Earlier today, official data showed that the Japanese initial manufacturing PMI for Feb declined to 50.2, missing expectations for drop to a level of 52.0. As a result, the yen moved lower against the greenback, which pushed USD/JPY above the level of 112. But did this increase change anything in the medium-term picture?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1512; initial downside target at 1.0572)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: long (stop-loss order at 0.9633; initial downside target at 1.0239)

- AUD/USD: none

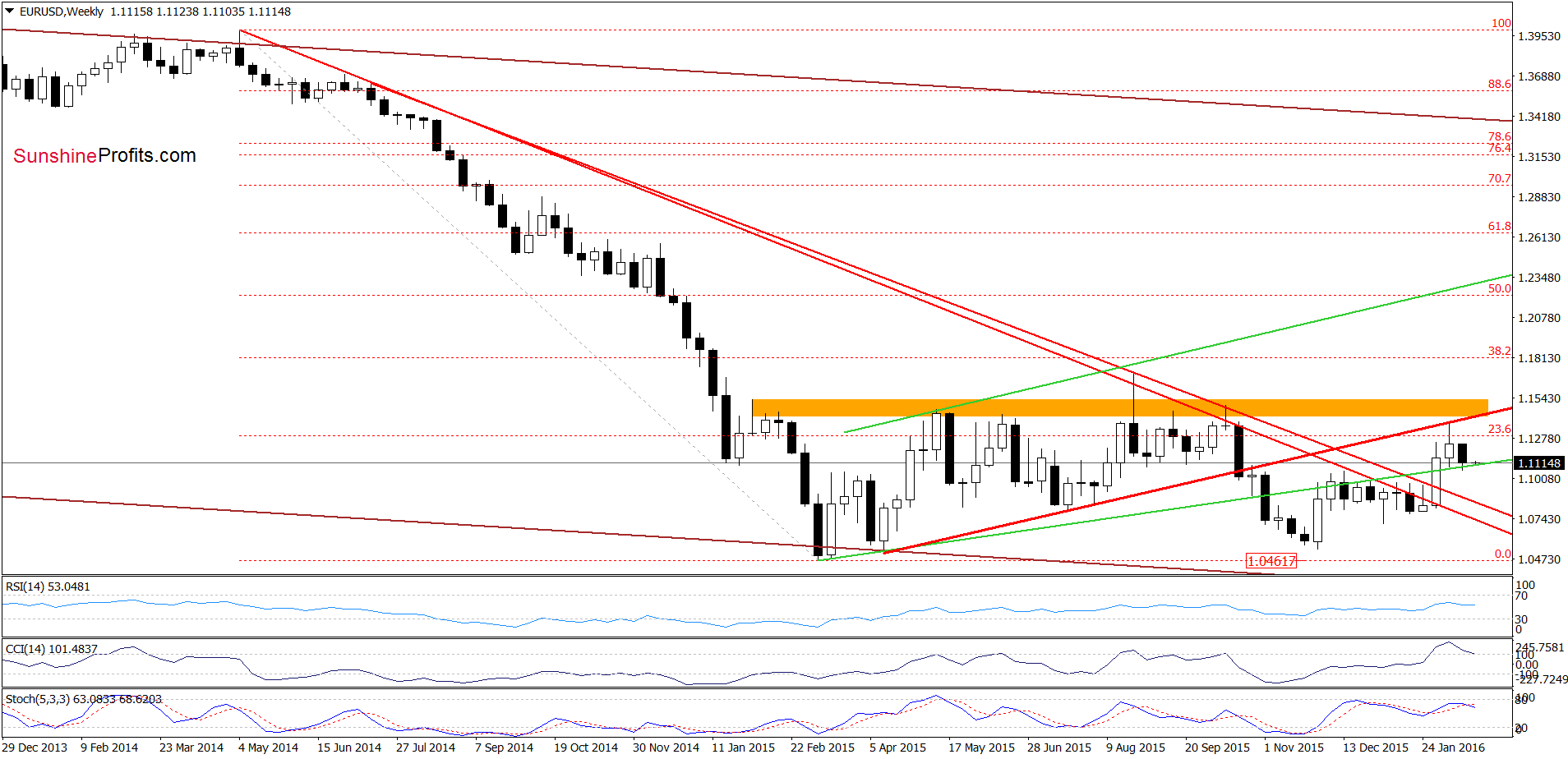

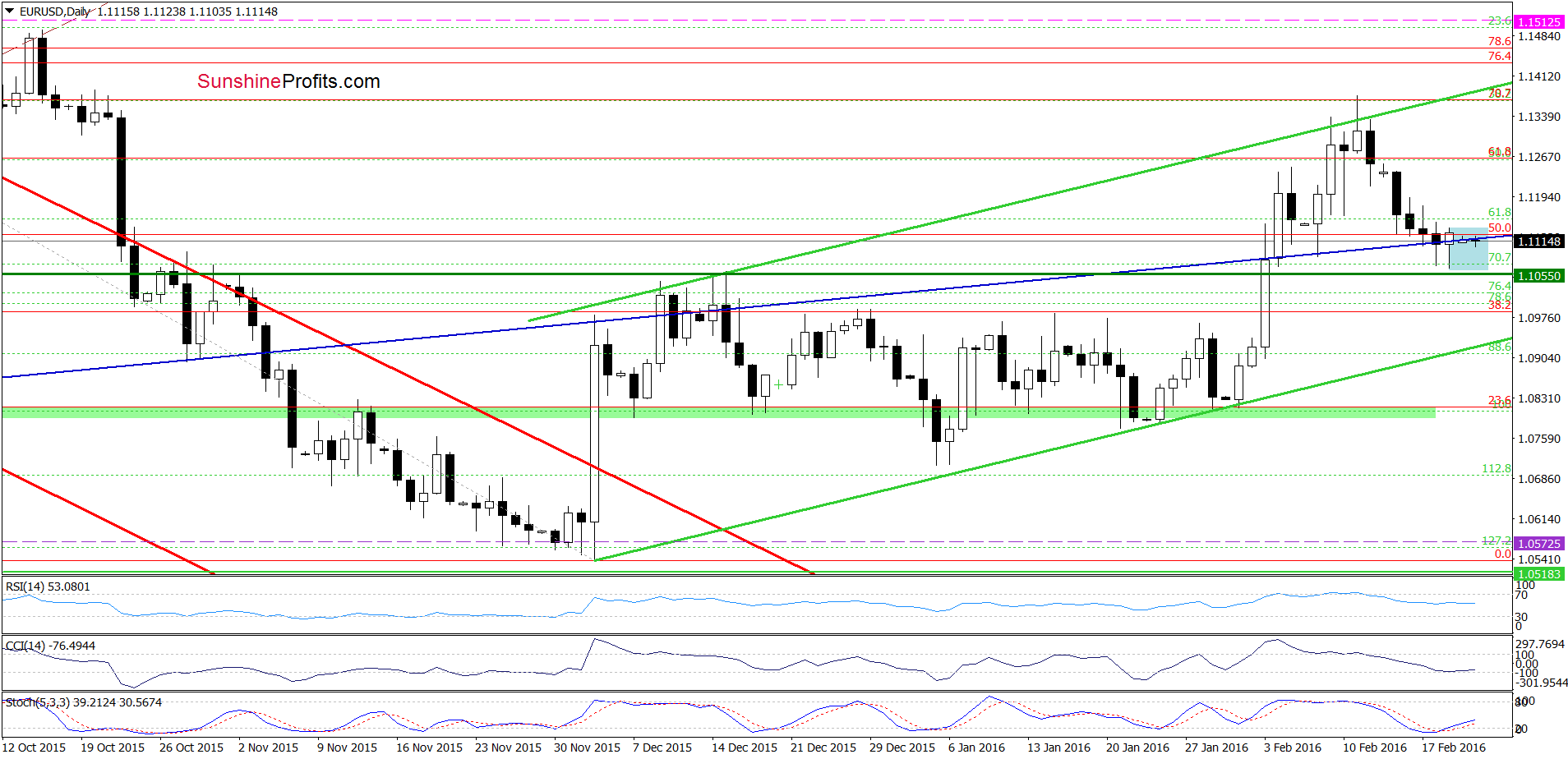

EUR/USD

On Friday, EUR/USD rebounded and climbed above the navy blue support/resistance line invalidating earlier breakdown. Despite this positive signal, the pair moved lower earlier today, which resulted in another drop under this important line. Taking this fact into account, we think that the exchange rate will extend decline and test the lower border of the blue consolidation and the green horizontal support line (based on the mid-Dec high) in the coming day.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1512 and the initial downside target at 1.0572) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

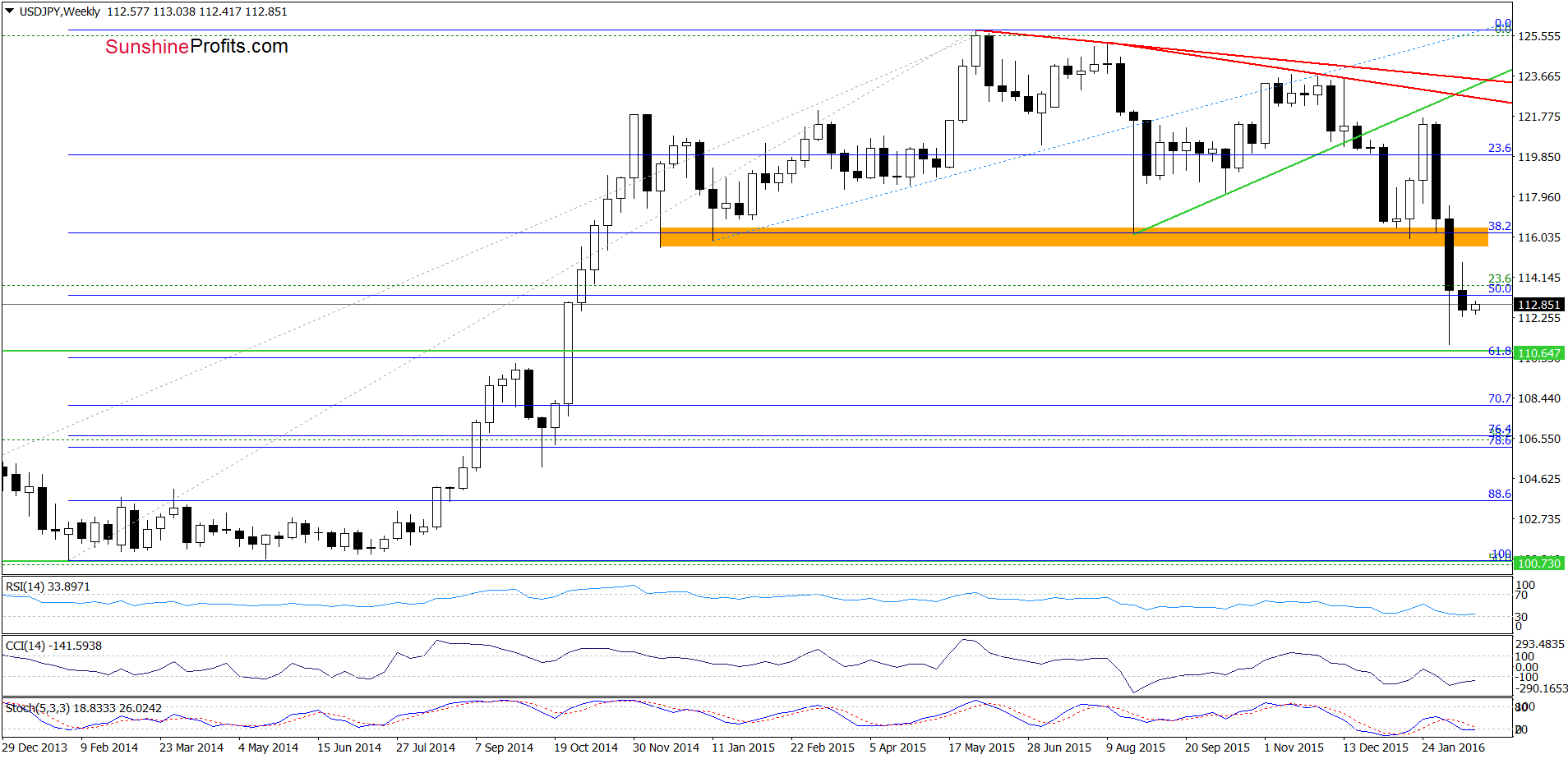

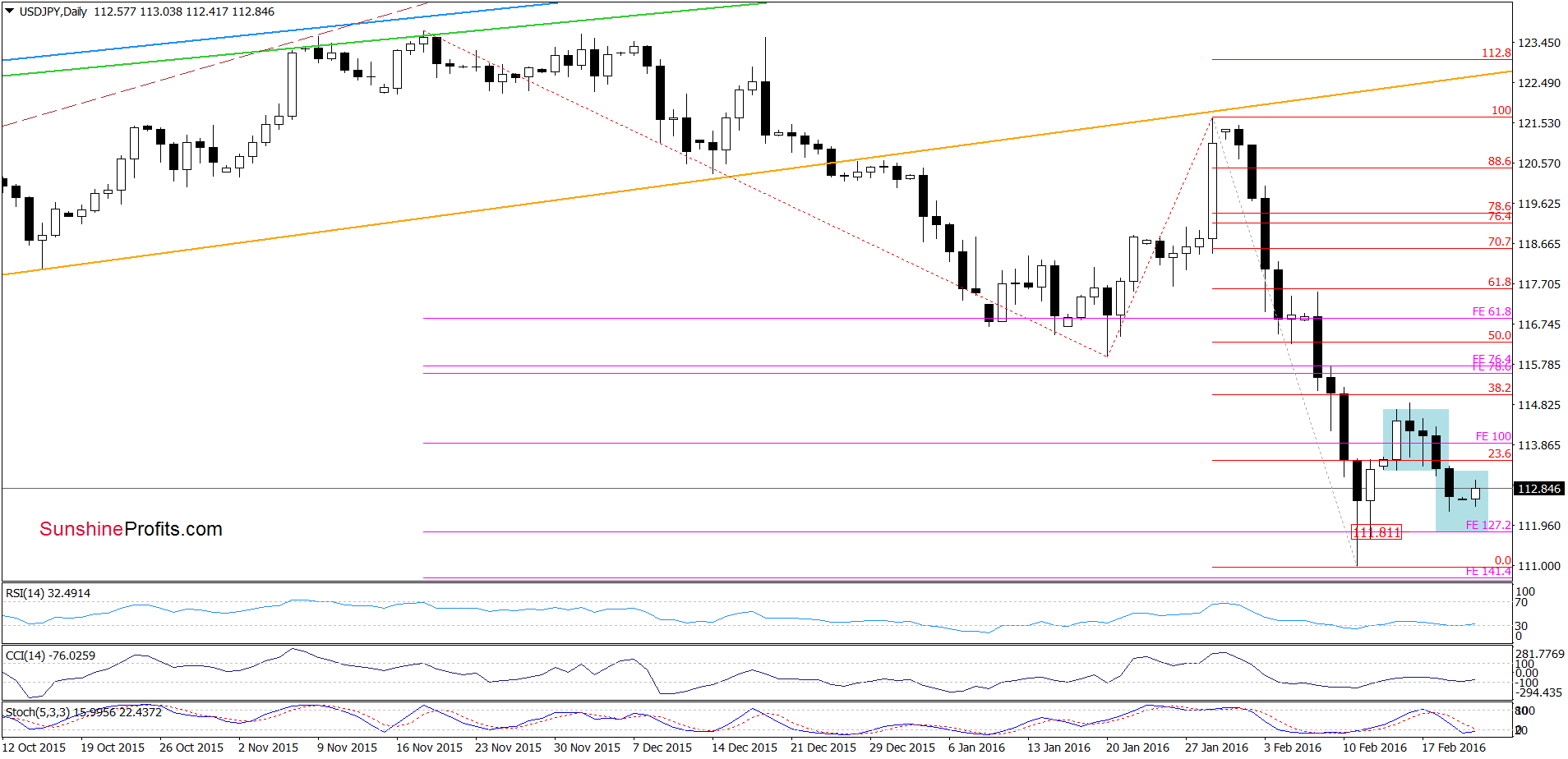

USD/JPY

On the medium-term chart, we see that although USD/JPY moved little higher, the size of the move is too small to say that the declines are over. On top of that, the exchange rate is still trading under the orange resistance zone, which suggests that as long as there is no invalidation of the breakdown under this area, anther downswing is likely.

Will the very short-term chart confirms this pro bearish scenario? Let’s check.

On the daily chart, we see that USD/JPY rebounded and climbed above 112 earlier today. Despite this move, the pair remains under the previously-broken lower border of the blue consolidation, which suggests that what we wrote on Friday is up-to-date:

(…) USD/JPY declined under the lower border of the consolidation. Taking this fact into account (…) we think that lower values of the exchange rate are ahead us. Therefore, in our opinion, we’ll see a drop to (at least) 111.81, where the size of the move will correspond to the height of the consolidation. If this level is broken, the next downside target would be the Feb 11 low of 110.96.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

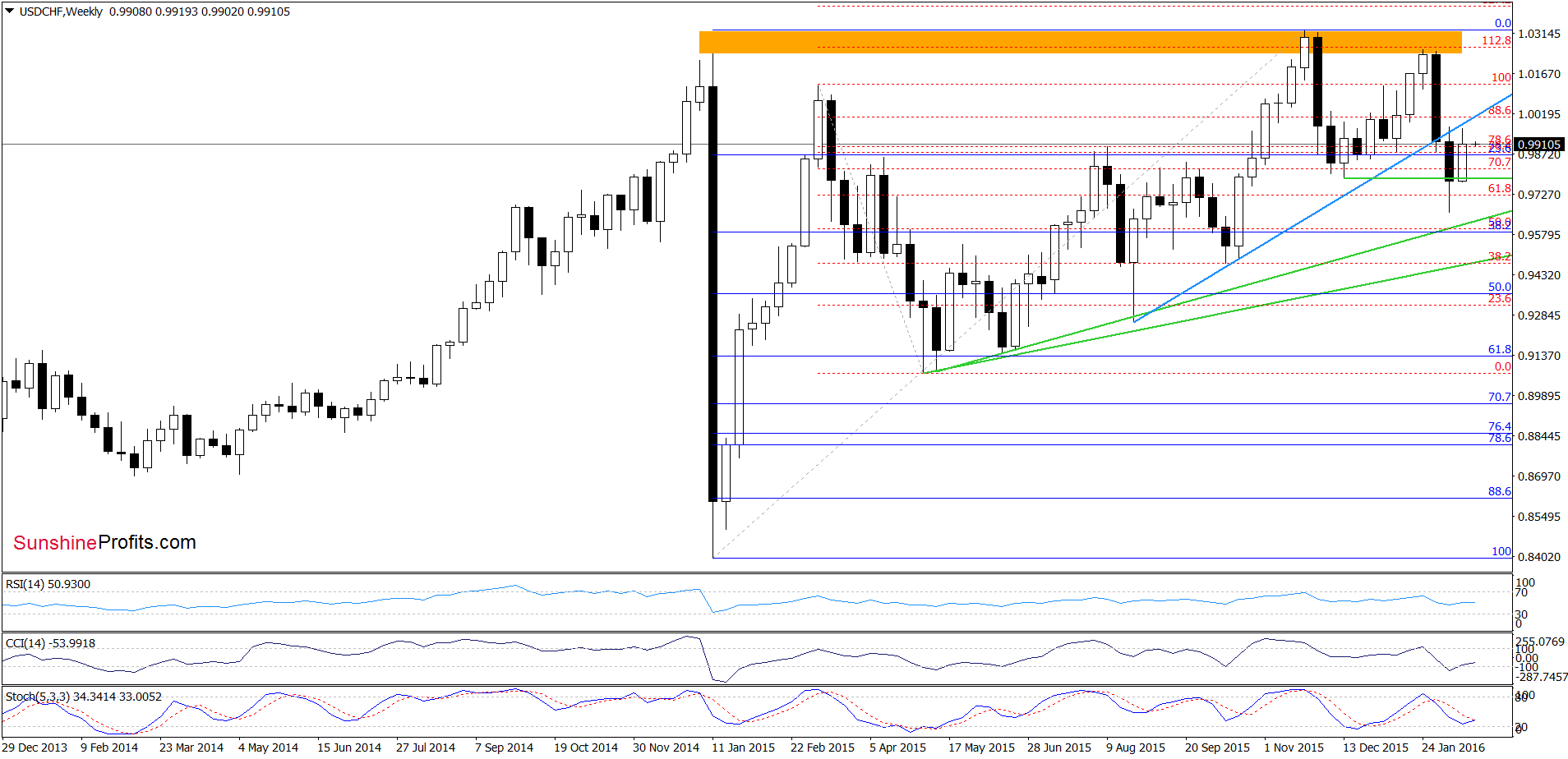

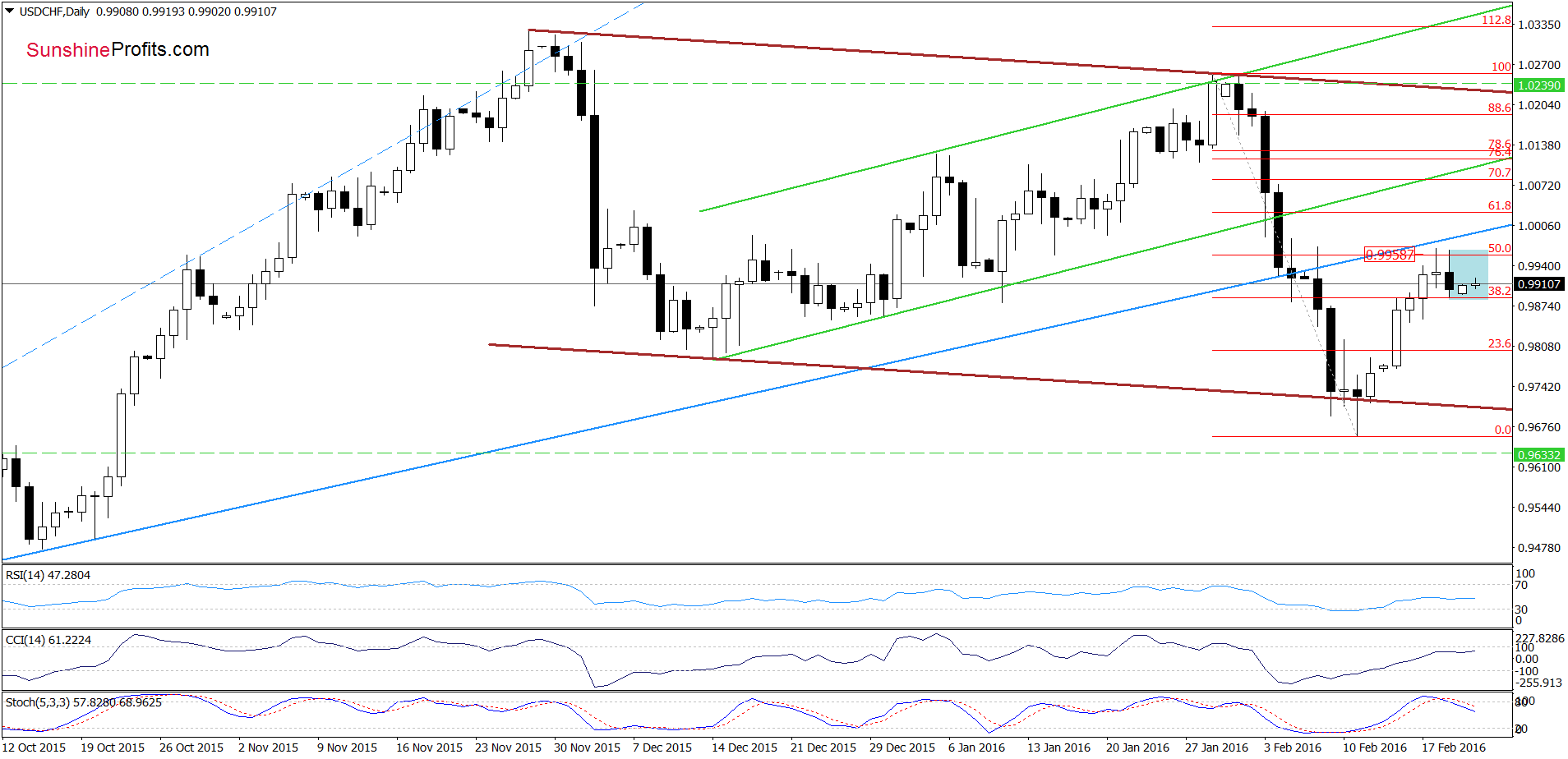

USD/CHF

On the daily chart, we see that the 50% Fibonacci retracement encouraged currency bears to act, which resulted in a pullback. With this drop the pair erased 23.6% of earlier upward move, which means that the correction is shallow and another test of the 50% Fibonacci retracement (or even the blue resistance line) in the coming day(s) is likely.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed with bullish bias

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at 0.9633 and the initial upside target at 1.0239) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts