Earlier today, USD/CAD moved higher, but the upper border of the rising trend channel continues to keep gains in check. Does it mean that declines are just around the corner?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1052; the initial downside target at 1.0521)

- GBP/USD: short (a stop-loss order at 1.3087; the initial downside target at 1.2602)

- USD/JPY: long (a stop-loss order at 107.62; the initial upside target at 111.16)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

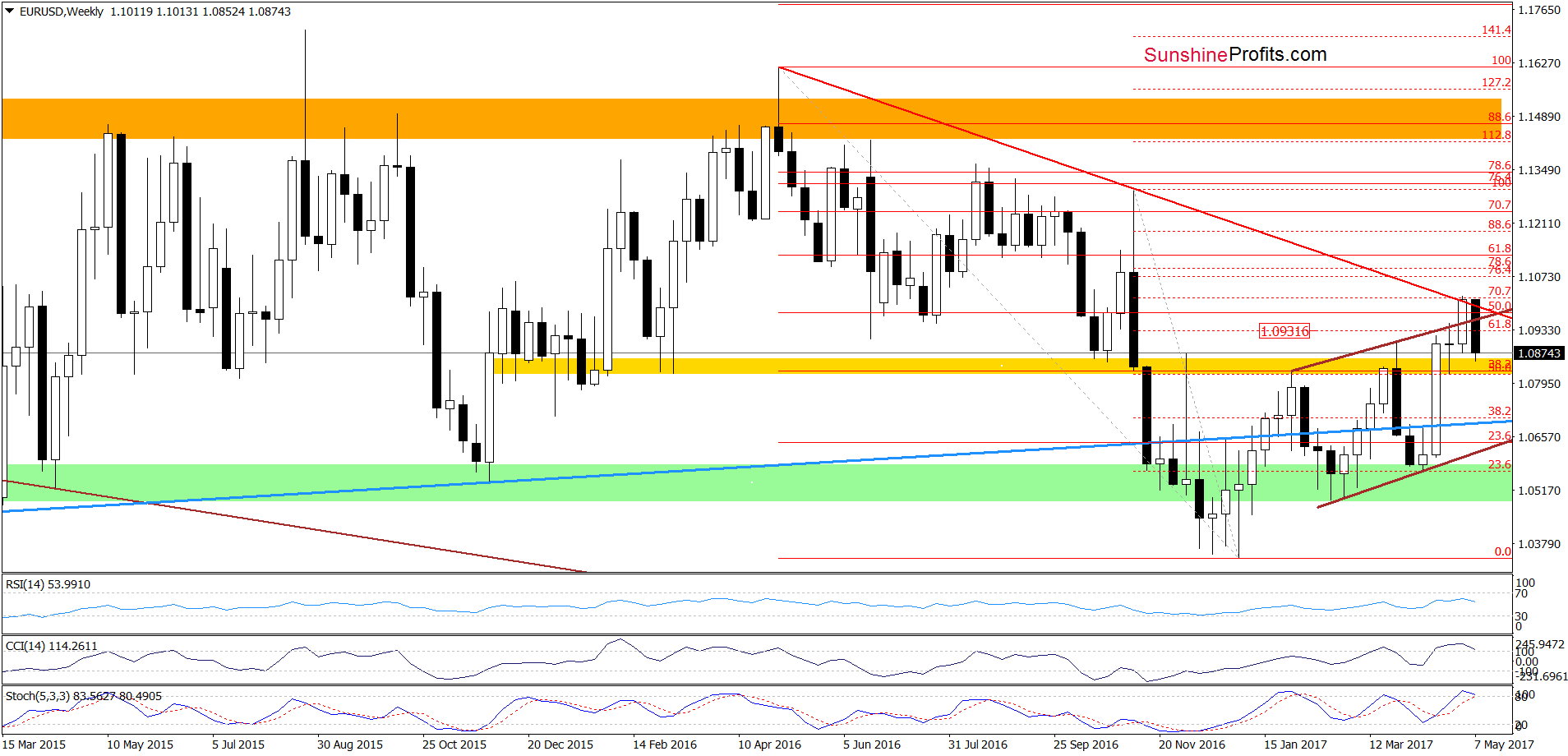

EUR/USD

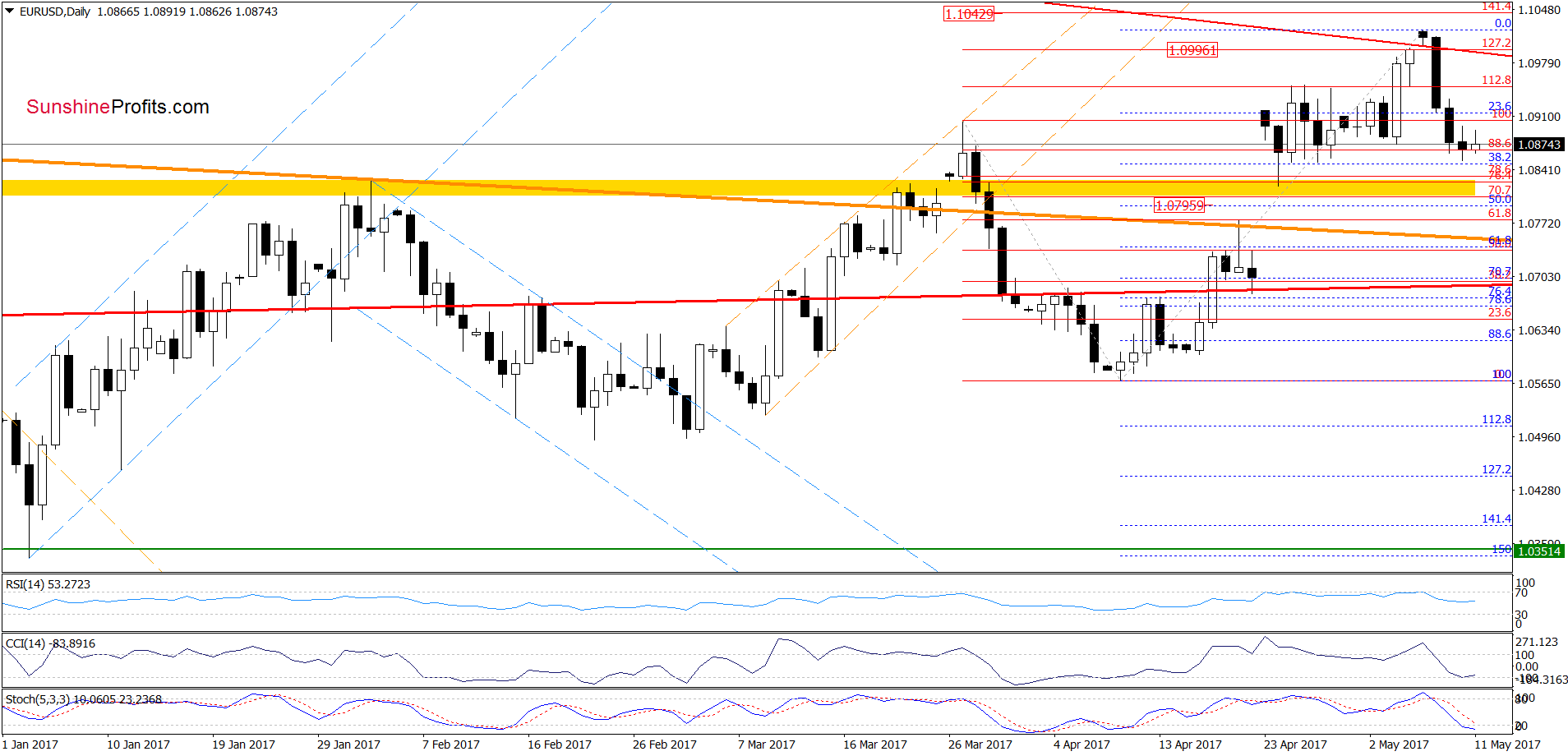

On the daily chart, we see that although EUR/USD moved a bit higher earlier today, the overall situation hasn’t changed much as exchange rate remains under the previously-broken upper border of the brown rising trend channel and the long-term red declining resistance line (both marked on the weekly chart). This means that an invalidation of the earlier breakouts and its negative impact on the exchange rate is still in effect.

On top of that, the sell signals generated by the indicators remain in place, suggesting lower values of the exchange rate. Therefore, if EUR/USD drops under 1.0851, we’ll see a test of the 50% Fibonacci retracement (around 1.0796) in the following days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1052 and the initial downside target at 1.0521) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

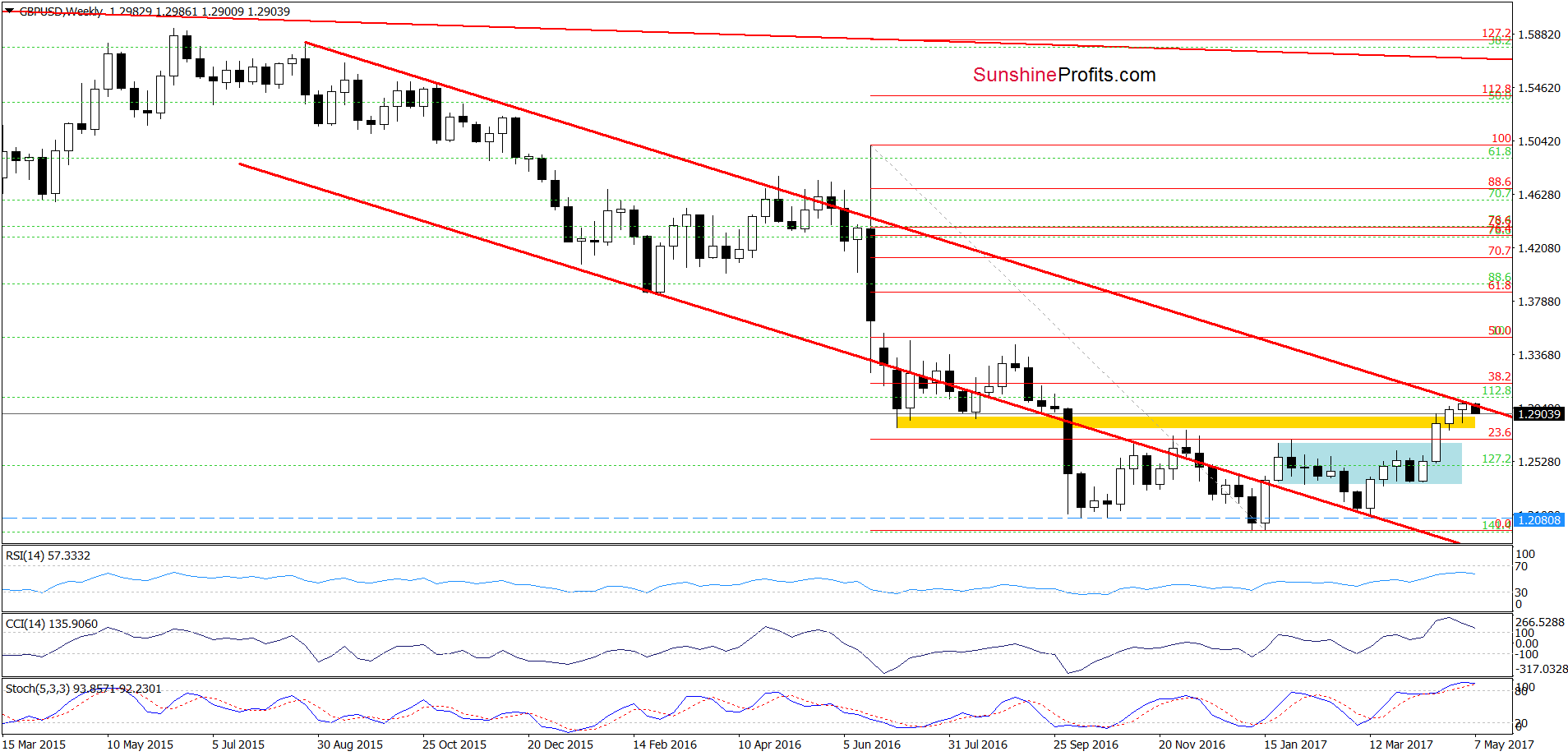

The first thing that catches the eye on the weekly chart is a drop under the upper border of the red declining trend channel. Thanks to this move GBP/USD invalidated the tiny breakout above this resistance line, which is a bearish development.

How did this decline affect the very short-term picture? Let’s examine the daily chart and find out.

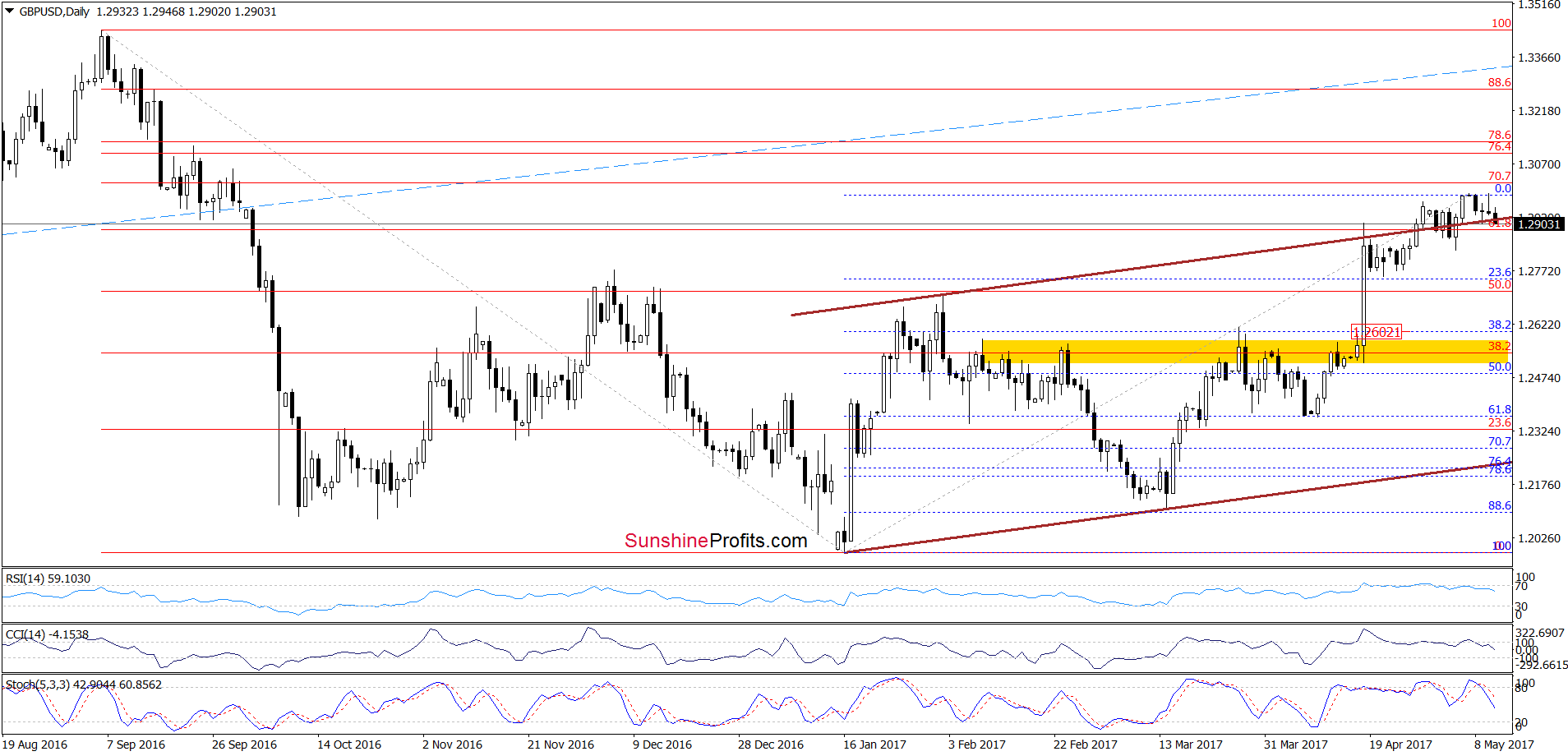

From this perspective, we see that today’s decline also took GBP/USD under the upper border of the brown rising trend channel. As a result, he pair invalidated the earlier breakout, which is an additional negative sign, which suggests further deterioration. On top of that, all indictors generated the sell signals, suggesting lower prices of GBP/USD in the coming days.

If this is the case and GBP/USD extends losses, the first downside target will be around 1.2749-1.2755, where the late April lows and the 23.6% Fibonacci retracement (based on the entire January-May upward move) are. Nevertheless, taking into account the current position of the weekly indicators, we think that the exchange rate will move lower in the following weeks.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.3087 and the initial downside target at 1.2602) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

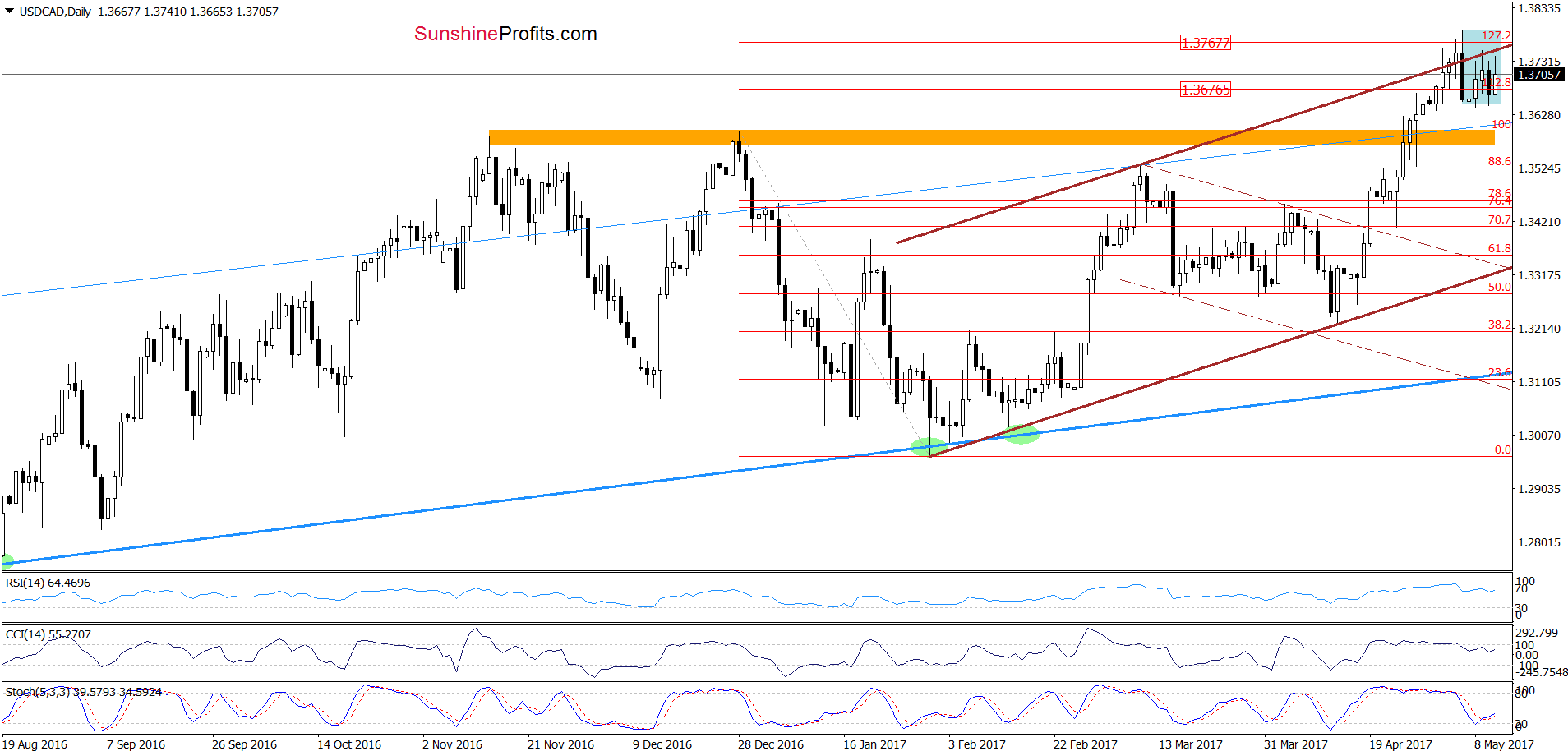

On the daily chart, we see that although USD/CAD moved higher earlier today, the upper border of the brown rising tend channel continues to keep gains in check. Additionally, the pair remains in the blue consolidation, which means that as long as there is no breakout above the upper line of the formation or a breakdown under the lower border another bigger move to the upside/downside is not likely to be seen and short-lived moves in both directions should not surprise us.

Nevertheless, the long- and medium-term charts suggest that the space for gains is limited and lower values of the exchange rate are just around the corner.

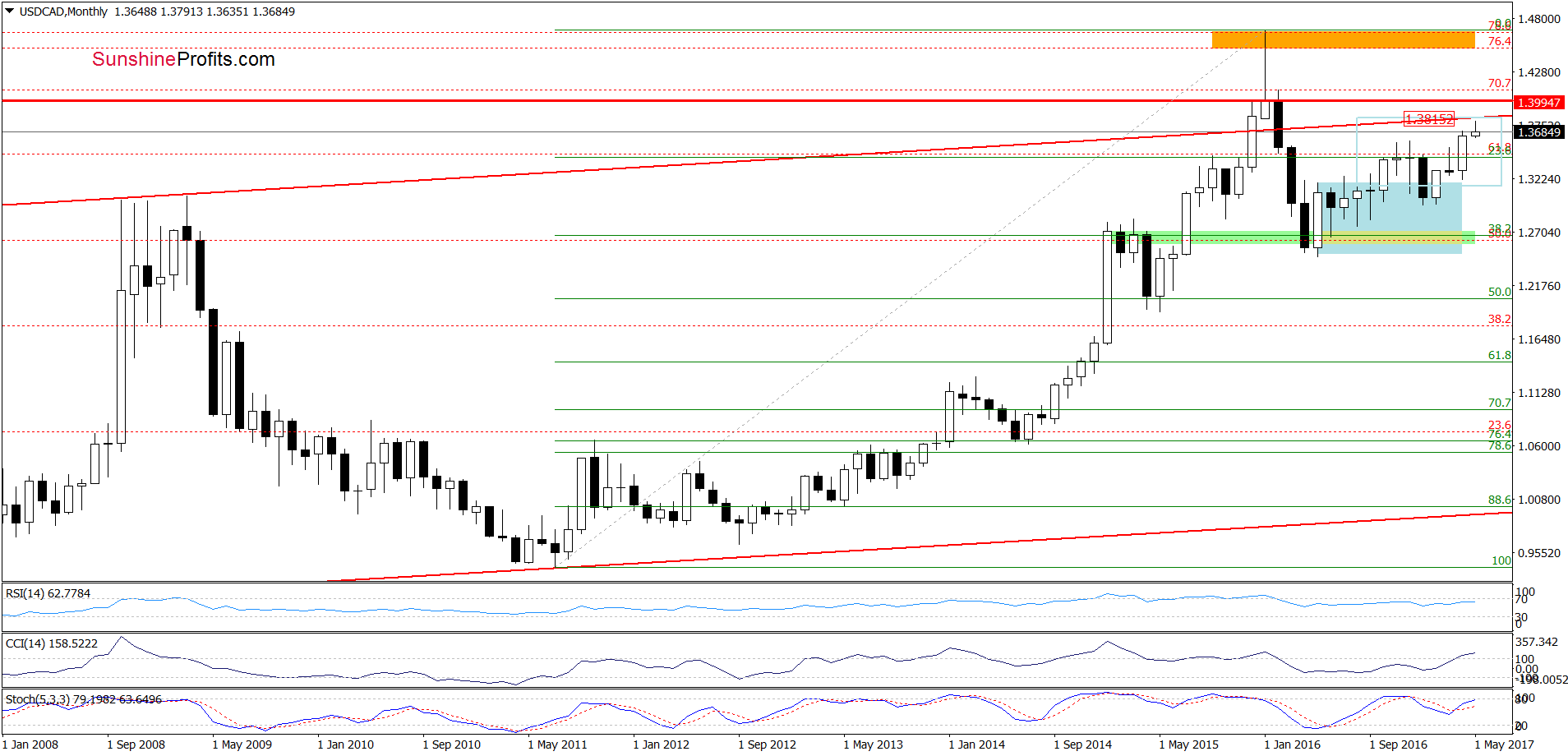

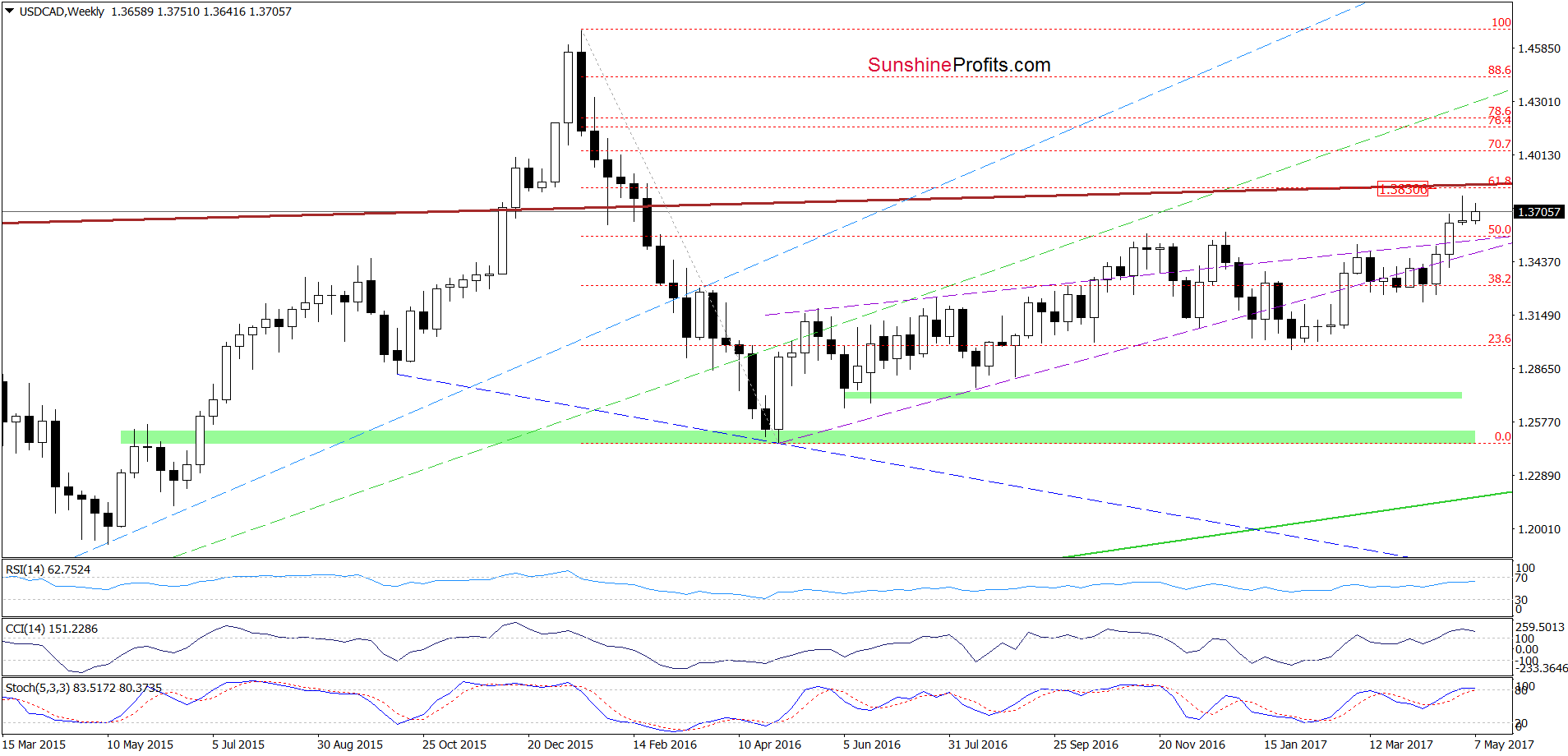

On the monthly chart, we see that USD/CAD approached the 61.8% Fibonacci retracement, which together with the proximity to the upper border of the red rising trend channel marked on the weekly chart below increase the probability of reversal in the coming week. If we see such price action and a drop below the lower border of the blue consolidation seen on the daily chart, we’ll consider opening short positions.

Very short-term outlook: mixed

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts