Earlier today, the Reserve Bank of Australia held rates at a record low 2%, which in combination with the minutes of its last meeting pushed the Australian dollar higher against its U.S. counterpart. Thanks to these circumstances, AUD/USD came back above the previously-broken support/resistance line, invalidating earlier breakdown. Is it enough to trigger further rally?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1512; initial downside target at 1.0572)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: long (stop-loss order at 0.9633; initial downside target at 1.0239)

- AUD/USD: none

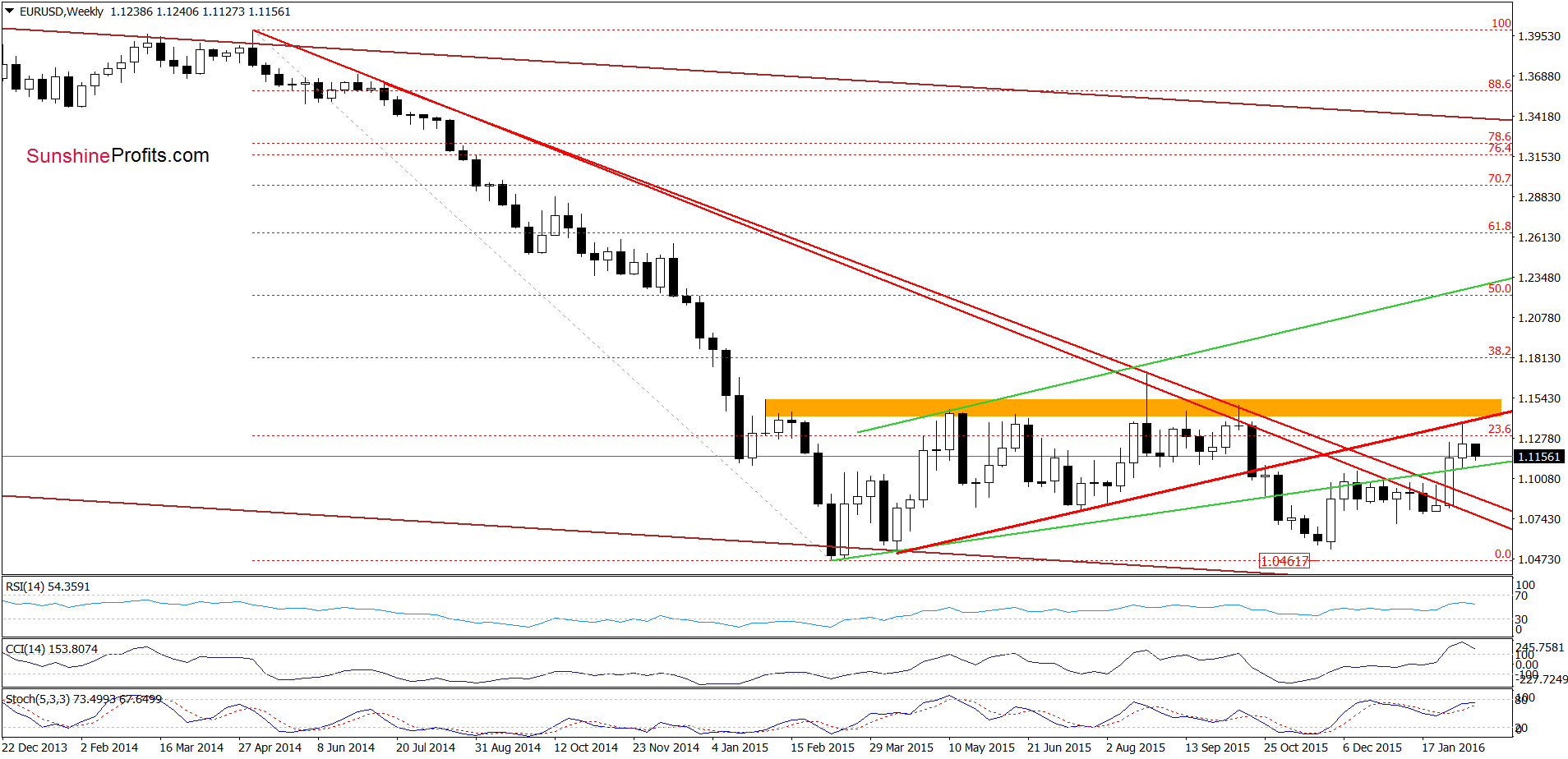

EUR/USD

On Friday, we wrote the following:

If (…) the pair declined from here, the initial downside target would be the previously-broken navy blue support line

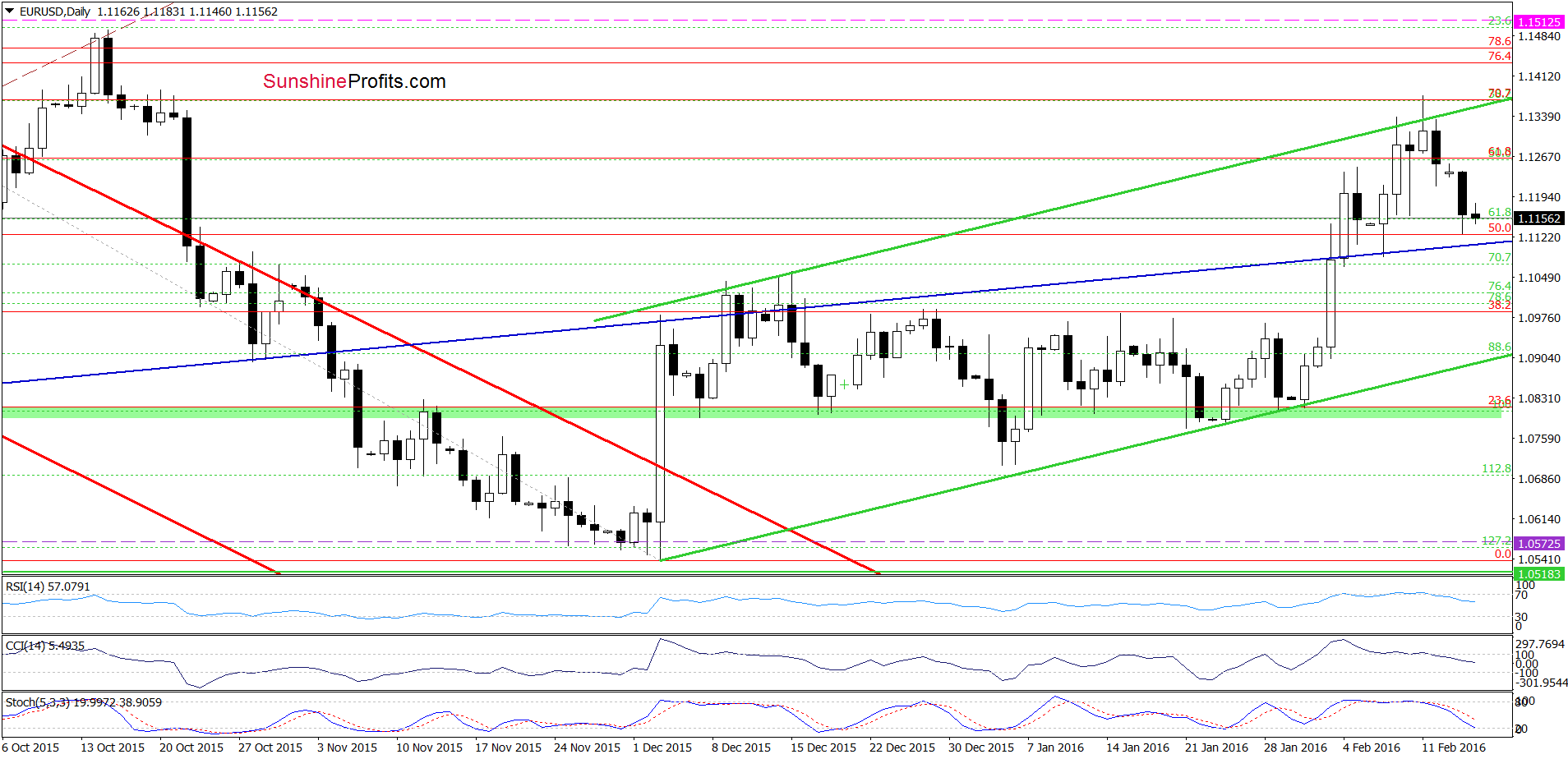

Looking at the charts, we see that EUR/USD extended losses and approached our first downside target yesterday. Although the proximity to this support line could encourage currency bulls to act (and trigger a rebound from here), we believe that as long as the exchange rate remains under the key resistance lines (red declining line based on the Apr, Jul and Aug lows and marked on the weekly chart and the upper border of the green rising trend channel) another attempt to move lower is more likely than not. This scenario is also reinforced by the current position of the daily indicators (sell signals remain in place, supporting currency bears). Nevertheless, in our opinion, an acceleration of declines will be more likely and reliable after a breakdown under the navy blue support line. In this case, the pair will test the lower border of the green rising trend channel in the following days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1512 and the initial downside target at 1.0572) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

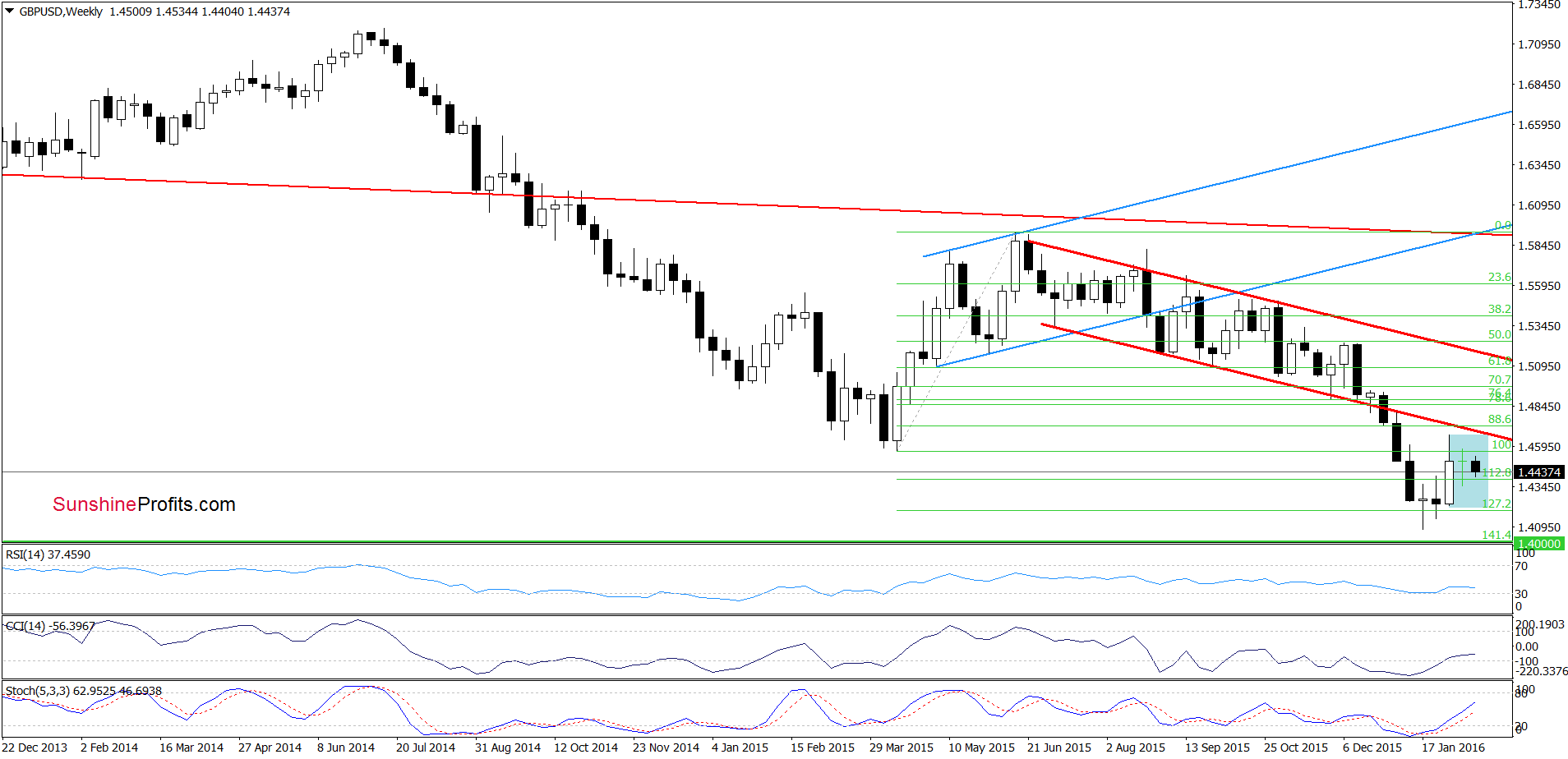

GBP/USD

The situation in the medium term hasn’t change much as GBP/USD is trading in the blue consolidation under the lower border of the red declining trend channel, which suggests that as long as there is no breakout above the upper line of the formation (or breakdown under the lower line) another bigger move is not likely to be seen.

Will the very short-term chart give us more clues about future moves? Let’s check.

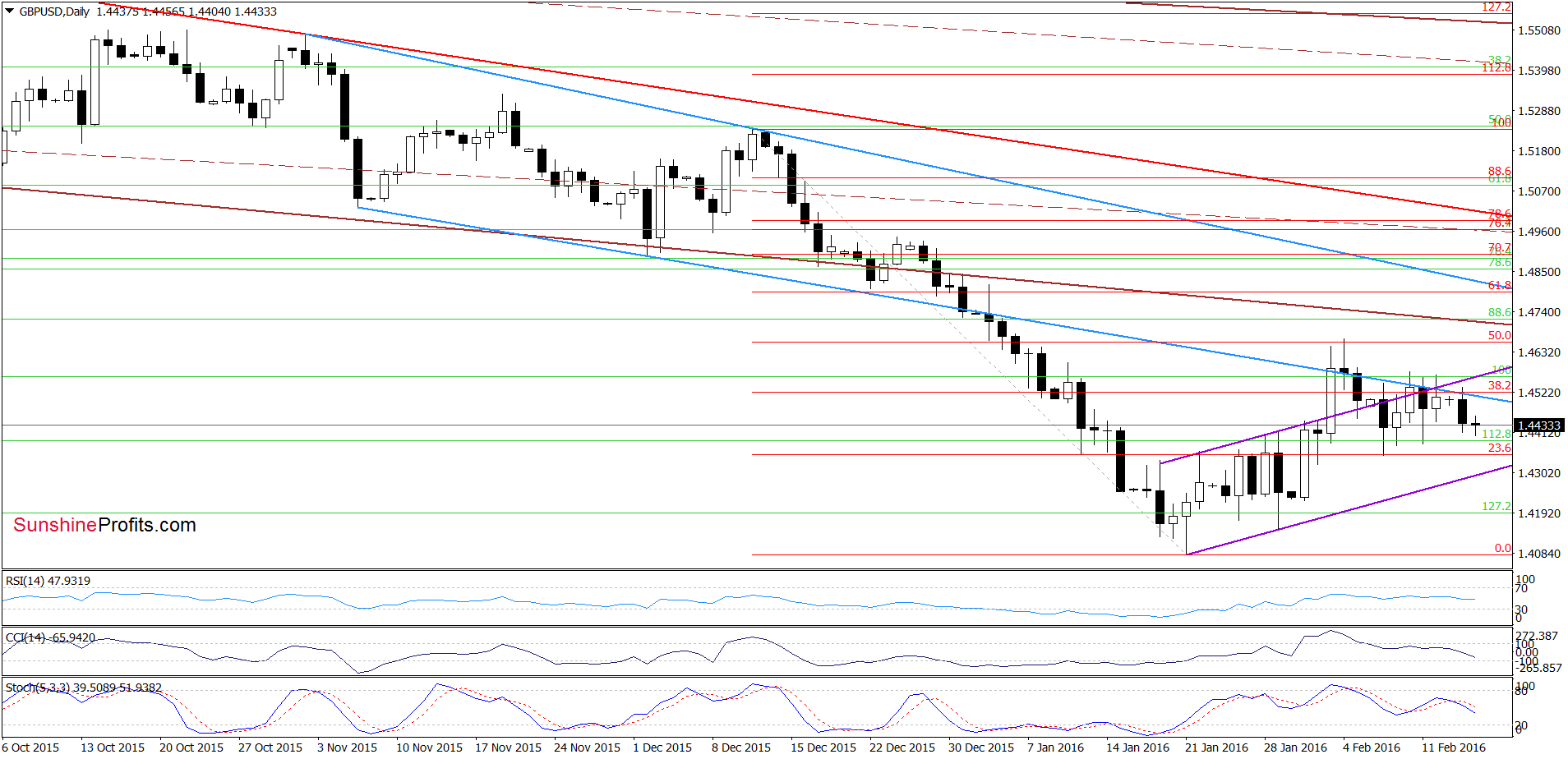

On the daily chart, we see that although GBP/USD moved higher and came back above the previously-broken upper border of the purple rising trend channel and the blue resistance line currency bulls didn’t manage to hold gained levels, which resulted in an invalidation of earlier small breakouts. This negative signal in combination with a sell signal generated by the Stochastic Oscillator triggered further deterioration, which suggests that we’ll see a test of the lower border of the purple rising trend channel in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

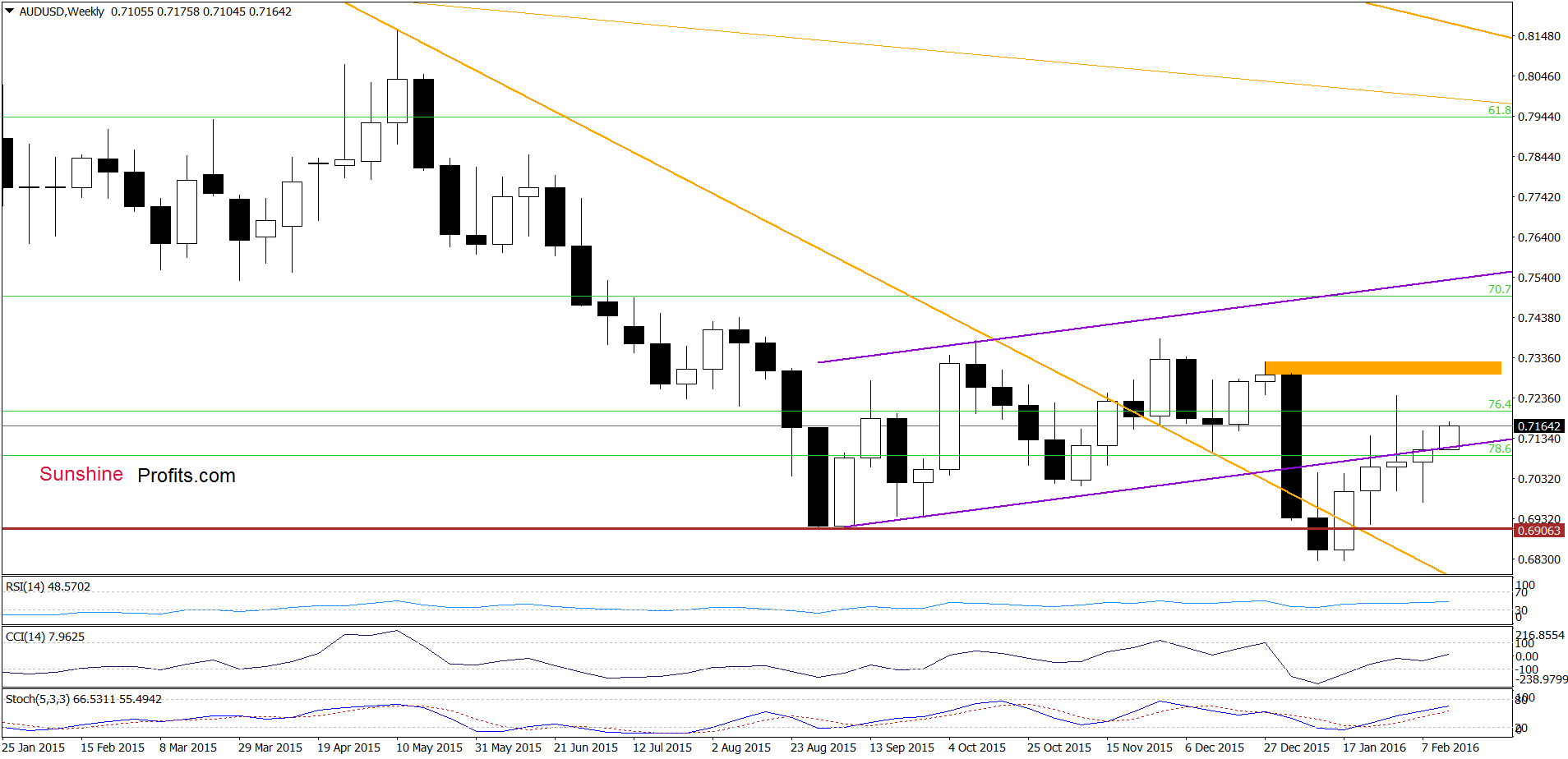

The first thing that catches the eye on the weekly chart is a comeback above the lower border of the purple rising trend channel. Although this is a positive signal, which suggests further improvement, we should keep in mind that we saw similar situation in the previous weeks. Therefore, in our opinion further rally will be more reliable if we see a weekly closure above this important support/resistance line. In this case, the initial upside target would be the orange resistance zone based on the Dec and Jan highs (around 0.7298-0.7325).

Will the daily chart confirm a pro-growth scenario? Let’s check.

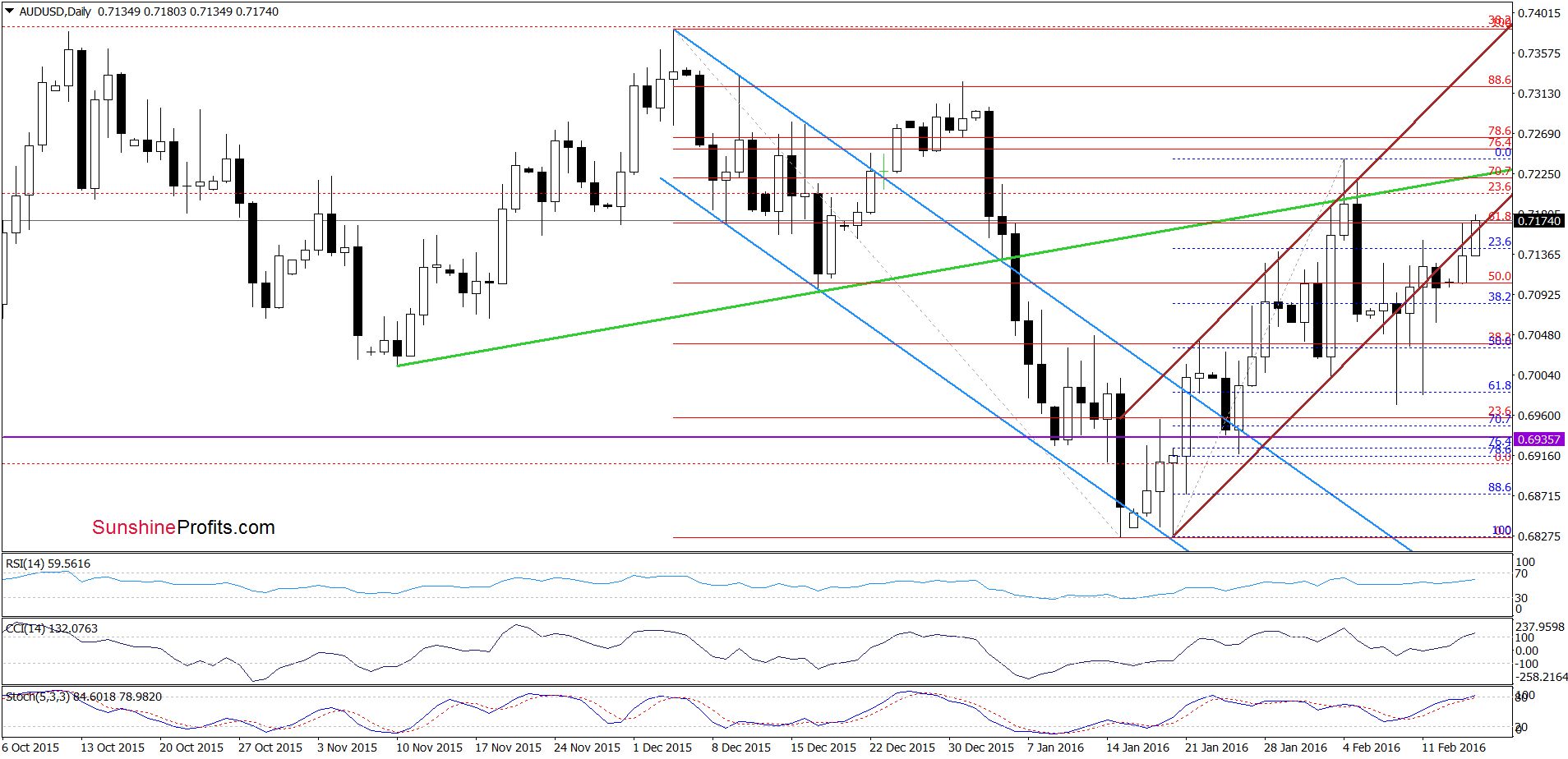

On the daily chart, we see that currency bears pushed the pair under the lower border of the brown rising trend channel several times in the previous week. Despite this deterioration, their opponents managed to stop further deterioration and invalidate earlier breakdowns. This suggests that AUD/USD will likely re-test the strength of the green resistance line in the coming days. Nevertheless, the current position of the indicators suggests that reversal and another downswing is just around the corner.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts