Yesterday’s data showed that existing home sales increased by 0.4% in the previous month, which supported the greenback and pushed the USD Index higher. Earlier in the day, the U.S. currency extended gains against the basket of major currencies on hopes that today’s new home sales data would show another increase. How did today’s increase affect the technical picture of EUR/USD, USD/JPY and USD/CAD?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1512; initial downside target at 1.0572)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: long (stop-loss order at 0.9633; initial downside target at 1.0239)

- AUD/USD: none

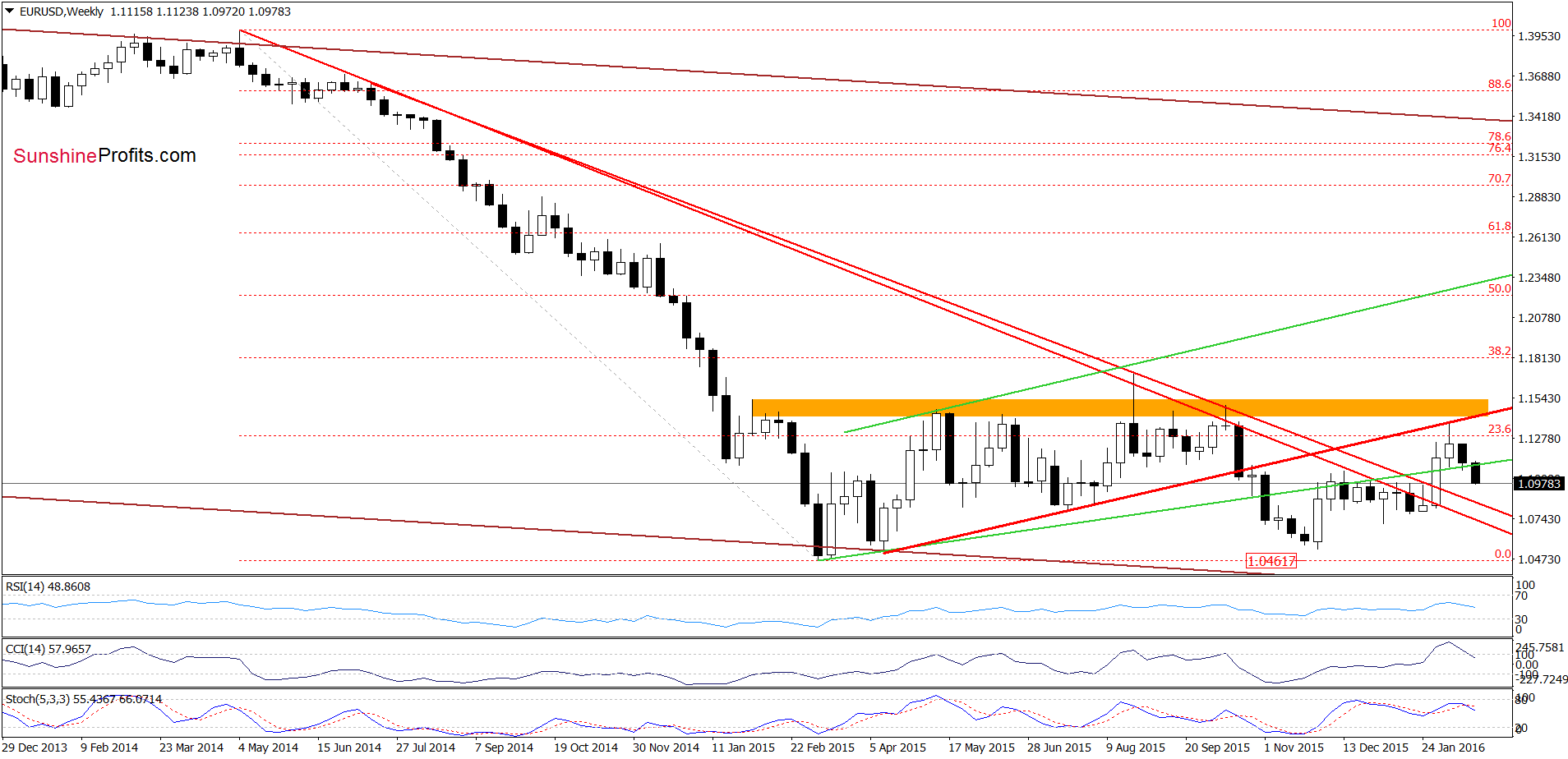

EUR/USD

Yesterday, we wrote the following:

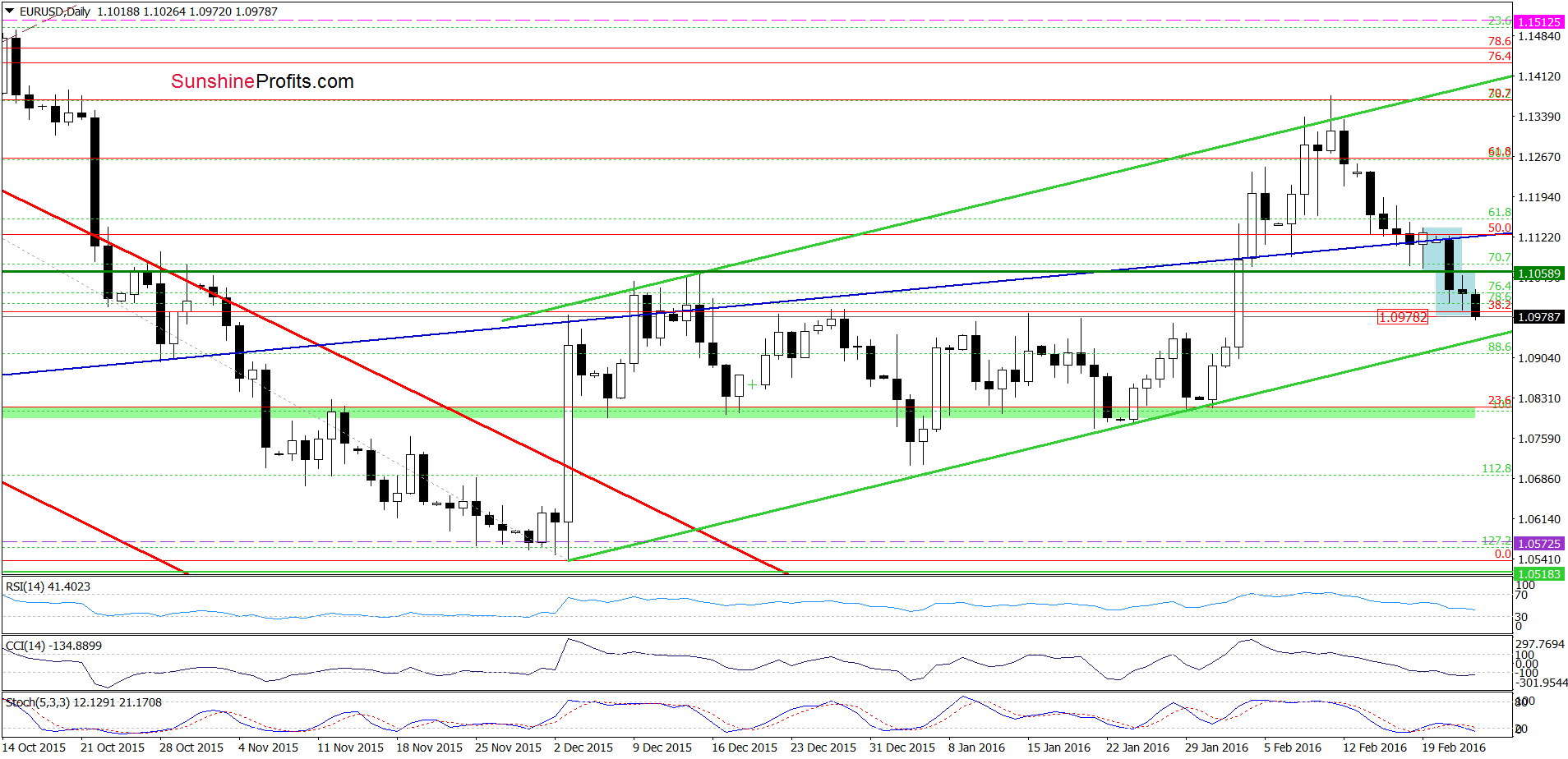

(…) the pair not only broke under the lower border of the blue consolidation, but also slipped below the mid-Dec highs. Earlier today, the exchange rate rebounded slightly and climbed to the green horizontal support/resistance line, but then reversed and declined, which looks like a verification of earlier breakdown. Such price action doesn’t bode well for EUR/USD and suggests lower values in the coming day. How low could the pair go? In our opinion, the initial downside target would be around 1.0978, where the size of the move will correspond to the height of the blue consolidation.

Looking at the daily chart, we see that the situation developed in line with the above scenario and EUR/USD reached our first downside target earlier today. What’s next? Taking into account the fact that the weekly CCI and Stochastic Oscillator generated sell signals, we think that lower values of the exchange rate are ahead us. Therefore, if the pair extends losses from here, our next downside target from Forex Trading Alert posted last Tuesday will be in play:

(...) an acceleration of declines will be more likely and reliable after a breakdown under the navy blue support line. In this case, the pair will test the lower border of the green rising trend channel in the following days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1512 and the initial downside target at 1.0572) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

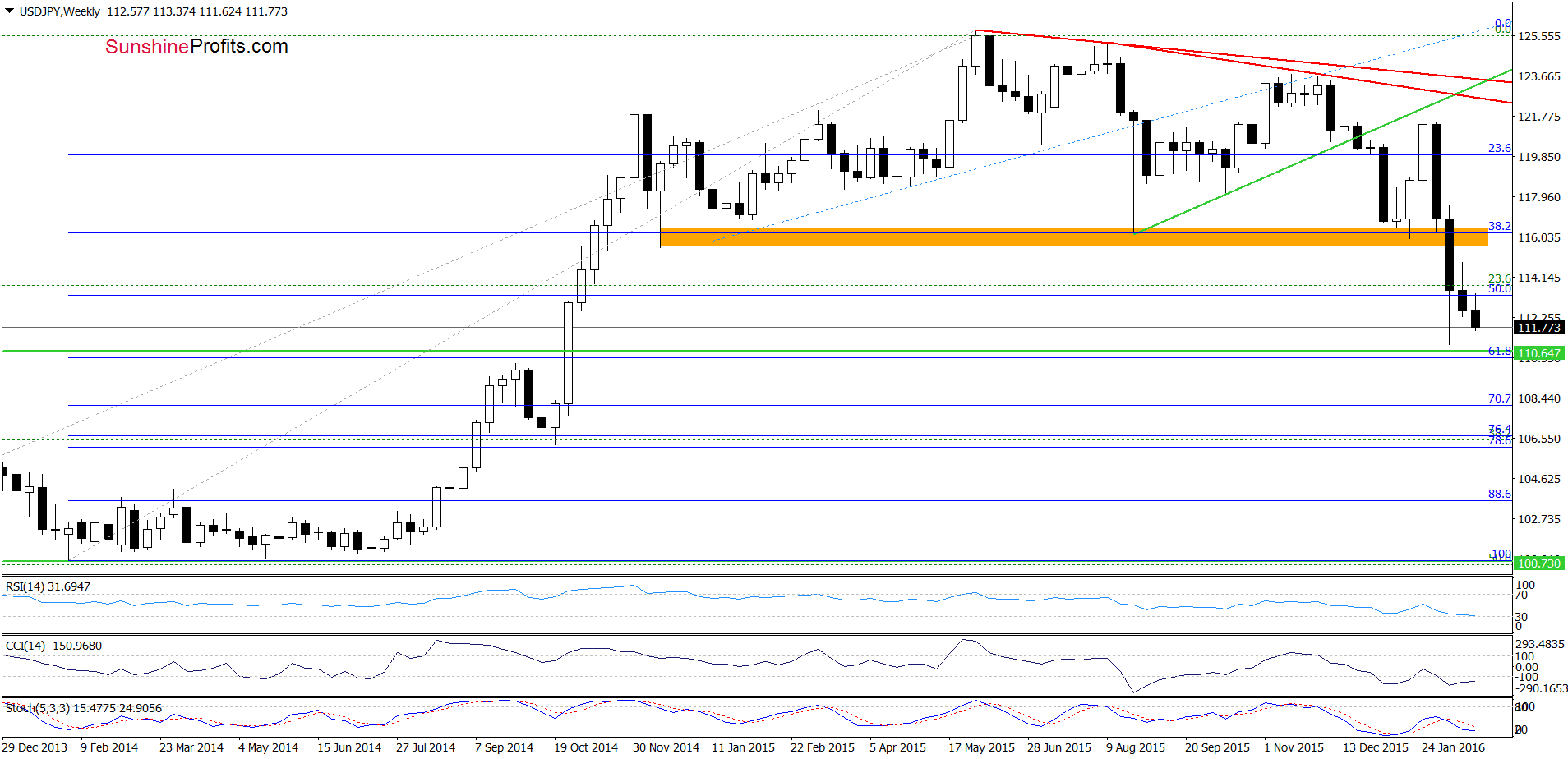

USD/JPY

Quoting our Monday’s alert:

(…) although USD/JPY moved little higher, the size of the move is too small to say that the declines are over. On top of that, the exchange rate is still trading under the orange resistance zone, which suggests that as long as there is no invalidation of the breakdown under this area, anther downswing is likely.

On the weekly chart, we see that currency ears pushed the pair lower as we had expected. What impact did this move have on the very short-term chart? Let’s check.

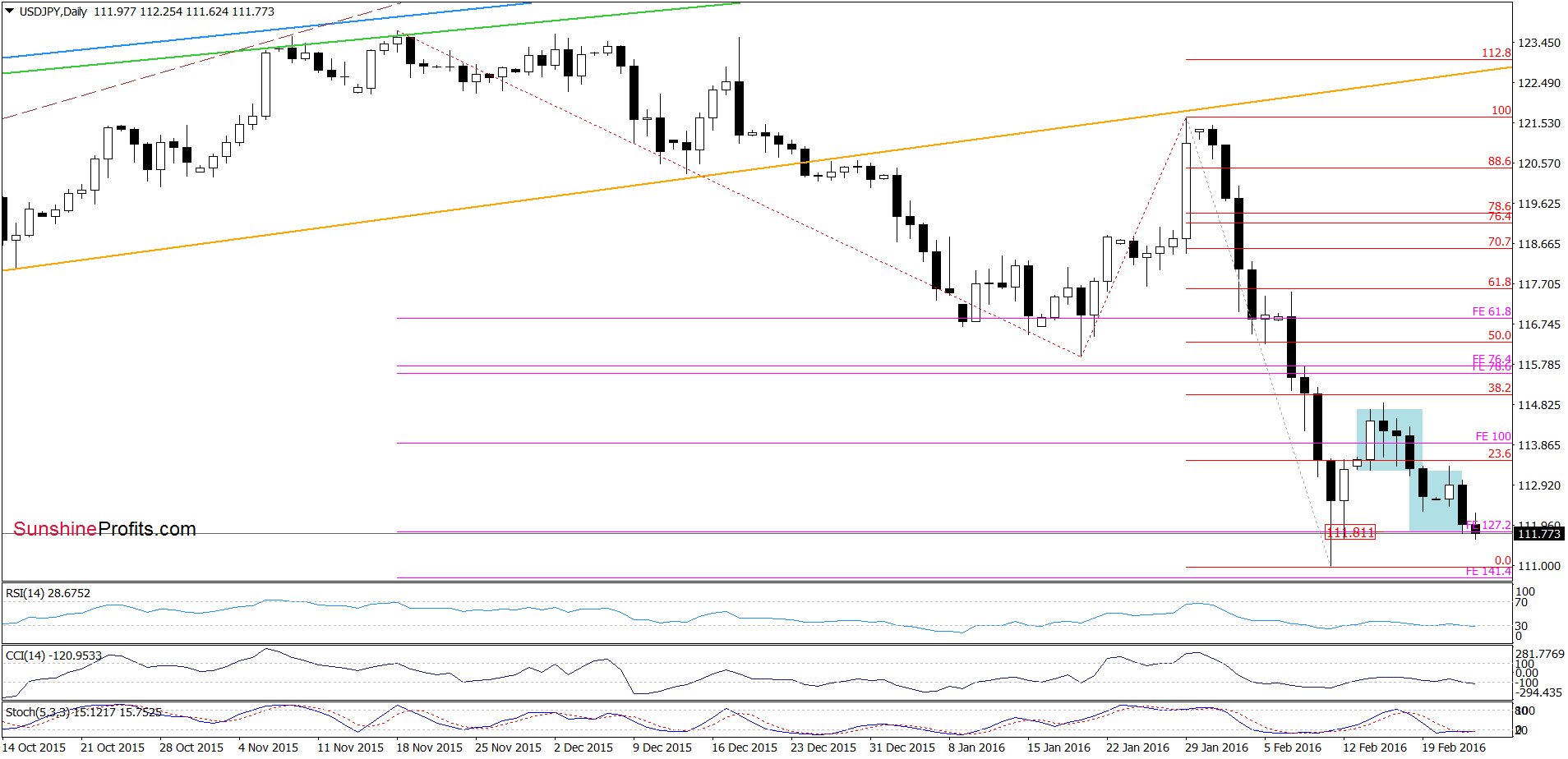

In our last commentary on this currency pair, we wrote the following:

(…) USD/JPY rebounded and climbed above 112 earlier today. Despite this move, the pair remains under the previously-broken lower border of the blue consolidation, which suggests that (…) lower values of the exchange rate are ahead us. Therefore, in our opinion, we’ll see a drop to (at least) 111.81, where the size of the move will correspond to the height of the consolidation.

From today’s point of view, we see that the situation developed in line with the above scenario and USD/JPY reached our first downside target. What’s next? Taking into account the fact that there are no buy signals, which could encourage currency bulls to act (although all our daily indicators are oversold), we think that another downswing is likely. Therefore, if the pair moves lower from here, the next downside target would be the Feb 11 low of 110.96.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

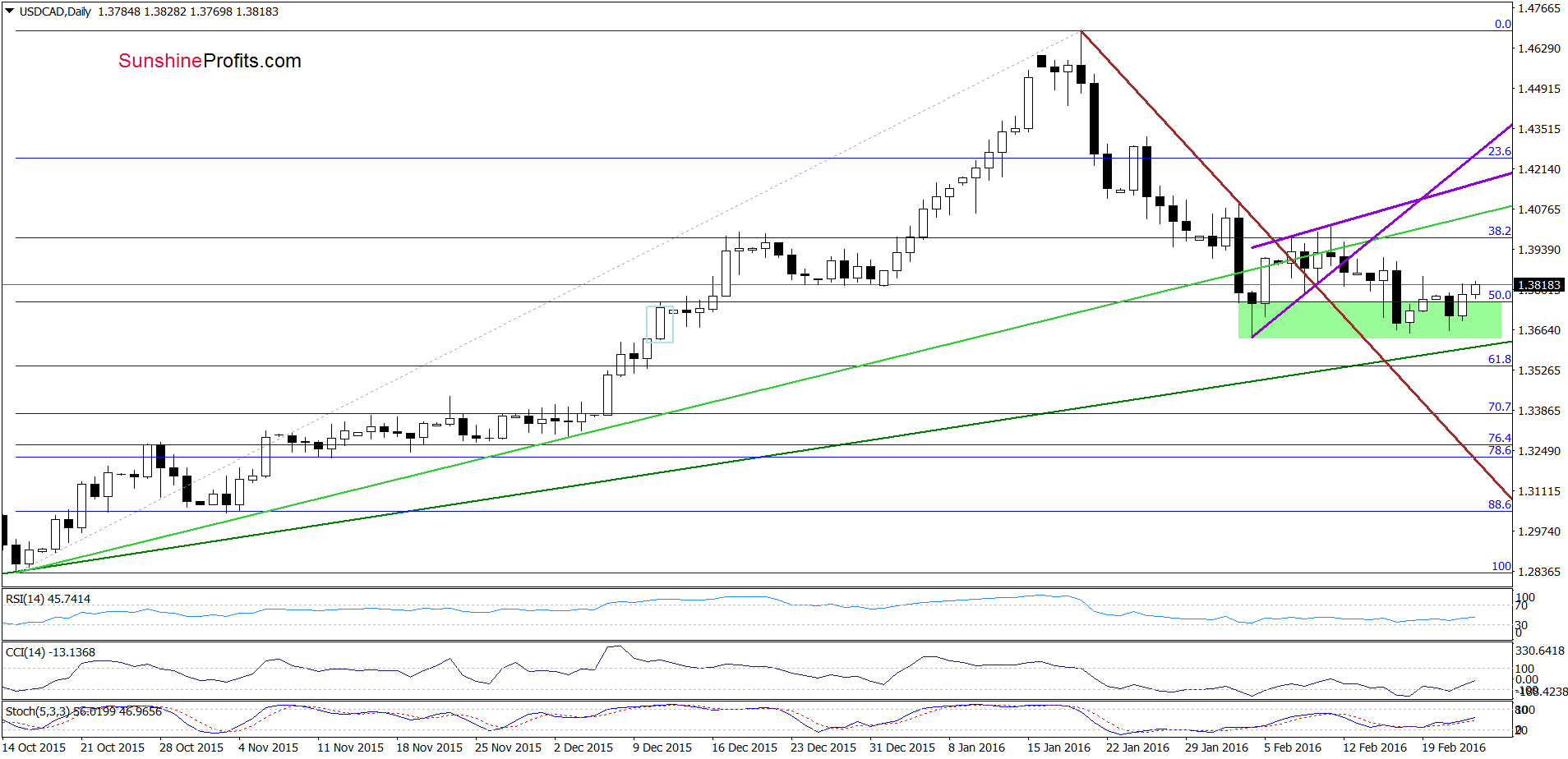

Looking at the weekly chart, we see that although USD/CAD slipped under the upper border of the long-term rising trend channel earlier this week, currency bulls pushed the pair higher, invalidating earlier breakdown.

How did this positive event affect the very short-term picture? Let’s examine the daily chart and find out.

As you see on the daily chart, USD/CAD bounced off the green support zone and came back above the previously-broken 50% Fibonacci retracement, which means that what we wrote on Friday on this currency pair is up-to-date also today:

(…) Although this area encouraged currency bulls to act and the exchange rate rebounded yesterday, the pair is still trading under the previously-broken lower border of the purple triangle/rising wedge and the medium-term green line, which together serve as the nearest resistance. Therefore, in our opinion, higher values of USD/CAD will be more likely if the pair comes back above these lines. Finishing today’s commentary on this currency pair it is worth noting that the CCI and Stochastic Oscillator generated buy signal, which in combination with the medium-term picture (…) suggests that reversal is just around the corner.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts