Yesterday, GBP/USD reversed and increased, which resulted in an invalidation of the breakdown under the medium-term resistance. Will this bullish development trigger further improvement in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1052; the initial downside target at 1.0521)

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 107.62; the initial upside target at 111.16)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

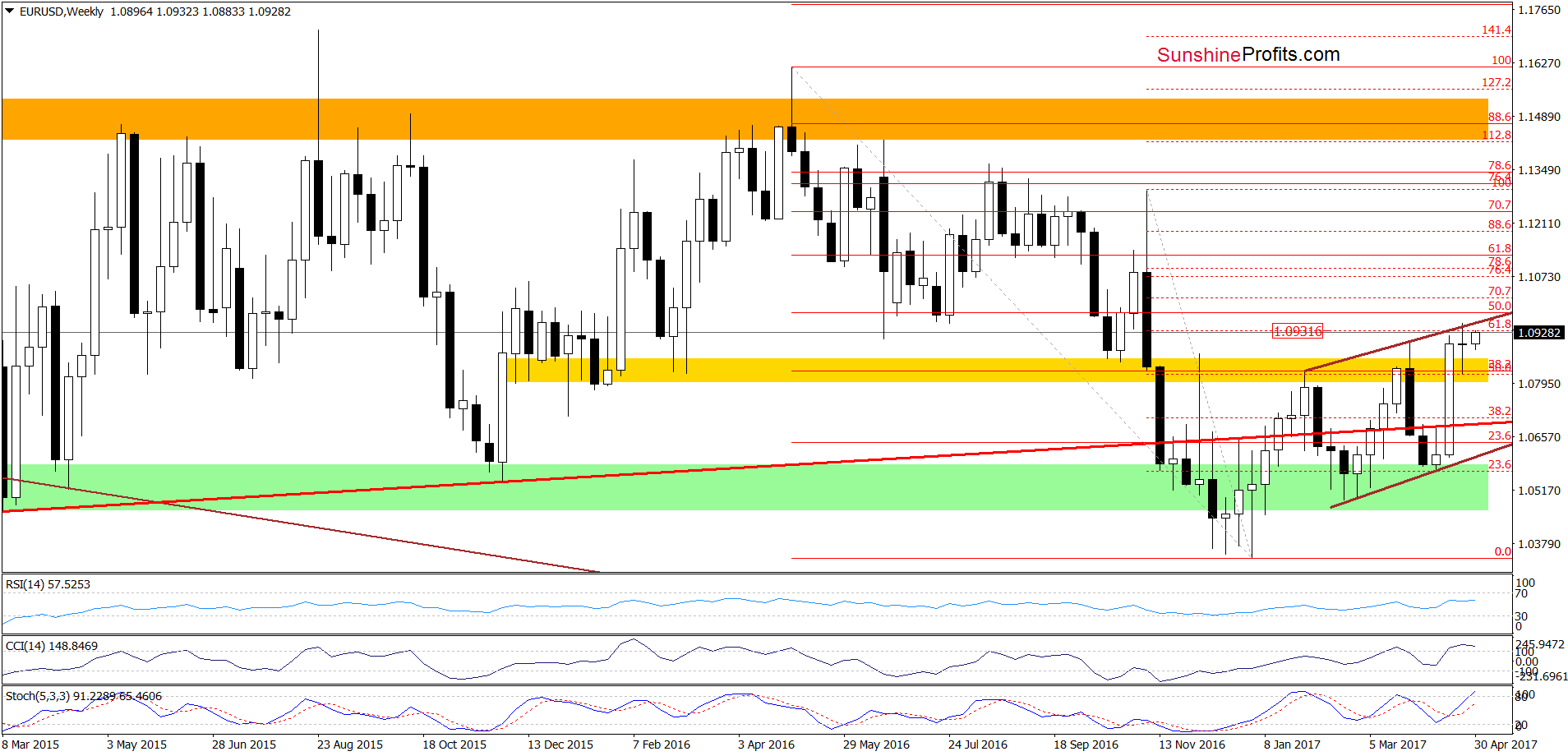

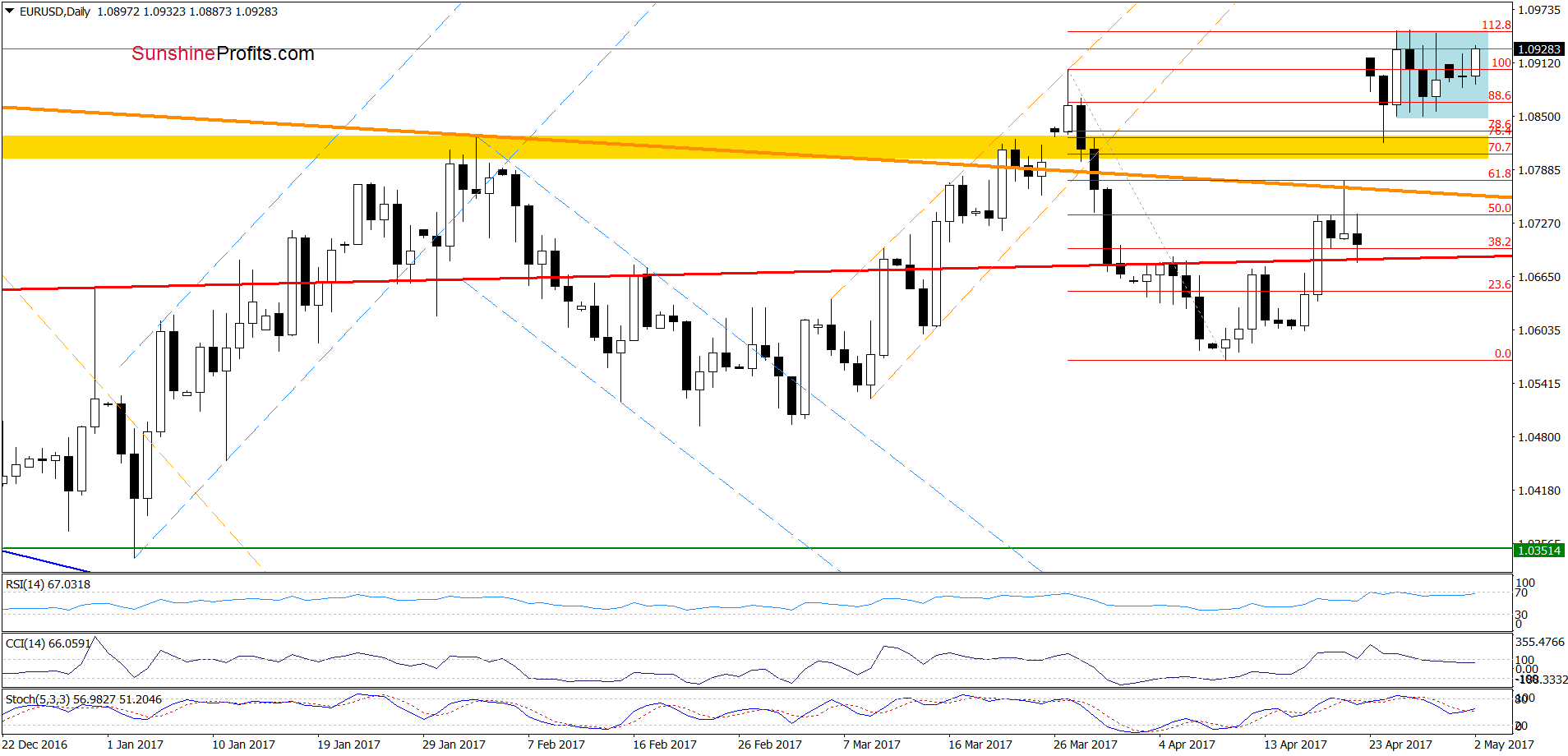

EUR/USD

Looking at the daily chart, we see that EUR/USD is still trading in the blue consolidation. However, currency bulls pushed the exchange rate above the March peak, invalidating the earlier breakdown, which suggests that we’ll likely see a test of the upper border of the formation and an increase to the upper line of the brown rising trend channel and the 61.8% Fibonacci retracement in the coming day(s). Nevertheless, as long as there is no breakout above this resistance area, lower values of the exchange rate are more likely than not.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1052 and the initial downside target at 1.0521) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

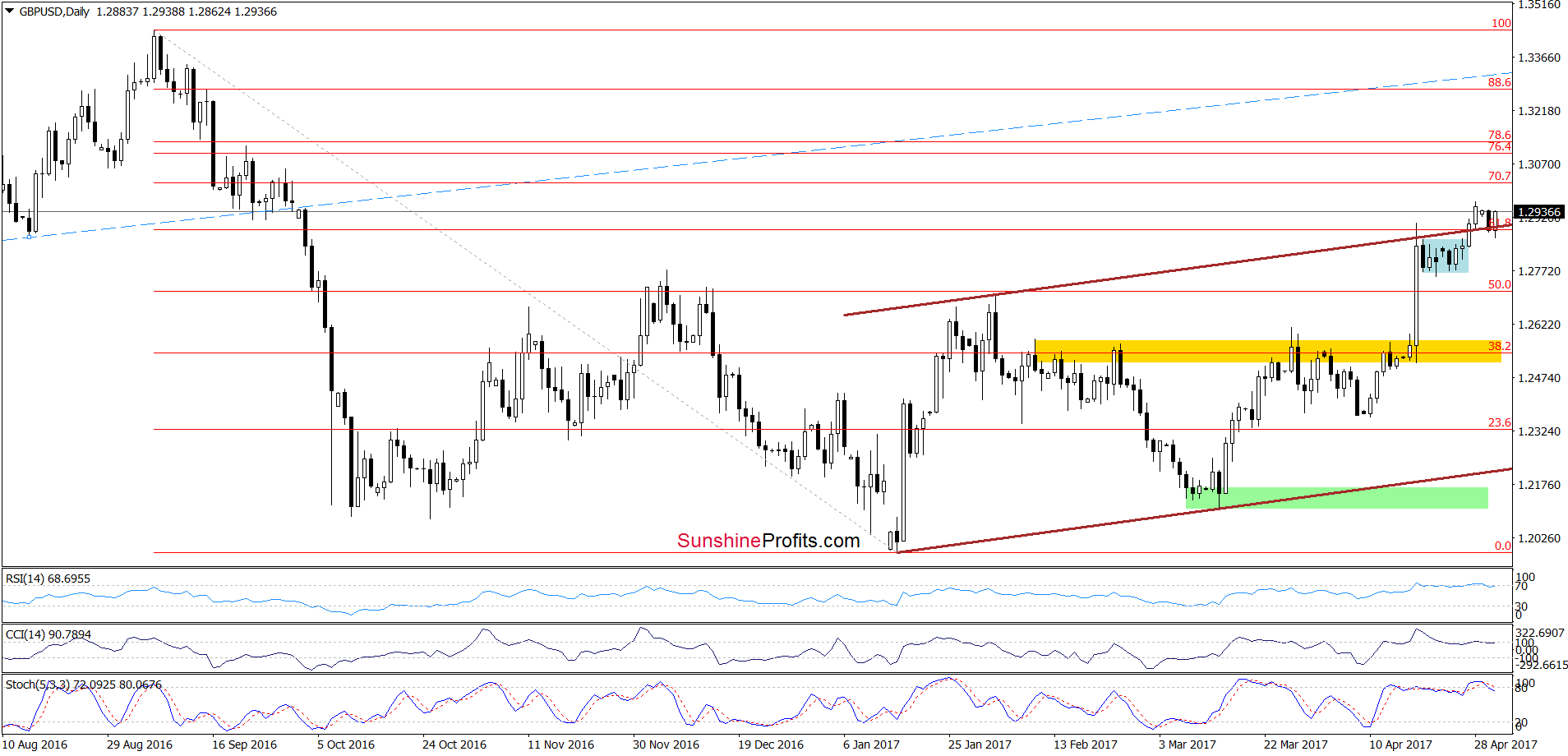

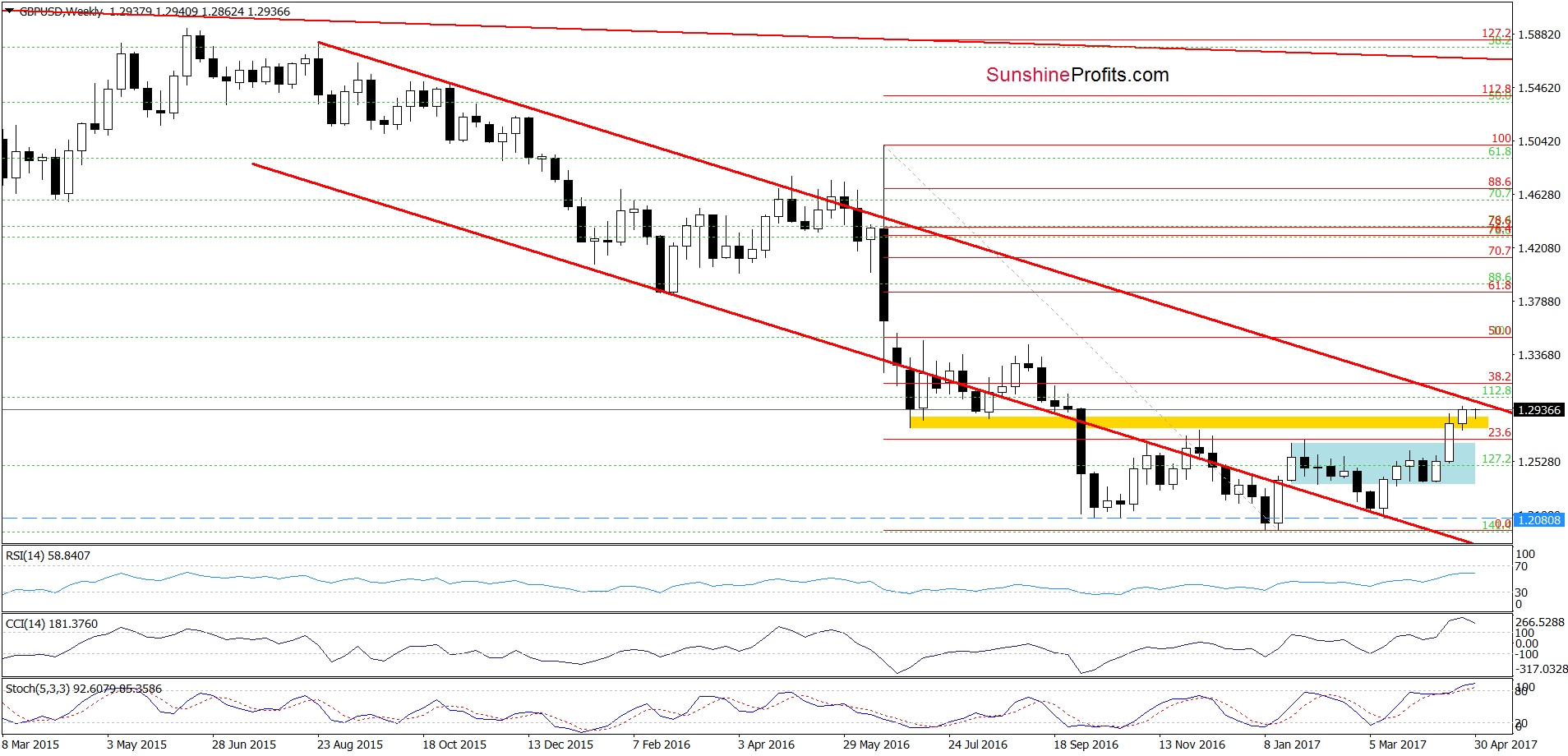

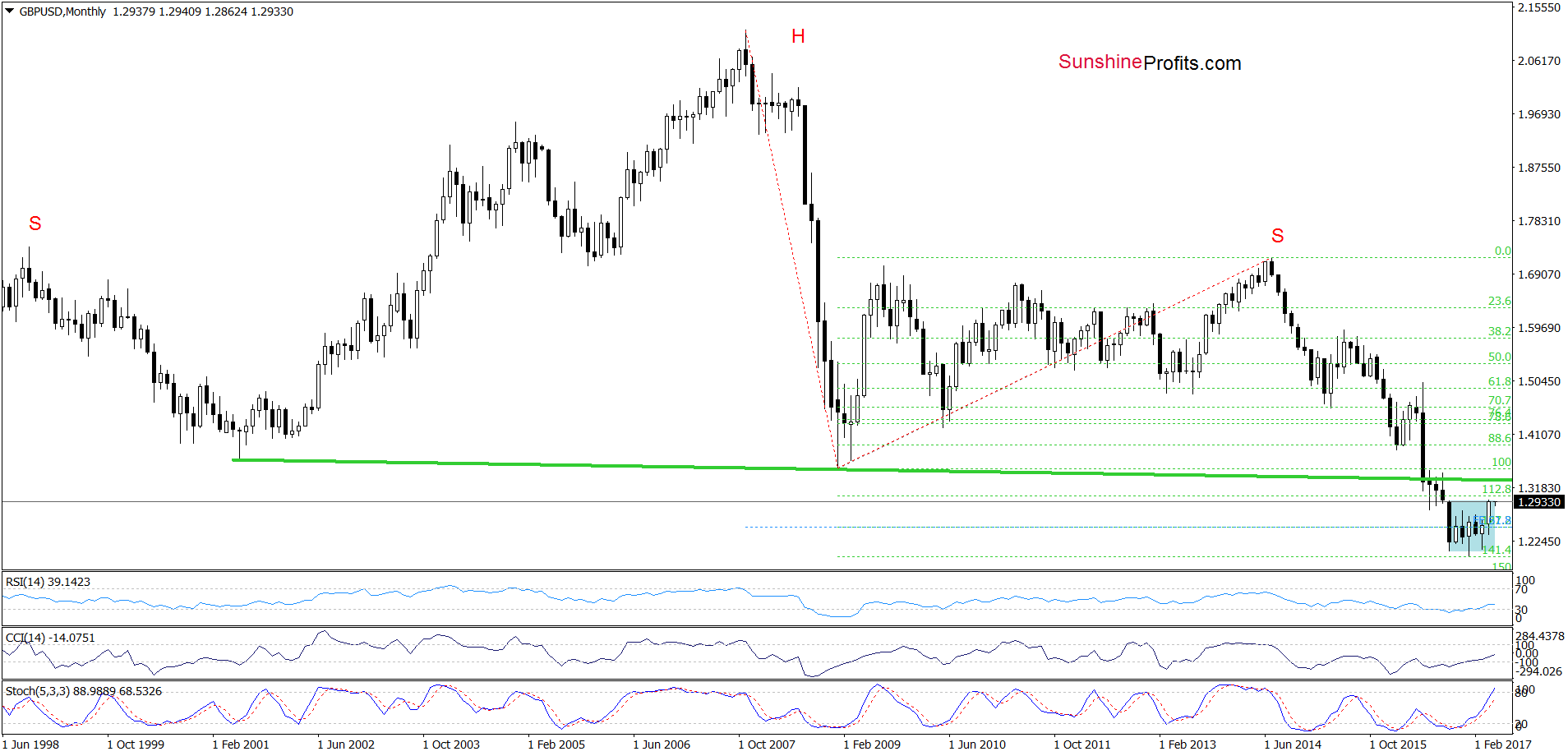

GBP/USD

On the daily chart, we see that although GBP/USD slipped under the upper border of the brown rising trend channel on Monday, currency bulls didn’t give up and pushed the exchange rate higher yesterday, invalidating the earlier breakdown. This is a positive development, which suggests further improvement. Nevertheless, the space for gains seems limited. Why? We believe that the best answe to this question will be the quote from our previous commentary on this currency pair:

(…) Firstly, all indicators are overbought. Secondly, there are negative divergences between indicators and the exchange rate, which suggests that reversal in the very near future should not surprise us. Thirdly, when we take a closer look at the weekly chart, we can see that GBP/USD approached the upper border of the red declining trend channel, which together with the current position of the weekly indicators increase the probability of declines in the coming week.

(...) on the monthly chart below, we can also see that the pair reached the upper border of the blue consolidation, which in combination with earlier factors could encourage currency bears to act in the following weeks.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. However, if we see an invalidation of the breakout above the upper border of the brown rising trend channel, we’ll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

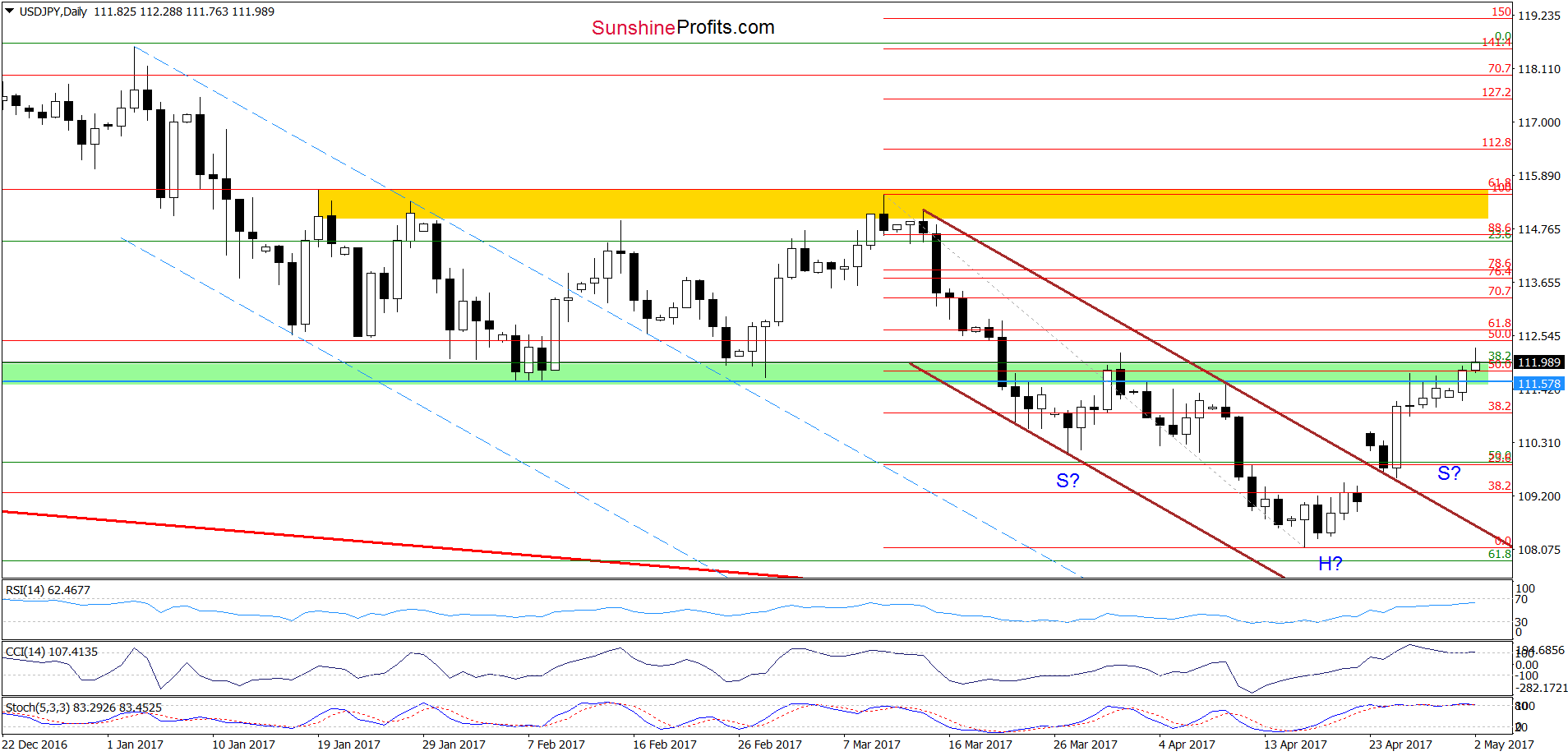

USD/JPY

From today’s point of view, we see that USD/JPY broke above the upper border of the recent consolidation and climbed slightly above the green resistance zone. Although this is a bullish development, the current position of the daily indicators suggests that we may see a pullback in the coming days. Nevertheless, even if we see such price action, in our opinion it will be nothing more than a right shoulder of the reverse head-and-shoulder formation.

Therefore, we believe that what we wrote on Monday is still valid:

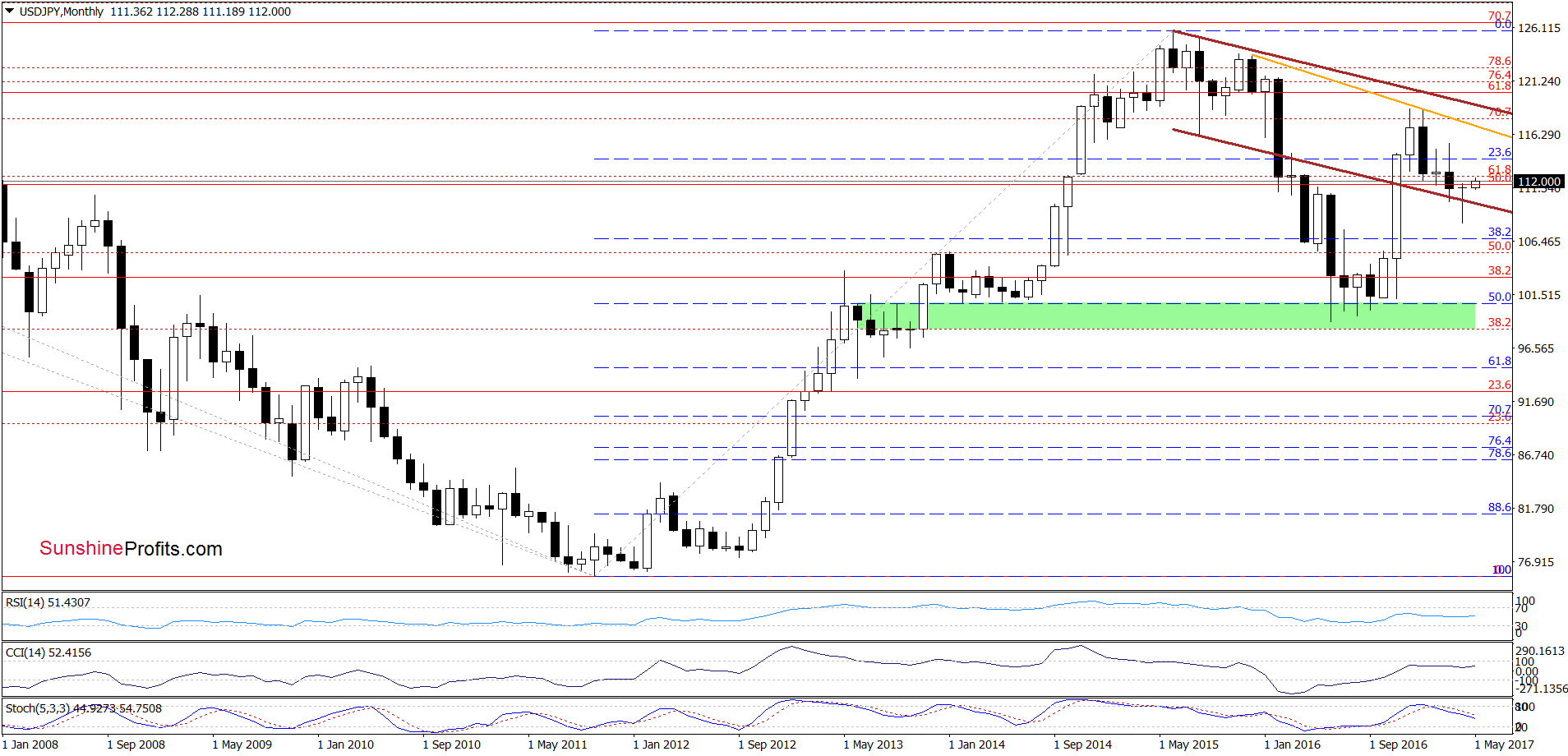

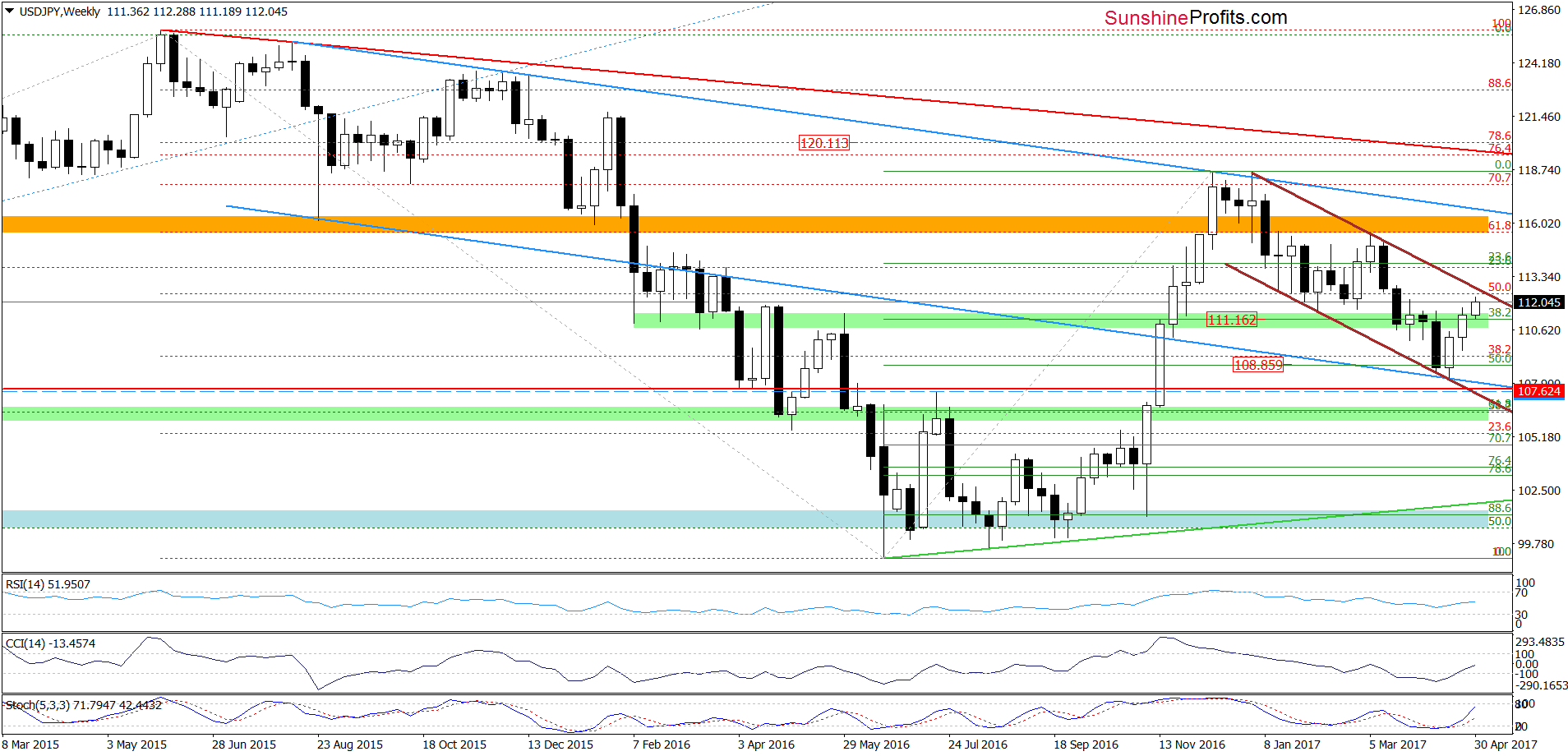

(…) we can see a similar pattern on the long-term chart below.

From the monthly perspective, we see that although USD/JPY slipped under the brown support line (the lower border of the brown declining trend channel), currency bulls invalidated this drop and the exchange rate closed the previous month above this support. This is a positive event, which suggests that even if the pair moves a bit lower in the coming day(s), we will rather see another test of the brown line than the acceleration of declines.

Additionally, when we take a closer look at the medium-term chart, we clearly see that the buy signals generated by the weekly indicators continue to support currency bulls and further improvement in the coming week(s). Therefore, our long positions continue to be justified from the risk/reward perspective.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at 107.62 and the initial upside target at 111.16) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, due to your editor’s travel plans, there will be no Forex Trading Alert on Thursday and Friday. The next Forex Trading Alert is scheduled for Monday, May 8 2017.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts