Yesterday’s disappointing data from the Institute of Supply Management (its non-manufacturing PMI dropped to 53.4 in Jan) in combination with an increase in the number of initial jobless claims in the week ending Feb 27 pushed the USD Index sharply lower. How did this drop affect the euro, yen and Swiss franc?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1512; initial downside target at 1.0572)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

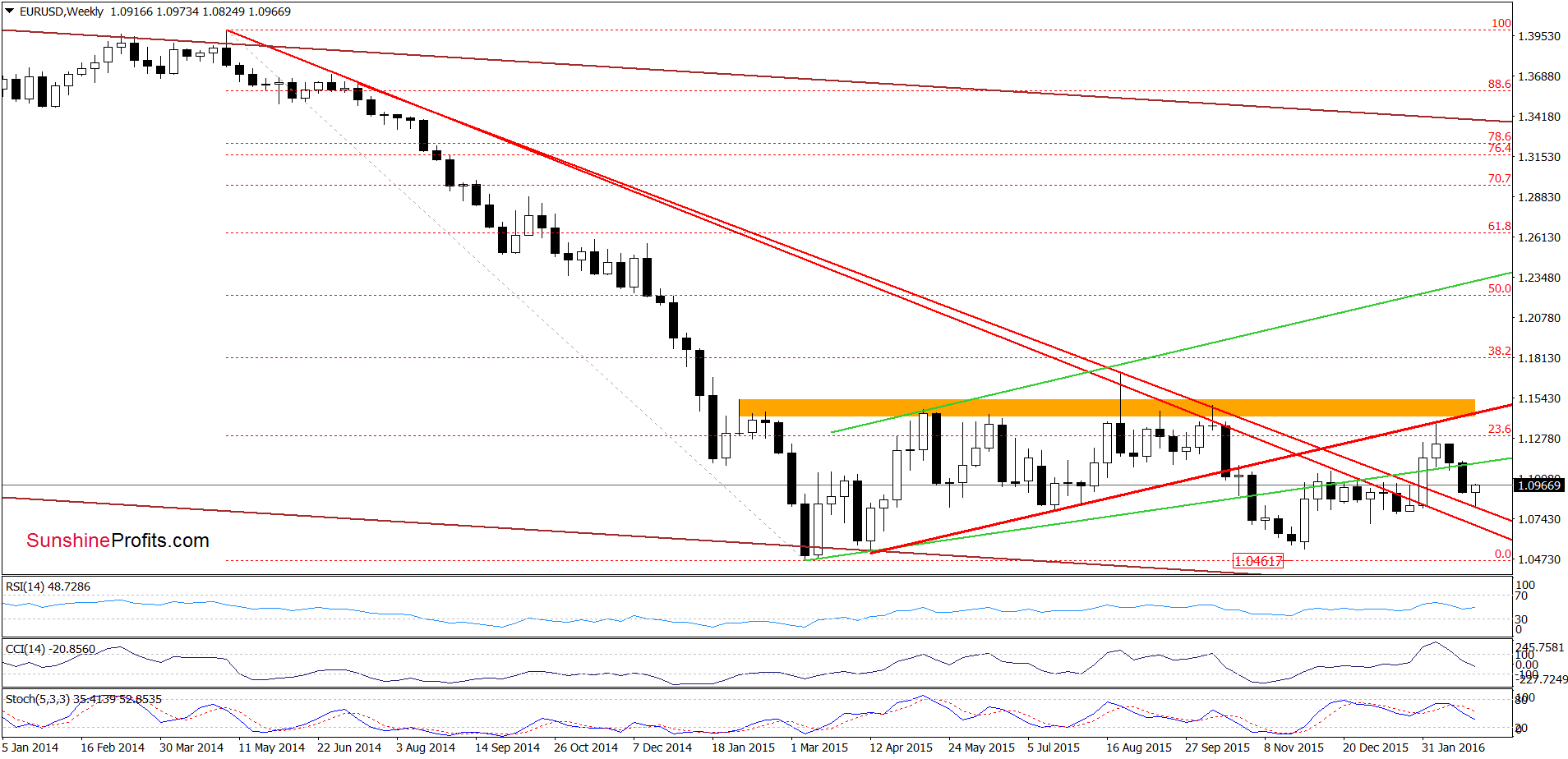

Looking at the weekly chart, we see that EUR/USD bounced off the previously-broken red declining resistance line. How did this move affect the very short-term picture? Let’s check.

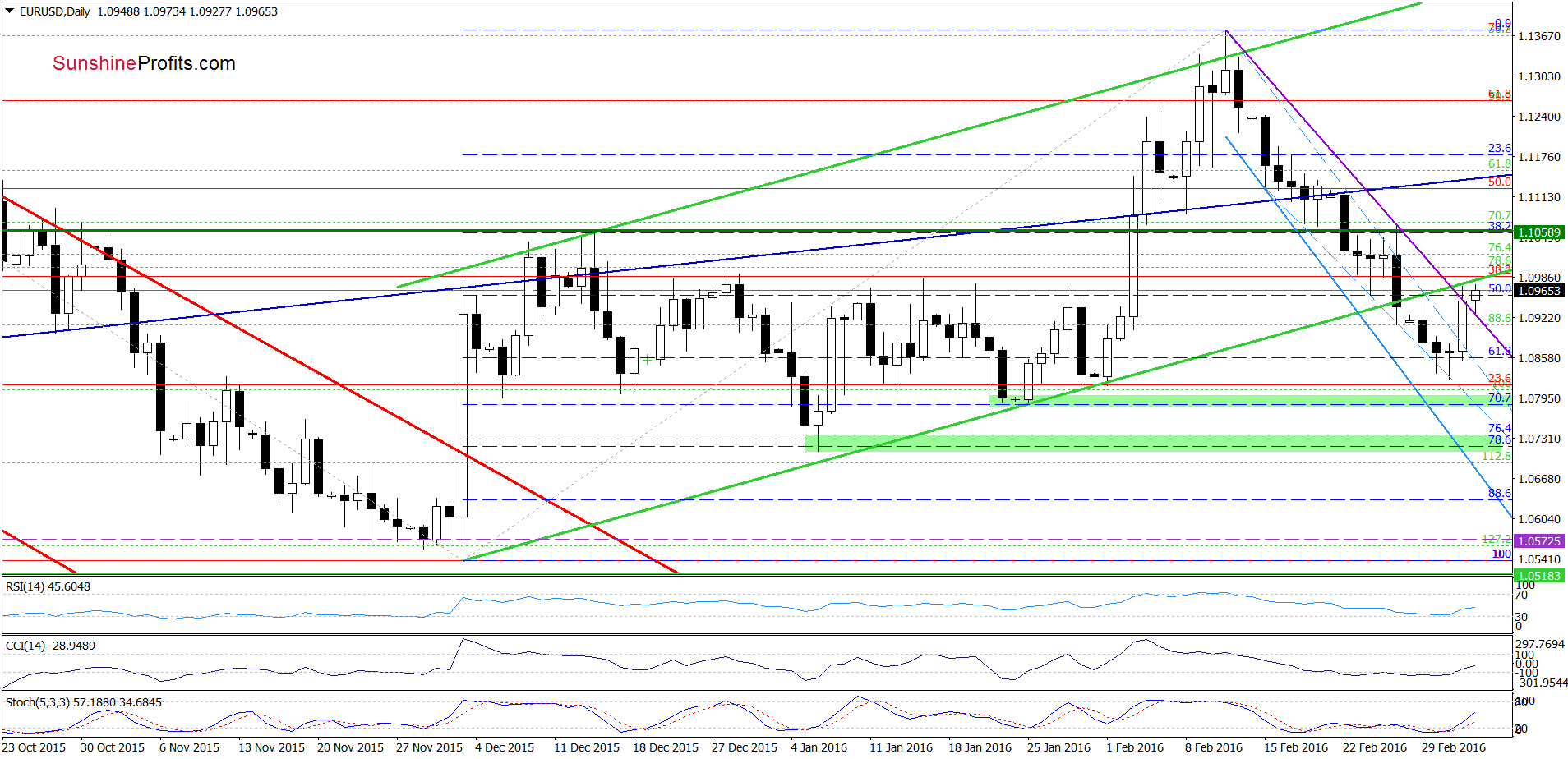

On the daily chart, we see that EUR/USD moved sharply higher and broke above the purple resistance line based on Feb 11 and Feb 26 highs, which is a positive signal. With the recent upward move, the exchange rate reached the previously-broken lower border of the green rising trend channel, which looks like a verification of earlier breakdown. If this is the case, and the pair declines from here, we’ll see a re-test of the 61.8% Fibonacci retracement in the coming days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1512 and the initial downside target at 1.0572) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

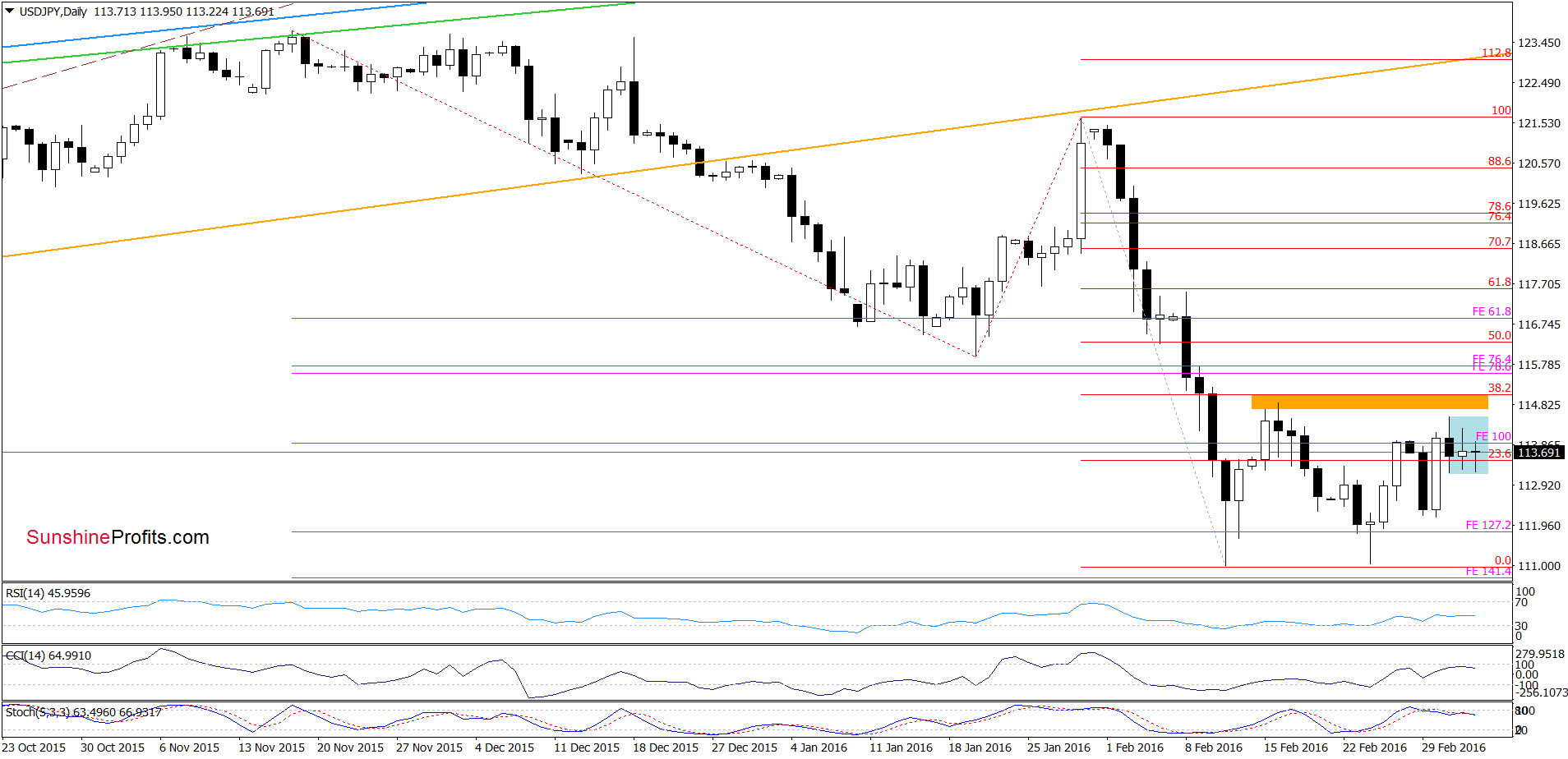

On the daily chart, we see that the situation hasn’t changed much as USD/JPY is trading in the blue consolidation under the orange resistance zone, which makes the very short-term picture a bit unclear. Nevertheless, the current position of the indicators (the Stochastic Oscillator generated a sell signal) suggests another attempt to move lower.

Are there any other factors that could encourage currency bulls to act? Let’s examine he long-term chart and find out.

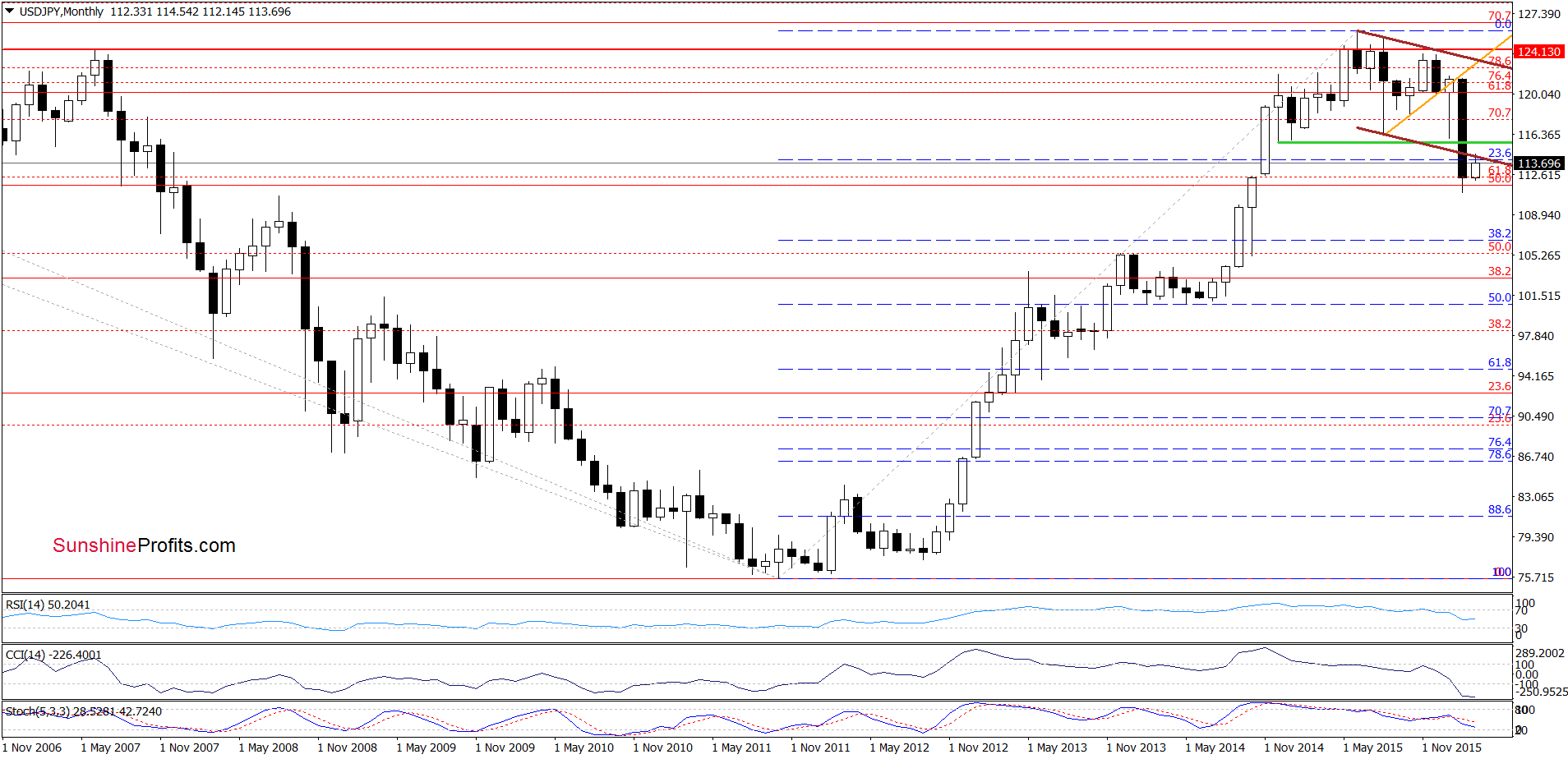

From this perspective, we see that the recent upswing took the exchange rate to the previously-broken lower border of the brown declining trend channel, which looks like a verification of earlier breakdown. Therefore, if the pair declines from here we may see a re-test of the recent lows in the coming week.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

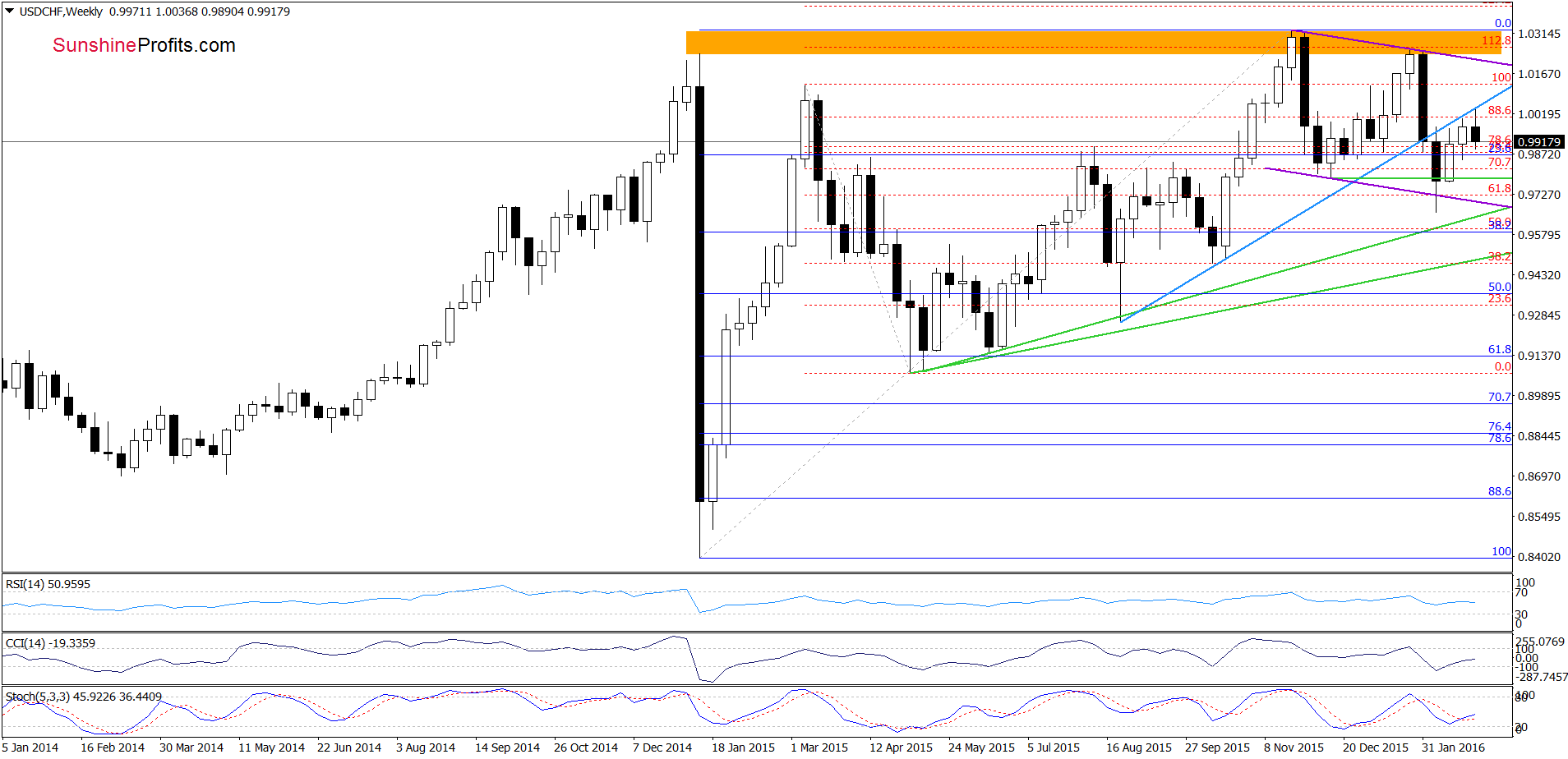

USD/CHF

Quoting our last commentary on this currency pair:

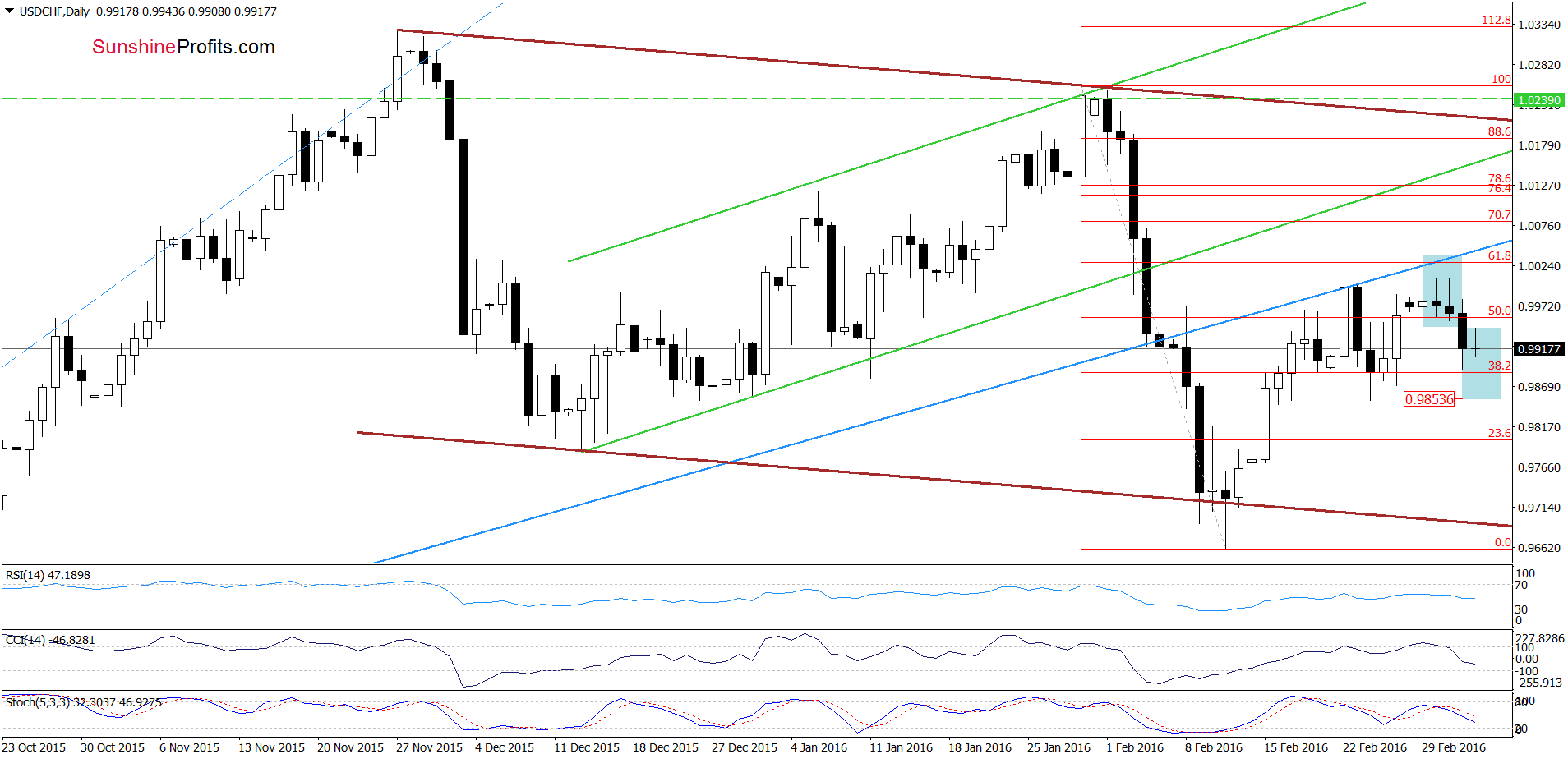

(…) USD/CHF gave up some gains as we had expected. As you see, the exchange rate is currently consolidating between the 50% Fibonacci retracement and the blue resistance line, which suggests that as long as there is no breakout above the Monday’s high or a breakdown below the lower line of the formation, another bigger move is not likely to be seen. Nevertheless, the position of the CCI and Stochastic Oscillator suggests that currency bears will try to push the pair lower in the coming days.

As you see on the charts, the situation developed in line with the above scenario and USD/CHF declined yesterday (which confirms that taking profits off the table on Monday was a good decision). With this downswing, the pair dropped under the lower border of the blue consolidation, which suggests a drop to around 0.9853, where the size of the move will correspond to the height of the formation. Additionally, this area is supported by the Feb 24 low, which could pause or even stop further deterioration.

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts