Yesterday, AUD/USD dropped under short-term support zone, but will this event trigger further deterioration in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1052; the initial downside target at 1.0521)

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 107.62; the initial upside target at 111.16)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

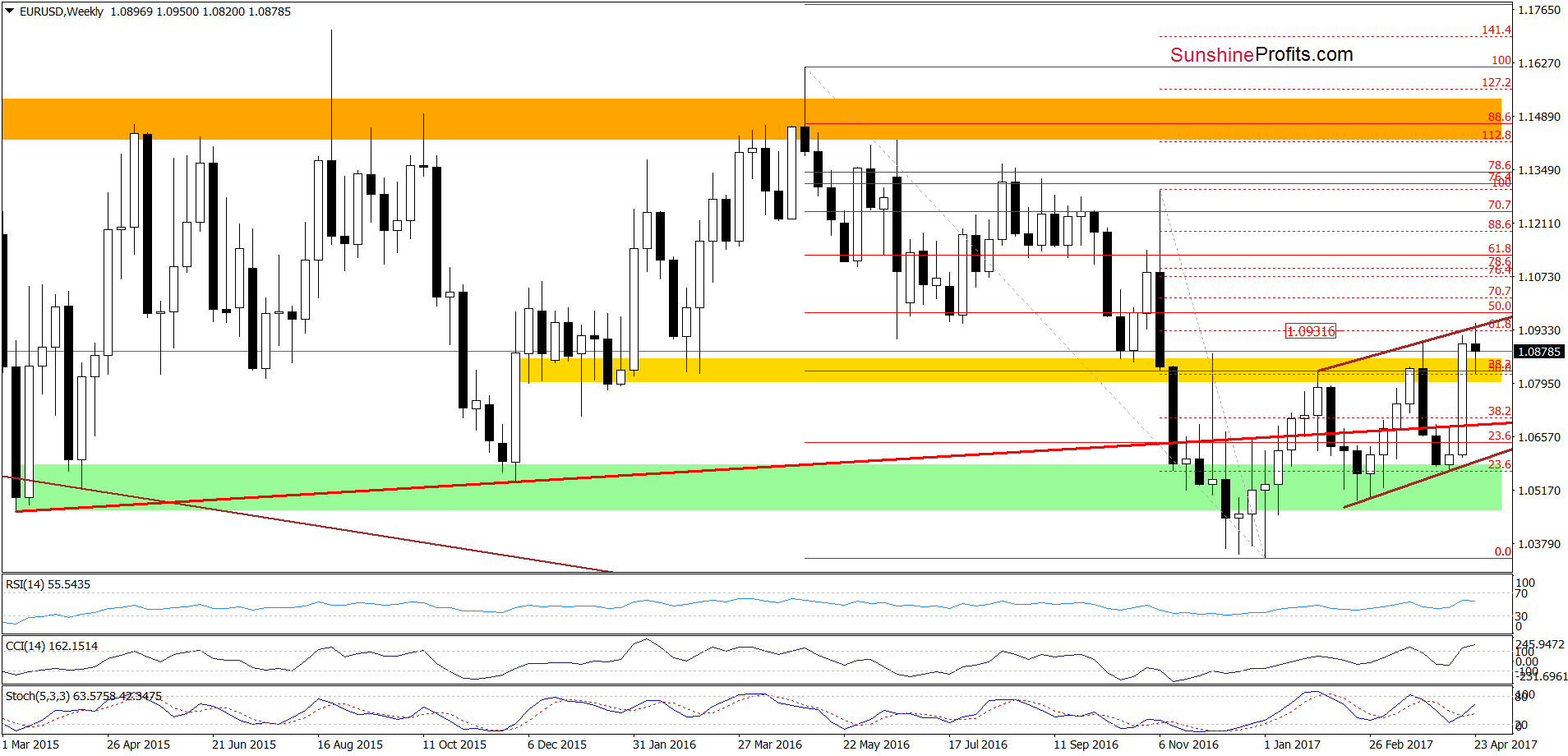

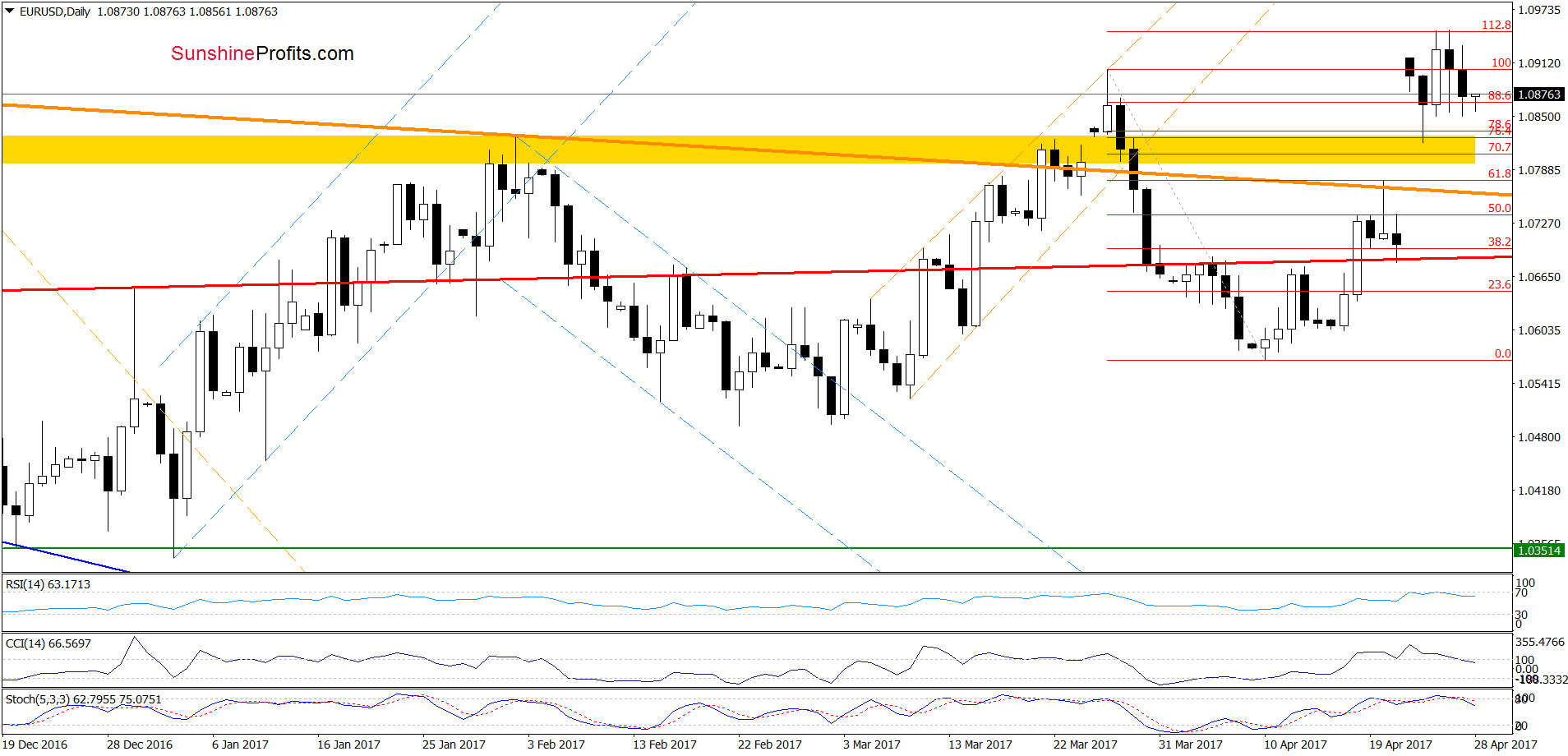

EUR/USD

From today’s point of view, we see that EUR/USD closed yesterday’s session under the March high, invalidating the earlier breakout, which means that our previous commentary on this currency pair is up-to-date:

(…) EUR/USD tested the strength of the upper border of the brown rising trend channel, the 61.8% Fibonacci retracement (both marked on the weekly chart) and the 112.8% Fibonacci extension (seen on the daily chart), which resulted in a comeback below the March high. Additionally, the sell signal generated by the RSI remains in place, supporting currency bears. On top of that, the CCI and the Stochastic Oscillator are very close to generating sell signals, which suggests that reversal and lower values of the exchange rate are just around the corner.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1052 and the initial downside target at 1.0521) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

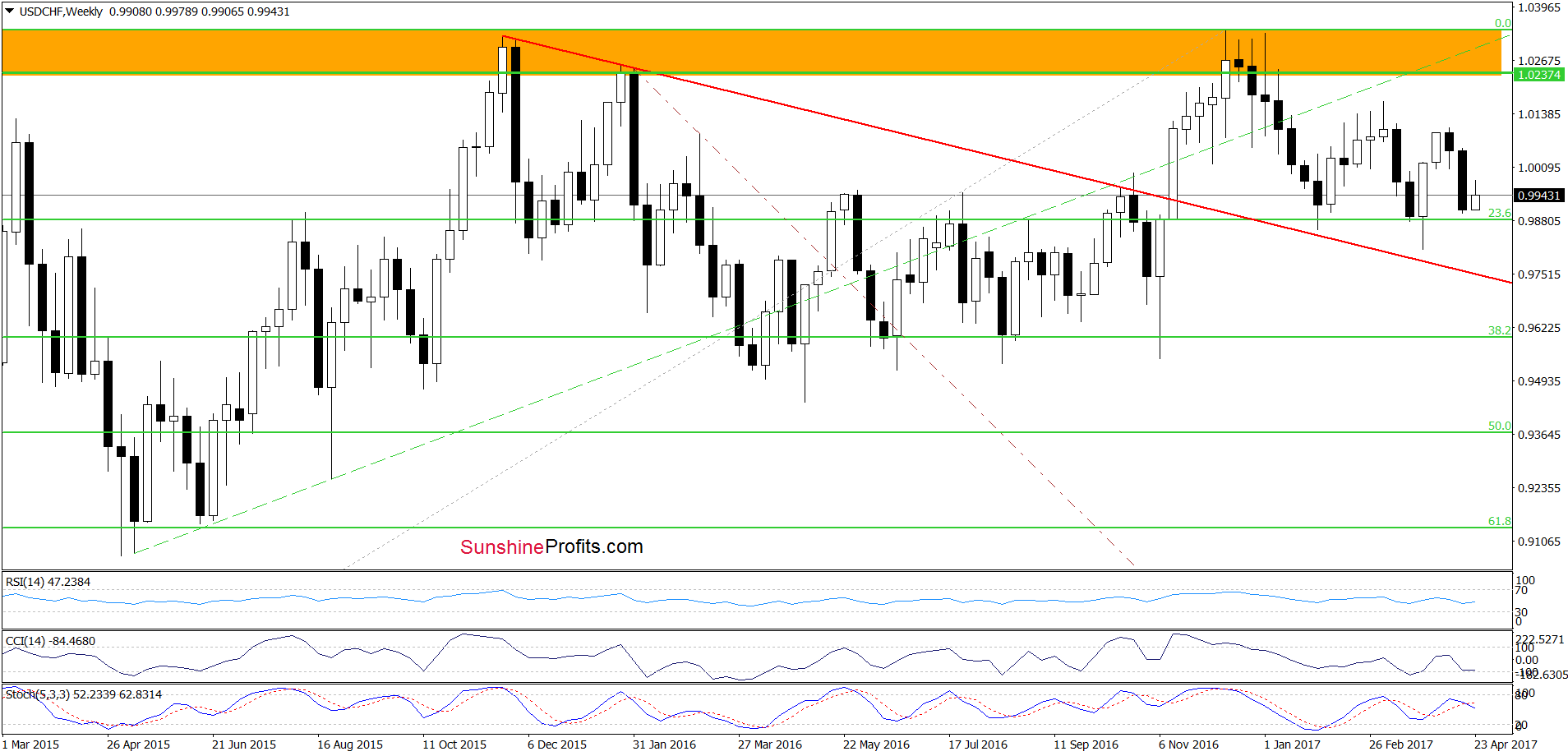

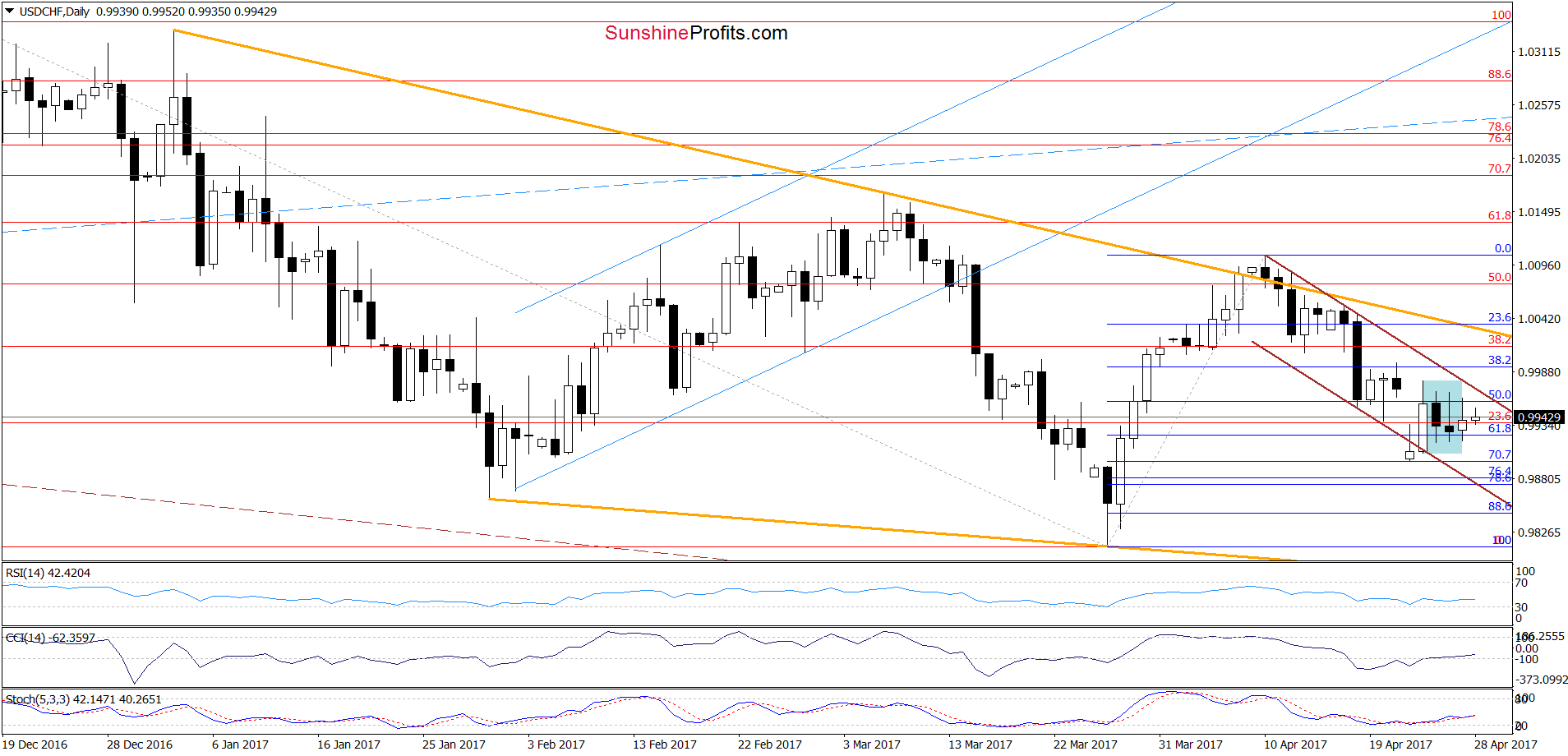

USD/CHF

Looking at the charts, we see that the overall situation hasn‘t changed much since our last commentary as USD/CHF is still trading in the blue consolidation. Therefore, what we wrote on Wednesday is still valid:

(…) USD/CHF remains in the blue consolidation inside the brown declining trend channel, which makes the very short-term picture unclear. Nevertheless, the current position of the indictors (the CCI and the Stochastic Oscillator generated buy signals) suggests that further improvement in the coming day(s) should not surprise us. However, in our opinion, a bigger move to the upside will be more likely and reliable if the exchange rate breaks above the upper line of the consolidation and the upper border of the trend channel. If we see such price action, we’ll consider opening long positions.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

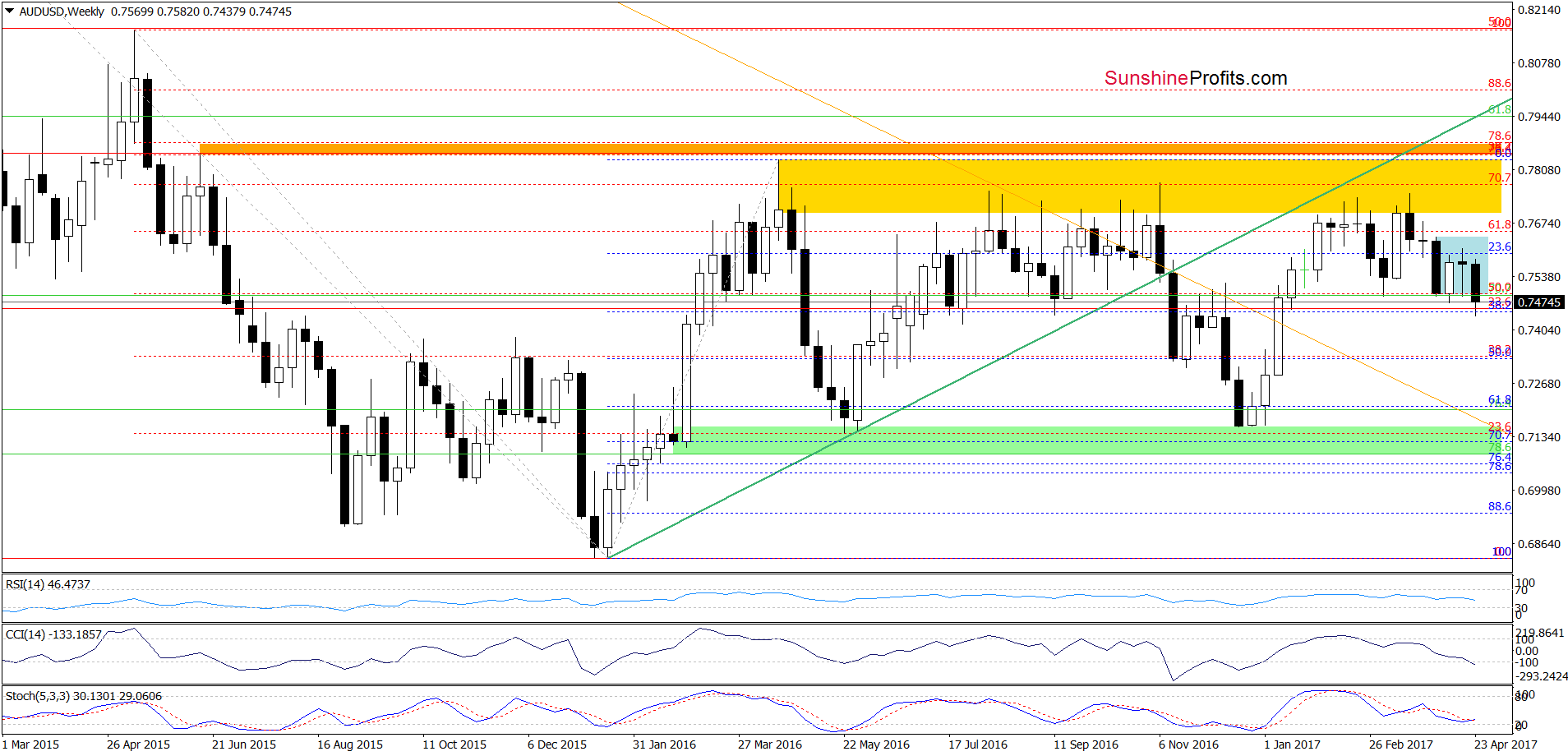

Looking at the weekly chart, we see that AUD/USD broke below the lower border of the blue consolidation, which is a negative signal that suggests further deterioration. But will we see such price action? Let’s take a closer look at the daily chart and find out.

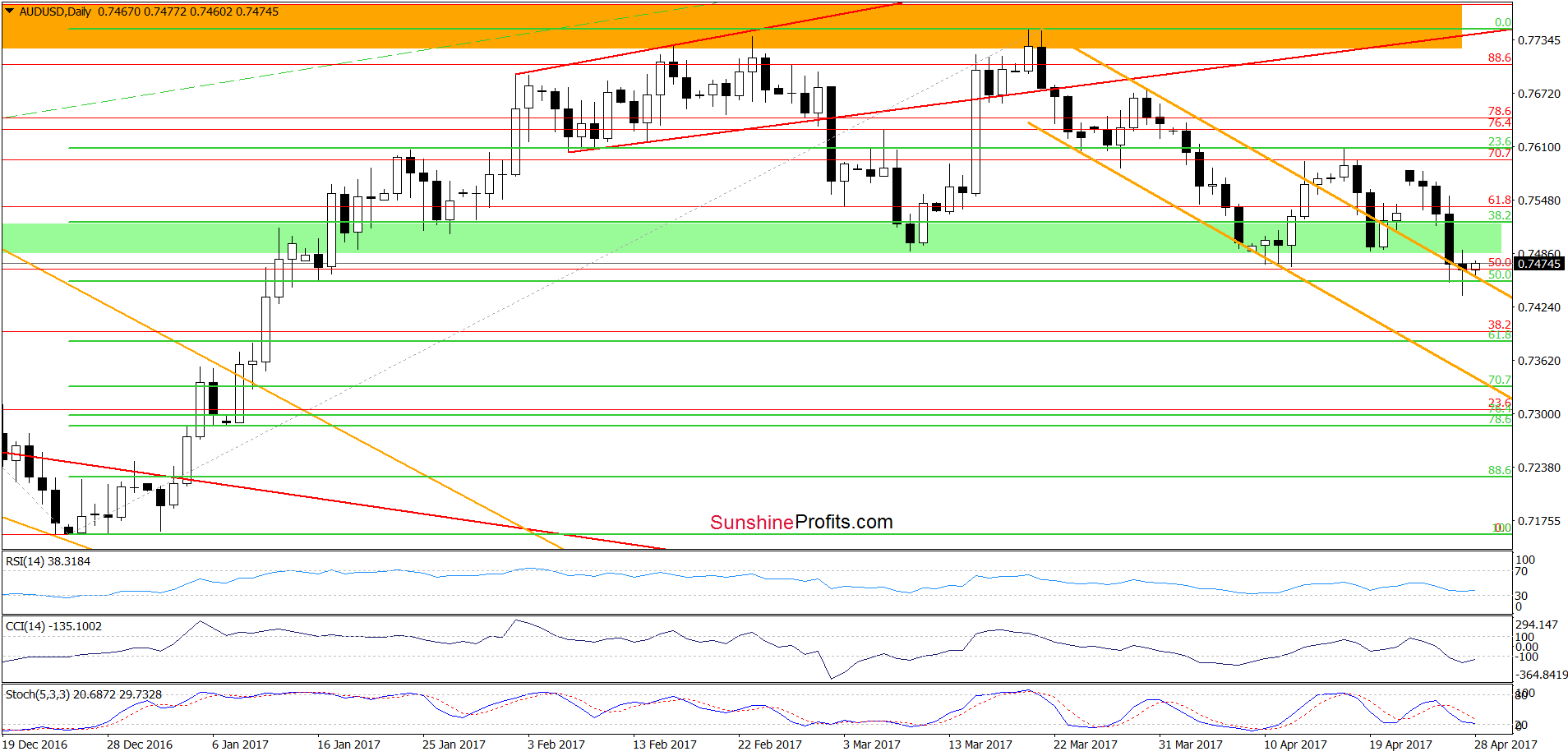

On the daily chart, we see that AUD/USD extended losses and slipped under the green support zone once again. Despite this drop, the upper border of the orange declining trend channel keeps declines in check. This suggests that further deterioration will be more likely only if we see a decline under this support line. If we see such price action, the next downside target for currency bears will be the 61.8% Fibonacci retracement or even the lower line of the trend channel.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts