On Friday, the Labor Department showed that the U.S. economy added 280,000 jobs in May, beating analysts’ forecast for 225,000. Thanks to this solid data GBP/USD declined sharply and re-tested Jan lows. Will we see a double bottom or further declines?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: Short positions (stop-loss order at 1.1667)

- GBP/USD: Short positions (stop-loss order at 1.5913)

- USD/JPY: none

- USD/CAD: Long positions (stop-loss order at 1.1706)

- USD/CHF: none

- AUD/USD: Short positions (stop-loss order at 0.8194)

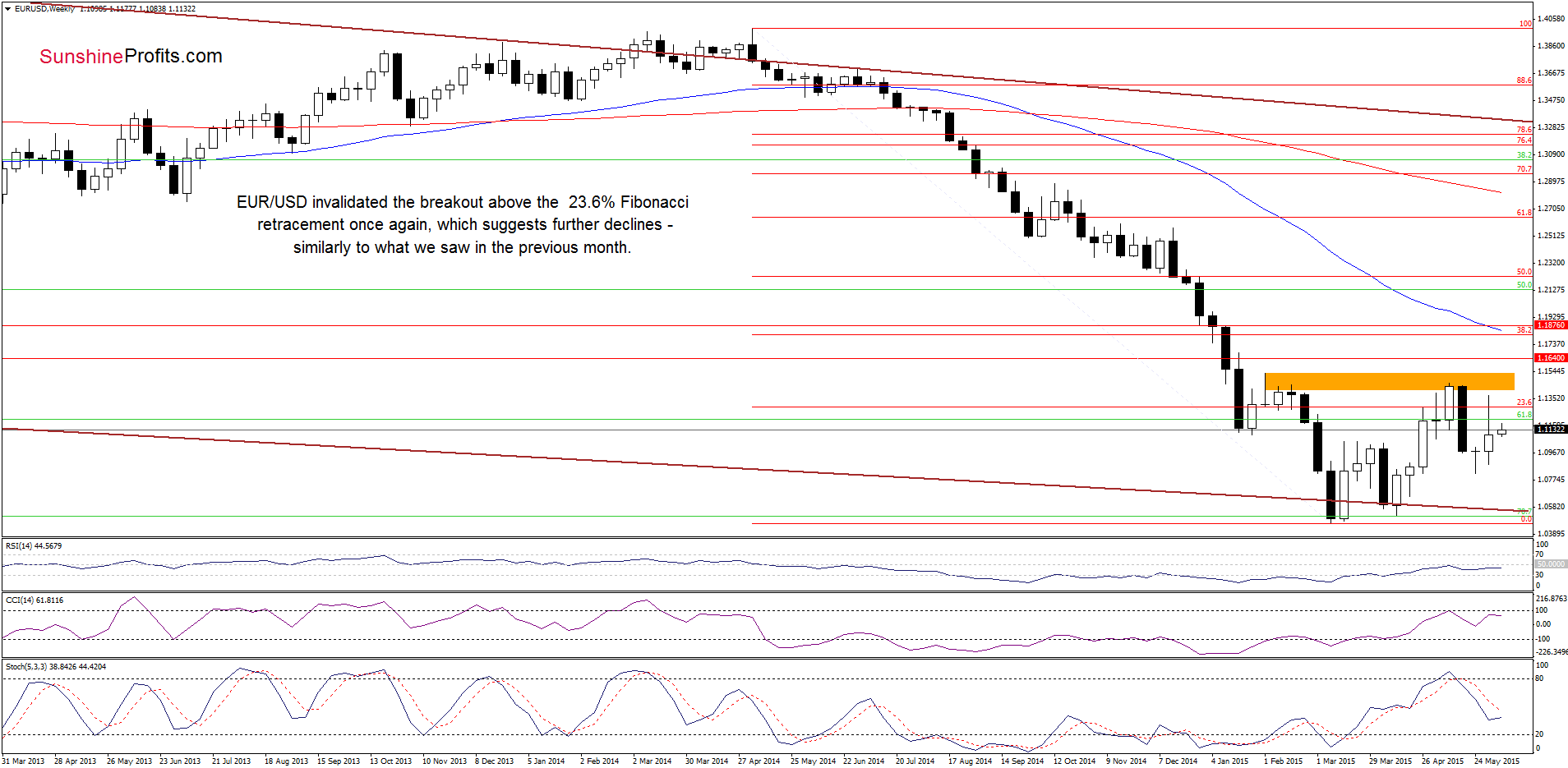

EUR/USD

On Friday, EUR/USD invalidated the breakout above the 23.6% Fibonacci retracement once again, which in combination with sell signals generated by the indicators suggests further declines – similarly to what we saw in the previous month.

Having said that, let’s examine the daily chart and find out what can we infer from it.

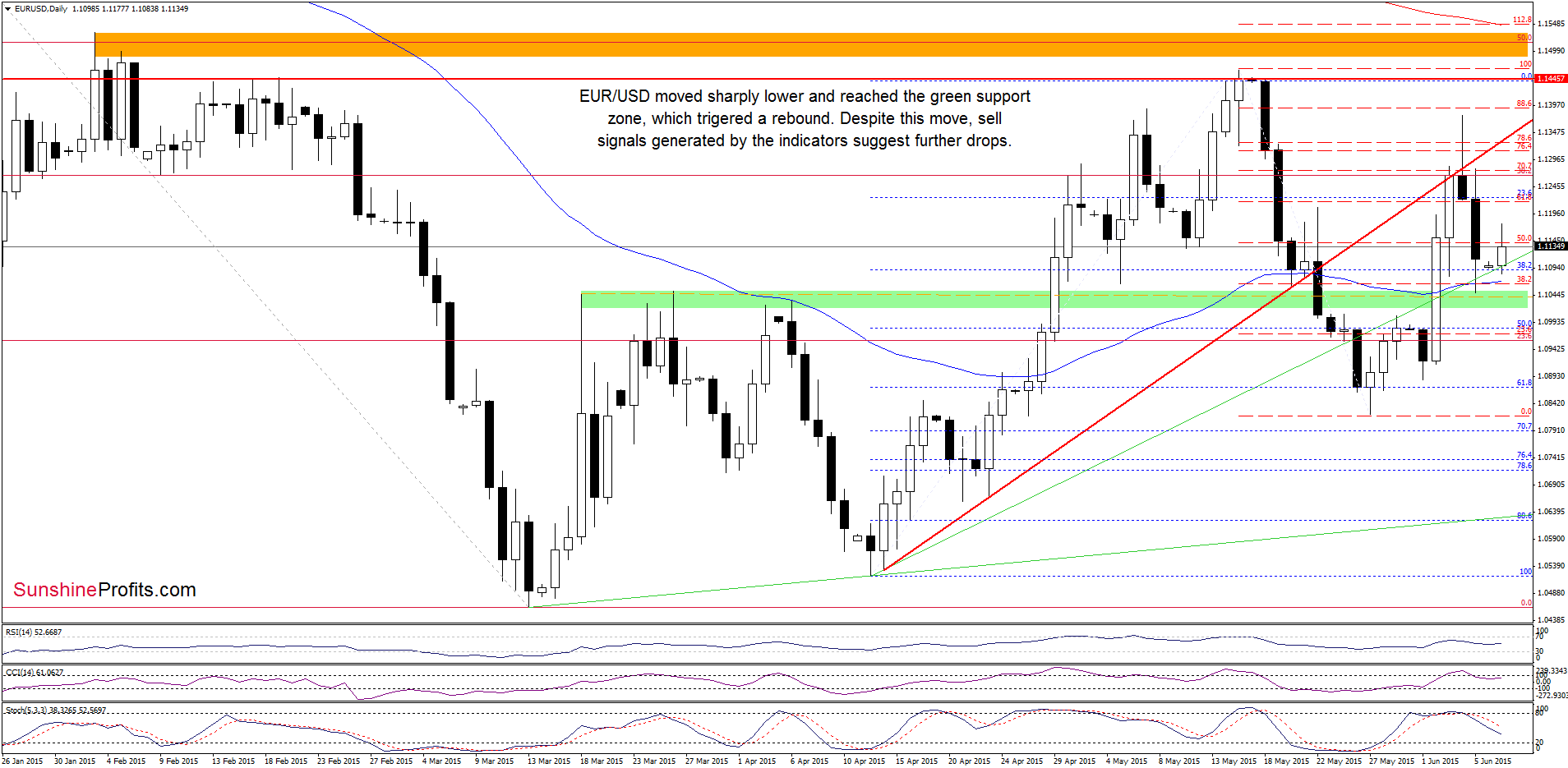

On Friday, we wrote the following:

(…) EUR/USD closed yesterday’s session under previously-broken levels. Taking this fact into account, and combining it with the current position of the indicators (the CCI and Stochastic Oscillator are very close to generating sell signals), we think that further deterioration is just around the corner. If this is the case, and the exchange rate declines from here, we’ll see a drop to (at least) around 1.1078, where the Wednesday’s low, the 50-day moving average and the green support line are.

Looking at the daily chart, we see that the situation developed in line with the above scenario and EUR/USD reached our downside target. As you see on the chart, the green support zone triggered a rebound, but despite this move, sell signals generated by the indicators remain in place, supporting further deterioration. Nevertheless, we think that another sizable move to the downside will be more likely if we see a daily close below the 50-day moving average and the green support area.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (which are profitable) with a stop-loss order at 1.1667 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

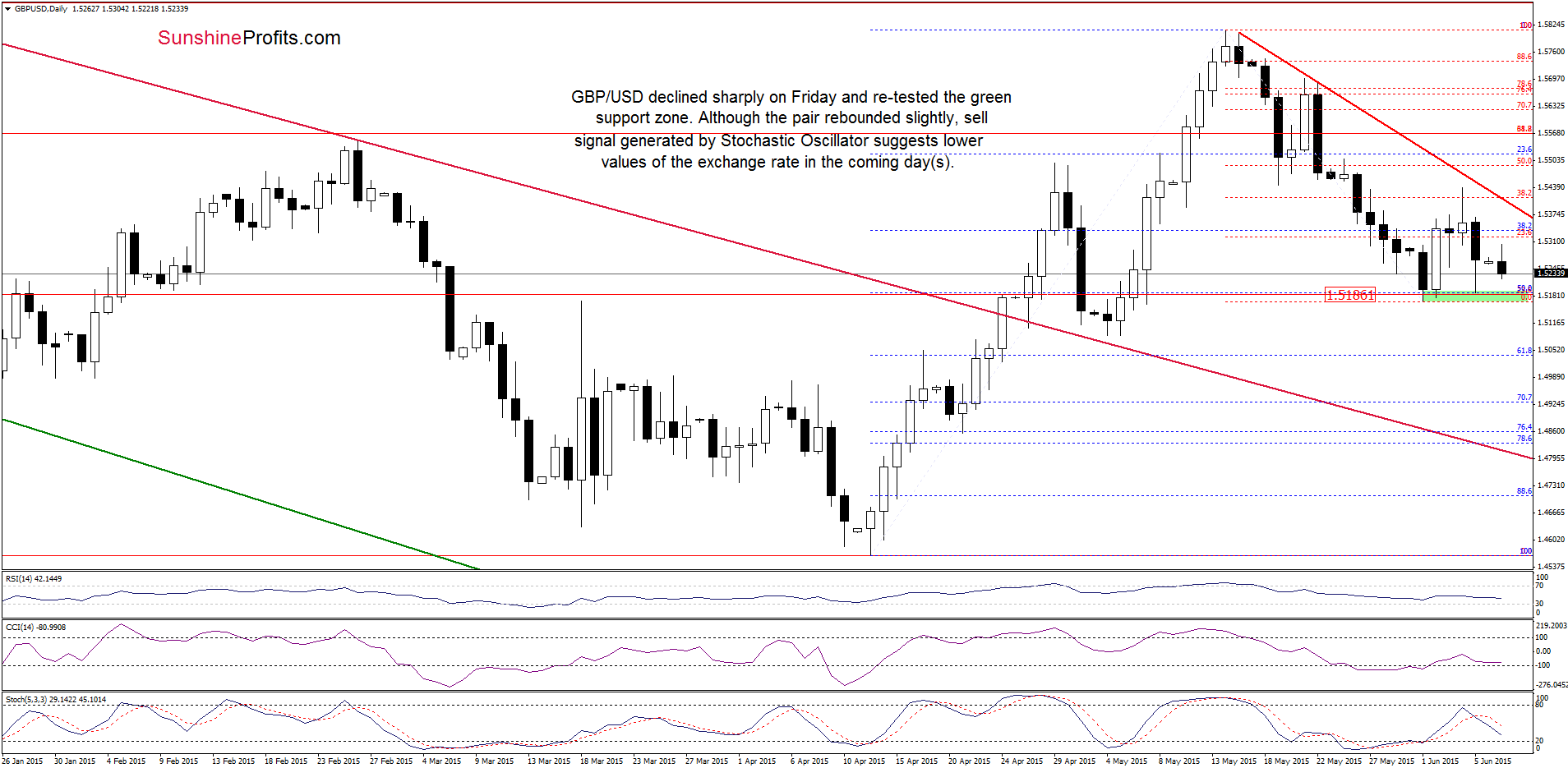

GBP/USD

On the weekly chart we see that GBP/USD verified the breakdown under the long-term green support/resistance line, which is a negative signal that suggests further deterioration (especially when we factor in sell signals generated by the indicators).

How low could the pair go in the coming days? Let’s take a closer look at the daily chart and find out.

Quoting our last commentary on this currency pair:

(…) If (…) the pair declines from here, the initial downside target would be around 1.5190, where the recent low is.

From this perspective, we see that currency bears pushed GBP/USD lower and the pair reached our downside target. Although the exchange rate rebounded slightly on Friday, sell signal generated by the Stochastic Oscillator suggests lower values of GBP/USD in the coming day(s). If this is the case, and the green support zone is broken, we might see a downward move to around 1.5088-1.5122, where the bottom of the previous correction (at the beginning of May) is.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (which are profitable) with a stop-loss order at 1.5913 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

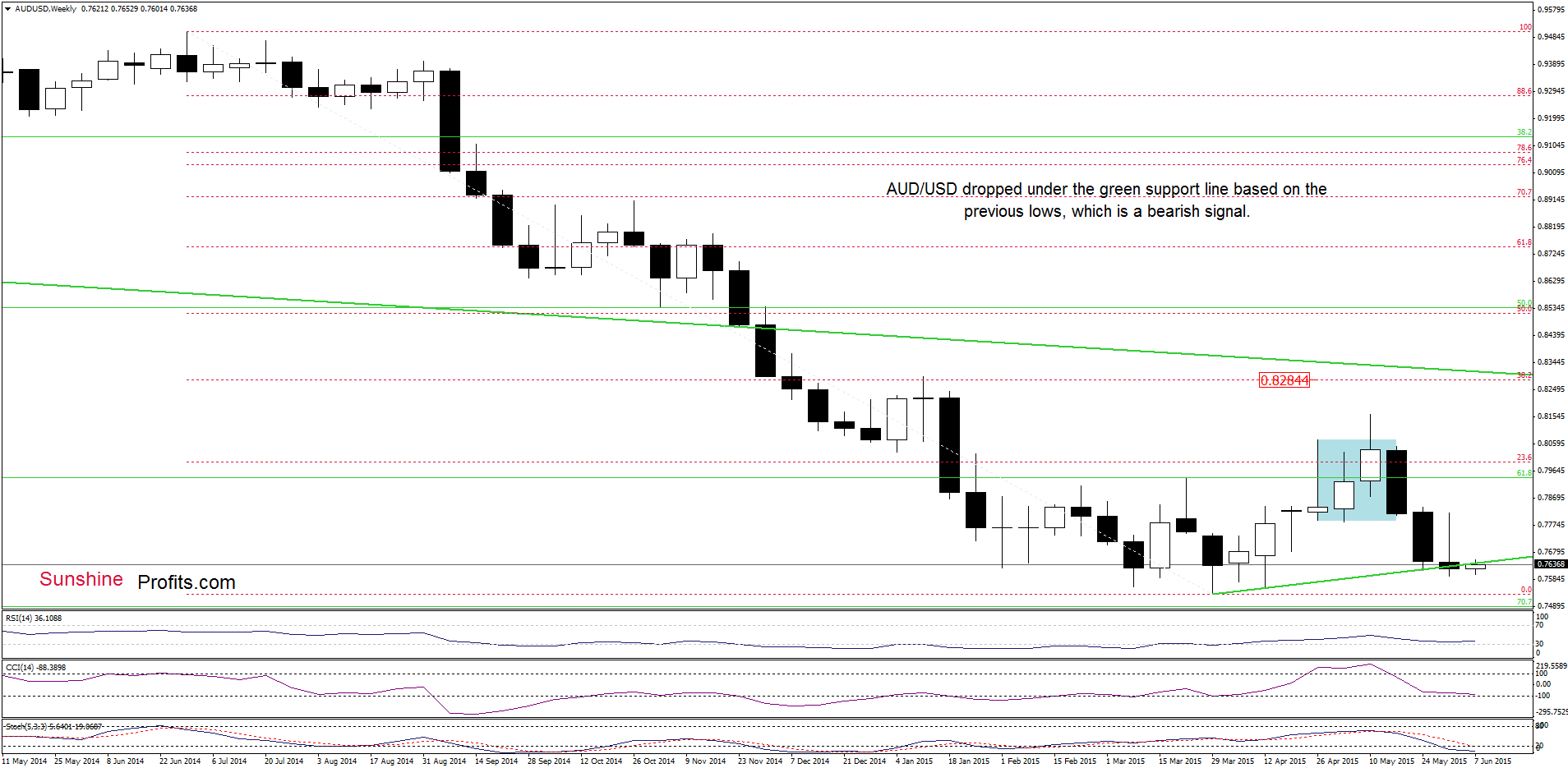

AUD/USD

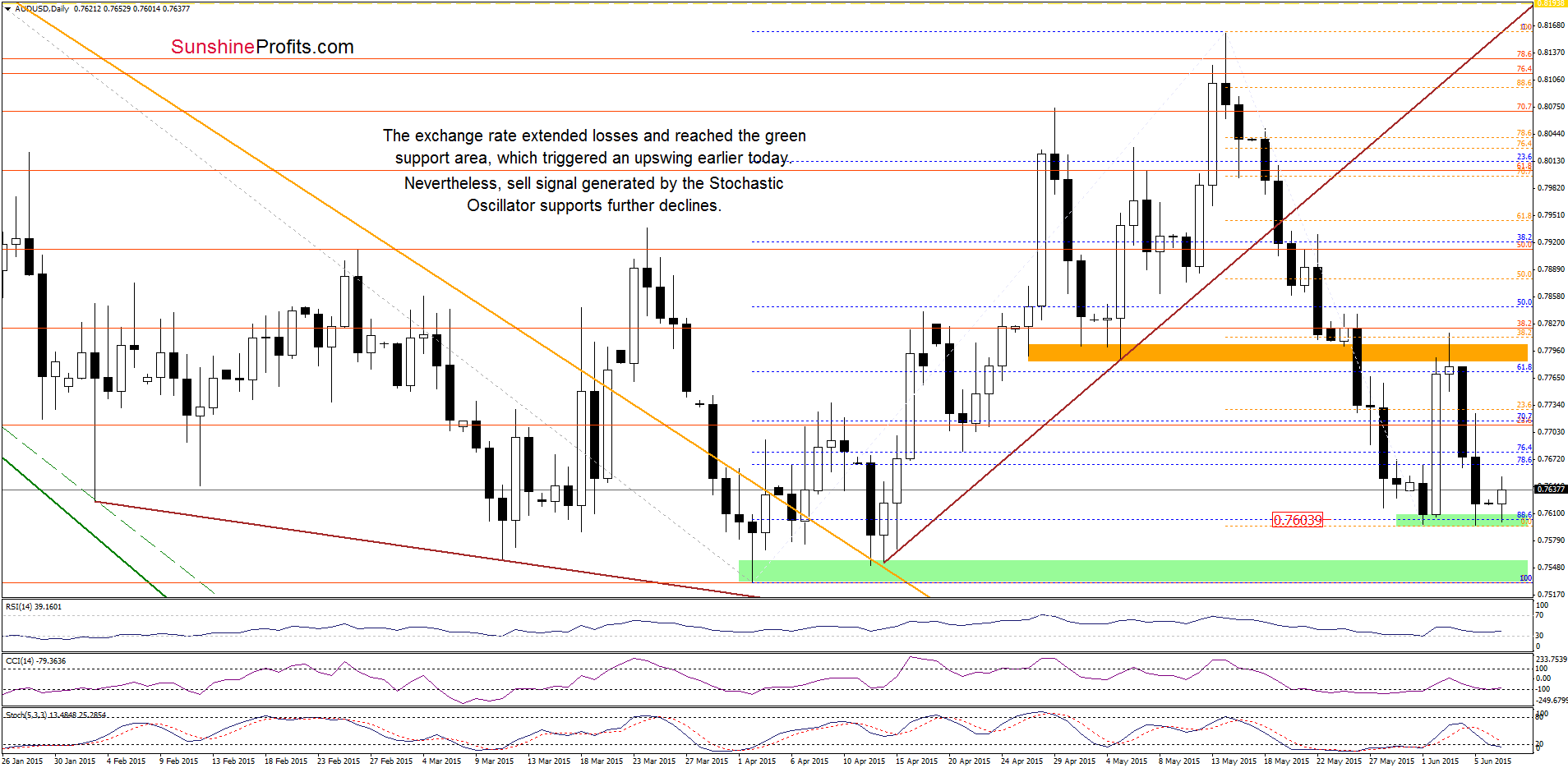

AUD/USD moved lower and broke below the green support line based on the Mar and Apr lows, which is a bearish signal – especially when we take into account sell signals generated by the indicators.

What does it mean for the exchange rate? Let’s examine the daily chart and find out.

Quoting out Forex Trading Alert posted on Friday:

(…) taking into account the current position of the Stochastic Oscillator (very close to generating a sell signal), it seems that another pullback is just around the corner.

From today’s point of view, we see that AUD/USD extended losses and reached the green support zone created by the recent lows. Earlier today, this area triggered an upswing, but sell signal generated by the Stochastic Oscillator suggests further declines. If the exchange rate drops from here and break below June lows, we’ll likely see a test of the next support zone (based on the Apr lows) in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (which are profitable) with a stop-loss order at 0.8194 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts