Yesterday, the U.S. Census Bureau reported that factory orders increased by 1.8% in June, which supported the greenback and pushed the USD Index above 98. Earlier today, the U.S. currency extended gains, approaching the Jul high. What impact did this rally have on the euro, yen and Australian dollar?

In our opinion the following forex trading positions are justified - summary:

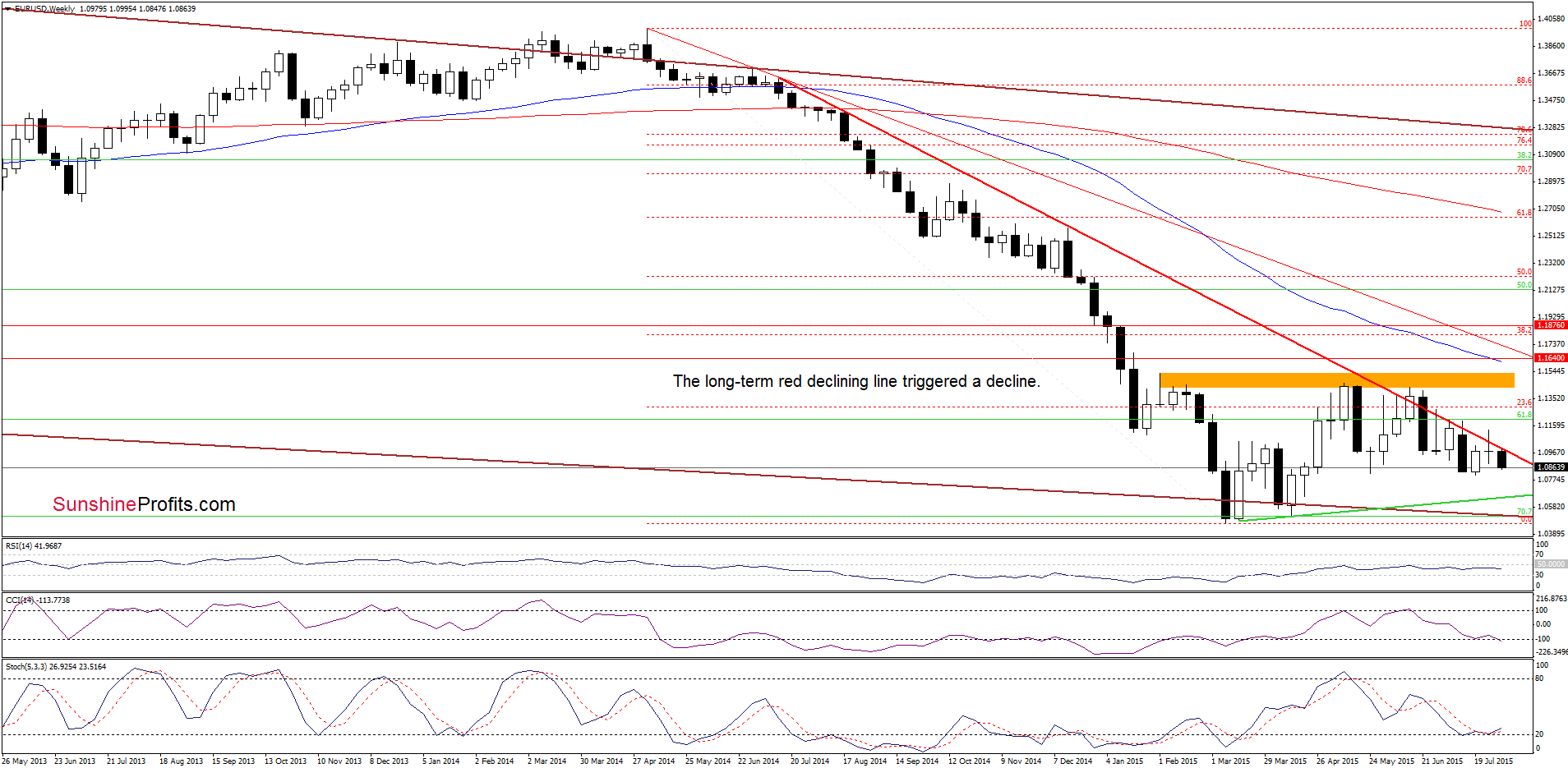

EUR/USD

The medium-term picture has deteriorated slightly as the long-term red declining resistance line pushed EUR/USD lower.

What impact did this move have on the very short-term picture? Let’s examine the daily chart and find out.

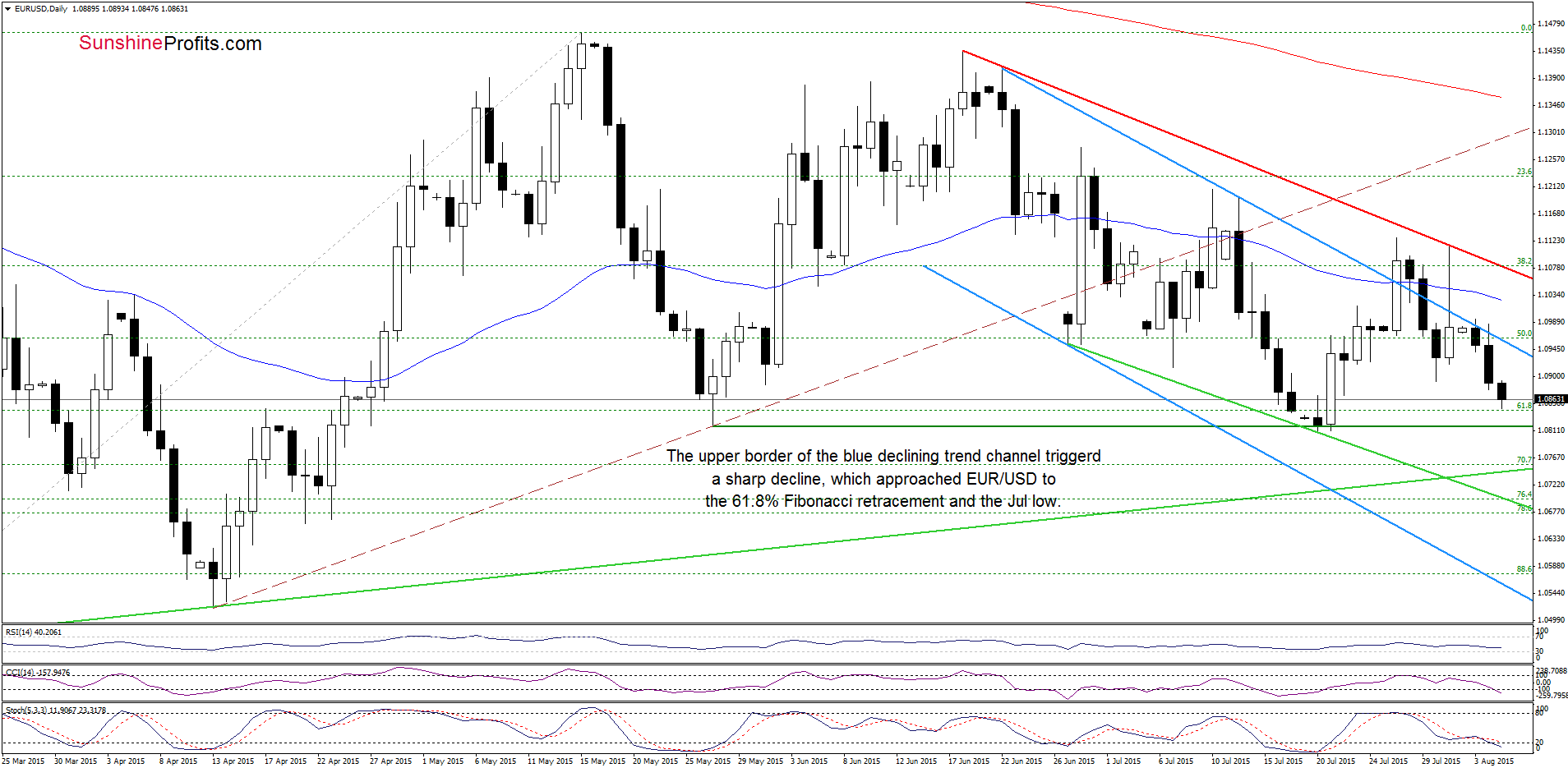

Looking at the daily chart we see that although EUR/USD moved little higher, currency bulls didn’t manage to hold gained levels and the exchange rate slipped under the previously-broken upper border of the blue declining trend channel. This negative signal encouraged currency bears to act, which resulted in a sharp decline. Earlier today, EUR/USD extended losses and reached the 61.8% Fibonacci retracement. Although this support could trigger a rebound, the current position of the indicators suggests that we’ll see a test of the green support line based on the May and Jul lows in the coming day(s). If it is broken, the next downside target would be around 1.0756, where the 70.7% Fibonacci retracement is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

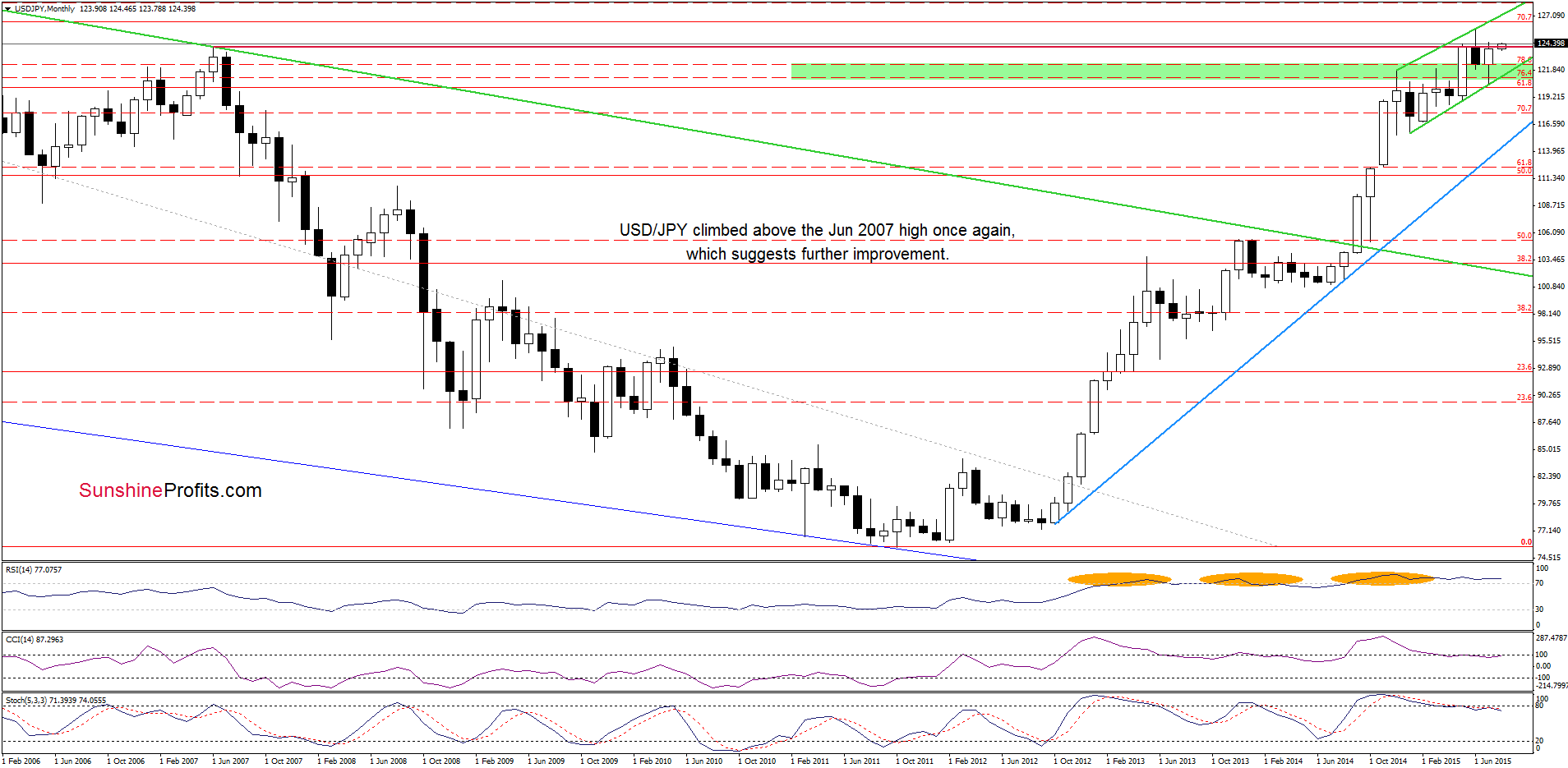

USD/JPY

The situation in the medium term has improved as USD/JPY broke above the June 2007, which is a positive signal that suggests further rally. But will we see such price action? Let’s take a closer look at the daily chart and find out.

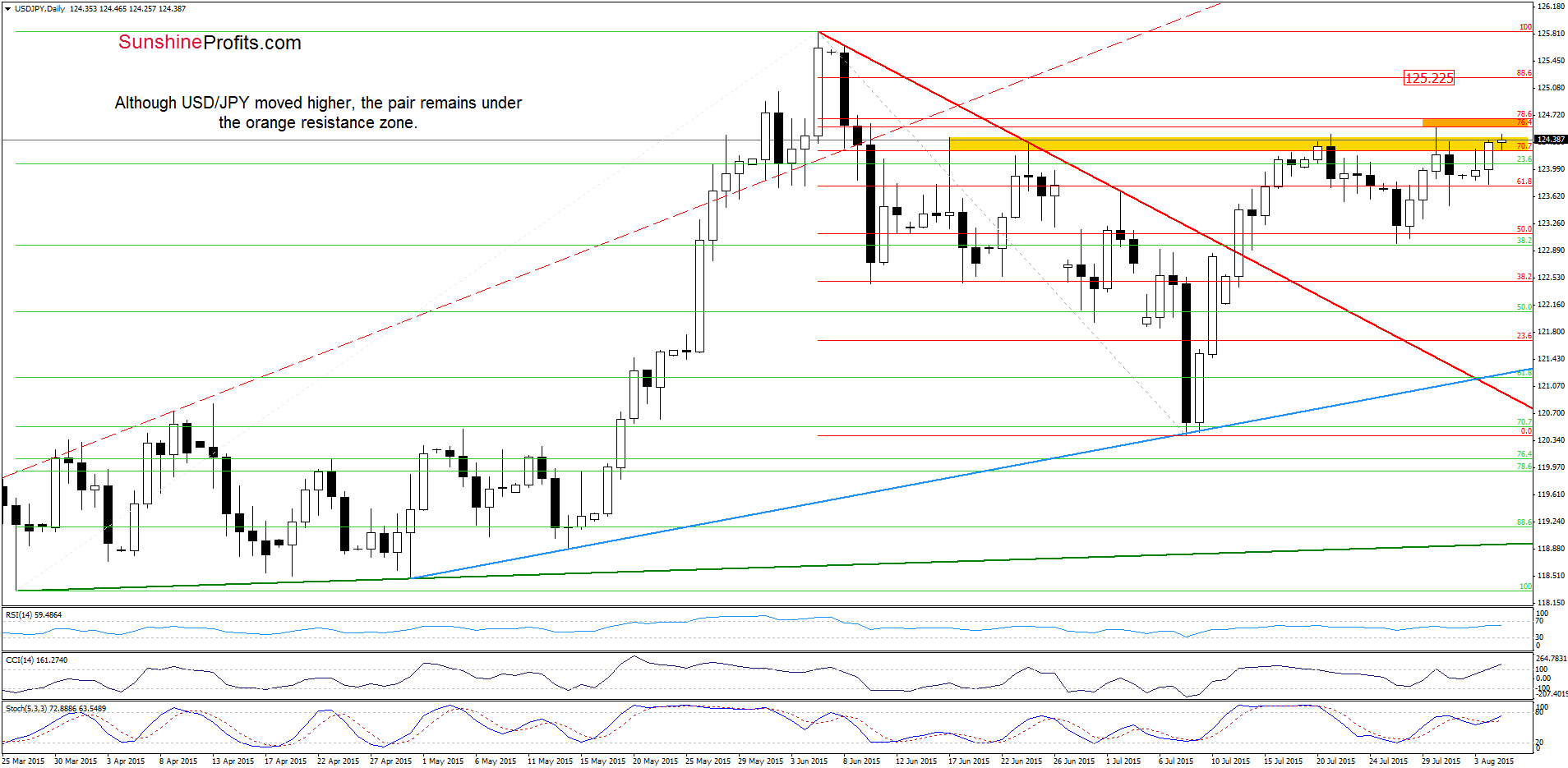

The first thing that catches the eye on the above chart is a breakout above the yellow resistance zone. But is this event as positive as it seems on the first sight? Not really because we saw similar price action in previous weeks. In all these cases, intraday’s breakouts haven’t been supported by further increases. Therefore, in our opinion, there won’t be a sizable rally as long as the orange resistance zone (created by the 76.4% and 78.6% Fibonacci retracement) keeps gains in check.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

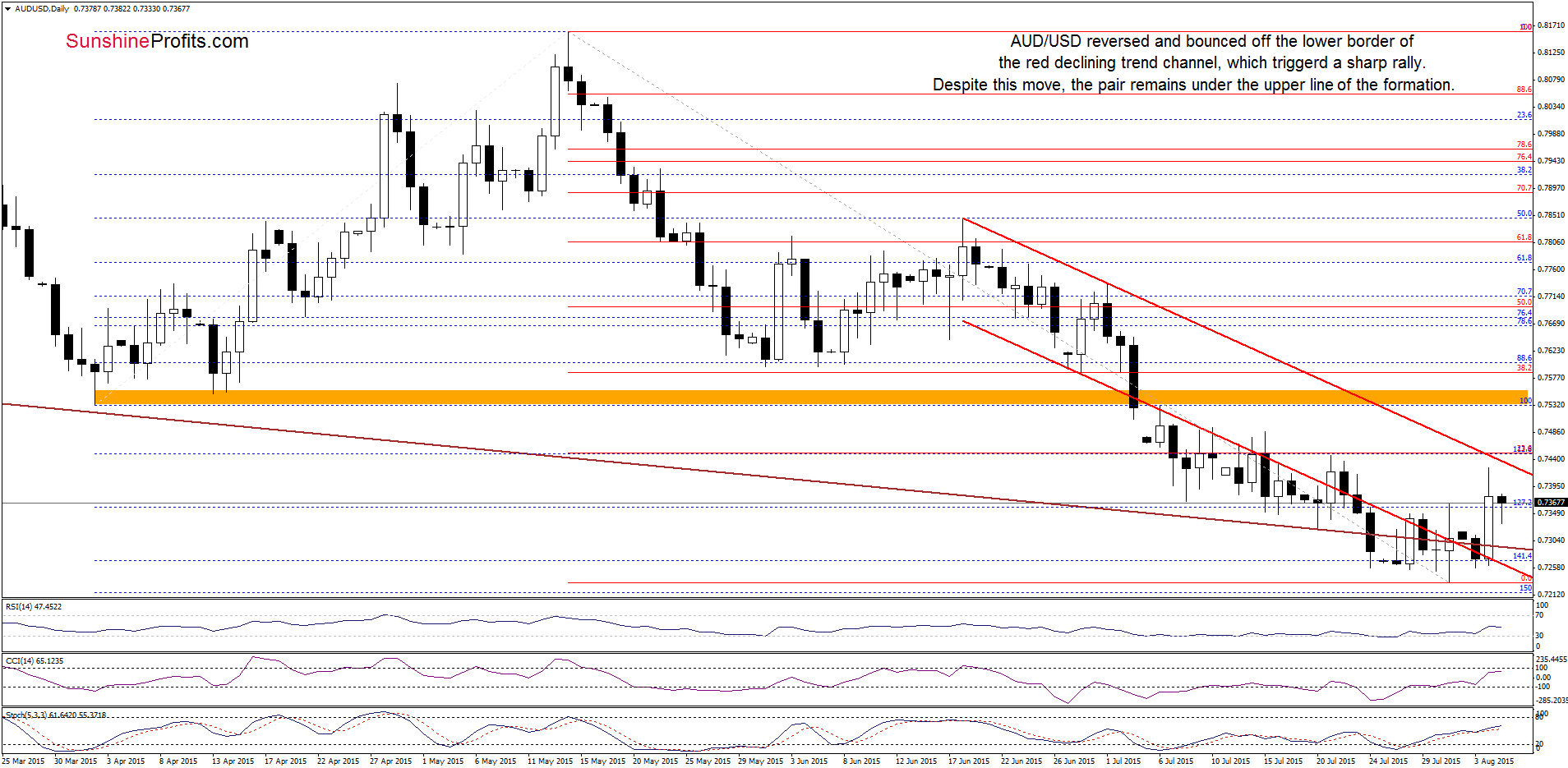

AUD/USD

From today’s point of view, we see that AUD/USD reversed and bounced off the lower border of the red declining trend channel, which triggered a sharp rally that invalidated the breakdown under the brown support line. Despite this improvement, the exchange rate remains under the upper line of the formation and also below the 23.6% Fibonacci retracement (based on the entire May-Jul decline). What’s next? Taking into account the current position of the indicators, it seems that currency bulls will try to push the pair above these resistances in the coming day(s). Nevertheless, as long as there won’t be a daily closure above them further improvement is questionable and another pullback should not surprise us.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts