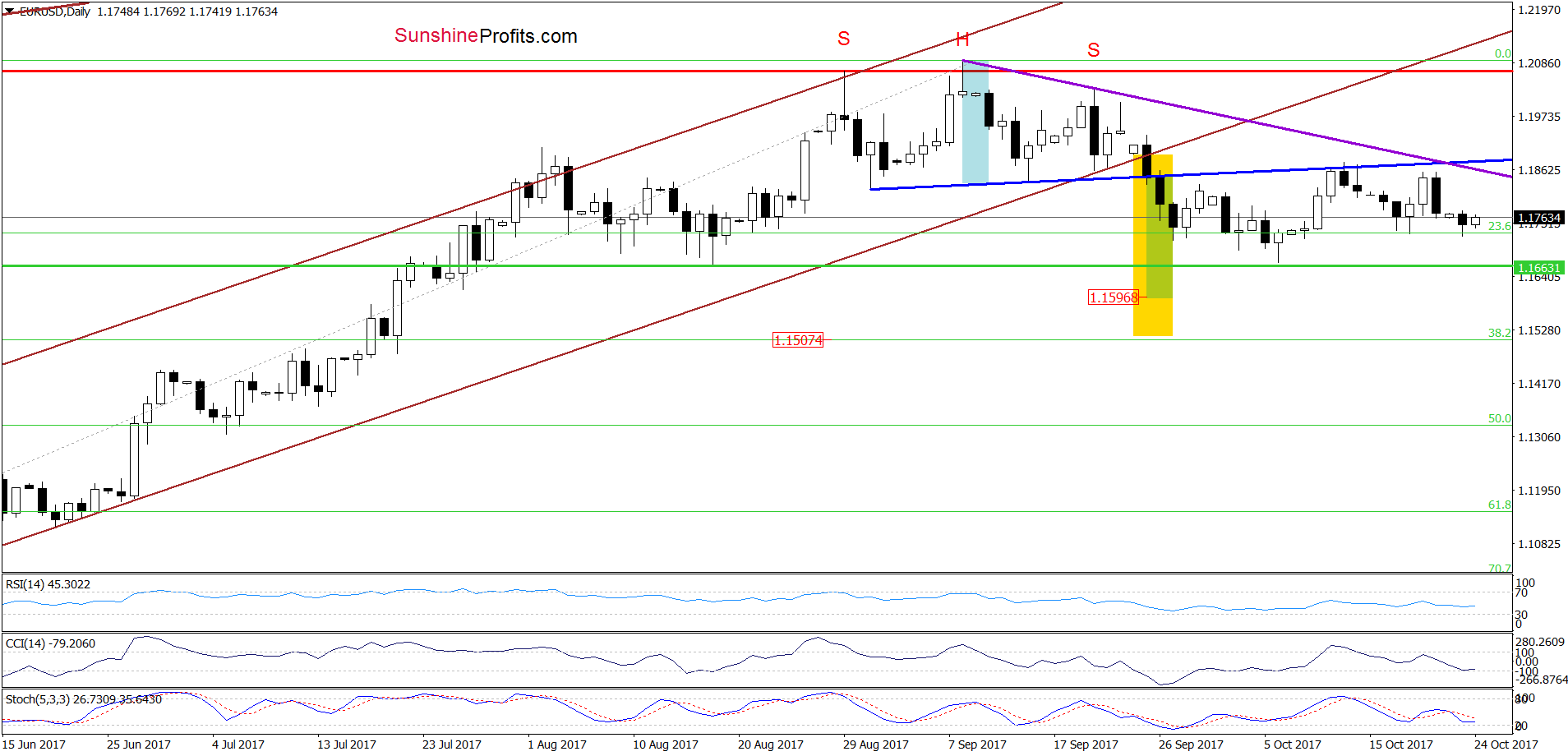

EUR/USD

From today’s point of view, we see that the overall situation remains almost unchained as EUR/USD is currently trading at yesterday levels. This means that our last commentary on this currency pair is up-to-date also today:

(…) the Stochastic Oscillator re-generated the sell signal, which encouraged currency bears to act (…) As a result, EUR/USD extended Friday losses, suggesting that (…) currency bears will re-test the green horizontal support line based on the mid-August low in the coming week.

Very short-term outlook: mixed with bearish bias

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short profitable positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1510) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

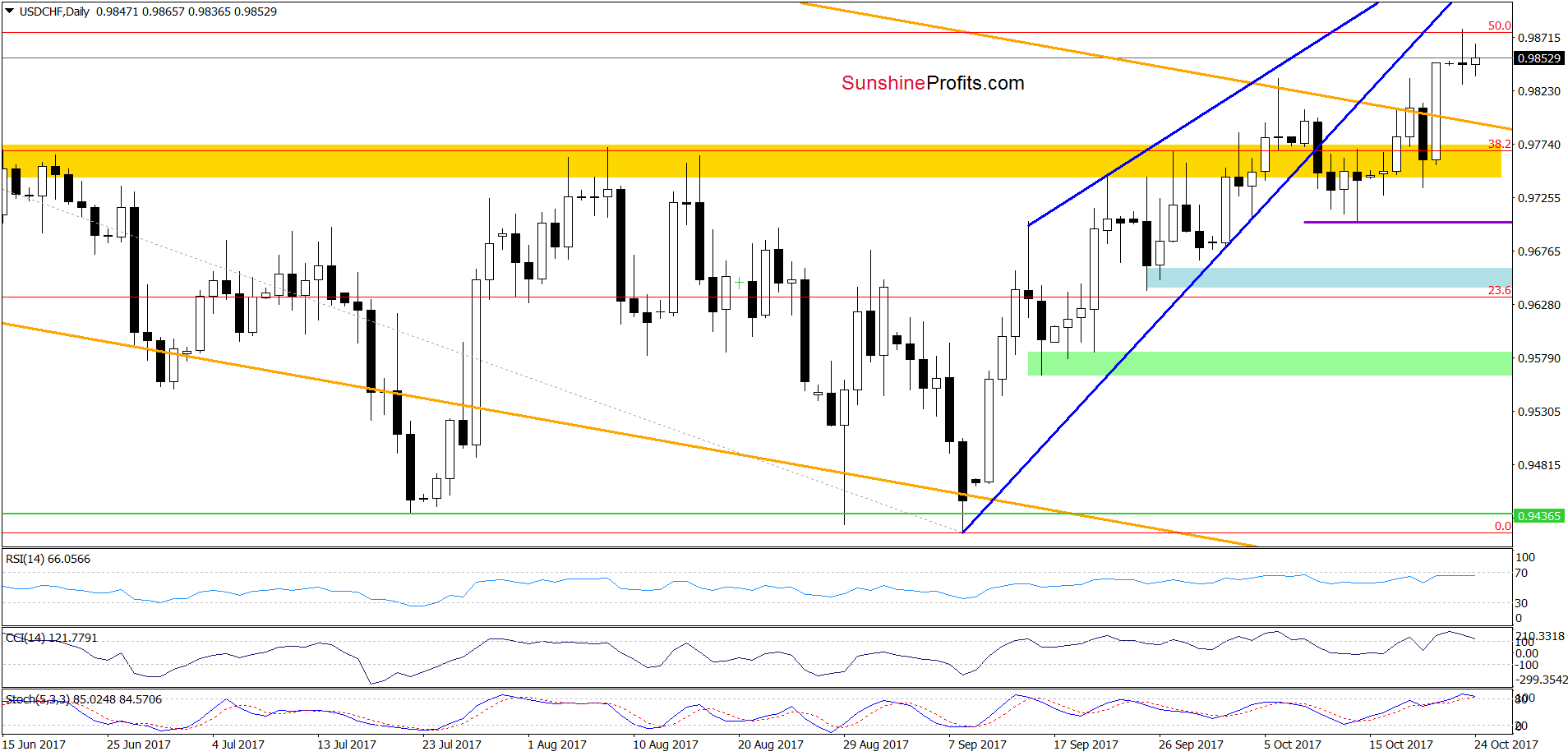

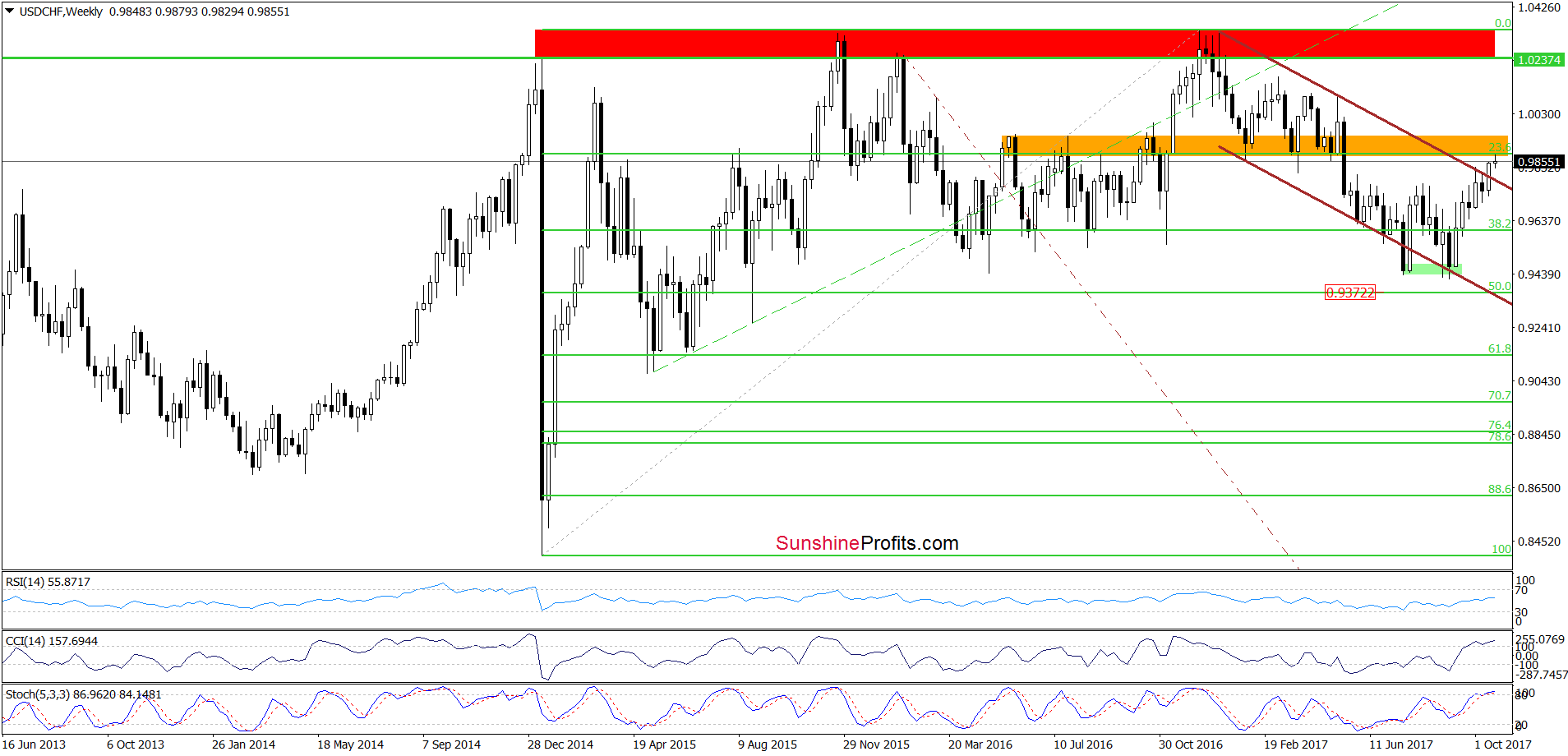

USD/CHF

Looking at the daily chart, we see that currency bulls pushed USD/CHF higher on Friday, which resulted in an invalidation of the breakdown below the upper border of the orange declining trend channel. This positive development triggered further improvement and the exchange rate climbed to the 50% Fibonacci retracement, which could stop further improvement – especially when we factor in the current position of the indicators (the CCI and the Stochastic Oscillator are very close to generating sell signals) and the situation in the medium term.

On the weekly chart, we see that USD/CHF increased to the orange resistance zone created by the May, June, October 2016 peaks and the January, March and April 2017 lows. Taking into account the importance of this area and the position of the daily and even weekly indicators (the CCI and the Stochastic Oscillator climbed to the highest levels since December 2016), we think that reversal and lower values of the exchange rate are just around the corner (even if we see a test of the lower border of the blue rising wedge seen on the daily chart first).

Very short-term outlook: mixed

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

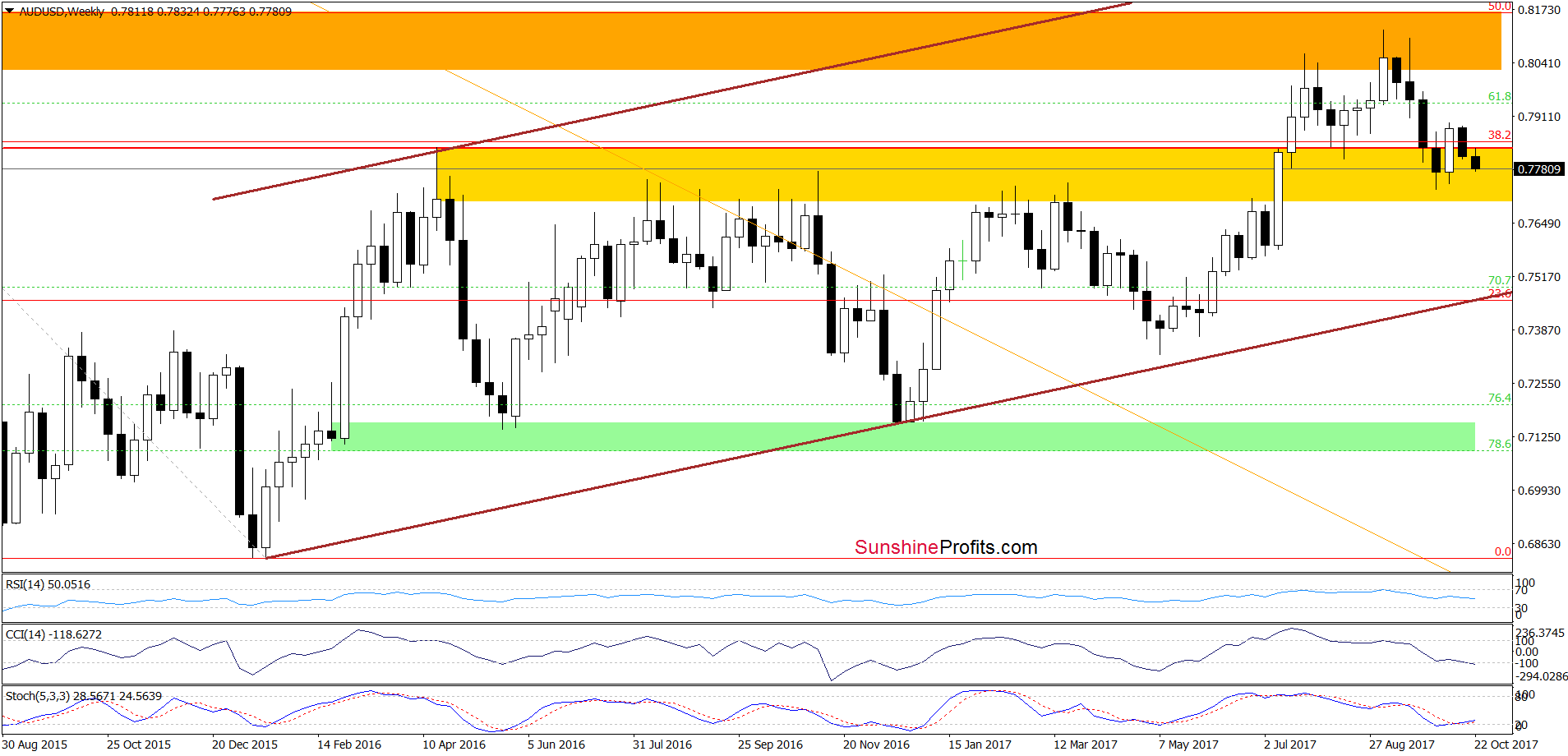

On the above chart, we see that AUD/USD broke below the lower border of the grey consolidation, which suggests that we’ll see a realization of the bearish scenario from our Friday alert in very near future:

(…) taking into account the sell signals generated by the CCI and the Stochastic Oscillator it seems to us that the pair will (at least) test the support zone created by the green horizontal lines and the October low of 0.7730 in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts