Disappointment - this is the only word, which describes currency bulls’ “action” during yesterday’s session. Despite favorable circumstances from previous days, they allowed their opponents to create a new 2018 low. Is there still a chance to stop the bears on their road to the south?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3221; the next downside target at 1.2790)

- USD/CHF: none

- AUD/USD: none

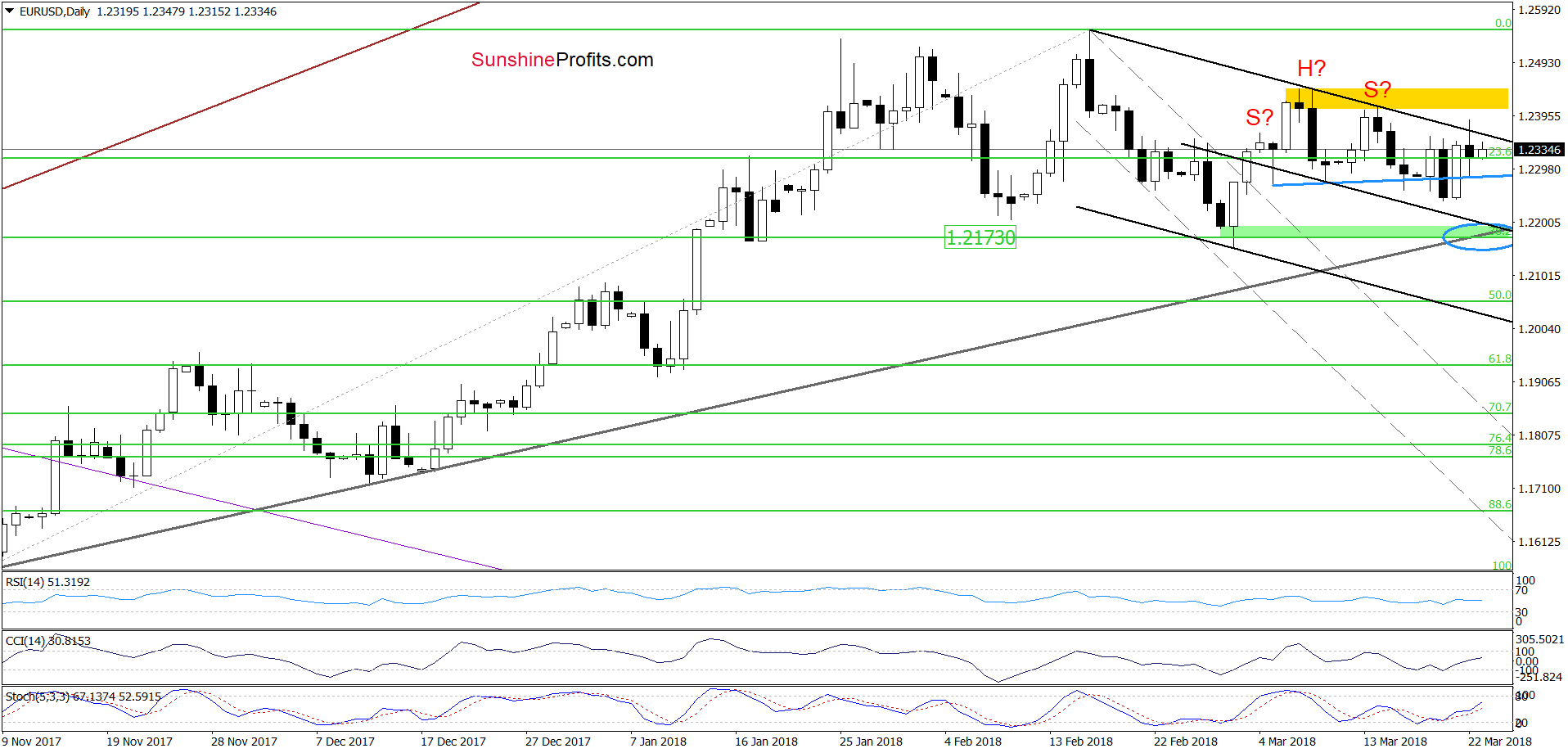

EUR/USD

Quoting our previous Forex Trading Alert:

(…) the exchange rate came back to the north and re-tested the strength of the black declining resistance line based on the previous highs.

(…) this nearest resistance stopped the buyers, triggering a pullback and an invalidation of the tiny breakout earlier today. This is a negative event, which suggests a drop to the blue line (…) in the following days.

Looking at the daily chart, we see that the situation developed in line with the above scenario and the exchange rate slipped to our first downside target. As you see the blue support line encouraged currency bulls to act, which resulted in a rebound. Earlier today, the pair extended gains, which suggests another test of the black declining resistance line.

Although the buy signals generated by the indicators remain in the cards, supporting further improvement, we think that as long as the pair is trading under the yellow resistance zone (created by the previous highs) another reversal and a re-test of the above-mentioned blue support line is very likely.

When can we expect a bigger move to the downside?

In our opinion, such price action will be more likely and reliable if EUR/USD declines under the green support zone (created by the 38.2% Fibonacci retracement and the March low and reinforced by the medium-term black rising support line based on the November and December lows). Until this time, short-lived moves in booth directions should not surprise us.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

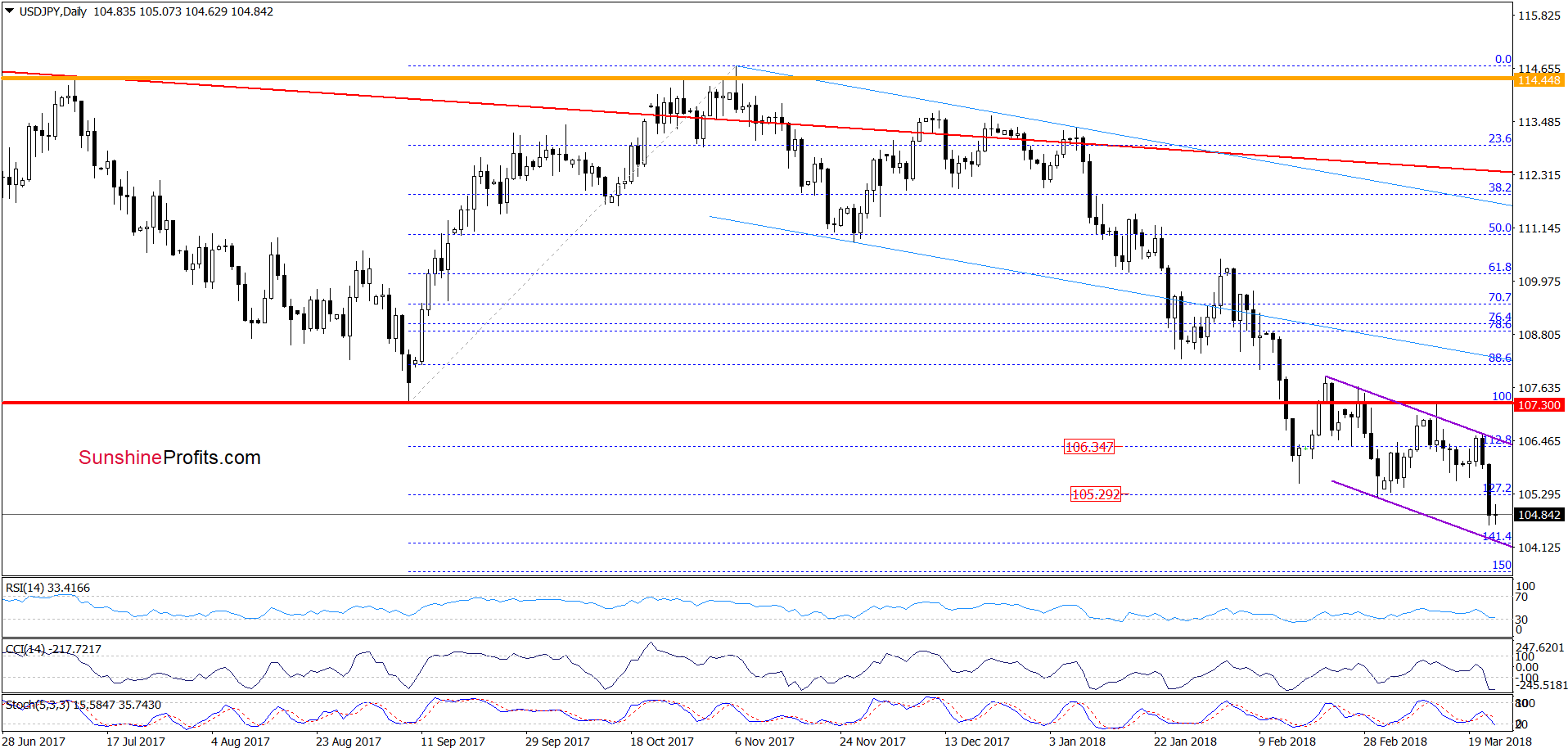

USD/JPY

Looking at the daily chart, we see that USD/JPY moved sharply lower yesterday, which resulted in a decline to a fresh 2018 low of 104.62. Thanks to this price action, the exchange rate crossed out its chances for a reverse head and shoulders formation, which together with the sell signals generated by the indicators suggests that one more downswing is likely.

If this is the case and the pair extends losses from here, the initial downside target will be the lower border of the purple declining trend channel and the 141.4% Fibonacci extension.

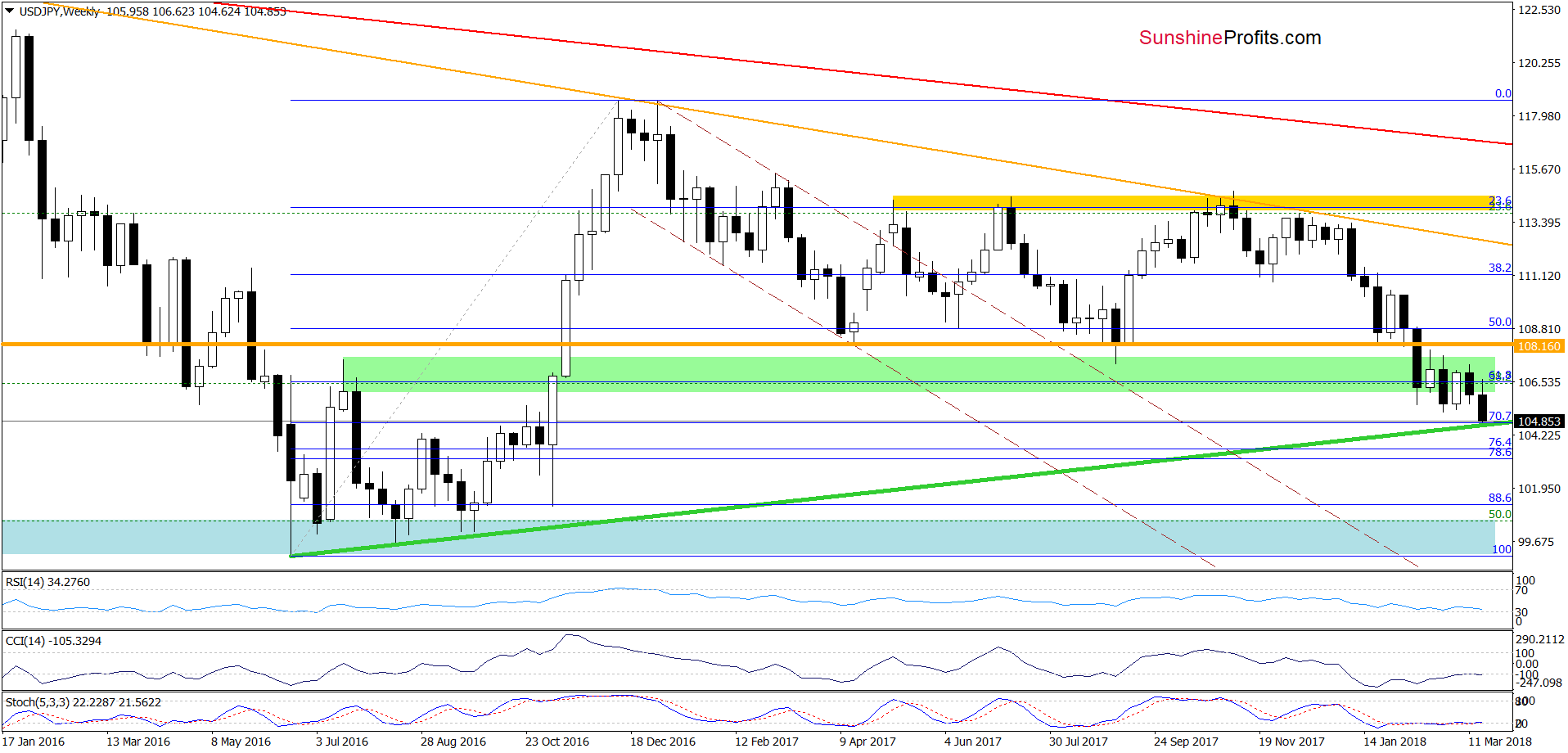

Will these supports manage to stop currency bears? At the first sight they seem to weak, but when we zoom out the chart, we’ll see one more bulls’ ally.

From this perspective, we see that the exchange rate slipped to the long-term green support line earlier this week, which in combination with the position of the medium-term indicators (they are oversold for some time) increase the probability of reversal and rebound in the coming week.

Nevertheless, if the bulls fail, the way to (at least) the next support area (created by the 76.4% and 78.6% Fibonacci retracements) will be open.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

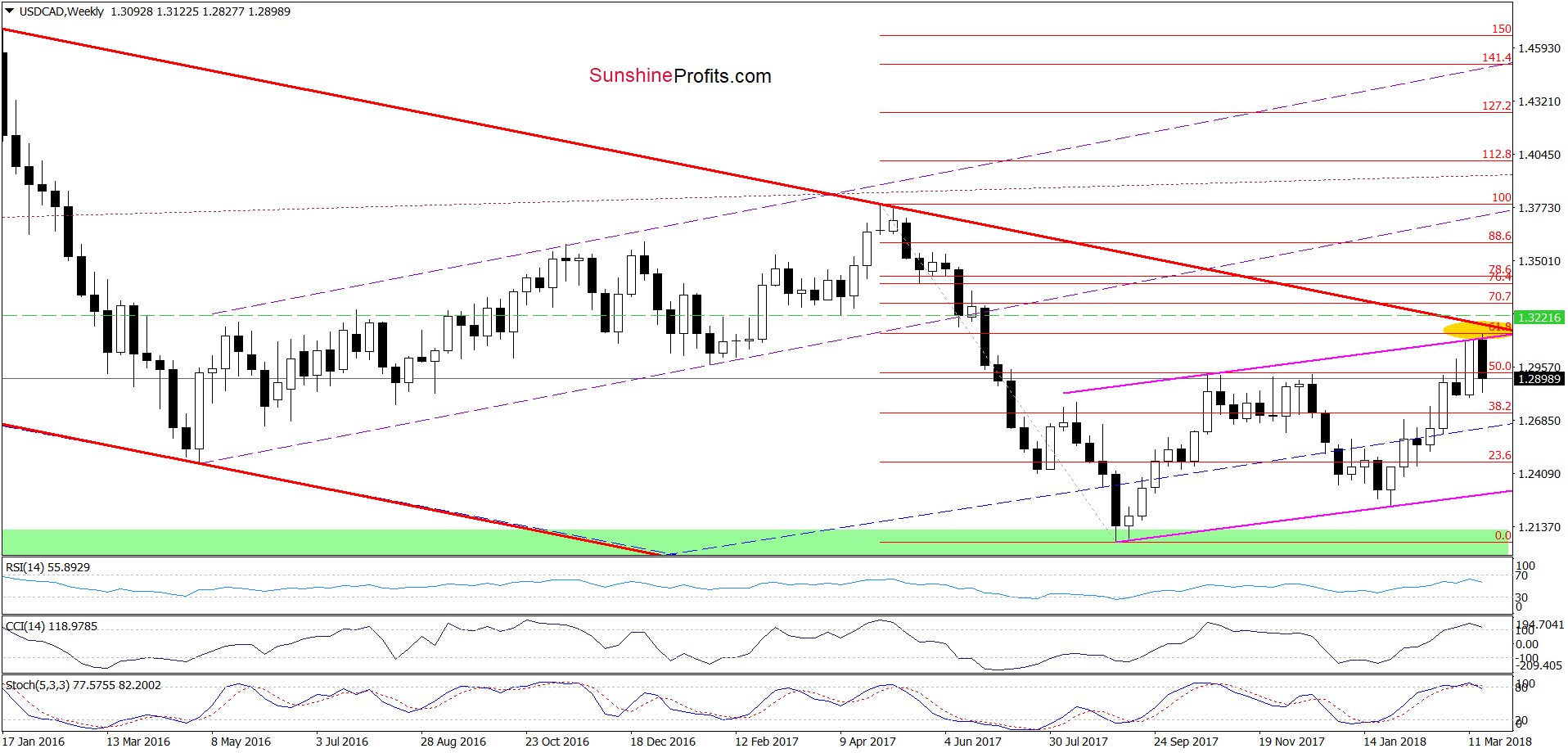

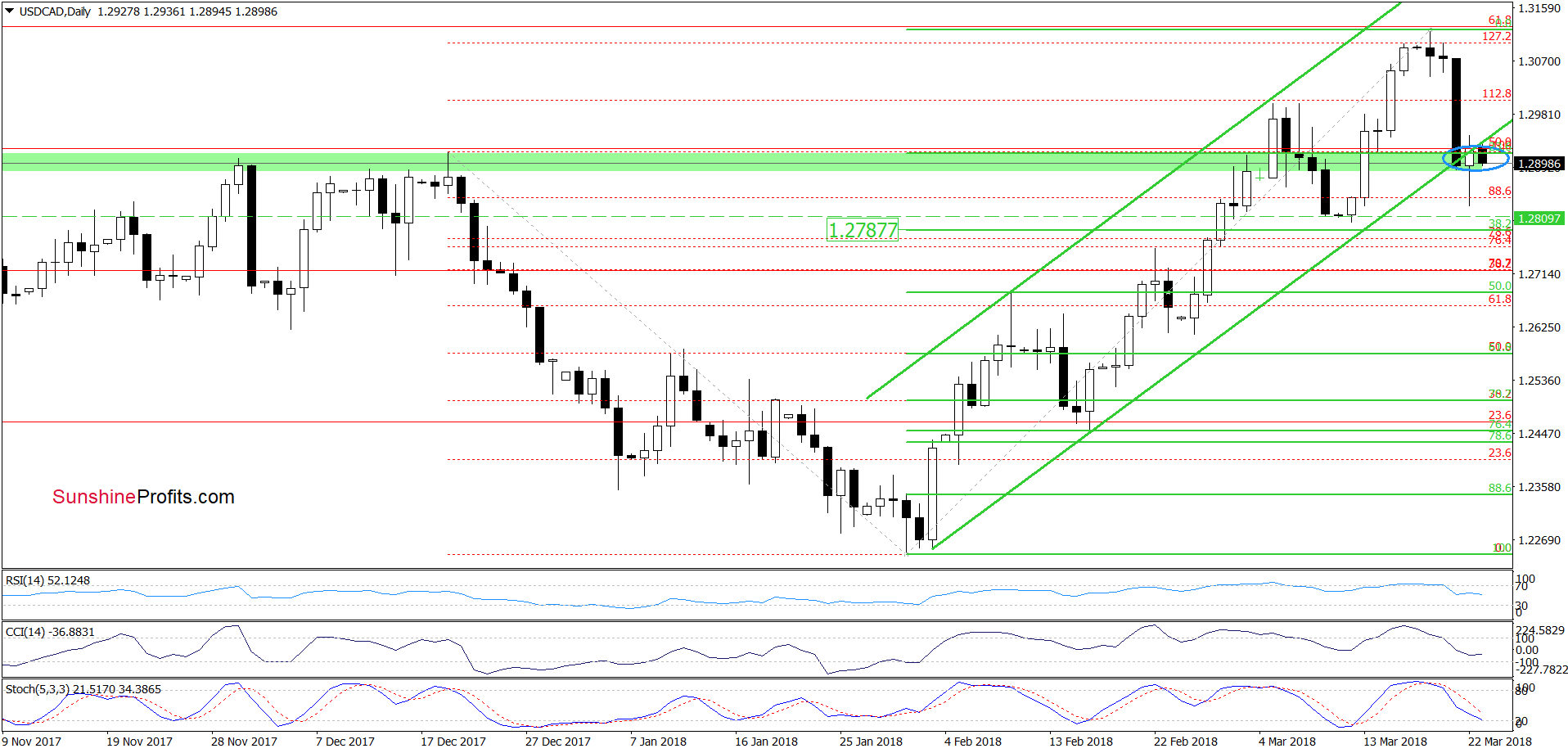

USD/CAD

In our Forex Trading Alert posted on Monday, we wrote the following:

(…) How low could USD/CAD go?

In our opinion, the initial downside target will be the lower border of the green rising trend channel marked on the daily chart (currently around 1.2875). However, if this support is broken, we’ll likely see a test of the March lows (around 1.2800-1.2813) in the following days.

From today’s point of view, we see that UD/CAD moved sharply lower in recent days, not only reaching, but also breaking below our first downside target. Although the pair rebounded yesterday, this move looks like a verification of the earlier breakdown under the lower border of the green rising trend channel, which together with the sell signals generated by the indicators indicate that we’ll see a decline to our next downside target - the March lows or even the 38.2% Fibonacci retracement in the coming week.

Trading position (short-term; our opinion): Profitable short positions (with a stop-loss order at 1.3221 and the next downside target at 1.2790 are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts