The recent price action in USD/CHF we can summarize in one simple word: consolidation. Are there any important technical factors, which can encourage currency bulls or bears to act in the coming week?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2806; the initial downside target at 1.2186)

- GBP/USD: short (a stop-loss order at 1.4548; the next downside target at 1.3685)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.8222; the initial downside target at 0.7743)

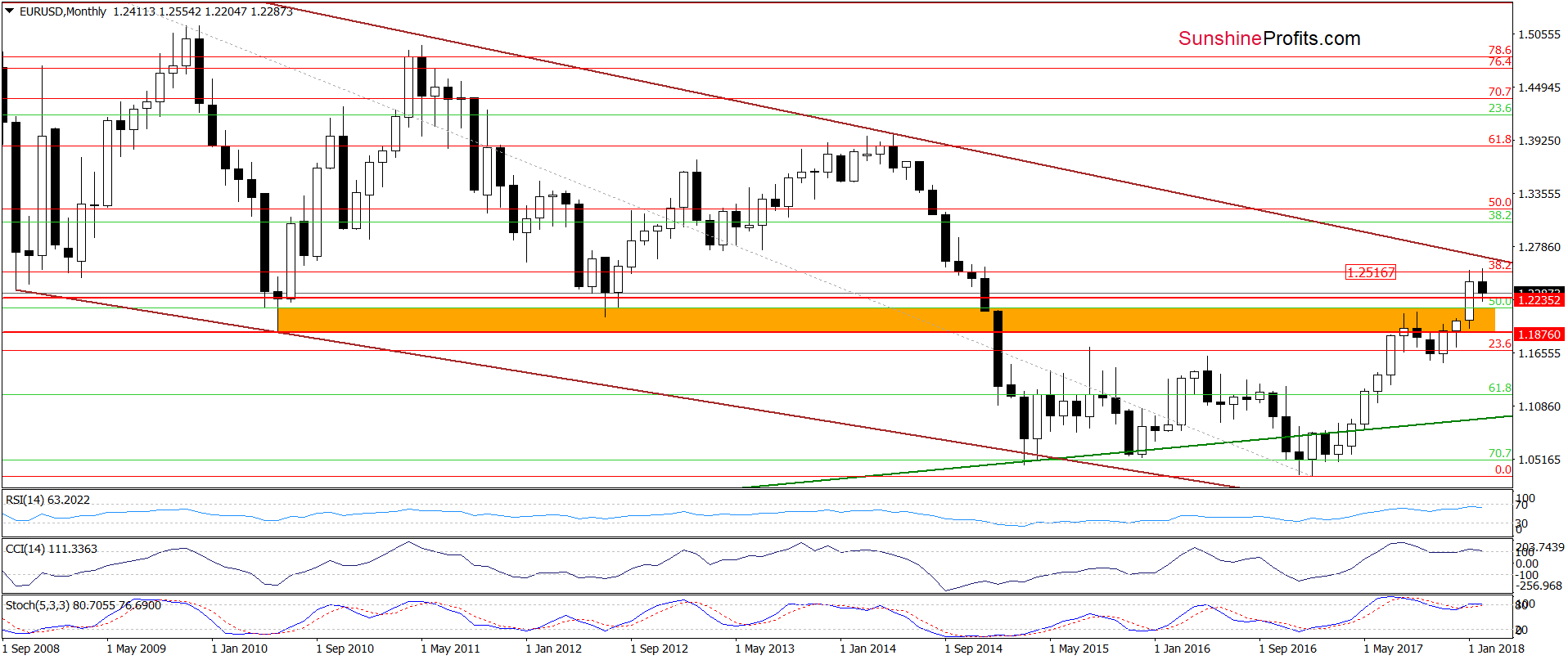

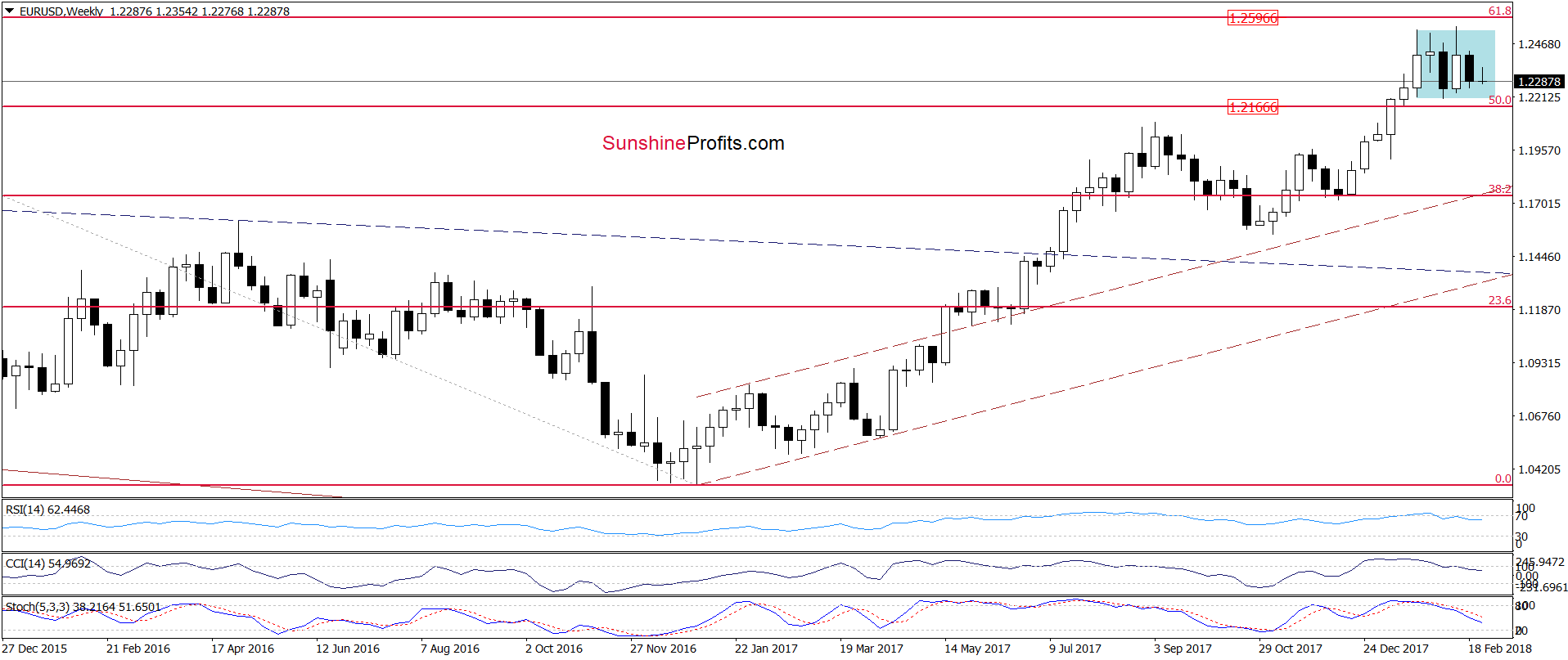

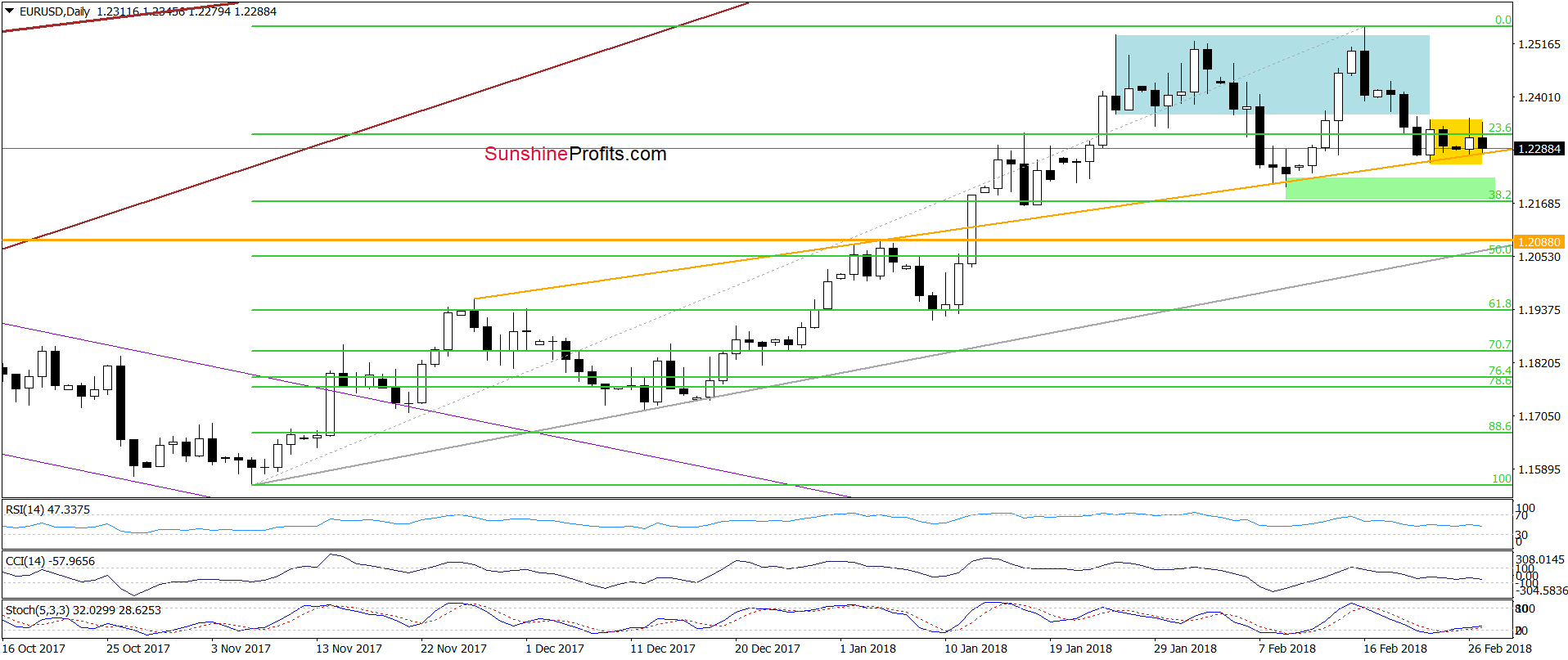

EUR/USD

Looking at the above charts, we see that the overall situation hasn’t changed much as EUR/USD is still trading in the yellow consolidation. Although currency bulls tried to push the exchange rate higher earlier today, the upper line of the formation stopped them once again, triggering a pullback. This show of weakness increases the probability that we’ll see not only a re-test of the orange line, but also the breakdown below it in the very near future.

If the situation developed in line with this assumption, the way to the 38.2% Fibonacci retracement will be open. Finishing today’s commentary on this currency pair it is worth noting that the daily indicators are oversold, which increases the probability of a rebound later this week. Nevertheless, before we see such price action, one more downswing seems to be more likely scenario – especially when we take into account the fact that EUR/USD remains in the blue consolidation under the previously-broken 38.2% Fibonacci retracement. This means that an invalidation of the earlier breakouts (above the retracement and the upper line of the blue consolidation) and its negative impact on the value of EUR/USD are still in effect, supporting currency bears.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.2806 and the initial downside target at 1.2186) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

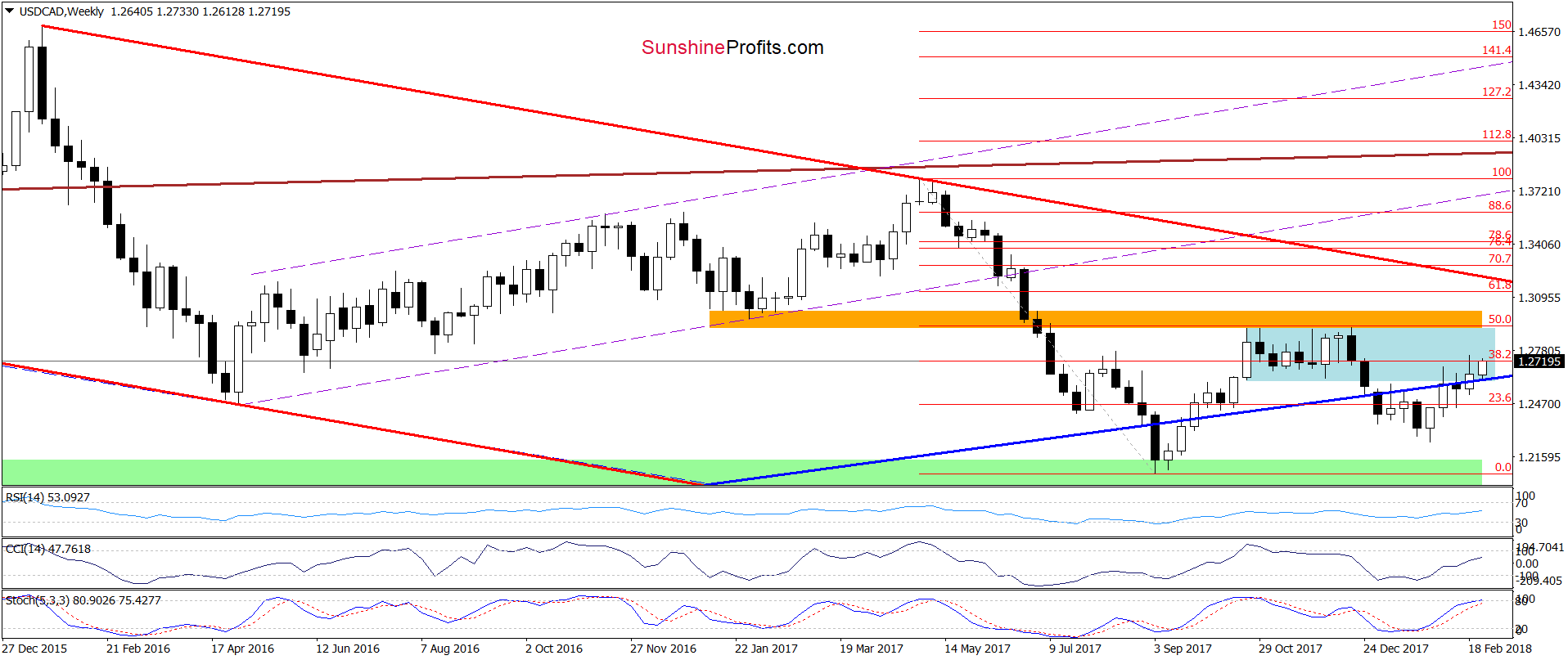

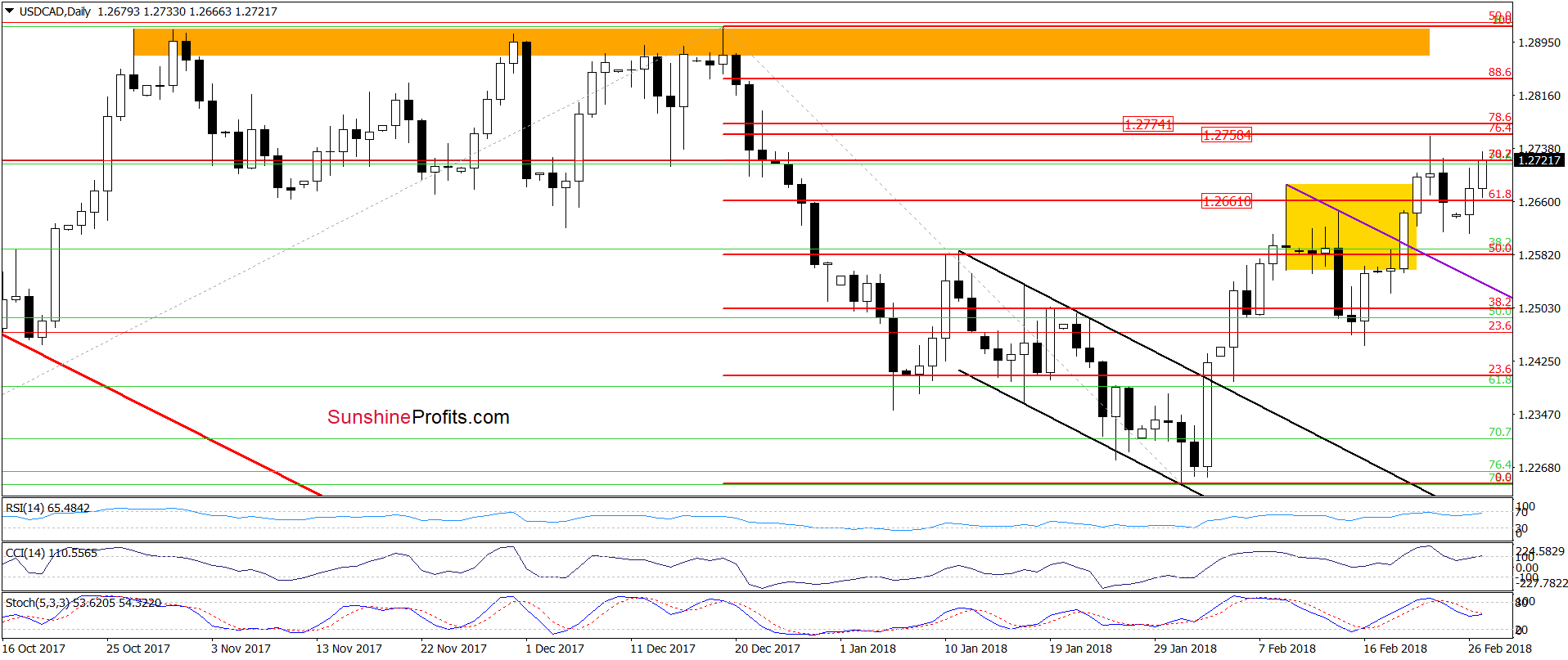

USD/CAD

On the medium-term chart, we see that invalidations of the breakdown under the long-term blue support line and the lower border of the blue consolidation and their potential positive impact on the exchane rate are still in effect, supporting currency bulls.

Are there any short-term resistances, which will be able to thwart the pro-growth plans?

From the daily perspective, we see that currency bulls pushed USD/CAD to the resistance area created by the 76.8% and 78.6% Fibonacci retracements in the previous week, which resulted in a pullback. Despite this short-lived deterioration, the pair reversed and rebounded, which together with the medium-term picture and the current position of the daily indicators suggests that we’ll see a re-test of the last week’s high (or even the upper border of the resistance zone) in the coming day(s).

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

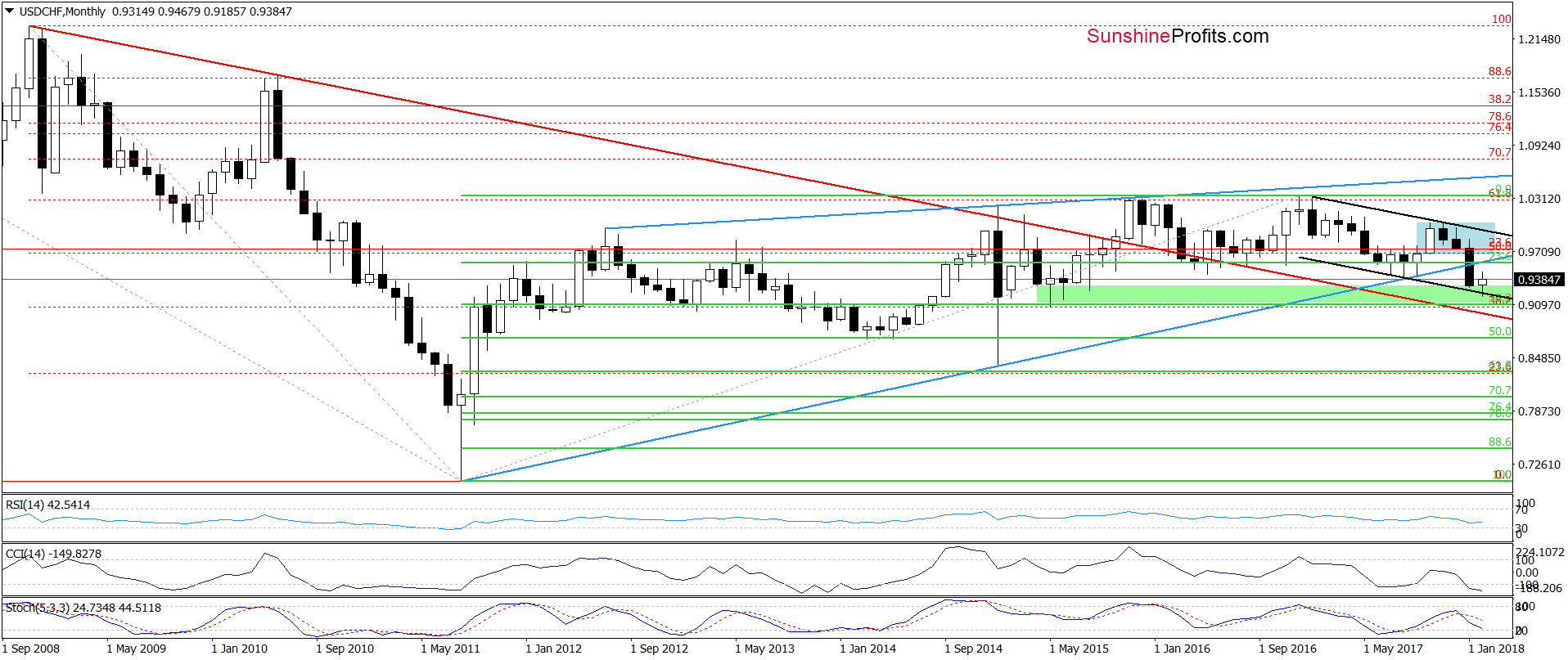

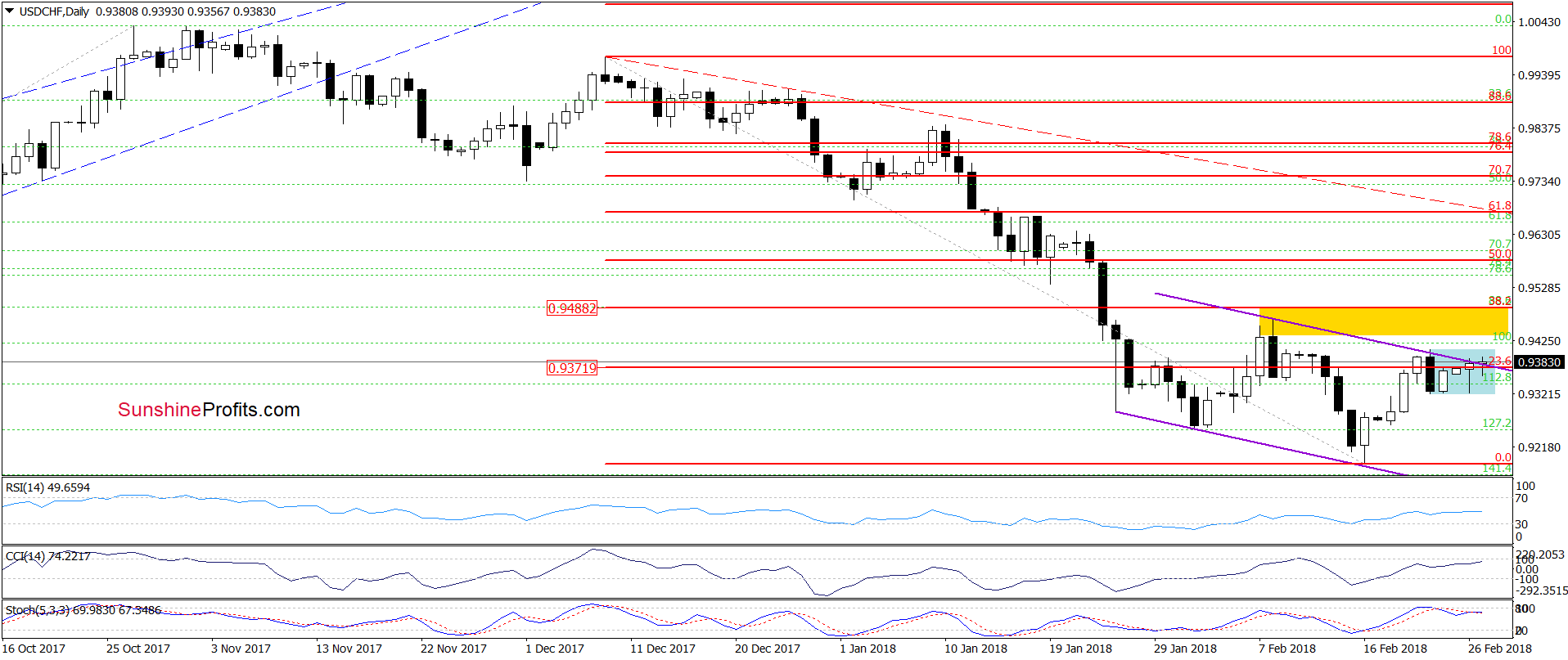

USD/CHF

Looking at the daily chart, we see that the situation in the very short term hasn’t changed much since our last commentary on this currency pair as USD/CHF is still consolidating under the upper border of the very short-term purple declining trend channel. This means that as long as there is no breakout above this line further improvement is not likely to be seen.

Nevertheless, if currency bulls manage to push the pair higher from current levels, we’ll likely see an increase to the yellow resistance zone created by the 38.2% Fibonacci retracement and the early February highs.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts