In recent days, the British pound moved lower against the greenback, which resulted in a comeback below the long-term resistance line. Earlier today, the pair slipped to the short-term support, but will it manage to stop currency bears in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1510)

- GBP/USD: short (a stop-loss order at 1.3773; the next downside target at 1.3000)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

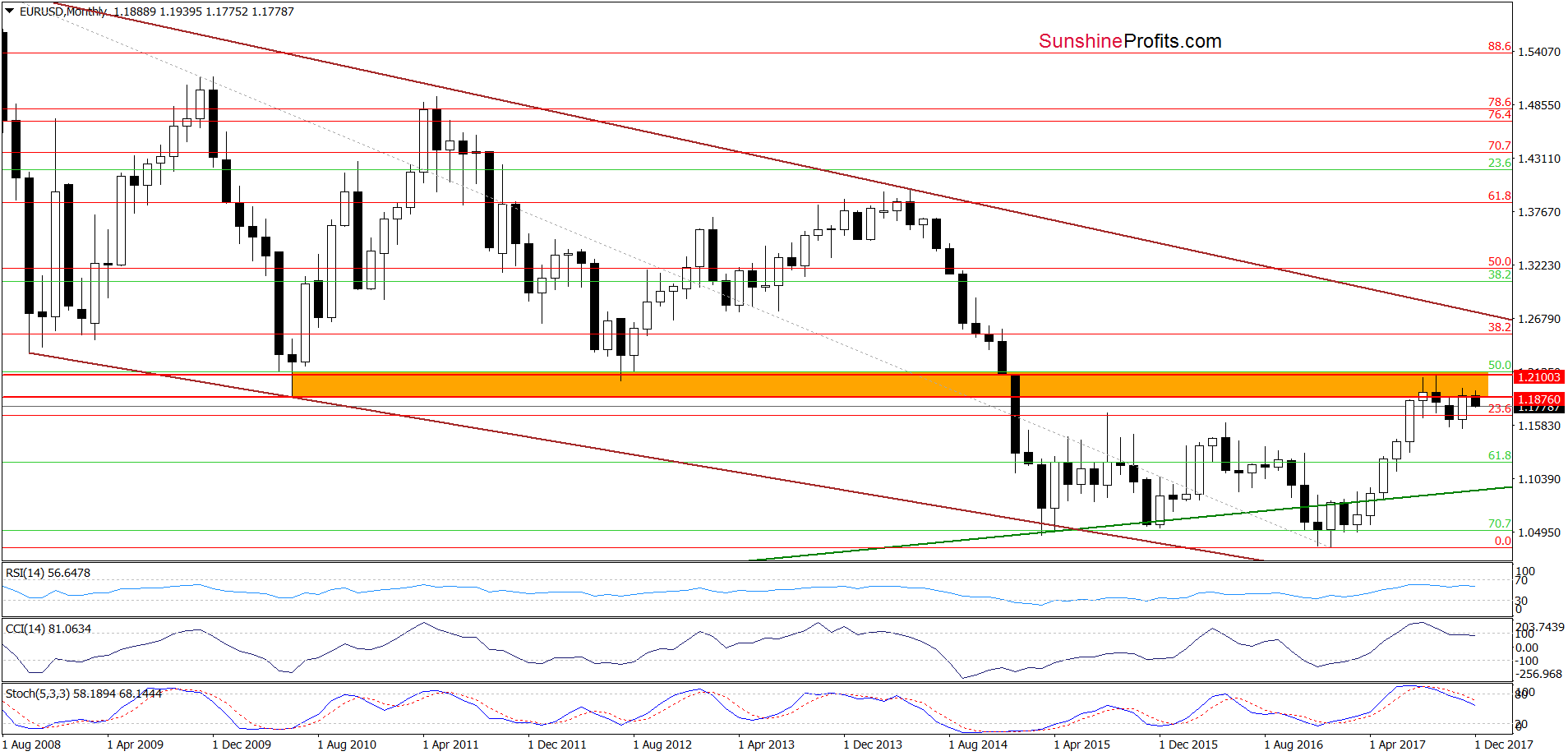

EUR/USD

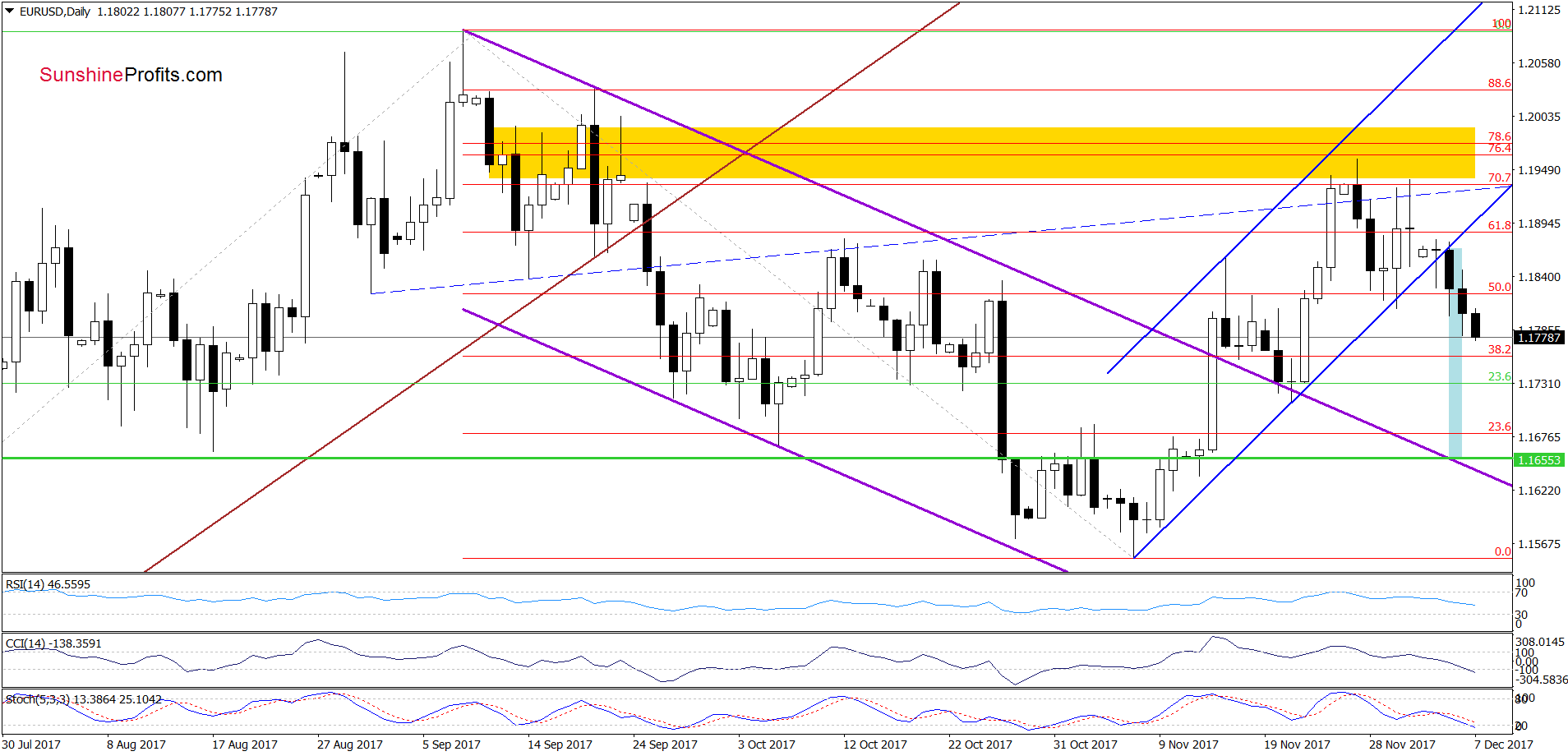

Looking at the above charts, we see that EUR/USD extended losses and slipped under Wednesday’s low earlier today, which together with the sell signals generated by the indicators means that what we wrote on Tuesday remains up-to-date:

(…) In our opinion, if EUR/USD drops under the lower border of the blue rising trend channel, the first downside target will be around 1.1732, where the November 22 low is. If this area is broken, the next target will be the previously-broken upper line of the purple declining trend channel seen on the daily chart (currently around 1.1660).

Trading position (short-term; our opinion): profitable short positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1510) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

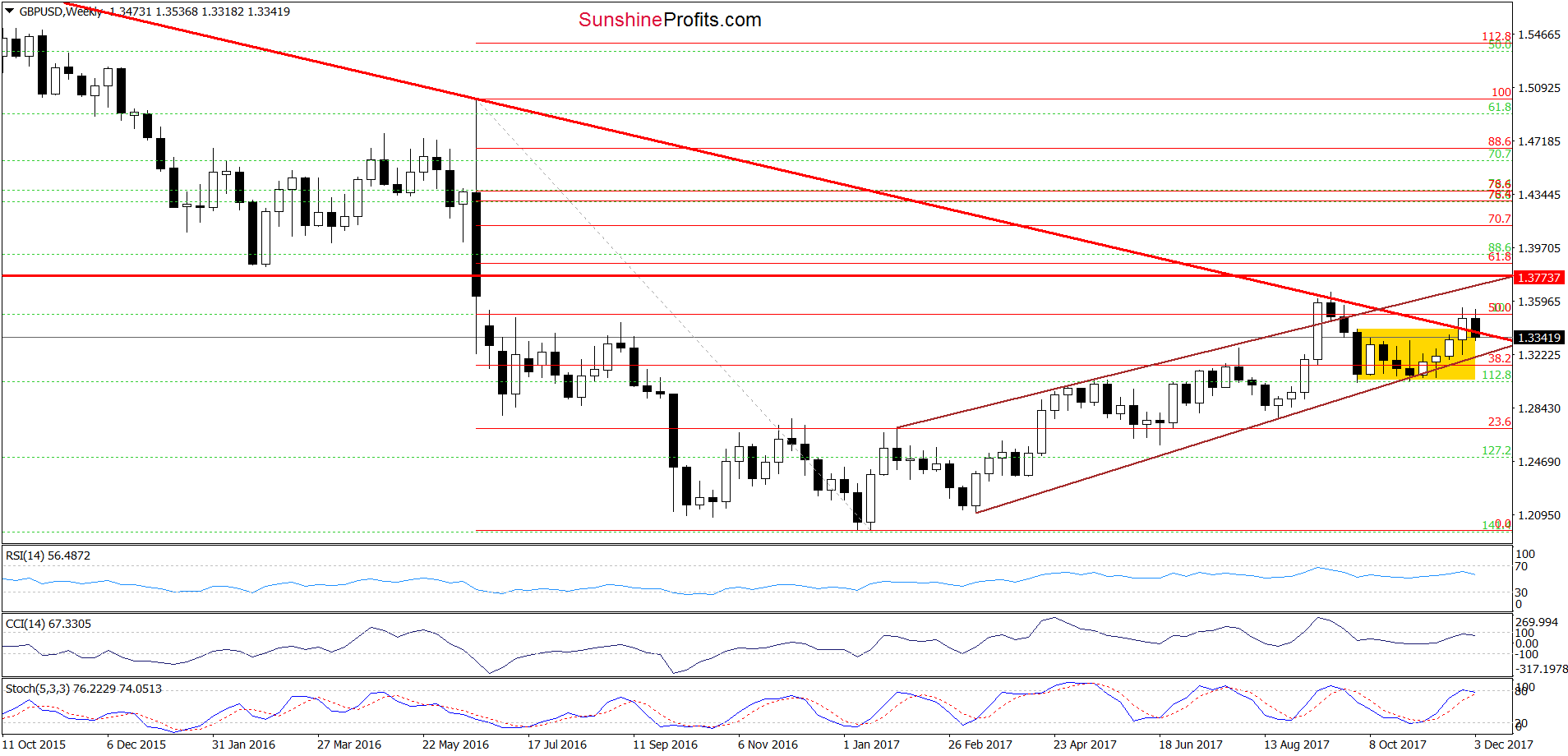

GBP/USD

The first thing that catches the eye on the medium-term chart is an invalidation of the breakout above the long-term ed declining support/resistance line. Although the pair didn’t close the week yet, the current position of the indcators suggests that further deterioration is just around the corner.

This scenario is also reinforced by the very shrt-term picture below.

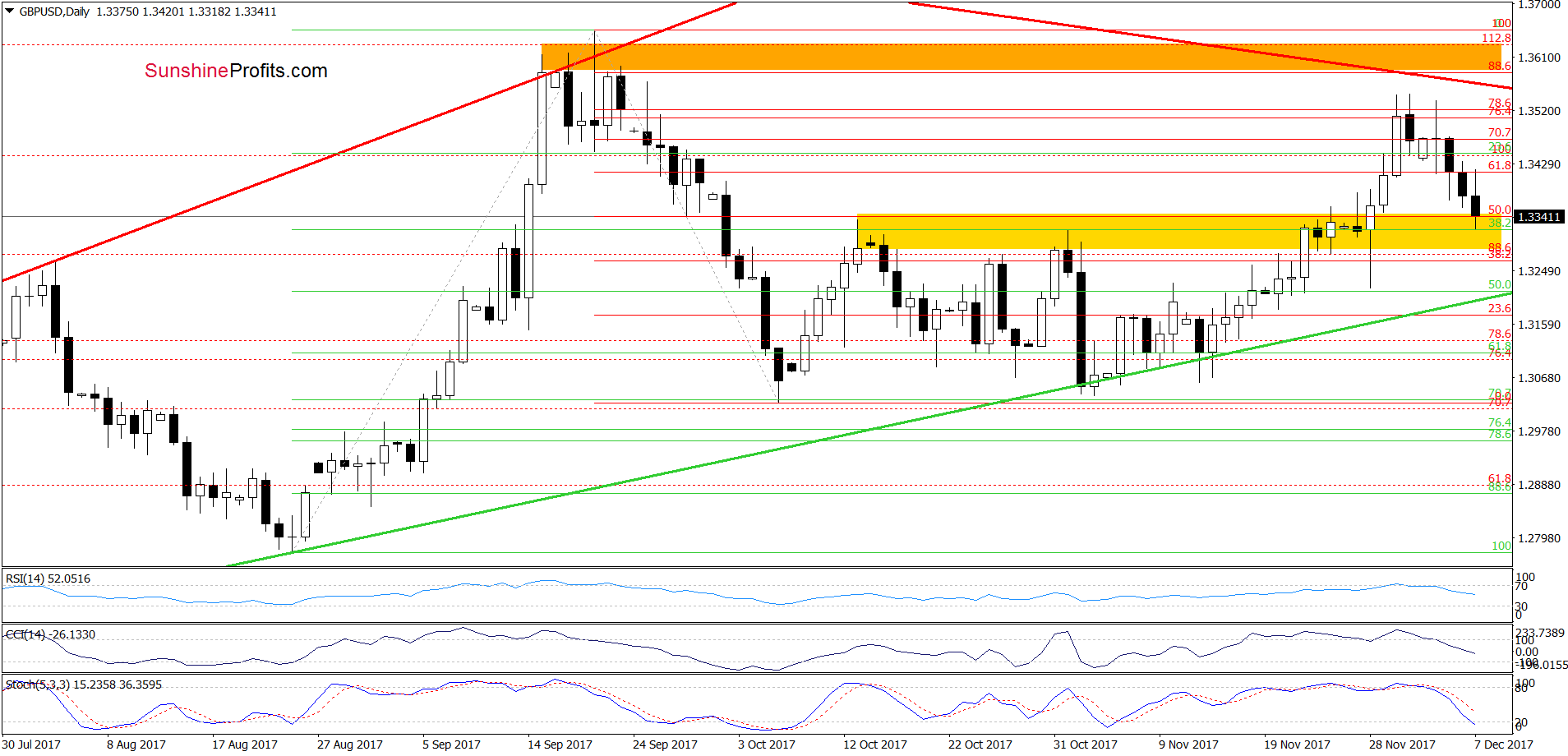

From the daily perspective, we see that the proximity to the orange resistance line in combination with the sell signals generated by the indicators encouraged currency bears to act, which triggered a downward move in recent days. As a result, the exchange rate came back to the previously-broken yellow zone based on the mid-October and the early November peaks earlier today. Although this area could trigger a rebound, the sell signals generated by the daily indicators are still in cards, suporting currency bears and further deterioration in the coming days.

Therefore, in our opinion, if this is the case and GBP/USD moves lower from current levels, we’ll likely see not only another test of the green support line seen on the daily chart, but also a drop to the October and November lows in the following days.

Trading position (short-term; our opinion): profitable short positions (with a stop-loss order at 1.3773 and the next downside target at 1.3000) continue to be justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

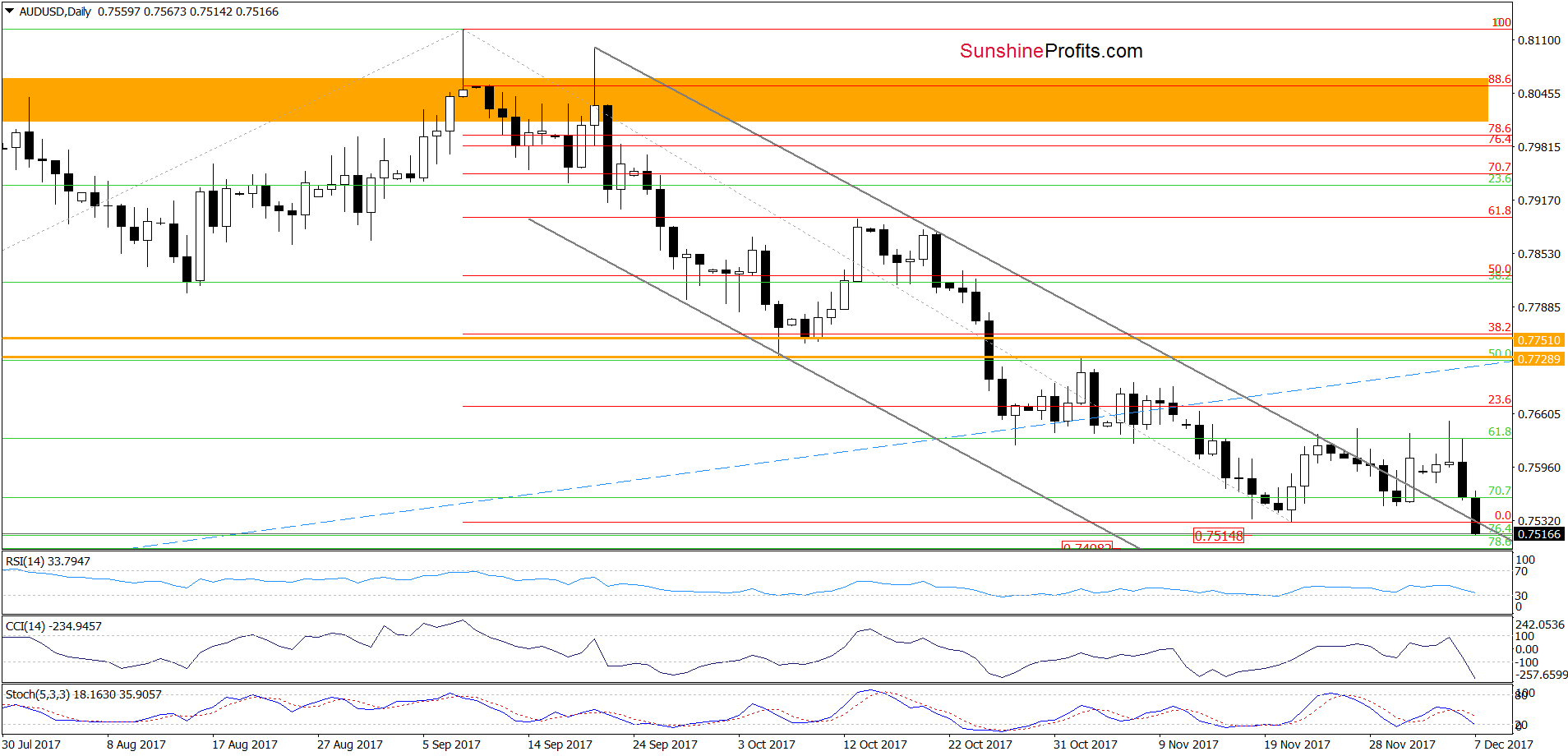

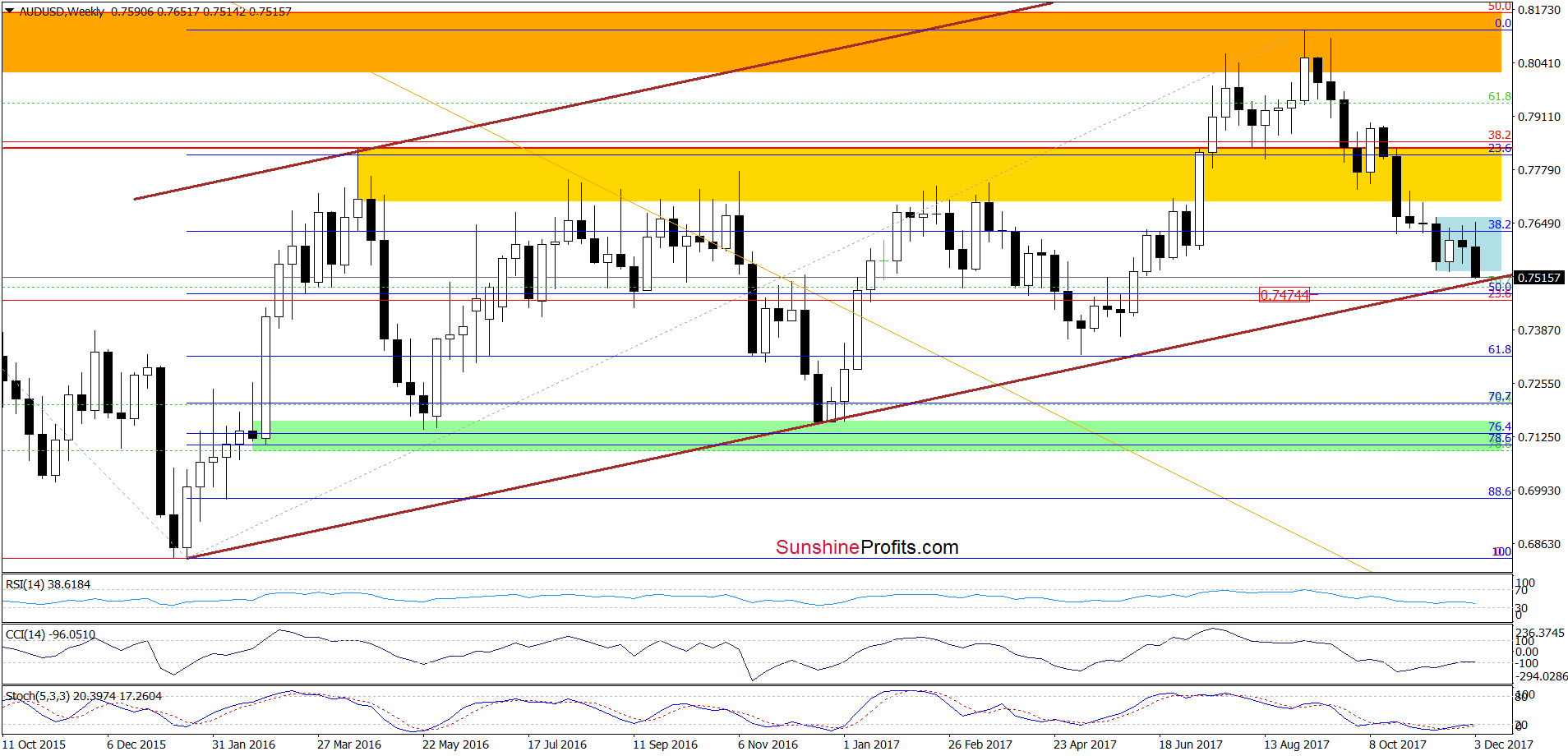

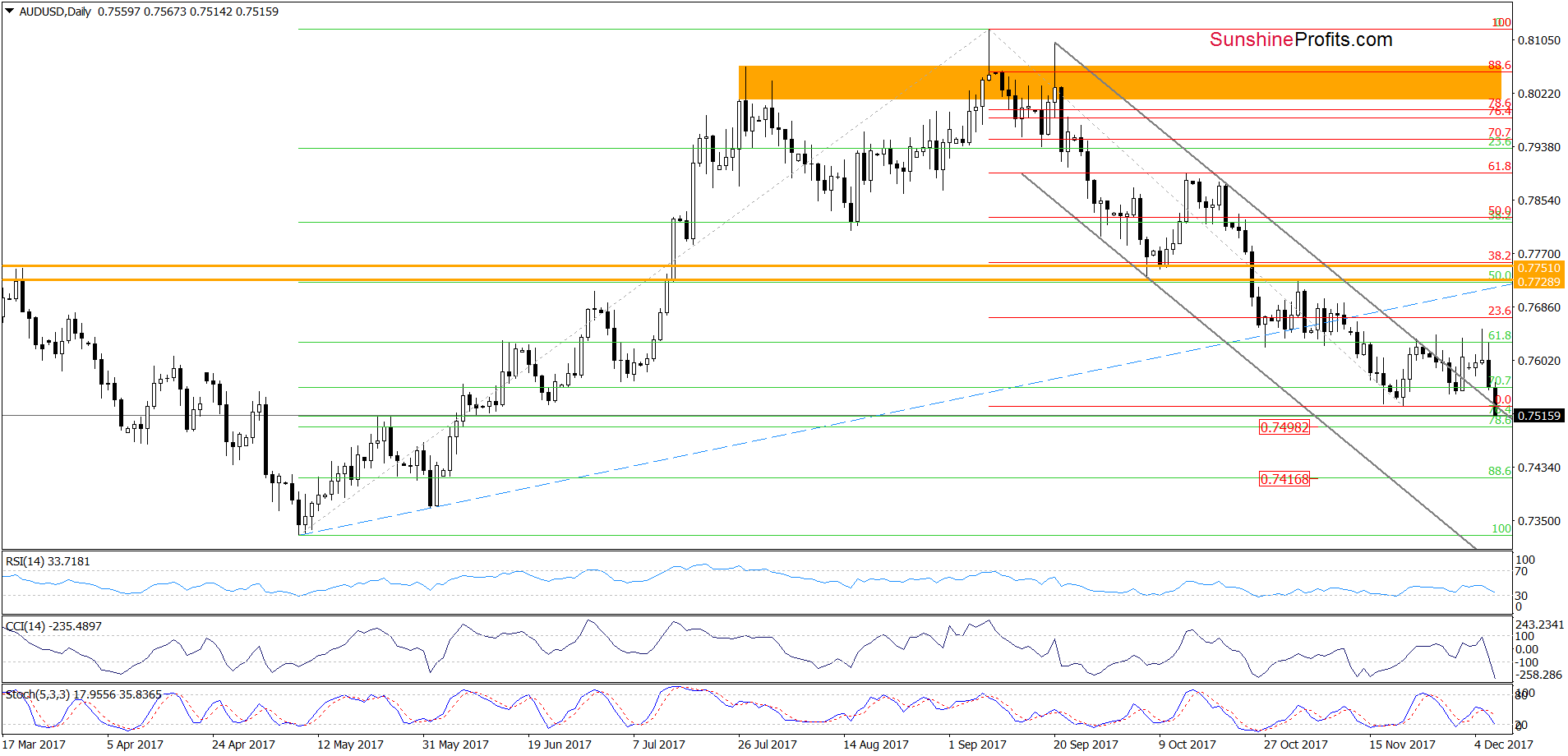

In our last commentary on this currency pair, we wrote the following:

(…) AUD/USD broke above the upper border of grey declining trend channel. Although this is a positive sign, the size of the upward move is quite small (compared to the importance of such breakout), which suggests that currency bulls may not be as strong as it seems at the first sight. At this point it is also worth noting that the rebound didn’t even reach the 23.6% Fibonacci retracement, which increases doubts about bulls’ strength.

Taking these facts into account, we think that the pair will reverse and decline in the coming days. How low could it go? In our opinion, we’ll see a test of the previously-broken upper border of grey declining trend channel and the recent lows in the coming days.

From today’s point of view, we see that the situation developed in line with the above scenario and AUD/USD not only reached, but also slipped slightly below our downside targets. What’s next? Taking into account the above-mentioned breakdown and the sell signals generated by the indicators, we believe that the pair will test the lower border of the brown rising trend channel (seen on the chart below) in the very near future.

Nevertheless, if currency bulls fail in this area and AUD/USD breaks below this support line, we may see a decline even to around 0.7420 where the 88.6% Fibonacci retracement (based on the entire May-September upward move) is (we marked it on the daily chart below).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts