Earlier today, the euro extended gains against the U.S. dollar, which pushed EUR/USD to a fresh 2017 high, but will we see further rally in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1563; the initial downside target at 1.1009)

- GBP/USD: short (a stop-loss order at 1.3232; the initial downside target at 1.2375)

- USD/JPY: long (a stop-loss order at 111.67; the initial upside target at 114.87)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7752; the initial downside target at 0.7473)

EUR/USD

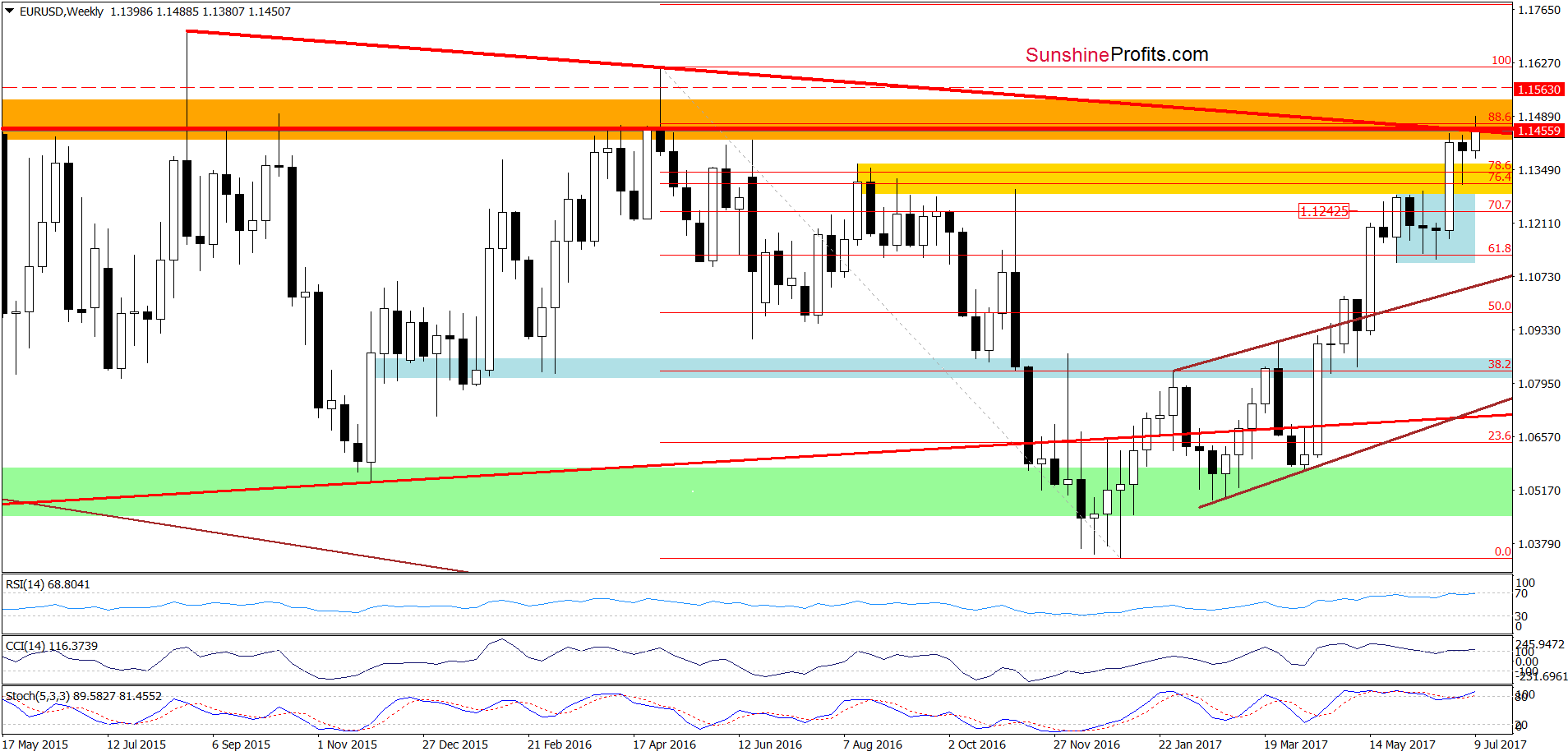

From the medium-term perspective, we see that although EUR/USD moved a bit higher earlier today, both key resistance lines (the long-term red resistance line based on the August 2015 and May 2016 peaks and the red horizontal resistance line cased on the highest weekly closures) continue to keep gains in check. Additionally, there are negative divergences between the CCI, the Stochastic Oscillator and the exchange rate, which increases the probability of reversal in the coming week.

Very short-term outlook: mixed with bearish bias

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1563 and the initial downside target at 1.1009) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

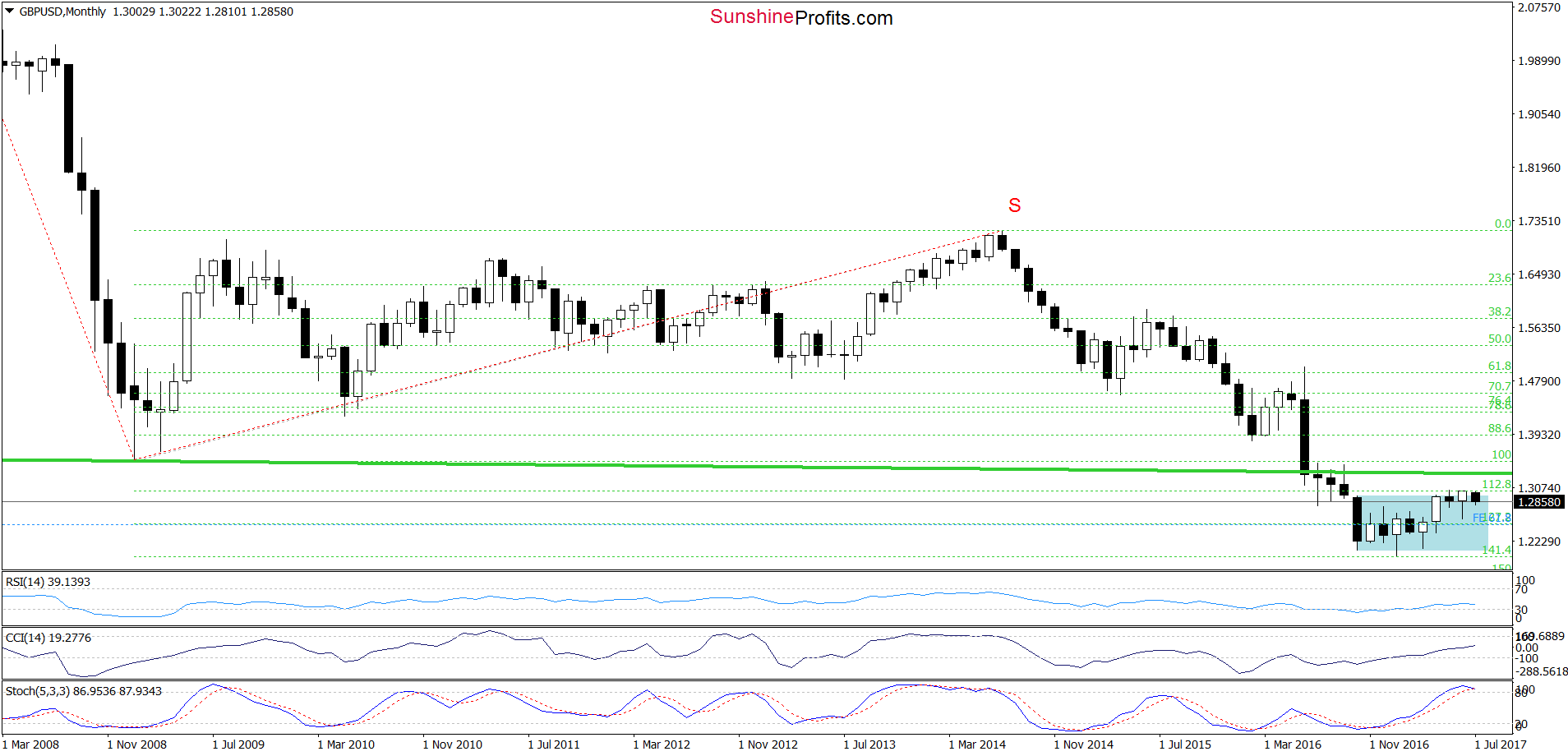

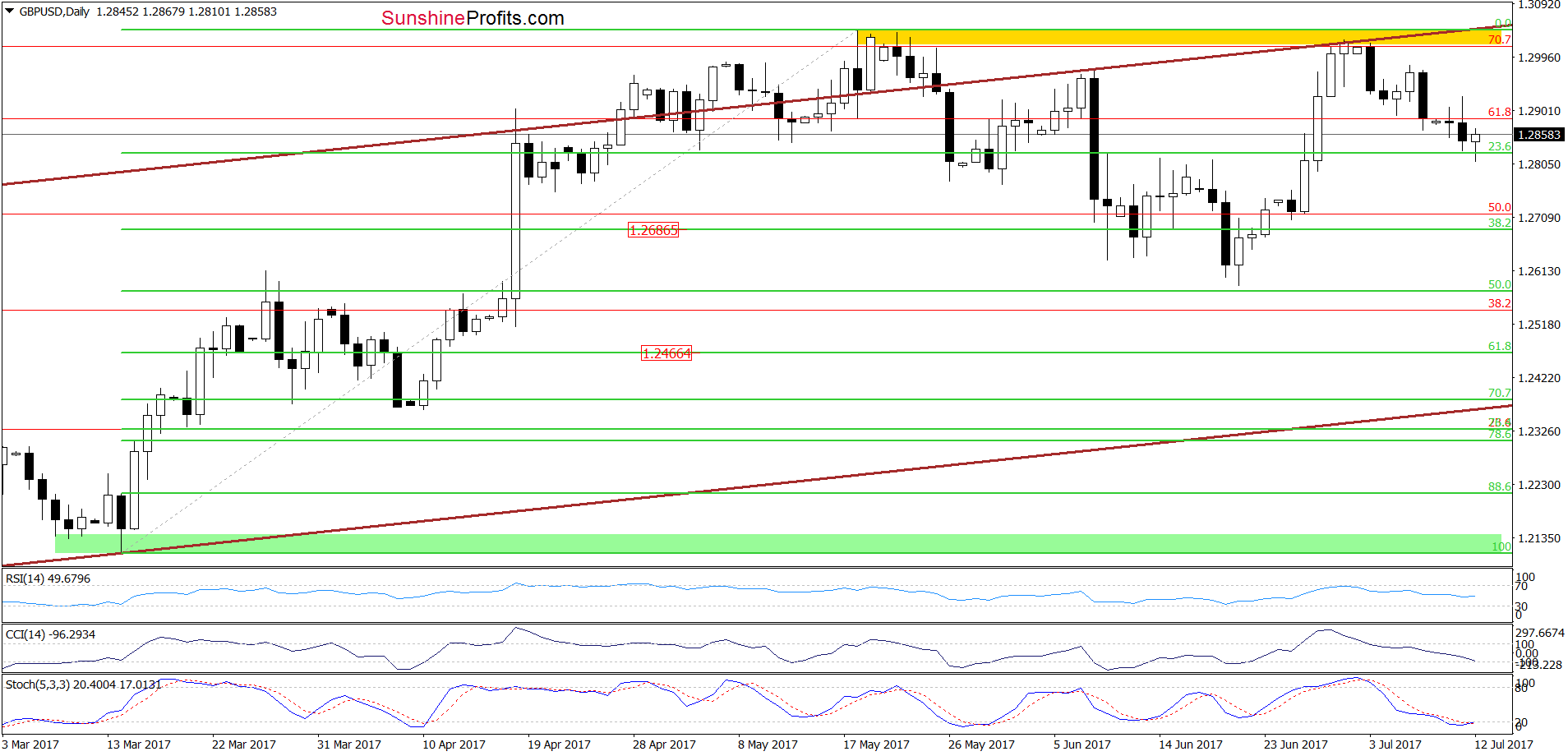

Looking at the daily chart, we see that the combination of the upper border of the brown rising trend channel and the yellow resistance zone encouraged currency bears to act, which resulted in a correction of the previous upward move. As a result, GBP/USD slipped to the 23.6$ Fibonacci retracement, which could trigger a small rebound. Nevertheless, the long-term picture suggests further deterioration in the coming weeks. If this is the case and GBP/USD declines below this first Fibonacci retracement, we’ll see a drop to at least 1.2686, where the next retracement is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.3232 and the initial downside target at 1.2375) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

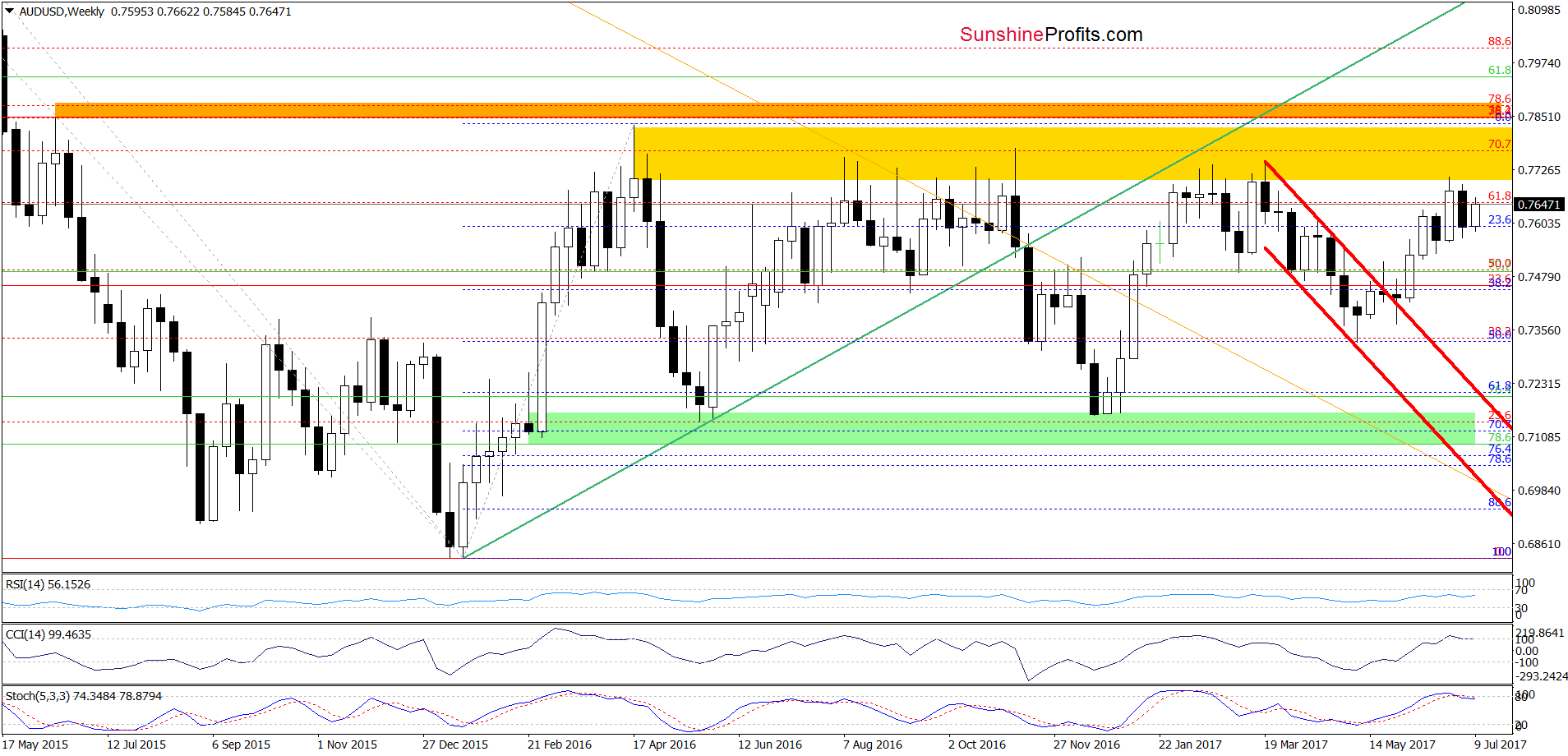

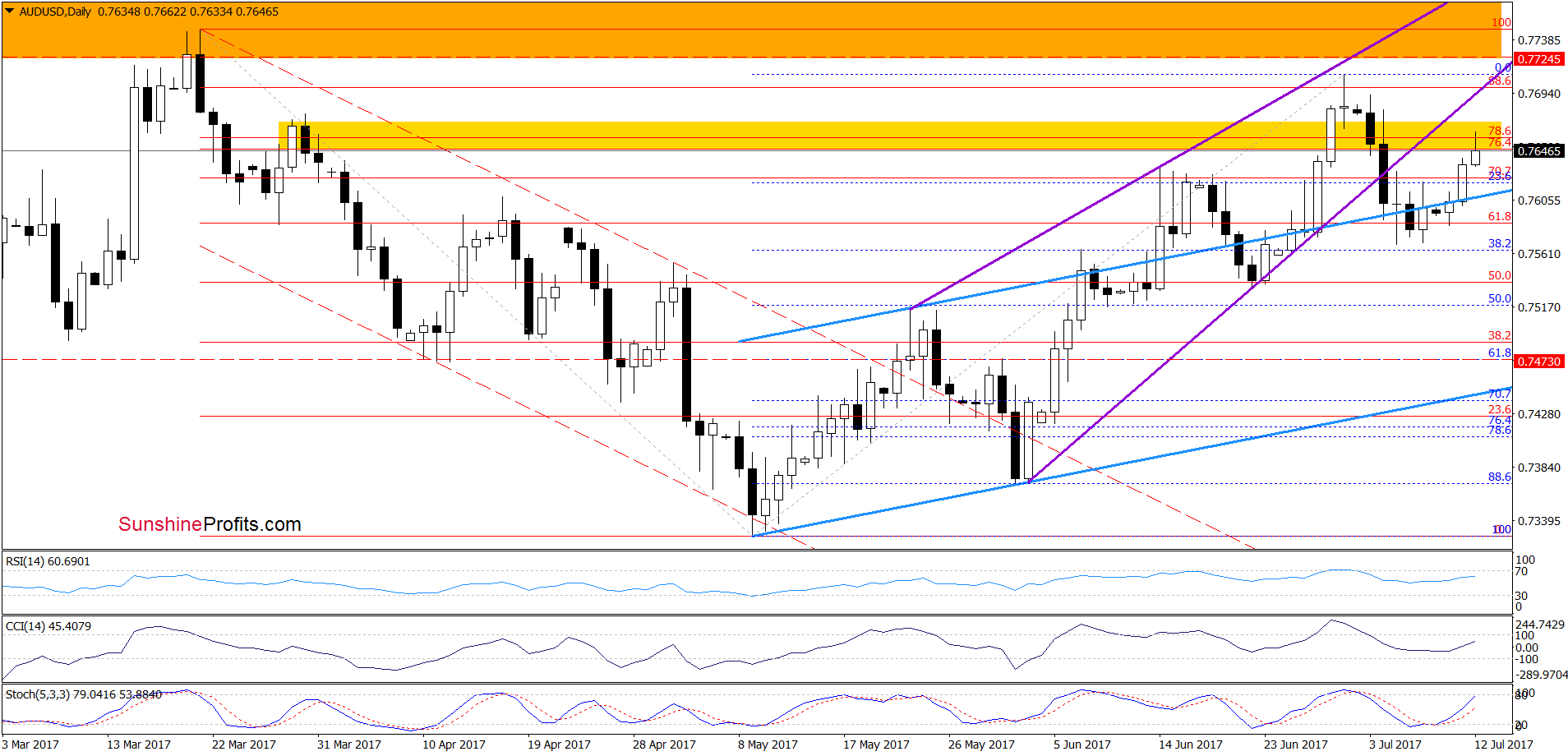

Looking at the weekly chart, we see that the yellow resistance zone continues to keep gains in check. Additionally, the Stochastic Oscillator generated the sell signal, while the CCI is very close to doing the same, which suggests another attempt to move lower in the coming week(s).

Will the very short-term chart confirm this scenario? Let’s check.

On the daily chart, we see that although AUD/USD extended gains in recent days, the pair is still trading under the yellow resistance zone. Nevertheless, the buy signal generated by the Stochastic Oscillator remains in cards, suggesting that we may see a test of the lower border of the purple rising wedge before another sizable move to the downside will be seen. In other words, as long as there is no invalidation of the breakdown under the lower border of the purple rising wedge short positions are justified from the risk/reward perspective.

Very short-term outlook: mixed with bearish bias

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 0.7752; the initial downside target at 0.7473) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts