Earlier today, the greenback moved lower against its Canadian counterpart as lower-than-expected U.S. consumer confidence data continued to weigh. Did this move change anything in the short-term picture of USD/CAD?

In our opinion the following forex trading positions are justified - summary:

EUR/USD

Looking at the above charts, we see that EUR/USD is still trading below the lower border of the consolidation range and the green support line, which means that what we wrote yesterday is up-to-date:

(…) EUR/USD extended declines and dropped below the lower border of the consolidation and the green support line (based on the Nov 7 and Dec 8 lows). This is a bearish signal, which suggests further deterioration and a pullback to around 1.2080, where the size of the downswing will correspond to the height of the consolidation (this area is also supported by the 150% Fibonacci extension based on the Dec 8-Dec 16 rally).

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

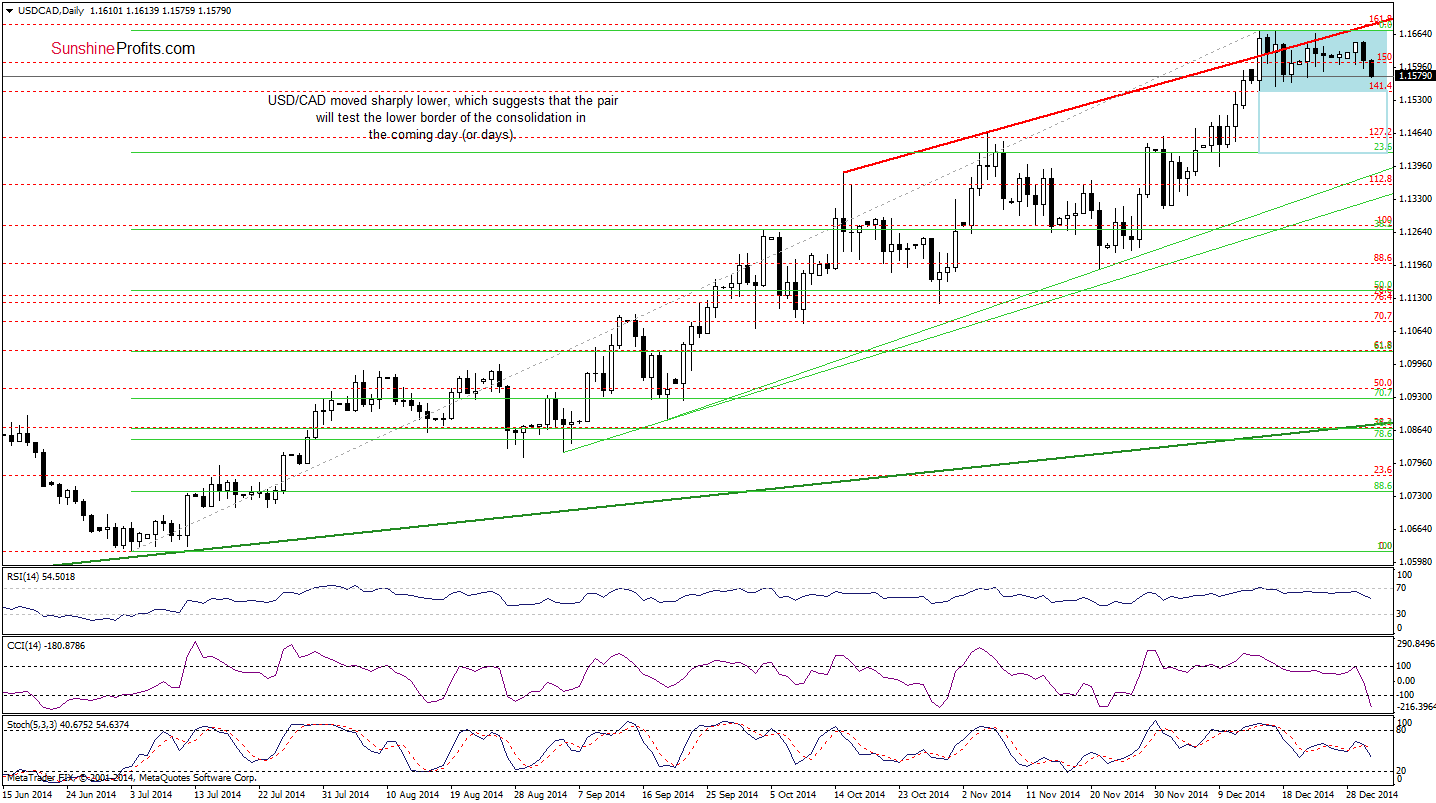

USD/CAD

The situation in the medium term hasn’t changed much as USD/CAD is still trading in a consolidation below the orange resistance zone (created by the 61.8% Fibonacci retracement and the Jul 2009 high), which keeps gains in check.

Having say that, let’s examine the daily chart.

From this perspective, we see that USD/CAD moved sharply lower, which suggests that the pair will test the lower border of the consolidation in the coming day (or days). If this support withstands the selling pressure, we’ll see a rebound to the upper line of the formation. However, if currency bulls fail and the pair drops lower, USD/CAD will decline to around 1.1425, where the size of the downswing will correspond to the height of the consolidation. At this point, it’s worth noting that this area is also supported by the 23.6% Fibonacci retracement (based on the entire Jul-Dec rally). Which scenario is more likely? Taking into account an invalidation of the breakout above the red resistance line, the current position of the indicators and the medium-term picture, it seems that currency bears have more arguments on their side.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. However, if we see a confirmation of the above, we’ll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

In our last commentary on this currency pair, we wrote the following:

(…) the green support line (based on the Nov 7 and Dec 9 lows) in combination with the support zone created by the 2010 lows (seen more clearly on the weekly chart) stopped further deterioration. (…) AUD/USD moved higher and broke above the upper line of the consolidation (marked with blue) (…) all indicators generated buy signals, which suggests that currency bulls will try to move higher in the coming days.

As you see on the daily chart, the situation developed in line with the above scenario and AUD/USD broke above the upper line of the declining trend channel. This is a bullish signal (especially when we factor in the fact that buy signals generated by the indicators are still in play), which suggests further improvement and an increase to around 0.8280, where the 23.6% Fibonacci retracement based on the Oct-Dec decline is.

Very short-term outlook: bullish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. However, if the pair confirms the breakout above the upper line of the declining trend channel, we’ll consider opening long positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts