Although the USD Index moved slightly lower earlier today, the greenback remains near recent highs as bullish ADP report continues to support the U.S. currency. Will Friday’s government report show similarly strong jobs growth? Before we know the answer to this question let’s take a look at the technical picture of EUR/USD, GBP/USD AND USD/CAD.

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1512; initial downside target at 1.0572)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

Looking at the charts, we see that the situation in EUR/USD hasn’t changed much since yesterday as the exchange rate is trading in the blue declining trend channel around the 61.8% Fibonacci retracement. Taking this fact into account, we think that as long as there is no breakout above the purple resistance line based on Feb 11 and Feb 26 highs another attempt to move lower is likely.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1512 and the initial downside target at 1.0572) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

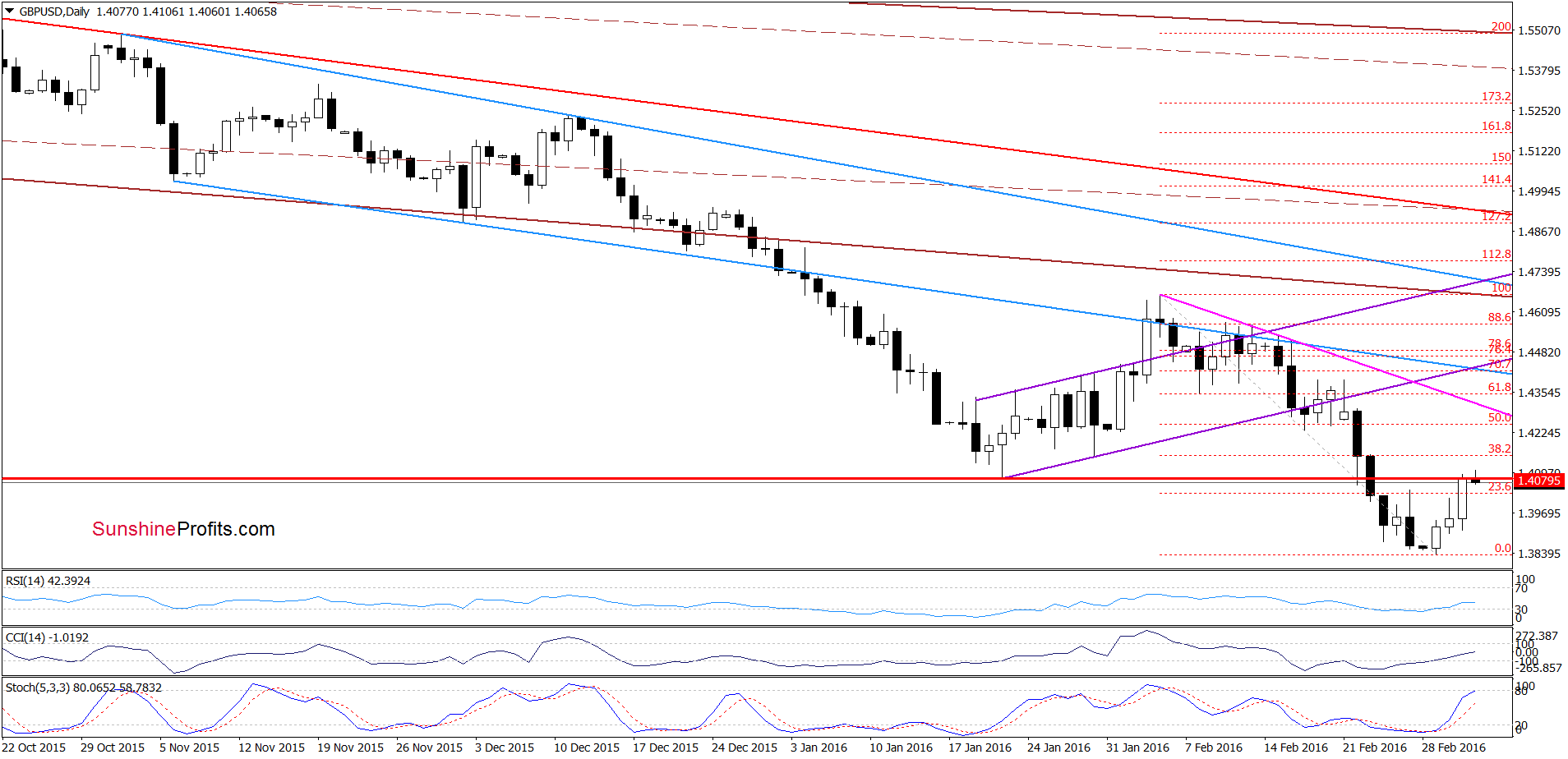

Looking at the long-term chart, we see that GBP/USD rebounded slightly and invalidated earlier breakdown under the 88.6% Fibonacci retracement, which is a positive signal that suggests further improvement. But will we see such price action? Let’s examine the daily chart and look for more clues about future moves.

From this perspective we see that although GBP/USD moved higher in recent days, the size of the move is tiny compared to the declines that we saw in the previous month. At this point it is also worth noting that the pair didn’t even reach the 38.2% Fibonacci retracement based on the Feb decline. As you see on the above chart, the recent upward move took the exchange rate to the Jan low, which could be a verification of earlier breakdown. Therefore, as long as there is no invalidation of the breakdown under the red horizontal line, another upswing is questionable.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

The situation in the medium term hasn’t changed as USD/CAD is still trading under the upper border of the long-term rising trend channel. Today, we’ll focus on the very short-term changes.

Quoting our Forex Trading Alert posted on Feb 26:

(…) the pair is still trading under the previously-broken lower green support line, which suggests that (…) the exchange rate will test the lower border of the blue declining trend channel in the coming days (please note that this area is reinforced by the 70.7% Fibonacci retracement).

On the daily chart, we see that the situation developed in line with the above scenario and USD/CAD reached our downside target. Although the exchange rate rebounded slightly in recent days, we think that as long as there is no breakout above the upper line of the blue consolidation, another upswing is not likely to be seen.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts