Although today’s data showed that the Markit U.K. manufacturing PMI increased to 52.0 in May, the data missed forecasts of 52.5, disappointing market participants. As a result, GBP/USD extended losses and hit a fresh 3-week low. Will we see the exchange rate below 1.5200 in the coming week?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: Short positions (stop-loss order at 1.1667)

- GBP/USD: Short positions (stop-loss order at 1.5913)

- USD/JPY: None

- USD/CAD: Long positions (stop-loss order at 1.1706)

- USD/CHF: None

- AUD/USD: Short positions (stop-loss order at 0.8194)

EUR/USD

The situation in the medium term remains almost unchanged as an invalidation of the breakout above the 23.6% Fibonacci retracement and sell signals generated by the indicators support further deterioration.

Are there any short-term factors that could encourage currency bears to act? Let’s check.

On Friday, we wrote the following:

(…) taking into account a buy signal generated by the Stochastic Oscillator, it seems that currency bulls will try to push the pair higher and test the strength of the orange resistance zone, which is currently reinforced by the 50-day moving average.

Looking at the daily chart, we see that the situation developed in line with the above scenario and EUR/USD reached our upside target. Despite this increase, combination of the orange zone and the red resistance line stopped further improvement, triggering a pullback earlier today. This means that what we wrote in our last commentary on this currency pair is up-to-date:

(…) If the exchange rate moves lower from here, the recent upward move would be nothing more than a verification of earlier breakdown and we’ll likely see a test of the recent low.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (which are profitable) with a stop-loss order at 1.1667 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

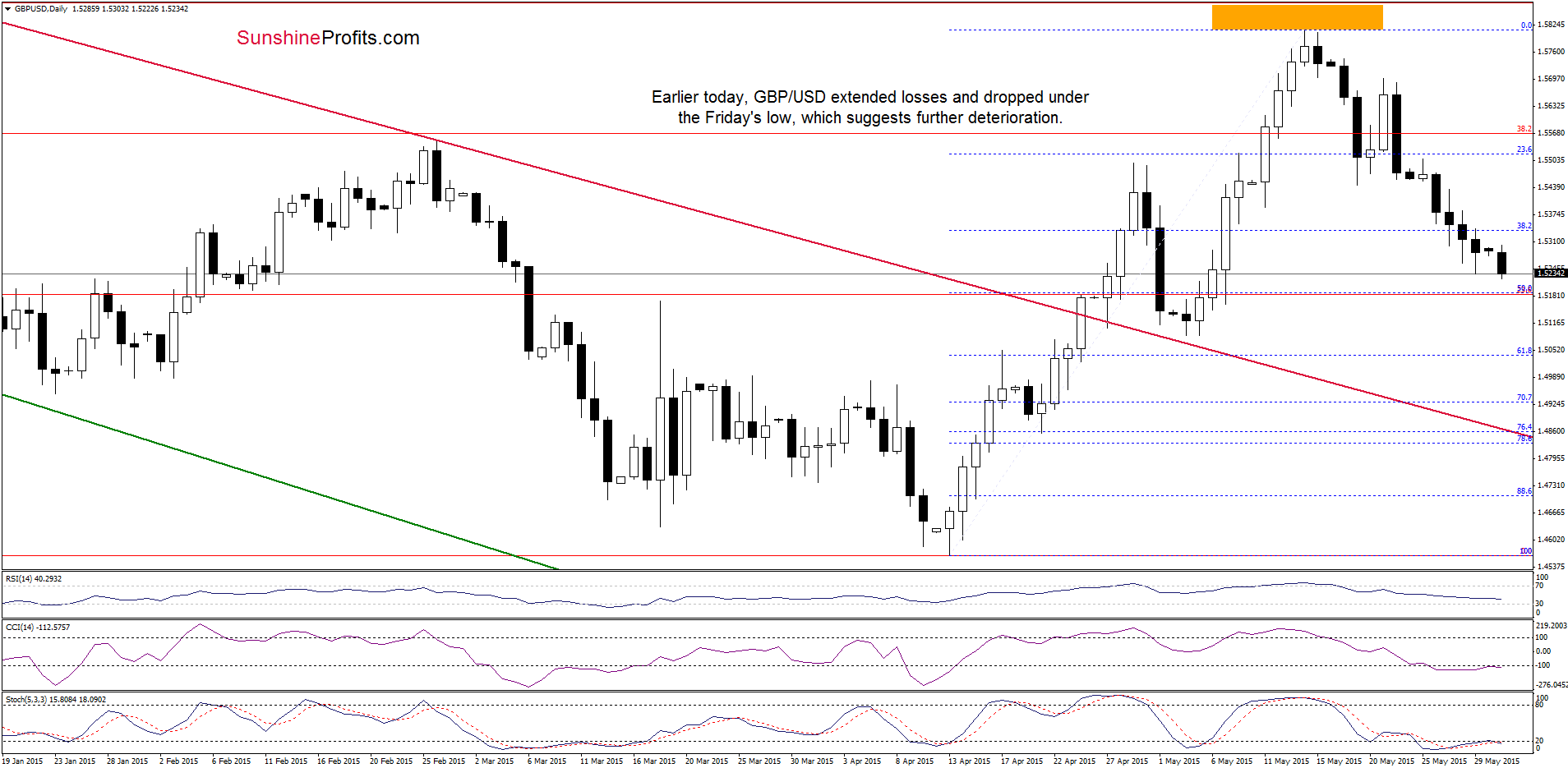

GBP/USD

The medium-term perspective hasn’t changed much as GBP/USD remains under the long-term green support line (which serves a resistance at the moment), which means that an invalidation of the breakout above this line and its negative impact on future moves is still in effect, suggesting further deterioration.

Having said that, let’s examine the daily chart and find out what can we infer from the very short-term picture.

Earlier today, GBP/USD reversed and declined once again, slipping under the Friday’s low, which suggests that we’ll see (at least) a test of the 50% retracement (around 1.5190) in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (which are profitable) with a stop-loss order at 1.5913 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

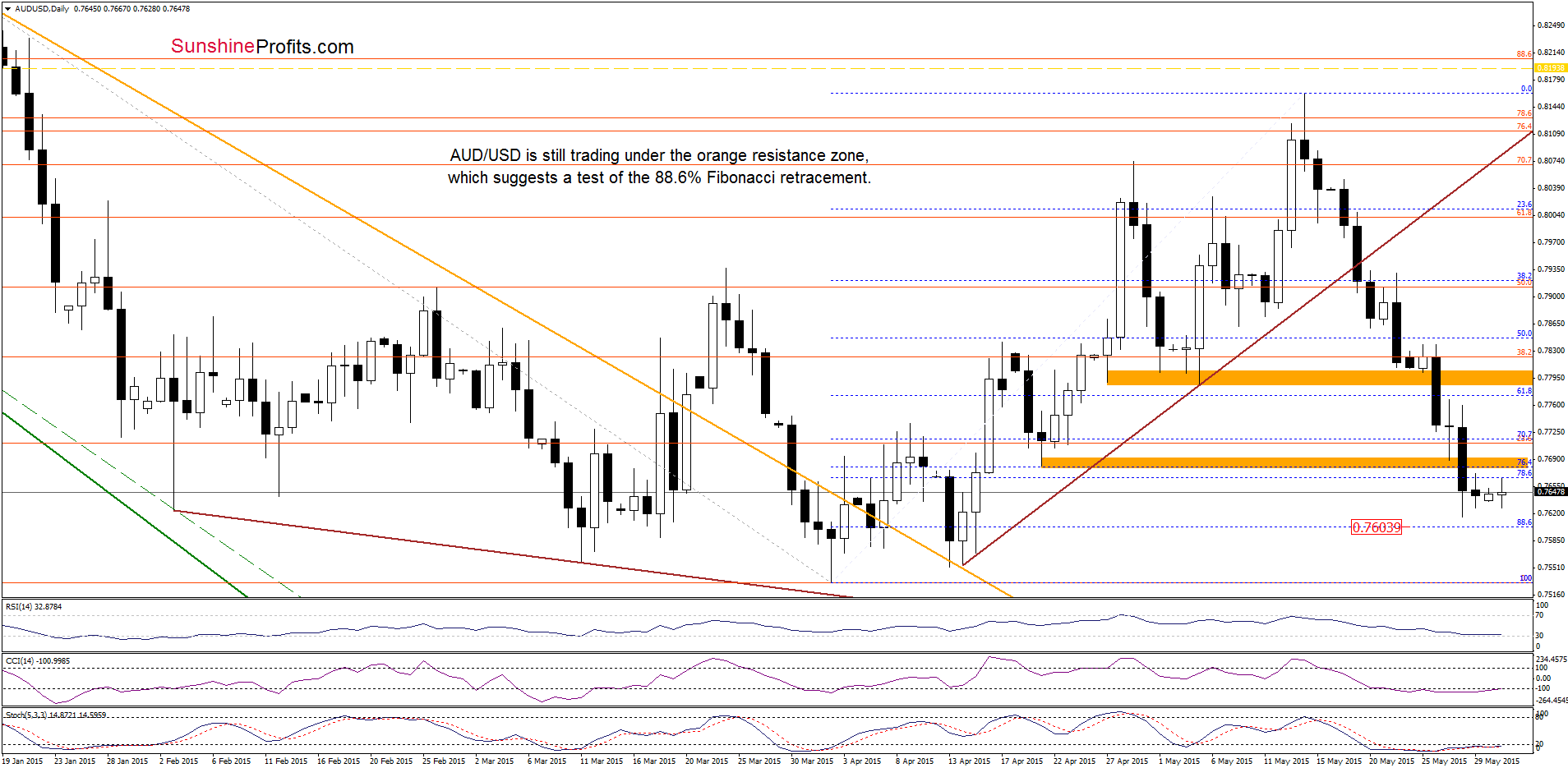

AUD/USD

The medium-term picture remains almost unchanged as AUD/USD is trading slightly above the support line based on the Mar and Apr lows. Will the very short-term picture give us more clues about future moves?

Not really, because AUD/USD is trading in a narrow range under the orange resistance zone created by the Apr 24 low and the 76.4% and 78.6% Fibonacci retracements. Although the current position of the indicators suggests that we could see a rebound in the coming week, we think that as long as there is no invalidation of the breakdown under this area further improvement is doubtful and another move lower is likely.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (which are profitable) with a stop-loss order at 0.8194 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts