Earlier today, the U.S. Labor Department reported that the jobless claims rose less-than-expected, which pushed the USD Index above 93.20. Did this increase have any impact on the technical picture of EUR/USD, GBP/USD and USD/CAD?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (a stop-loss order at 1.3272; the initial downside target at 1.2375)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

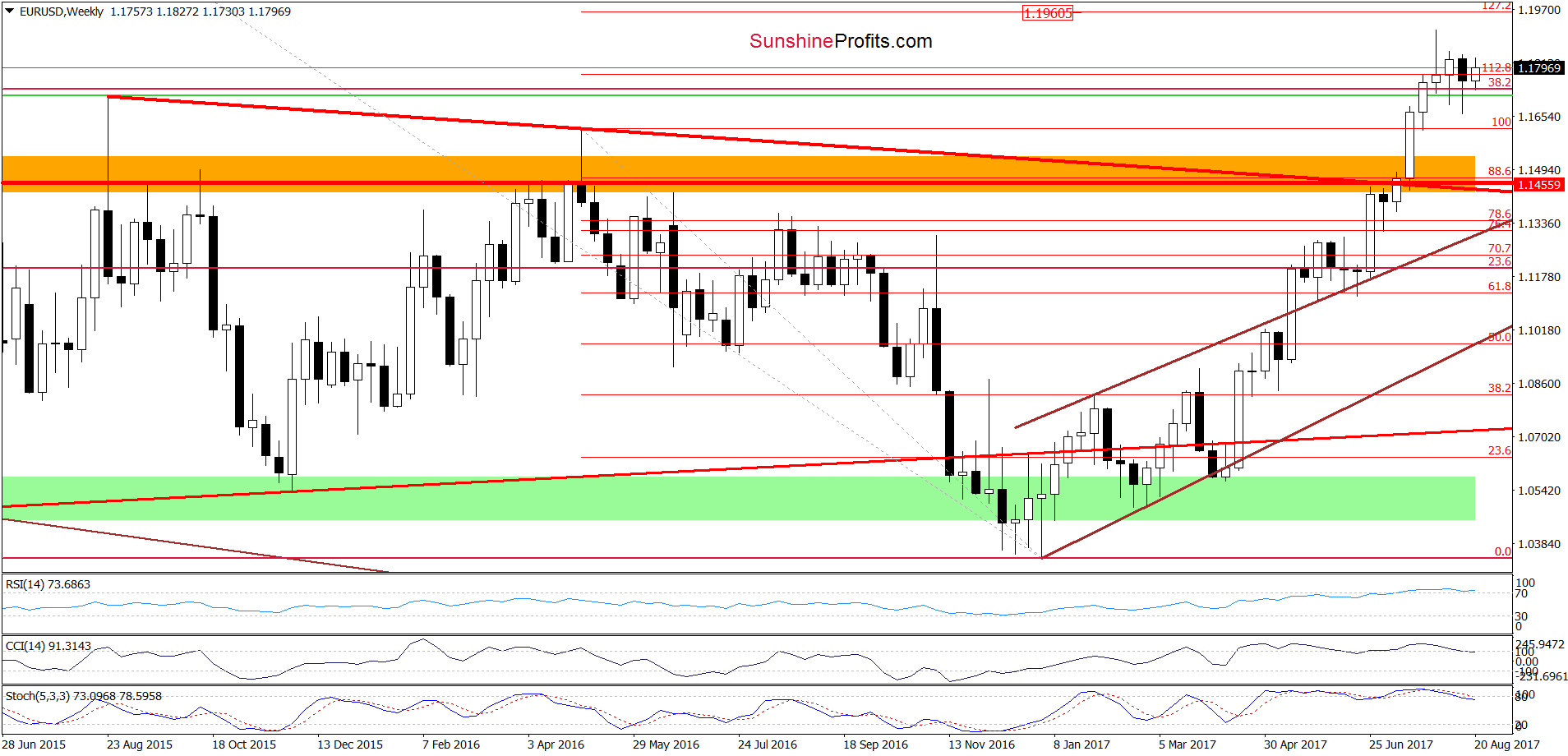

EUR/USD

Looking at the daily chart, we see that EUR/USD is still trading in the blue consolidation under the upper border of the brown rising trend channel, which makes the very short-term situation unclear. Nevertheless, the pair climbed above the 38.2% Fibonacci retracement and the 112.8% Fibonacci extension (marked on the weekly chart), which suggests an invalidation of the earlier tiny breakdowns under these lines and another attempt to move higher. However, we saw such sideway moves recently, which means, in our opinion, that as long as there is no breakout above the August high or a breakdown below the lower border of the brown trend channel another bigger move to the upside/downside is not likely to be seen and short-lived moves in both directions should not surprise us. Therefore, we think that waiting at the sidelines for a profitable opportunity is the best decision at the moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

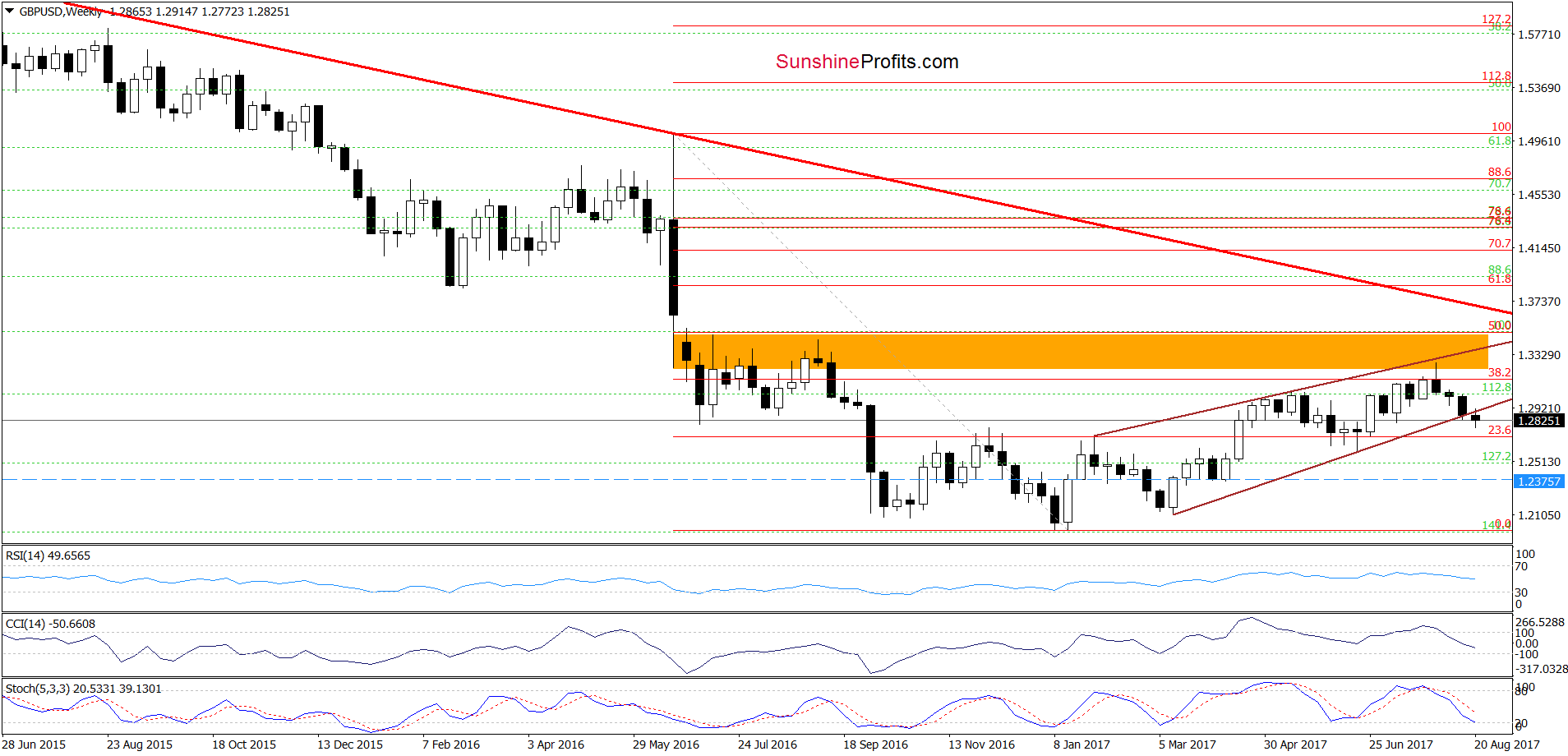

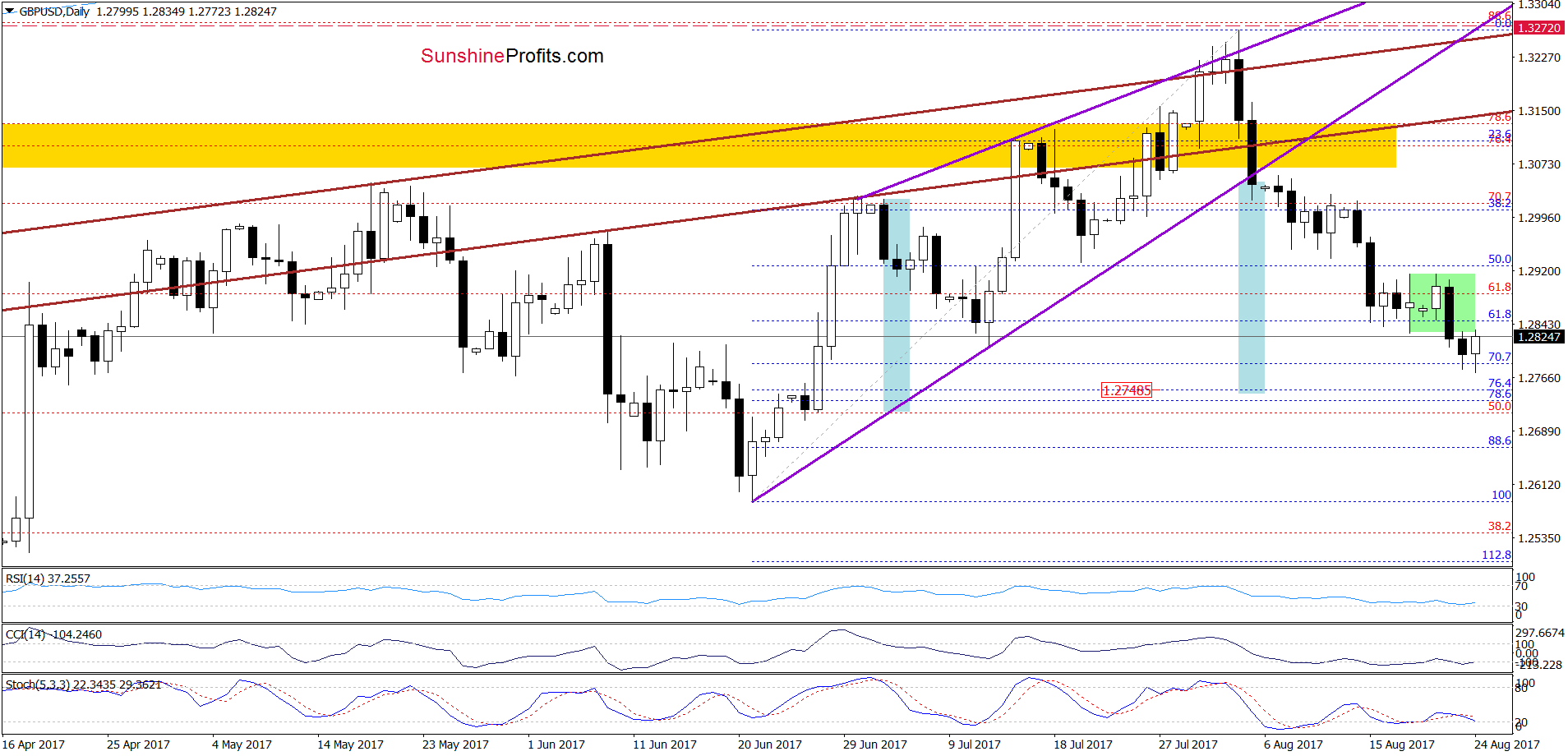

GBP/USD

On Tuesday, we wrote the following:

(…) the exchange rate dropped below the 61.8% Fibonacci retracement making our short positions even more profitable. Taking into account today’s price action and a drop below the lower border of the brown rising wedge marked on the weekly chart, we believe that we’ll see a realization of the bearish scenario from our Forex Trading Alert posted on August 7, 2017 (…)

From today’s point of view, we see that GBP/USD extended losses yesterday and slipped slightly below the 70.7% Fibonacci retracement seen on the daily chart. As you see, this support triggered a small rebound earlier today, which resulted in an increase to the previously-broken lower border of the green consolidation. What does it mean for the exchange rate? Taking into account the medium-term picture (the pair remains under the lower border of the brown rising wedge and the sell signal generated by the Stochastic Oscillator we think that today’s move is just a verification of the earlier breakdown and another move to the downside is still likely. Therefore, if we see such price action another downside target for currency bears will be around 1.2748, where the size of the downward move will correspond to the height of the rising wedge and where the 76.4% and 78.6% Fibonacci retracements are.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short (profitable) positions (with a stop-loss order at 1.3272 and the initial downside target at 1.2375) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

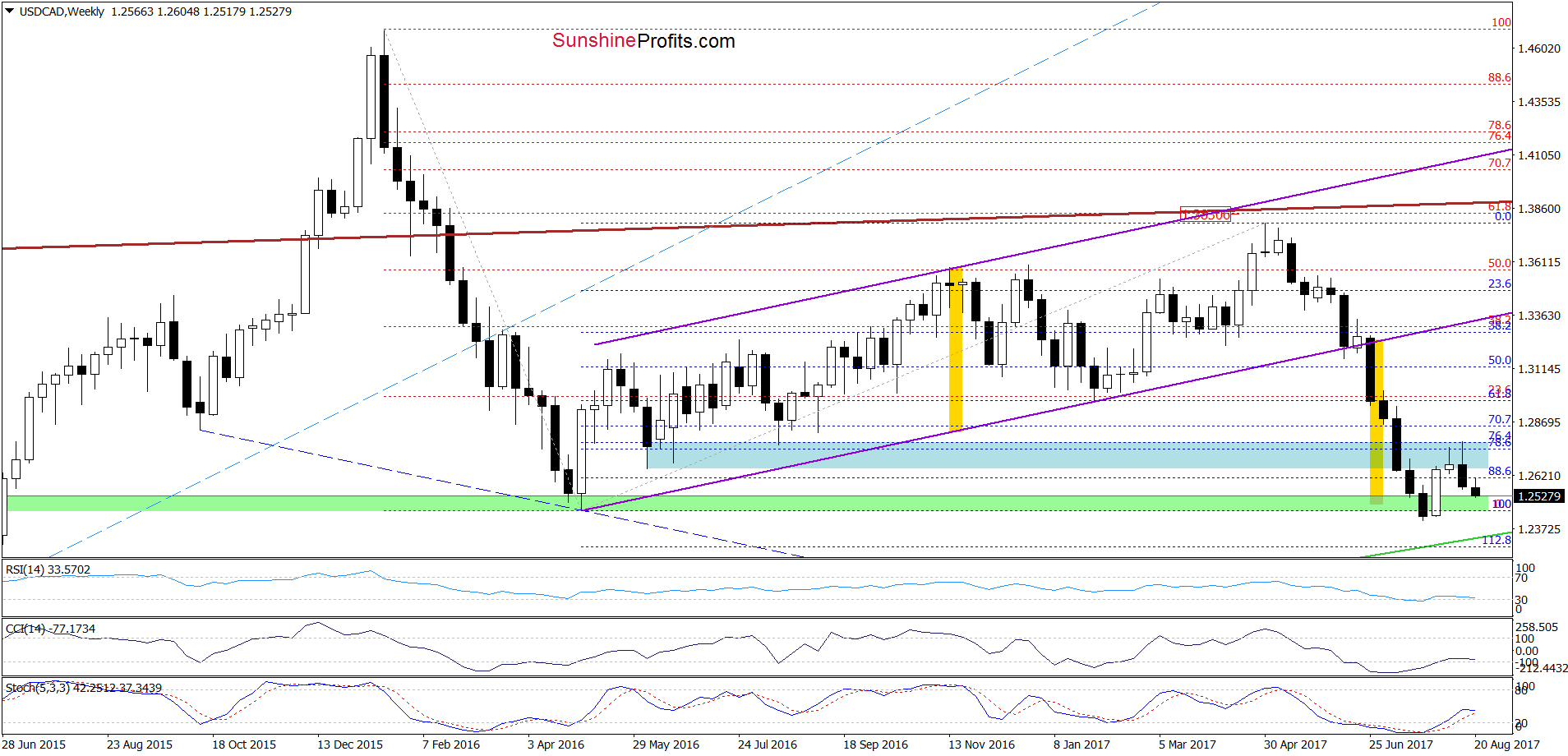

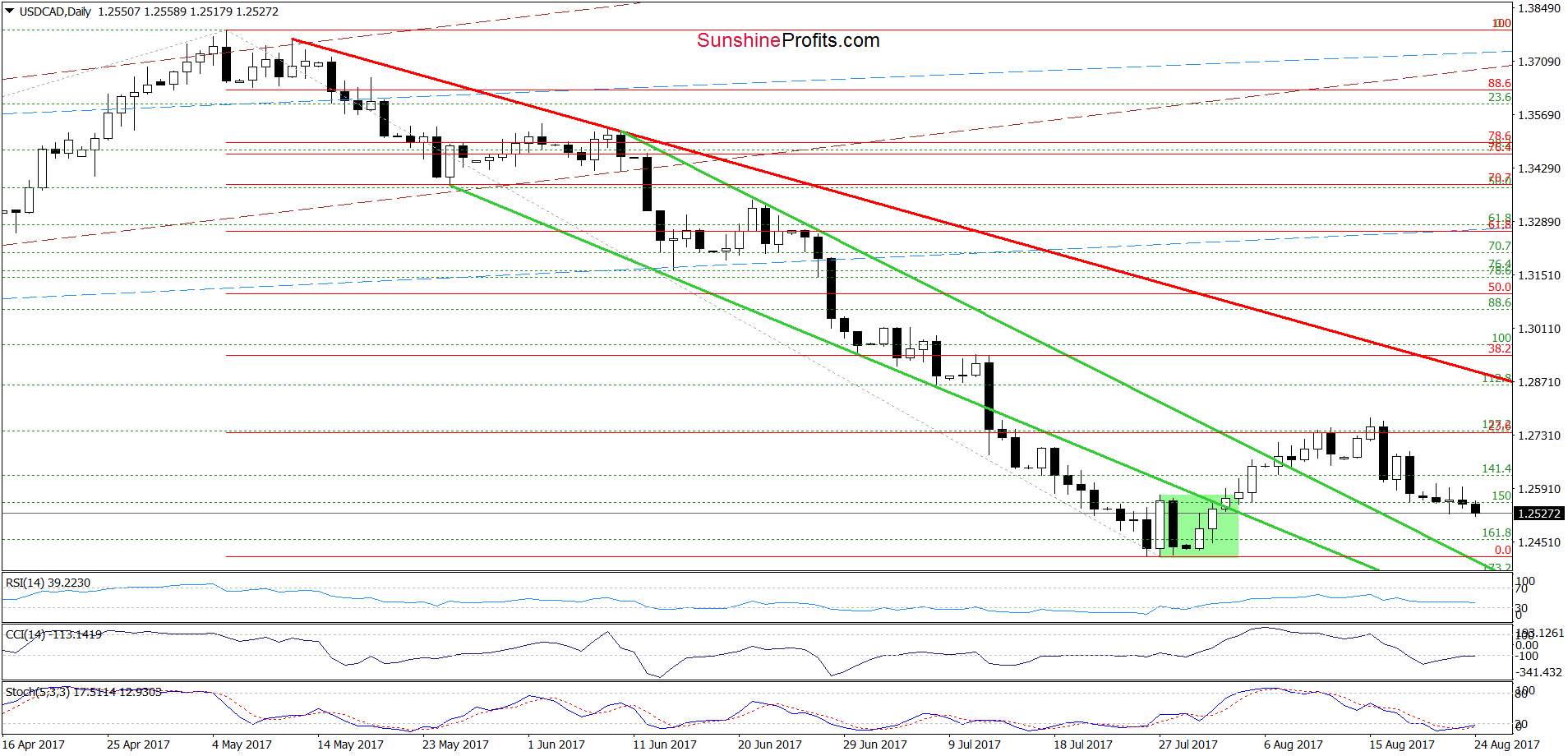

USD/CAD

On Monday, we wrote the following:

(…) USD/CAD reached our first downside target – the previously-broken upper border of the green consolidation. What’s next? Taking into account the size of Friday’s downswing and the lack of buy signals we think that another downswing is just around the corner and we’ll see the exchange rate on the upper border of the green declining wedge in the following days.

On the daily chart, we see that currency bears pushed USD/CAD lower as we had expected. Earlier today, the pair hit almost 3-weeks low, which suggests that we’ll see realization of the above bearish scenario in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts