Although Chicago PMI dropped to 50.6 this month, disappointing market’s participants, earlier data showed that consumer spending increased 0.5% and personal income rose by 0.3% in Sep, which pushed the euro lower against the greenback. As a result, EUR/USD dropped below the previously-broken levels, invalidating earlier breakouts. What does it mean for the exchange rate?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 1.0000; initial downside target at 0.9841)

- AUD/USD: short (a stop-loss order at 0.7769; initial downside target at 0.7542)

EUR/USD

Quoting our Wednesday’s alert:

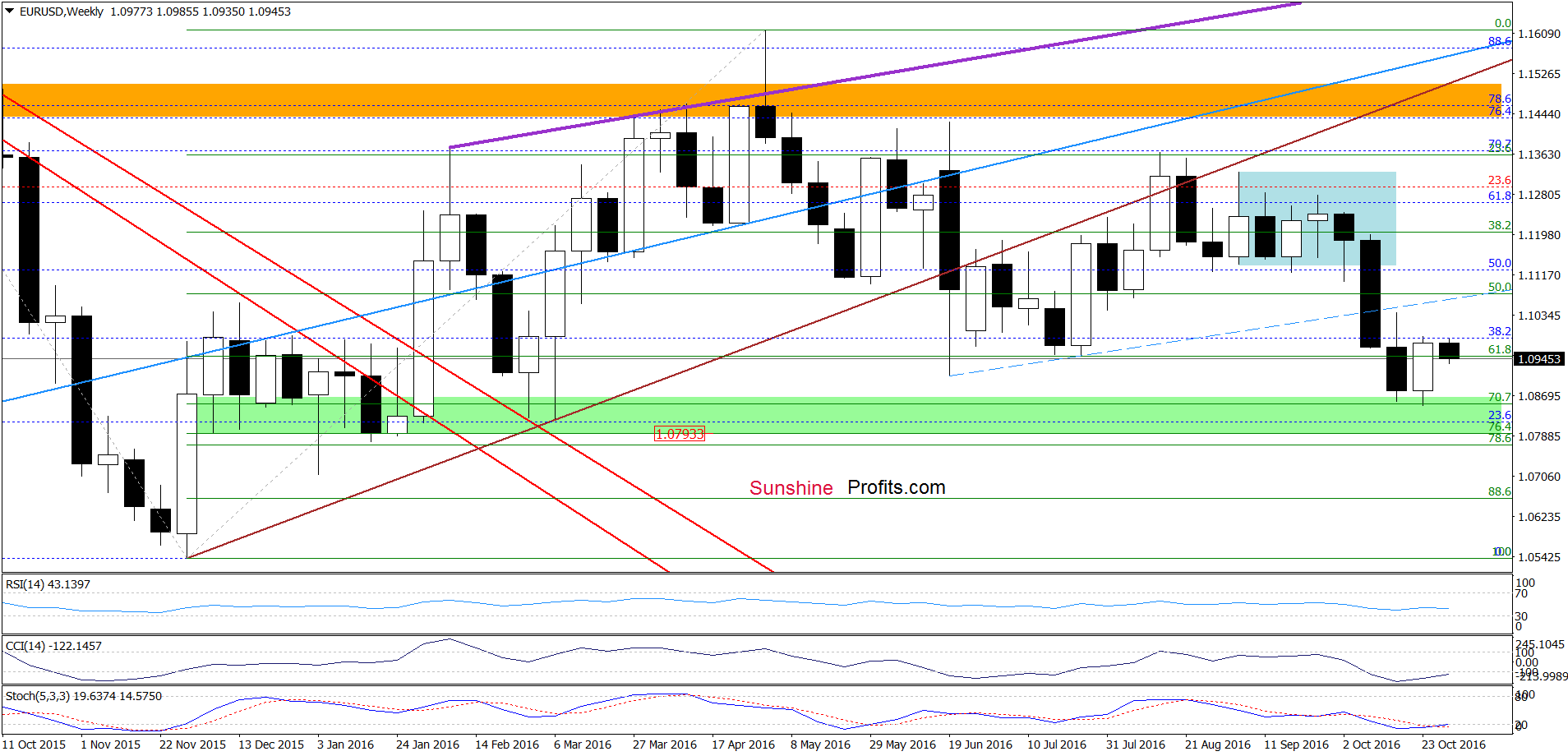

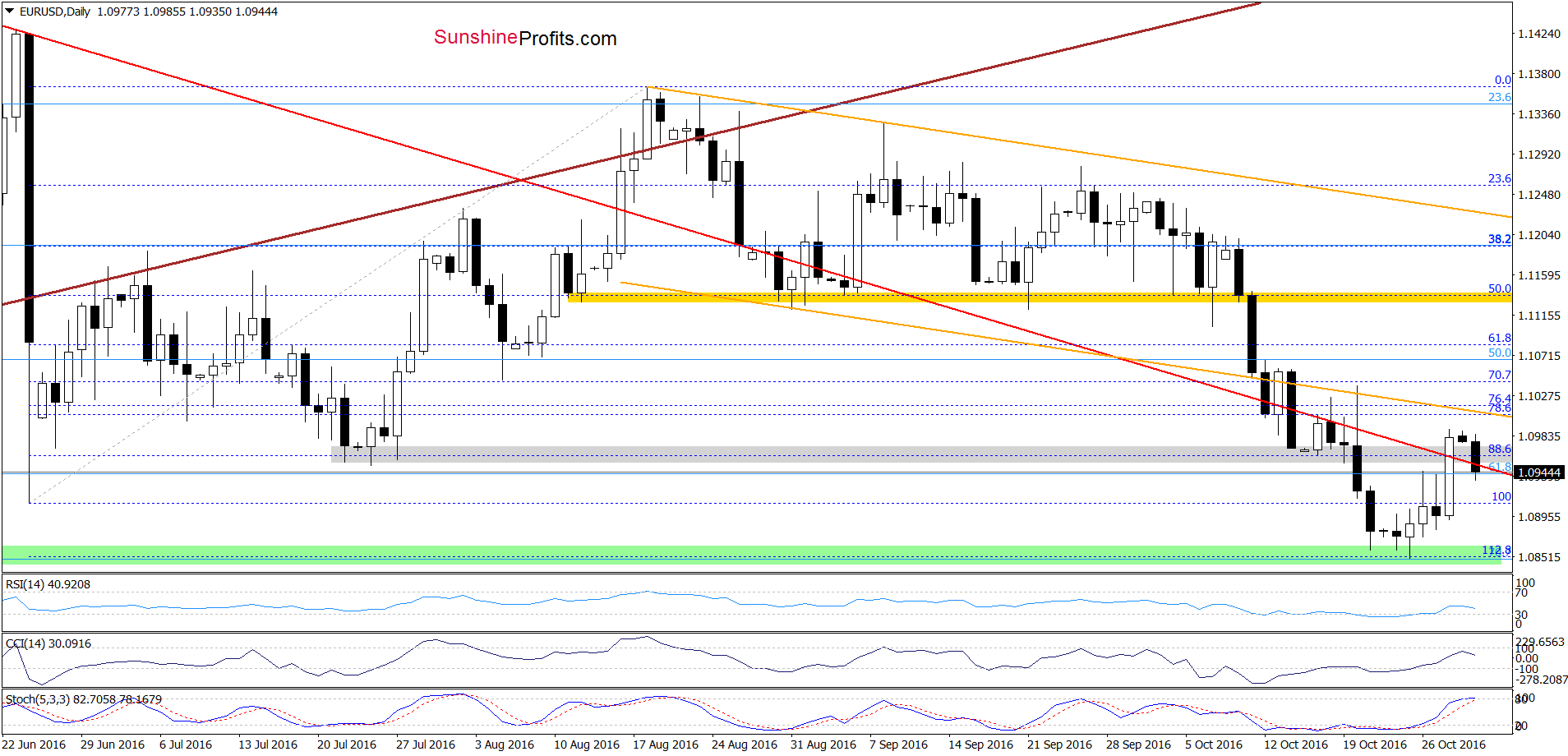

(…) the green support zone in combination with buy signals generated by all daily indicators encouraged currency bulls to act, which resulted in a rebound above 1.0900. Taking these facts into account, we think that the pair will extend gains and climb to the previously-broken grey zone and the red declining resistance line in the coming days.

From today’s point of view, we see that the situation developed in line with the above scenario and EUR/USD reached our upside targets on Friday. Despite this improvement, currency bulls didn’t manage to hold gained levels, which resulted in a reversal and a decline earlier today. With this move, the exchange rate slipped below the grey zone and the red line, invalidating breakouts, which doesn’t bode well for EUR/USD – especially when we factor in the facts that the CCI moved lower and the Stochastic Oscillator is very close to generating a sell signal. Nevertheless, today’s drop will be more bearish event if the exchange rate closes today’s session under the abve-mentioned levels. In this case, the pair will extend losses and re-test the strength of the green support zone in the following days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. However, if the pair closes today’s session under the grey zone and the red declining line, we’ll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

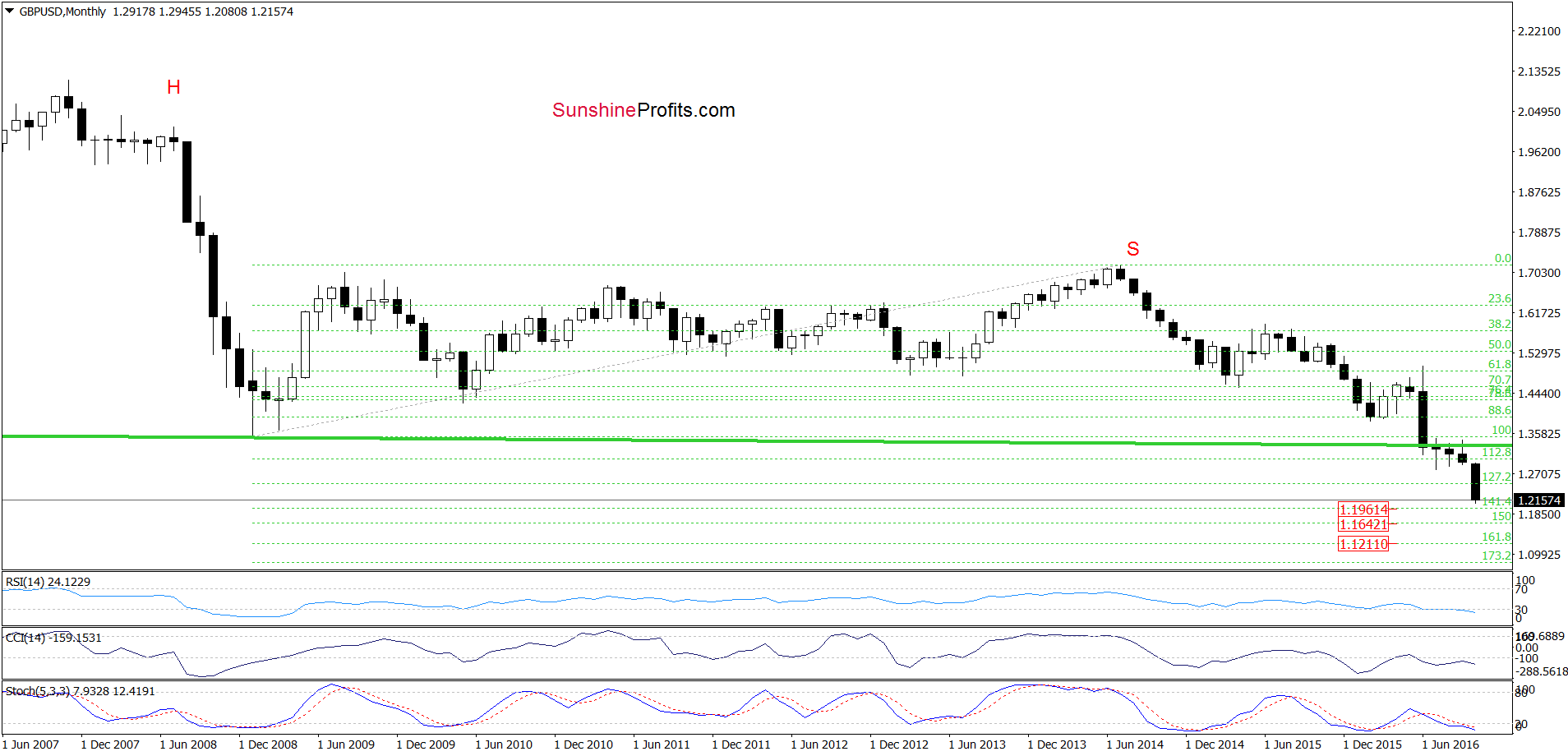

GBP/USD

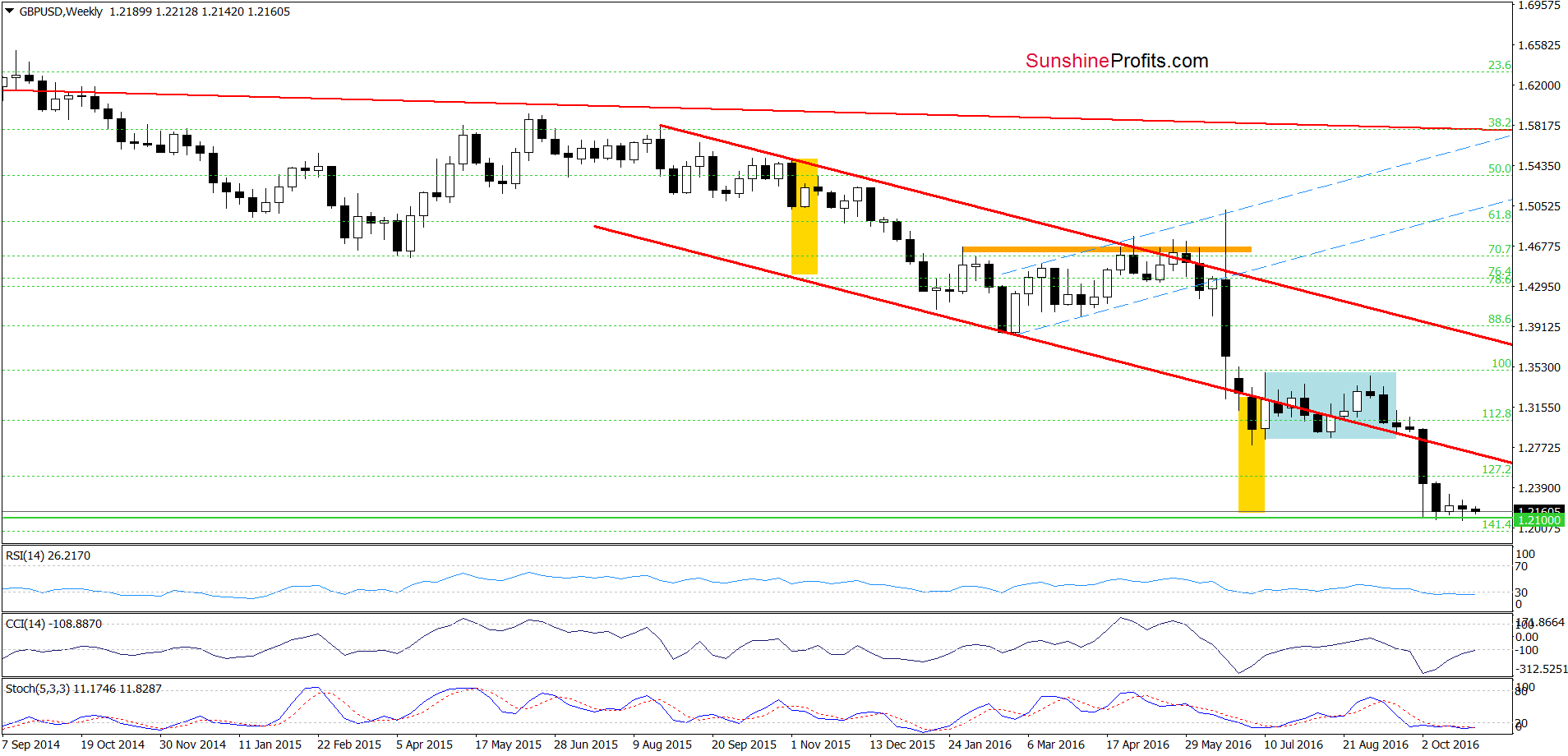

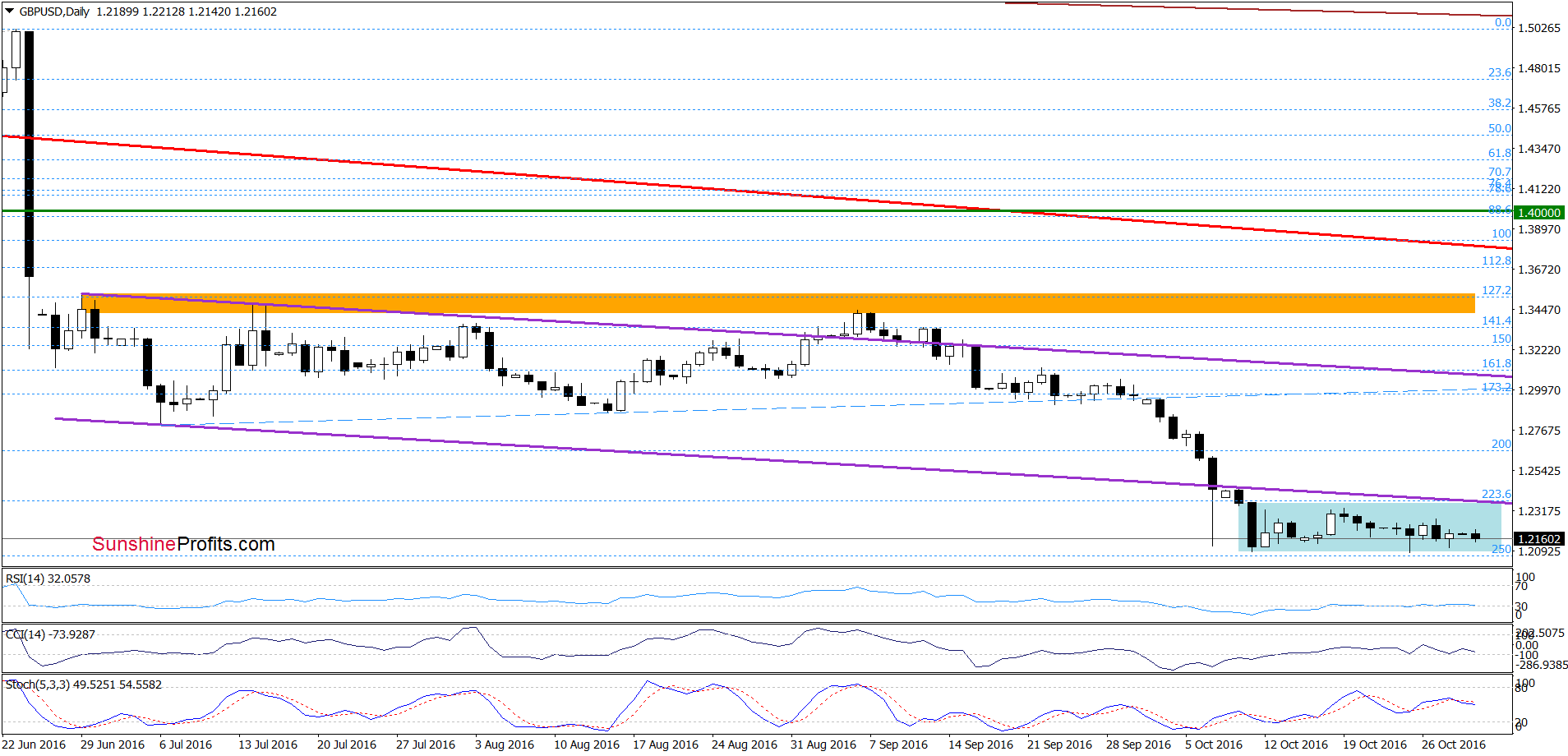

Looking at the above charts, we see that the overall situation hasn’t changed much as GBP/USD remains in the blue consolidation, slightly above recent lows. This means that our previous commentary on this currency pair is up-to-date also today:

(…) currency bulls didn’t (…) push GBP/USD to higher levels, which resulted in a reversal and a drop to recent lows and the level of 1.2100. As you see, this area was strong enough to stop declines several times in the past, which could result in another rebound – even to the lower border of the purple declining trend channel. Nevertheless, if currency bulls fail and their opponents manage to successfully break below these support levels, we’ll see a test of the barrier of 1.2000 in the coming week.

What could happen if it is broken?

(...) if GBP/USD extends losses the next downside target would be around 1.1961 (the 141.4% Fibonacci extension), 1.1642 (the 150% extension) or even at 1.1211, where the 161.8% extension is.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

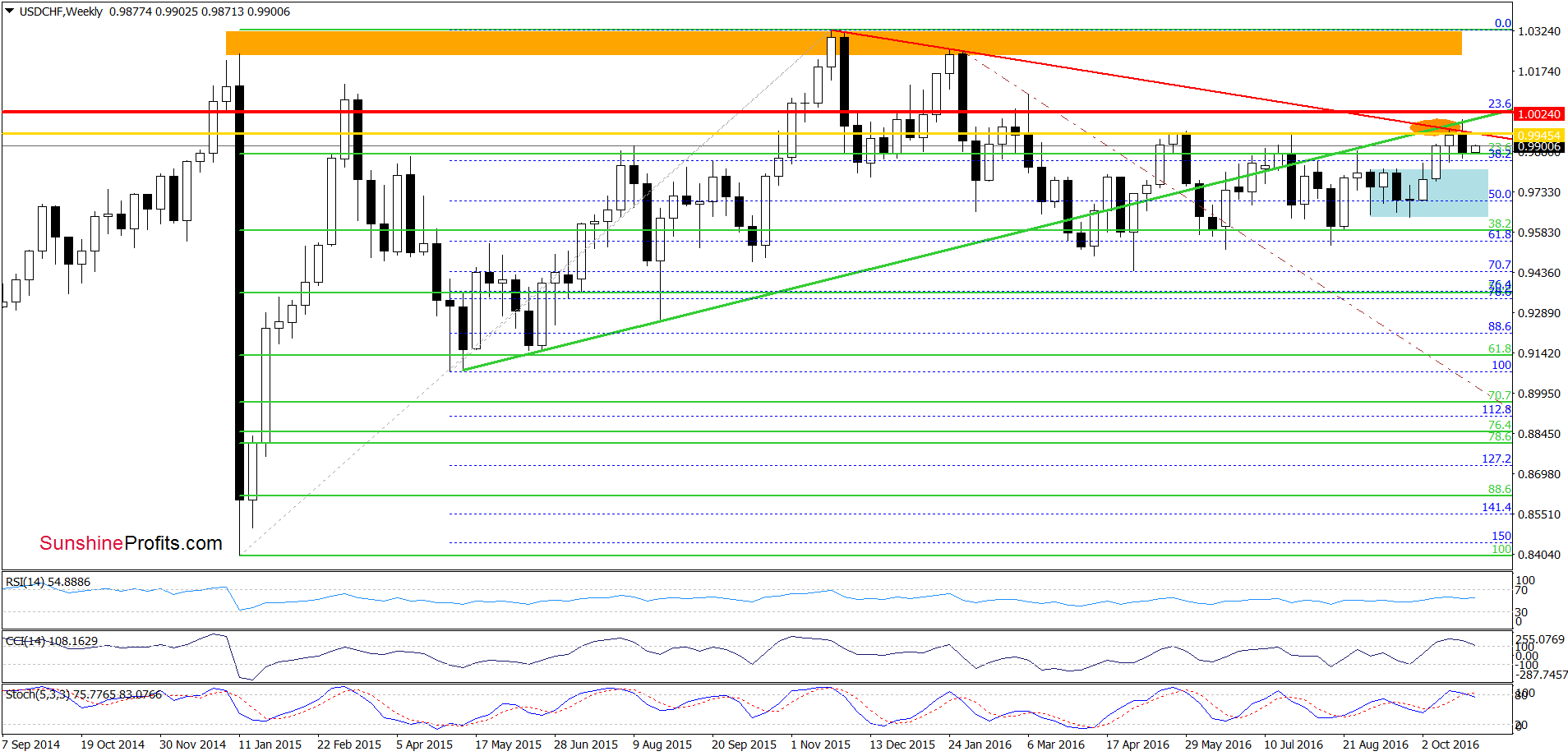

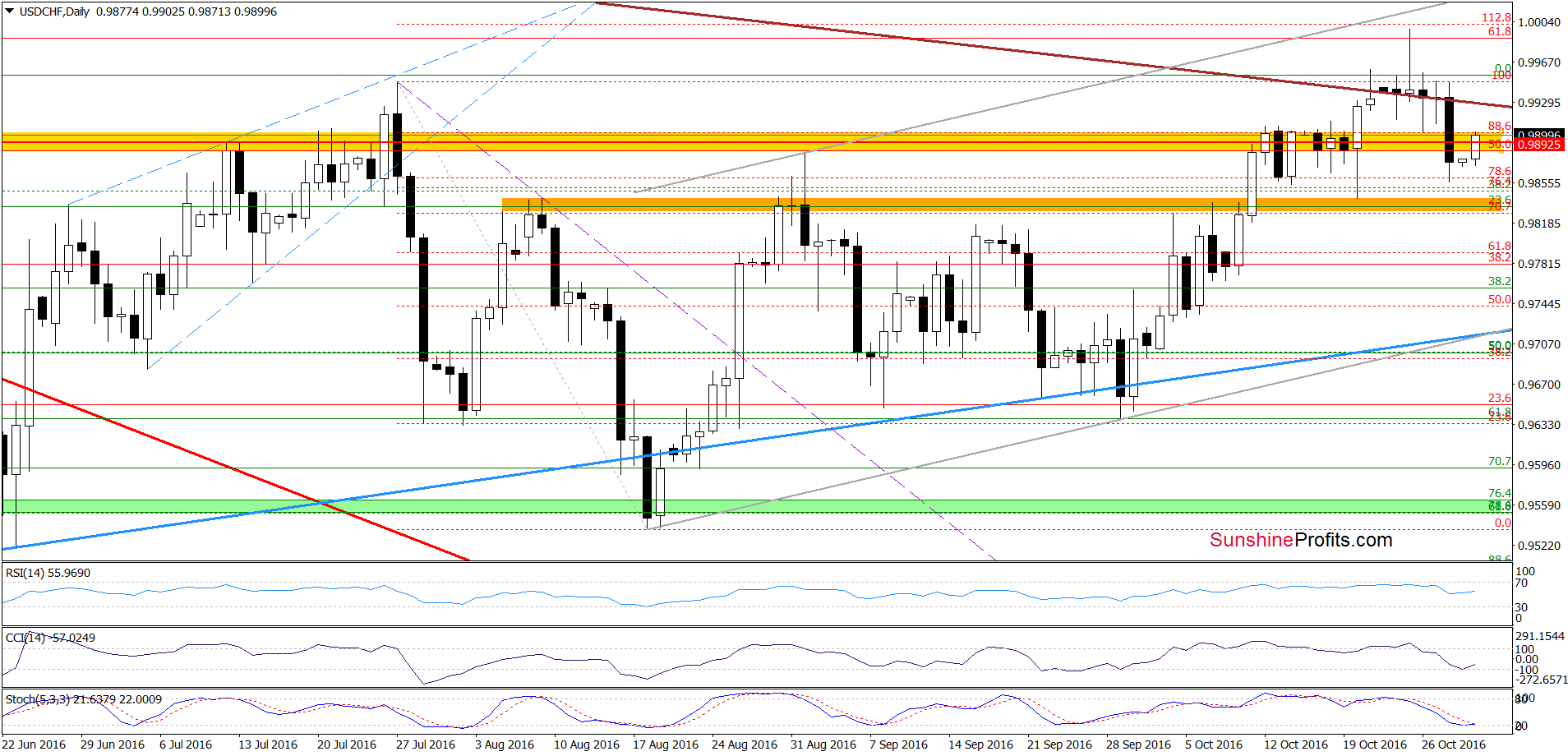

USD/CHF

On the weekly chart, we see that although USD/CHF rebounded slightly, the key resistance zone created by the long-term red declining resistance line based on the Nov and Feb highs, the green rising line based on the May and Aug 2015 lows and May and Jul highs (marked with orange ellipse) continues to keep gains in check.

How did this increase affect the very short-term picture? Let’s check.

Quoting our previous commentary on this currency pair:

(…) although USD/CHF moved little higher and broke above the brown resistance line (the red resistance line seen on the weekly chart), this improvement was only temporary and the exchange rate erased some of earlier gains, which in combination with sell signals generated by the CCI and Stochastic Oscillator and the medium-term picture suggests further deterioration in the coming week. Therefore, if the pair moves lower from current levels the initial downside target would be around 0.9841, where the last Thursday’s low is.

From today’s point of view, we see that USD/CHF moved sharply lower and approached our initial downside target on Friday. Although the pair rebounded earlier today, it is still trading in the yellow resistance zone under the brown resistance line (the red resistance line seen on the weekly chart), which means that invalidation of the breakout above this line and its negative impact on the exchange rate is still in effect. This suggests that another reversal and lower values of USD/CHF are just around the corner.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.0000 and initial downside target at 0.9841) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts