Although AUD/USD broke above the upper order of the short-term declining trend channel on Friday, we didn’t notice a significant move to the upside. What does it mean for the exchange rate?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1510)

- GBP/USD: short (a stop-loss order at 1.3773; the next downside target at 1.3000)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

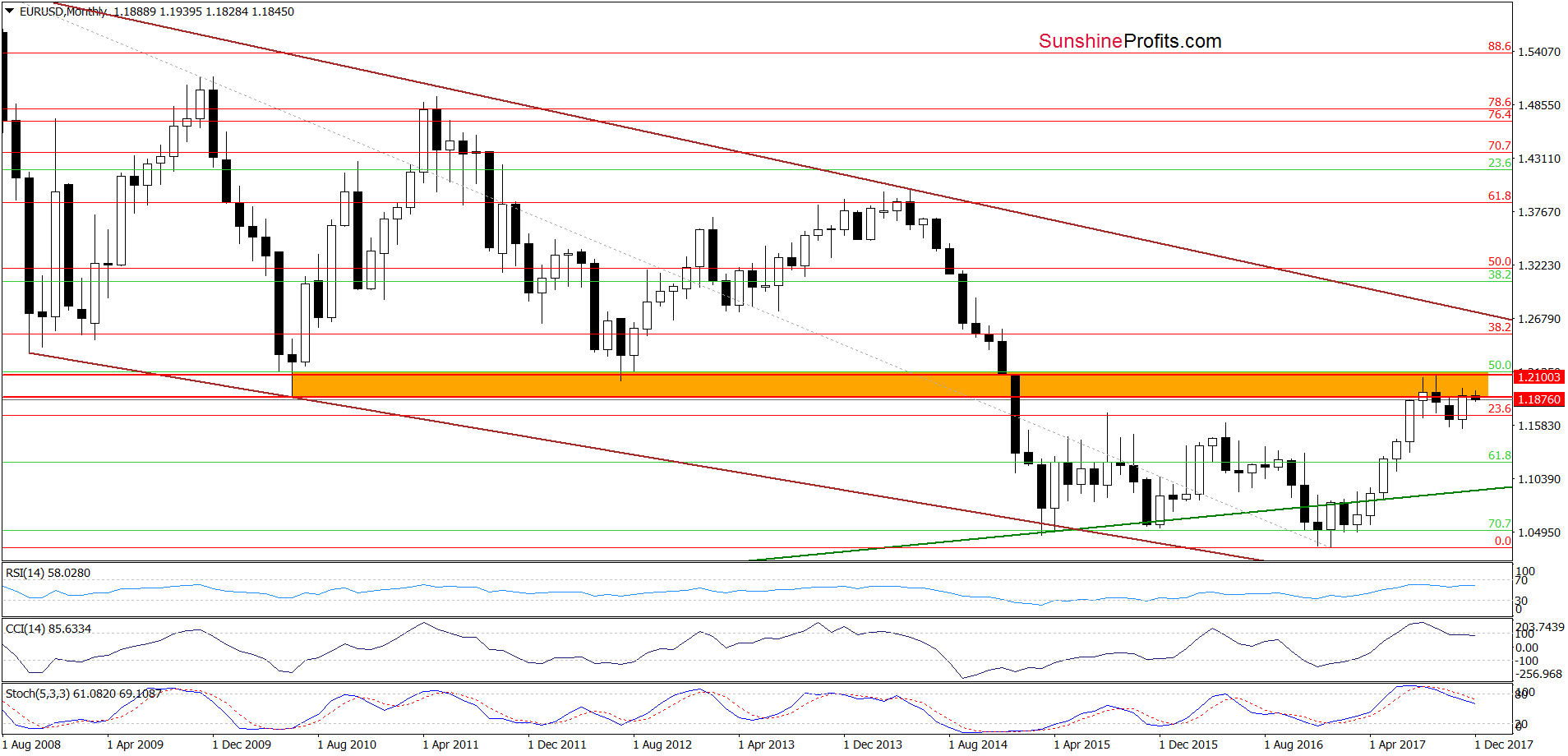

EUR/USD

Yesterday, we wrote the following:

(…) EUR/USD slipped to our first downside target earlier today. What’s next? Taking into account currency bulls’ weakness (seen in the previous week) and the sell signals generated by the indicators, we think that the pair will extend losses in the coming week.

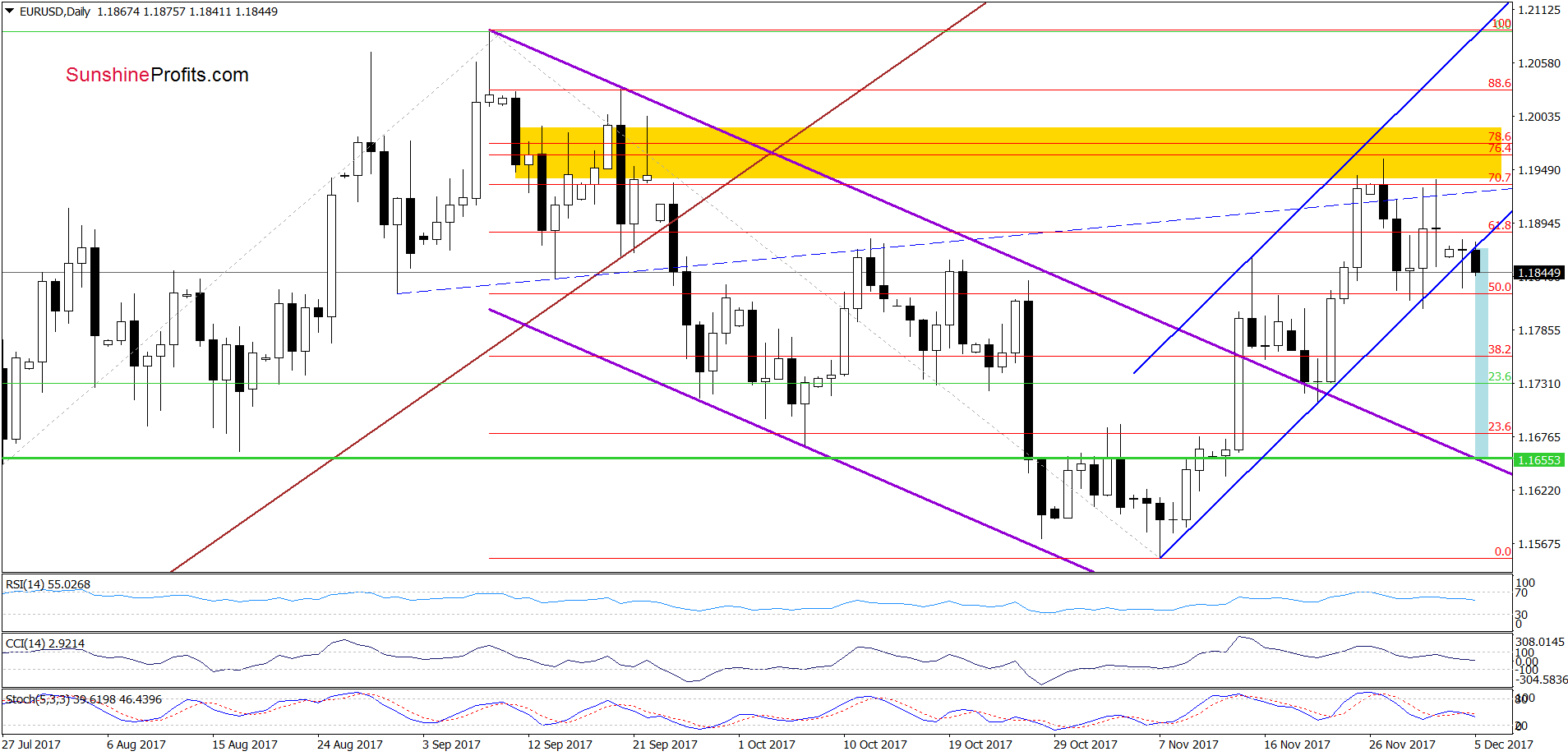

From today’s point of view, we see that the situation developed in tune with our assumptions and the pair declined earlier today. Thanks to this drop the exchange rated slipped under the lower border of the blue rising trend channel, which doesn’t bode well for higher values of EUR/USD. Taking this fact into account, we believe that the pair wll extend losses in the coming days.

How low could the exchange rate go? We think that the best answer to this question will be the quote from our yesterday alert:

(…) In our opinion, if EUR/USD drops under the lower border of the blue rising trend channel, the first downside target will be around 1.1732, where the November 22 low is. If this area is broken, the next target will be the previously-broken upper line of the purple declining trend channel seen on the daily chart (currently around 1.1660).

Trading position (short-term; our opinion): short positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1510) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

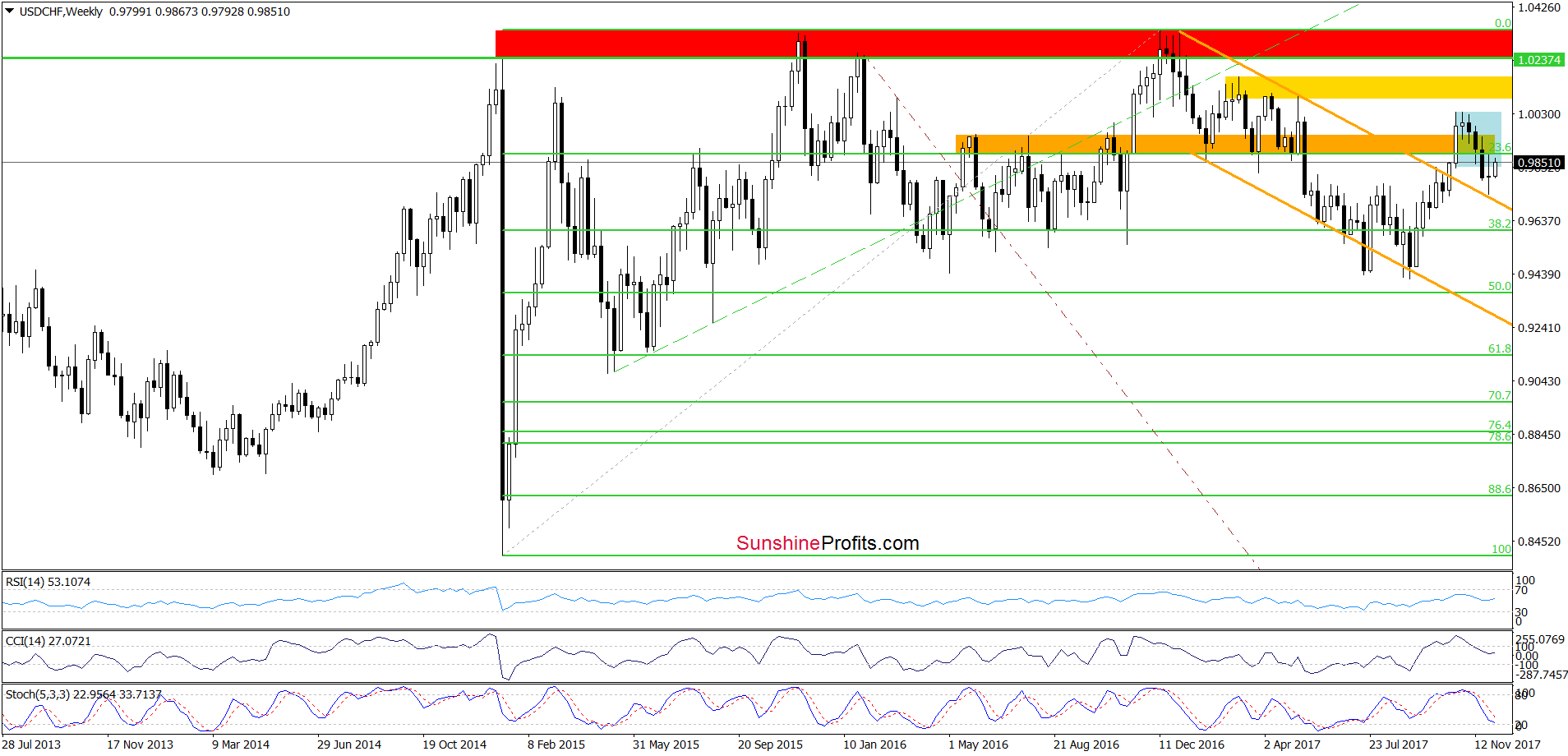

USD/CHF

Looking at theweekly chart, we see that USD/CHF rebounded this week and invalidated the earlier breakdown under the lower border of the blue consilidation, which is a positive event.

How did the recent price action affect the short-term picture? Let’s exaine the daily chart to find out.

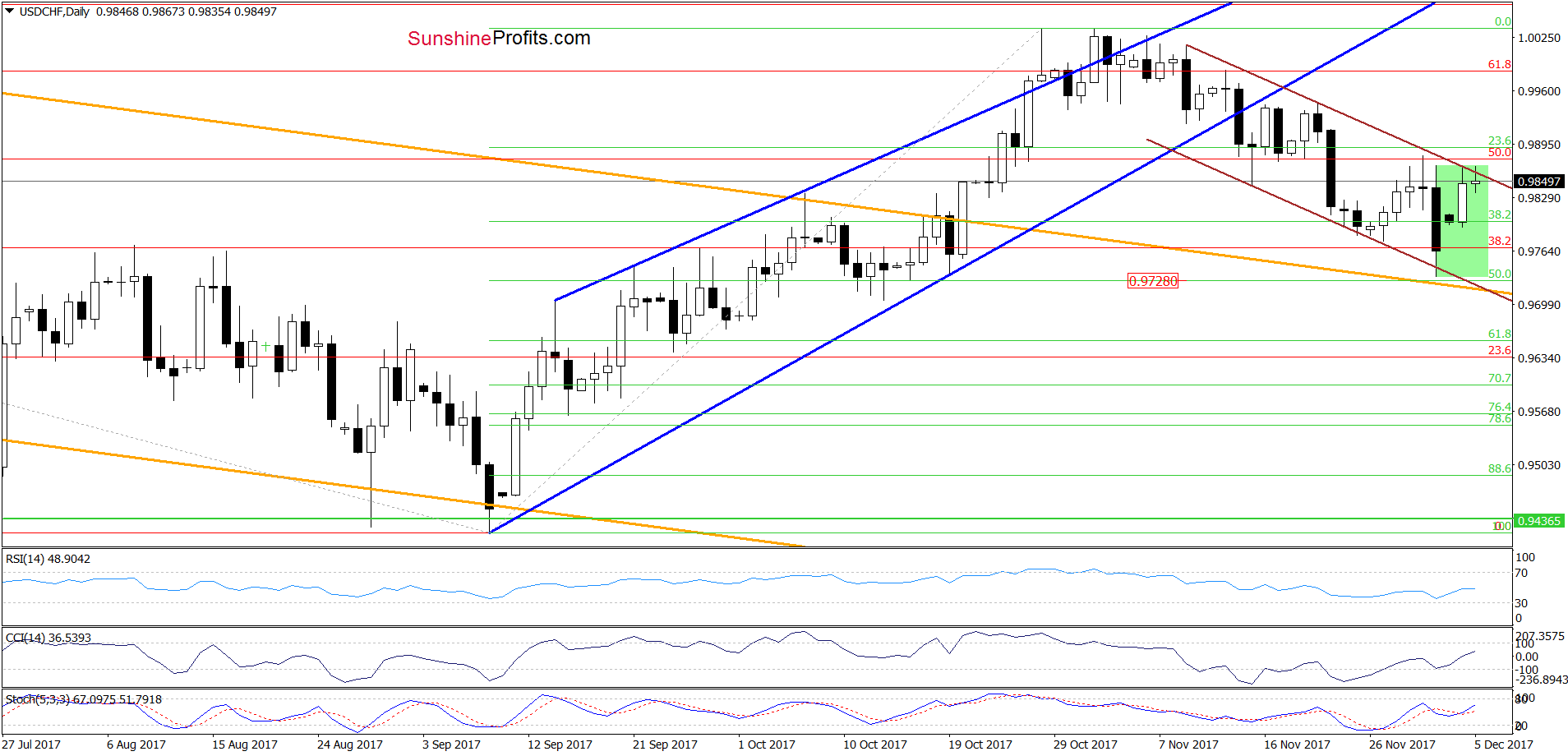

On the daily chart, we see the lower border of the brown declining trend channel stopped further declines once again and triggered an upward move this week. As a result, the exchange rate came back to the upper border of the formation. Will we see a breakout above it? Taking into account the medium-term picture of the pair and the buy signals generated by the daily indicators, we think that such price action is very likely. Therefore, if we see a breakout and a daily closure above this resistance line, we’ll consider opening short positions. As always will keep you – our subscribers – informed should anything change.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

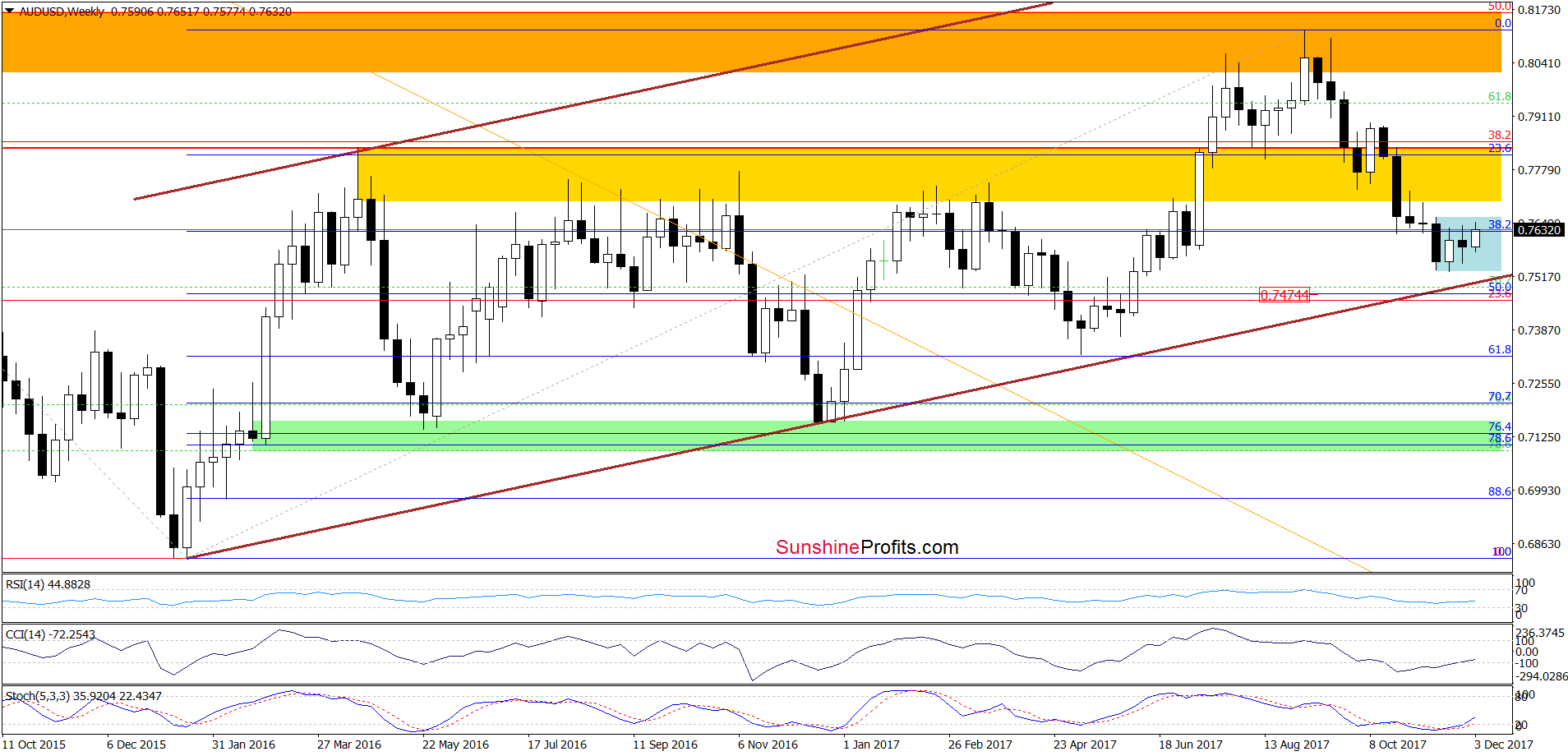

The situation in the medium term remains almost unchanged as AUD/USD remains in the blue consolidation. Therefore, in our opinion, as long as there is no breakout above the upper border of the formation or a breakdown under the lower line, the situation will remain a bit unclear.

Will the very short-term chart give us more clues about future moves? Let’s check

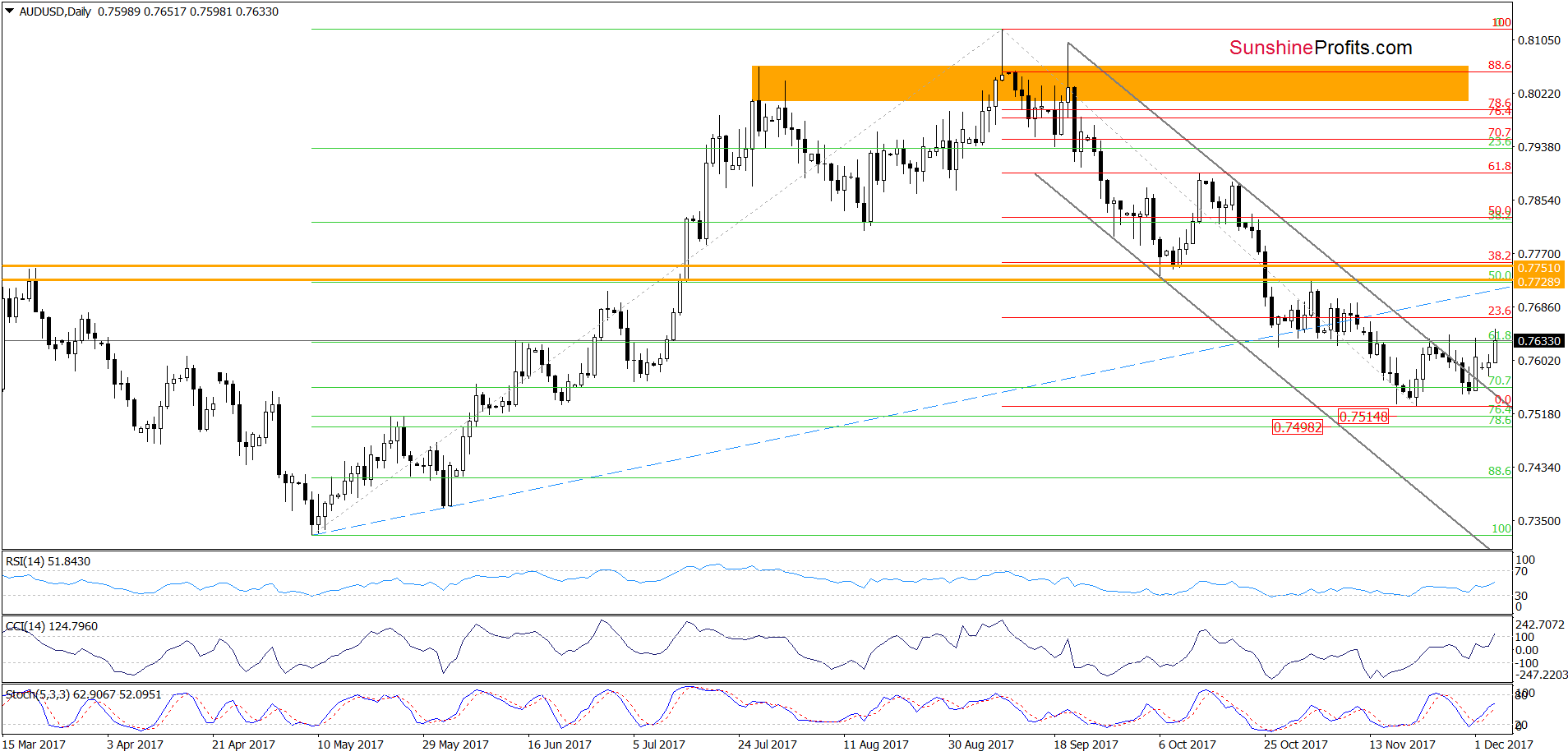

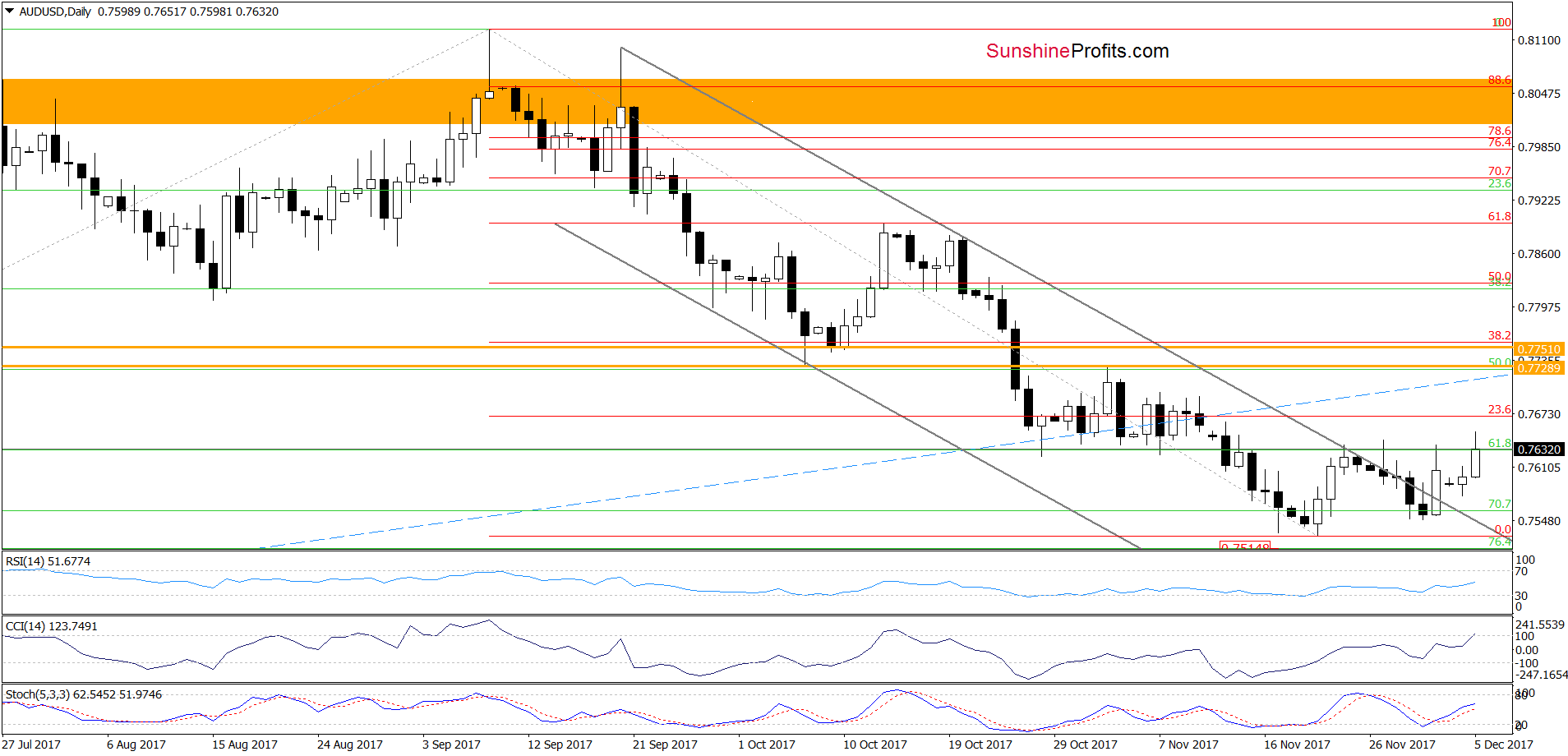

Looking at the above charts, we see that AUD/USD broke above the upper border of grey declining trend channel. Although this is a positive sign, the size of the upward move is quite small (compared to the importance of such breakout), which suggests that currency bulls may not be as strong as it seems at the first sight. At this point it is also worth noting that the rebound didn’t even reach the 23.6% Fibonacci retracement, which increases doubts about bulls’ strength.

Taking these facts into account, we think that the pair will reverse and decline in the coming days. How low could it go? In our opinion, we’ll see a test of the previously-broken upper border of grey declining trend channel and the recent lows in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts