There’s not much going on in the currency market today, so we will dedicate this alert to one thing that has actually changed recently. The USD Index moved only a little higher yesterday but this little move was all that was needed to see the Index at the key, long-term resistance level. Will this trend be enough to keep the U.S. dollar’s rally in check?

In our opinion the following forex trading positions are justified - summary:

All individual currency pairs that we cover are connected to the US Dollar so what’s going on in the USD Index has material impact on all of them. Since the index reached such an important resistance level, it’s critical to take a closer look at this development. Let’s take a look (charts courtesy of http://stockcharts.com).

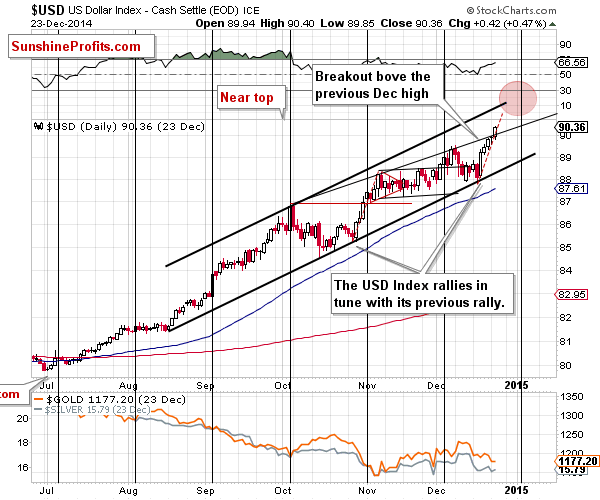

The USD Index moved higher only insignificantly, and we don’t see much change on the short-term chart. One could argue whether there was a short-term breakout or not, but even if we agree that there indeed was one, it’s not confirmed. Consequently, the short-term picture doesn’t provide us with much new information.

Let’s take a look at the situation in the USD Index from the very long-term perspective.

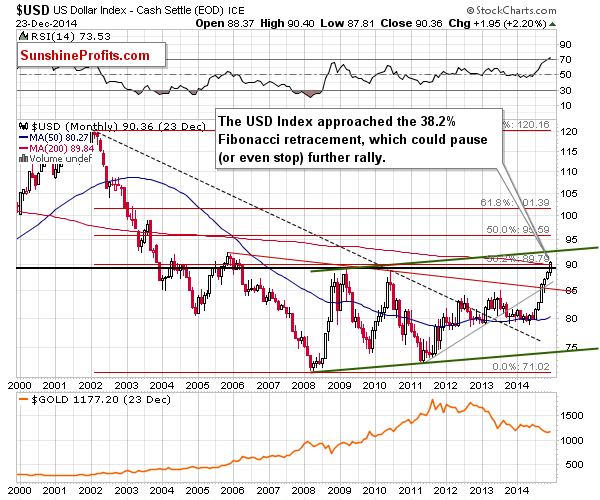

The USD Index has just encountered a major resistance line that it needs to surpass before a rally to 92 becomes very probable – the 38.2% Fibonacci retracement levels based on the entire 2002 – 2008 decline.

The Fibonacci retracements have worked for the USD Index many times in the past, so it could be the case that this level will keep the rally in check for some time. If not, and we see a confirmed breakout, then we’ll likely see another big rally – to the 92 level or perhaps even to the next retracement at 96.11.

However, we would first need to see the breakout and its confirmation. For now, we have just seen a move to this critical level. What does it mean? That the USD Index will likely move significantly, but the direction of the next move is not very clear. At this time it seems that no matter what currency pair one is interested in, it would be better – from the risk/reward perspective – to wait for either a confirmed breakout in the USD Index or a decline from this level, before opening any positions. As always, we’ll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts

P.S. On an administrative note, there will be no alerts on Thursday (Dec. 25) and Friday (Dec. 26) this week. We will start posting them again on Monday, Dec. 29.