In our opinion the following forex trading positions are justified - summary:

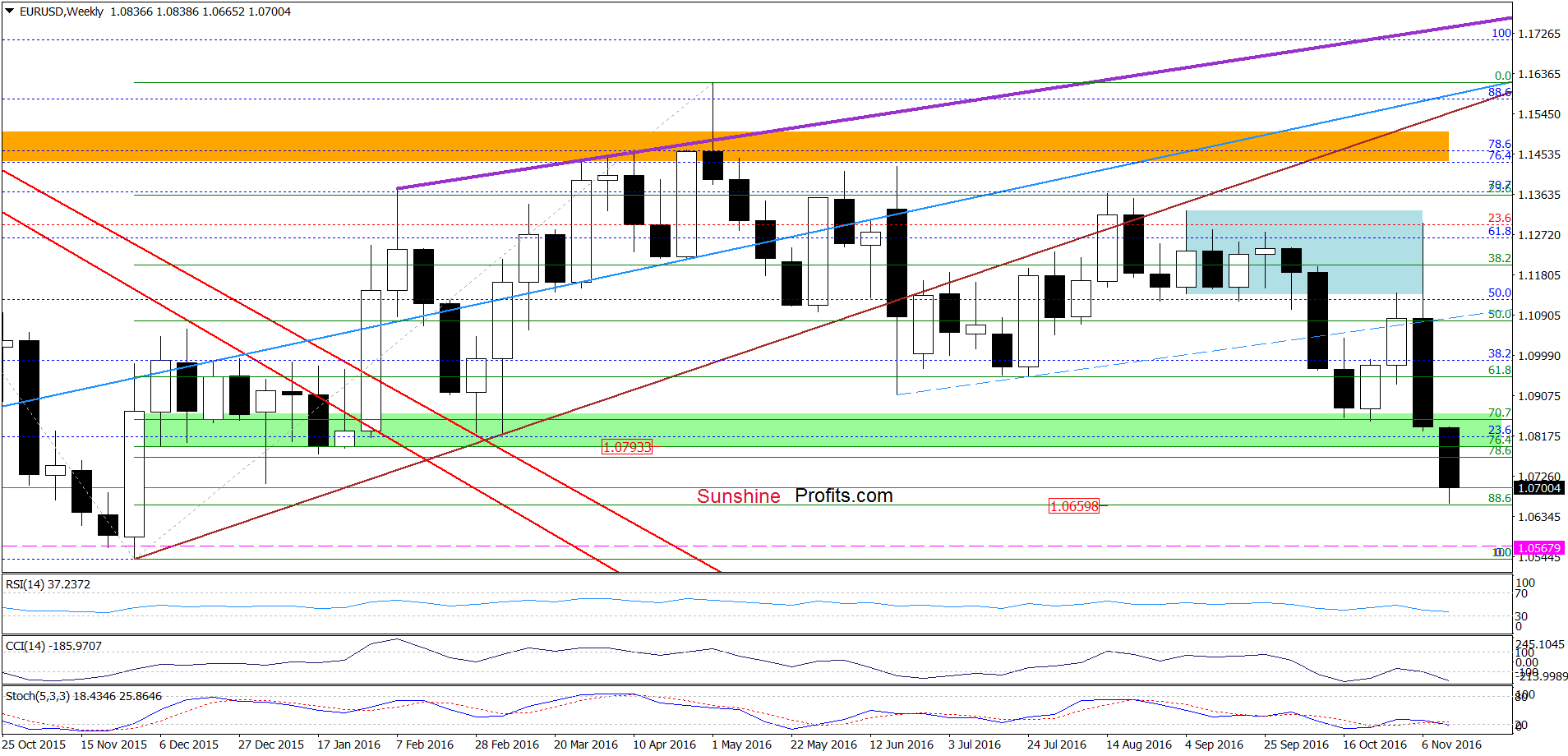

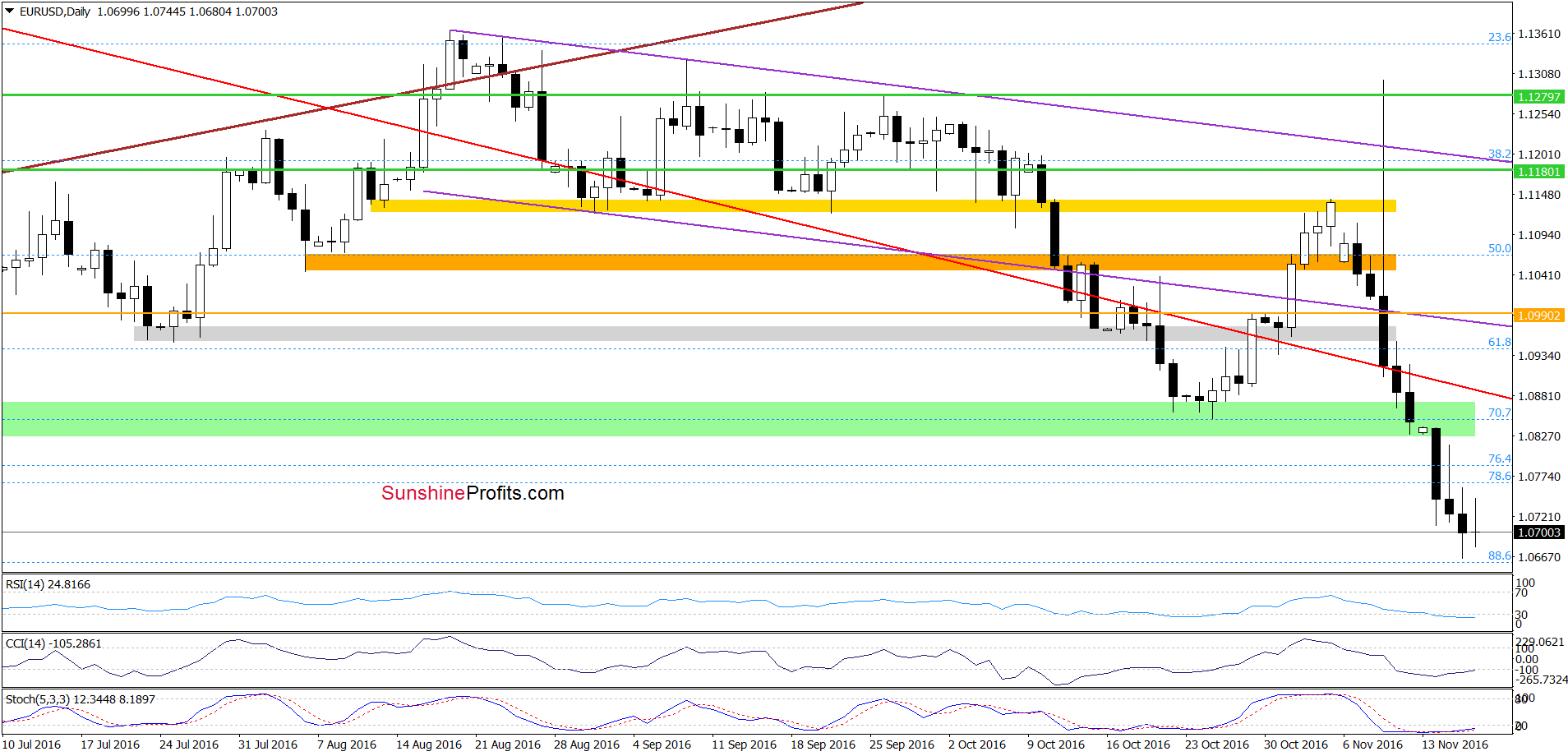

EUR/USD

Quoting our Monday’s alert:

(…) EUR/USD not only slipped to our Friday’s target, but also declined below it (…), which is a negative signal that suggests further deterioration and a test of the 88.6% Fibonacci retracement in the coming day(s).

From today’s point of view, we see that the situation developed in line with the above scenario and EUR/USD almost touched our downside target. Taking this fact into account and the current position of the daily and weekly indicators, we think that the probability of reversal is too high to keep short positions. Therefore, in our opinion, closing them and taking profits off the table (as a reminder, we opened short positions when EUR/USD was trading around 1.1024) is justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

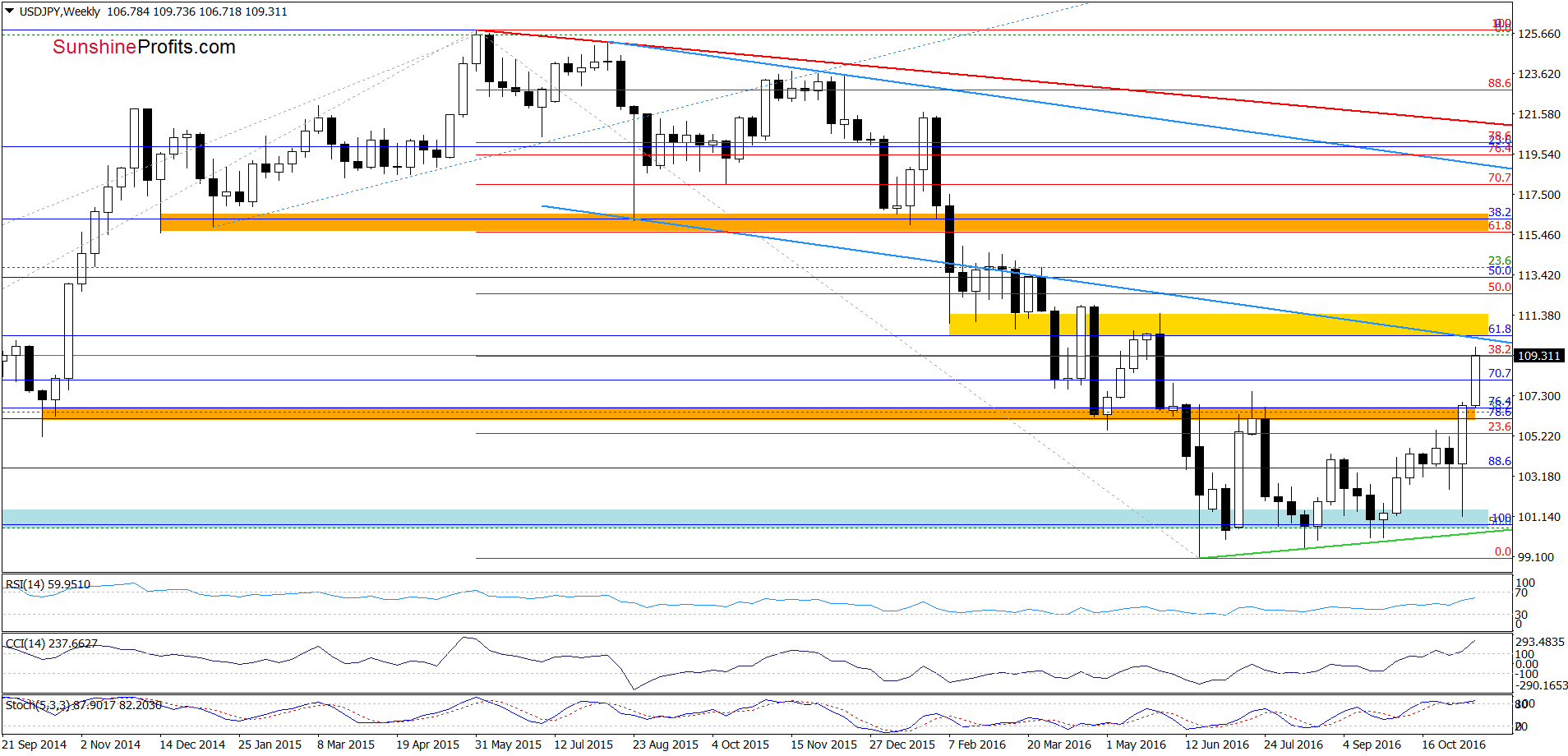

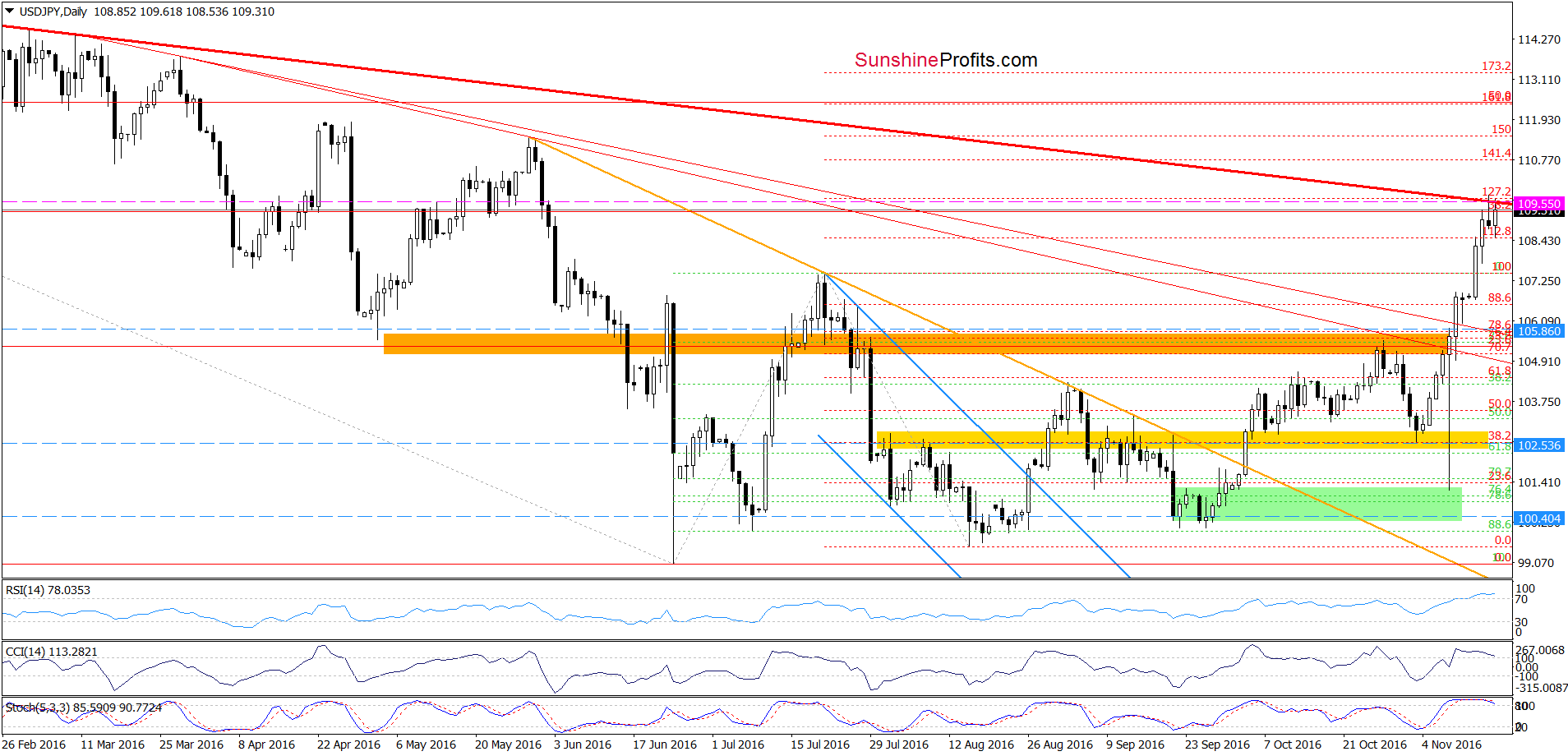

USD/JPY

On Monday, we wrote:

(…) the pair also climbed above the red resistance line (based on the March highs) and the Jul high, which suggests that we may see a rally even to the red bold resistance line (based on the Feb and March highs) around 109.55 in the coming week (this area is also reinforced by the 127.2% Fibonacci extension based on the Jul-Aug downward move and the 38.2% Fibonacci retracement based on the entire 2015-016 downward move, which increases the probability of reversal in this zone).

Looking at the daily chart, we see that currency bulls pushed USD/JPY higher (as we had expected) and the pair reached our upside target. Additionally, the RSI climbed above the level of 70, while the CCI and Stochastic Oscillator are very close to generating sell signals, which suggests that reversal and lower values of the exchange rate are just around the corner. If this is the case and the pair moves lower from here, we’ll likely see a comeback to the previously-broken Jul high.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

On Monday, we wrote the following:

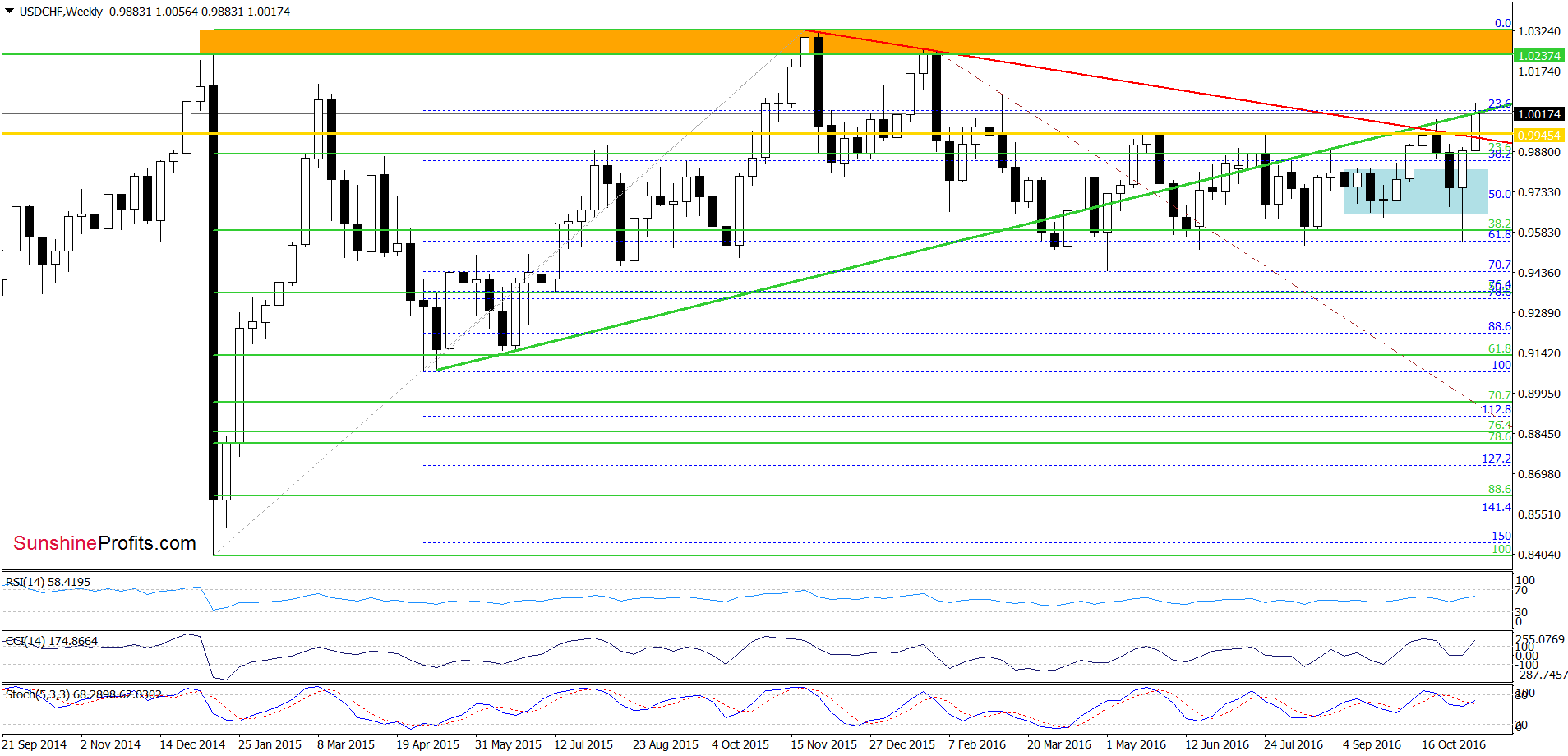

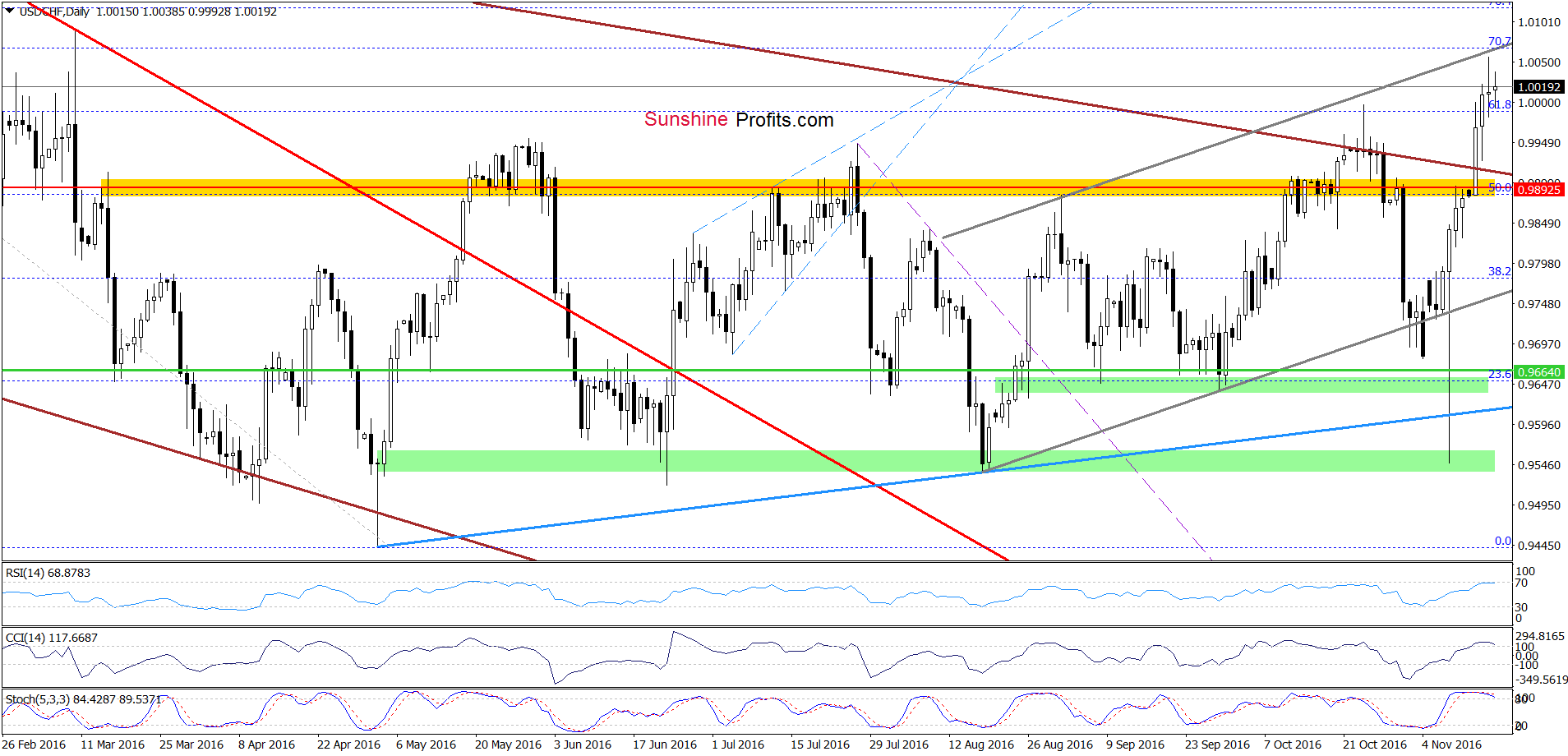

(…) we may see a rally to around 1.0020 (the previously-broken green line marked on the weekly chart, which serves now as the nearest resistance) or even to 1.0056, where the upper border of the grey rising trend channel (seen on the daily chart) currently is.

On the above charts, we see that the situation developed in line with our assumptions and USD/CHF climbed to the previously-broken green resistance line. Additionally, the pair almost touched the upper border of the grey rising trend channel, which in combination with the current position of the daily indicators (they are overbought and very close to generating sell signals) increases the probability of reversal in very near future. Therefore, in our opinion, closing long positions and taking profits off the table (we opened them when USD/CHF was trading around 0.9776) is the best decision at the moment. Nevertheless, if we see bullish developments (like a breakout above the grey line) we’ll consider re-opening long positions.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts