Even though currency bulls gained a certain ally earlier this week, its credibility aroused our distrust. Today, he proved to be a liar who changed his mind and joined the bulls’ enemy. How can this development will affect the future of EUR/USD?

In our opinion the following forex trading positions are justified - summary:

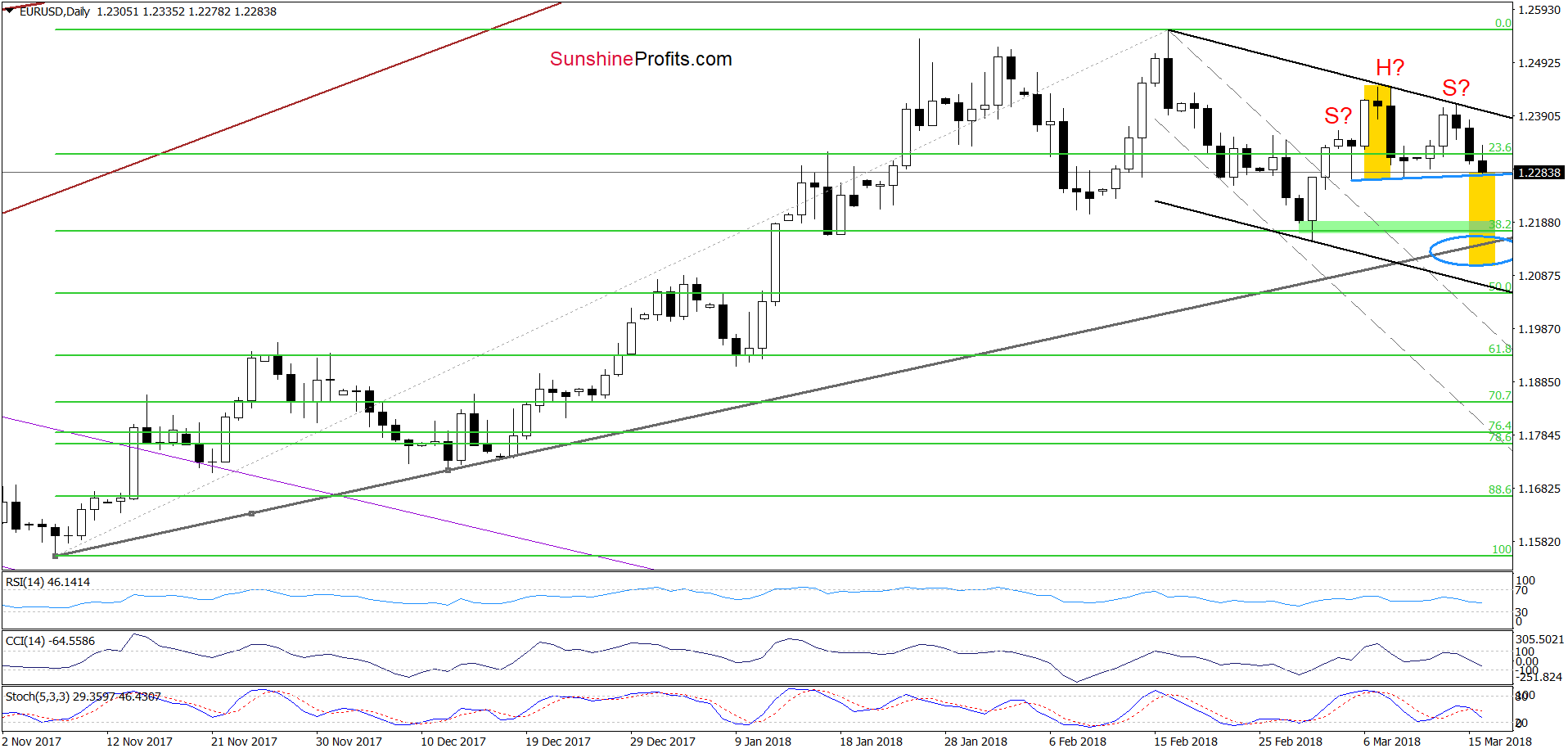

EUR/USD

Yesterday, we wrote:

(…) the probability of the head and shoulders formation remains in the cards – especially when we factor in the fact that EUR/USD reversed and decline after a climb to the black declining resistance line based on the previous highs.

Such price action suggests that despite the support from the site of the Stochastic, the pair could move lower and test the blue support line (the neck line of the above-mentioned pattern) in the coming day(s).

If we see a breakdown under this line, we’ll consider opening short positions.

On the daily chart, we see that the situation developed in line with the above scenario and EUR/USD extended losses earlier today, reaching our first downside target and increasing the probability that we’ll see the breakdown later in the day. Additionally, the Stochastic Oscillator changed its mind and generated the sell signal, which suggests that short positions are just around the corner. So, stay tuned!

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

Quoting our last commentary on this currency pair:

(…) GBP/USD climbed to our upside target yesterday. Earlier today, the pair re-tested this resistance area, but there was no breakout above it, which together with the current position of the indicators suggests that reversal may be just around the corner.

Looking at the above chart, we see that GBP/USD moved a bit lower (as we had expected) and slipped under the previously-broken upper border of the purple declining trend channel (marked with dashed lines), which increases the likelihood that we’ll see an invalidation of the earlier breakout later in the day.

Therefore, if the pair closes today’s session under this line, we’ll consider opening short positions in the very near future.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

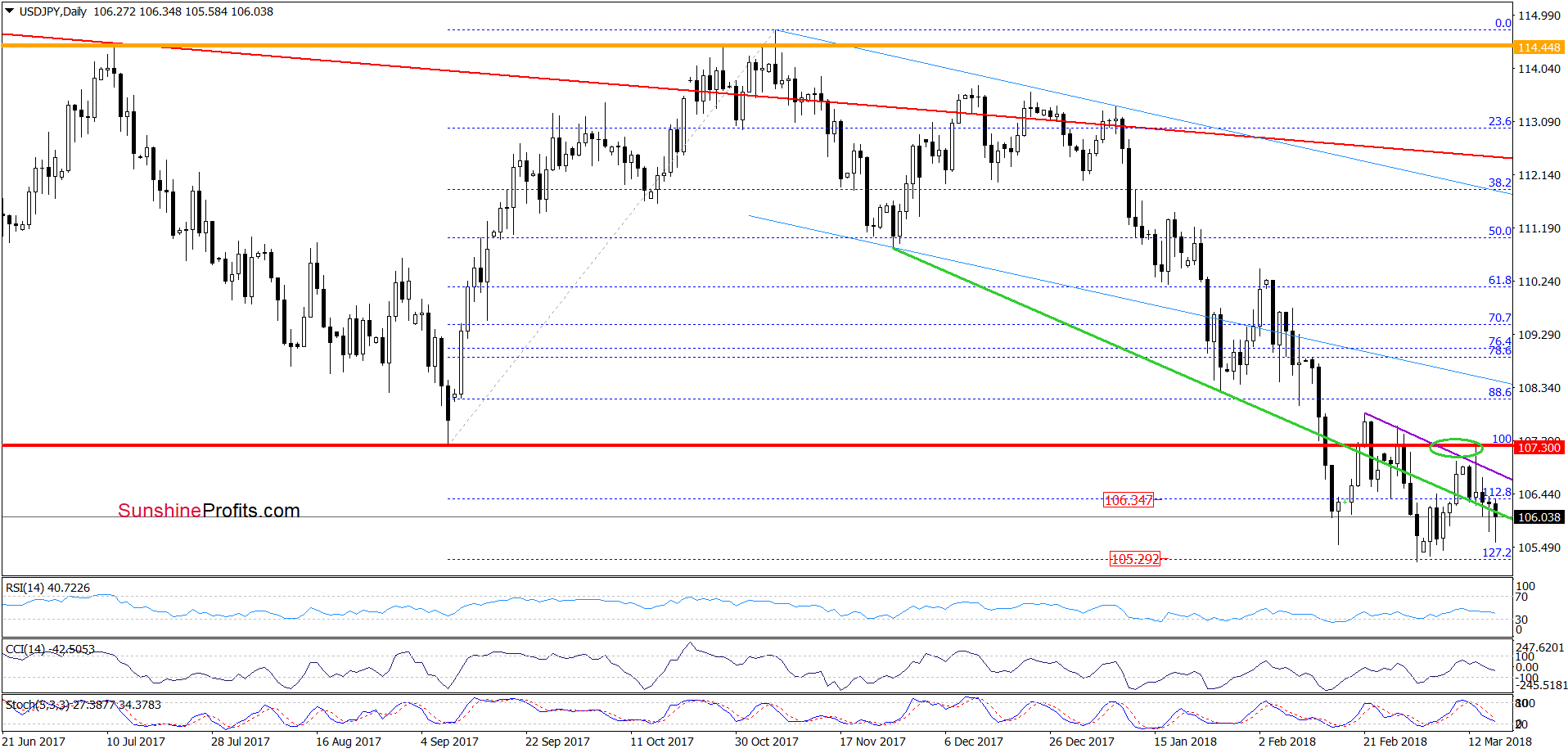

USD/JPY

On Wednesday, we wrote:

(...) the proximity to the resistance area created by the September low (the red horizontal resistance line) and the purple declining resistance line based on the previous peaks was enough to encourage currency bears to act.

As a result, the pair reversed and declined yesterday, which together with the current position of the indicators (the Stochastic Oscillator generated the sell signal), suggests that we’ll likely see further deterioration in the coming days.

(…) If we see such price action, the initial downside target will be around 105.92, where the 61.8% retracement (based on the recent rebound) is.

From today’s point of view, we see that the situation developed in tune with our assumptions and the exchange rate not only tested our downside target, but also slipped below it. Despite this deterioration, the pair bounced off today’s low quite quickly, which suggests that if we see a daily closure above the previously-broken green line, the exchange rate will likely test the recent highs at the beginning of the coming week.

Nevertheless, in this case, we do not open long positions as long as the exchange rate remains under the red resistance horizontal line and the February 21 peak of 107.88. If we see a breakout above these resistances, we’ll consider going long. Until this time, waiting at the sidelines seems to be the best decision – especially when we factor in the fact that potentially profitable positions on other currency pairs are just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts