Earlier today, the USD Index slipped under the level of 100 as growing worries over U.S. President Donald Trump's policy continued to weigh on the greenback. In this environment, the U.S. dollar moved lower against the Swiss franc, but will we see further deterioration in the coming days?

In our opinion the following forex trading positions are justified - summary:

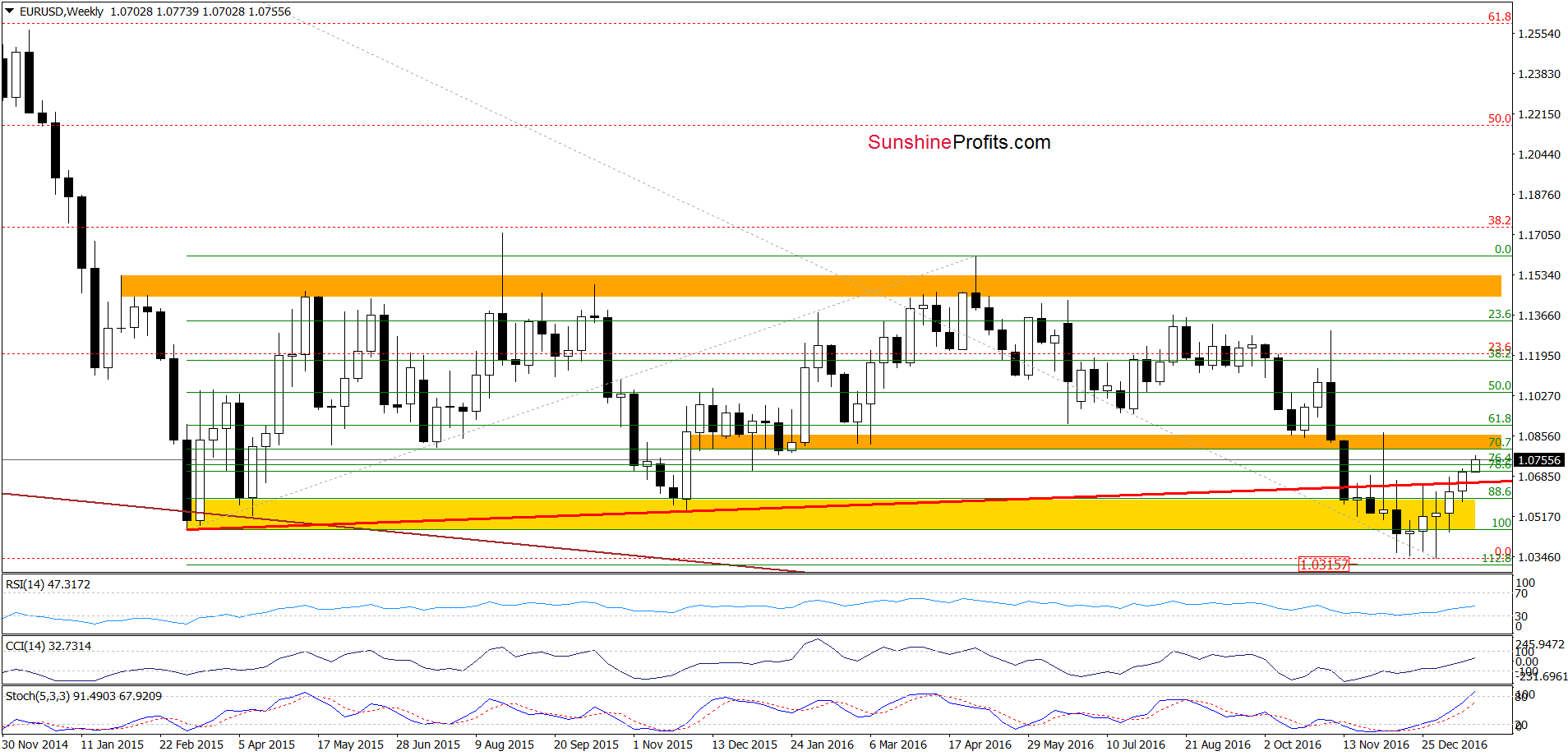

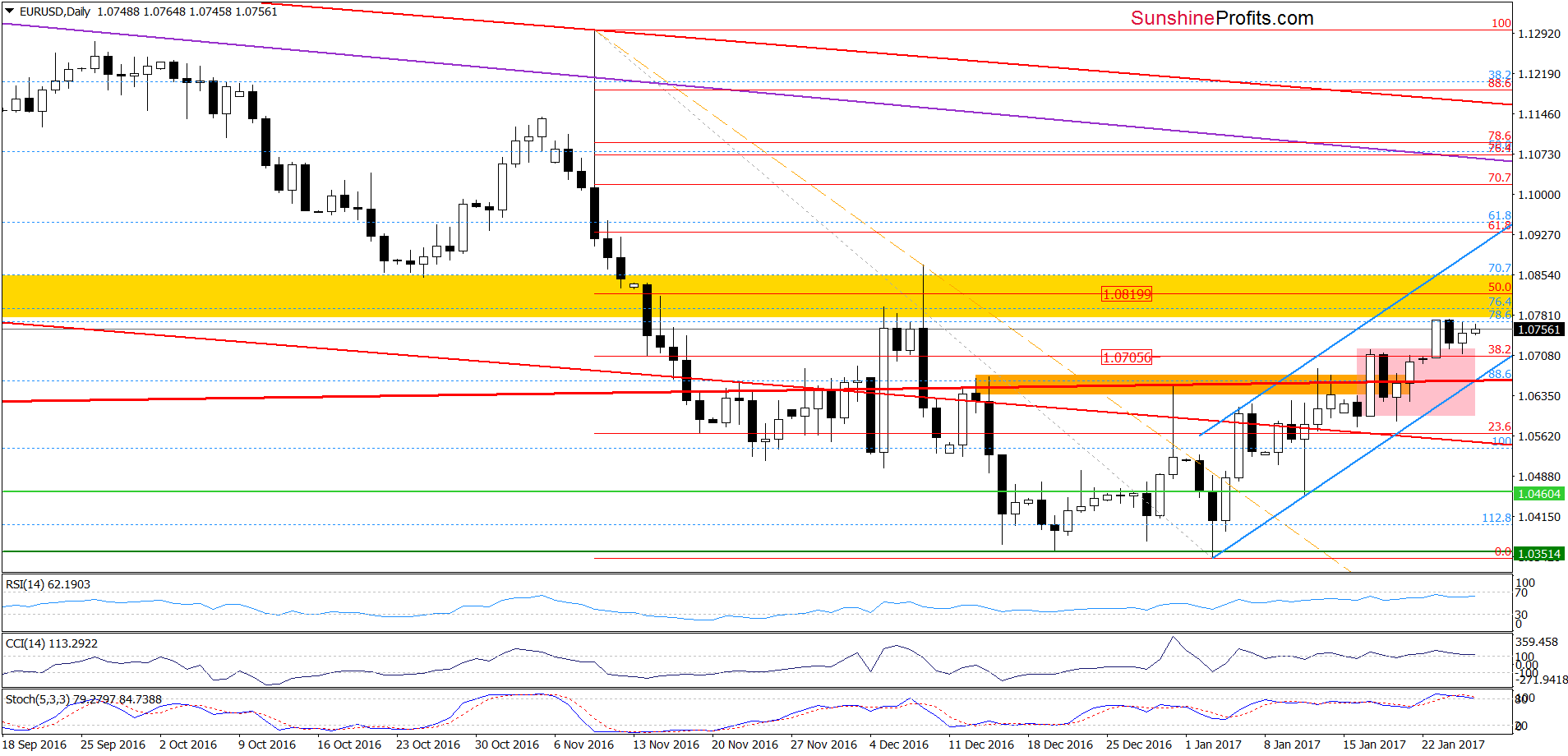

EUR/USD

Looking at the charts, we see that the situation in the medium and short term hasn’t changed much as EUR/USD is still trading in a narrow range between the previously-broken upper border of the pink consolidation and the yellow resistance zone. This means that what we wrote yesterday is still valid:

(…) EUR/USD verified the earlier breakout above the 38.2% Fibonacci retracement and the upper border of the pink consolidation (…) Additionally, there are no sell signals at the moment of writing these words, which means that as long as there is no invalidation of the breakout above these levels another attempt to move higher and a test of the 50% Fibonacci retracement (around 1.0820) and the yellow resistance zone is likely.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

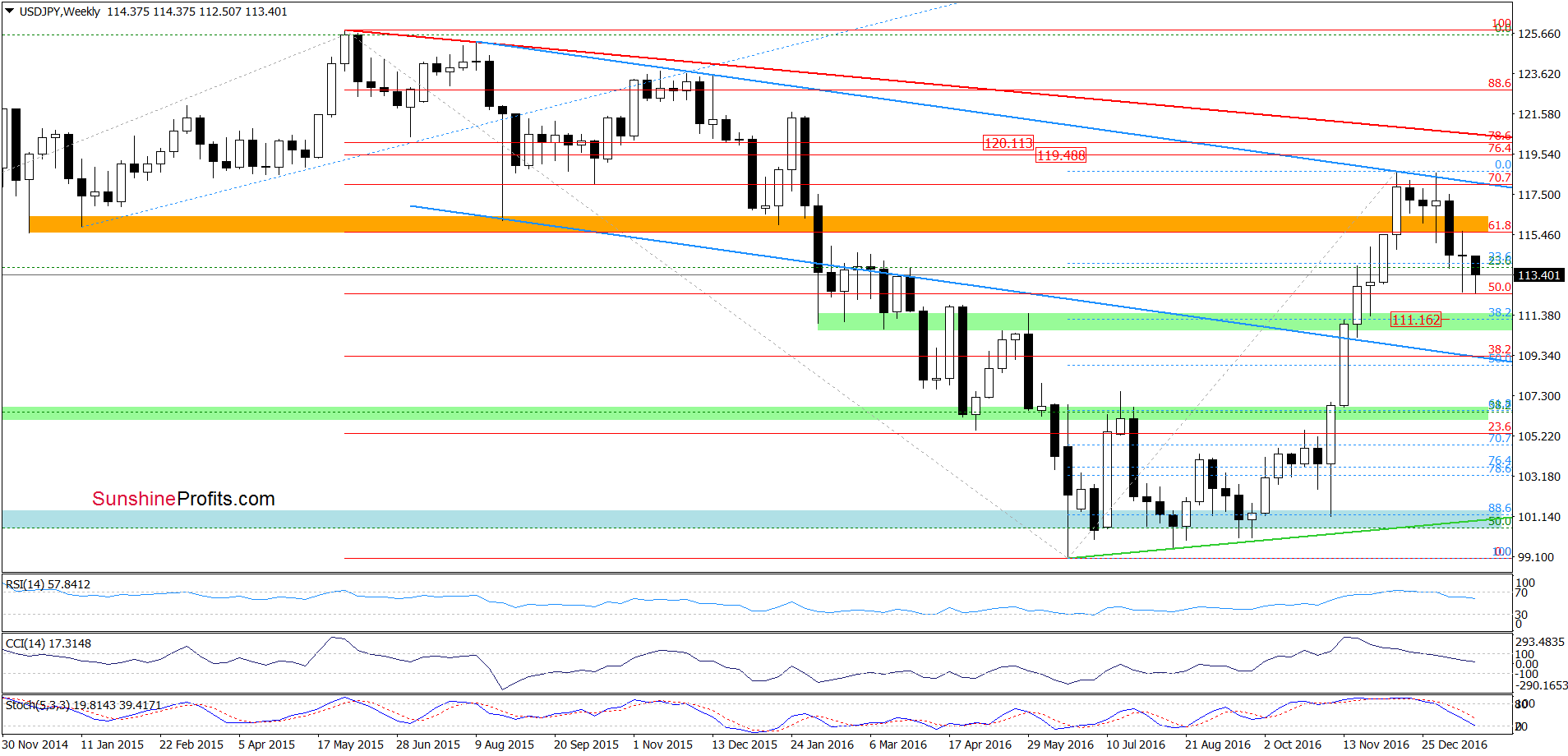

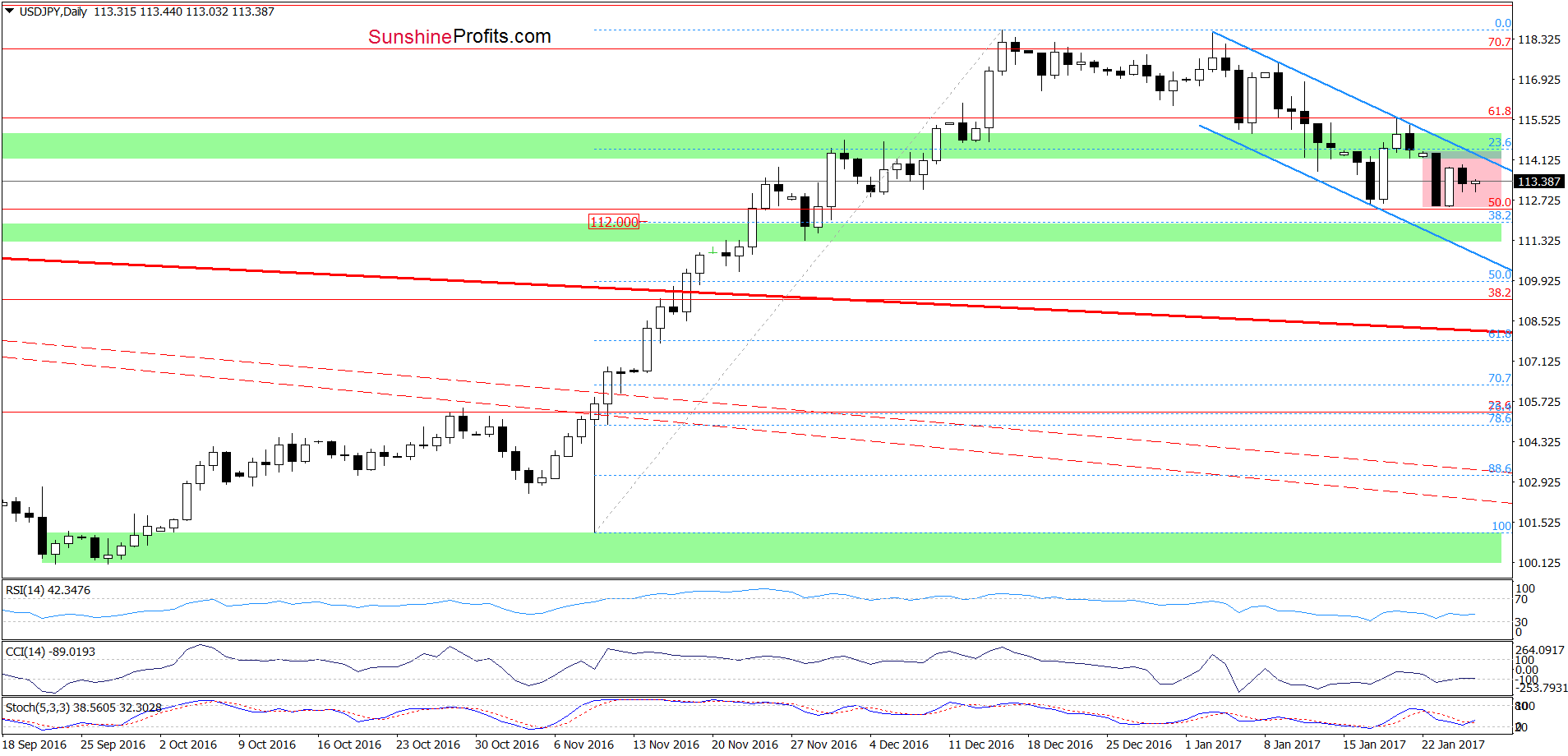

USD/JPY

On the daily chart, we see that USD/JPY is consolidating inside the blue declining trend channel, which makes the very short-term picture unclear. Nevertheless, the CCI and the Stochastic Oscillator generated the buy signals, which suggests another attempt to move higher. When can we expect a bigger move to the upside? In our opinion, it will be more likely and reliable if USD/JPY breaks above the upper border of the blue declining trend channel. Until this time short-lived moves in both directions should not surprise us and waiting on the sidelines for a profitable opportunity is justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

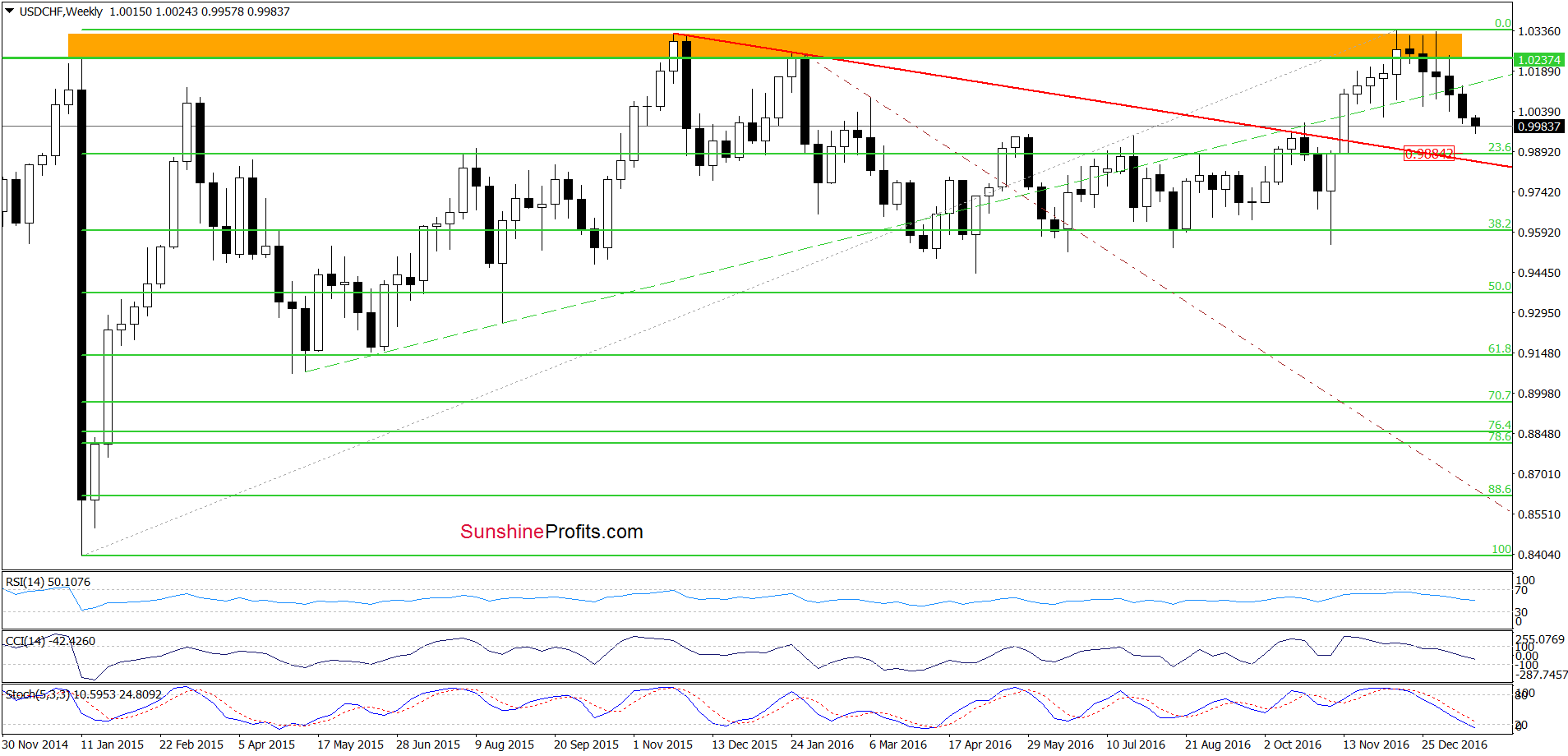

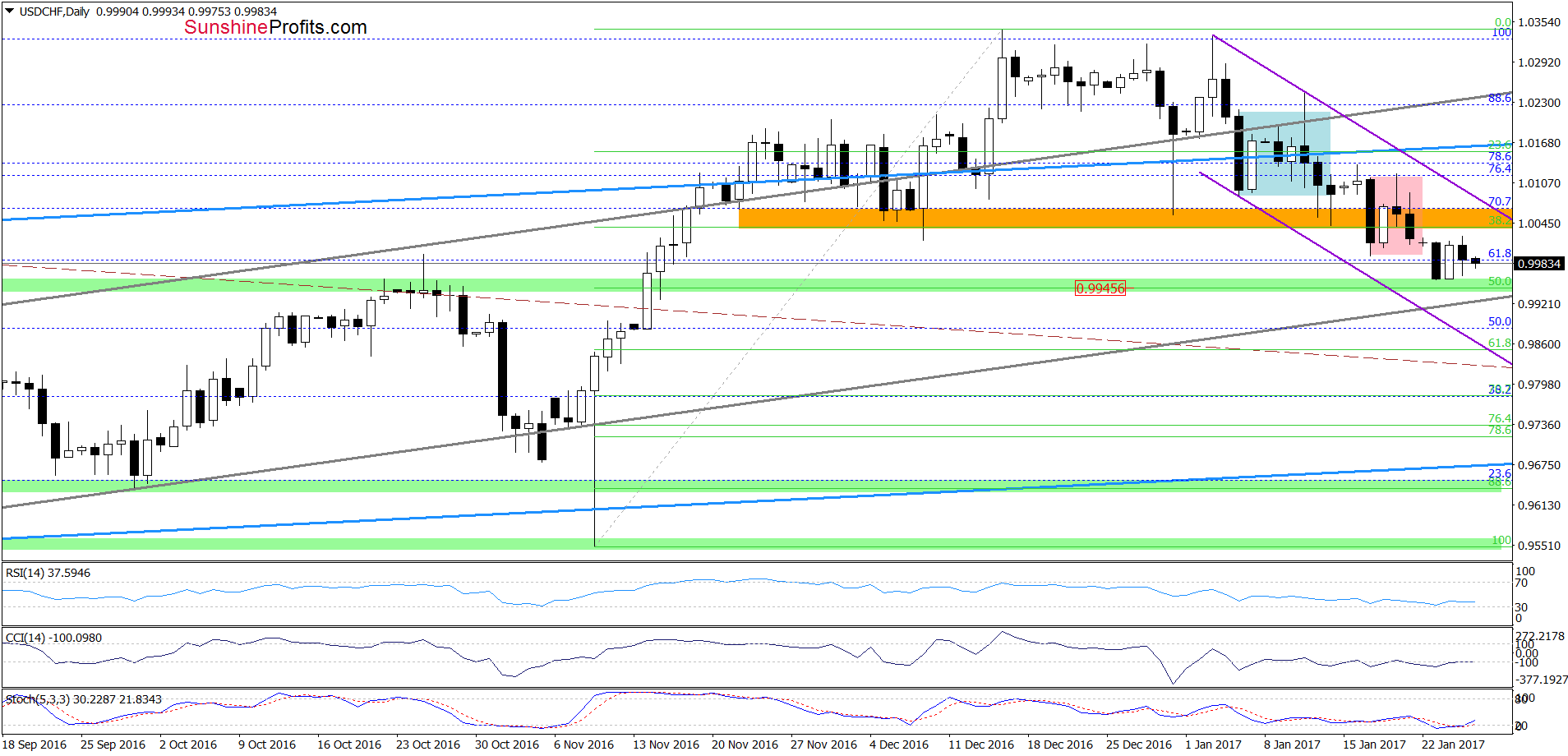

USD/CHF

From today’s point of view, we see that the situation in the short term hasn’t changed much since our last commentary as USD/CHF is consolidating between the previously-broken lower border of the pink consolidation and the green support zone, which makes the situation a unclear – especially when we factor in the fact that the exchange rate remains in the purple declining trend channel. When can we expect another bigger move? In our opinion, USD/CHF extends gains only if we see a breakout above the orange resistance zone and the upper border of the trend channel. However, another downswing and a re-test of the green support zone before a move to the upside can’t be ruled out.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts