Earlier today, the Westpac Banking Corporation showed that consumer sentiment in Australia dropped by 3.5% in Jan, which pushed the Australian dollar lower against the greenback. Thanks to this drop, AUD/USD approached the last week’s low. Double bottom or further declines?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1363; initial downside target at 1.0462)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

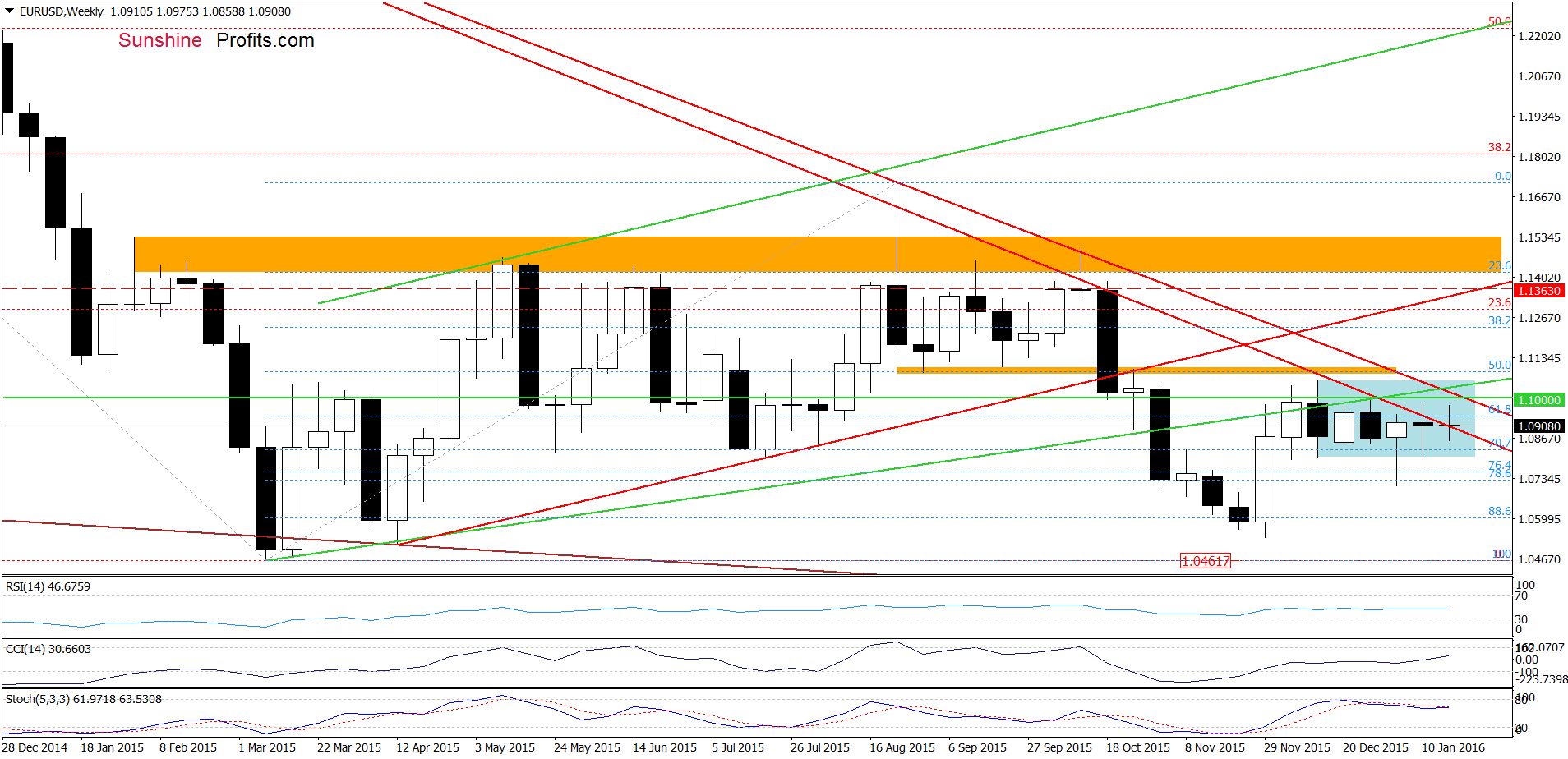

Looking at the weekly chart, we see that although currency bulls pushed EUR/USD above the long-term red declining resistance line, this improvement was only temporary and the pair erased earlier gains. Taking this fact into account, we think that what we wrote on Monday is up-to-date:

(…) What does it mean for the exchange rate? When we take a closer look at the weekly chart, we can notice see that there were similar situations in Aug and Oct. Back then, an invalidation of earlier breakout above the long-term red line was the first bearish signal before bigger decline. Taking this fact into account, we think that history will repeat itself once again and we’ll see another downward move in the coming week(s).

How did this move affect the very short-term picture? Let’s check.

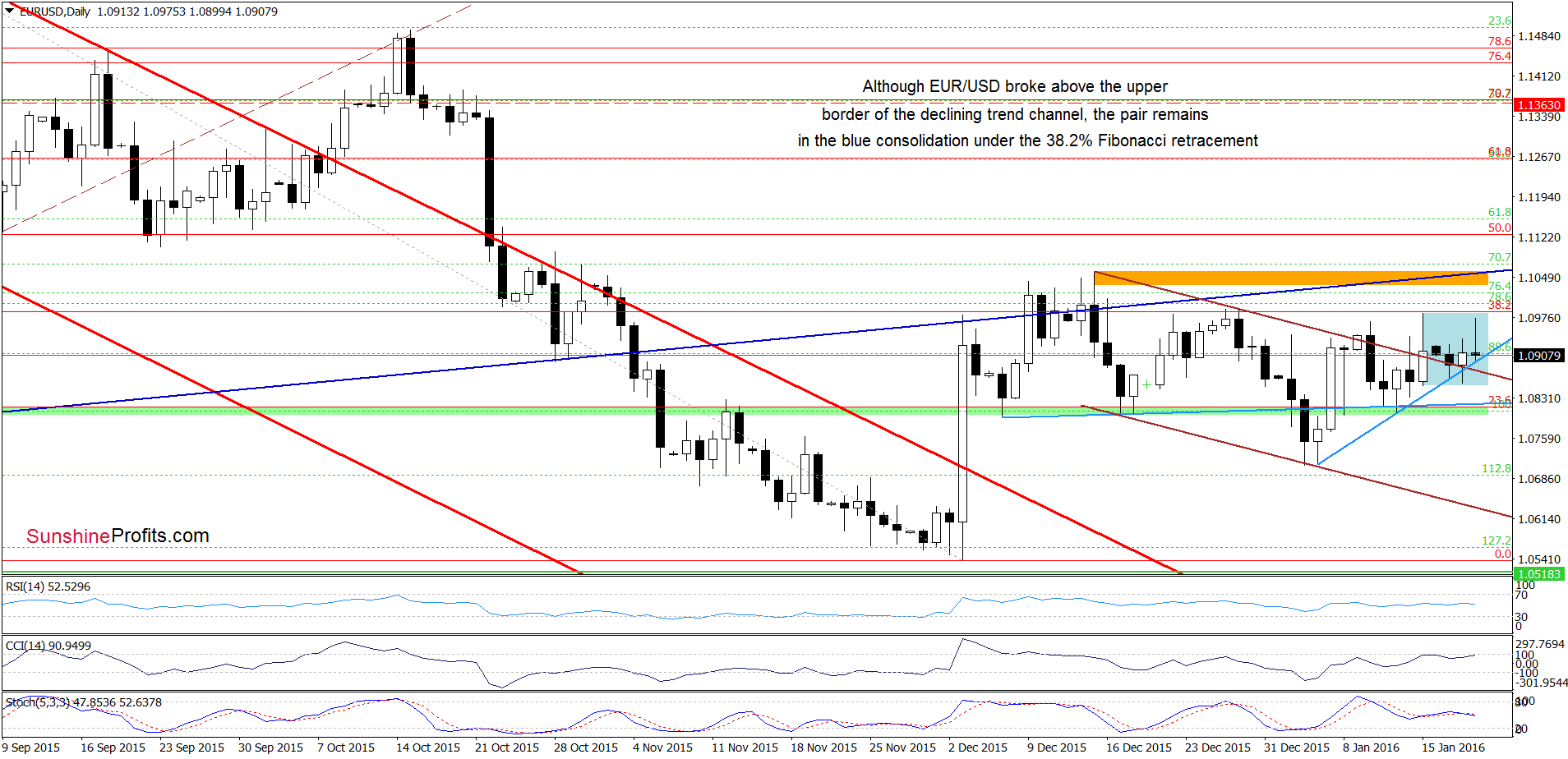

From this perspective, we see that EUR/USD moved higher once again, but the combination of the 38.2% Fibonacci retracement and the late Dec highs stopped further improvement – similarly to what we saw on Friday. Therefore, it seems that the pair will extend losses and we’ll see another attempt to break below the previously-broken upper border of the brown declining trend channel. If we see such price action, the initial downside target would be the green support zone.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1363 and the initial downside target at 1.0462) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

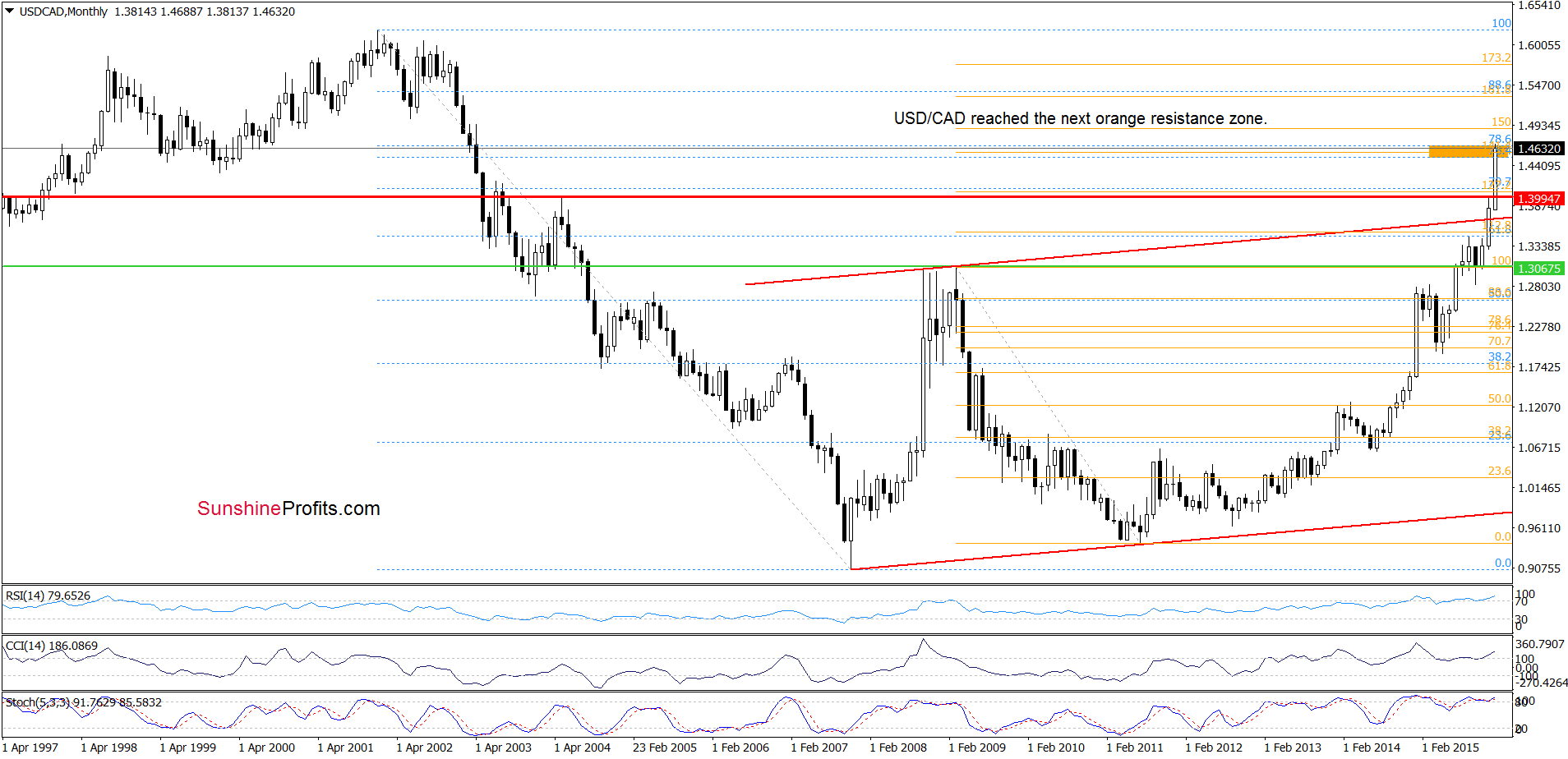

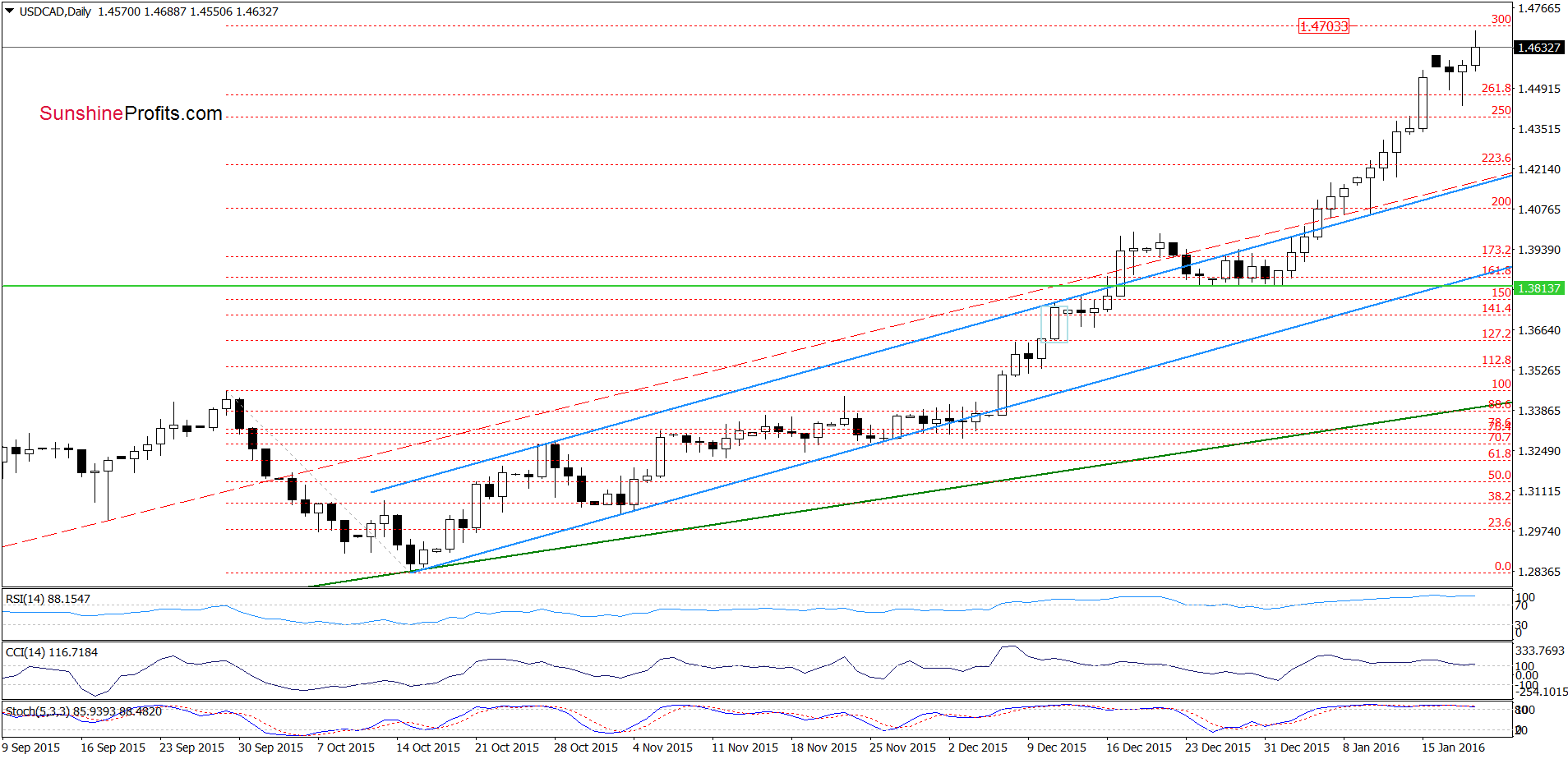

On the above charts, we see that USD/CAD extended gains, which resulted in an increase to the upper border of the orange resistance zone (marked on the long-term chart). If this support withstands the buying pressure, we’ll see another pullback in the coming days, however, if it is broken, the pair will increase to (at least) 1.4703, where the 300% Fibonacci extension is.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

Quoting our last commentaryon this currency pair:

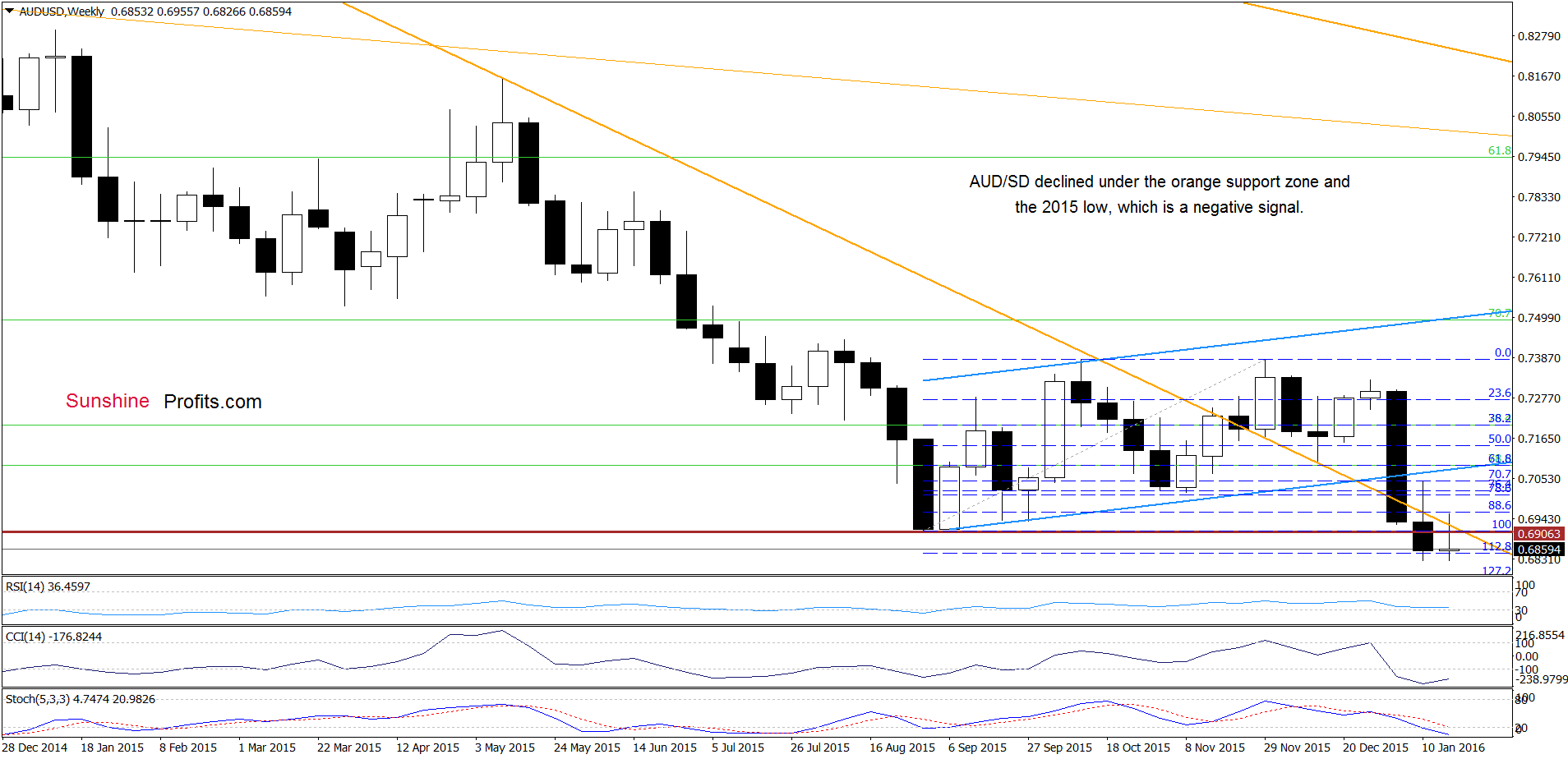

(…) AUD/USD declined not only below the Aug low, but also dropped under the long-term orange support line. As you see, this week’s upward move looks like a verification of earlier breakdown, which suggests lower values of the exchange rate and a re-test of the last week’s low.

From today’s point of view we see that the situation developed in line with the above scenario and the exchange rate declined to the last week’s low. What’s next? Let’s take a closer look at the daily chart and try to find the answer.

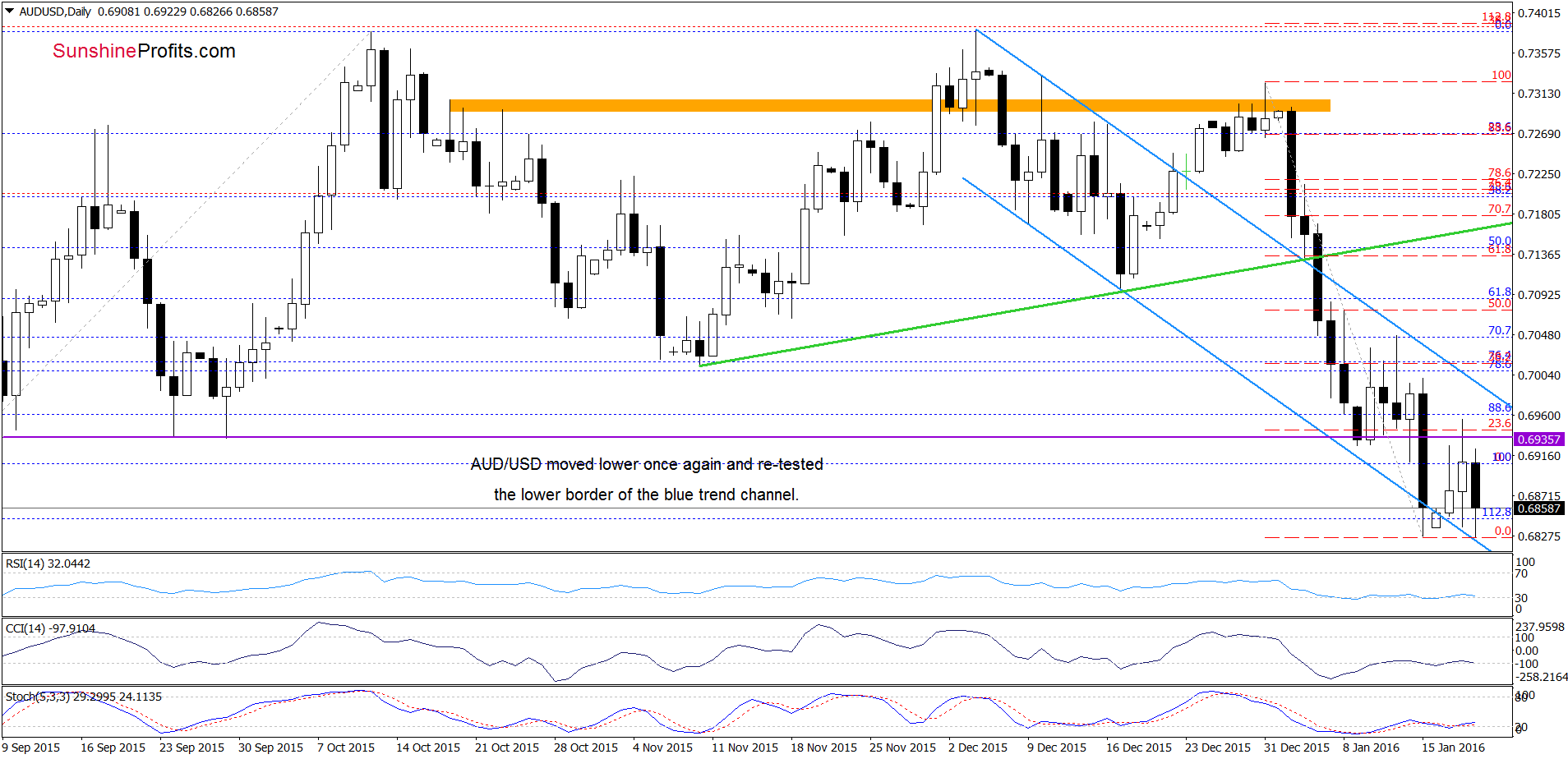

In our alert posted on Monday, we wrote:

(…) the exchange rate (…) rebound to the Jan 10 low. Although today’s move is a positive signal, we think that as long as there is no comeback above the horizontal purple resistance line, all upswings will be nothing more than a verification of earlier breakdown. If this is the case, another downswing should not surprise us – especially when we factor in the medium-term picture.

As you see on the very short-term chart, the 23.6% Fibonacci retracement triggered another decline, which took AUD/USD to the lower border of the blue declining trend channel. The current position of the indicators, in combination with the blue support line and a potential double bottom formation suggests another rebound from here in the coming days. Nevertheless, in our opinion, as long as the pair remains under the horizontal purple resistance line and the long-term orange declining line (marked on the weekly chart) a sizable upward move is not likely to be seen.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts