In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1505; the initial downside target at 1.1009)

- GBP/USD: short (a stop-loss order at 1.3232; the initial downside target at 1.2375)

- USD/JPY: long (a stop-loss 111.67; the initial upside target at 114.87)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

In today’s Forex Trading Alert we’ll focus on 2 most important developments that we have just seen – the move in the EUR/USD to the key resistance level and the triple breakout (breakdown in JPY/USD) in case of the USD/JPY pair.

Let’s start with the former (chart courtesy of http://stockcharts.com).

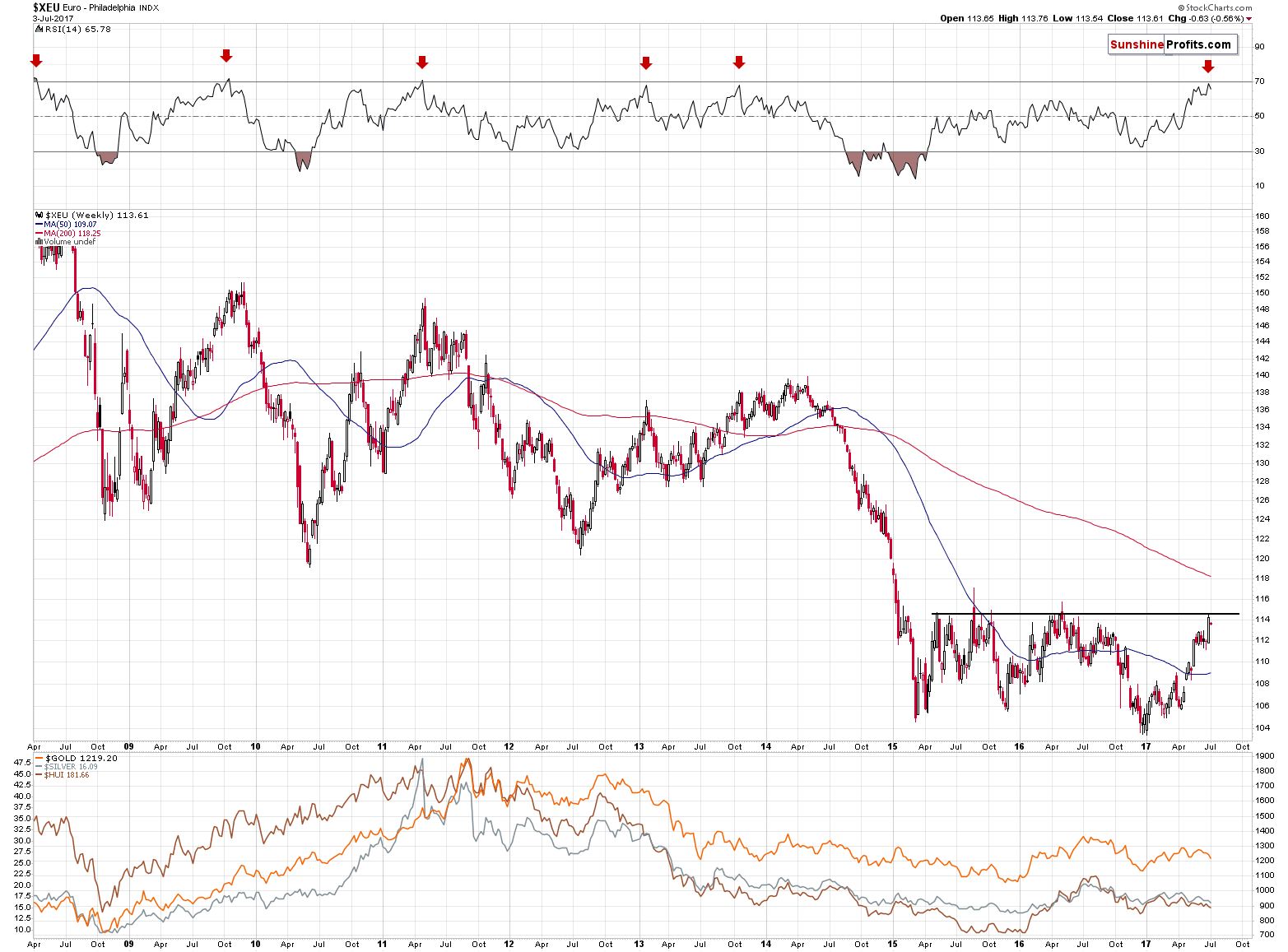

We discussed the big picture of the Euro Index in the previous Gold & Silver Trading Alerts and we wrote the following:

In short, it strongly appears that the euro has either reached its top or is about to do so shortly (perhaps today). The horizontal resistance line that you can see on the above chart is based on the highest weekly closes of the previous years. The weekly closing prices are the key closes to keep in mind in the case of bigger trends and the level that was just reached stopped the rally twice. There were temporary moves above it, but they all were very temporary. Since the week is ending today, it appears that the top is in or that we will see only a temporary upswing and a weekly close back at/below the resistance line.

A strong bearish confirmation comes from the RSI indicator – practically in all recent cases (the last 9 years), the readings of the RSI that were as high as the current ones meant that the euro was going to reverse shortly.

So, despite the bullish action [last] week, the outlook for the euro is actually very bearish and the chart is quite clear about that.

Monday’s session seems to have confirmed the above – the Euro Index declined, just like it did previously when it approached similar price levels in terms of the weekly closing prices. The outlook remains strongly bearish – it seems that another sizable decline has already started.

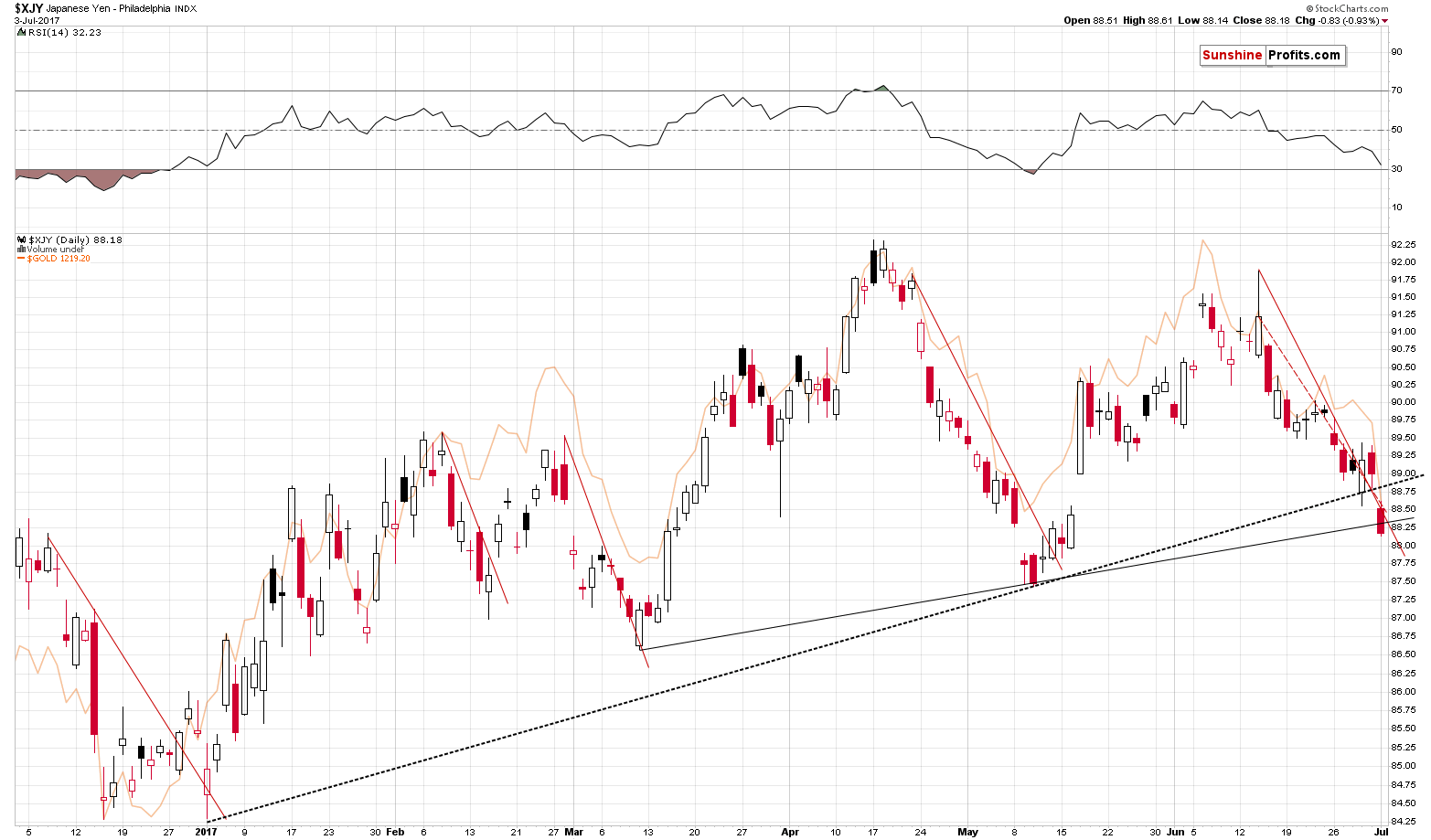

As far as the Japanese yen is concerned, we’ve seen a quite odd and important development this week.

Yen (JPY/USD) did something unlikely – even though it had previously moved to support levels and broke above the resistance line (and it continues to seem that taking profits from the trading position in this currency pair was justified), it declined sharply on Monday, breaking through (and closing below) 3 support lines: the short-term one based on the recent tops and 2 medium-term ones based on the previous lows. The short-term outlook for the Japanese yen has just deteriorated substantially.

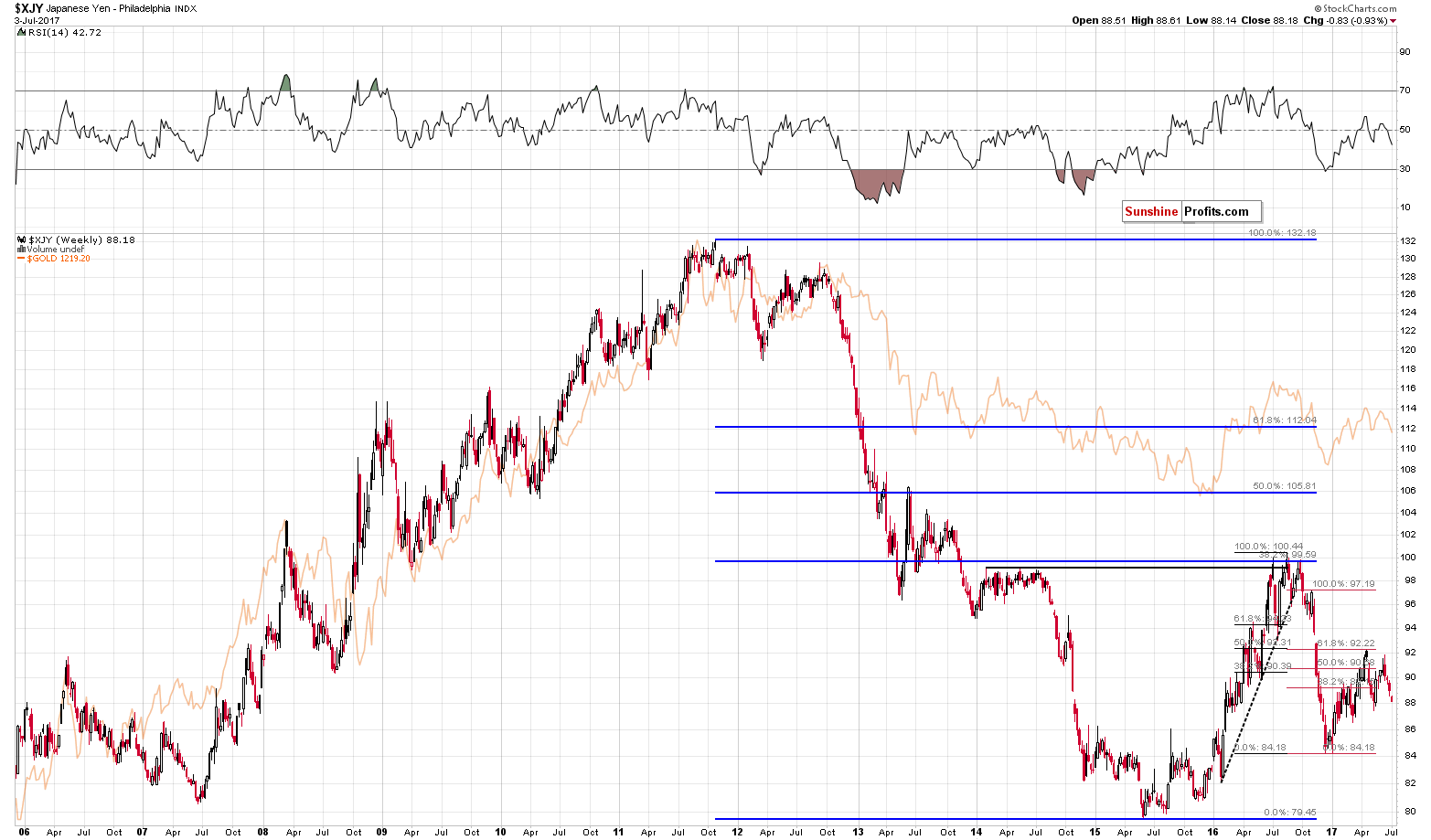

Given the above long-term yen chart, the change in the short-term outlook implies that the 2017 corrective upswing is over and that the yen can now move substantially lower (below the 2016 low and quite possibly below the 2015 low as well).

Please note that the above charts feature the JPY/USD pair, while we usually feature the inverse pair – USD/JPY and the target prices as well as stop loss levels are provided for the latter (the outlook for JPY/USD is bearish, so the outlook for the USD/JPY is bullish).

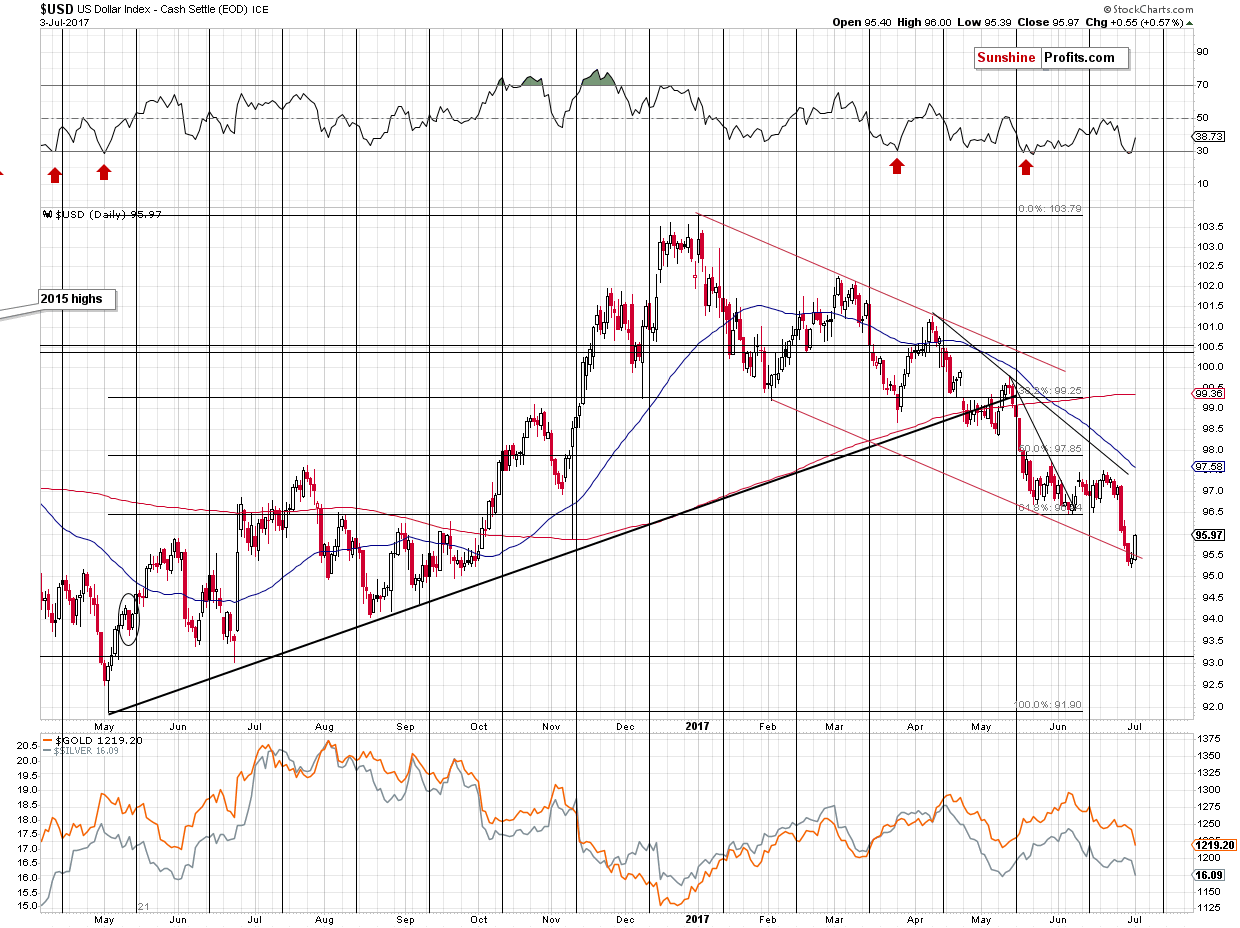

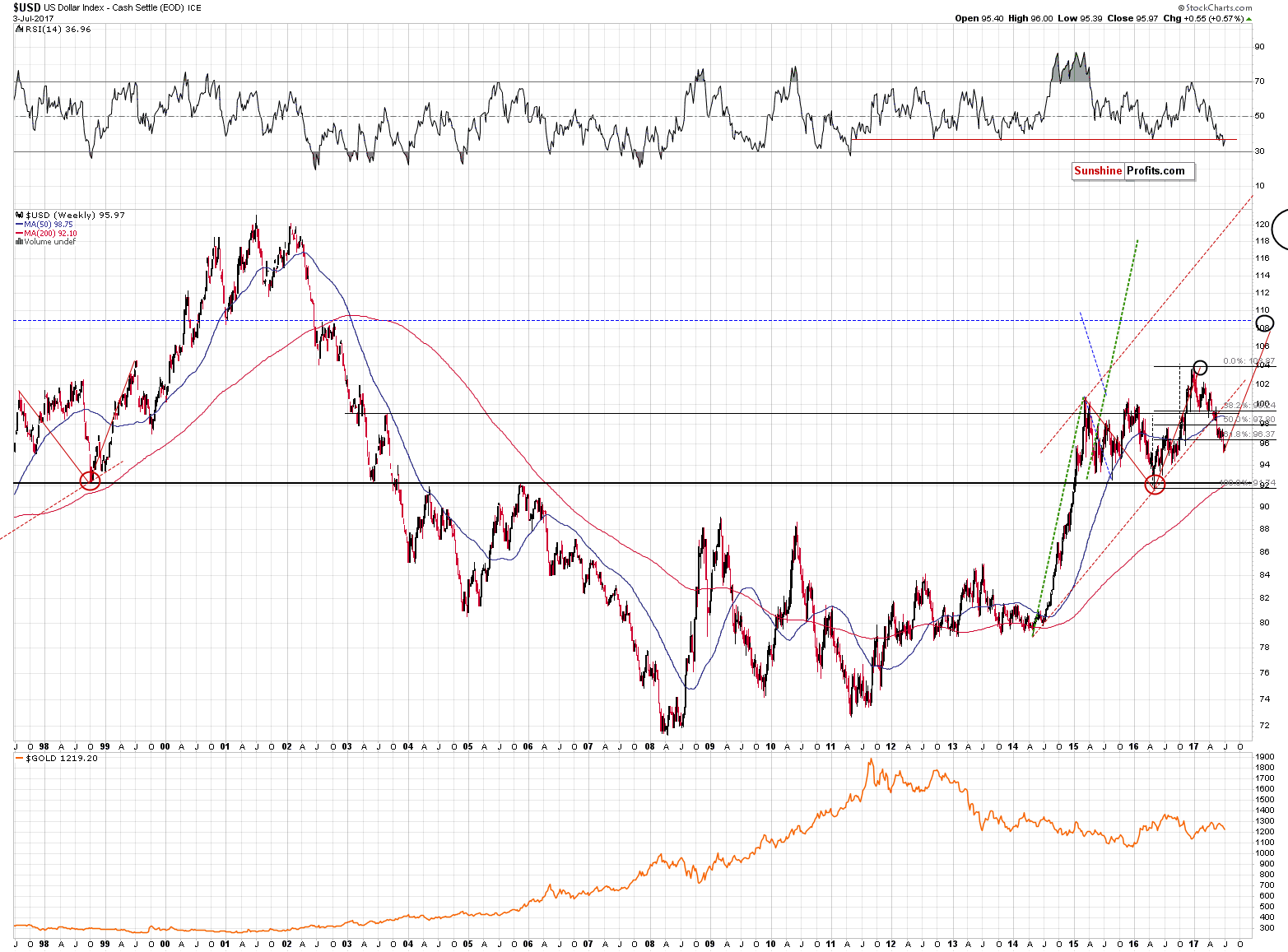

The above changes in individual currency pairs are reflected by changes in the USD Index – it invalidated the breakdown below the declining red support line (visible on the short-term chart; marked with red) and it seems that it’s about to invalidate the breakdown below the 61.8% Fibonacci retracement level seen on the long-term chart. The latter is at about 96.37 and the USD Index already moved to 96.24 today. The target for the following months at about 108 – 110 remains up-to-date – it seems that we will see a lot of strength in the American currency in the upcoming months, which is likely to provide us with great trading opportunities.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts