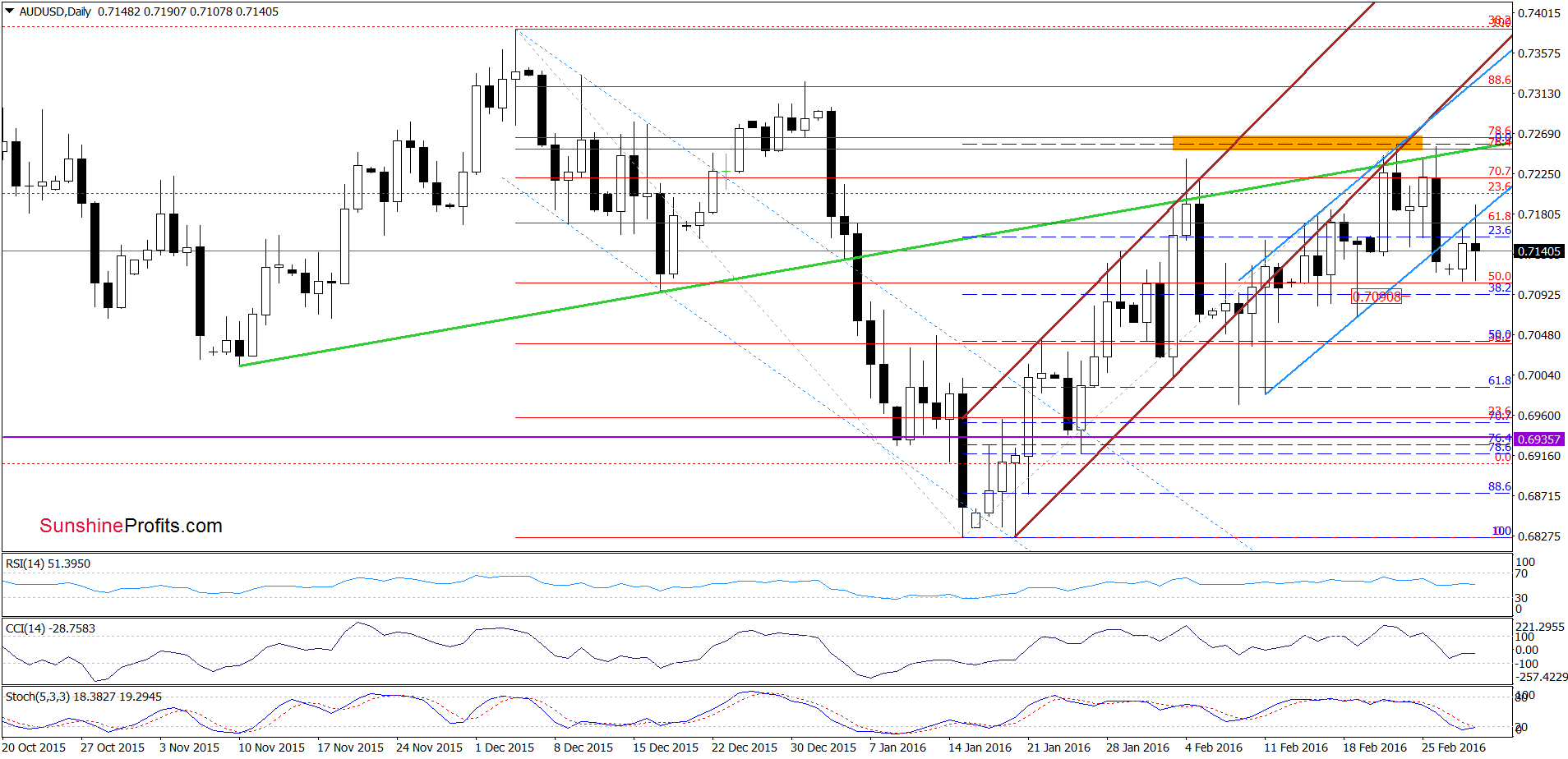

Earlier today, the Australian dollar moved lower against its U.S. counterpart as the combination of news that the central bank kept rates at a record low 2% and disappointing Chinese data (China's Caixin PMI dropped to 4, the manufacturing PMI fell to 49 and the non-manufacturing PMI slipped to 52.7, missing analysts’ forecasts) weighed on investors’ sentiment. Thanks to this downswing, the exchange rate verified earlier breakdown. What’s next?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1512; initial downside target at 1.0572)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

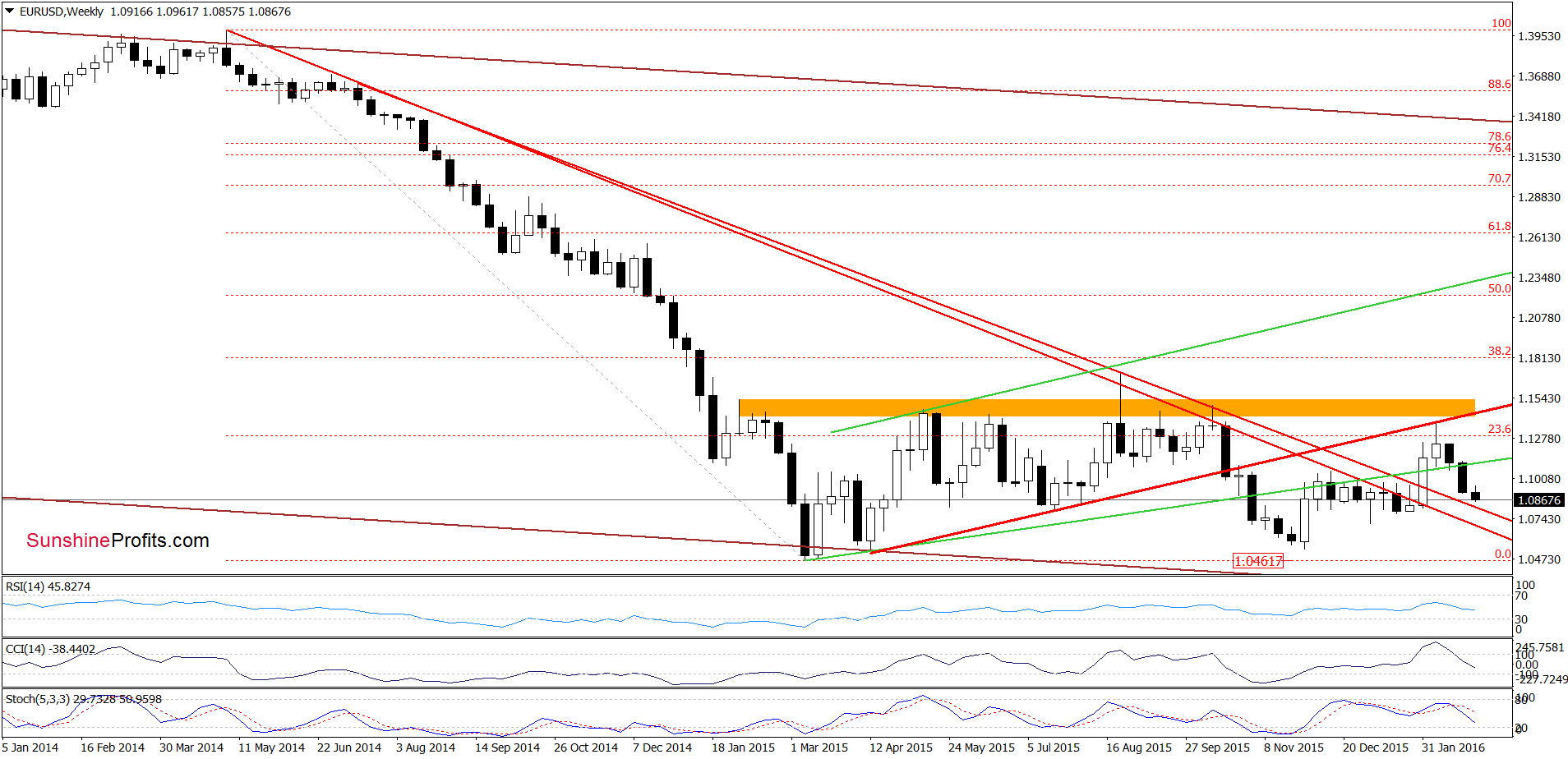

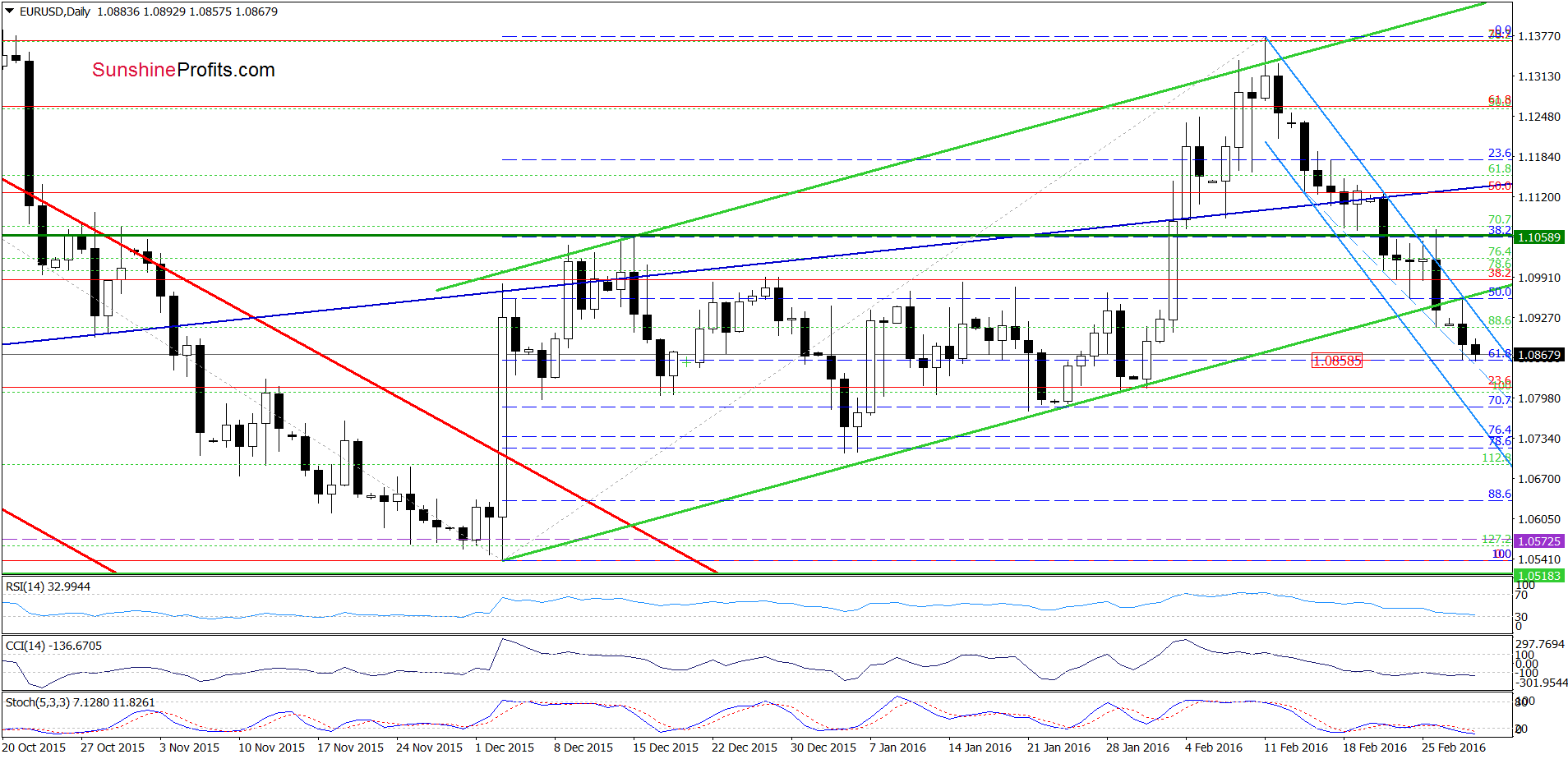

EUR/USD

Yesterday, we wrote the following:

(…) the pair verified the breakdown, which suggests (at least) a test of the 61.8% Fibonacci retracement (at 1.0858).

On the daily chart, we see that currency bears pushed the pair lower (as we had expected) and reached the 61.8% Fibonacci retracement. Although EUR/USD could rebound from here, yesterday’s verification of the breakdown under the lower border of the green rising trend channel in combination with sell signals generated by the weekly indicators suggests that further deterioration is just around the corner. Therefore, if this support level is broken, we may see a decline to around 1.0814, where the previously-broken long-term red declining line (marked on the weekly chart) is.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1512 and the initial downside target at 1.0572) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

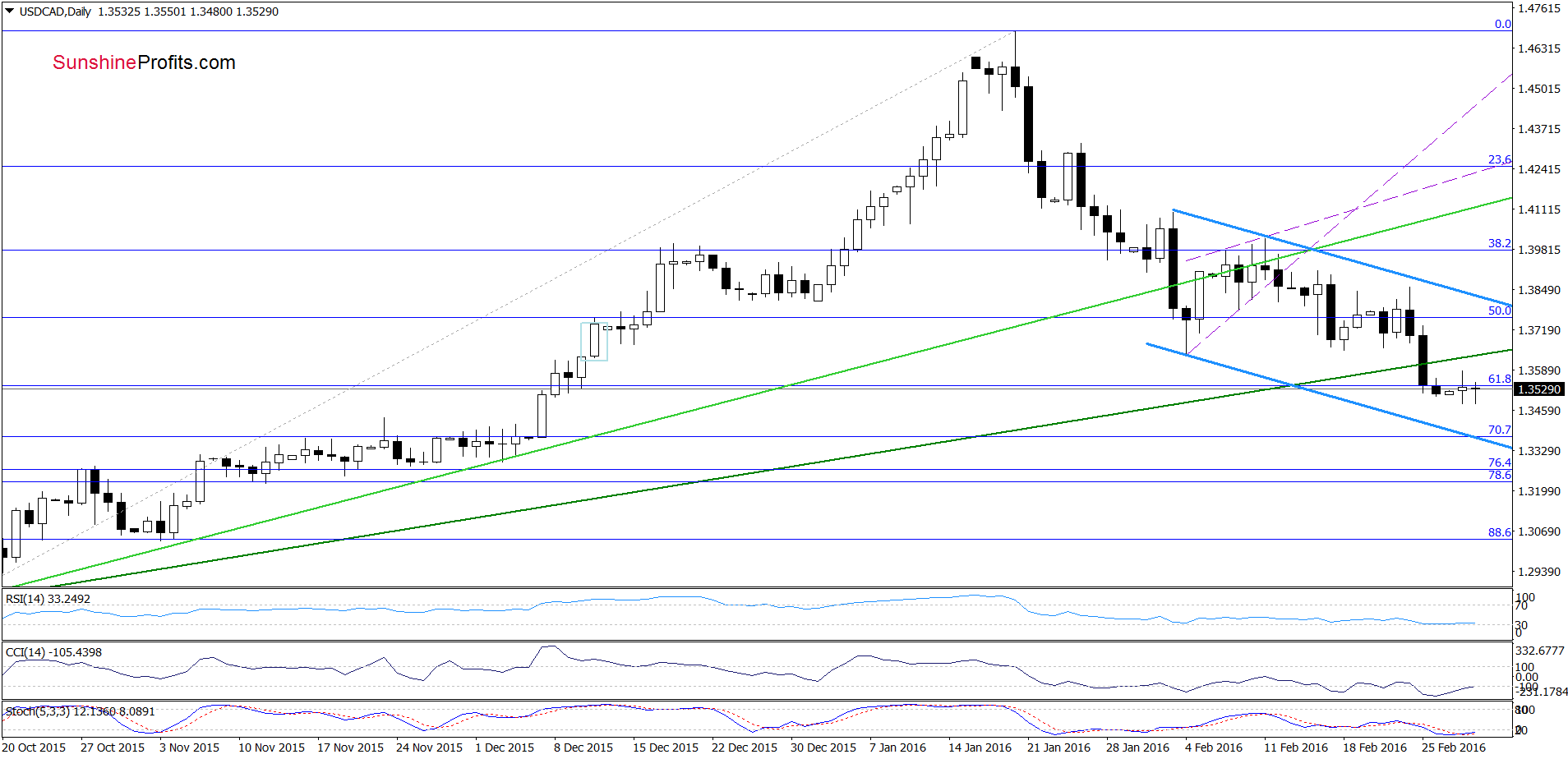

USD/CAD

The situation in the medium term hasn’t changed as USD/CAD is still trading under the upper border of the long-term rising trend channel. Today, we’ll focus on the very short-term changes.

From this perspective, we see that USD/CAD is still trading around the 61.8% Fibonacci retracement, which means that our yesterday’s commentary on his currency air is up-to-date also today:

(…) the pair is still trading under the previously-broken lower green support line, which suggests that (…) the exchange rate will test the lower border of the blue declining trend channel in the coming days (please note that this area is reinforced by the 70.7% Fibonacci retracement).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

The medium-term picture remains almost unchanged as AUD/USD is trading in the purple rising trend channel. Are there any short-term changes which could give us more clues about future moves? Let’s examine the daily chart and find out.

Quoting yesterday’s alert:

(…) AUD/USD slipped under the lower border of the blue rising trend channel on Friday. Although the pair rebounded earlier today, the blue resistance line stopped further improvement, which suggests that the exchange rate verified earlier breakdown. If this is the case, we’ll see a drop to the 38.2% Fibonacci retracement (around 0.7090) in the coming days.

Looking at the daily chart, we see that history repeated itself once again and AUD/USD climbed to the lower border of the blue rising trend channel. Despite this move, currency bulls didn’t manage to hold gained levels - similarly to what we saw yesterday, which suggests that our downside target will be in play in the coming day(s).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts