Yesterday, the euro extended gains against the greenback, which pushed EUR/USD to the highest level since the beginning of 2015. Despite this improvement, the pair reversed and pulled back. Will we see a bigger downward move in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (a stop-loss order at 1.3272; the initial downside target at 1.2375)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

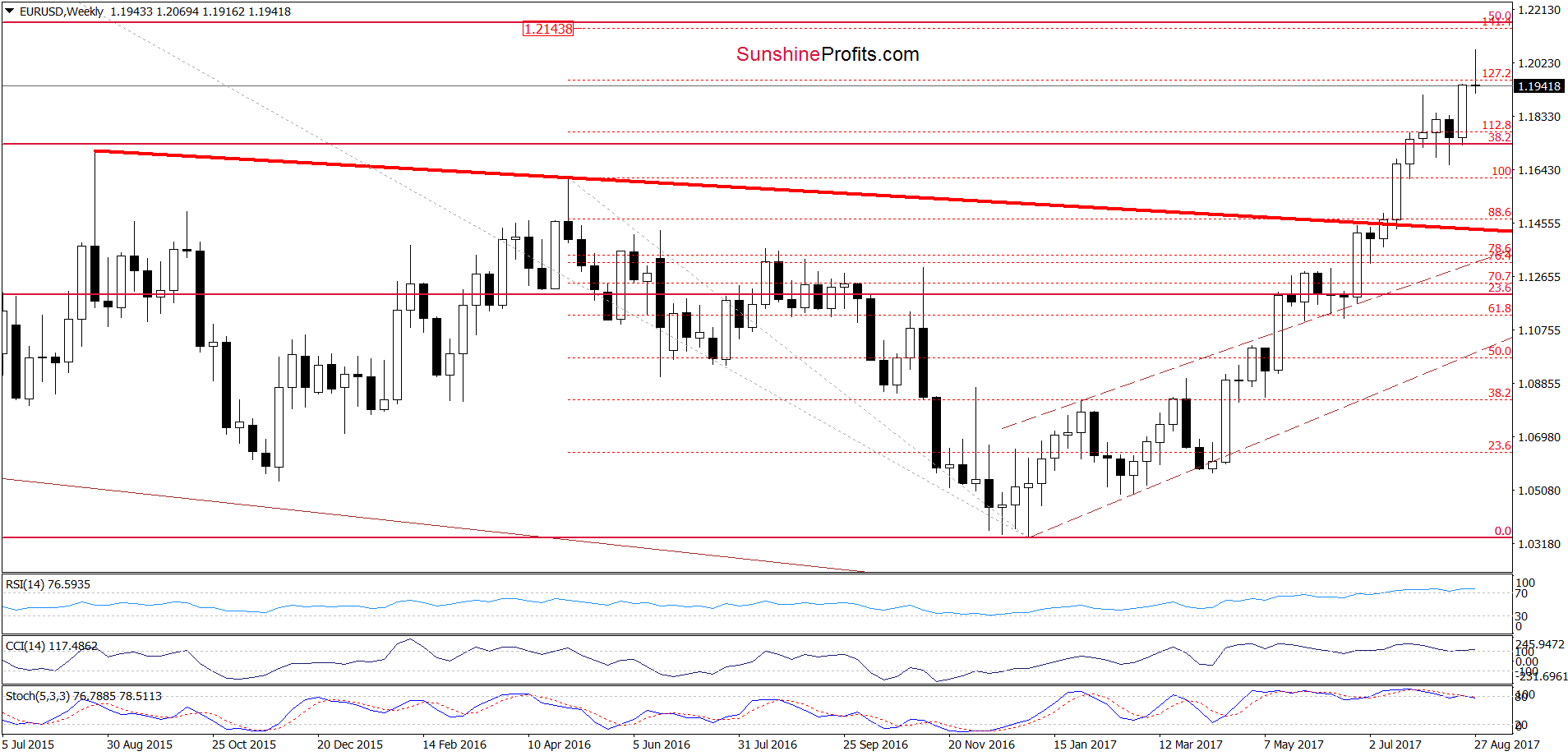

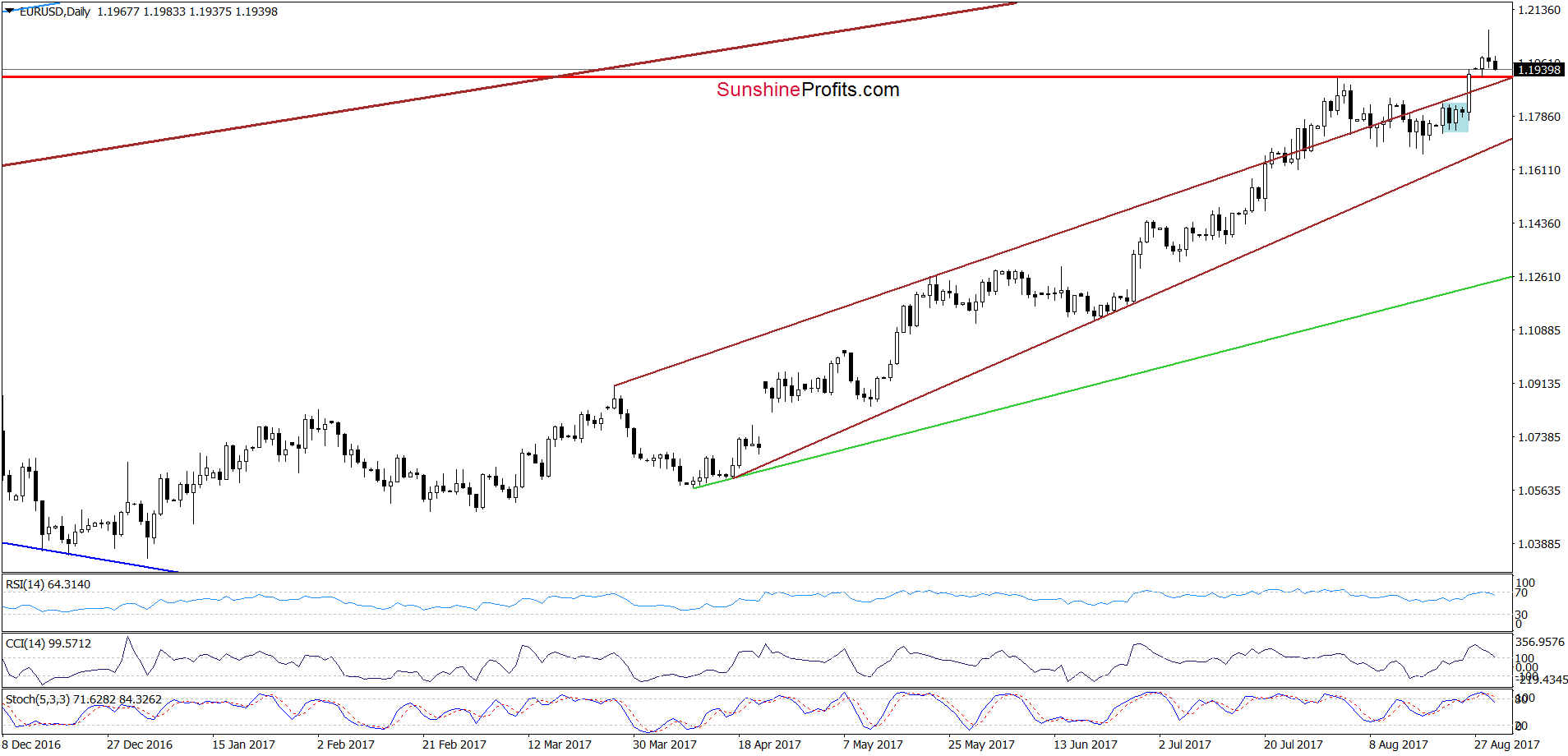

Yesterday, EUR/USD extended gains, which resulted in a fresh 2017 high. Despite this improvement, the pair reversed and pulled back, which triggered further deterioration earlier today. As a result, the exchange rate invalidated the earlier breakout above the 127.2% Fibonacci extension and approached the previously-broken August peak. Additionally, daily indicators generated the sell signals, which suggest further deterioration in the coming days.

Nevertheless, in our opinion, as long as there is no invalidation of the breakout above the early August high and a weekly closure below the 127.2% Fibonacci extension a sizable move to the downside is not reliable enough to open short positions. Therefore, waiting at the sidelines for a profitable opportunity is justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

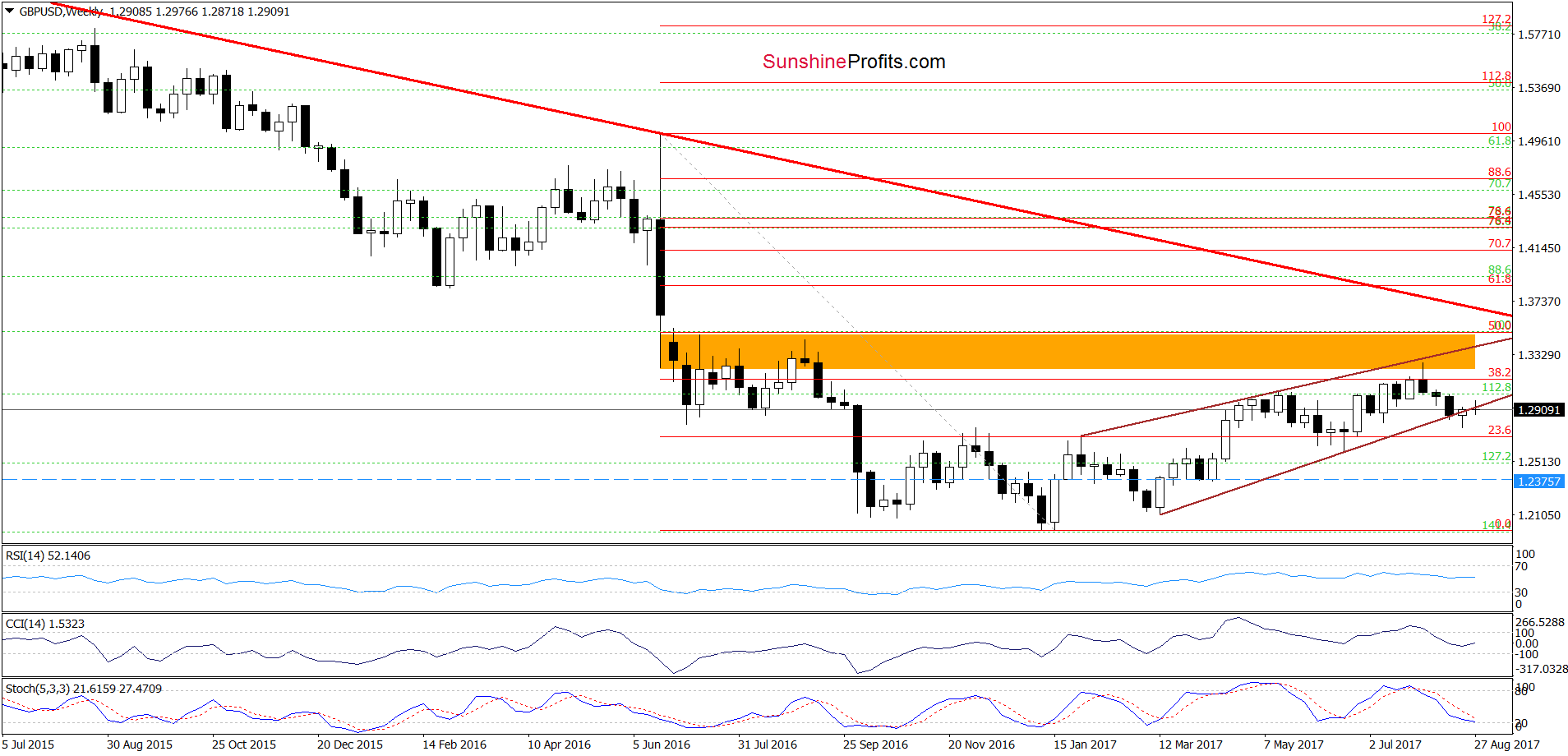

Looking at the weekly chart, we see that although GBP/USD moved a bit higher earlier this week, the exchange rate pulled back and came back below the lower border og the brown rising trend channel. Additionally, the sell signals generated by the medium-term indicators remain in place, suggesting that another move to the downside is just around the corner.

Having said the above, let’s check how this drop affected the very short-term chart.

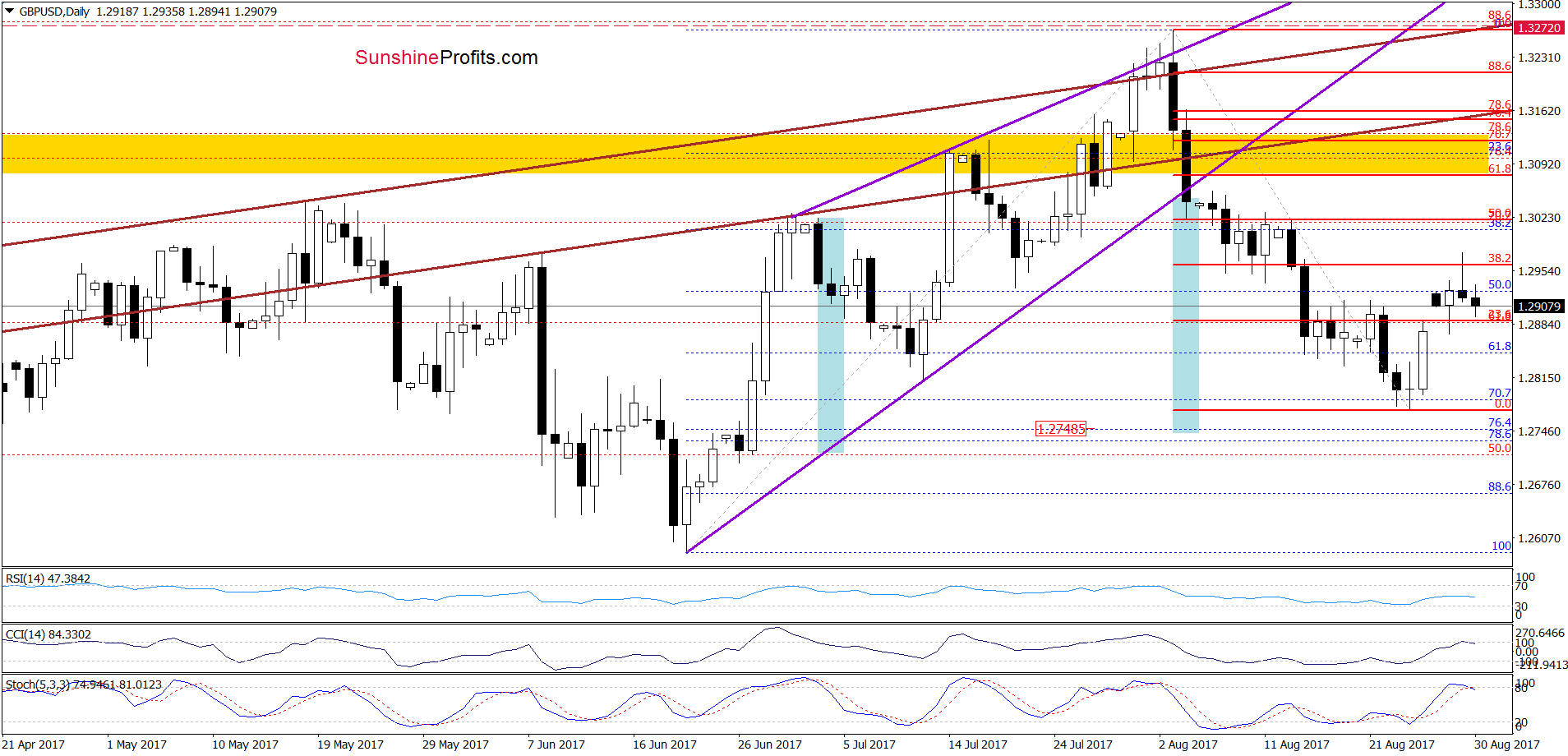

From today’s point of view, we see that although GBP/USD extended gains yesterday, the 38.2% Fibonacci retracement successfully stopped currency bears, triggering a pullback. Earlier today, the pair extended losses, which together with the current position of the indicators (the CCI and the Stochastic Oscillator generated the sell signals) suggests that we’ll see further deterioration in the coming days.

How low could the exchange rate go in the coming days? In our opinion, the first downside target for currency bears will be the 70.7% Fibonacci retracement and the August low of 1.2772. However, taking into account the breakdown under the lower border of the purple rising wedge, we think that GBP/USD will decline to the downside target from our Forex Trading Alert posted on August 24:

(…) another downside target for currency bears will be around 1.2748, where the size of the downward move will correspond to the height of the rising wedge and where the 76.4% and 78.6% Fibonacci retracements are.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short (profitable) positions (with a stop-loss order at 1.3272 and the initial downside target at 1.2375) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

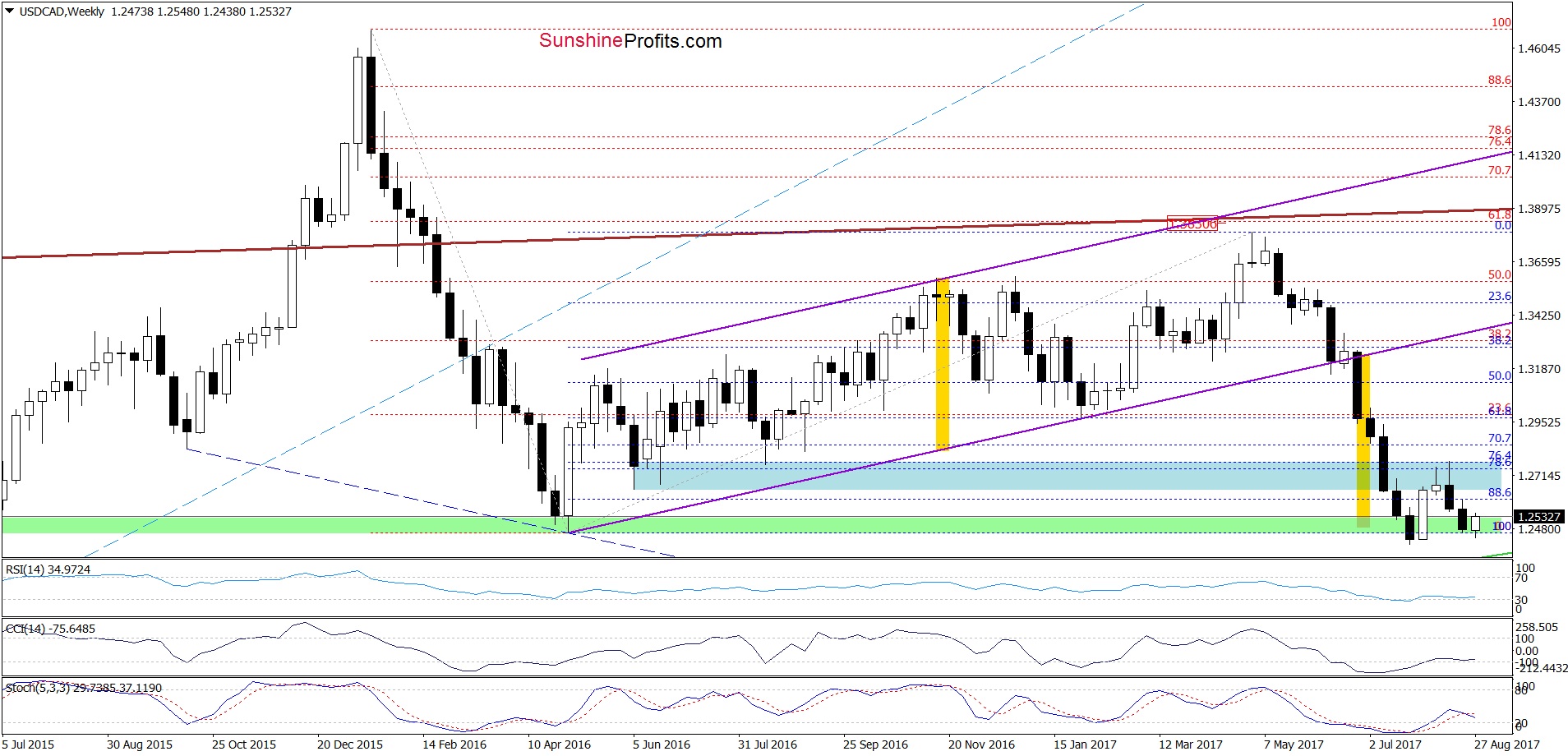

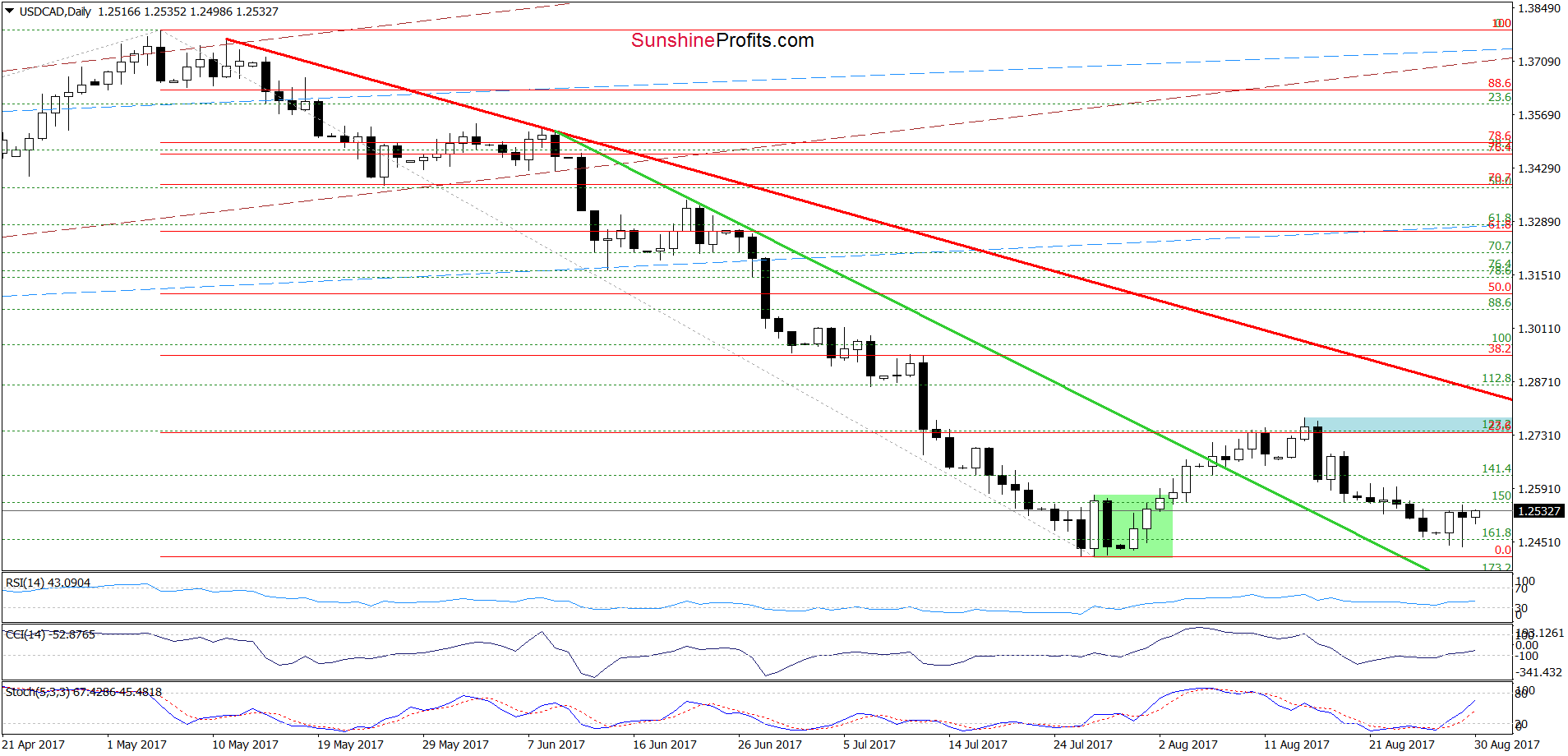

USD/CAD

Looking at the above charts, we see that the green support zone (marked on the weekly chart) together with the 161.8% Fibonacci extension (seen on the daily chart) stopped currency bears and recent declines. As a result, USD/CAD rebounded, which together with the buy signals generated by the daily indicators suggests that we’ll see further improvement and a test of the blue resistance zone and the red declining resistance line (marked on the daily chart) in the coming days. Nevertheless, in our opinion, as long as there is no breakout above these resistances a sizable move to the upside is not likely to be seen.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts