Earlier today, the USD Index extended losses and hit a fresh Oct low of 94.67 as the minutes of the Federal Reserve's latest meeting continued to weigh on investors' sentiment. Thanks to these circumstances, EUR/USD extended gains and reached the key resistance zone. What’s next?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1887; the downside target around 1.0938)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

Quoting our previous commentary:

(…) EUR/USD moved above (…) the orange resistance zone (…), which suggests a test of the barrier of 1.400, where the 50% Fibonacci retracement is

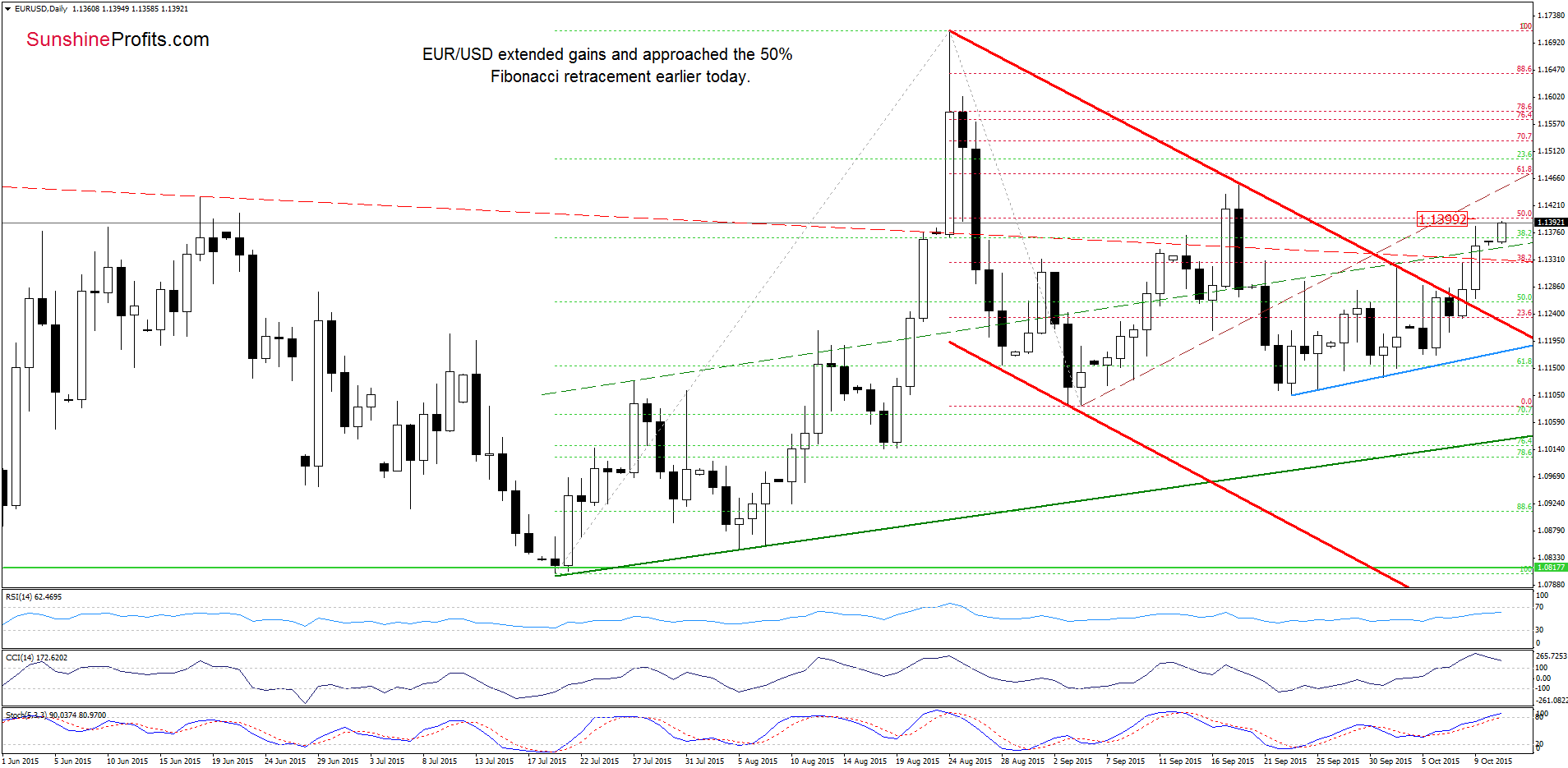

As you see on the chart, the situation developed in line with the above scenario and EUR/USD extended gains, approaching the barrier of 1.400 and the 50% Fibonacci retracement earlier today.

Will we see further improvement? Let’s examine the weekly chart and find out what can we infer from it.

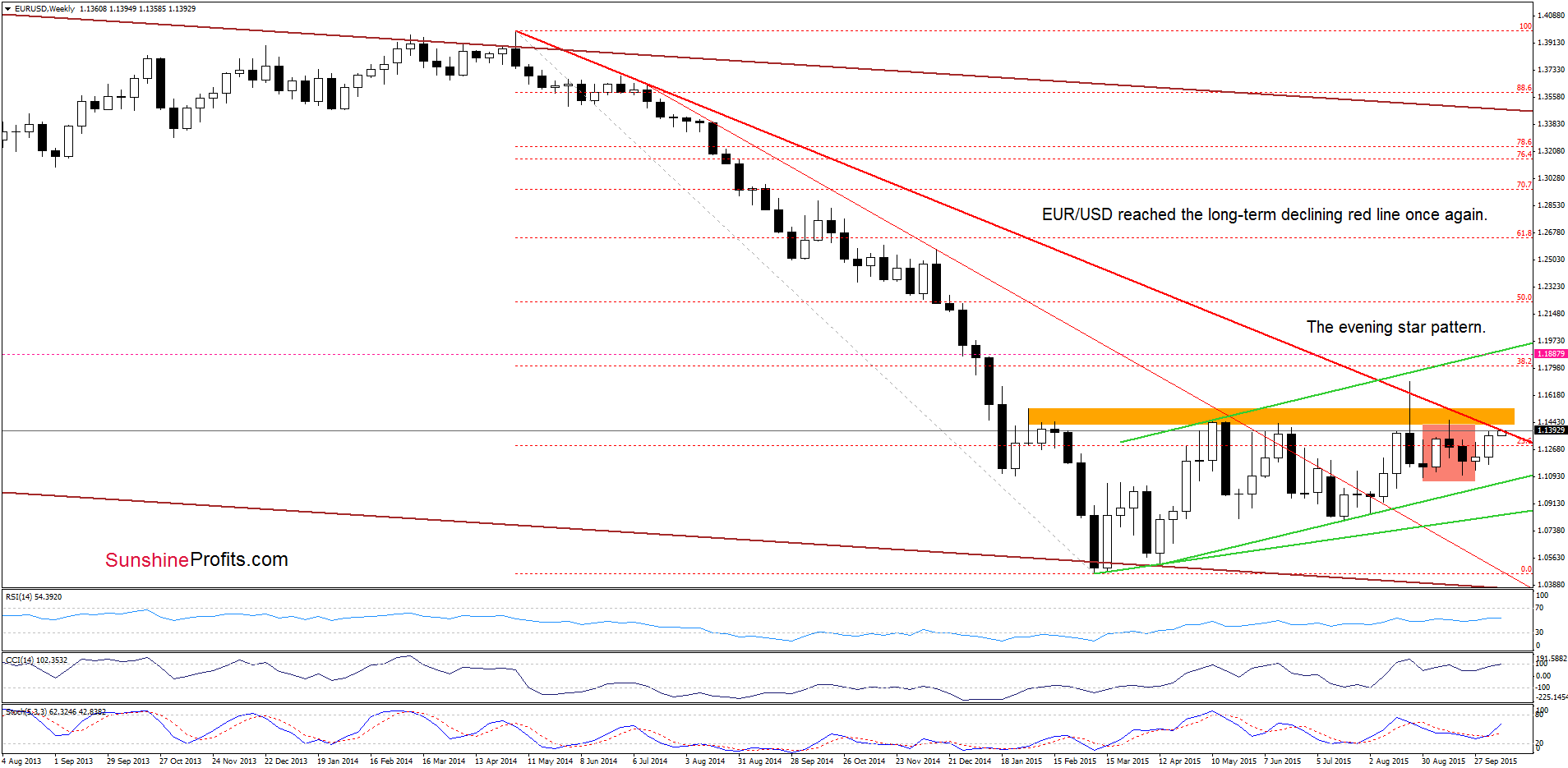

From this perspective we see that the exchange rate reached the long-term red declining resistance line and re-approached the orange resistance zone (reinforced by the bearish evening pattern). In previous weeks this area was strong enough to stop currency bulls and trigger a pullback, which suggests that we’ll likely see similar price action in the coming days. This scenario is also reinforced by the current position of daily indicators (the Stochastic Oscillator climbed above the level of 80, while the CCI is overbought and we can notice a negative divergence between the indicator and the exchange rate). All the above suggests that the space for further gains is limited and reversal is just around the corner.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1887 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

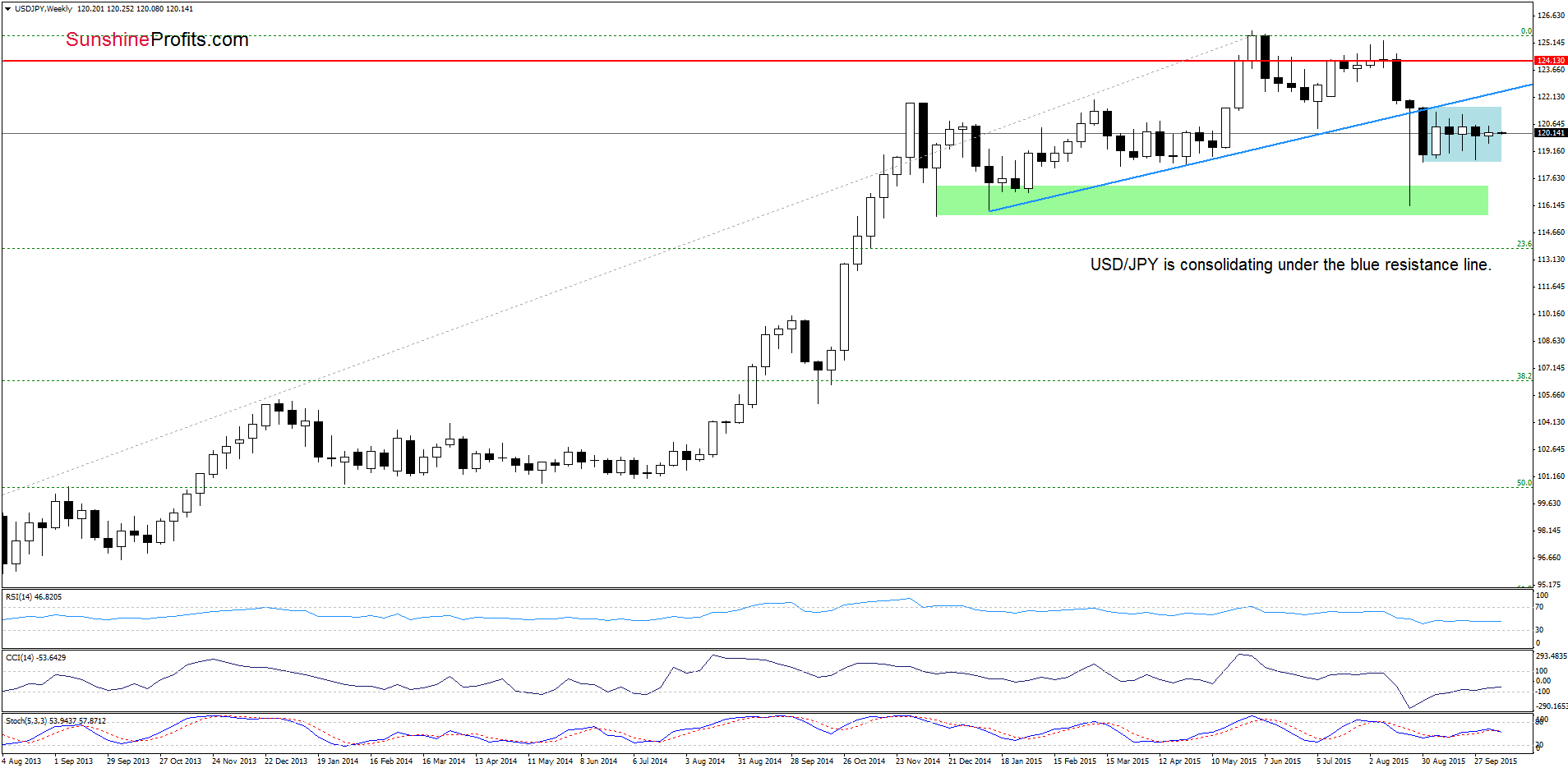

The medium-term picture hasn’t changed much as the exchange rate is still trading in the consolidation under the blue resistance line. Will the daily chart give us more clues about future moves? Let’s check.

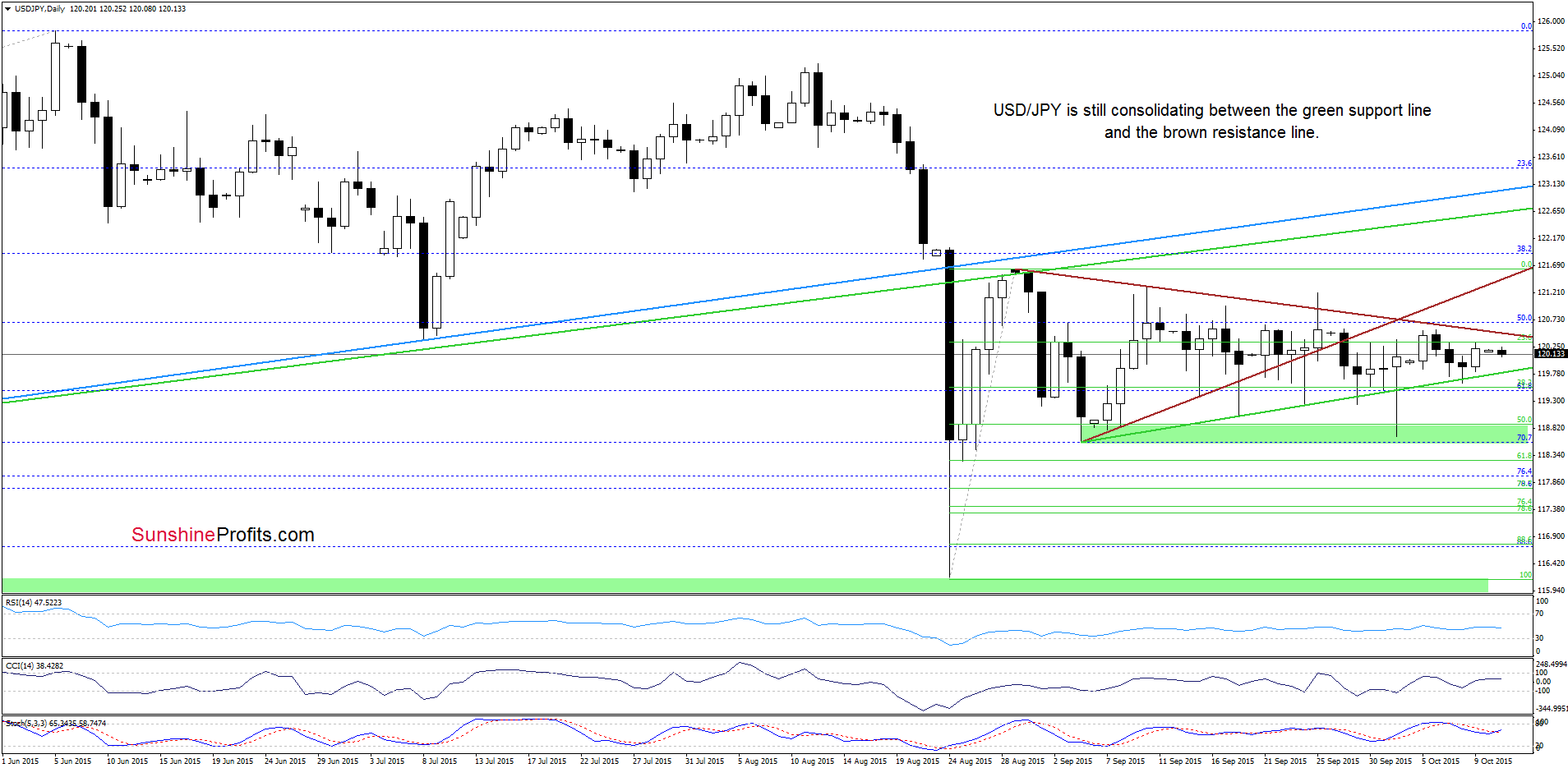

Looking at the daily chart from today’s point of view, we see that the situation in the very short term also hasn’t changed much as USD/JPY remains between the green support line and the brown resistance line. This means that our last commentary on this currency pair is still up-to-date:

(…) we think that as long as there is no successful breakout above brown resistance lines or a breakdown below the green line, another sizable move is not likely to be seen and short-lived moves in both directions should not surprise us.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

Earlier today, AUD/USD broke above the last week’s high, which suggests that we’ll see a realization of our Friday’s scenario in the coming day(s):

(…) AUD/USD extended gains and climbed above the upper border of the previously-broken green zone, invalidating earlier breakdown. This is a positive signal that suggests further improvement and a test of the medium-term orange declining resistance line (currently around 0.7433) in the coming week.

(…) AUD/USD not only climbed to the Sep high, but also broke above it earlier today. This is a bullish signal, which suggests an increase to around 0.7385-0.7438, where the orange resistance zone (created by the 38.2% Fibonacci retracement and the Aug highs) is.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts