Earlier today, the U.S. dollar moved lower against its Canadian counterpart, which resulted in a drop to the solid medium-term support line. Will it withstand the selling pressure once again?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1402; the initial downside target at 1.1009)

- GBP/USD: short (a stop-loss order at 1.3232; the initial downside target at 1.2375)

- USD/JPY: long (a stop-loss order at 107.62; the initial upside target at 113.08)

- USD/CAD: long (a stop-loss order at 1.2931; the initial upside target at 1.3436)

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7683; the initial downside target at 0.7444)

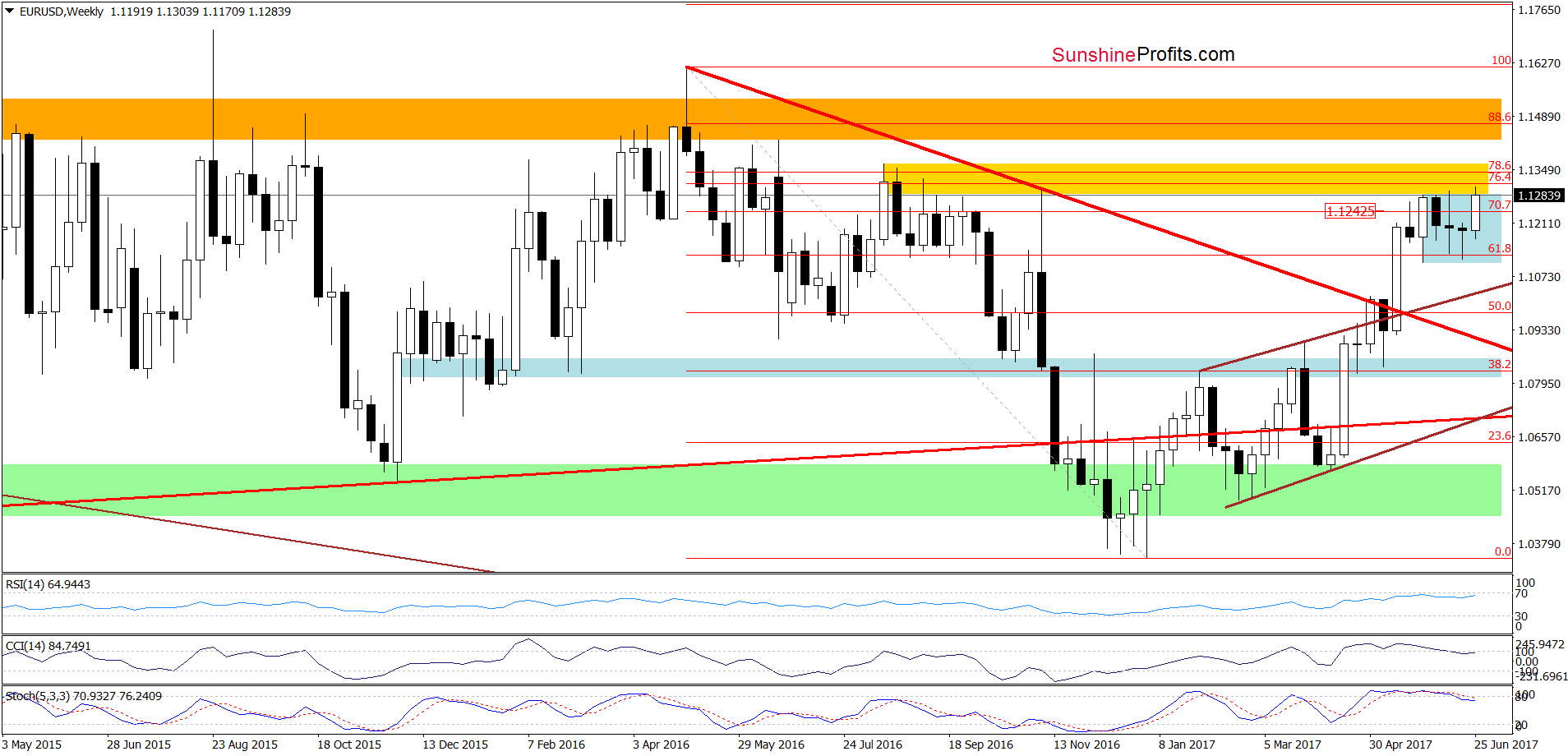

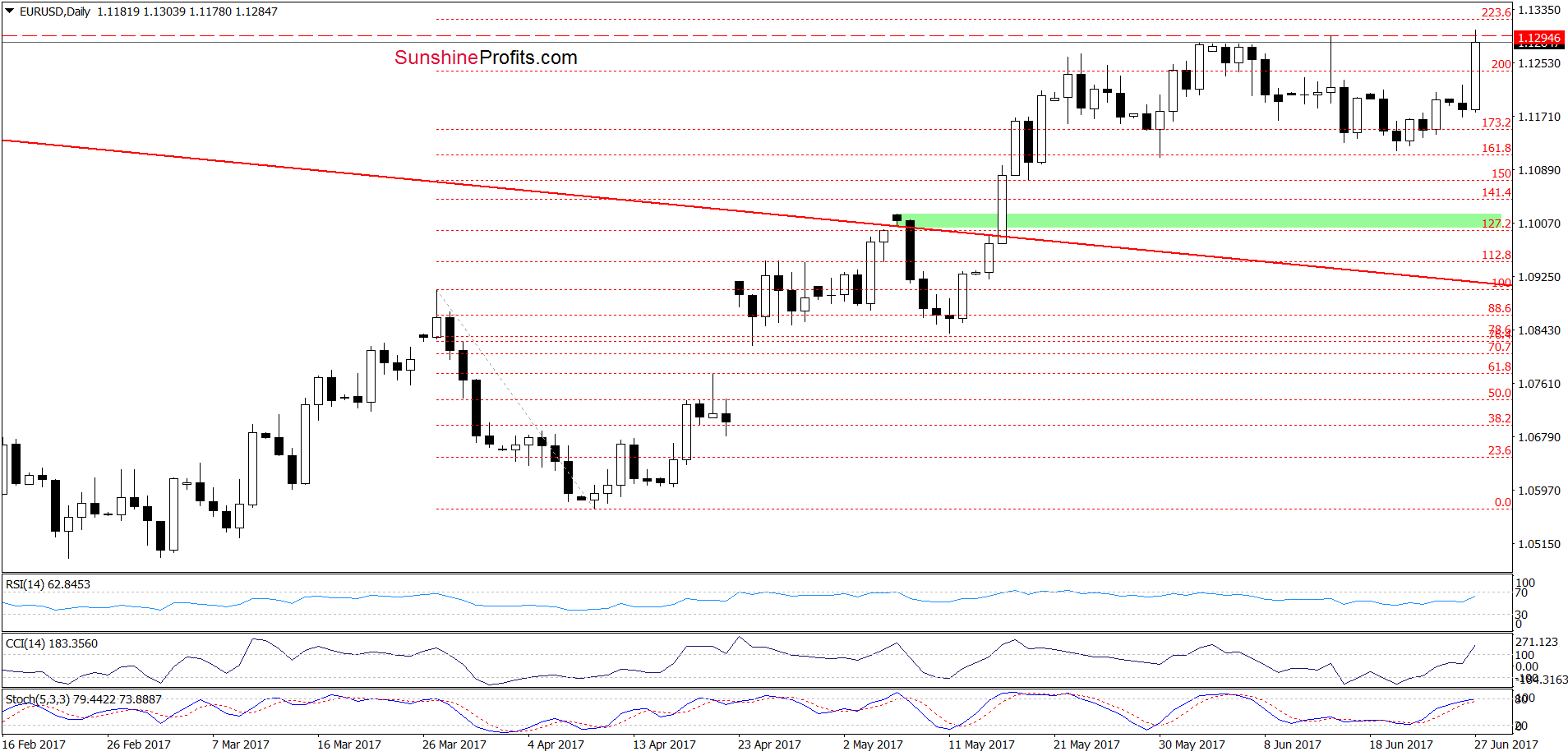

EUR/USD

Earlier today EUR/USD moved sharply higher, which resulted in a climb to a fresh multi-month high. Thanks to this increase, the exchange rate also broke above the upper border of the blue consolidation marked on the weekly chart, which is a positive development. Despite this improvement, the exchange remains below the yellow resistance zone and the sell signals generated by the medium-term indicators are still in cards, which suggest that we may see a reversal in the coming day(s).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1402 and the initial downside target at 1.1009) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

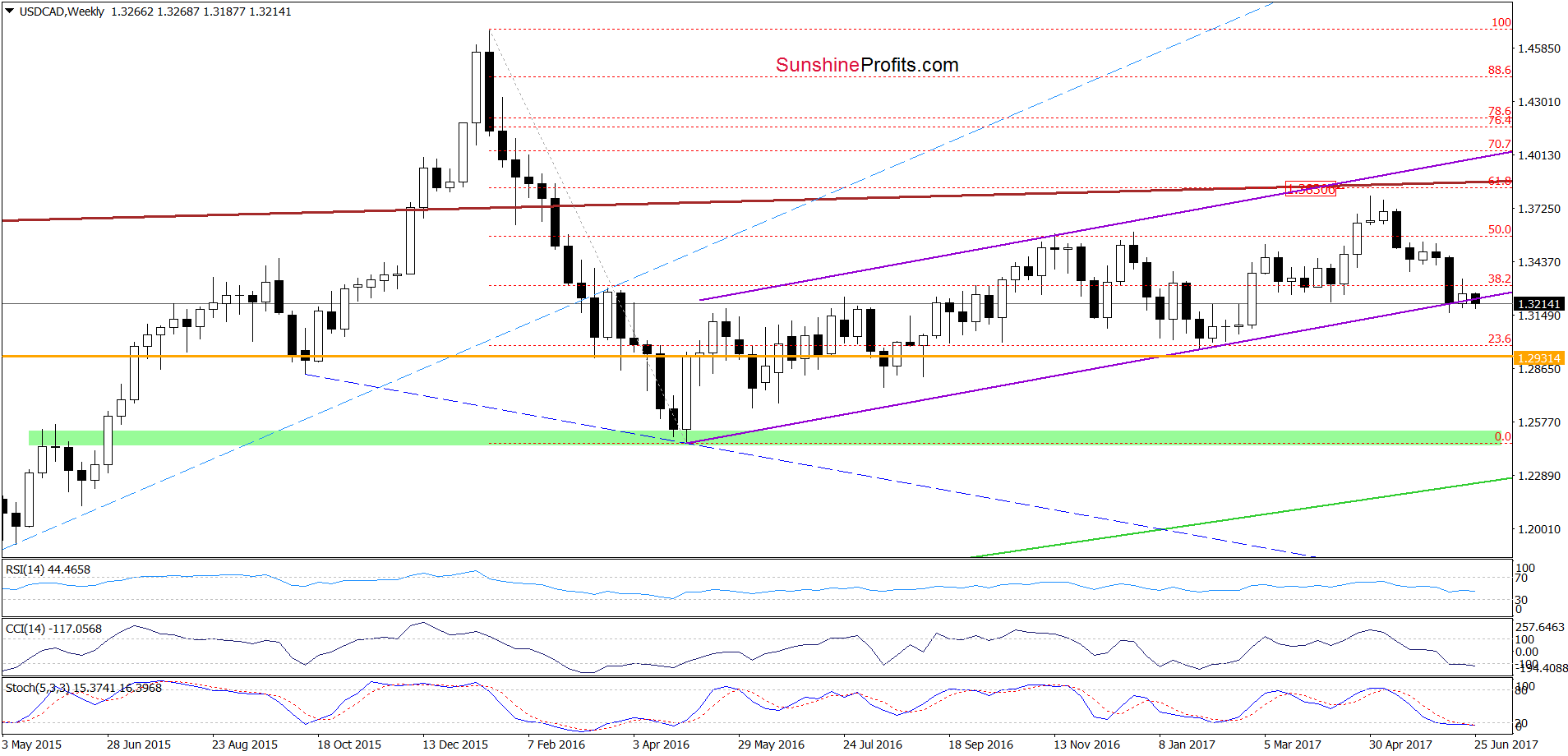

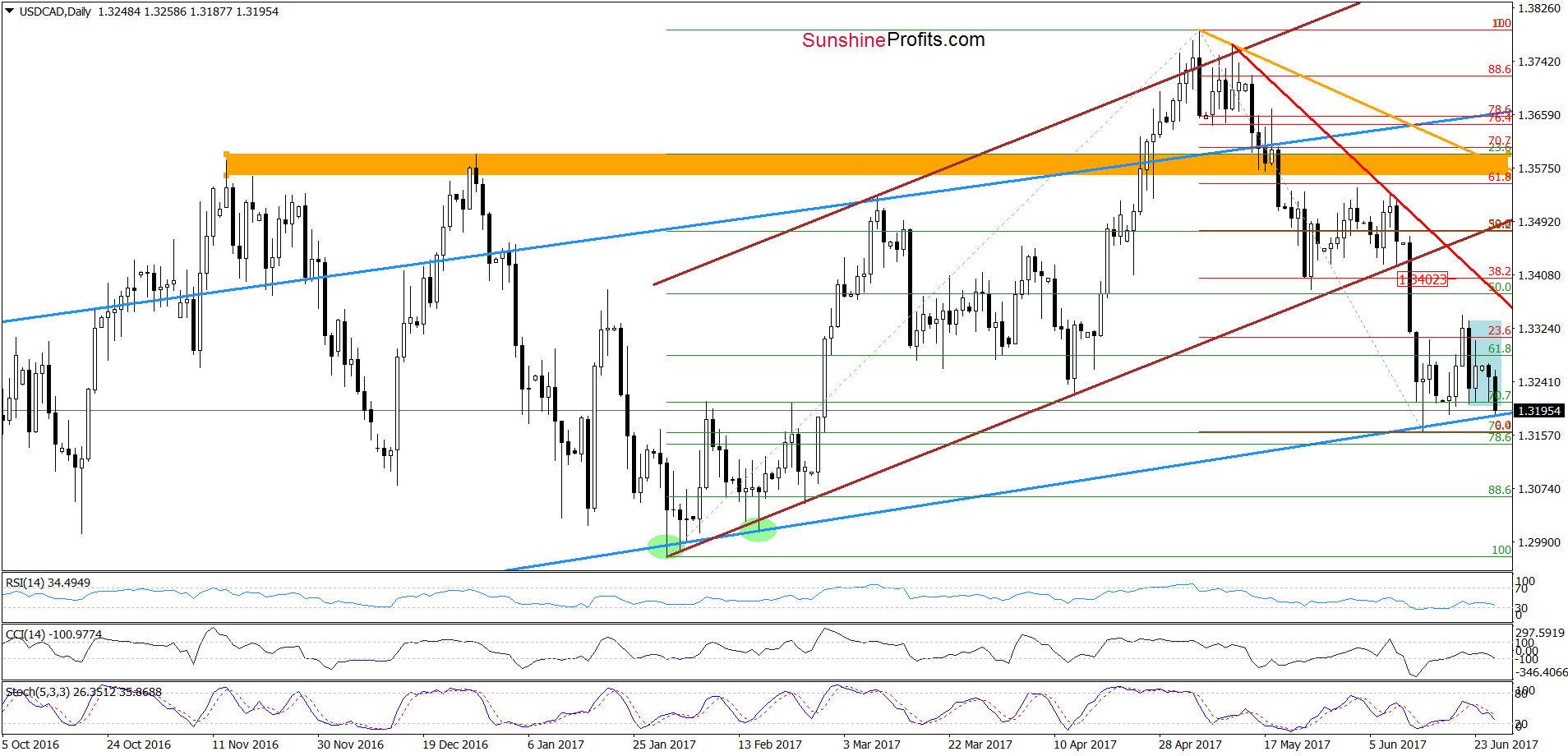

USD/CAD

On the medium-term chart, we see that USD/CAD moved lower once again and slipped under the lower border of the purple rising trend channel, which is negative event. Nevertheless, it will turn into bearish only if we see a weekly closure below this line. Until this time, another rebound is likely.

Having said that, let’s examine the very short-term chart.

On the daily chart, we see that currency bears pushed USD/CAD lower earlier today, which resulted in a test of the strength of the blue line. As you see, this support currency bears two times earlier today, which increases the probability that the history will repeat itself one again. Nevertheless, if we see a daily closure below this line we will close long positions.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.2931 and the initial upside target at 1.3436 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

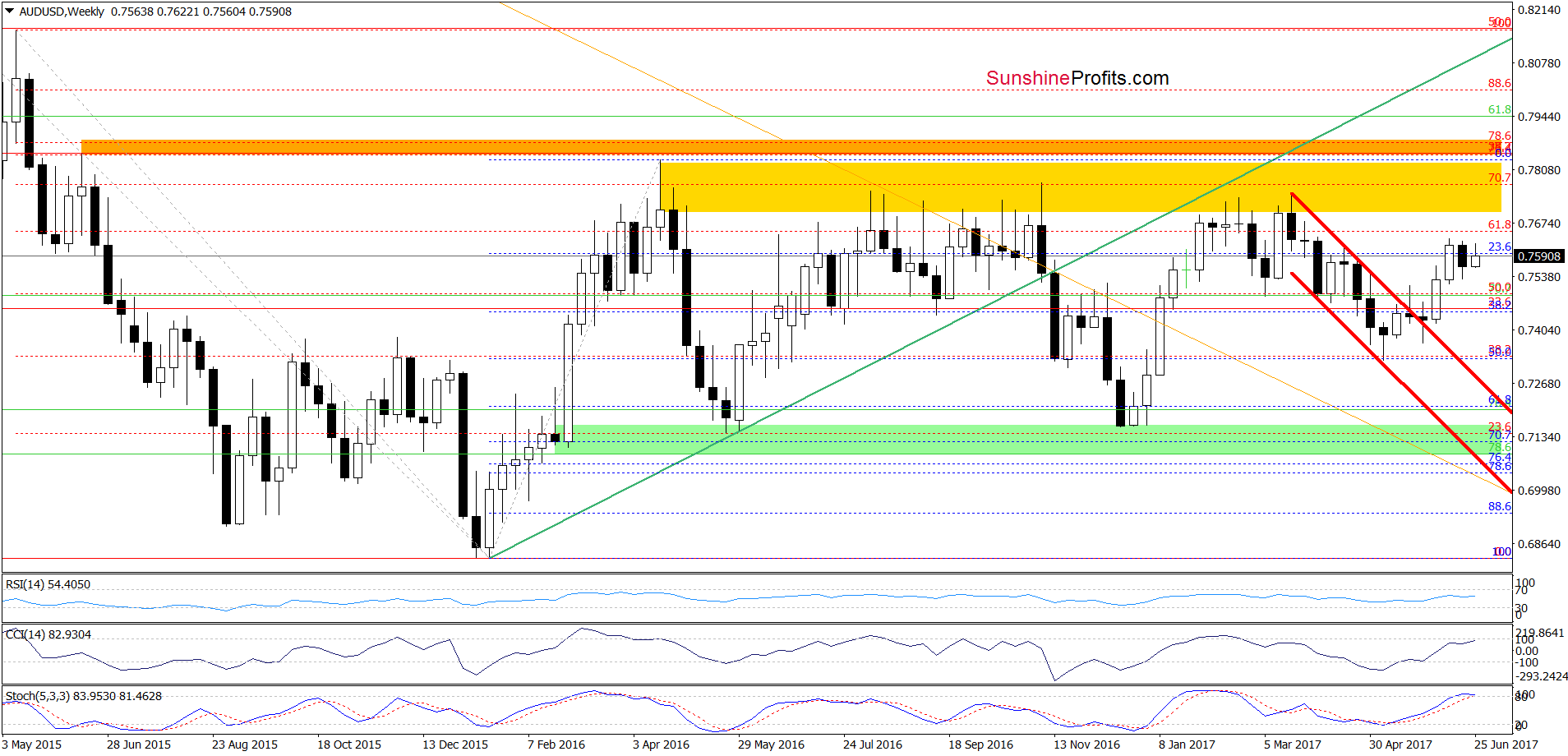

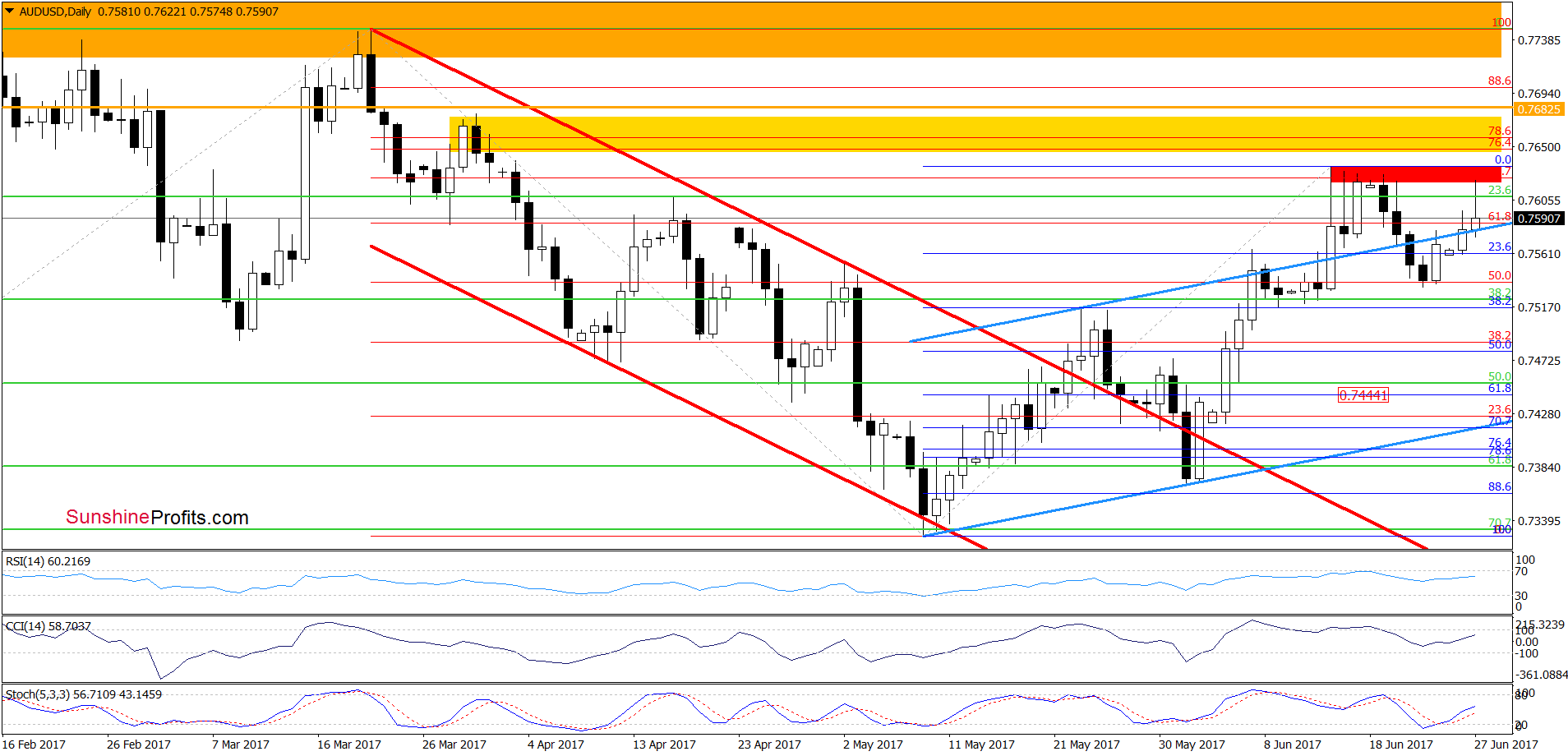

AUD/USD

Looking at the daily chart, we see that AUD/USD extended gains and came back above the upper border of the blue rising trend channel. Despite this improvement, the red resistance zone created by the previous highs paused currency bulls, triggering a pullback earlier today. Taking this fact into account and the proximity to the higher (yellow) resistance zone, we think that lower values of AUD/USD are still ahead us.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 0.7683 and the initial downside target at 0.7444) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts