Earlier today, the pound extended losses and declined to the lowest level since Mar 2009 against the greenback as yesterday’s International Monetary Fund head comments and HSBC warnings (if the UK leaves the European Union in June, the pound could drop another 20%) continued to weigh on the currency pair. What’s next?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1512; initial downside target at 1.0572)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: long (stop-loss order at 0.9633; initial downside target at 1.0239)

- AUD/USD: none

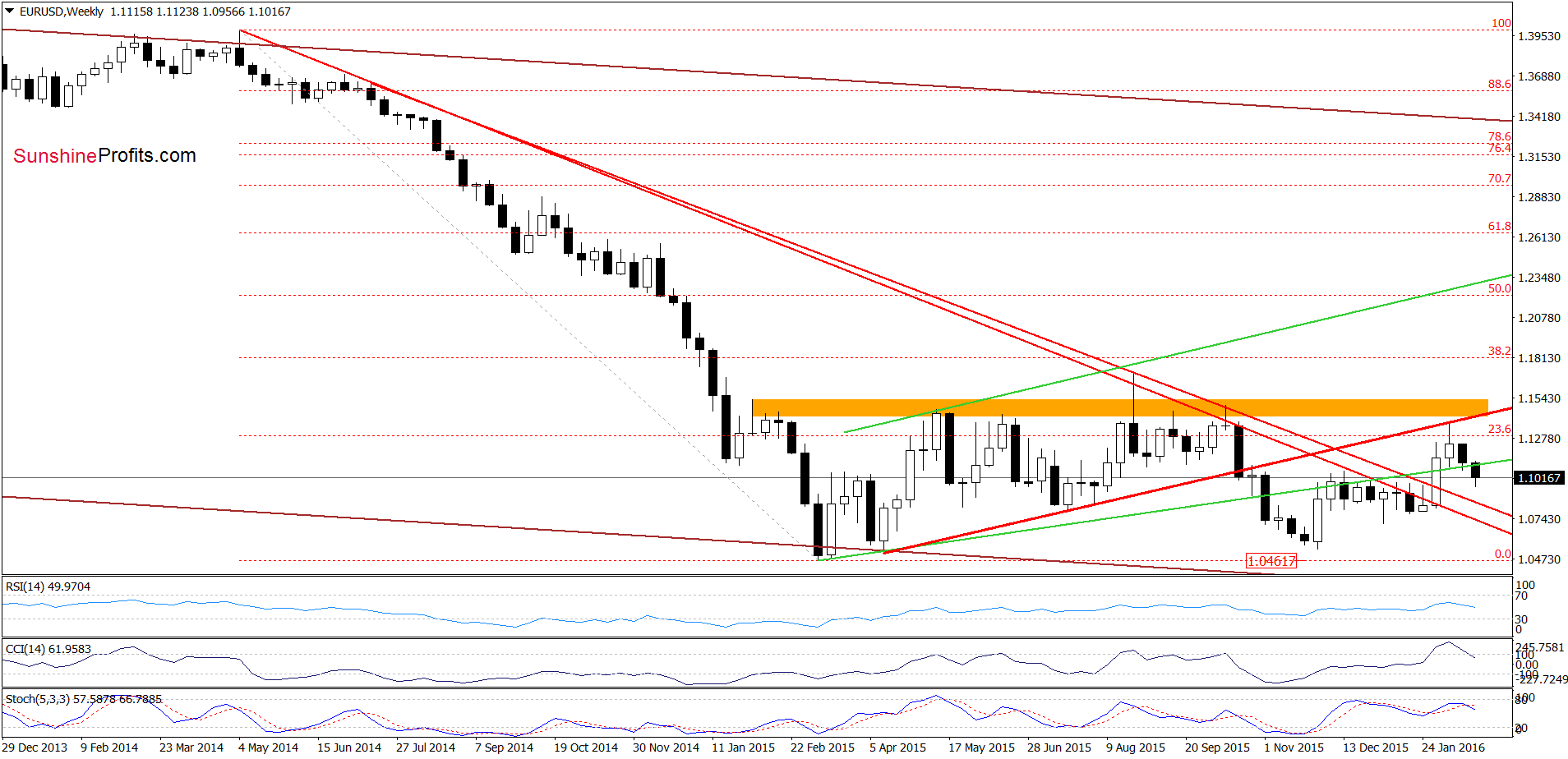

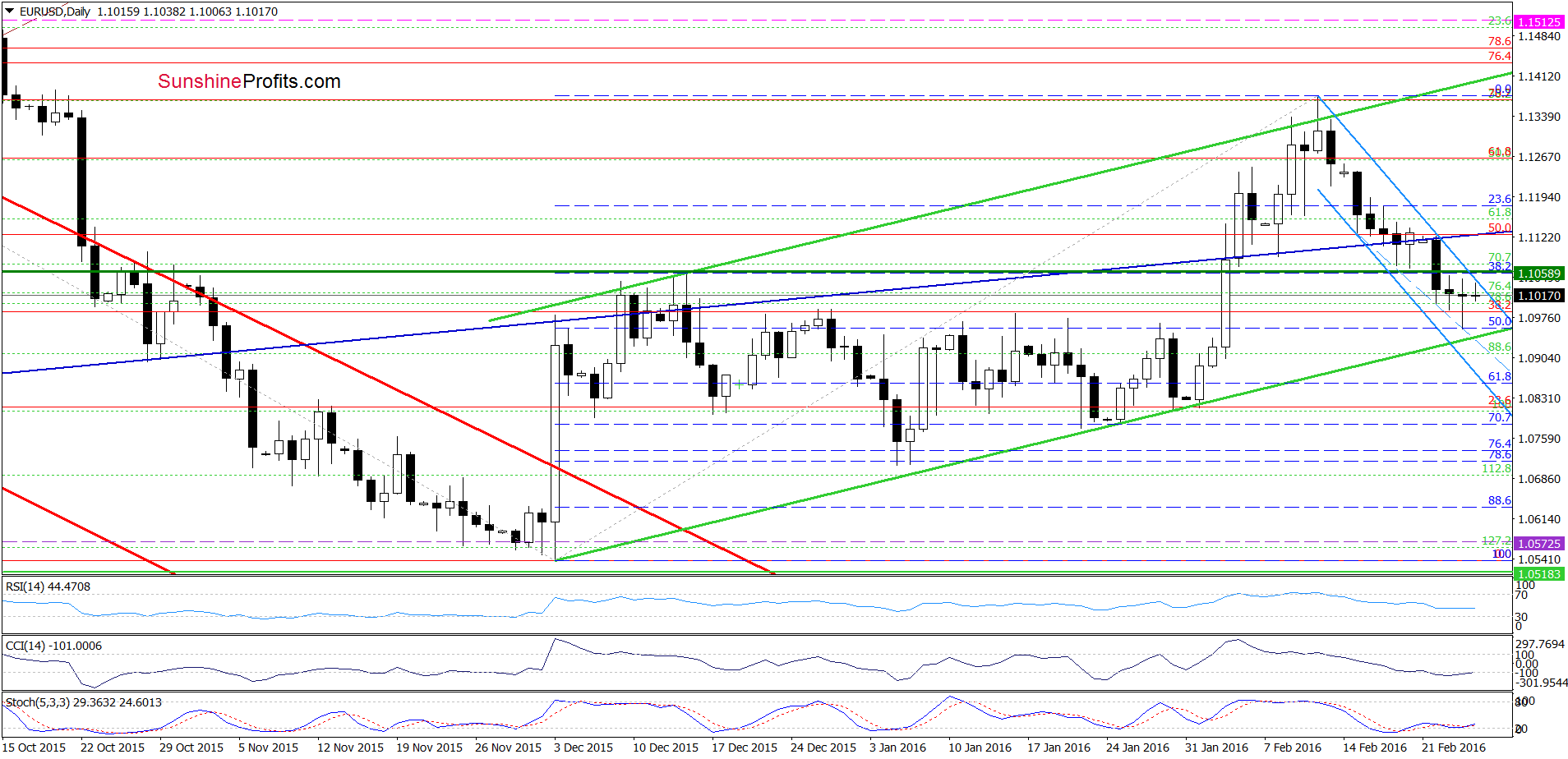

EUR/USD

Yesterday, EUR/USD extended losses and reached the 50% Fibonacci retracement based on the Dec-Feb upward move. Earlier today, this support triggered a small rebound, but we think that the combination of the green horizontal resistance line (based on the mid-Dec high) and the upper border of the blue declining trend channel will stop further improvement and trigger further deterioration later in the day. Therefore, if the pair extends losses from here, our next downside target from Forex Trading Alert posted last Tuesday will be in play:

(...) an acceleration of declines will be more likely and reliable after a breakdown under the navy blue support line. In this case, the pair will test the lower border of the green rising trend channel in the following days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1512 and the initial downside target at 1.0572) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

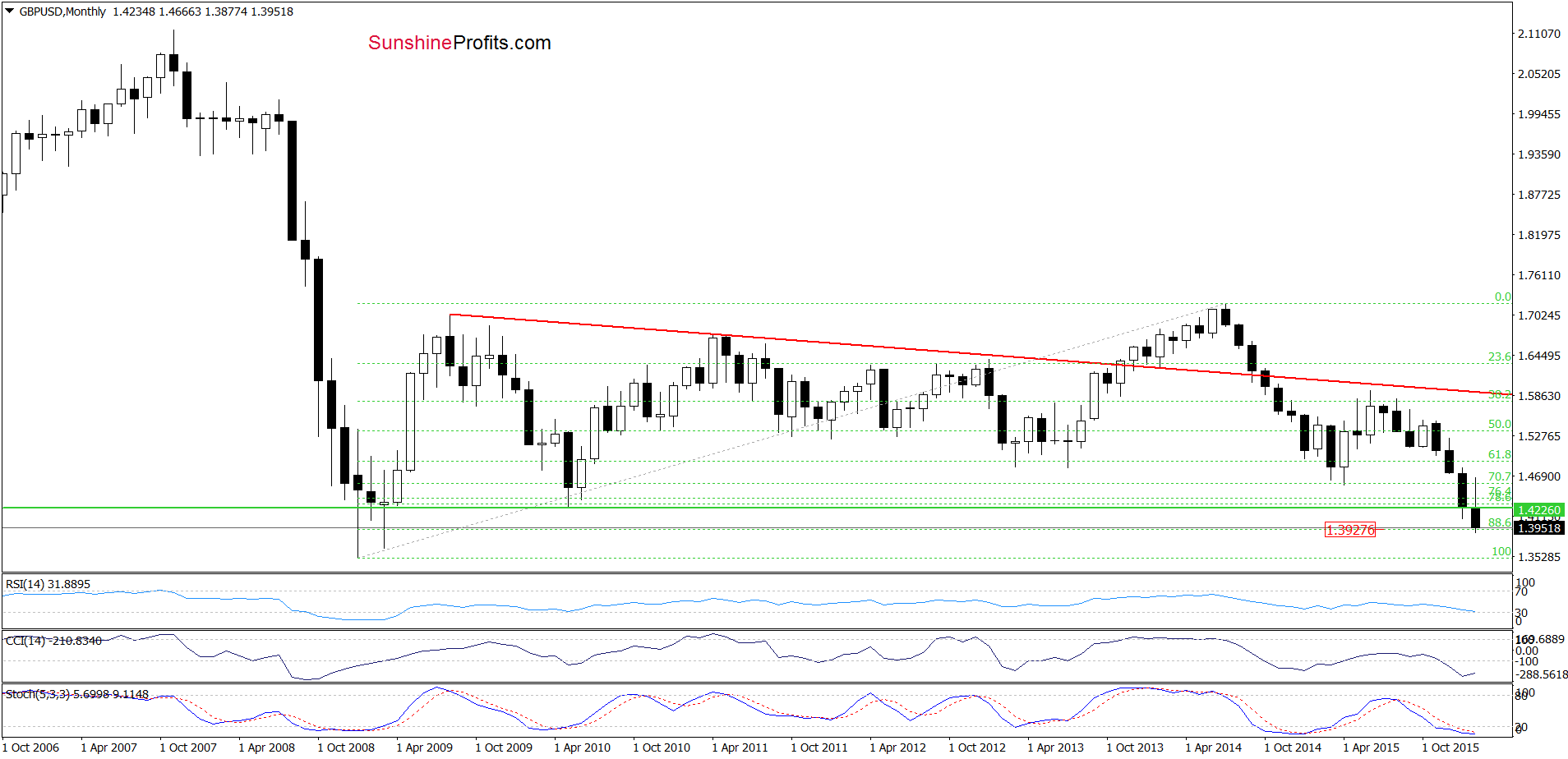

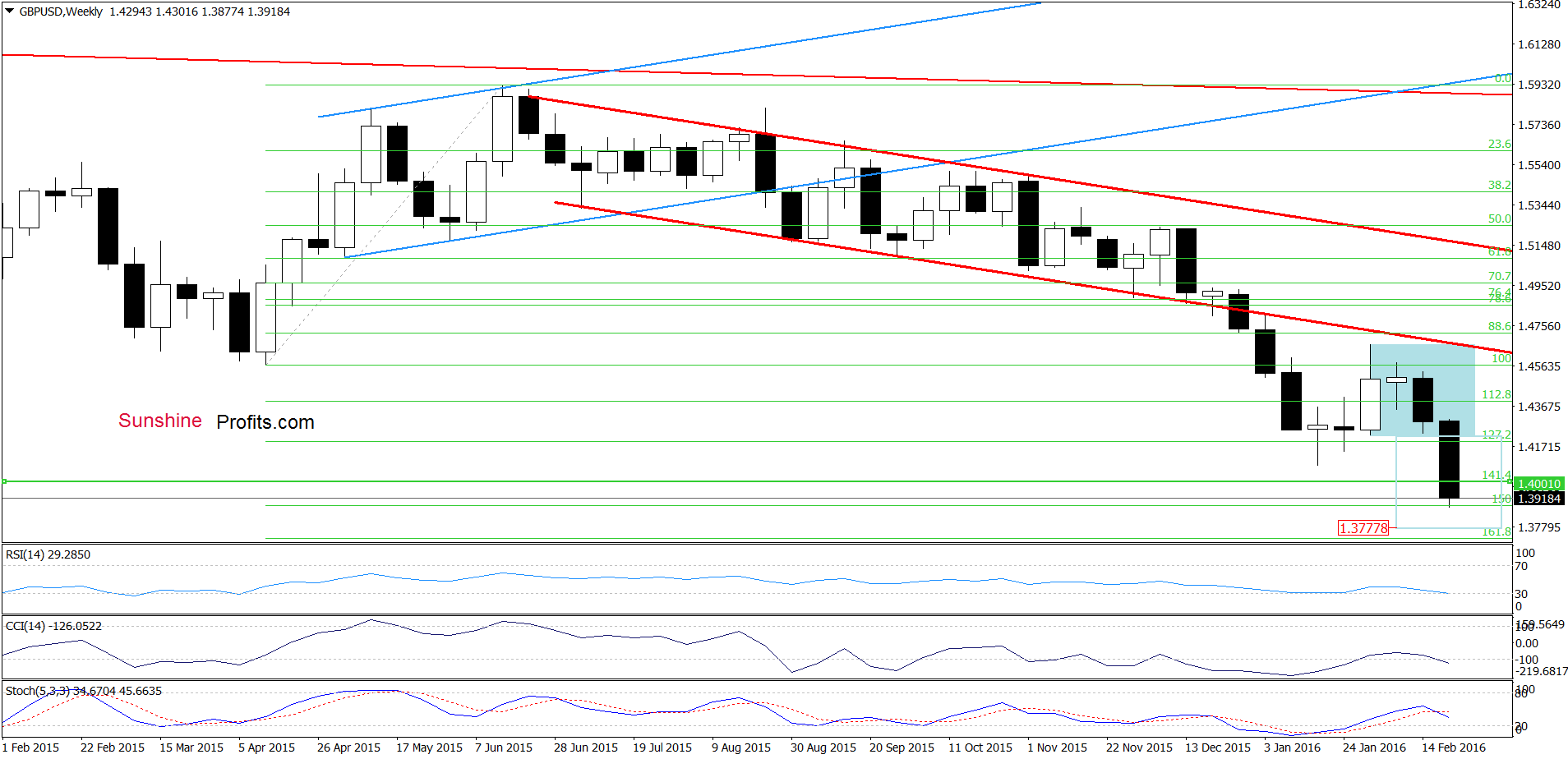

GBP/USD

Looking at the long-term chart, we see that GBP/USD extended losses and dropped under the Jan low. With this downward move, the pair reached the 88.6% Fibonacci retracement, which could trigger a rebound from here. But will we see such price action? Let’s examine the weekly chart and look for more clues about future moves.

Quoting our last commentary on this currency pair:

(…) the currency pair dropped under the lower border of the blue consolidation, which suggests further deterioration. If this is the case and GBP/USD moves lower from here, the initial downside target would be the psychologically important barrier of 1.4000.

On the weekly chart, we see that the situation developed in line with the above scenario and GBP/USD moved sharply lower, breaking under our first downside target. Taking this fact into account, we think that even if the pair moves little higher from here, our next downside target would be in play in the coming days:

(…) taking into account the breakdown from the consolidation, we may see a decline even to around 1.3777, where the size of the downward move will correspond to the height of the formation. (…) it is worth noting that the Stochastic Oscillator generated a sell signal, supporting currency bears.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

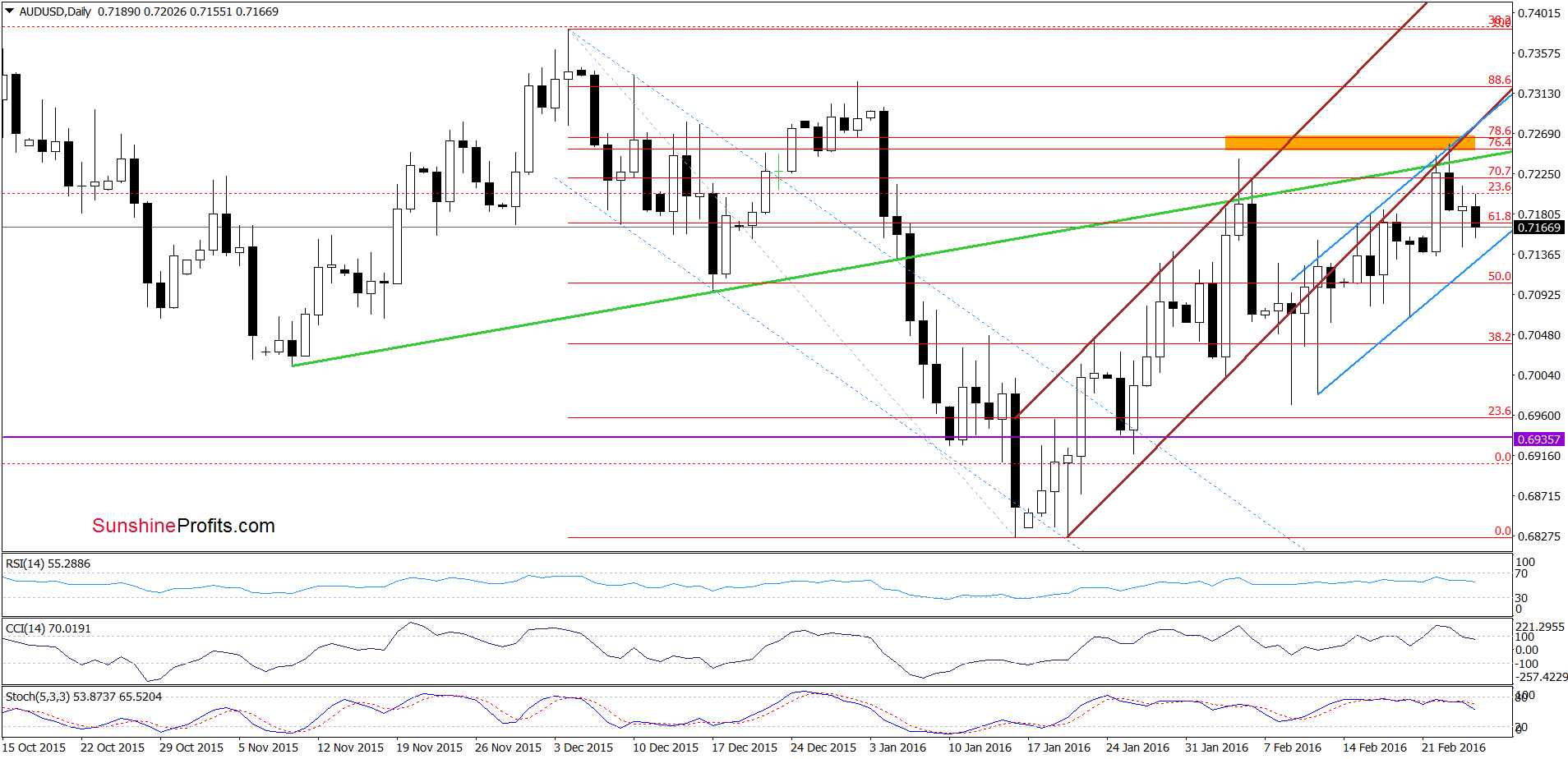

The overall situation in the medium term hasn’t changed much as AUD/USD is trading in the purple rising trend channel. Today, we’ll focus on the very short-term changes.

On Tuesday, we wrote the following:

(…) the pair extended gains and climbed to the orange resistance zone created by the 76.4% and 78.6% Fibonacci retracement levels and the lower border of the previously-broken brown rising trend channel. Taking this resistance area into account, we think that reversal and decline from here is just around the corner – especially when we factor in the current position of the indicators. Nevertheless, such price action will be more likely if the exchange rate invalidates today’s breakout above the green and brown lines.

On the daily chart, we see that currency bears pushed the pair lower as we had expected. With the recent downward move, AUD/USD invalidated earlier breakout above the green and brown lines, which in combination with sell signals generated by the indicators suggests further deterioration. Therefore, if the exchange rate moves lower from here, the initial downside target would be the blue support line based on the previous lows, which is also the lower border of the blue rising trend channel. If it is broken, the next target would be around 0.7090, where the 38.2% Fibonacci retracement (based on the entire Jan-Feb upward move) is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts