Earlier today, the USD Index extended gains and approached the level of 95. As a result, EUR/USD verified the breakdown under the support/resistance line and declined. What’s next?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1887; the downside target around 1.0938)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

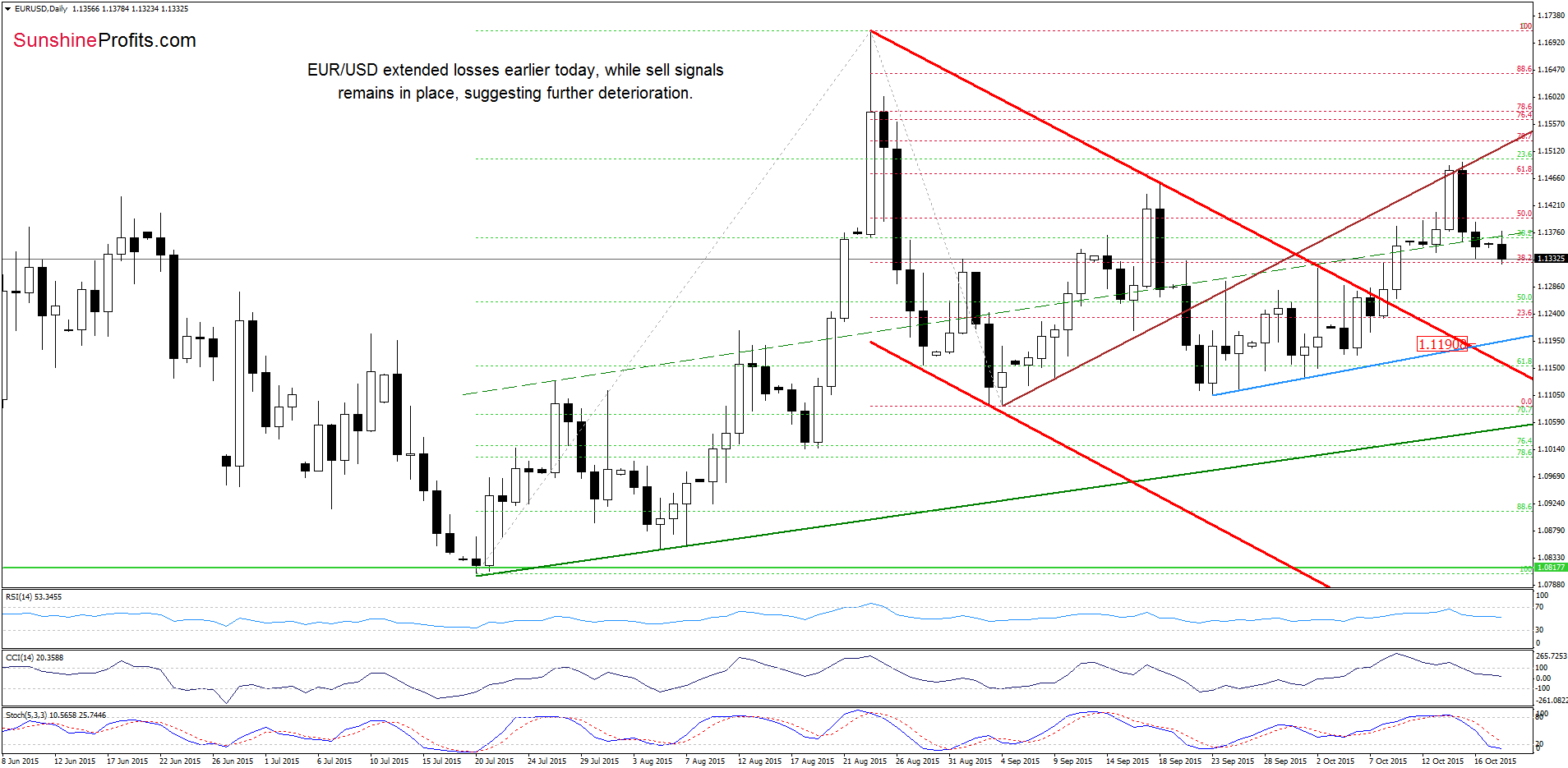

EUR/USD

EUR/USD invalidated the breakout above the long-term red declining resistance line and closed the week below it, which is a bearish signal that suggests further deterioration in the coming week.

Having said that, let’s find out what impact did this move have on the very short-term picture.

Looking at the daily chart, we see that EUR/USD verified the breakdown under the upper border of the rising trend channel (marked with green dashed line) earlier today. This negative event in combination with sell signals generated by the indicators encouraged currency bears to act, which resulted in further deterioration. Taking this fact into account, we believe that lower values of the exchange rate are just around the corner. If EUR/USD moves lower from here, the initial downside target would be the blue support line (around 1.1194) or even the previously-broken upper border of the red declining trend channel (currently around 1.1157).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1887 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

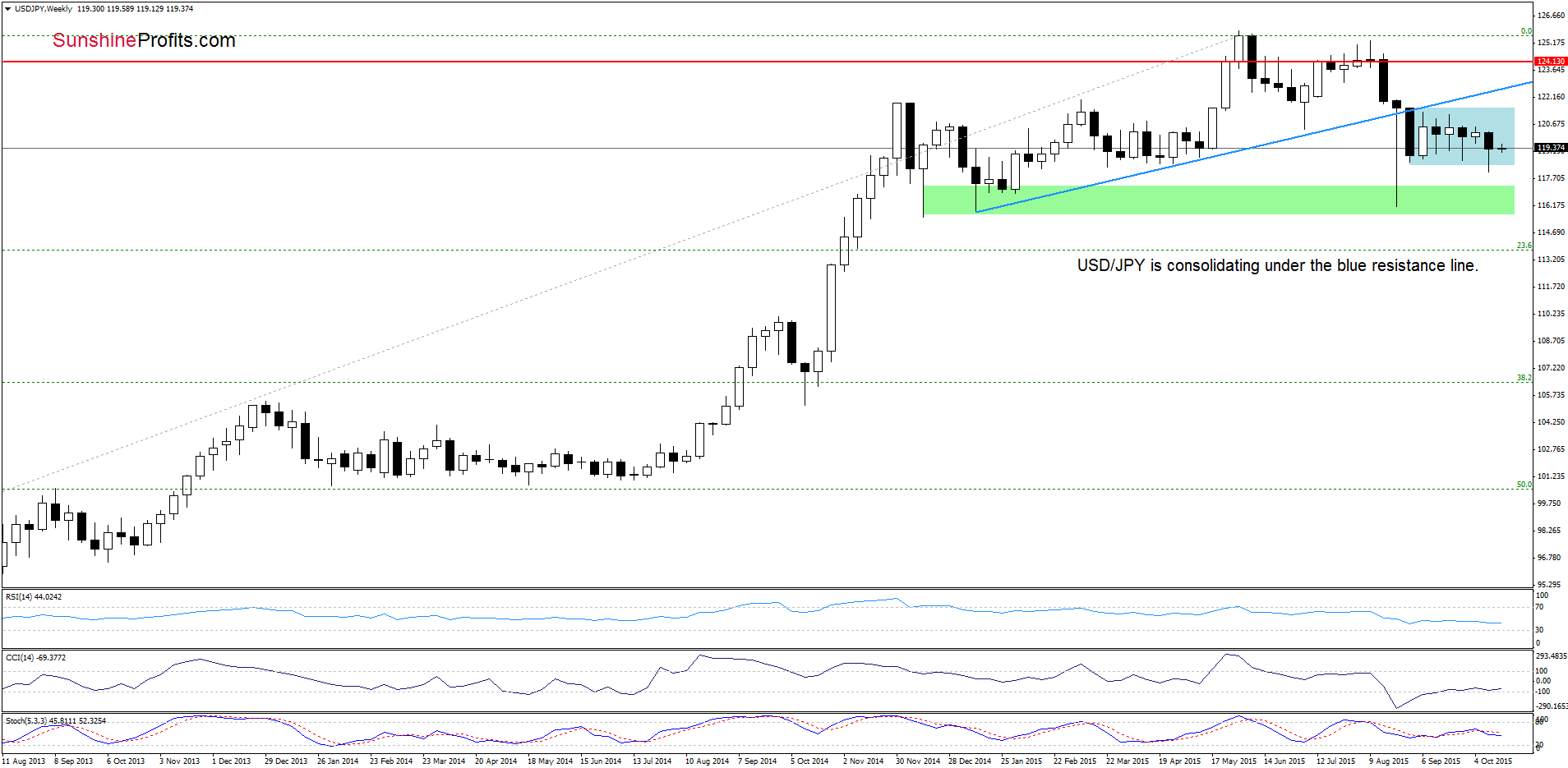

USD/JPY

The medium-term picture hasn’t changed much as the exchange rate is still trading in the consolidation under the blue resistance line.

Today, we’ll focus on the very short-term changes.

On Friday, USD/JPY rebounded and invalidated earlier breakdown under the green zone. As you see on the chart, the pair is currently trading slightly below the Friday’s high, which means that what we wrote in our last commentary is up-to-date:

(…) Taking this positive signal into account and combining it with the current position of the indicators, we think that further improvement is more likely than not. If this is the case, and USD/JPY moves higher from here, the initial upside target would be around 119.95, where the previously-broken green line is.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

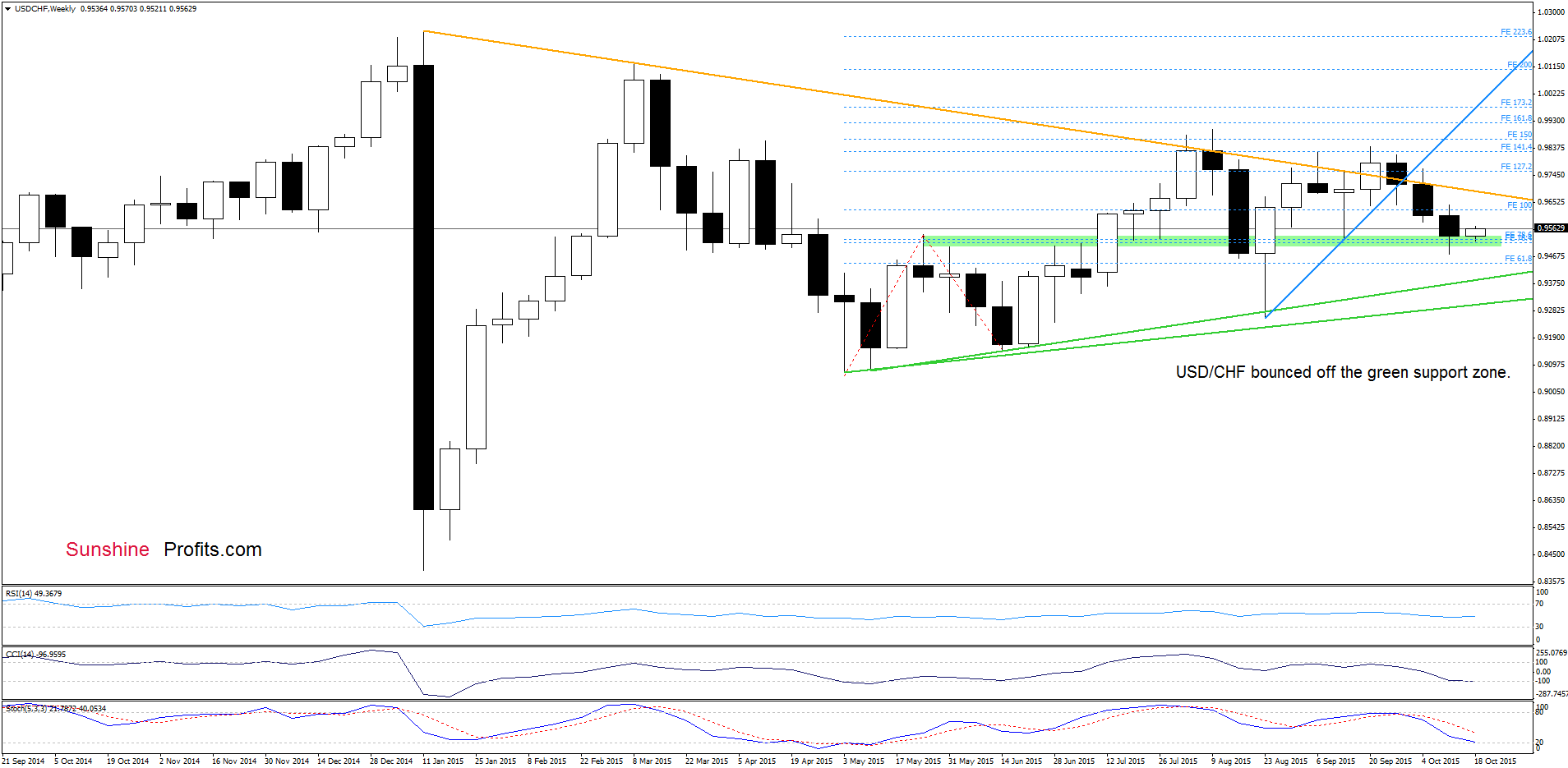

USD/CHF

Looking at the long- and medium-term charts, we see that USD/CHF reached the key support area (created by the green support zone marked on the weekly chart and reinforced by the blue support line seen on the monthly chart), which triggered a rebound.

What impact did this increase have on the daily chart? Let’s check.

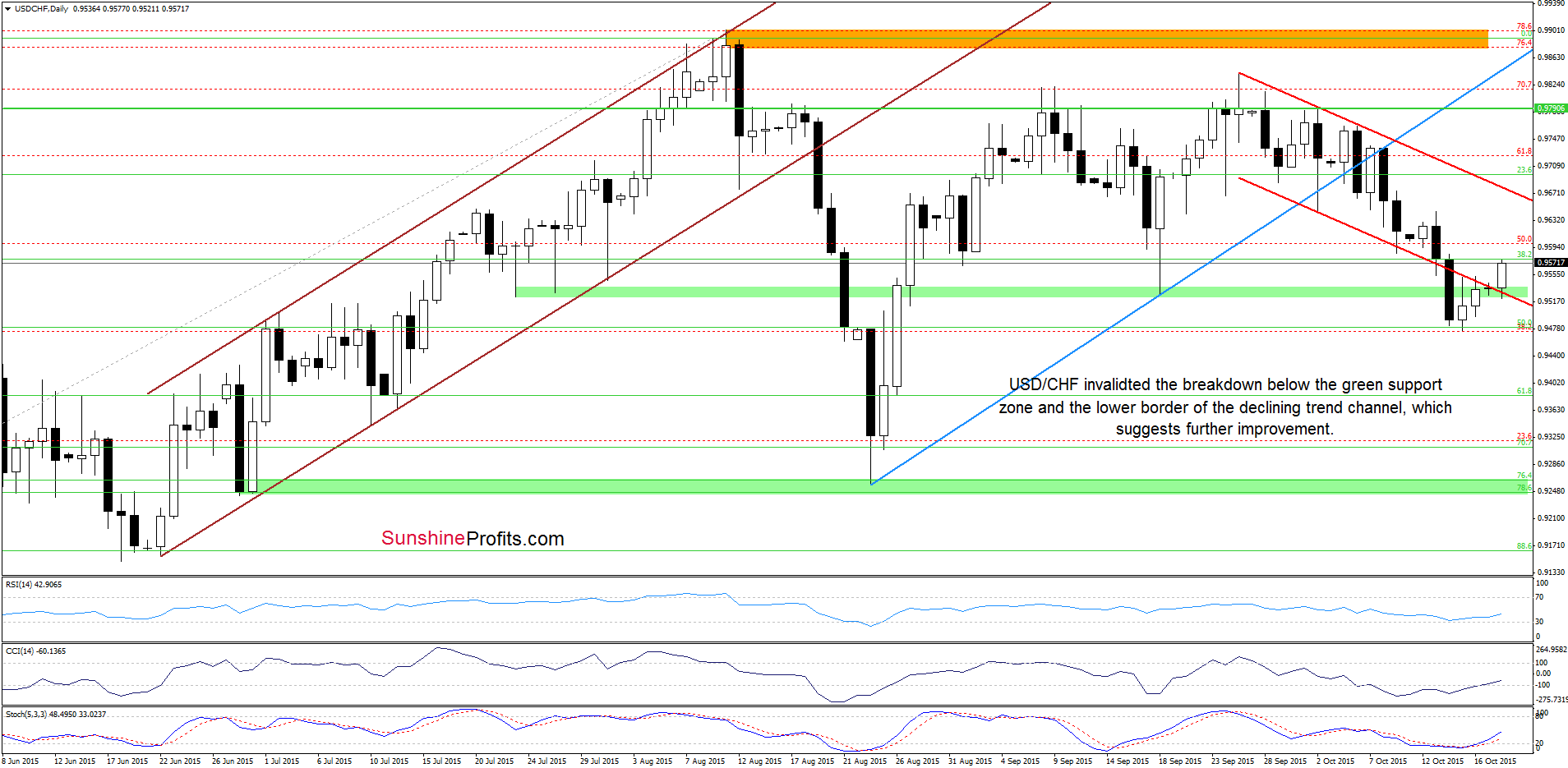

From this perspective, we see that USD/CHF moved higher and invalidated the breakdown under the green support zone and the lower border of the red declining trend channel. This is a positive signal, which suggests further improvement – especially when we factor in buy signals generated by the indicators. How high could the pair go? In our opinion, the initial upside target would be around 0.9644, where the Oct 13 high is. If this resistance is broken, we may see an increase to the upper border of the declining trend channel in the coming days.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts