Earlier today, official data showed that euro zone industrial production rose 0.6% in Oct, beating expectations for a 0.3% gain. Thanks to these numbers, EUR/USD bounced off the session’s low and came back above 1.0980. But did this move change anything in the short-term picture of the exchange rate?

In our opinion the following forex trading positions are justified - summary:

EUR/USD

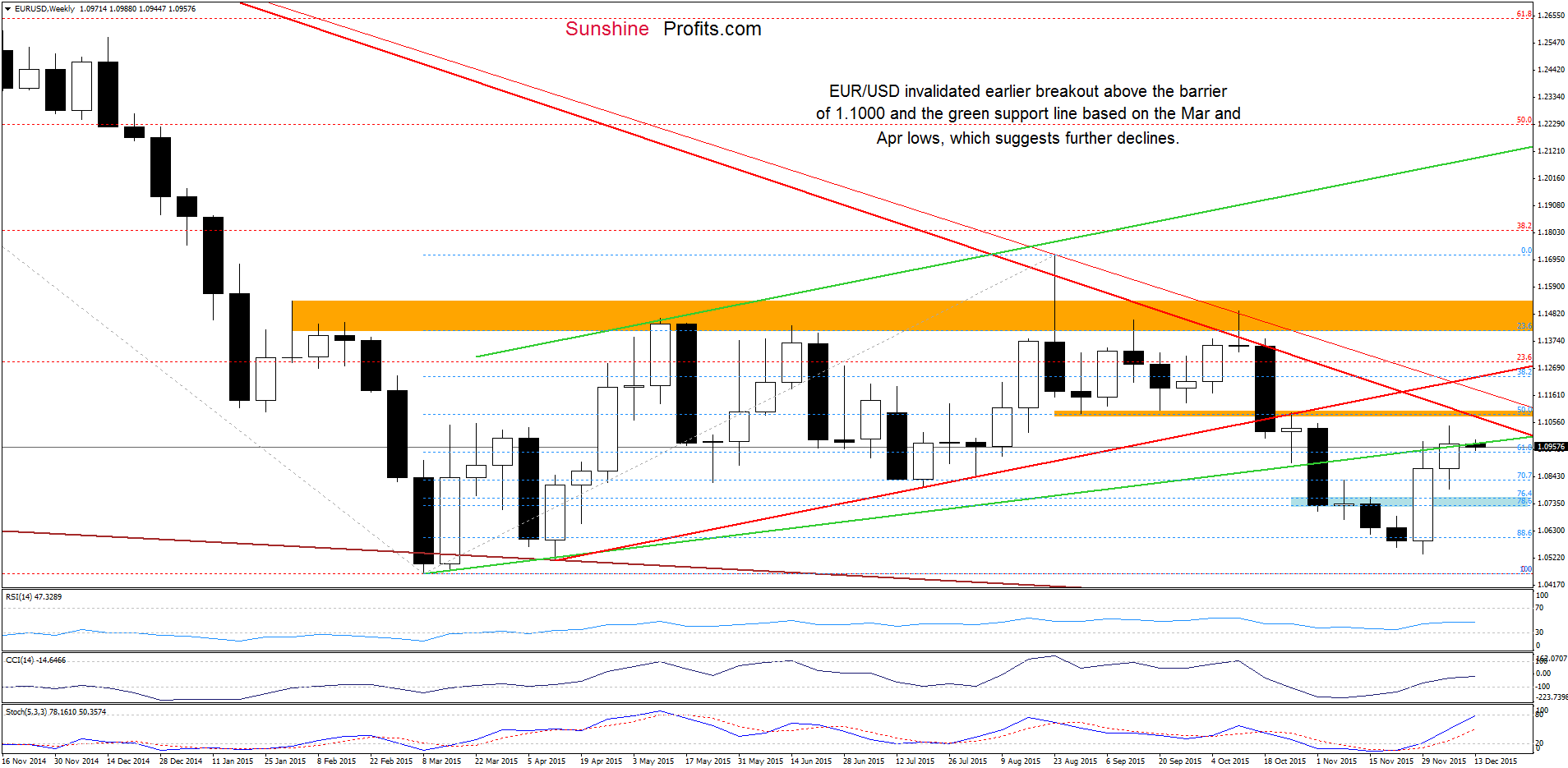

Looking at the weekly chart, we see that EUR/USD is still trading under the previously-broken barrier of 1.1000 and the green line based on the Mar and Apr lows, which suggests that another downswing is likely.

Will the daily chart give us more clues about future moves? Let’s check.

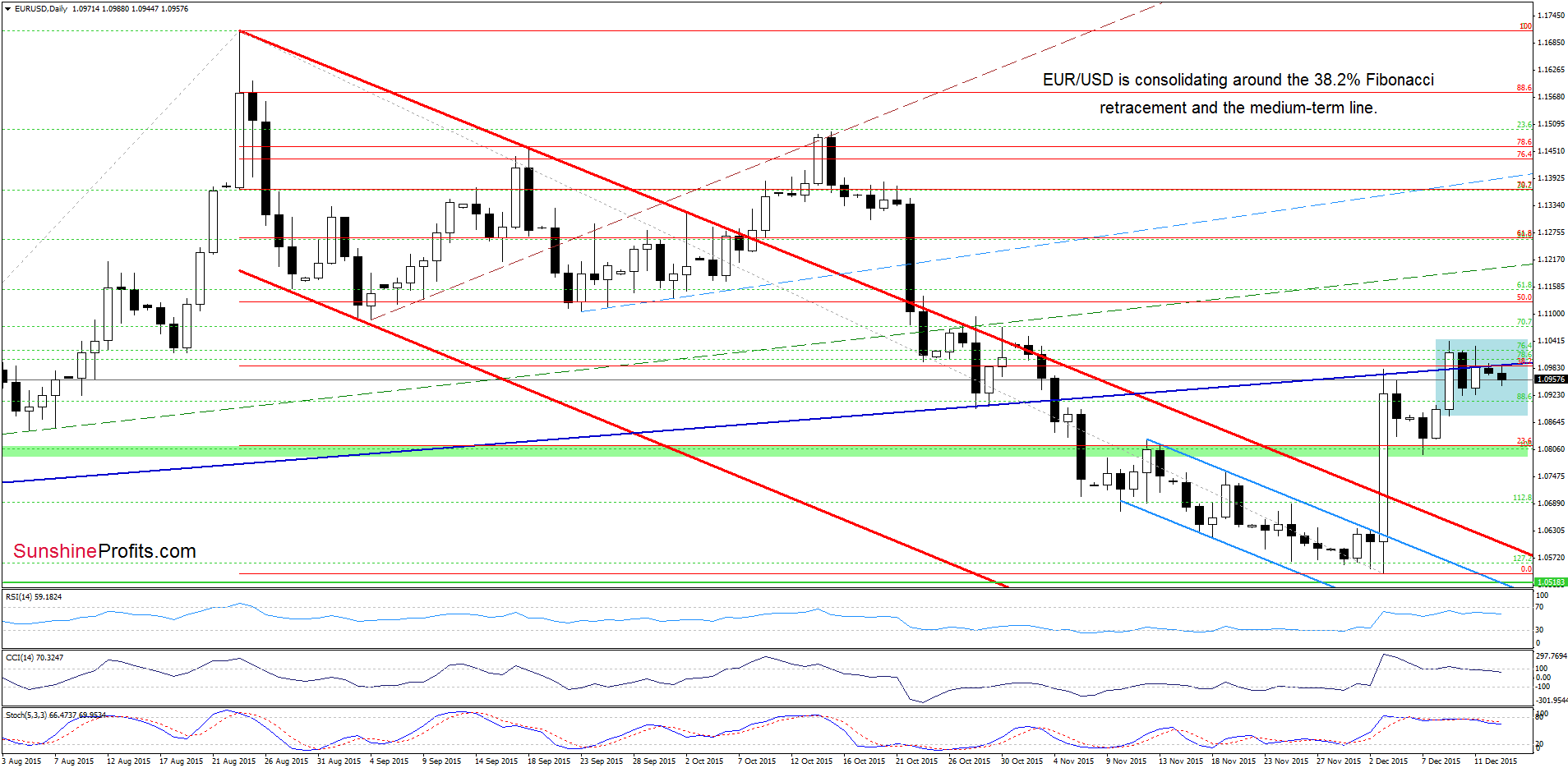

From this perspective, we see that EUR/USD is still consolidating around the 38.2% Fibonacci retracement and the navy blue support/resistance line. Taking this fact into account, we think that as long as there is no breakout above the upper line of the formation (or a breakdown under the lower border) another sizable move is not likely to be seen. Nevertheless, please keep in mind that the current position of the indicators suggests that reversal and lower values of EUR/USD are just around the corner.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

Quoting our previous alert:

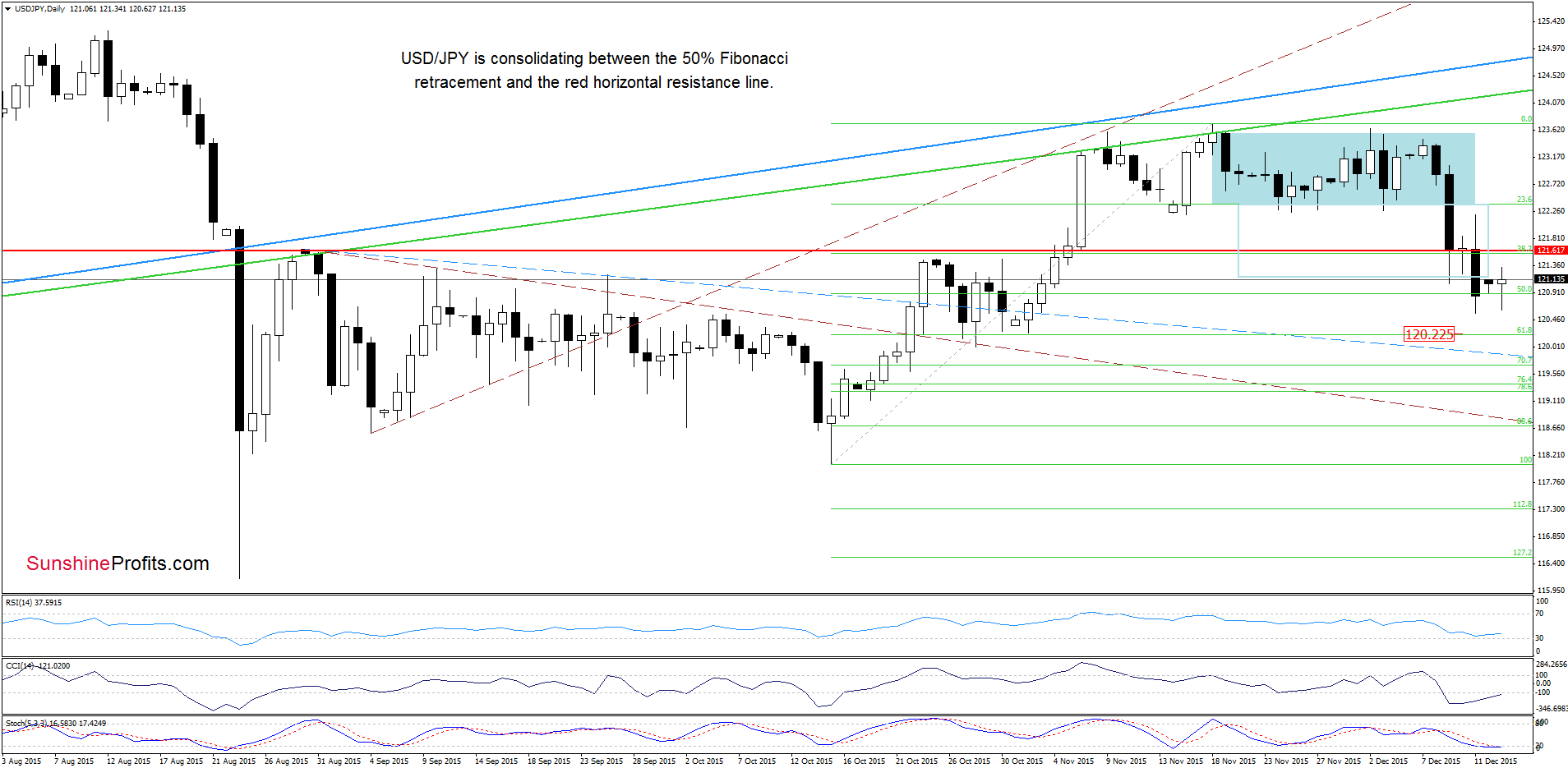

(…) the exchange rate rebounded and climbed to the previous lows and the 23.6% retracement, which looks like a verification of earlier breakdown. If this is the case and USD/JPY declines from here, we’ll likely see a drop to around 120-120.22, where the 61.8% Fibonacci retracement and the bottom of the pullback that we saw at the end of Oct are.

Looking at the daily chart, we see that USD/JPY is consolidating between the 50% retracement and the red horizontal resistance line. Although the CCI and Stochastic Oscillator are oversold, we think that as long as there are no buy signals another downswing is likely. In this case, the above-mentioned downside target would be in play.

Will we see further deterioration? Let’s examine the weekly chart and find out.

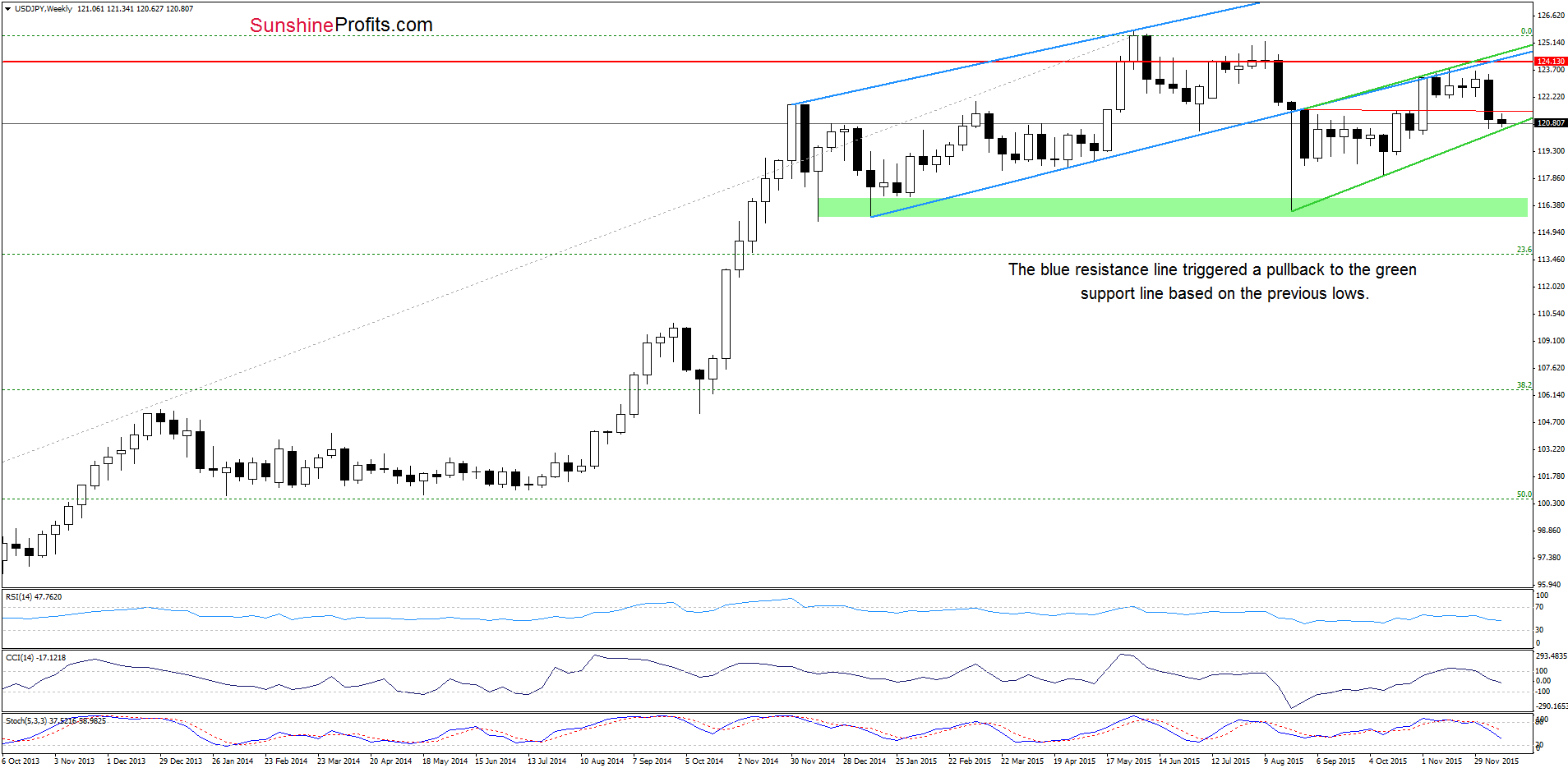

On the medium-term chart, we see that USD/JPY approached the green support line (based on the previous lows), which suggests that the space for declines might be limited.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

On Friday, we wrote:

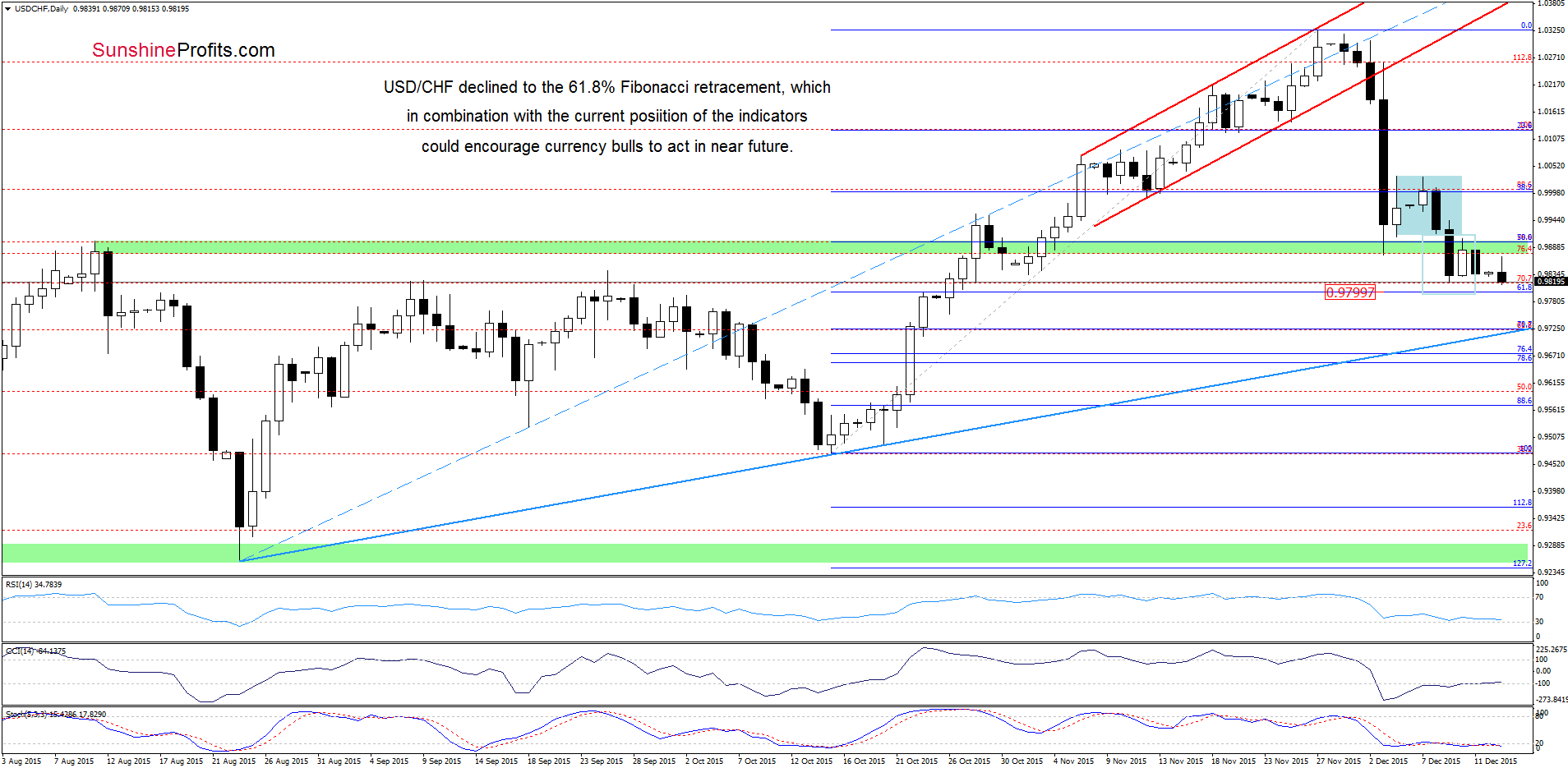

(…) the pair remains under the green zone, which suggests that yesterday’s upswing could be just a verification of earlier breakdown. If this is the case, and the exchange rate declines from here, we’ll see a drop to around 0.9800.

From today’s point of view, we see that the situation developed in line with the above scenario and the pair almost touched our downside target earlier today. As you see on the chart, there are positive divergences between the CCI and the exchange rate, which in combination with the support level (the 61.8% Fibonacci retracement) could encourage currency bulls to act – especially when we factor in the long-term picture.

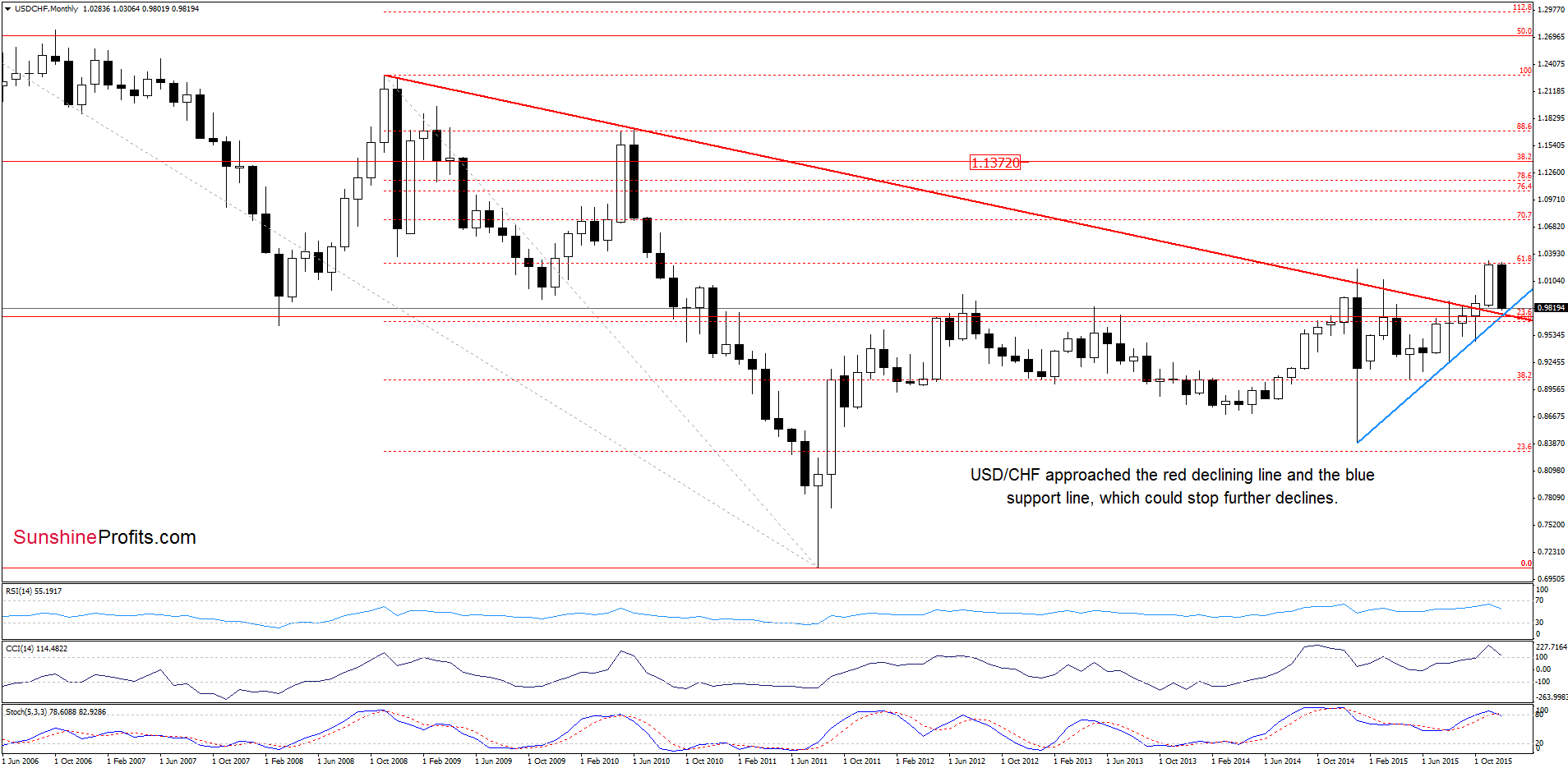

From this perspective, we see that USD/CHF approached the previously-broken long-term red declining line and the blue support line based on the previous lows, which together could trigger a rebound in the near future.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts