In recent days, the U.S. dollar extended gains against its Canadian counterpart, which resulted in a breakout above the short-term resistance and an invalidation of the breakdown under the long-term line. Is it enough to trigger further rally?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1466)

- GBP/USD: short (a stop-loss order at 1.3773; the initial downside target at 1.3317)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

Looking at the charts, we see that EUR/USD extended losses, which means that what we wrote yesterday remain up-to-date also today:

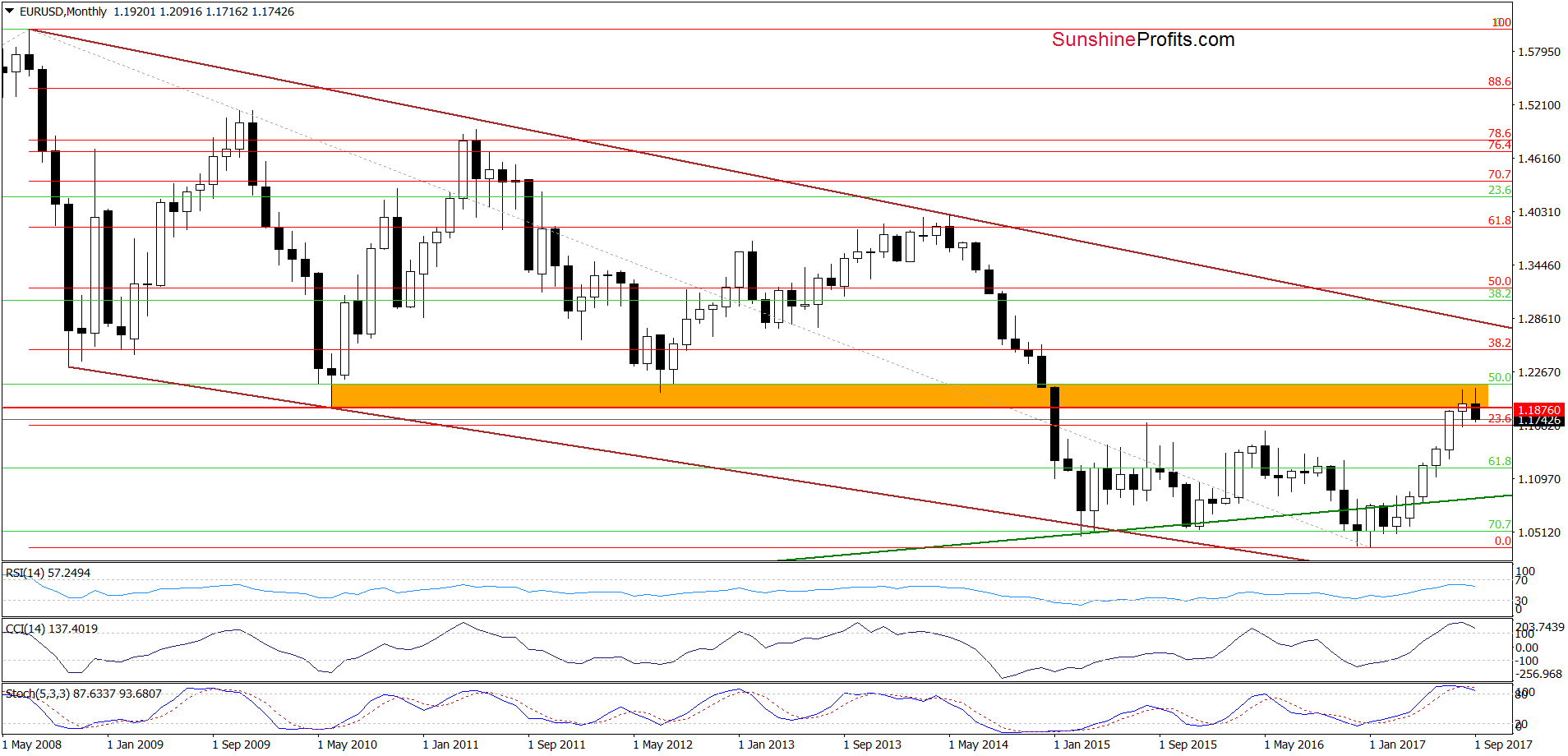

(…) EUR/USD extended losses below the orange resistance zone, which together with the current situation in the medium term, increases the probability of further declines. Why? (…) the sell signals generated by the medium-term indicators remain in cards, supporting currency bears and lower values of the exchange rate. Additionally, EUR/USD slipped to the previously-broken 38.2% Fibonacci retracement, which means that if the pair drops below this support level, currency bears will receive another important reason to act in the following days.

What’s interesting, this pro-bearish scenario is currency reinforced by the short-term picture below.

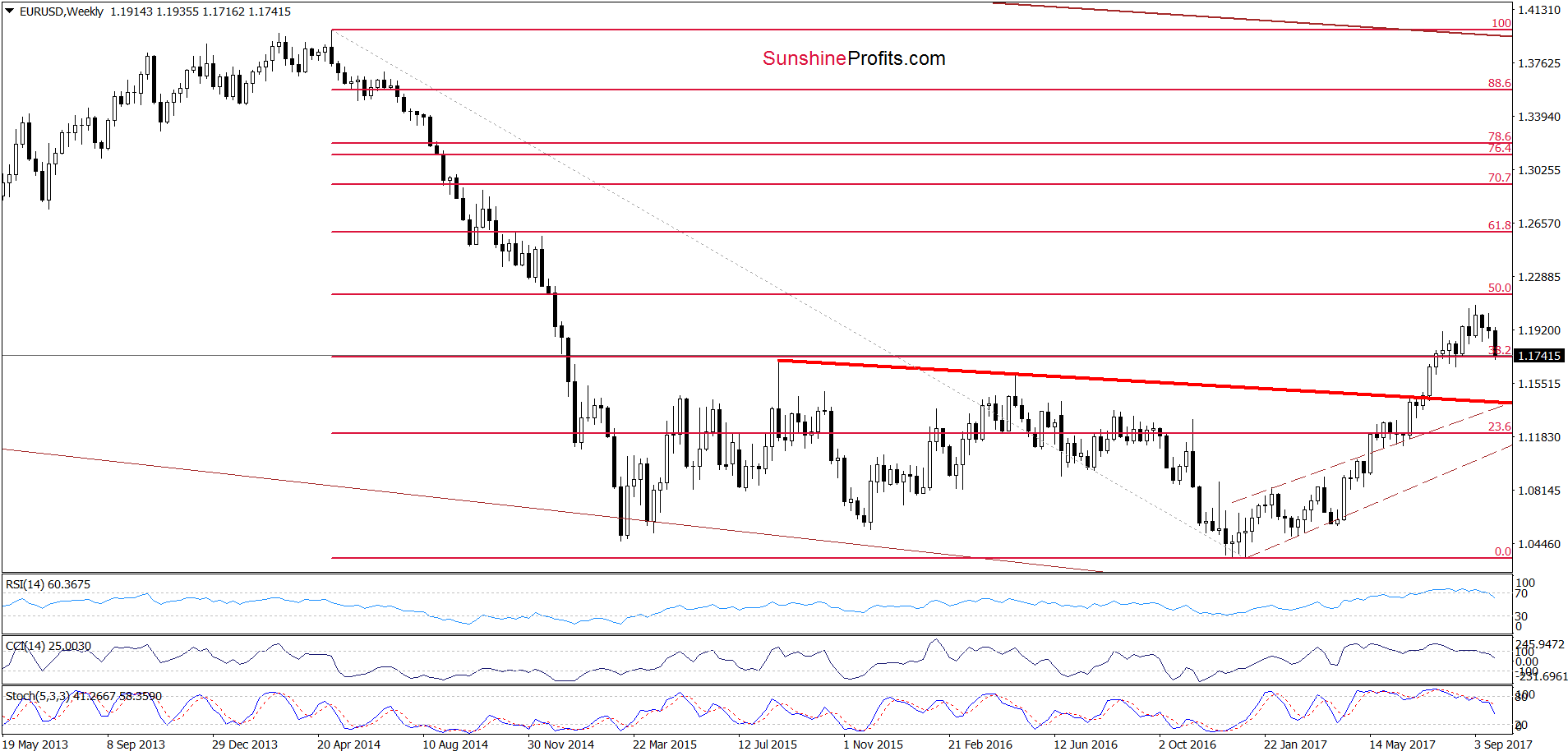

(…) Looking at the above chart, we clearly see a (…) head and shoulders formation. Therefore, if EUR/USD declines under the neck line of the pattern (the blue support line based on the previous lows), we’ll see a downward move to around 1.1596, where the size of the move will correspond to the height of the formation.

However, when we take into account a drop under the lower border of the brown rising trend channel and the broader picture of EUR/USD, we think that currency bears push the exchange rate even lower – to around 1.1508, where the size of declines will be equal to the height of trend channel. Taking all the above into account, we believe that our profitable short positions are justified from the risk/reward perspective.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short profitable positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1466) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

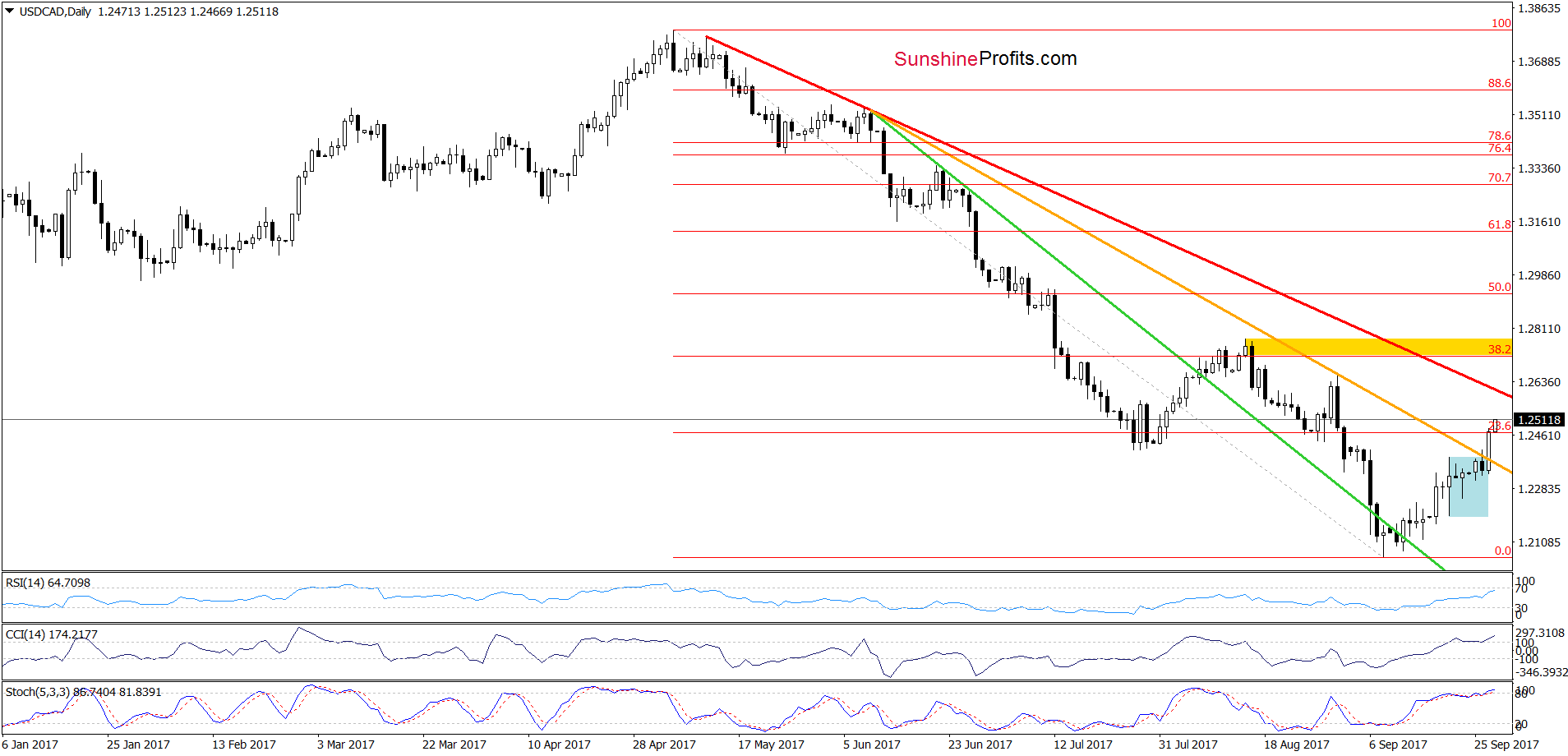

USD/CAD

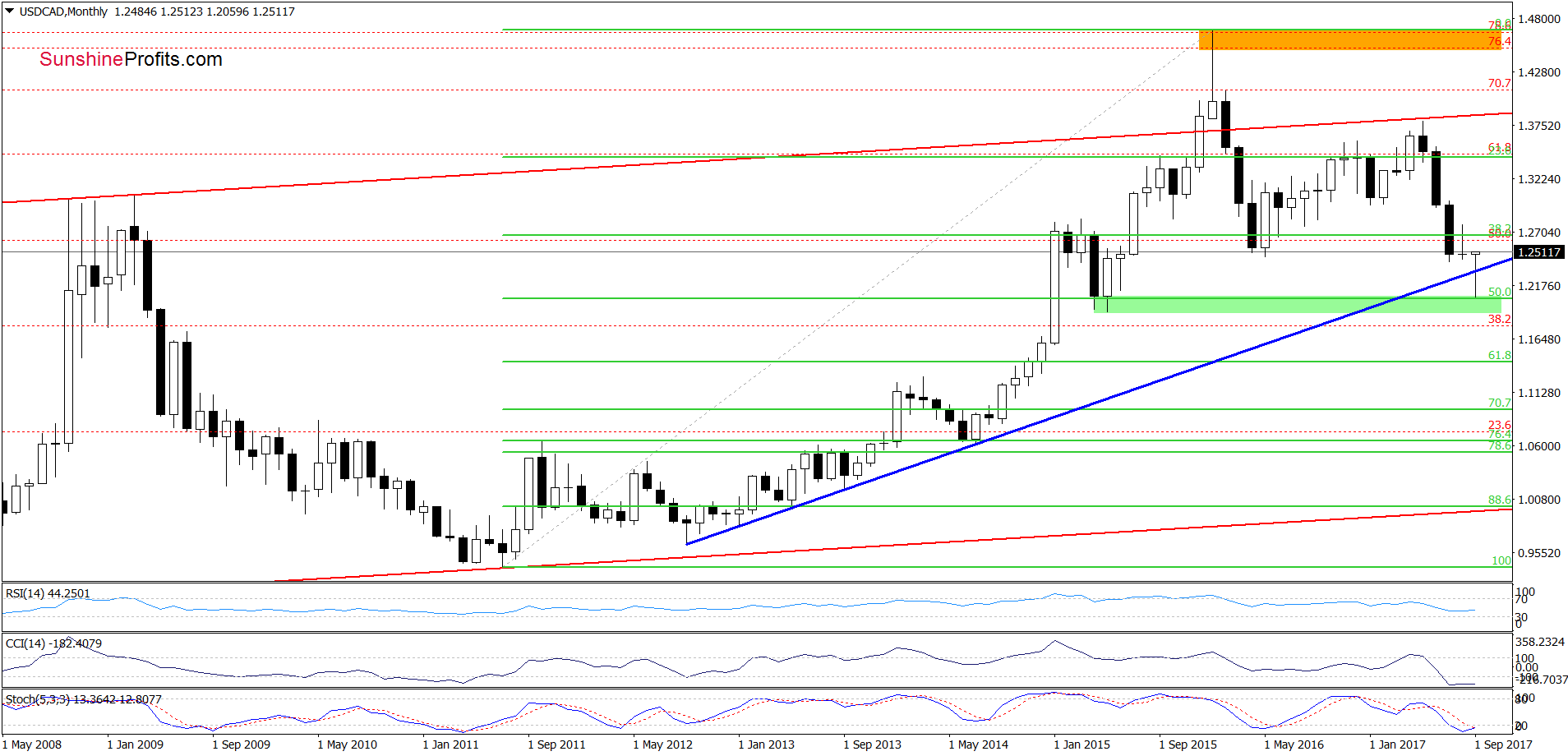

The first thing that catches the eye on the above charts is an invalidation of the breakdown under the previously-broken long-term blue support line based on the September 2012, September 2013 and June 2014 lows (seen more clearly on the monthly chart). This is a bullish development, which together with the buy signals generated by the medium-term indictors suggests further improvement.

Will the very short-term chart confirm this scenario? Let’s examine the daily chart and find out.

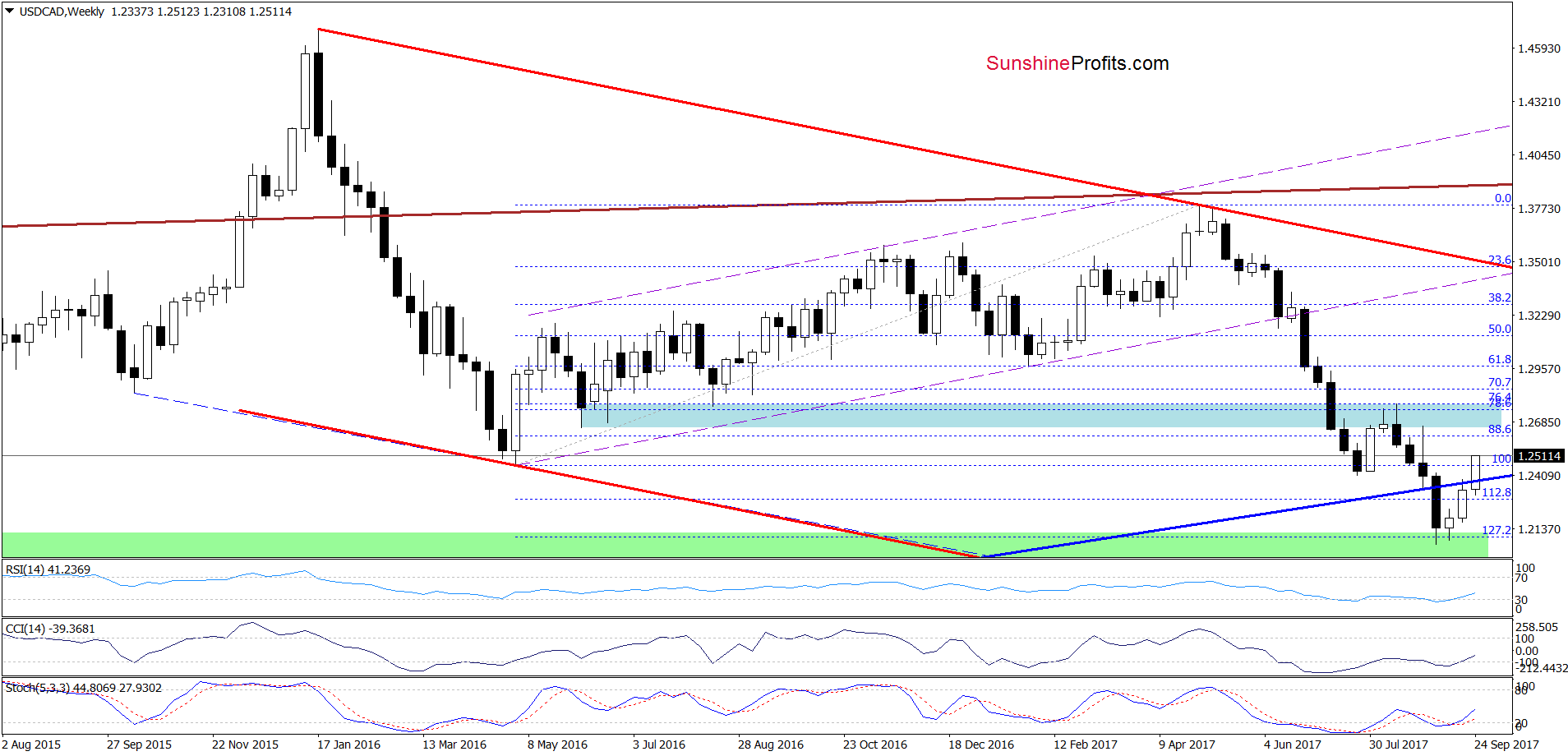

From the very short-term perspective, we see that USD/CAD broke above the upper border of the blue consolidation, the orange declining resistance line and the July lows, which encouraged currency bulls to act. As a result, the exchange rate also climb above the 23.6% Fibonacci retracement based on the entire May-September downward move, which suggests a test of the red declining resistance line in the coming days.

Very short-term outlook: bullish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

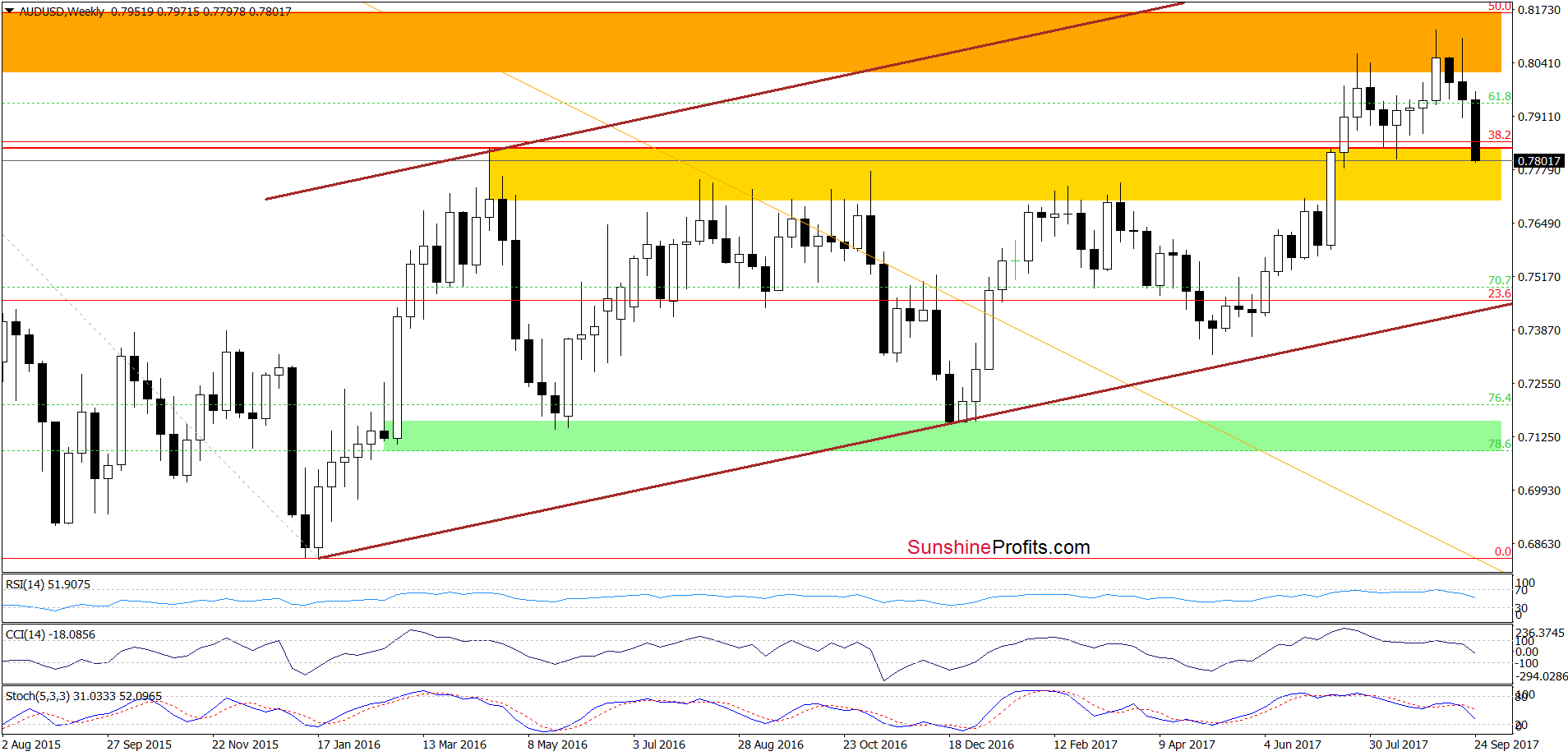

AUD/USD

On Tuesday, we wrote:

(…) AUD/USD moved a bit lower earlier this week, which suggests that the sell signals generated by the indicators will continue to support currency bears and lower values of the exchange rate.

On the weekly chart, we see that the situation developed in tune with our assumptions and AUD/USD extended losses.

How did this drop affect the very short-term picture? Let’s check.

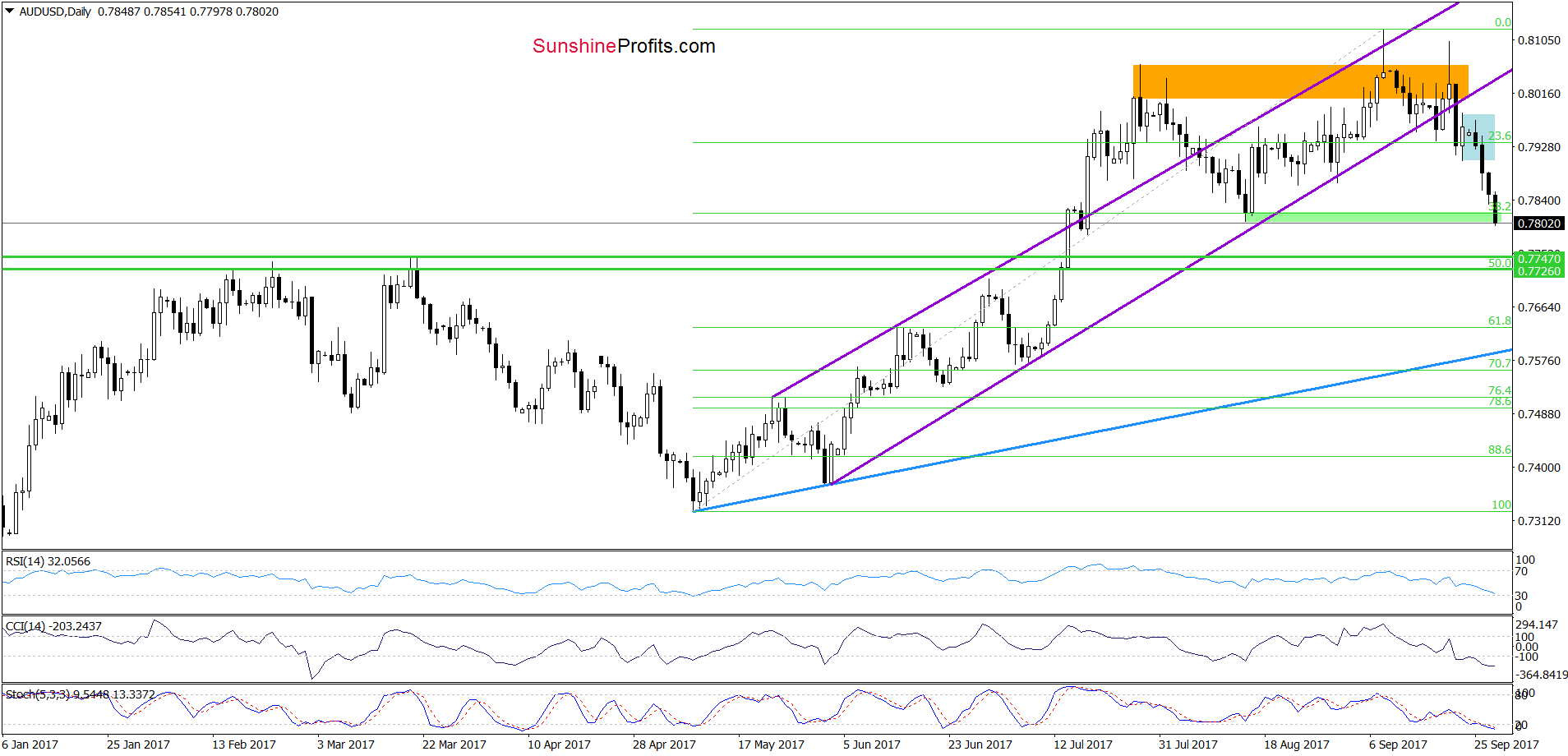

Quoting our last commentary on this currency pair:

(…) AUD/USD stuck in the blue consolidation around the 23.6% Fibonacci retracement. Nevertheless, taking into account the medium-term picture and the breakdown under the lower border of the purple rising trend channel, we think that further deterioration is just around the corner.

How low could the pair go? In our opinion, if AUD/USD declines from current levels, the initial downside target will be around 0.7805-0.7820, where the green support zone (created by the mid-August lows and the 38.2% Fibonacci retracement) is.

Looking at the daily chart, we see that currency bears pushed AUD/USD lower as we had expected. Thanks to the recent decline the exchange rate slipped to our downside target earlier today. What’s next? Taking into account the above-mentioned green support zone and the current position of the indicators, it seems that we’ll see a rebound and a verification of the breakdown under the blue consolidation in the very near future.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts