Wednesday’s upswing took USD/JPY not only above recent highs, but also approached the exchange rate to the early August peaks and an important Fibonacci retracement. Will currency bears be active in this area and erase recent gains in the very near future?

EUR/USD

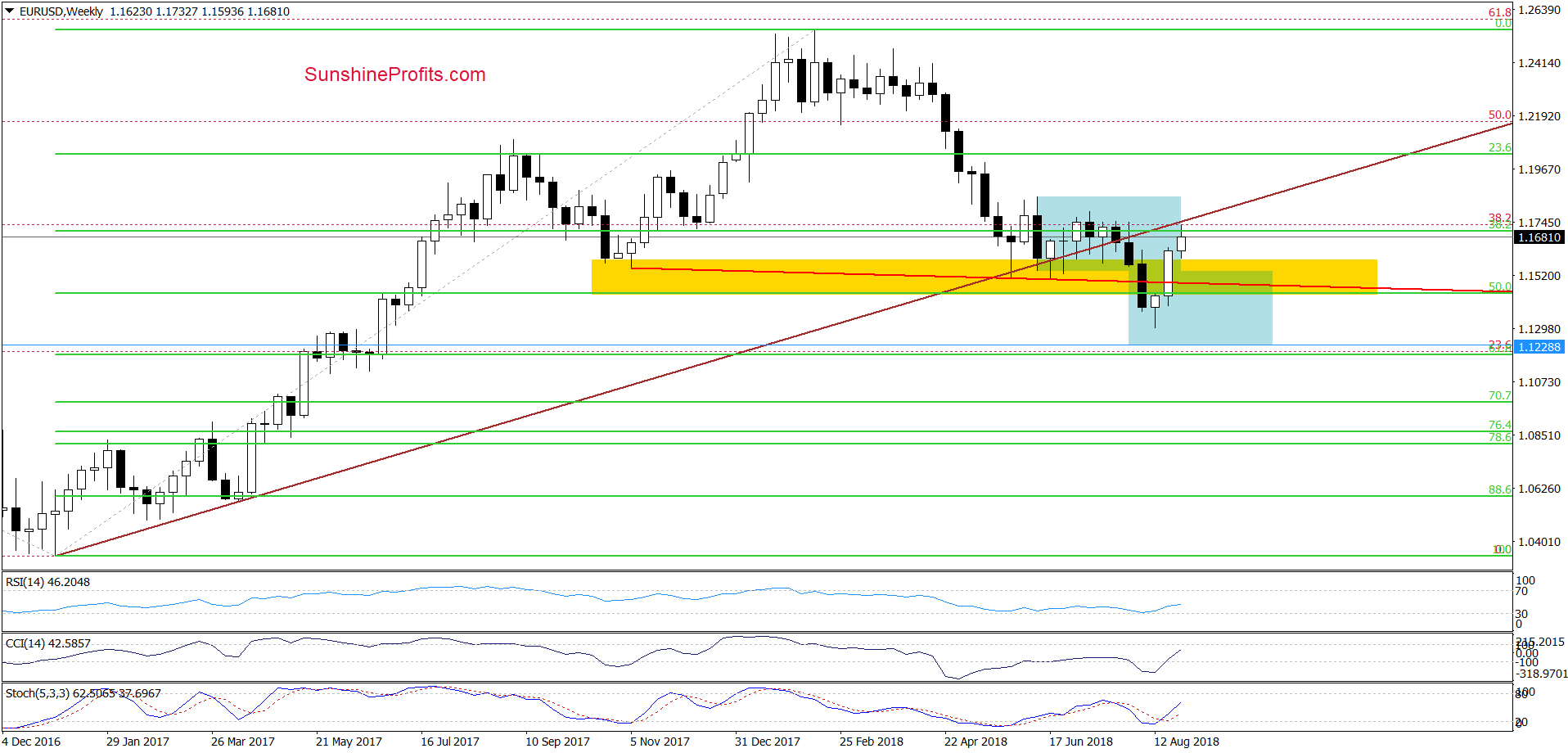

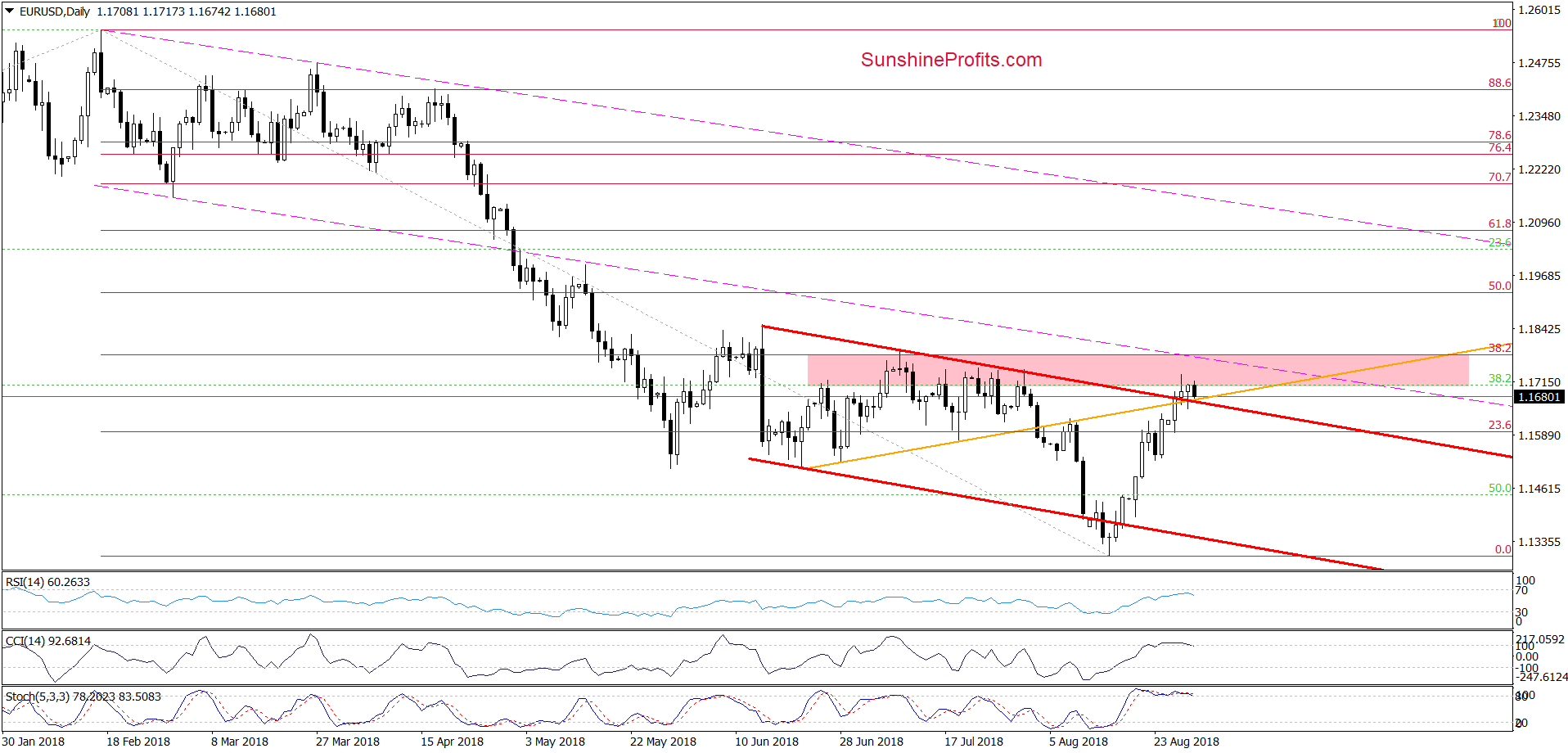

Looking at the above charts, we see that although currency bulls managed to push EUR/USD above the upper border of the red declining trend channel and the orange resistance line once again, the exchange rate is still trading below the long-term brown line (seen on the weekly chart).

This means that as long as there is no comeback above this line all upswing could be nothing more than a verification of the earlier breakdown. Additionally, the current position of the daily indicators (the CCI and the Stochastic Oscillator generated the sell signals) suggests that the space for gains is limited and reversal is just around the corner.

If this is the case and we see a daily closure under both short-term lines (marked on the daily chart), we’ll likely open short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective, but if the pair closes today’s session inside the red declining trend channel, we’ll likely open short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

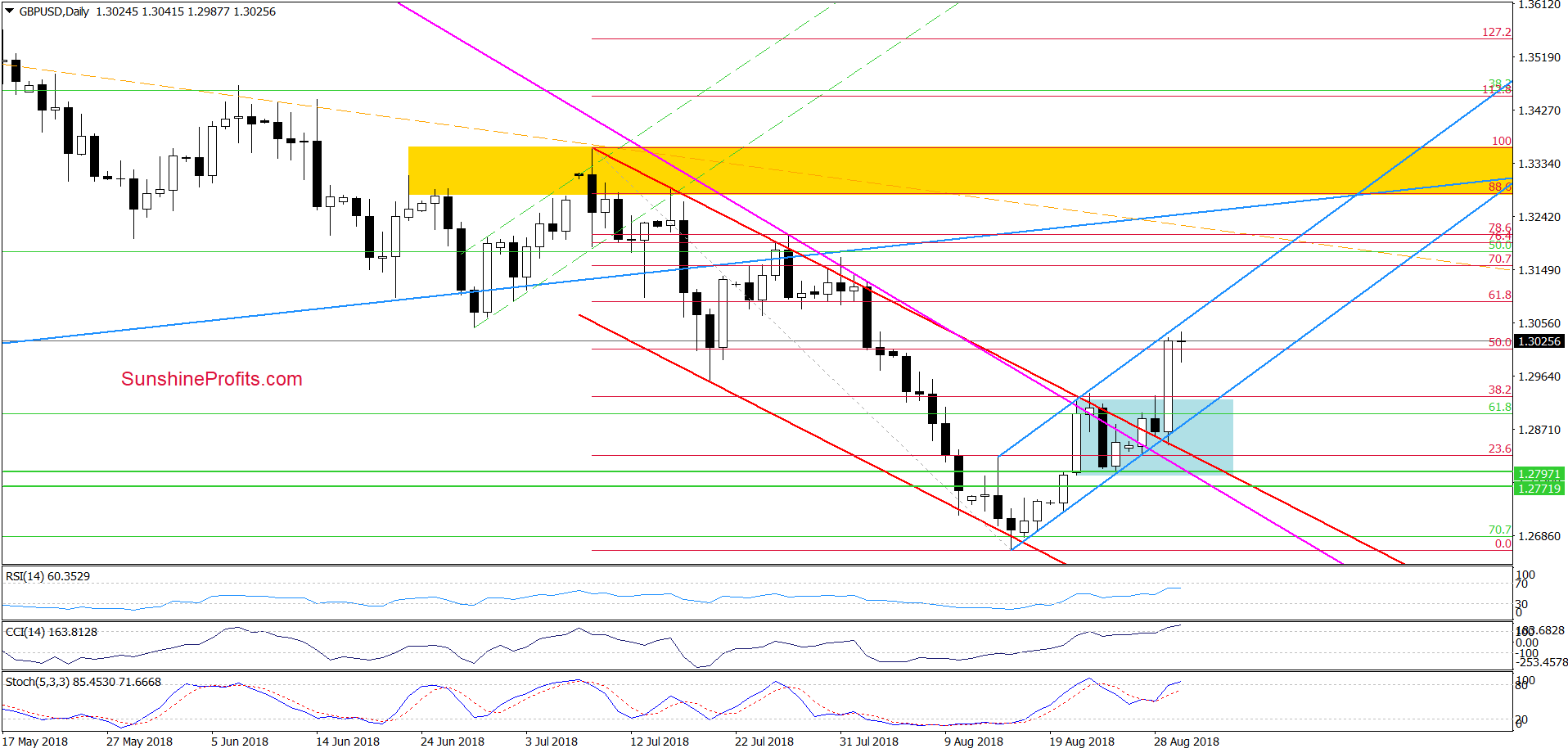

The first thing that catches the eye on the daily chart is the breakout above the upper line of the red declining trend channel and the medium-term pink declining line, which triggered a sharp move to the upside on Wednesday.

Thanks to this increase, GBP/USD climbed above the 50% Fibonacci retracement and approached the upper line of the very short-term blue rising trend channel, which suggests that even if the pair moves higher from here, the space for growth may be limited and the bears attack should not surprise us in the coming days.

If the situation develops in tune with our assumptions, GBP/USD will likely drop to the lower line of the above-mentioned blue rising trend channel.

Nevertheless, as long as there are no sell signals generated by the indicators, one more upswing and a test of the next Fibonacci retracement (around 1.3093) is likely.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

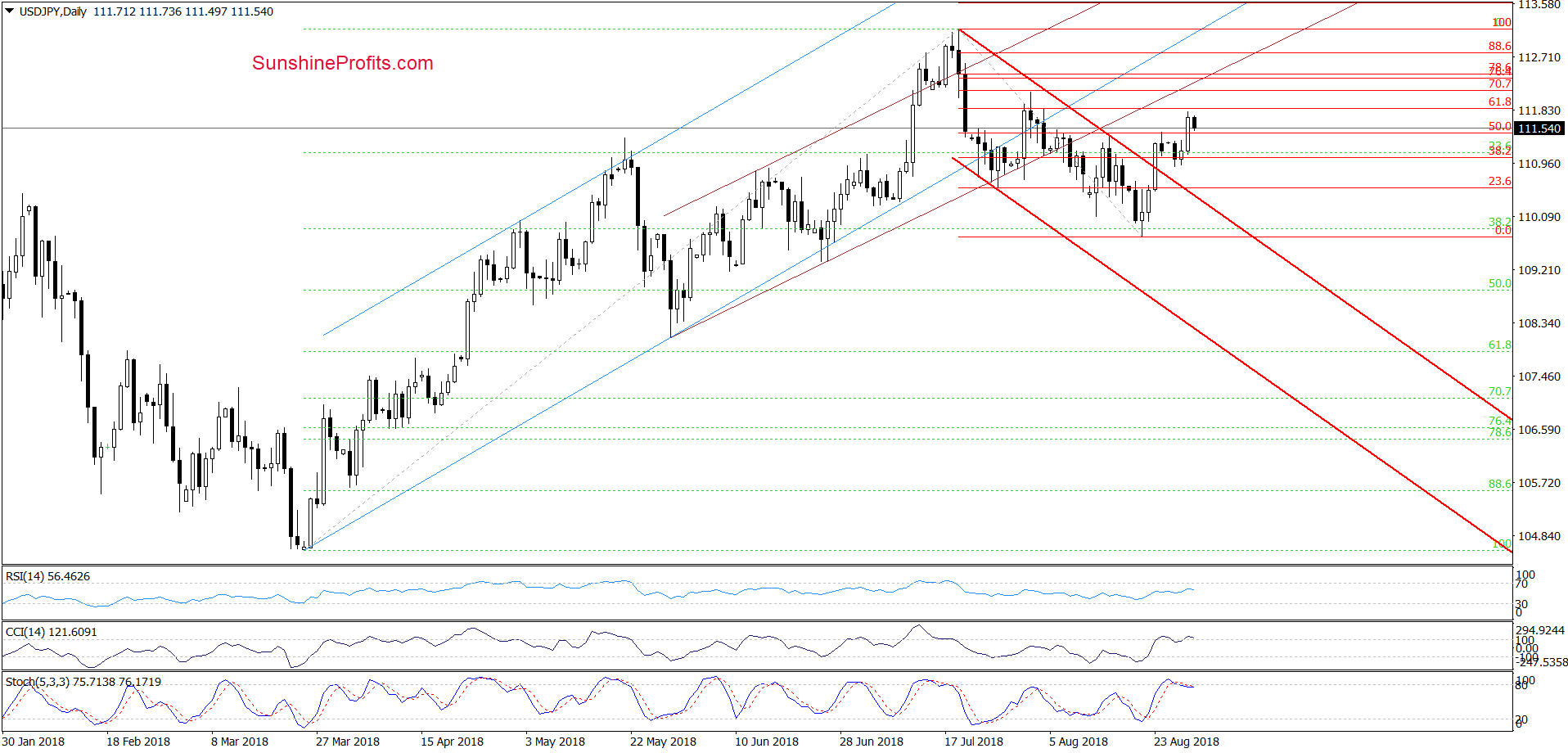

USD/JPY

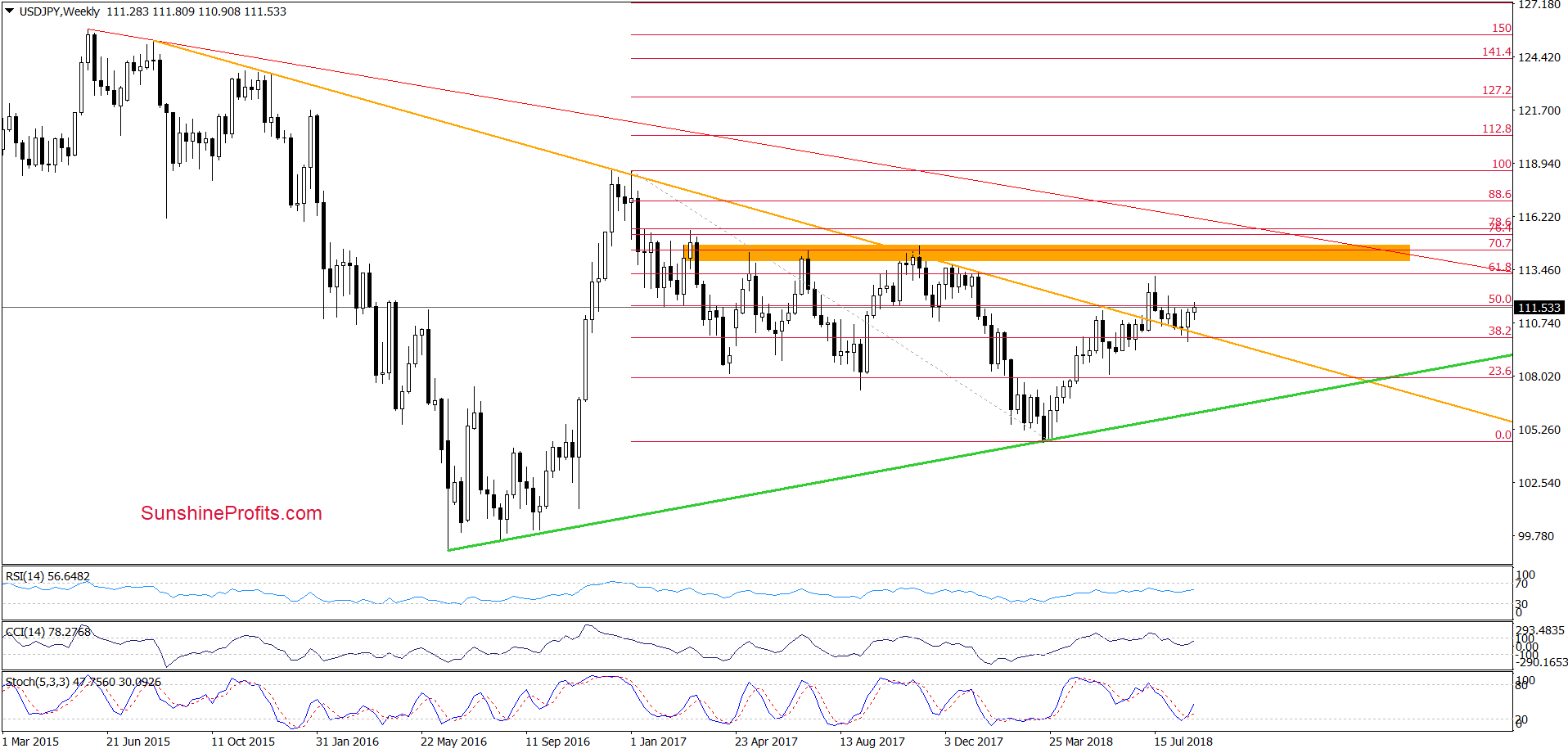

From the medium-term perspective, we see that the overall situation remains almost unchanged as USD/JPY is trading above the previously-broken long-term orange declining line (which serves as the major support).

Having said the above, let’s check what can we infer from the short-term chart.

On the daily chart, we see that USD/JPY extended the recent upward move during yesterday’s session, which approached the pair to the 61.8% Fibonacci retracement (based on the entire July-August decline) and the August peaks.

Despite this improvement, currency bears came back to the trading floor, which triggered a pullback earlier today. Additionally, the Stochastic Oscillator generated the sell signal (while the CCI is very close to doing the same), which increases the probability that we’ll see lower values of the exchange rate in the following days.

If this is the case and the pair declines from here, we’ll likely see a drop to the previously-broken upper border of the red declining trend channel in the near future. Nevertheless, as long as the long-term orange support line remains in the cards a sizable move to the downside is not likely to be seen.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative and personal note, there will be no Alerts posted on Monday as the markets are closed in the U.S. (Labor Day) and as far as Friday (tomorrow) is concerned, there will be no regular Gold & Silver-, Oil-, and Forex Trading Alerts. The note is personal due to the reason behind tomorrow’s changes in our regular publication schedule. Przemyslaw and I are getting married on Saturday and we’ll need more offline time tomorrow for the final preparations. Yet, if something major happens, you’ll still receive a quick message with the details, so while we’re not going to write regular Alerts, we will keep you informed if anything major changes.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts