Although the U.S. Department of Labor reported that the number of initial jobless claims in the week ending February 20 increased by 10,000 (missing analysts expectations), the U.S. Commerce Department showed that total durable goods orders increased by 4.9% last month and core durable goods orders (without volatile transportation items) rose by 1.8%, beating forecasts. Thanks to these mixed data, the greenback wavered around 97.50 yesterday. Will today’s GDP numbers support the U.S. currency? Before we know the answer to this question, let’s check the current picture of the euro, Canadian dollar and Swiss franc.

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1512; initial downside target at 1.0572)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: long (stop-loss order at 0.9633; initial downside target at 1.0239)

- AUD/USD: none

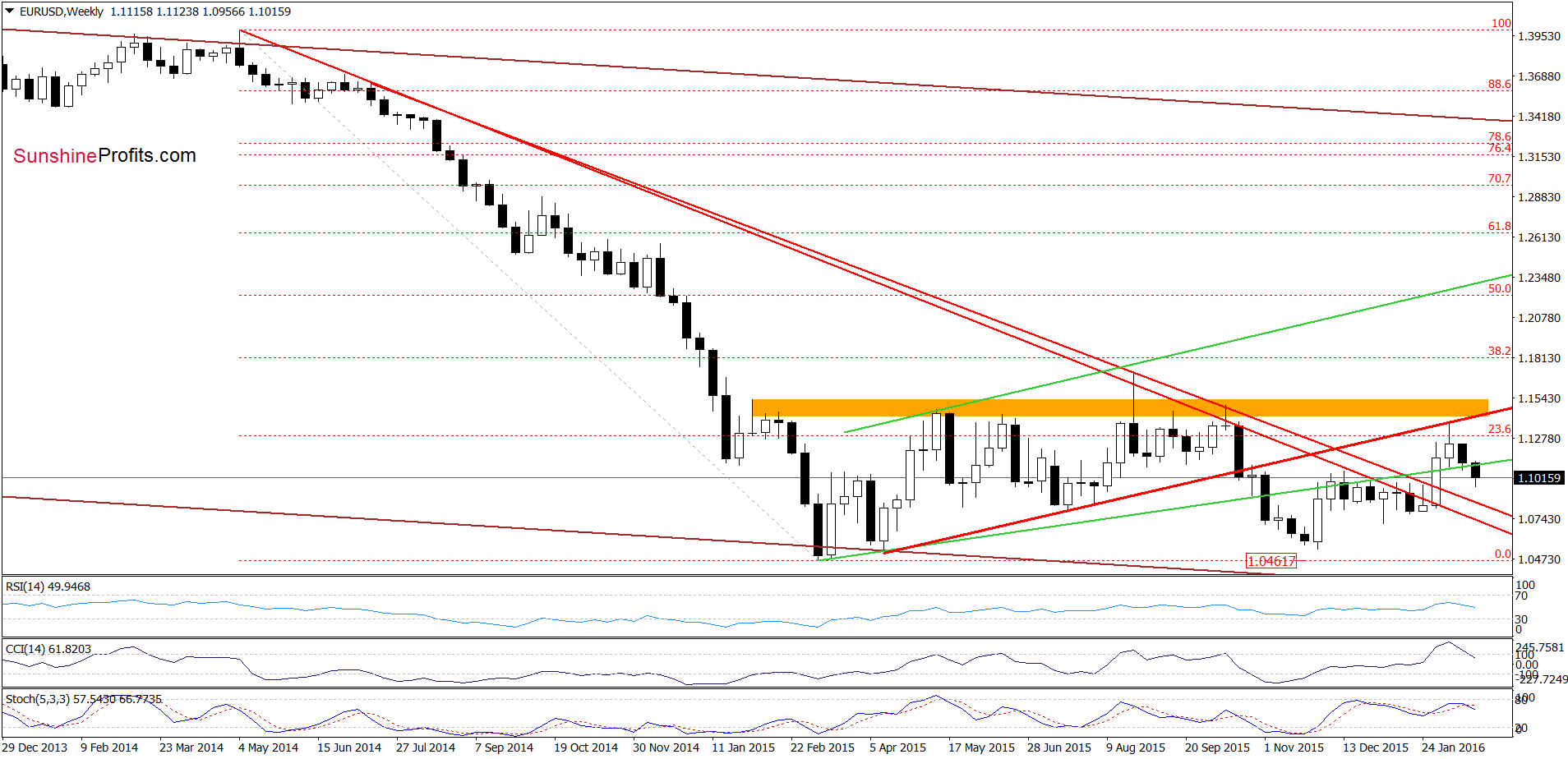

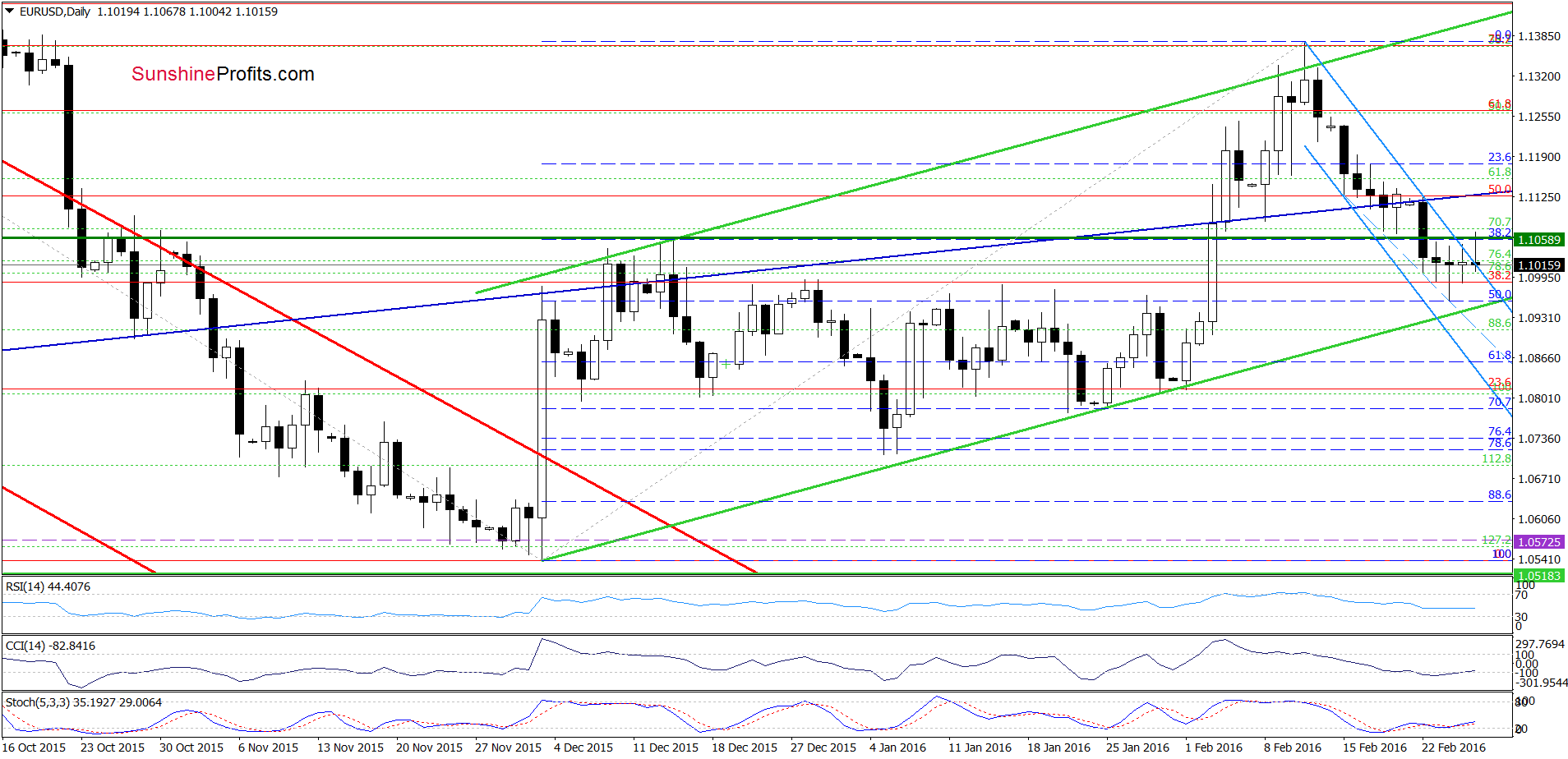

EUR/USD

Looking at the charts, we see that although EUR/USD moved higher earlier today, the pair reversed and declined, which resulted in a comeback to the blue declining trend channel. Such price action suggests that what we wrote yesterday remains up-to-date:

(…) we think that the combination of the green horizontal resistance line (based on the mid-Dec high) and the upper border of the blue declining trend channel will stop further improvement and trigger further deterioration (…) Therefore, if the pair extends losses from here, (…) the pair will test the lower border of the green rising trend channel in the following days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1512 and the initial downside target at 1.0572) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

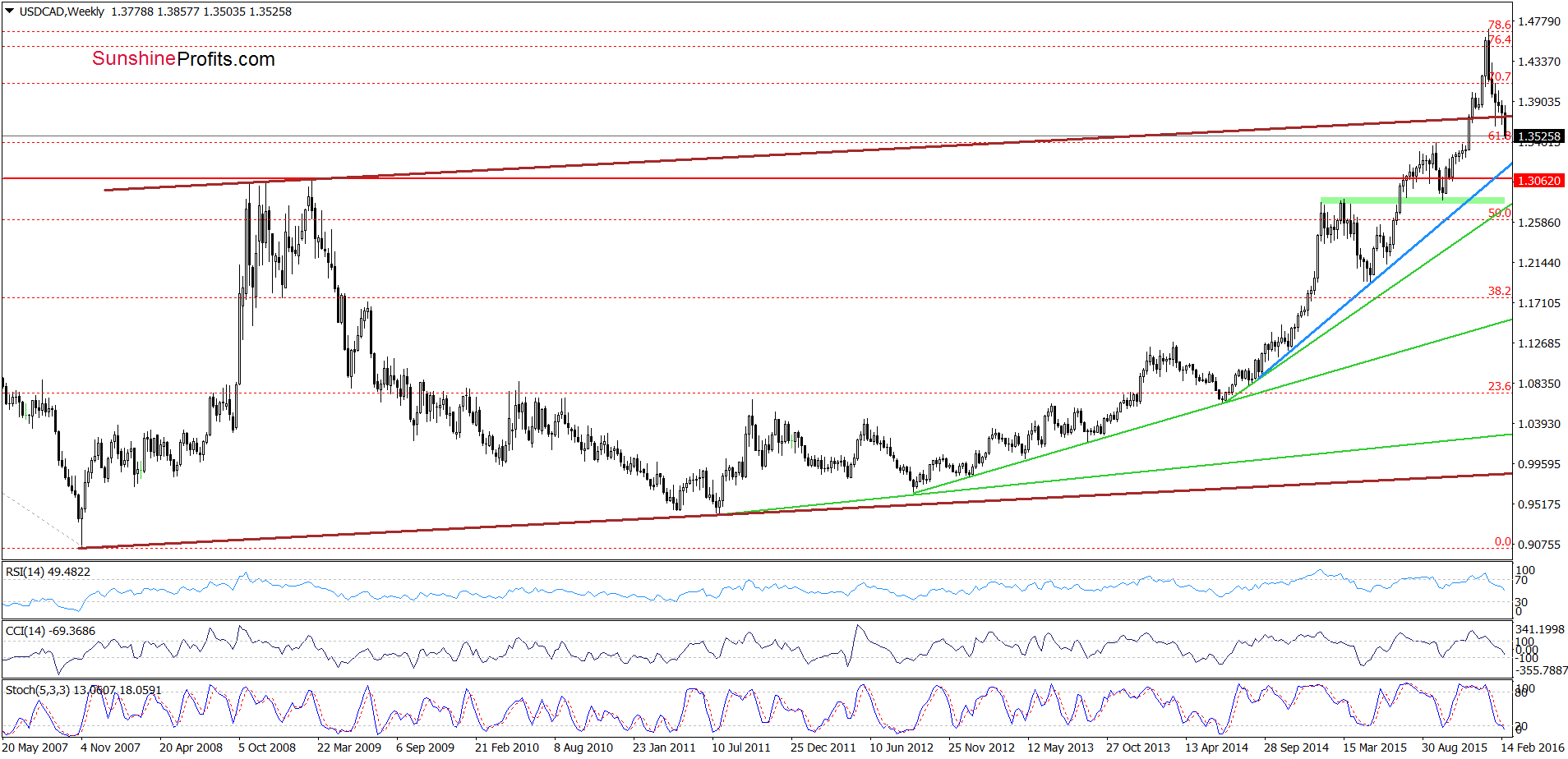

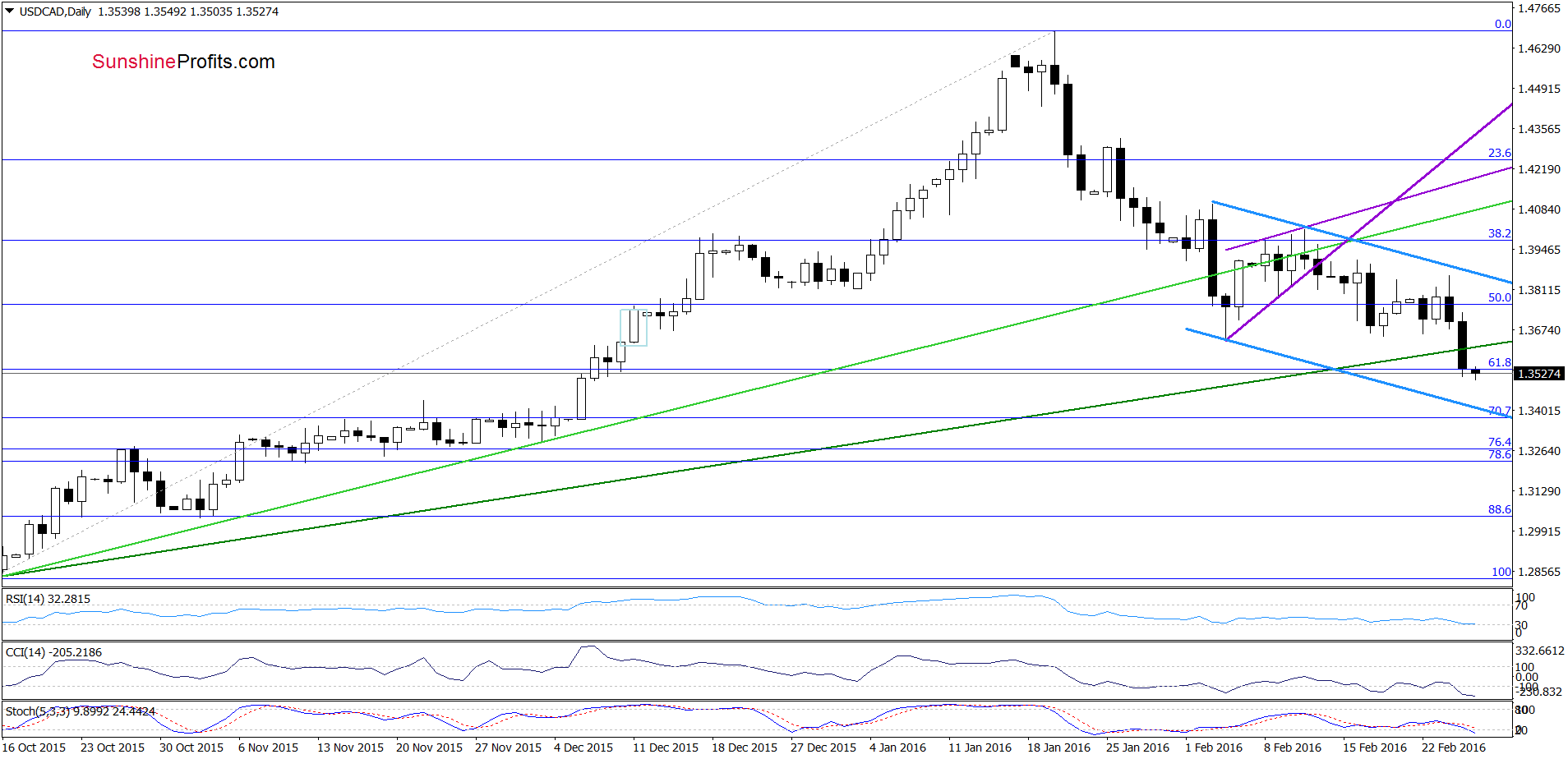

USD/CAD

The first thing that catches the eye on the weekly cart is a breakdown under the upper border of the long-term rising trend channel. In this way, the pair invalidated earlier breakout above this line, which is a negative signal. What impact did move have on the very short-term picture? Let’s check.

From this perspective, we see that USD/CAD extended losses and declined below the previously-broken 50% Fibonacci retracement and recent lows, which resulted in a breakdown under the lower green support line. This is a negative signal, which suggests that the exchange rate will test the lower border of the blue declining trend channel in the coming days (please note that this area is reinforced by the 70.7% Fibonacci retracement).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

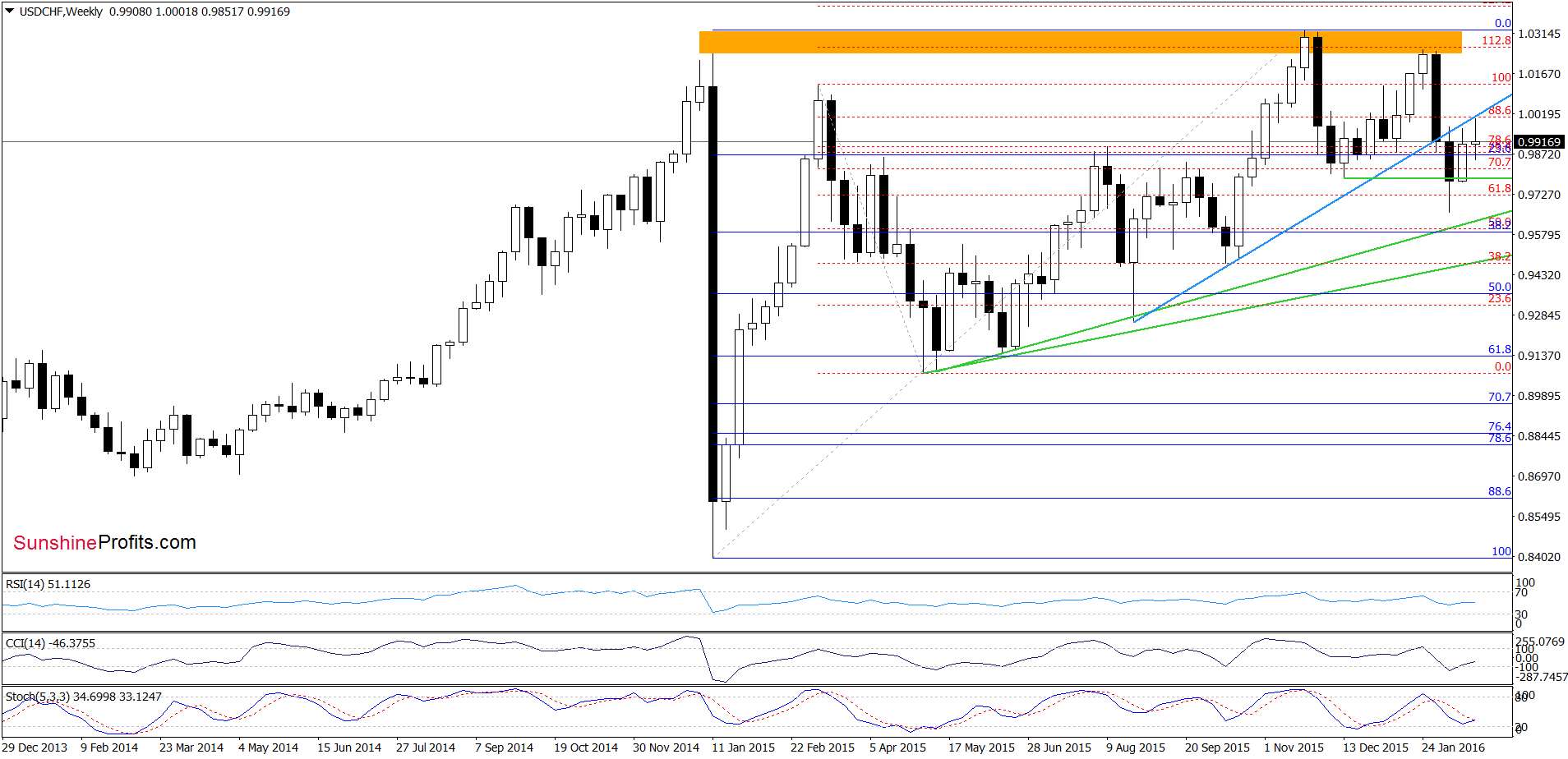

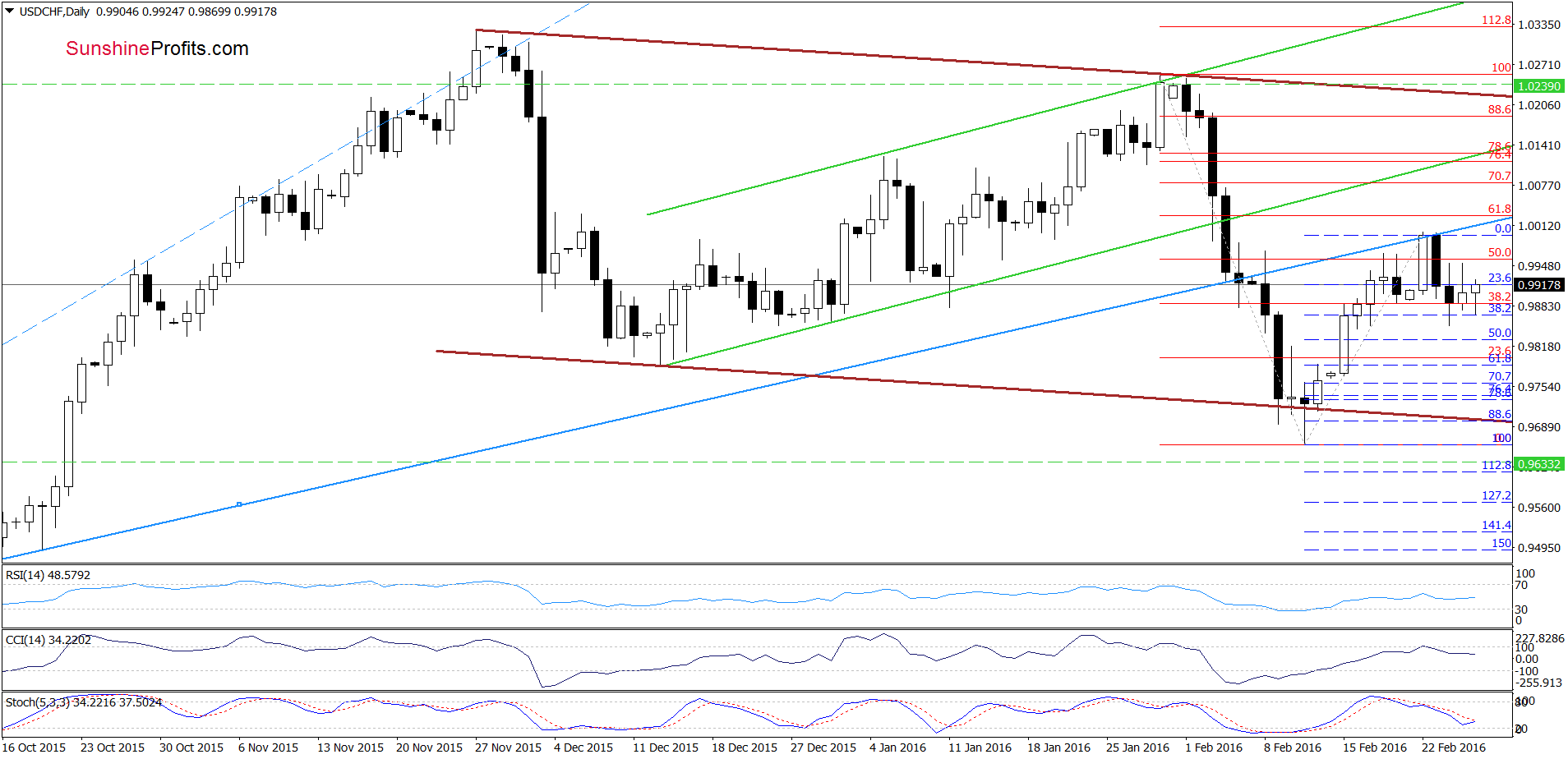

USD/CHF

On the above charts, we see that USD/CHF moved lower in previous days, which resulted in a drop to the 38.2% Fibonacci retracement based on the Feb upward move. As you see, this support level encouraged currency bulls to act, which resulted in a rebound. Taking this fact into account, and combining it with the current position of the weekly indicators (the CCI and Stochastic Oscillator generated buy signals, while the daily Stochastic Oscillator is very close to doing the same), we think that another attempt to move higher is just around the corner. If we see such price action and the pair moves higher from here, the initial upside target would be he previously-broken blue resistance line (currently around 1.0000).

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed with bullish bias

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at 0.9633 and the initial upside target at 1.0239) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts