Earlier today, the euro, the Australian dollar and the greenback reached their key support/resistance areas. This means that the moment of truth is just ahead of us. Is it possible that the technical picture of EUR/USD and AUD/USD give us valuable clues about the future moves?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2806; the initial downside target at 1.2186)

- GBP/USD: short (a stop-loss order at 1.4548; the next downside target at 1.3685)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.8222; the initial downside target at 0.7743)

EUR/USD

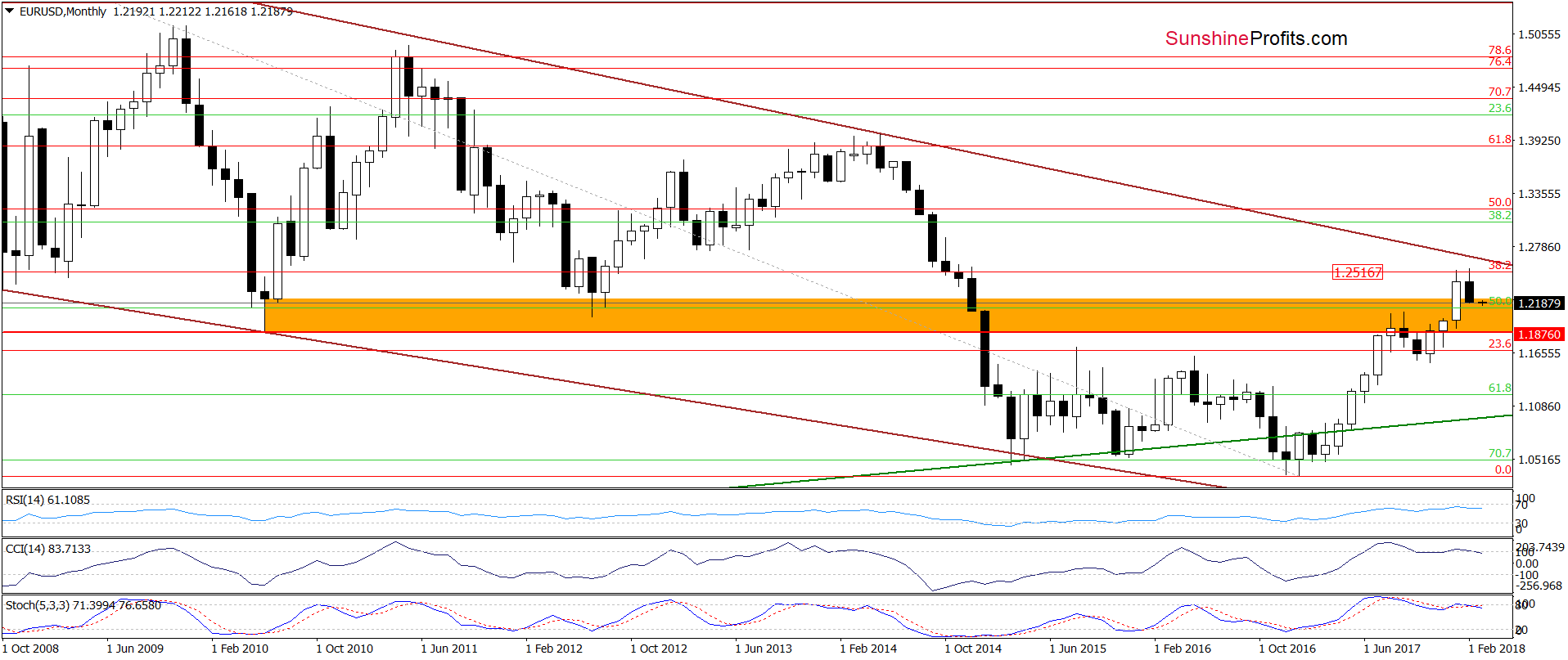

As you see on the long-term chart EUR/USD closed February under the previously-broken 38.2% Fibonacci retracement, confirming an invalidation of the earlier breakdown. This means that the negative implications of this development and their impact on the exchange rate remain in the cards, supporting currency bears.

What impact did this price action have on the very short-term chart?

Before we answer this question, let’s recall the quote form our Tuesday’s Forex Trading Alert:

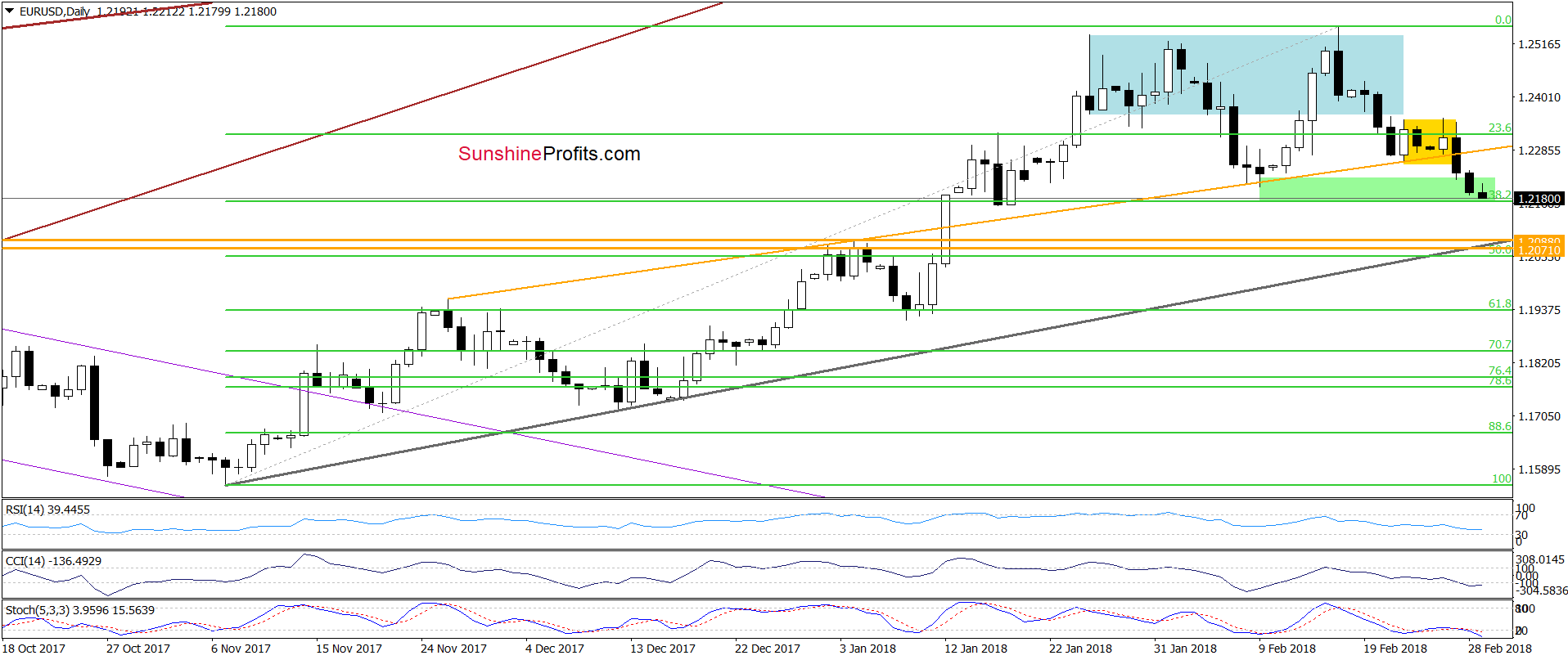

(…) the upper line of the formation [the yellow consolidation] stopped them once again, triggering a pullback. This show of weakness increases the probability that we’ll see not only a re-test of the orange line, but also the breakdown below it in the very near future.

If the situation developed in line with this assumption, the way to the 38.2% Fibonacci retracement will be open.

Looking at the daily chart from today’s point of view, we see that currency bears took EUR/USD to our downside target earlier today.

What’s next for the exchange rate?

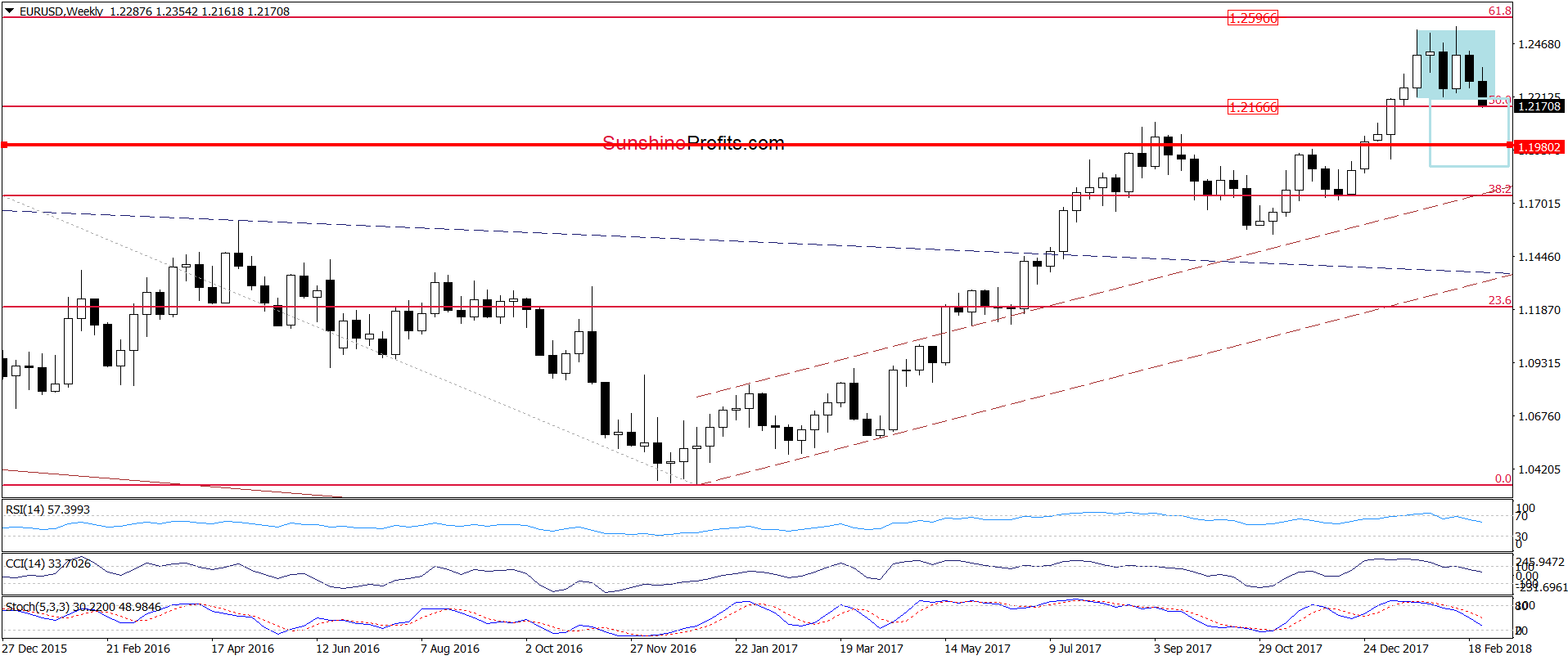

As you see on the very short-term chart, the daily indicators are oversold, which increases the probability of a rebound in the coming days. Nevertheless, the current situation on the medium-term chart suggests that if the pair closes the week under the lower line of the blue consolidation (seen on the chart below), we could see lower values in the near future.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.2806 and the initial downside target at 1.2186) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

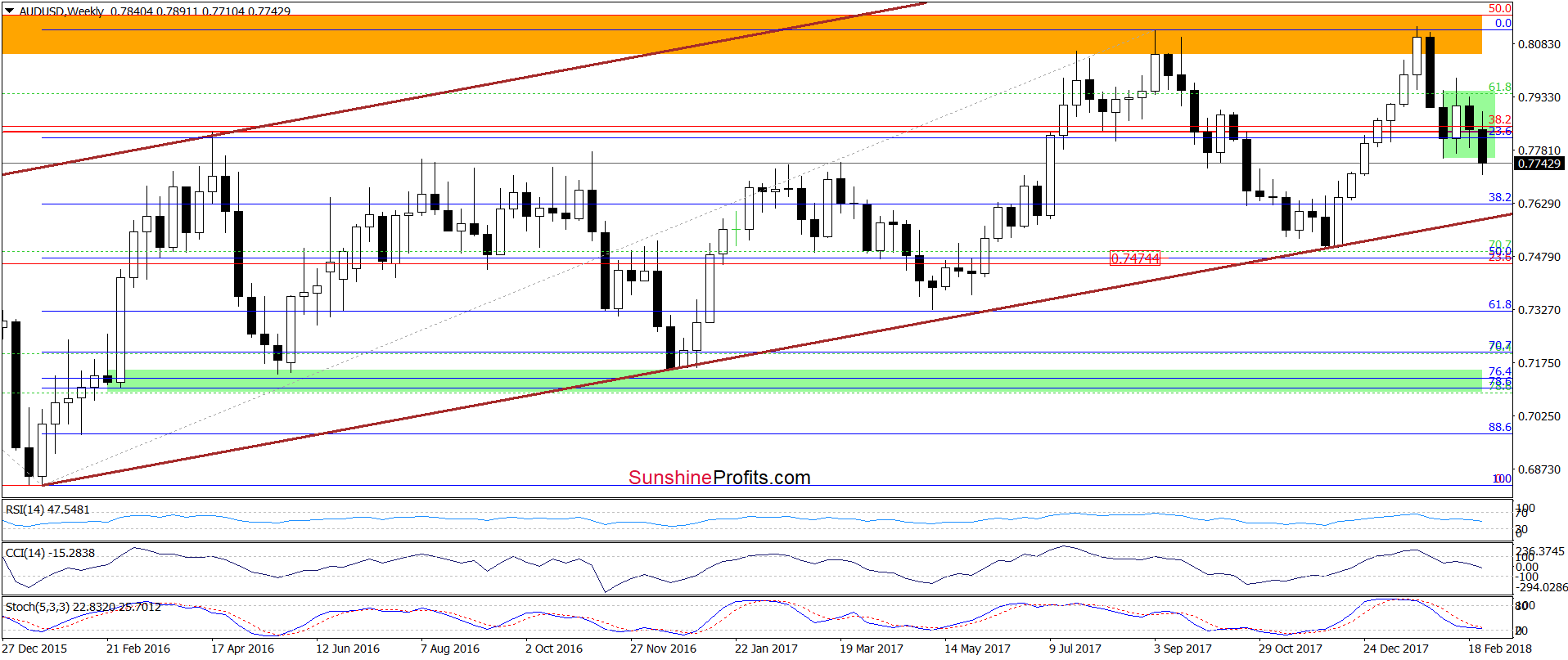

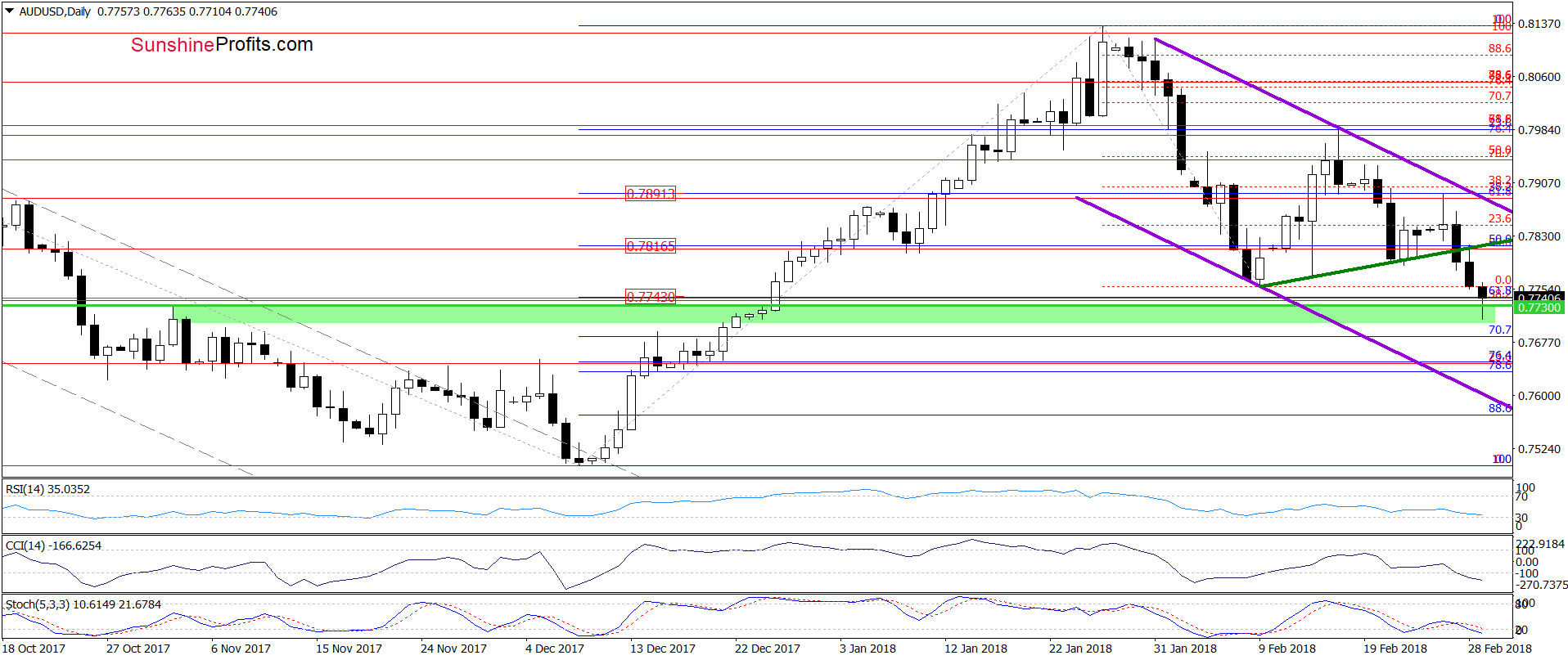

On the medium-term chart, we see that AUD/USD dropped under the lower border of the green consolidation, which suggests that the Australian dollar will extend declines against its U.S. counterpart in the coming days. Nevertheless, this scenario will be more likely and reliable if the pair closes the week under the lower line of the formation.

Having said the above, let’s check what can we infer from the daily chart.

From the very short-term pint of view, we see that AUD/USD extended losses and broke below the green support line based on the previous lows. This bearish development together wit the sell signals generated by the daily indicators triggered further deterioration in the following days, which resulted in a test of the green support zone.

Although this area could encourage currency bulls to act, the sell signals generated by the weekly and daily indicators remain in the cards, which together with the medium-term picture suggests that one ore attempt to move lower can’t be ruled out.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 0.8222 and the initial downside target at 0.7743) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts