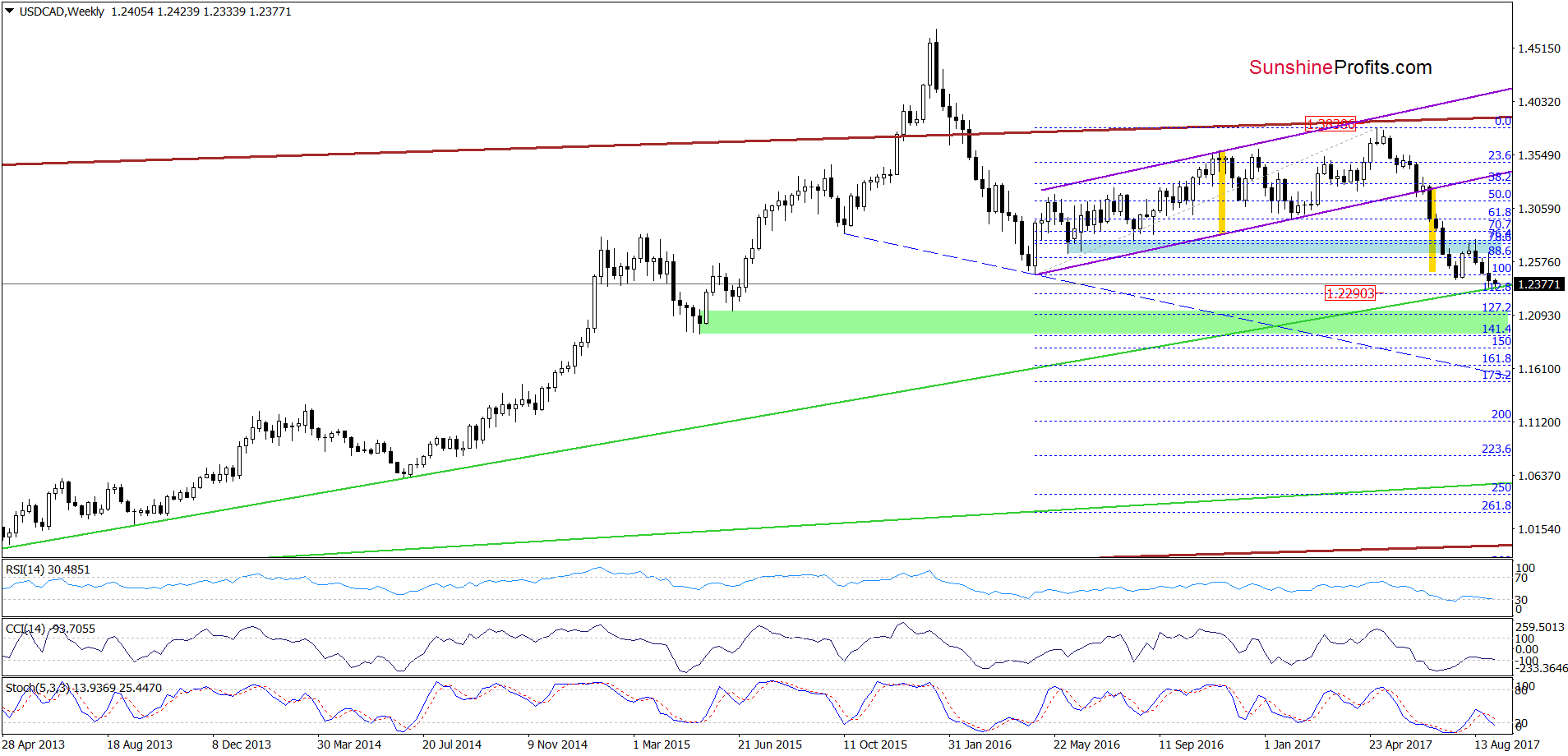

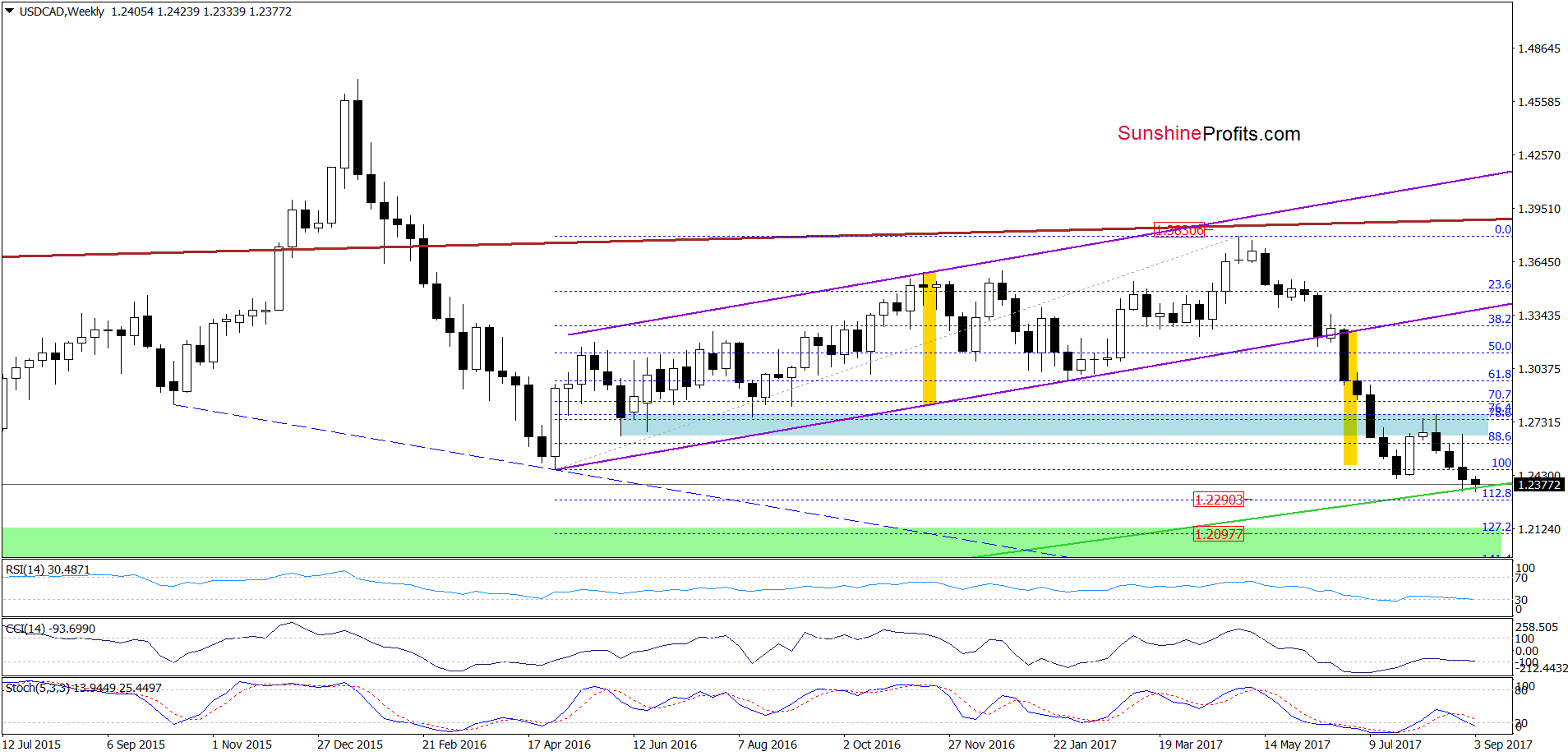

In the previous week, the Fibonacci retracement stopped USD/CAD two times and triggered a pullback. Will we see a test of the recent lows in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1466)

- GBP/USD: short (a stop-loss order at 1.3272; the initial downside target at 1.2375)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

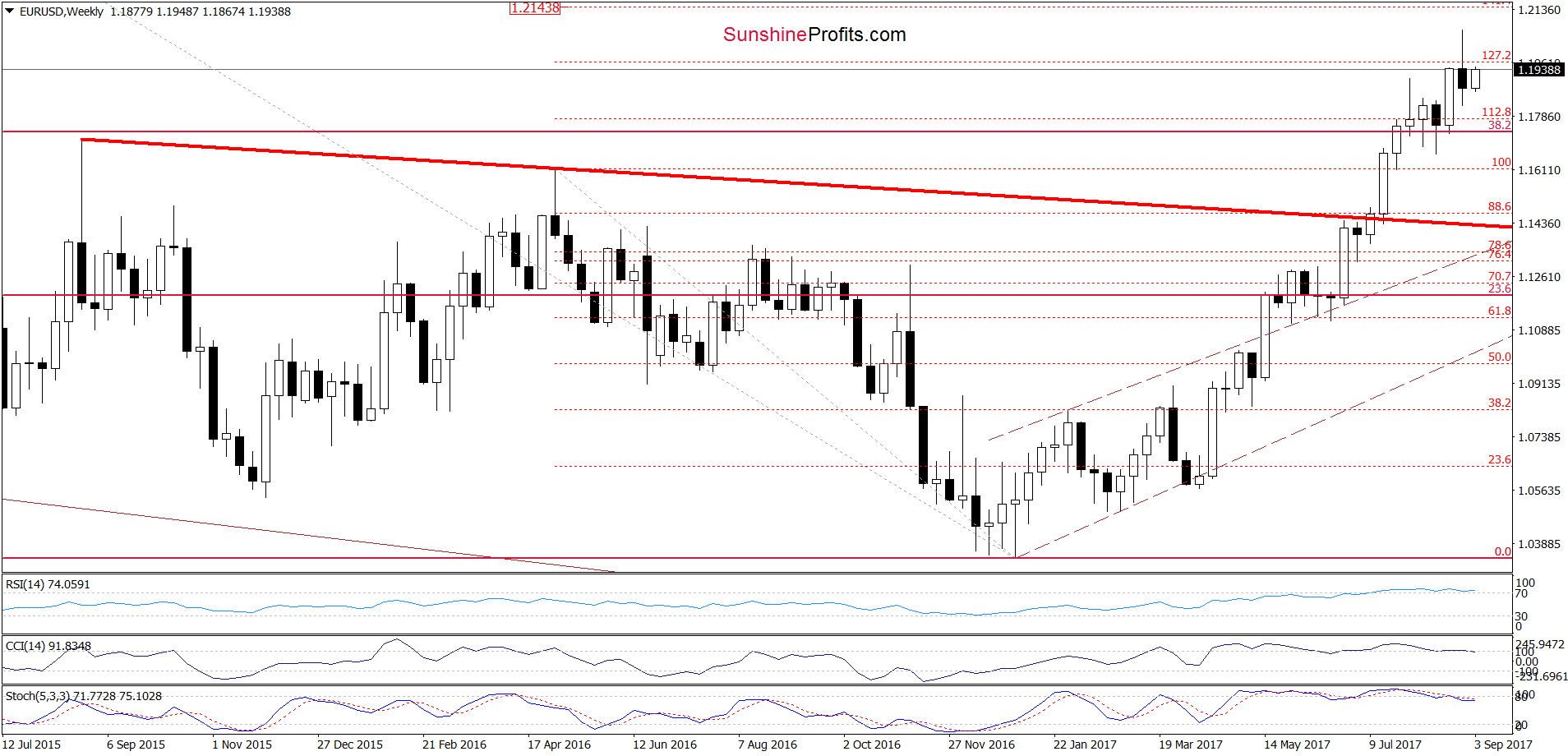

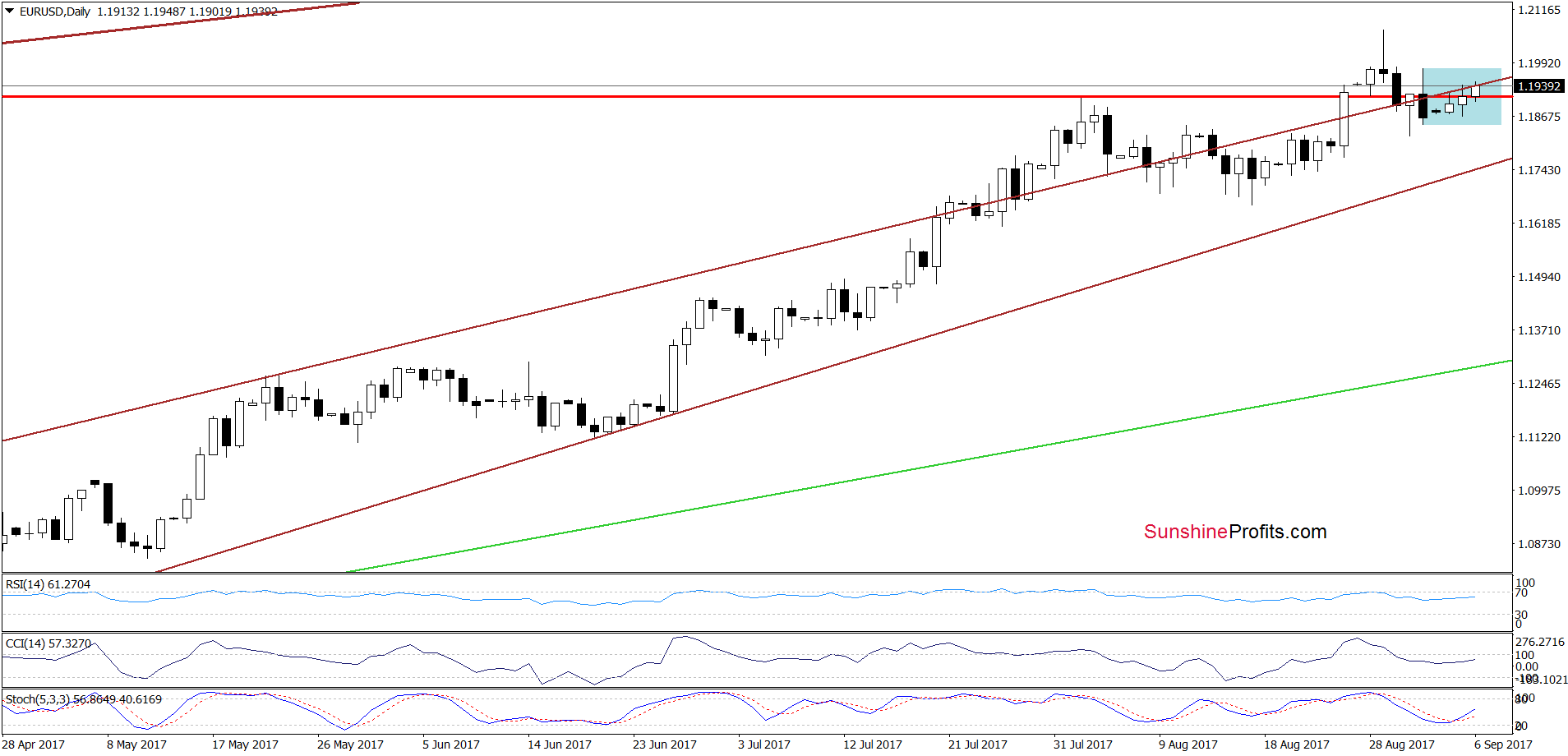

On the daily chart, we see that although EUR/USD moved a bit higher earlier today, the exchange rate is still trading in the blue consolidation under the previously-broken 127.2% Fibonacci extension and the upper border of the brown rising wedge, which means that as long as there is no invalidation of the breakdown under these resistances a bigger move to the upside is doubtful and another attempt to move lower is very likely.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1466) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

On Friday, we wrote the following:

(…) the exchange rate declined sharply, which together with the sell signals generated by the daily indicators suggest that we’ll see a test of the recent lows or even a drop to the long-term green support line (currently around 1.2340) seen on the weekly chart below.

From today’s point of view, we see that the situation developed in line with the above scenario and USD/CAD slipped to the long-term green line marked on the weekly chart. Although this support triggered a rebound in the previous week, currency bears re-tested its strength in recent days. What’s next? Taking into account the proximity to the above-mentioned support line and the 173.2% Fibonacci extension (seen on the daily chart) it seems that USD/CAD will move higher in the coming days. Nevertheless, before we see such price action, one more downswing and a test of the 112.8% Fibonacci extension (based on the May 2016-April 2017 upward move and marked on the weekly chart) can’t be ruled out.

Very short-term outlook: mixed

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

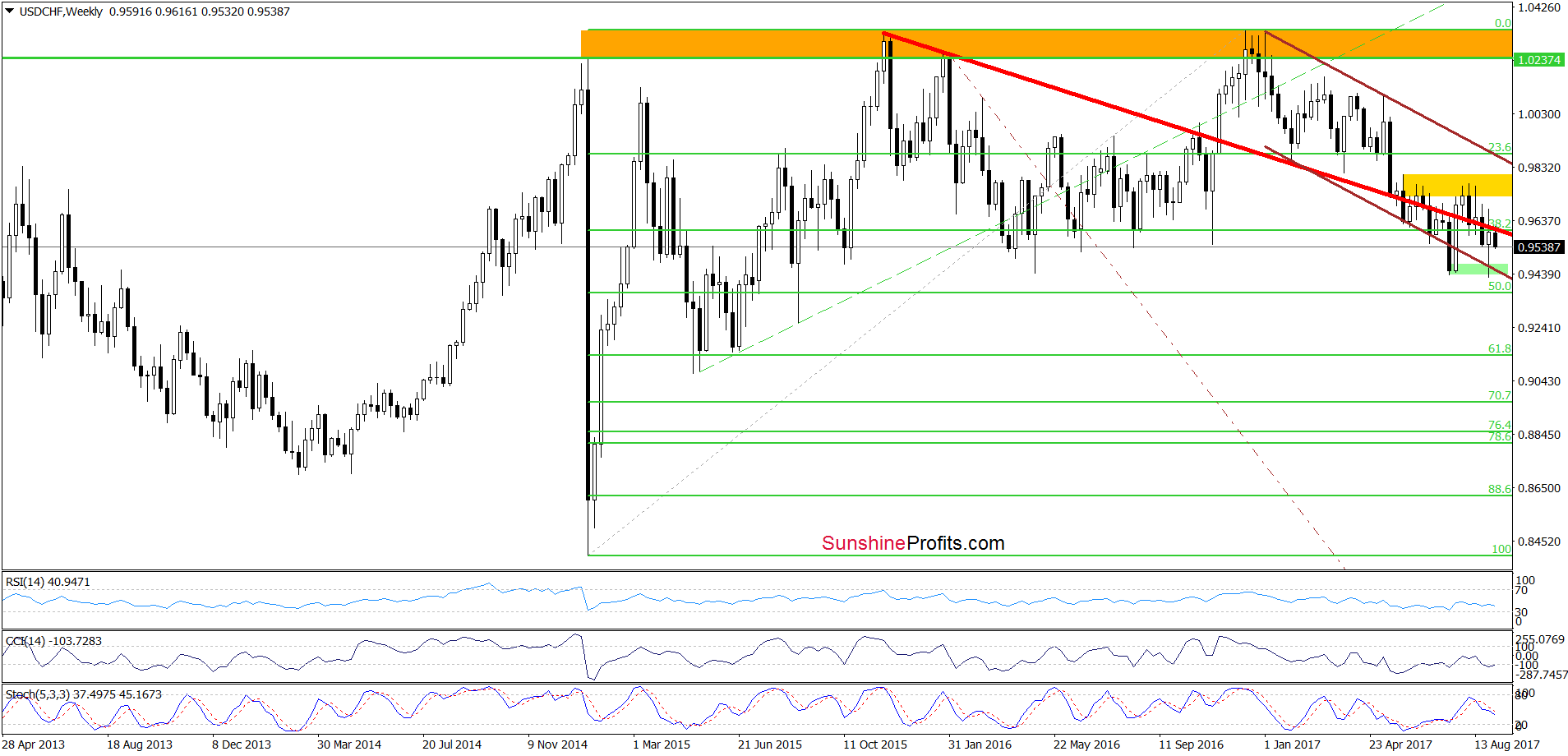

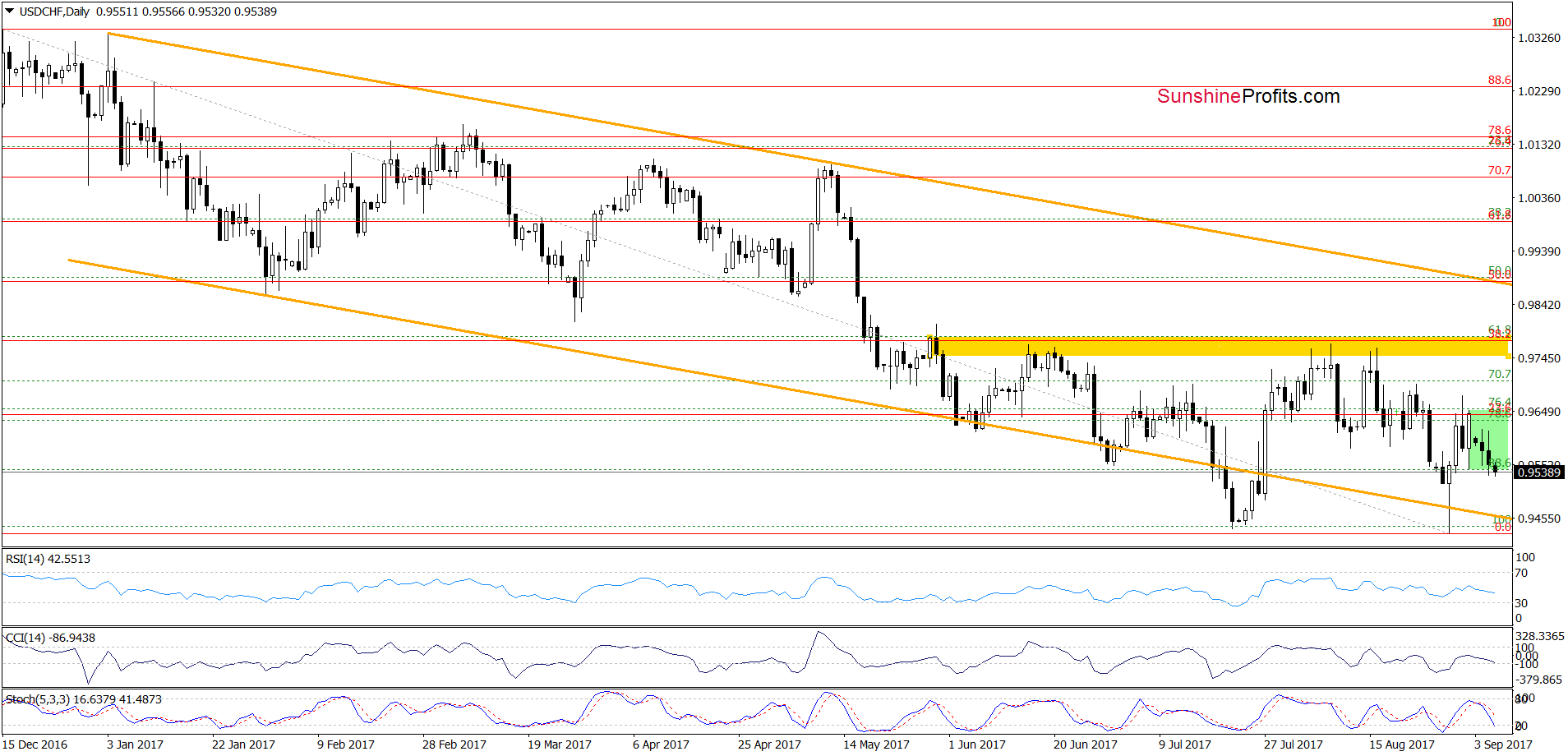

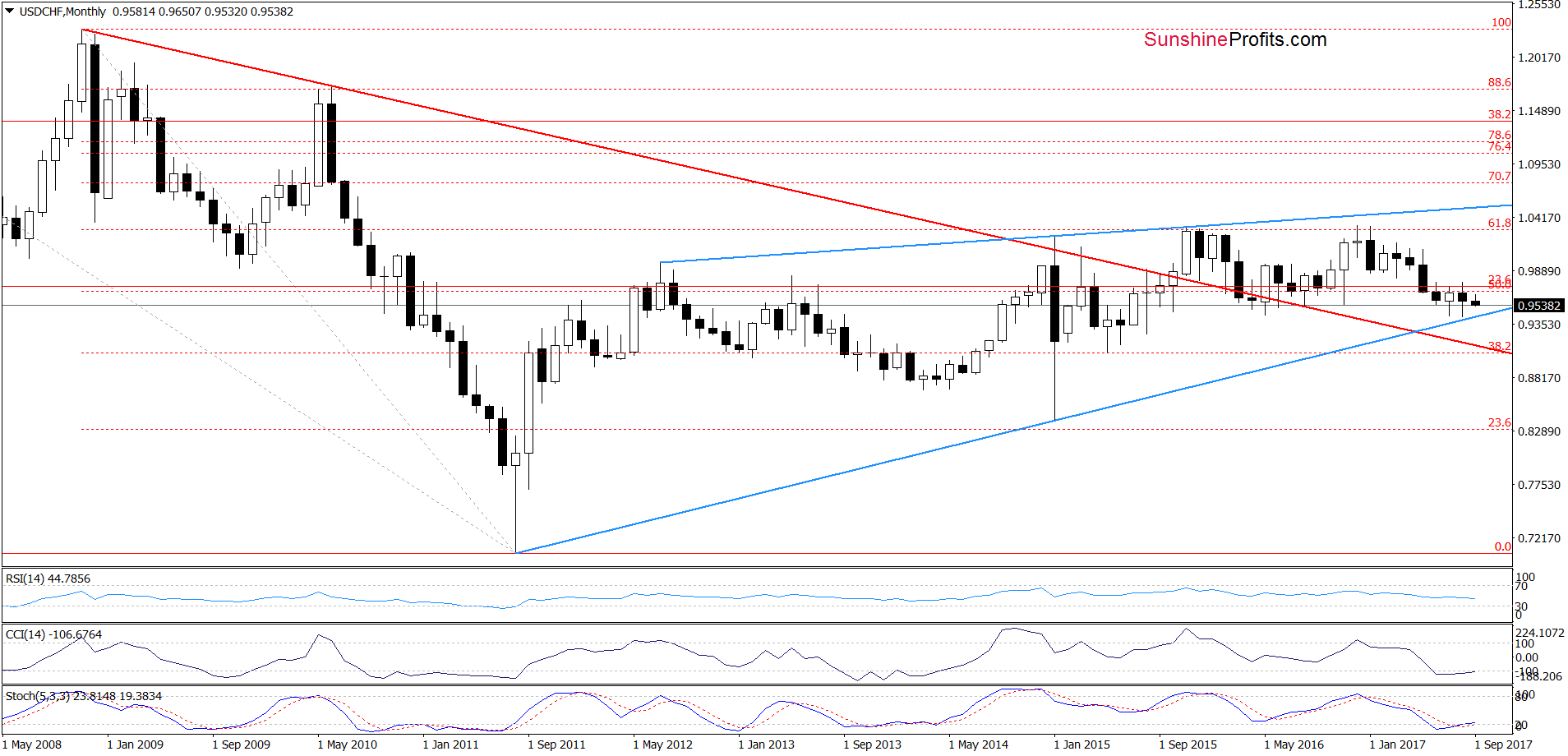

Looking at the charts, we see that the 23.6% Fibonacci retracement (based on the entire mid-December-August downward move) stopped further improvement two times and currency bulls didn’t even manage to reach the yellow resistance zone in the previous week. As a result, the exchange rate pulled back and stuck in the green consolidation. Earlier today, currency bears pushed USD/CHF under the lower border of the formation, which is a negative development. Nevertheless, in our opinion, it will be more bearish and reliable if the pair closes today’s session under 0.9544. In this case, we’ll likely see further deterioration and a test of the support area (around 0.9440-0.9455) created by the lower border of the orange declining trend channel and the long-term blue rising support line seen on the chart below.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts