In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1510)

- GBP/USD: short (a stop-loss order at 1.3773; the next downside target at 1.3000)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

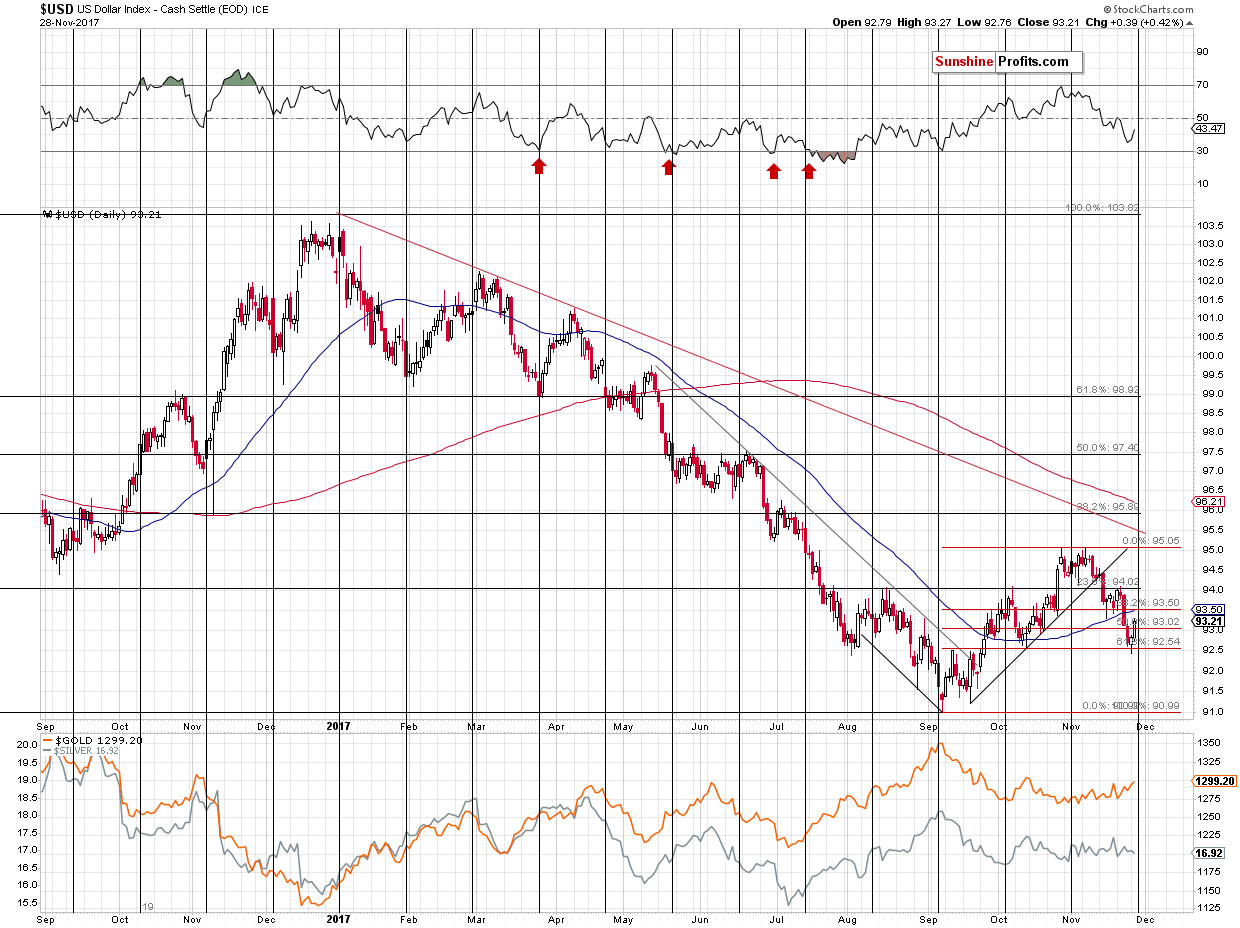

While we usually discuss individual currency pairs in our alerts, in today’s issue we would like to say more about the general direction of the USD Index – it provides the context for moves in the individual currency pairs and can thus help us determine what’s likely to happen not only in the coming days, but also in the coming months.

In other words, we will provide an update to the analysis that we featured 3 weeks ago. As a reminder, we wrote about a possible decline to about 93 – 93.5 and we emphasized that the decline could be even bigger, (…) it should take USD at least approximately 2.5 index points lower. When we wrote the above, the USD Index was after a close at 94.8. The intraday low that we saw on Monday was 92.43, which is approximately 2.5 index points lower.

Let’s start with the short-term outlook (charts courtesy of http://stockcharts.com):

The USD Index moved lower in the past few weeks, but not in the past few days. The decline took away most of the September – November gains, but stopped a bit below the 61.8% Fibonacci retracement level. The breakdown was invalidated and the implications thereof were bullish after Monday’s close. The Monday reversal took place quite close to the cyclical turning point, which further increases the odds that the bottom is really in and yesterday’s rally further confirmed that the local bottom might be in.

This is likely also based on the analogy in terms of time to the previous corrections in the early parts of major rallies in the USD.

One of the reasons due to which we expect the USD Index to rally in the coming months is the analogy to its behavior during previous series of rate hikes. The USD didn’t start to rally immediately after the rates were increased in the recent past and while it may seem surprising, this is exactly how things developed in the past. There was a specific delay in the USD’s reaction and it seems that it will also be the case also this time. If the history is to repeat itself, it seems that the series of rate hikes is going to trigger a massive rally in the USD Index any week now.

But didn’t USD Index just decline for a few weeks? Doesn’t it invalidate any bullish implications here?

That’s a very good question and we decided to take a closer look at the analogy to the previous major bottoms and the early parts of major rallies. It is often said that time is more important than price and we analyzed the previous upswings and the early corrections with the above in mind. Namely, we checked how long the initial rallies lasted and how long the USD was correcting. You will find the details below:

- 1998 – 1999: the initial rally: 6 weeks, followed by 2 weeks of declines

- 1999 - 2000 the initial rally: 7 weeks, followed by 5 weeks of declines

- 2005 - the initial rally: 6 weeks, followed by 4 weeks of declines

- 2008 - the initial rally: 7 weeks, followed by 5 weeks of declines

- 2009 – 2010 - the initial rally: 4 weeks, followed by 3 weeks of declines

- 2011 - the initial rally: 10 weeks, followed by 2-5 (unclear) weeks of declines

- 2014 - 2015 - the initial rally: 4 weeks, followed by 4 weeks of declines

- 2016 - the initial rally: 4 weeks, followed by 3 weeks of declines

- 2017 (current upswing) - the initial rally: 7? weeks, followed by 4? weeks of declines

The initial rallies lasted between 4 and 10 weeks with the 10 number being the outlier. The average is 6, while the most recent rally either took 7 weeks (quite in tune with the past patterns) or it’s not over yet with 10 weeks so far. If it’s not over, then it would need to rally for an additional week or two, thus making the entire rally even longer than the previous outlier at 11 or 12 weeks (or longer).

Is it therefore possible that the rally will still continue before a bigger correction is seen? Yes. Is it likely? No. Based on the above time analogies it’s more likely that the initial rally is already over and we are after 3 weeks of declines.

Is the above good or bad? Both. It’s good, because we’re likely closer to the big decline in the precious metals market than it first appeared, but it’s bad because we may not get a meaningful and tradable corrective upswing in the precious metals sector after the USD Index moves close to the 96 level. Ultimately, it’s not really a matter of deciding whether the current environment is better or worse, but adapting to it and tweaking the strategy so that it remains up-to-date with the most recent observations. After all, trading is like a game of poker - at times you will get a good hand and at times you will get a back hand, but by having a good strategy toward both situations you’ll likely come out ahead over time.

So, what’s the likely follow-up action from here? If we are indeed after 3 weeks of declines, then if we can estimate how long the rally is likely to last, we could check how long it should take, additionally, for the USD to bottom.

The average length of the correction is between 3.5 and 3.875 weeks depending on the interpretation of the 2011 action. We are already after 4 weeks.

What if instead of using the average, we take into account the most similar cases - where the initial rallies took 6 or 7 weeks. In this case we get an average of 4 weeks (based on 2, 5, 4, and 5 weeks). 5 weeks is the most common analogy (half of the cases), though. Finally, what if we assume that the most recent rally (2016) is most likely to be repeated as it’s most similar fundamental-wise? In this case, we should expect the decline to take 3 weeks. In other words, it could be over.

All in all, if we average the above approaches, it seems likely that we have either already seen the final bottom or we’re going to see it this week. Next week is also a possible time target, but it’s not as likely.

Summing up, the decline that we saw in the past few weeks, was not something out-of-the-box. Conversely, it was in tune with the past price patterns that characterized the early parts of the biggest multi-month upswings in the USD. In light of the above, there’s no reason to view the above as something bearish for the following weeks as far as the USD Index is concerned.

Based on the USD’s short-term chart and the recent reversal, it seems even more likely that the final bottom is already in.

We will keep you informed should anything change, or should we see a confirmation / invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts