Earlier today, investors turned their eyes towards the old continent awaiting news from the ECB. As it turned out, the central bank left euro zone interest rates unchanged and dropped decision to expand its stimulus program, which supported the euro. How the bulls used these favorable conditions?

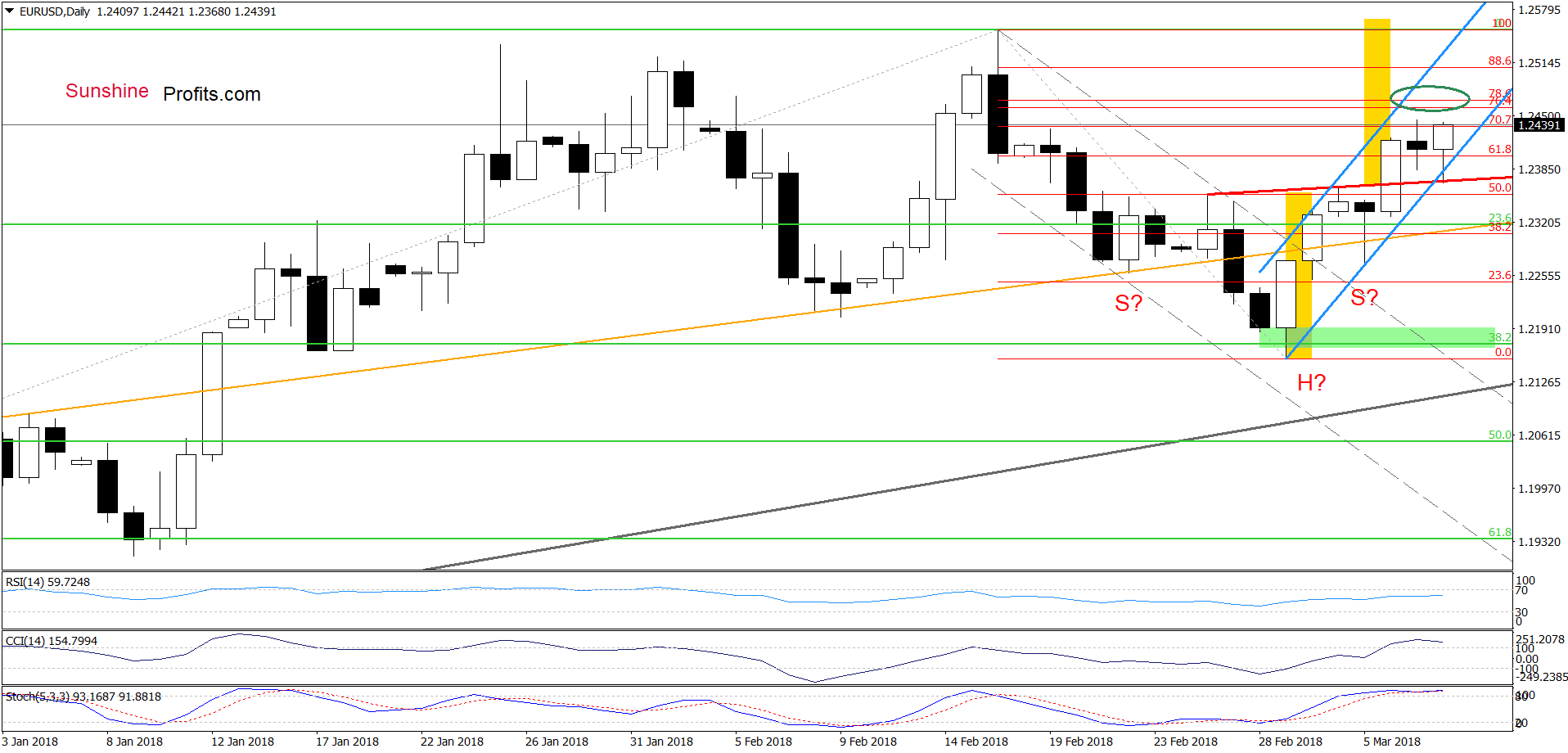

EUR/USD – Verification of the Breakdown

As you see on the daily chart, although EUR/USD moved lower earlier today, the previously-broken neck line of the reverse head and shoulders formation together with the lower border of the blue rising trend channel stopped currency bears, triggering a rebound.

Such price action looks like a verification of the earlier breakout above the red line, which is a positive development that suggests further improvement.

How high could the exchange rate go? We think tat the best answer to this question will be the quote from our yesterday’s alert:

(…) currency bulls closed Tuesday above the red resistance line, which opened the way to higher levels. Nevertheless, the CCI and the Stochastic Oscillator climbed to their overbought areas, which suggests that the space for gains may be limited.

So, how high could the exchange rate go in the coming days? In our opinion, the first upside target will be the resistance area marked with the green eclipse (created by the 76.4% and 78.6% Fibonacci retracements and the upper border of the blue rising trend channel). This means that as long as there is no breakout above it, higher values of EUR/USD are not likely to be seen and reversal in the coming day(s) can’t be ruled out.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

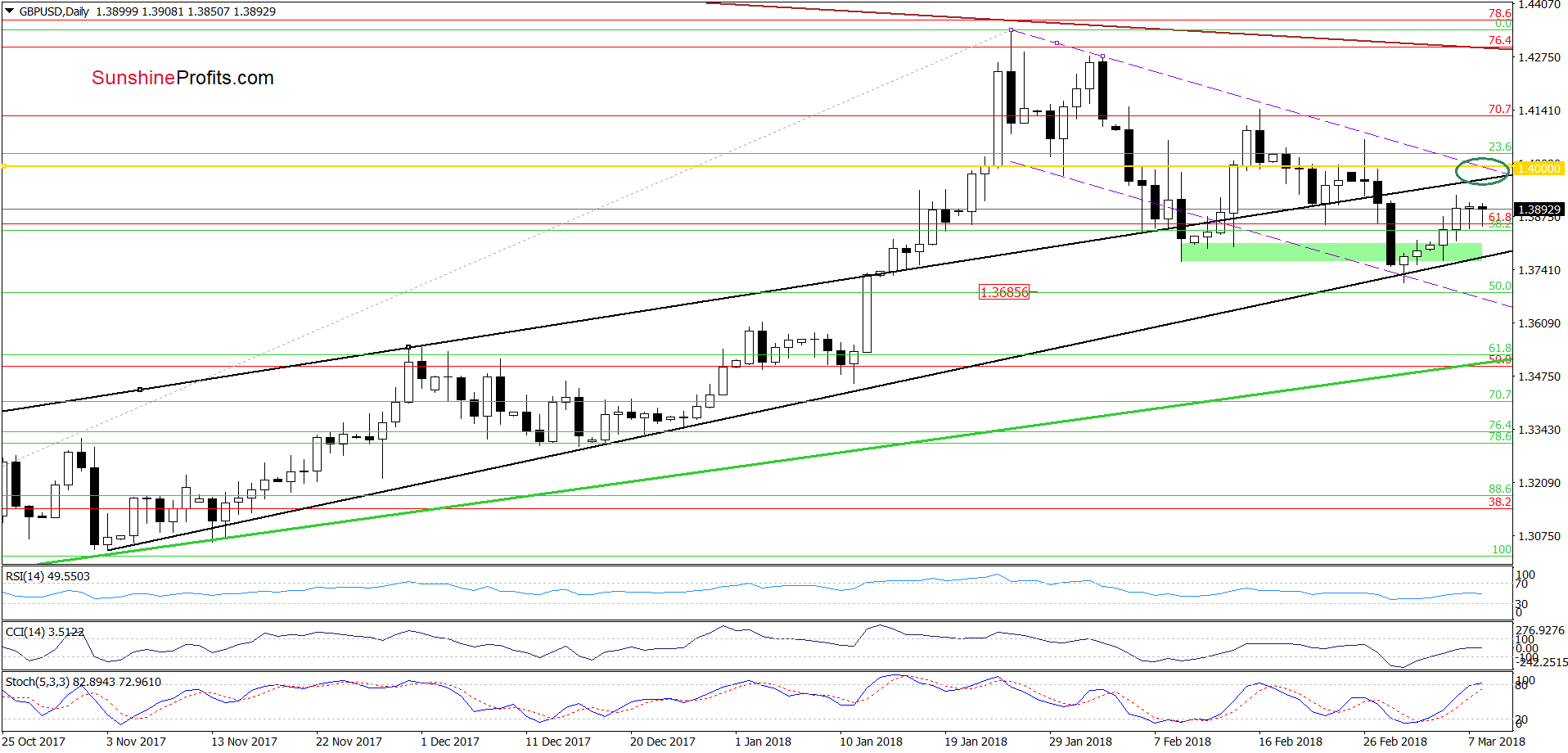

GBP/USD - North or South?

Looking at the daily chart, we see that the overall situation in the very short term hasn’t changed much as GBP/USD is consolidating inside the black rising wedge. Additionally, the buy signals generated by the indicators remain in the cards, suggesting that further improvement and a test of the resistance area (marked with the green ellipse) created by the upper border of the purple declining trend channel (marked with dashed lines), the upper line of the black rising wedge and the barrier of 1.4000 is still likely.

Nevertheless, if we see a reliable bulls’ weakness, we’ll consider re-opening short positions in the coming day(s).

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

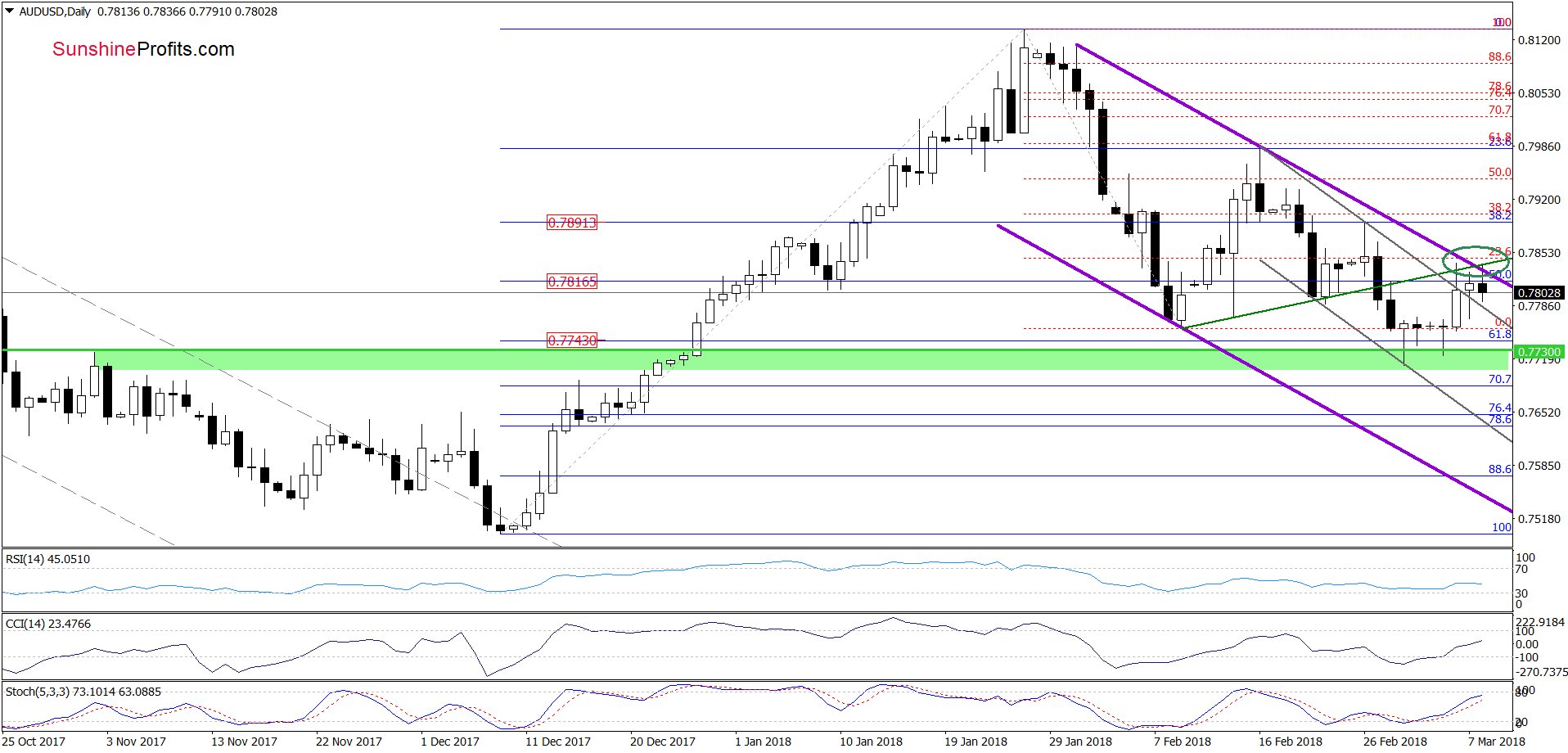

AUD/USD vs. First Resistance Area

From today’s point of view, we see that although currency bulls pushed AUD/USD sharply higher on Tuesday, the resistance area (our first upside target marked with the green ellipse) stopped them triggering a pullback earlier today.

This sign of weakness suggests that further deterioration may be just around the corner. However, as long as there is no invalidation of the earlier breakout above the upper border of the grey declining trend channel and sell signals generated by the indicators, we think that re-opening short positions is not justified from the risk/reward perspective yet. Why? Because, we can see a verification of the earlier breakout above the upper line of the grey trend channel and more test of the above-mentioned resistance area.

Nevertheless, if we see any reliable bearish signs on the horizon, we’ll consider opening short positions in the following day(s).

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts